2026 B3X Price Prediction: Expert Analysis and Market Forecast for the Next Generation Digital Asset

Introduction: B3X Market Position and Investment Value

Bnext (B3X), positioned as a pioneering Web 3.0 financial platform connecting Europe and Latin America, has demonstrated its commitment to blockchain-based innovation since launching its token in March 2022. As of February 2026, B3X maintains a market capitalization of approximately $229,784 with a circulating supply of around 1.76 billion tokens, trading at roughly $0.0001303. This asset, recognized for its utility-driven approach within cross-border remittance solutions, continues to play a role in the evolving landscape of blockchain-enabled financial services.

This article provides a comprehensive analysis of B3X's price trajectory from 2026 through 2031, examining historical patterns, market supply-demand dynamics, ecosystem developments, and broader macroeconomic factors to offer professional price forecasts and practical investment strategies for interested market participants.

I. B3X Price History Review and Market Status

B3X Historical Price Evolution Trajectory

- 2022: Launched IEO in March 2022 as Spain's second-largest token and the first financial platform to issue tokens, reached historical high of $0.02009271 in October

- 2023-2025: Experienced significant market adjustments, price gradually declined from previous highs

- 2026: Price continued to face downward pressure, dropping to historical low of $0.00013001 in early February

B3X Current Market Situation

As of February 8, 2026, B3X is trading at $0.0001303 with a 24-hour trading volume of $17,994.93. The token shows a modest 1-hour increase of 0.22%, while experiencing declines across longer timeframes: down 1.66% over 7 days, 21.8% over 30 days, and 59.98% over the past year.

The current market capitalization stands at $229,784.05, with 1.76 billion tokens in circulation, representing 50.39% of the total supply of 3.5 billion tokens. The fully diluted market cap is $456,050, and B3X holds a market share of 0.000018%. The token is currently listed on 2 exchanges.

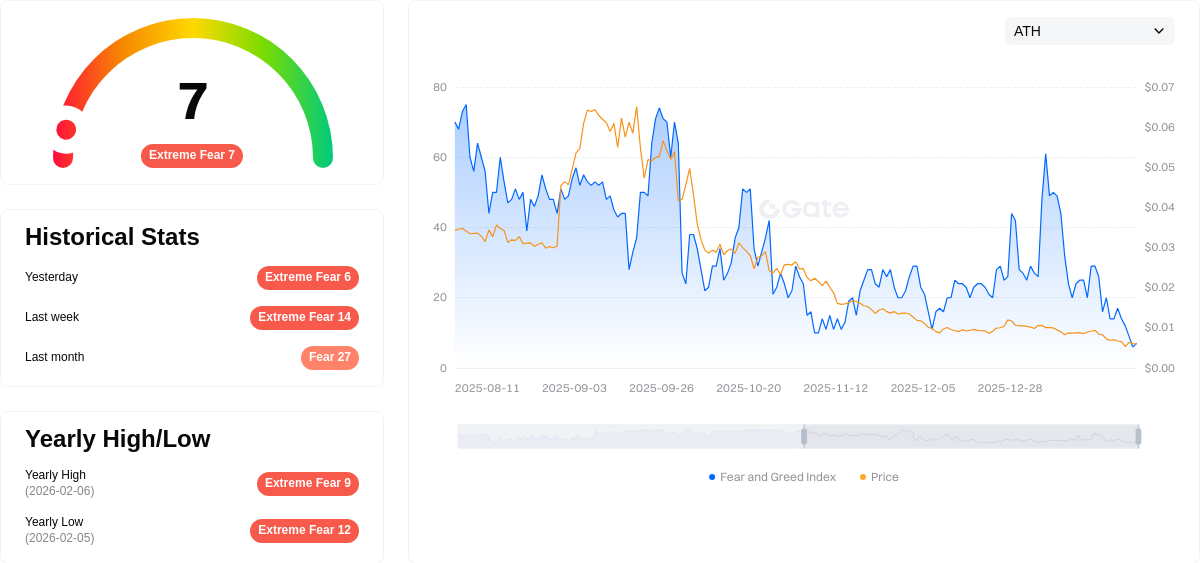

Market sentiment remains cautious, with the crypto fear and greed index at 7, indicating extreme fear conditions. The 24-hour price range has been relatively stable, fluctuating between $0.0001303 and $0.0001306.

Click to view current B3X market price

B3X Market Sentiment Index

02-08-2026 Fear & Greed Index: 7 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear with an index reading of just 7. This exceptionally low sentiment indicates severe market pessimism and heightened investor anxiety. During periods of extreme fear, market participants are often overly cautious, creating potential opportunities for contrarian traders. Historical data suggests such extreme readings may indicate oversold conditions. However, investors should exercise caution and conduct thorough research before making trading decisions. Monitor market developments closely as sentiment can shift rapidly in crypto markets.

B3X Holding Distribution

The holding distribution chart illustrates the concentration of B3X tokens across different wallet addresses, providing insights into the decentralization level of token ownership. This metric is crucial for understanding market structure, as highly concentrated holdings may indicate potential price manipulation risks, while a more distributed pattern typically suggests a healthier, more resilient ecosystem.

Based on the current data, B3X exhibits a relatively moderate concentration pattern. The top-tier addresses collectively control a significant portion of the total supply, which is common for emerging blockchain projects. However, the distribution across multiple major holders rather than dominance by a single entity suggests some degree of diversification. This structure reflects a transitional phase where the project is moving toward broader community participation while still maintaining substantial positions among early investors and strategic holders.

The current holding distribution pattern has notable implications for market dynamics. The presence of multiple large holders creates a multi-stakeholder environment that can contribute to price stability, as no single entity possesses overwhelming control. Nevertheless, coordinated movements among top holders could still trigger significant price volatility. From a long-term perspective, the gradual expansion of the holder base and reduction in concentration levels would be positive indicators of growing adoption and enhanced decentralization, ultimately strengthening the project's resistance to market manipulation and improving overall ecosystem health.

Click to view current B3X Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing B3X Future Price

Supply Mechanism

- Token Economic System: B3's tokenomics design incorporates gameplay growth, technical architecture, and community engagement mechanisms that collectively shape its supply dynamics.

- Historical Patterns: The token's supply mechanism is designed to balance between rewarding early participants and maintaining long-term sustainability through controlled distribution.

- Current Impact: The interplay between token utility within the ecosystem and community-driven demand creates potential price pressure points based on adoption rates.

Institutional and Major Holder Dynamics

- Community Cohesion: B3 demonstrates strong community engagement as a key pillar of its value proposition, with community strength serving as a fundamental driver of token stability and growth potential.

- Ecosystem Adoption: The project's development trajectory depends significantly on the expansion of its gaming applications and user base within its ecosystem.

- Market Positioning: B3's competitive positioning within the blockchain gaming sector influences institutional interest and strategic partnerships.

Macroeconomic Environment

- Market Competition Impact: The broader cryptocurrency market dynamics and competitive landscape among gaming tokens affect B3's relative valuation and investor sentiment.

- Risk Factors: External economic pressures and market volatility contribute to price uncertainty, requiring careful assessment of broader financial conditions.

Technical Development and Ecosystem Building

- Gameplay Growth: Continuous enhancement of gaming experiences and user engagement features represents a primary driver of platform value and token utility.

- Technical Design: The underlying technical architecture and its scalability determine the project's ability to support growing user demands and complex gaming functionalities.

- Ecosystem Applications: Expansion of use cases within the B3 ecosystem, including integration with decentralized applications and gaming platforms, strengthens the token's fundamental value proposition.

- AI-Driven Predictions: Analytical models incorporating artificial intelligence provide forward-looking perspectives on potential development trajectories, though these remain subject to market variables and execution risks.

III. 2026-2031 B3X Price Prediction

2026 Outlook

- Conservative forecast: $0.00012

- Neutral forecast: $0.00013

- Optimistic forecast: $0.00019 (requires favorable market conditions)

2027-2029 Outlook

- Market stage expectation: The token is anticipated to enter a gradual growth phase with moderate volatility as the project develops its ecosystem and user base

- Price range forecast:

- 2027: $0.00015 - $0.00021

- 2028: $0.00014 - $0.00019

- 2029: $0.0001 - $0.00021

- Key catalysts: Potential platform upgrades, increased trading volume, and broader market adoption could serve as primary drivers for price appreciation

2030-2031 Long-term Outlook

- Baseline scenario: $0.00015 - $0.00029 (assuming steady market conditions and continued project development)

- Optimistic scenario: $0.00020 - $0.00035 (contingent on successful ecosystem expansion and favorable regulatory environment)

- Transformative scenario: Above $0.00035 (requires exceptional market conditions, major partnerships, or significant technological breakthroughs)

- 2026-02-08: B3X $0.00012 - $0.00019 (early-stage price discovery phase with gradual accumulation patterns)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00019 | 0.00013 | 0.00012 | 0 |

| 2027 | 0.00021 | 0.00016 | 0.00015 | 22 |

| 2028 | 0.00019 | 0.00018 | 0.00014 | 40 |

| 2029 | 0.00021 | 0.00019 | 0.0001 | 43 |

| 2030 | 0.00029 | 0.0002 | 0.00015 | 52 |

| 2031 | 0.00035 | 0.00024 | 0.00014 | 86 |

IV. B3X Professional Investment Strategies and Risk Management

B3X Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Investors seeking exposure to blockchain-based fintech solutions and Web 3.0 financial infrastructure

- Operational Recommendations:

- Consider accumulation during market corrections, given the token's historical volatility

- Monitor Bnext's expansion progress into Latin American remittance markets

- Utilize Gate Web3 Wallet for secure storage and asset management

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume (currently $17,994.93) for liquidity assessment

- Price Level Tracking: Observe key support around the all-time low of $0.00013001 (February 6, 2026) and resistance levels

- Swing Trading Considerations:

- Track short-term momentum indicators, noting the 1-hour change of +0.22%

- Consider the token's recent decline of -21.8% over 30 days for potential entry points

B3X Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Active Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 7-10% of high-risk portfolio segment

(2) Risk Hedging Approaches

- Diversification: Balance B3X holdings with stablecoin positions to mitigate volatility

- Position Sizing: Implement scaled entry strategies rather than lump-sum investments

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and staking

- Cold Storage Approach: Hardware wallet solutions for long-term holdings exceeding $1,000

- Security Considerations: Enable two-factor authentication and regularly verify contract addresses (B3X Algorand contract: 663905154)

V. B3X Potential Risks and Challenges

B3X Market Risks

- High Volatility: The token has experienced a -59.98% decline over the past year, indicating substantial price fluctuation

- Limited Liquidity: With a 24-hour trading volume of approximately $17,995, liquidity may be constrained during volatile market conditions

- Low Market Capitalization: A market cap of $229,784.05 suggests higher susceptibility to large order impacts

B3X Regulatory Risks

- Cross-border Remittance Regulations: Bnext's expansion into Latin American remittance markets may face evolving regulatory frameworks across multiple jurisdictions

- E-Money Licensing Compliance: While Bnext holds a Spanish e-money issuer license valid across the EU, regulatory changes could impact operational scope

- Token Classification Uncertainty: Evolving securities regulations may affect B3X's classification and trading status

B3X Technical Risks

- Smart Contract Dependencies: B3X operates on the Algorand blockchain (contract address: 663905154), exposing it to underlying protocol risks

- Low Exchange Availability: Listed on only 2 exchanges, limiting trading venues and liquidity sources

- Token Concentration: With only 50.39% of maximum supply in circulation (1,763,500,000 of 3,500,000,000 tokens), potential future releases could impact price dynamics

VI. Conclusion and Action Recommendations

B3X Investment Value Assessment

B3X represents an experimental position in the blockchain-enabled fintech sector, particularly targeting the Spain-Latin America remittance corridor. The project's backing by Algorand and possession of EU-wide e-money licensing provide foundational legitimacy. However, the token's performance indicators—including a one-year decline of nearly 60%, low liquidity, and limited exchange presence—signal elevated risk levels. The utility-focused tokenomics with over 10 practical use cases may provide long-term value, but near-term price stability remains uncertain.

B3X Investment Recommendations

✅ Beginners: Consider observing project development milestones before committing capital; if interested, limit exposure to less than 1% of total crypto holdings ✅ Experienced Investors: May allocate 2-5% of speculative portfolio for potential upside, employing dollar-cost averaging during periods of reduced volatility ✅ Institutional Investors: Conduct comprehensive due diligence on Bnext's remittance product adoption metrics and regulatory compliance status before position establishment

B3X Trading Participation Methods

- Spot Trading: Available on Gate.com with USDT pairing for direct purchase and sale

- Dollar-Cost Averaging: Systematic periodic purchases to mitigate timing risk in volatile markets

- Limit Orders: Strategic placement of buy orders near support levels (around $0.00013) to optimize entry pricing

Cryptocurrency investments carry extreme risk, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is B3X? What are its uses and application scenarios?

B3X is a blockchain-based utility token designed for decentralized finance and Web3 applications. It enables governance participation, transaction settlement, and access to ecosystem services. B3X powers smart contracts and DeFi protocols, serving users in crypto trading, staking, and digital asset management within the Web3 infrastructure.

What are the main factors affecting B3X price?

B3X price is primarily influenced by market supply and demand dynamics, trading volume, market sentiment, and broader cryptocurrency market trends. Regulatory developments and adoption rates also play significant roles in price movements.

What is the historical price trend of B3X?

B3X is currently trading at $0.0001302 as of February 8, 2026. The token is down 99.40% from its all-time high of BTC0.051051, while trading 0.20% above its historical low of BTC0.081222. Recent 24-hour trading volume stands at $19,186.77.

2024年B3X价格预测会如何发展?

B3X价格在2024年呈现上升趋势,受市场需求和生态发展驱动。预计中期内保持稳定增长,交易额持续提升,长期看好其价值表现。

What risks should I consider when investing in B3X?

B3X investment involves market volatility risk, liquidity risk, and technology risk. Investors should carefully assess these factors before investing. Consider your risk tolerance and investment goals accordingly.

What are the advantages and disadvantages of B3X compared to other similar tokens?

B3X offers fast transaction speeds and low fees, with strong scalability performance. However, it lacks a fixed supply cap which may cause inflation concerns, and faces competition from more established cryptocurrencies in the market.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Ethereum 2.0 in 2025: Staking, Scalability, and Environmental Impact

2025 Layer-2 Solution: Ethereum Scalability and Web3 Performance Optimization Guide

What is BOOP: Understanding the Web3 Token in 2025

Altcoin Season Index 2025: How to Use and Invest in Web3

Byzantine Fault Tolerance Explained

What is Ergo? A Combination of Bitcoin and Ethereum

7 Strategies for Earning Passive Income with Crypto Assets

A detailed explanation of the differences, advantages, and disadvantages between PoS and PoW

Which ASIC Miner Should You Buy? A Review of Top Models for Cryptocurrency Mining