2026 AARK Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: AARK's Market Position and Investment Value

Aark (AARK), as a pioneering leverage-everything perpetual decentralized exchange (DEX), has been innovating in the decentralized finance sector since its launch in 2024. As of February 2026, AARK maintains a market capitalization of approximately $226,727, with a circulating supply of about 167 million tokens, and the price hovering around $0.0013576. This asset, recognized as "the first-of-its-kind leverage platform for super-long tail assets," is playing an increasingly significant role in decentralized derivatives trading and liquidity provision.

This article will comprehensively analyze AARK's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. AARK Price History Review and Market Status

AARK Historical Price Evolution Trajectory

- 2024: AARK launched in June with an initial offering price of $0.035, reaching an all-time high of $0.0992 on June 10, 2024, representing a significant increase from its launch price

- 2025: The token experienced substantial downward pressure throughout the year, declining to its all-time low of $0.0002154 on August 29, 2025

- 2026: As of early February, AARK is trading at $0.0013576, showing some recovery from its historical low but remaining significantly below its peak levels

AARK Current Market Situation

As of February 08, 2026, AARK is trading at $0.0013576, with a 24-hour trading volume of $17,875.69. The token has shown a modest 24-hour price increase of 0.77%, while experiencing a decline of 1.87% over the past week and 9.41% over the past month. The year-over-year performance indicates a decrease of 66.23%.

The current circulating supply stands at 167,006,277.68 AARK tokens, representing approximately 16.70% of the total supply of 559,427,979.59 tokens. With a maximum supply cap of 1,000,000,000 tokens, the project maintains significant token reserves for future distribution. The current market capitalization is $226,727.72, while the fully diluted market cap reaches $759,479.43, indicating a market cap to FDV ratio of 16.7%.

The 24-hour price range has fluctuated between $0.0012546 and $0.0013576, demonstrating relatively contained volatility during this period. The token holder count stands at 8,419 addresses, suggesting an established user base within the ecosystem.

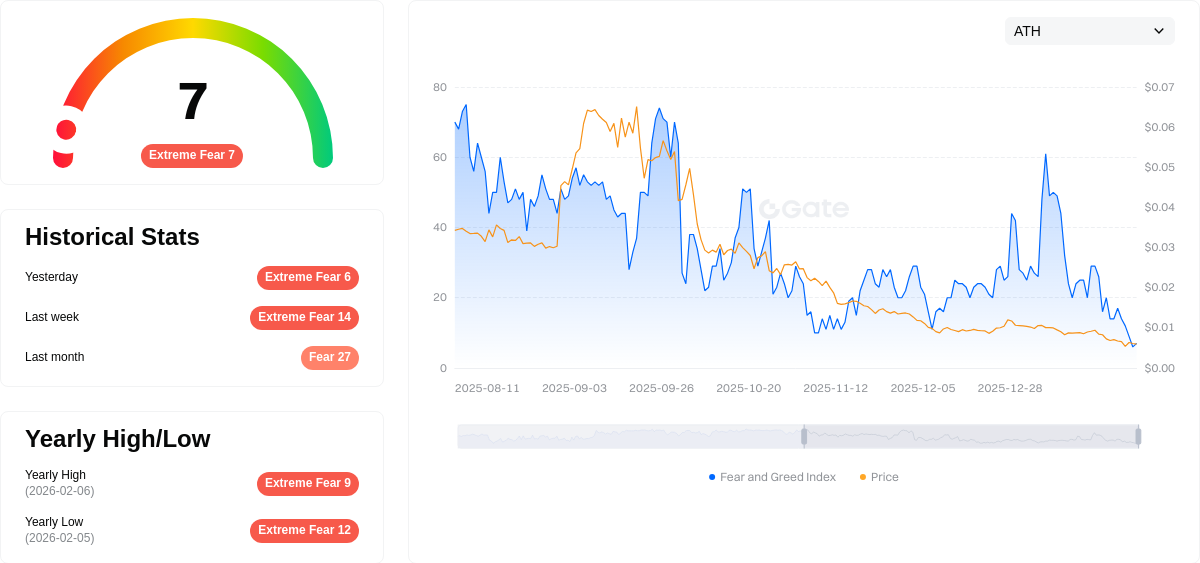

AARK maintains a market dominance of 0.000030% and is ranked #3795 in the overall cryptocurrency market. The current market sentiment indicator shows a value of 7, corresponding to extreme fear conditions in the broader market.

Click to view current AARK market price

AARK Market Sentiment Indicator

02-08-2026 Fear and Greed Index: 7 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at just 7. This exceptionally low reading signals significant market pessimism and investor anxiety. During such periods, market volatility tends to spike as traders react to negative sentiments and uncertain conditions. This extreme fear environment often presents both risks and opportunities for investors. Long-term believers may view this as a potential accumulation point, while risk-averse traders should exercise caution. Monitor market developments closely on Gate.com to stay informed about price movements and emerging trading opportunities.

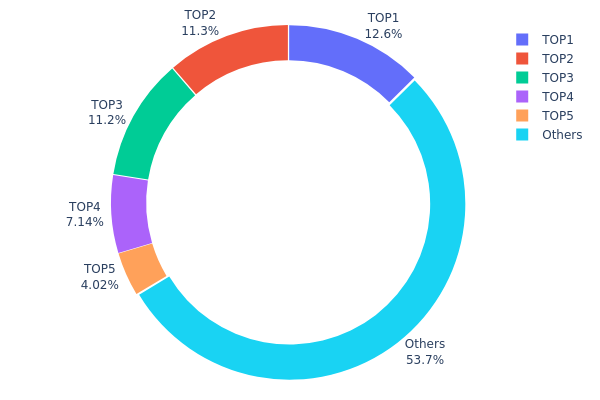

AARK Holding Distribution

The holding distribution chart reflects the concentration of token ownership across different addresses on the blockchain. By analyzing the proportion of tokens held by top addresses versus smaller holders, this metric provides insights into the decentralization level and potential market manipulation risks. A highly concentrated distribution may indicate increased volatility and susceptibility to large-scale sell-offs, while a more dispersed distribution typically suggests a healthier, more resilient market structure.

According to the current data, AARK exhibits a moderate concentration pattern. The top five addresses collectively hold approximately 46.22% of the total supply, with the largest single address controlling 12.60% (70,555.73K tokens), followed by the second and third addresses holding 11.32% and 11.16% respectively. Meanwhile, the remaining addresses outside the top five account for 53.78% of the supply, suggesting that while significant concentration exists among major holders, the majority of tokens remain distributed across a broader base of participants.

This distribution structure presents both opportunities and risks. The presence of several large holders could lead to heightened price volatility if these addresses execute significant transactions simultaneously. However, the fact that over half of the supply is dispersed among smaller holders indicates a reasonable degree of decentralization, which may help absorb sudden selling pressure and maintain market stability. From an on-chain structural perspective, AARK demonstrates a relatively balanced ecosystem that neither exhibits extreme whale dominance nor complete fragmentation, positioning it within a typical range for emerging crypto assets.

Click to view current AARK Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0d07...b492fe | 70555.73K | 12.60% |

| 2 | 0x9b64...cf77e5 | 63366.07K | 11.32% |

| 3 | 0xf89d...5eaa40 | 62487.49K | 11.16% |

| 4 | 0xd4eb...da6a6e | 39928.81K | 7.13% |

| 5 | 0x4e23...e68681 | 22489.46K | 4.01% |

| - | Others | 300739.10K | 53.78% |

II. Core Factors Influencing AARK's Future Price

Market Trends and Adoption Rate

- Market Dynamics: AARK's price movement is influenced by broader cryptocurrency market trends, with digital assets exhibiting inherent volatility that can lead to price fluctuations.

- Adoption Patterns: The token's future performance depends on its adoption rate across various use cases and platforms within the blockchain ecosystem.

- Current Impact: Market participants should monitor how increasing or decreasing adoption rates correlate with price movements in the near term.

Macro-Economic Environment

- Global Economic Conditions: International economic factors, including monetary policies and inflation expectations, play a role in shaping investor sentiment toward digital assets like AARK.

- Risk Considerations: As an emerging asset class, AARK carries investment risks associated with high volatility, potentially resulting in value depreciation during unfavorable market conditions.

- Market Sensitivity: Price movements may respond to changes in global liquidity conditions and shifts in risk appetite among institutional and retail investors.

Technical Infrastructure and Ecosystem Development

- DeFi Integration: The broader DeFi ecosystem continues to evolve, with platforms offering decentralized trading, lending, and yield optimization services that could indirectly impact token valuations.

- Blockchain Technology: Advancements in blockchain infrastructure, including improvements in transaction efficiency and cross-chain interoperability, may influence the utility and demand for tokens within the ecosystem.

- Security Framework: The underlying technology's resilience against security threats, such as smart contract vulnerabilities and potential exploits, remains a factor in long-term price stability.

III. 2026-2031 AARK Price Forecast

2026 Outlook

- Conservative Prediction: $0.0009 - $0.00136

- Neutral Prediction: Around $0.00136

- Optimistic Prediction: Up to $0.00178 (requires favorable market conditions and ecosystem development)

2027-2029 Mid-term Outlook

- Market Stage Expectation: AARK may enter a gradual growth phase, with price movements potentially influenced by broader cryptocurrency market cycles and platform adoption rates.

- Price Range Forecast:

- 2027: $0.00124 - $0.00183, with an average around $0.00157 (approximately 15% change from 2026)

- 2028: $0.00146 - $0.00182, with an average around $0.0017 (approximately 25% change from 2026)

- 2029: $0.00114 - $0.00206, with an average around $0.00176 (approximately 29% change from 2026)

- Key Catalysts: Platform feature enhancements, user base expansion, and potential partnerships within the DeFi ecosystem could drive price appreciation.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00128 - $0.00201 in 2030 (assuming steady ecosystem development and market stability)

- Optimistic Scenario: $0.00161 - $0.00219 in 2031 (assuming increased platform adoption and favorable regulatory environment)

- Transformative Scenario: Prices could approach the upper range of $0.00219 (requires significant breakthrough in user adoption, strategic integrations, or major market uptrend)

- 2026-02-08: AARK price forecasts suggest potential growth trajectory with average prices ranging from $0.00136 in 2026 to $0.00196 in 2031, representing approximately 44% cumulative change over the five-year period.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00178 | 0.00136 | 0.0009 | 0 |

| 2027 | 0.00183 | 0.00157 | 0.00124 | 15 |

| 2028 | 0.00182 | 0.0017 | 0.00146 | 25 |

| 2029 | 0.00206 | 0.00176 | 0.00114 | 29 |

| 2030 | 0.00201 | 0.00191 | 0.00128 | 40 |

| 2031 | 0.00219 | 0.00196 | 0.00161 | 44 |

IV. AARK Professional Investment Strategies and Risk Management

AARK Investment Methodology

(I) Long-Term Holding Strategy

- Suitable for: Investors with high risk tolerance seeking exposure to innovative DeFi protocols

- Operational Recommendations:

- Consider accumulating positions during periods of lower volatility, monitoring the token's correlation with broader DeFi market trends

- Evaluate AARK's protocol development progress and liquidity provider adoption rates as key fundamental indicators

- Implement secure storage solutions using non-custodial wallets such as Gate Web3 Wallet to maintain full control over private keys

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume of $17,875.69 relative to market cap to identify potential liquidity shifts

- Support and Resistance Levels: Track the current price of $0.0013576 against recent ranges ($0.0012546 - $0.0013576) to identify short-term trading opportunities

- Swing Trading Considerations:

- Given the token's 24-hour change of 0.77% and 7-day decline of 1.87%, short-term traders should remain cautious of momentum shifts

- Set strict stop-loss orders due to the token's historical volatility range between $0.0002154 and $0.0992

AARK Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 5-10% with active monitoring and hedging strategies

(II) Risk Hedging Solutions

- Portfolio Diversification: Balance AARK exposure with established DeFi blue-chip tokens to reduce protocol-specific risks

- Position Sizing: Limit individual position size based on the token's relatively low market cap of $226,727.72 and liquidity constraints

(III) Secure Storage Solutions

- Software Wallet Recommendation: Gate Web3 Wallet offers convenient access while maintaining security through encrypted private key storage

- Multi-Signature Approach: For larger holdings, consider implementing multi-signature wallet solutions to enhance security protocols

- Security Precautions: Never share private keys, enable two-factor authentication, and regularly update wallet software to protect against emerging threats

V. AARK Potential Risks and Challenges

AARK Market Risks

- High Volatility Exposure: The token has demonstrated extreme price fluctuations, declining 66.23% over the past year from higher levels

- Liquidity Constraints: With a relatively modest 24-hour trading volume of $17,875.69 and listing on only one exchange, large position exits may face slippage challenges

- Market Correlation: As a DeFi-focused token, AARK may experience amplified downside during broader cryptocurrency market corrections

AARK Regulatory Risks

- DeFi Regulatory Uncertainty: Evolving regulatory frameworks for decentralized exchanges and perpetual trading platforms may impact protocol operations

- Jurisdictional Compliance: Changes in cryptocurrency regulations across different regions could affect token accessibility and trading availability

- Leverage Trading Scrutiny: The protocol's focus on high-leverage trading may attract increased regulatory attention regarding investor protection standards

AARK Technical Risks

- Smart Contract Vulnerabilities: Despite protocol innovations, the complex architecture supporting leverage mechanisms introduces potential security attack vectors

- Protocol Dependency: The token's value is closely tied to the success and adoption of the Aark DEX platform and its unique Hyper-Diverse LP model

- Arbitrum Network Reliance: As an Arbitrum-based token, AARK's performance depends on the underlying Layer 2 network's stability and security

VI. Conclusion and Action Recommendations

AARK Investment Value Assessment

AARK represents an innovative approach to decentralized perpetual trading with unique features including support for long-tail assets and feeless leverage opportunities for liquidity providers. However, the token faces significant challenges including limited exchange availability (currently listed on one platform), substantial price depreciation over the past year, and a relatively small market capitalization of $226,727.72. The circulating supply represents only 16.70% of total supply, suggesting potential future token unlocks. While the protocol's technological innovations in the DeFi space show promise, investors should weigh these potential benefits against considerable market volatility and liquidity risks.

AARK Investment Recommendations

✅ Beginners: Approach with extreme caution; consider allocating no more than 1% of crypto portfolio after thorough research into DeFi mechanisms and perpetual trading concepts ✅ Experienced Investors: May consider small speculative positions (2-3% allocation) while actively monitoring protocol development milestones and liquidity provider growth metrics ✅ Institutional Investors: Conduct comprehensive due diligence on smart contract audits, team credentials, and competitive positioning before considering any allocation to this micro-cap DeFi protocol

AARK Trading Participation Methods

- Spot Trading: Purchase AARK tokens through available exchange platforms, monitoring order book depth to minimize slippage on larger orders

- DCA Strategy: Implement dollar-cost averaging to reduce timing risk, given the token's current 30-day decline of 9.41%

- Liquidity Provision: Advanced users may explore participating as liquidity providers on the Aark platform itself, subject to understanding impermanent loss and protocol-specific risks

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is AARK? What are its uses and value?

AARK is the native token of Aark decentralized exchange, enabling governance and trading. It powers low-fee perpetual contracts with up to 1000x leverage. AARK holders gain platform governance rights and benefit from sustainable token economics.

How to predict AARK price? What are the analysis methods?

AARK price prediction uses technical and fundamental analysis. Technical methods include moving averages, RSI, and chart patterns. Fundamental analysis examines project development, trading volume, and market demand. Combine multiple indicators for comprehensive predictions.

What is AARK's historical price trend and current price?

AARK's all-time high reached $0.09894 and all-time low was $0.0002333. Currently trading significantly below its peak. As of February 8, 2026, AARK shows strong recovery potential with improved market fundamentals.

What are the risks of investing in AARK and what should I pay attention to?

AARK carries high volatility risk due to exposure to small-cap, less liquid stocks. During market downturns, it may experience significant price declines. Limit your position to no more than 10% of your portfolio to manage risk effectively.

What are the key differences between AARK and other similar tokens?

AARK features a fixed supply of 100 million tokens, differentiating it from competitors with larger supplies. As an emerging AI platform, AARK offers innovative solutions compared to mature oracle networks. Its distinctive tokenomics and ecosystem positioning provide unique value proposition in the decentralized infrastructure space.

What are the future development prospects and price expectations for AARK?

AARK Token is expected to grow at approximately 5% annually in the coming years. Price movements will be influenced by market demand, adoption trends, institutional participation, and broader economic factors. While 2027 projections remain uncertain, the token shows positive long-term potential based on current market fundamentals.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

How To Use Beefy Finance

What is Blum and How to Earn with It

Byzantine Fault Tolerance Explained

What is Ergo? A Combination of Bitcoin and Ethereum

7 Strategies to Generate Passive Income Using Crypto Assets