2026 APRS Price Prediction: Expert Analysis and Market Forecast for the Next Generation of Digital Asset Trading

Introduction: APRS Market Position and Investment Value

Apeiron (APRS), as a pioneering Web3 gaming token that merges god simulation mechanics with roguelike adventure elements, has been carving its niche in the blockchain gaming sector since its launch in 2024. As of February 2026, APRS maintains a market capitalization of approximately $218,079, with a circulating supply of around 197.71 million tokens, trading at approximately $0.001103. This asset, characterized as a "play-to-earn strategic gaming token," is playing an increasingly significant role in the Web3 gaming ecosystem and NFT marketplace integration.

This article will comprehensively analyze APRS price trends from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasting and practical investment strategies.

I. APRS Price History Review and Current Market Status

APRS Historical Price Evolution Trajectory

- 2024: Project launched in April with an initial price of $0.15, reaching an all-time high of $0.7901 on May 24, 2024, demonstrating strong early market interest.

- 2025: Market entered a correction phase, with the price declining substantially from its peak, reaching an all-time low of $0.001001 on December 4, 2025.

- 2026: As of February 8, 2026, the token is trading at $0.001103, showing signs of recovery from its historical low.

APRS Current Market Status

As of February 8, 2026, APRS is trading at $0.001103, with a market capitalization of approximately $218,080 and a fully diluted market cap of $1,103,000. The token's circulating supply stands at 197,714,888 APRS, representing 19.77% of the maximum supply of 1 billion tokens.

Recent price movements show mixed signals across different timeframes. The token experienced a 3.86% increase over the past hour and a 3.08% gain over the past seven days. However, the 24-hour performance shows a decline of 3.75%, with the price fluctuating between $0.001018 and $0.00115. The 30-day and 1-year performances indicate significant downward pressure, with declines of 82% and 97.46% respectively.

The 24-hour trading volume stands at approximately $8,173, reflecting modest market activity. With only 877 token holders and trading available on a limited number of exchanges, the token maintains a relatively small market presence. APRS currently ranks #3,841 in the cryptocurrency market with a market dominance of 0.000043%.

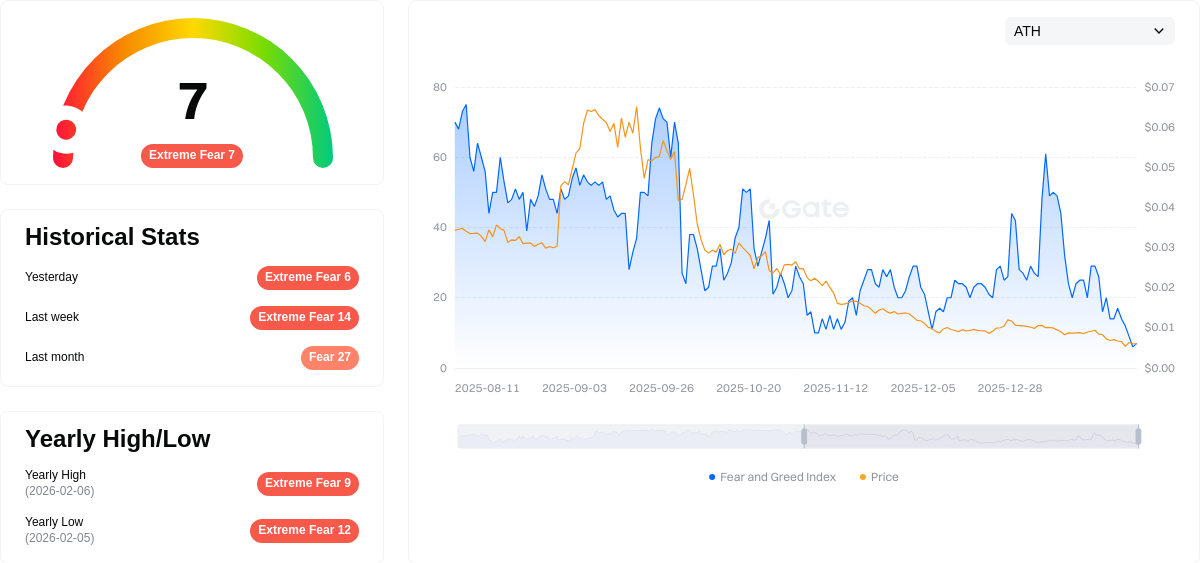

The market sentiment index currently registers at 7 on the fear and greed scale, indicating extreme fear conditions in the broader cryptocurrency market. This sentiment may be influencing short-term price movements and investor behavior regarding APRS.

Click to view the current APRS market price

APRS Market Sentiment Index

2026-02-08 Fear and Greed Index: 7 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at a critically low level of 7. This indicates intense market pessimism and heightened selling pressure across digital assets. When the index reaches such extreme levels, it often signals potential capitulation in the market. Experienced investors typically view this as a contrarian indicator, suggesting possible accumulation opportunities for long-term positioned traders. However, caution remains warranted as markets may continue testing lower support levels before stabilizing. Monitor key technical levels and macroeconomic factors closely during this volatile period.

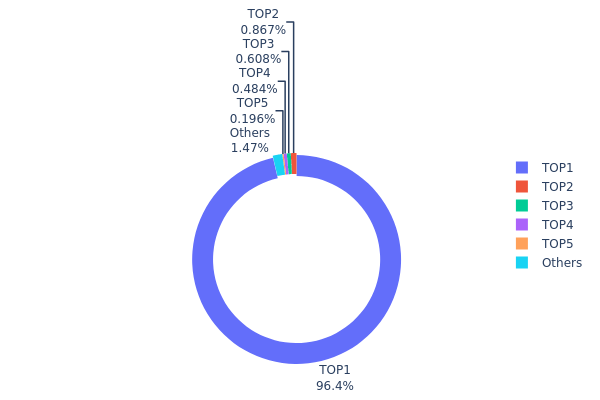

APRS Holding Distribution

The holding distribution chart reveals the allocation of token supply across different wallet addresses, serving as a crucial indicator of market decentralization and potential concentration risks. Based on the current data, APRS exhibits an extremely high concentration pattern, with the top holder controlling 963,721.46K tokens, representing 96.37% of the total supply. This singular address dominates the entire token ecosystem, while the second through fifth largest holders collectively account for merely 2.13% of circulation. The remaining addresses categorized as "Others" hold only 1.5%, indicating minimal distribution among retail participants.

Such extreme centralization poses significant structural concerns for APRS's market dynamics. The overwhelming dominance of a single entity creates substantial vulnerability to price manipulation and liquidity shocks, as any movement from the primary holder could trigger dramatic market reactions. This concentration pattern suggests either centralized exchange custody, project treasury reserves, or potentially locked liquidity provisions rather than organic market distribution. The minimal presence of diverse mid-tier holders reflects limited decentralization progress, which may deter institutional participation and reduce market resilience during volatility periods.

From a chain structure perspective, this distribution profile indicates an immature token economy with weak decentralization fundamentals. While concentrated holdings might provide short-term price stability through reduced selling pressure, they fundamentally compromise the project's censorship resistance and community-driven governance principles that typically characterize healthy blockchain ecosystems.

Click to view current APRS Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5882...fe97b1 | 963721.46K | 96.37% |

| 2 | 0xf89d...5eaa40 | 8670.96K | 0.86% |

| 3 | 0xeab4...6bdc15 | 6079.99K | 0.60% |

| 4 | 0xa461...705867 | 4844.51K | 0.48% |

| 5 | 0x5077...bab2f6 | 1955.63K | 0.19% |

| - | Others | 14727.45K | 1.5% |

II. Core Factors Influencing APRS's Future Price

Supply Mechanism

-

Token Distribution Model: APRS employs a total supply of 1 billion tokens. Approximately 500 million tokens were allocated to the team and investors, with the remaining supply distributed quarterly to NFT holders and top-ranked competitive players. The release schedule appears relatively gradual, potentially minimizing major selling pressure.

-

Consumption Scenarios: The token features built-in utility mechanisms. Players need to consume APRS tokens for breeding new planets, minting apostles, and purchasing in-game items. This creates organic demand that may help balance token supply dynamics.

-

Historical Impact: Based on available information, early Token Generation Event (TGE) participants acquired tokens at approximately $0.11, representing an 8x increase from initial cost basis at previous peak prices around $1.83.

Ecosystem Adoption and Community Engagement

-

Ronin Ecosystem Integration: Following migration to the Ronin network in December 2023, Apeiron has consistently maintained a top-3 position in daily active users on the chain. Recent weekly active user numbers reached 4 times those of Axie Infinity, demonstrating strong community traction within the Ronin ecosystem.

-

Gaming Guild Partnerships: The project secured cooperation agreements with 22 blockchain gaming guilds. Major guilds including YGG, GuildFi, and Ancient8 participated in the seed round financing, reflecting industry confidence in the project's potential.

-

Platform Expansion: The game launched on the Epic Games platform, with mobile client releases planned for 2024, potentially expanding the user base significantly.

Competitive Dynamics and Player Retention

-

Gameplay Complexity: Apeiron integrates multiple game mechanics including god simulation, RPG, card-based combat, and NFT elements. This sophisticated design creates high competitive appeal but also raises entry barriers for new players.

-

Anti-Cheat Measures: Community feedback indicates concerns about inadequate anti-cheat systems since public beta launch. The prevalence of cheating could impact player retention and long-term value proposition. Effective resolution of this issue represents a critical factor for sustainable growth.

-

Esports Potential: The development team includes members with over 4 years of esports experience. Plans to establish competitive tournaments may enhance community engagement and create additional value drivers.

Institutional and Market Support

-

Seed Round Financing: Apeiron completed a seed funding round in April 2022, raising $13.5 million with $10 million led by Hashed, one of Asia's largest blockchain investment firms. Hashed's track record includes successful investments in Axie Infinity and The Sandbox.

-

Market Recognition: The substantial institutional backing validates the project's innovation model and market potential, though this does not guarantee future performance.

Technical Development and Ecosystem Building

-

Three-Token Economic Model: The project implements a complex tri-token system including Apeiros (APRS), Anima, and Ringularity (RINGU). Each token serves distinct functions from governance to rewards and specific gameplay mechanics, adding economic complexity.

-

Play-to-Earn Mechanisms: Anima tokens can be earned through completing quests or winning ranked matches. The team plans to dynamically adjust token consumption in celestial breeding to maintain healthy supply-demand balance.

-

Planet Breeding System: The game features a unique "Celestial Union" mechanism where planets can breed new offspring, creating potential for thousands of new entities from an initially limited NFT supply.

-

Multi-Mode Gameplay: The platform offers PvE dungeons, PvP competitive arenas, GvG guild battles, and simulation management modes, providing diverse engagement opportunities that may support sustained player interest.

III. 2026-2031 APRS Price Forecast

2026 Outlook

- Conservative Prediction: $0.00105 - $0.0011

- Neutral Prediction: Around $0.0011

- Optimistic Prediction: Up to $0.00161 (requiring favorable market sentiment and enhanced adoption)

2027-2029 Mid-term Outlook

- Market Phase Expectation: Gradual recovery and stabilization phase with moderate growth momentum as the project potentially expands its ecosystem presence

- Price Range Forecast:

- 2027: $0.00095 - $0.00156, with average trading around $0.00136

- 2028: $0.0014 - $0.00172, with average trading around $0.00146

- 2029: $0.0013 - $0.00172, with average trading around $0.00159

- Key Catalysts: Sustained user adoption, potential technological developments within the APRS ecosystem, and overall cryptocurrency market recovery trends

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00091 - $0.00188 in 2030 (assuming steady ecosystem growth and stable market conditions)

- Optimistic Scenario: $0.00165 - $0.00262 by 2031 (supported by significant protocol upgrades or broader market adoption)

- Transformative Scenario: Approaching $0.00262 (under conditions of exceptional market momentum and widespread integration)

- February 8, 2026: APRS trading within the projected range of $0.00105 - $0.00161 (early-stage price discovery phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00161 | 0.0011 | 0.00105 | 0 |

| 2027 | 0.00156 | 0.00136 | 0.00095 | 23 |

| 2028 | 0.00172 | 0.00146 | 0.0014 | 32 |

| 2029 | 0.00172 | 0.00159 | 0.0013 | 44 |

| 2030 | 0.00188 | 0.00165 | 0.00091 | 49 |

| 2031 | 0.00262 | 0.00177 | 0.00165 | 60 |

IV. APRS Professional Investment Strategy and Risk Management

APRS Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors who believe in the long-term potential of blockchain gaming and Web3 gaming ecosystems

- Operational Recommendations:

- Consider accumulating positions during periods of market correction, given APRS has experienced significant price decline of approximately 97.46% from its all-time high

- Monitor project development milestones and ecosystem growth indicators on the Ronin blockchain

- Utilize secure storage solutions such as Gate Web3 Wallet for asset custody and management

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Current 24-hour trading volume of approximately $8,172 suggests relatively limited liquidity, which may impact execution of larger orders

- Price Range Monitoring: Recent 24-hour price range between $0.001018 and $0.00115 provides reference points for short-term trading decisions

- Swing Trading Considerations:

- The token shows moderate short-term volatility with 1-hour change of 3.86% and 7-day change of 3.08%

- Consider the low circulating supply ratio of approximately 19.77% when planning position sizing

APRS Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: Allocation should not exceed 1-2% of total crypto portfolio given the token's high volatility

- Aggressive Investors: May consider 3-5% allocation within gaming and Web3 sector exposure

- Professional Investors: Could allocate 5-8% with active risk monitoring and hedging strategies

(II) Risk Hedging Solutions

- Diversification Strategy: Balance APRS exposure with other blockchain gaming tokens and established cryptocurrencies

- Position Sizing: Implement strict position limits based on market capitalization of approximately $218,079 and limited exchange availability

(III) Secure Storage Solutions

- Hot Wallet Option: Gate Web3 Wallet provides convenient access for active trading while maintaining security protocols

- Cold Storage Plan: For long-term holdings, consider transferring assets to hardware wallets with proper backup procedures

- Security Precautions: Never share private keys, enable two-factor authentication, and verify contract addresses (0x95b4B8CaD3567B5d7EF7399C2aE1d7070692aB0D on Ethereum) before transactions

V. APRS Potential Risks and Challenges

APRS Market Risks

- Liquidity Risk: With current 24-hour trading volume of approximately $8,172 and availability on limited exchanges, the token may experience significant slippage during larger transactions

- Volatility Risk: The token has demonstrated extreme price volatility, declining approximately 82% over 30 days and 97.46% over one year from its historical high of $0.7901

- Market Cap Risk: With a relatively small market capitalization of approximately $218,079 and market dominance of 0.000043%, the token is susceptible to significant price fluctuations from modest trading activity

APRS Regulatory Risks

- Gaming Token Classification: Blockchain gaming tokens may face evolving regulatory frameworks regarding their classification as securities or utility tokens in various jurisdictions

- Play-to-Earn Model Scrutiny: Regulatory bodies in different regions may implement restrictions on play-to-earn gaming models and related token economics

- Cross-border Compliance: Operating on blockchain infrastructure requires adherence to diverse regulatory requirements across multiple jurisdictions

APRS Technical Risks

- Smart Contract Risk: Despite deployment on Ethereum network, smart contract vulnerabilities could potentially impact token functionality and security

- Blockchain Dependency: The project's reliance on Ronin blockchain infrastructure means any technical issues or security concerns with the underlying blockchain could affect APRS ecosystem

- Token Economics Complexity: The three-token system mentioned in the project design requires careful balance and management to maintain sustainable economic model

VI. Conclusion and Action Recommendations

APRS Investment Value Assessment

APRS represents a project combining blockchain gaming with play-to-earn mechanics built on Ronin blockchain infrastructure. The token currently trades at approximately $0.001103, which represents a substantial decline from its historical high. While the project offers strategic card-based gameplay and guild competition features, investors should carefully weigh the significant price depreciation, limited liquidity, and concentrated market presence against potential future ecosystem development. The low circulating supply ratio of approximately 19.77% presents both opportunity and risk depending on future token release schedules.

APRS Investment Recommendations

✅ Beginners: Consider starting with educational research about blockchain gaming sector before committing capital; if investing, limit exposure to very small percentage of portfolio and use only funds you can afford to lose entirely

✅ Experienced Investors: May explore small speculative position as part of diversified blockchain gaming portfolio; monitor project development milestones, community engagement metrics, and potential exchange listing announcements

✅ Institutional Investors: Conduct thorough due diligence on project fundamentals, token distribution schedule, and competitive positioning within Web3 gaming landscape before considering allocation

APRS Trading Participation Methods

- Spot Trading: Available on Gate.com with ETH contract address 0x95b4B8CaD3567B5d7EF7399C2aE1d7070692aB0D

- Wallet Management: Utilize Gate Web3 Wallet for integrated trading and secure storage functionality

- Research Resources: Review project whitepaper at https://whitepaper.apeironnft.com/ and monitor official communications via project website and social channels

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is APRS and what is its purpose?

APRS is a decentralized cryptocurrency token designed for real-time data sharing and tracking applications. It enables secure transactions, decentralized governance, and serves as utility within blockchain-based tracking and information systems, offering users enhanced privacy and transparency in data management.

What is the current price of APRS? How has the historical price trend been?

APRS is currently trading at $0.001109 USD. The token has shown volatility in its price movement. For detailed historical trends and chart analysis, please refer to real-time market data and price tracking tools to monitor APRS performance over different timeframes.

What is the 2024 APRS price prediction?

Based on market analysis, APRS showed significant volatility with an all-time high of $1.89 in March 2024. Current price fluctuates around $0.001-0.001149, indicating substantial corrections from peak levels. Future performance depends on ecosystem development and market sentiment recovery.

What are the main factors affecting APRS price?

Key factors include market speculation, trading volume, investor sentiment, regulatory changes, and macroeconomic conditions. Speculation drives significant price movements, while increased trading activity typically amplifies volatility.

APRS and other similar assets compared, what advantages or disadvantages does it have?

APRS offers decentralized governance where players vote on game development, providing stronger community control than traditional assets. However, it may experience higher market volatility compared to more established cryptocurrencies.

What are the risks to pay attention to when investing in APRS?

APRS carries significant price volatility risk that may result in loss of principal. Investors bear full responsibility for their investment decisions. Market risks cannot be ignored, and there is no guarantee of capital recovery.

What do technical and fundamental analysis of APRS indicate?

APRS technical analysis shows strong internal consistency across key metrics. Fundamentally, the asset demonstrates solid performance in achievement indicators, impulse control mechanisms, and learning efficiency factors, suggesting robust underlying utility and sustainable growth potential.

What do professional analysts think about APRS's future prospects?

Professional analysts predict APRS will maintain steady growth due to increasing demand in renewable energy sectors. Market trends suggest strong future potential. Analysts highlight innovation and government support as key drivers.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

Top 8 Cryptocurrency Exchanges for Lowest Trading Fees

What is mobile mining, and can you earn income with it

Stochastic RSI Indicates Bitcoin Price Bottom

Comprehensive Guide to Creating and Selling NFT Tokens

Comprehensive Guide to Blockchain Technology and Applications in Thailand