2026 ADAPAD Price Prediction: Expert Analysis and Market Outlook for the Next Generation DeFi Token

Introduction: ADAPAD's Market Position and Investment Value

ADAPad (ADAPAD), as a token launch platform on Cardano featuring deflationary mechanisms, has been navigating the cryptocurrency landscape since its inception in 2021. As of February 6, 2026, ADAPAD maintains a market capitalization of approximately $448,135, with a circulating supply of around 371.28 million tokens, and the price hovering near $0.001207. This asset, characterized by its deflationary tokenomics tied to sales, unlocking events, and IDO participation, is gradually establishing its presence in the decentralized fundraising ecosystem.

This article will comprehensively analyze ADAPAD's price trends from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. ADAPAD Price History Review and Market Status

ADAPAD Historical Price Evolution Trajectory

- October 2021: ADAPAD reached a notable price level of $1.28 during the bull market cycle, reflecting strong market interest in Cardano-based launchpad platforms

- 2022-2025: The token experienced a prolonged correction phase alongside broader market downturns, with prices declining from peak levels as market conditions evolved

- February 2026: Price reached $0.00120049, marking a significant retracement from previous highs as market dynamics shifted

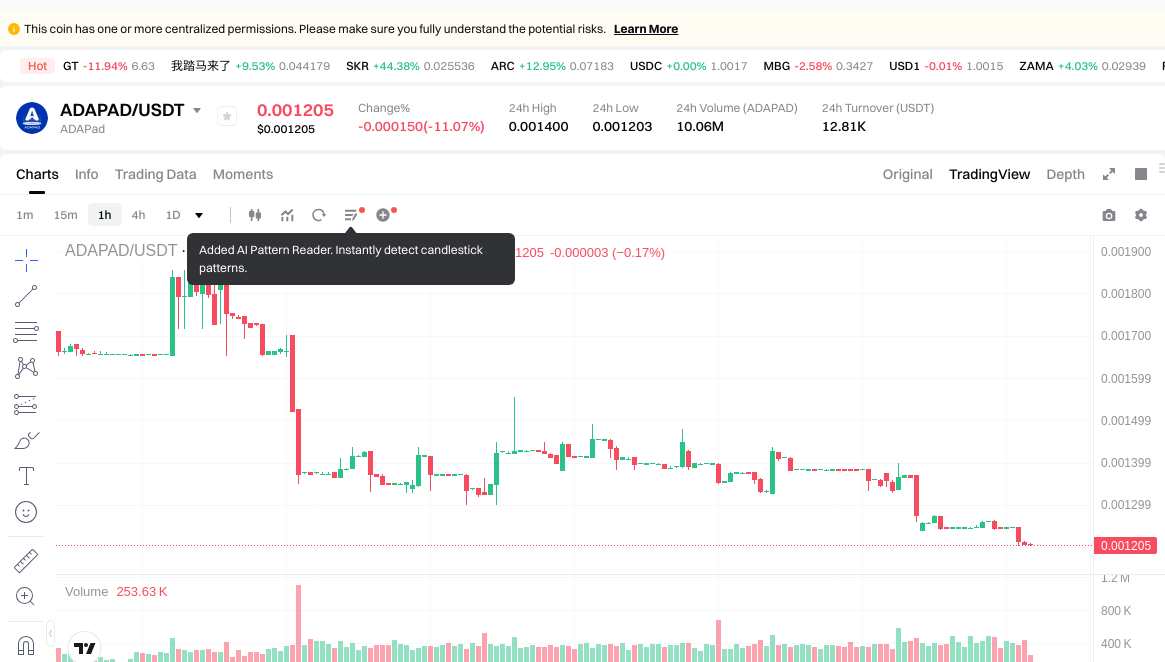

ADAPAD Current Market Status

As of February 6, 2026, ADAPAD is trading at $0.001207, showing recent price movements across multiple timeframes. The token has experienced a decline of 0.74% over the past hour and 10.92% over the past 24 hours. Weekly performance shows a 30.99% decrease, while the 30-day trend reflects a 29.90% decline. The annual performance indicates a 63.29% reduction from year-ago levels.

The 24-hour trading range spans from $0.001203 to $0.0014, with total trading volume reaching $12,789.44. The current market capitalization stands at approximately $448,135, with a circulating supply of 371,280,438 ADAPAD tokens representing 37.13% of the total supply of 371,281,061 tokens. The maximum supply is capped at 1 billion tokens.

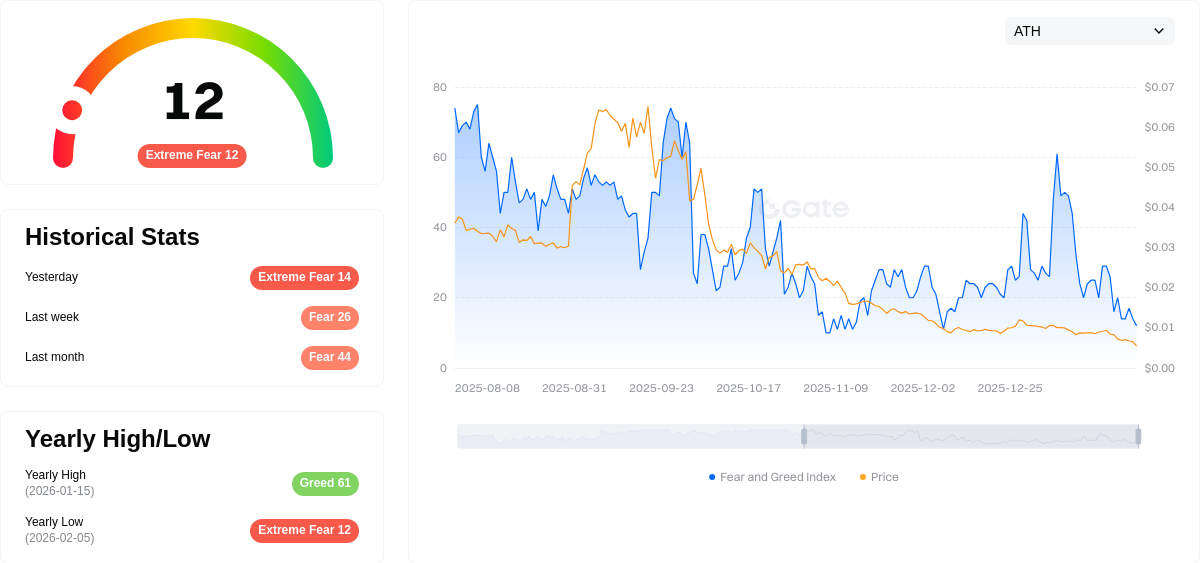

ADAPAD maintains a market dominance of 0.000019% within the broader cryptocurrency landscape. The token has attracted 14,927 holders across its smart contract deployments on Ethereum and BSC networks. Market sentiment indicators reflect an Extreme Fear reading with a volatility index of 12.

Click to view current ADAPAD market price

ADAPAD Market Sentiment Indicator

2026-02-05 Fear and Greed Index: 12 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear, with the Fear and Greed Index dropping to 12. This historically low reading suggests significant market pessimism and panic selling. When fear reaches such extremes, it often presents contrarian opportunities for long-term investors, as markets tend to overshoot downside. However, caution remains warranted until stabilization signals emerge. Monitor key support levels closely and consider your risk tolerance before making investment decisions during this volatile period.

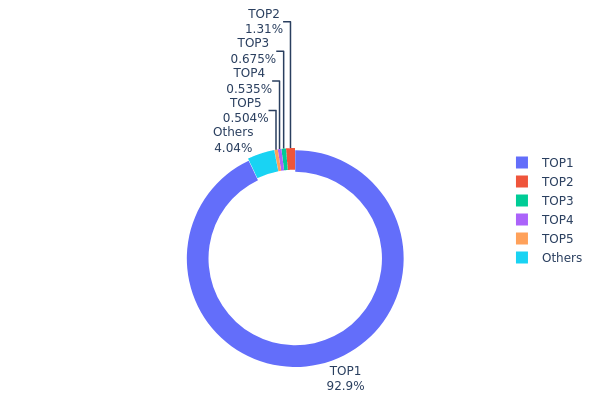

ADAPAD Holding Distribution

The holding distribution chart illustrates the concentration of token ownership across different wallet addresses, serving as a critical indicator of decentralization and market structure. By examining how tokens are allocated among top holders and smaller participants, analysts can assess the potential for price manipulation, market stability, and the overall health of the token's ecosystem.

Current data reveals an extremely concentrated holding pattern for ADAPAD, with the top address (0x5880...c9c532) controlling 312,690.98K tokens, representing 92.93% of the total supply. This overwhelming concentration in a single wallet raises significant concerns about centralization. The second-largest holder possesses only 1.31%, while the remaining top five addresses collectively hold less than 3% of the supply. Such distribution indicates that approximately 93% of circulating tokens are controlled by a single entity, which could be a treasury wallet, liquidity pool, or institutional holder.

This highly centralized structure presents both opportunities and risks for market participants. The dominant holder's trading decisions could trigger substantial price volatility, as large-scale transfers or sales would significantly impact liquidity and market depth. Additionally, the concentration limits the token's decentralization benefits and may expose investors to heightened manipulation risks. The minimal holdings among other addresses (4.06% distributed across all remaining participants) suggest limited retail participation and potentially shallow market liquidity. For investors, monitoring the activities of the primary holder becomes essential for understanding price movements and assessing near-term market dynamics.

Click to view current ADAPAD Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5880...c9c532 | 312690.98K | 92.93% |

| 2 | 0x82cb...c64362 | 4418.50K | 1.31% |

| 3 | 0x0d07...b492fe | 2270.79K | 0.67% |

| 4 | 0xa698...879f2f | 1800.00K | 0.53% |

| 5 | 0xd2ff...722c66 | 1695.37K | 0.50% |

| - | Others | 13598.22K | 4.06% |

II. Core Factors Influencing ADAPAD's Future Price

Supply Mechanism

- Deflationary Model: ADAPAD implements a deflationary tokenomics structure with a total supply of 1,000,000,000 tokens and a circulating supply of 67,000,000 tokens, creating potential scarcity dynamics.

- Historical Pattern: Supply constraints have historically contributed to price volatility, with limited circulation enhancing sensitivity to demand fluctuations.

- Current Impact: The deflationary mechanism may support price appreciation as adoption increases, though market forces remain the primary determinant.

Institutional and Major Holder Dynamics

- Institutional Positioning: Information regarding specific institutional holdings was not available in the provided materials.

- Enterprise Adoption: The project's integration within the Cardano ecosystem positions it for potential enterprise-level applications, though specific corporate adoption cases were not detailed.

- Regulatory Environment: Cryptocurrency regulatory developments across multiple jurisdictions continue to shape market conditions, with policy clarity potentially influencing institutional participation.

Macroeconomic Environment

- Monetary Policy Impact: Global central bank policies and interest rate trends affect capital flows into digital assets, with risk appetite fluctuating based on monetary conditions.

- Inflation Hedge Characteristics: As part of the broader cryptocurrency market, ADAPAD may serve as an alternative asset during periods of currency devaluation, though performance varies with market sentiment.

- Geopolitical Factors: International economic dynamics and regulatory stances toward digital assets create both opportunities and challenges for cryptocurrency valuations.

Technical Development and Ecosystem Building

- Cardano Integration: ADAPAD's connection to the Cardano network provides access to a mature smart contract platform and growing DeFi infrastructure.

- DeFi Ecosystem Expansion: The project's positioning within decentralized finance creates potential for increased utility as the sector develops.

- Application Development: Ecosystem growth depends on the adoption of decentralized applications and protocols utilizing ADAPAD within the Cardano environment.

III. 2026-2031 ADAPAD Price Forecast

2026 Outlook

- Conservative estimate: $0.00094 - $0.00121

- Neutral estimate: $0.00121 (average scenario)

- Optimistic estimate: $0.00154 (requires favorable market conditions)

2027-2029 Outlook

- Market phase expectation: The token may experience gradual growth momentum as the ecosystem develops and adoption increases

- Price range forecast:

- 2027: $0.00084 - $0.00152, with an average price around $0.00137

- 2028: $0.00100 - $0.00157, showing approximately 20% growth

- 2029: $0.00099 - $0.00222, potentially reaching 24% growth year-over-year

- Key catalysts: Platform development milestones, partnership announcements, and broader market recovery cycles could serve as primary price drivers

2030-2031 Long-term Outlook

- Baseline scenario: $0.00138 - $0.00197 (assuming steady ecosystem growth and stable market conditions)

- Optimistic scenario: $0.00173 - $0.00236 (assuming accelerated adoption and favorable regulatory environment)

- Transformative scenario: Potential to exceed $0.00236 (requires breakthrough technological advancements and widespread institutional adoption)

- 2026-02-06: ADAPAD trading within the early-year projected range, establishing foundation for potential multi-year growth trajectory

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00154 | 0.00121 | 0.00094 | 0 |

| 2027 | 0.00152 | 0.00137 | 0.00084 | 13 |

| 2028 | 0.00157 | 0.00145 | 0.001 | 20 |

| 2029 | 0.00222 | 0.00151 | 0.00099 | 24 |

| 2030 | 0.00197 | 0.00186 | 0.00138 | 54 |

| 2031 | 0.00236 | 0.00192 | 0.00173 | 58 |

IV. ADAPAD Professional Investment Strategy and Risk Management

ADAPAD Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Investors who believe in the Cardano ecosystem's long-term growth potential and are willing to tolerate short-term volatility

- Operational Recommendations:

- Consider accumulating positions during market downturns, as ADAPAD has experienced significant price corrections from its all-time high

- Establish a dollar-cost averaging plan to mitigate timing risk, given the token's current price volatility with a 24-hour change of -10.92%

- Storage Solution: Utilize Gate Web3 Wallet for secure storage with multi-signature protection and cold storage options for large holdings

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Monitor 7-day and 30-day trends; current data shows -30.99% and -29.90% respectively, indicating sustained downward pressure

- Volume Analysis: Track 24-hour trading volume ($12,789.44) relative to market cap ($448,135.49) to identify potential reversal signals

- Swing Trading Key Points:

- Pay attention to the 24-hour price range between $0.001203 and $0.0014 to identify support and resistance levels

- Consider the token's deflationary mechanism which includes 10% fees on token sales and up to 25% early unlock fees as potential price catalysts

ADAPAD Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 8% with active hedging strategies

(2) Risk Hedging Solutions

- Stablecoin Reserve: Maintain 30-50% of crypto holdings in stablecoins to capitalize on potential accumulation opportunities

- Stop-loss Orders: Set stop-loss levels at 15-20% below entry price given the token's high volatility

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading with built-in security features and convenient access

- Cold Storage Solution: Hardware wallet storage for long-term holdings exceeding $1,000

- Security Precautions: Enable two-factor authentication, never share private keys, verify contract addresses (ETH: 0xDB0170e2d0c1CC1b2E7a90313d9B9afA4f250289, BSC: 0xDB0170e2d0c1CC1b2E7a90313d9B9afA4f250289) before transactions

V. ADAPAD Potential Risks and Challenges

ADAPAD Market Risks

- Extreme Price Volatility: The token has declined 63.29% over the past year and reached its all-time low of $0.00120049 on February 6, 2026, indicating sustained selling pressure

- Limited Liquidity: With a 24-hour trading volume of only $12,789.44 and market cap of $448,135.49, large orders may experience significant slippage

- Low Market Cap Vulnerability: At a market cap ranking of 3088 and 0.000019% market dominance, the token is susceptible to manipulation and extreme volatility

ADAPAD Regulatory Risks

- Launchpad Platform Scrutiny: Token issuance platforms may face increased regulatory oversight regarding securities laws and investor protection requirements

- Cardano Ecosystem Dependency: Any regulatory challenges facing the Cardano network could negatively impact ADAPAD's operational environment

- Geographic Restrictions: Potential limitations on IDO participation in certain jurisdictions may reduce platform utility and token demand

ADAPAD Technical Risks

- Smart Contract Vulnerabilities: Despite audits, potential bugs or exploits in the platform's smart contracts could lead to fund losses

- Platform Adoption Risk: With 14,927 holders, the relatively limited user base may indicate challenges in platform traction and ecosystem growth

- Deflationary Mechanism Effectiveness: The sustainability of the 10% sales fee and 25% early unlock penalty may be tested during prolonged bear markets

VI. Conclusion and Action Recommendations

ADAPAD Investment Value Assessment

ADAPAD presents as a high-risk, potentially high-reward opportunity within the Cardano ecosystem's launchpad sector. The token's deflationary mechanics, including fees on sales and early unlocks, provide a unique value proposition. However, the current market conditions reflect significant challenges: the token trades near its all-time low with a market cap-to-FDV ratio of 37.13%, indicating substantial circulating supply concerns. The 63.29% annual decline and persistent downward pressure across all timeframes suggest caution is warranted. Long-term value depends on successful platform adoption, quality project launches, and broader Cardano ecosystem growth.

ADAPAD Investment Recommendations

✅ Beginners: Avoid or allocate no more than 0.5-1% of your crypto portfolio, only after thoroughly understanding the risks and platform mechanics ✅ Experienced Investors: Consider small speculative positions (2-3%) with strict stop-loss orders; focus on technical support levels and deflationary event catalysts ✅ Institutional Investors: Conduct comprehensive due diligence on platform fundamentals, team backgrounds, and upcoming IDO pipeline before considering strategic allocation

ADAPAD Trading Participation Methods

- Spot Trading on Gate.com: Direct purchase and trading with access to ADAPAD/USDT pairs and advanced trading tools

- Dollar-Cost Averaging: Establish systematic purchase plans to accumulate positions gradually during market downturns

- IDO Participation: Hold ADAPAD tokens to gain priority access to token launches on the ADAPad platform, potentially generating additional returns

Cryptocurrency investment carries extreme risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is ADAPAD? What is its purpose?

ADAPad is a launchpad platform built on the Cardano blockchain, enabling token holders to participate in initial DEX offerings. It provides powerful technology to enhance Cardano's ecosystem and facilitate early-stage token launches.

What is the historical price trend of ADAPAD?

ADAPAD has experienced price fluctuations throughout its trading history. In early September 2025, the token traded around $0.0027, showing volatility in the market. The cryptocurrency has demonstrated dynamic price movements influenced by market conditions and investor sentiment.

What is the current price of ADAPAD?

ADAPad is currently trading at $0.001421, down 20.81% in the last 24 hours. This reflects the latest market data for ADAPAD.

What will be the ADAPAD price prediction for 2024?

ADAPad is projected to fluctuate between $0.000177 and $0.001455 in 2026. Cryptocurrency markets are highly volatile, and predictions may not account for extreme price swings. These forecasts are based on current market trends.

What are the main factors affecting ADAPAD price?

ADAPAD price is primarily influenced by supply and demand dynamics, market sentiment driven by news and social media, regulatory developments such as ETF approvals, institutional adoption rates, and macroeconomic trends including inflation and interest rates. These factors collectively determine ADAPAD's price movement and market outlook.

What risks should I pay attention to when investing in ADAPAD?

ADAPAD is a high-risk asset with significant price volatility. Market fluctuations are unpredictable and could result in substantial losses. Investors must conduct thorough research and only invest what they can afford to lose.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

What Do NGMI and WAGMI Mean in Crypto?

What Is a Physical Bitcoin and What Is Its Worth?

What is crypto scalping and how does it work

Meme coins are making headlines—are you a dog person or a cat person? Which is the better buy?

What is blockchain in simple terms