2026 BDP Price Prediction: Expert Analysis and Market Forecast for the Next Year

Introduction: BDP's Market Position and Investment Value

Big Data Protocol (BDP), positioned as a decentralized data tokenization platform, has been operating in the crypto ecosystem since its launch in 2021. Through a network of professional data providers, the protocol tokenizes commercially valuable data and enables data token circulation on Uniswap. As of February 2026, BDP maintains a market capitalization of approximately $306,580, with a circulating supply of around 24.16 million tokens, and the price holding near $0.01269. This asset, characterized as a "data economy enabler," is exploring its potential role in the decentralized data marketplace and DeFi liquidity provision sectors.

This article will comprehensively analyze BDP's price trajectory from 2026 to 2031, incorporating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. BDP Price History Review and Market Status

BDP Historical Price Evolution Trajectory

- 2021: Token launch in March with an initial price of $8.88, reaching a peak of $14.93 on March 7th during the early adoption phase

- 2021-2025: Extended downward trend as market sentiment shifted, with price declining from its historical high

- 2026: Price reached a historical low of $0.0106 on February 6th, reflecting broader market consolidation

BDP Current Market Situation

As of February 7, 2026, BDP is trading at $0.01269. The token has demonstrated notable volatility across different timeframes. In the past hour, the price showed a marginal increase of 0.030%. Over the last 24 hours, BDP recorded a gain of 12.1%, with prices fluctuating between $0.01092 and $0.01558.

The medium-term performance indicates a downward trajectory, with a 7-day decline of 24.87% and a 30-day decrease of 32.28%. The annual performance shows a significant contraction of 81.089%.

The current trading volume stands at $22,088.03 over the past 24 hours. The circulating supply is approximately 24.16 million BDP tokens, representing 30.2% of the total supply of 64.92 million tokens, with a maximum supply capped at 80 million. The current market capitalization is approximately $306,580, with a fully diluted valuation of $823,876.

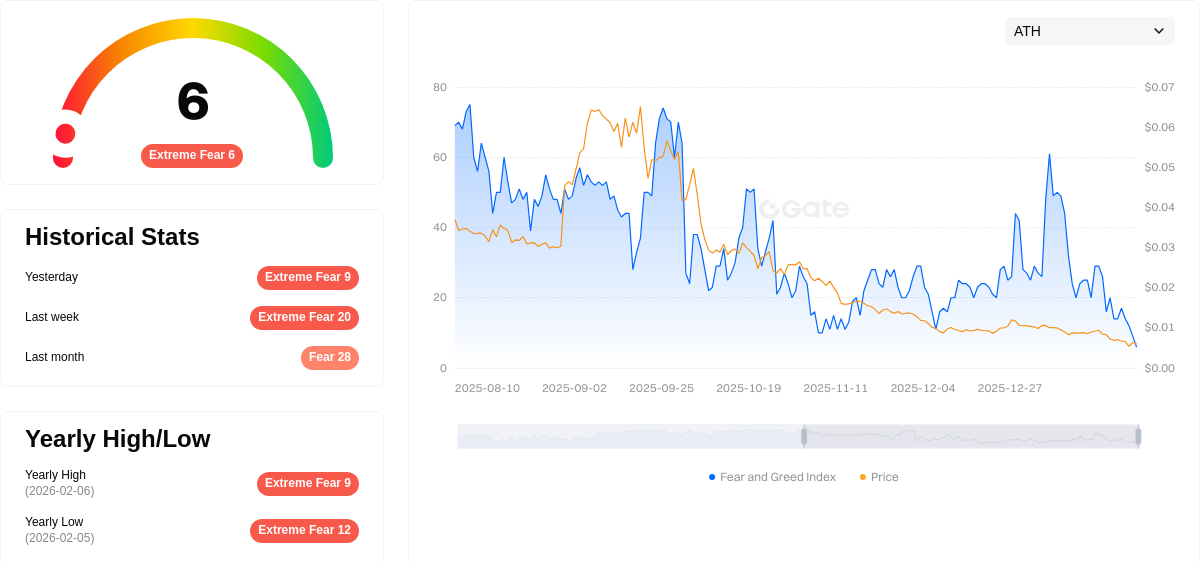

The token's market dominance is minimal at 0.000032%, reflecting its limited presence in the broader cryptocurrency market. According to current market sentiment indicators, the fear and greed index registers at 6, indicating an "Extreme Fear" condition in the market.

Click to view current BDP market price

BDP Market Sentiment Index

2026-02-07 Fear and Greed Index: 6 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index hitting a historic low of 6. This indicates severe pessimism and panic selling across the market. Such extreme fear typically presents contrarian opportunities for long-term investors, as markets often recover from panic-driven lows. However, heightened caution is recommended, as further downside movements are possible. Monitor key support levels and market catalysts closely before making investment decisions. Consider dollar-cost averaging strategies to mitigate timing risks during periods of extreme market stress.

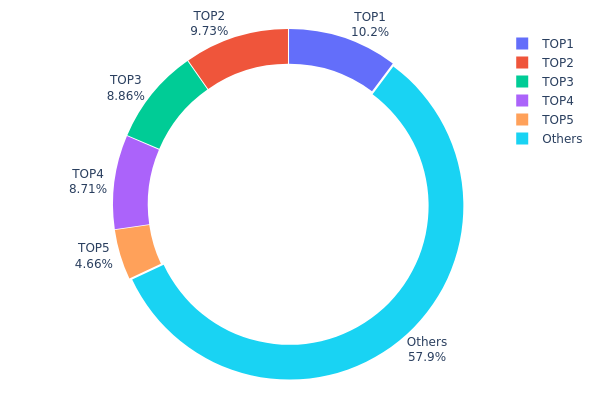

BDP Holding Distribution

The holding distribution chart reflects the concentration level of token holdings across different addresses on the blockchain, serving as a crucial indicator for assessing decentralization and potential market manipulation risks. According to current data, the top 5 addresses collectively hold 42.12% of BDP's total supply, with the largest holder controlling 10.18% (6.61M tokens), followed by addresses holding 9.72%, 8.85%, 8.71%, and 4.66% respectively. The remaining 57.88% is distributed among other addresses, indicating a moderate concentration pattern within the market.

This distribution structure suggests that BDP exhibits relatively balanced holdings compared to many emerging tokens, though concentration remains notable among top addresses. The fact that no single address controls more than 11% of supply demonstrates reasonable dispersion, yet the top 5 addresses' combined 42% stake creates potential vulnerability to coordinated market movements. Such concentration could amplify price volatility during periods of large-scale selling or strategic accumulation, particularly if these major holders execute simultaneous transactions. The relatively substantial "Others" category holding 57.88% indicates healthy participation from retail and smaller institutional investors, which serves as a stabilizing factor against excessive manipulation by whale addresses.

From a market structure perspective, BDP's current distribution reflects a developing ecosystem that has achieved partial decentralization while maintaining some degree of strategic holder concentration. This pattern is typical for tokens transitioning from early-stage controlled distribution toward broader community adoption, suggesting moderate on-chain stability with manageable systemic risks from large holder behavior.

Click to view current BDP Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3cc9...aecf18 | 6610.32K | 10.18% |

| 2 | 0xa749...32170b | 6314.52K | 9.72% |

| 3 | 0x0de8...11b372 | 5749.13K | 8.85% |

| 4 | 0x80a0...879ff3 | 5654.94K | 8.71% |

| 5 | 0x9642...2f5d4e | 3028.42K | 4.66% |

| - | Others | 37565.92K | 57.88% |

II. Core Factors Influencing BDP's Future Price

Supply Mechanism

- Policy and Economic Factors: BDP's supply dynamics are influenced by macroeconomic environments, national industrial policies, and market supply-demand relationships. Traditional economic factors such as interest rates, inflation, and GDP performance directly affect market sentiment.

- Historical Patterns: When inflation or policy changes occur, investors may seek alternative assets like BDP, potentially increasing demand and driving price movements.

- Current Impact: Policy factors continue to play a significant role in BDP market demand and development trends, with regulatory changes potentially affecting future supply conditions.

Institutional and Market Dynamics

- Market Competition: The competitive landscape and raw material prices remain key factors affecting BDP price trends. Industry competition situations and international trade environments contribute to price volatility.

- Demand Drivers: Market demand fluctuations, influenced by specific order volumes and downstream industry requirements, can create price pressure when demand decreases or raw material costs rise.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, including interest rate adjustments and refinancing operations, influence overall market liquidity and investor risk appetite, which may affect BDP's position as an alternative investment.

- Inflation Hedge Characteristics: During periods of inflation or policy-driven currency weakness, BDP may attract increased attention as investors diversify their portfolios, potentially supporting price levels.

- Geopolitical Factors: International trade environments and regulatory changes across different jurisdictions continue to shape market conditions for BDP and similar assets.

Technical Development and Ecosystem

- Market Infrastructure: The development of trading platforms and market infrastructure affects BDP's accessibility and liquidity, with improvements potentially supporting broader adoption.

- Industry Applications: BDP's applications in various industrial sectors, including its use in chemical and materials industries, influence fundamental demand patterns and long-term price sustainability.

III. 2026-2031 BDP Price Forecast

2026 Outlook

- Conservative prediction: $0.01129 - $0.01269

- Neutral prediction: $0.01269

- Optimistic prediction: $0.01865 (requires favorable market conditions)

2027-2029 Outlook

- Market stage expectation: The token is anticipated to enter a gradual growth phase, with price volatility potentially reflecting broader market sentiment and project development milestones.

- Price range predictions:

- 2027: $0.01473 - $0.02022

- 2028: $0.014 - $0.02153

- 2029: $0.01441 - $0.02921

- Key catalysts: Potential price drivers may include increased adoption, ecosystem expansion, and overall cryptocurrency market trends during this period.

2030-2031 Long-term Outlook

- Baseline scenario: $0.0186 - $0.02643 (assuming steady market conditions and continued project development)

- Optimistic scenario: $0.02448 - $0.02749 (with enhanced utility adoption and positive market momentum)

- Transformative scenario: Approaching $0.02749 (under exceptionally favorable conditions including significant ecosystem breakthroughs)

- 2026-02-07: BDP trading within the early 2026 range (reflecting current market positioning)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.01865 | 0.01269 | 0.01129 | 0 |

| 2027 | 0.02022 | 0.01567 | 0.01473 | 23 |

| 2028 | 0.02153 | 0.01794 | 0.014 | 41 |

| 2029 | 0.02921 | 0.01974 | 0.01441 | 55 |

| 2030 | 0.02643 | 0.02448 | 0.0186 | 92 |

| 2031 | 0.02749 | 0.02546 | 0.02189 | 100 |

IV. BDP Professional Investment Strategies and Risk Management

BDP Investment Methodology

(I) Long-term Holding Strategy

- Target investors: Investors with high risk tolerance and long-term vision who believe in the value proposition of data tokenization

- Operational recommendations:

- Allocate a small portion of your crypto portfolio to BDP, considering its low market cap and high volatility

- Monitor developments in the Big Data Protocol ecosystem, including data provider network expansion and platform usage metrics

- Store BDP tokens securely using Gate Web3 Wallet for convenient access to protocol features and potential airdrops

(II) Active Trading Strategy

- Technical analysis tools:

- Volume analysis: Track the relatively low daily trading volume ($22,088) to identify potential liquidity risks and avoid large position entries that may impact price

- Support and resistance levels: Monitor the 24-hour range ($0.01092 - $0.01558) and historical price levels for entry and exit points

- Swing trading considerations:

- Be aware of high volatility, as evidenced by the 12.1% 24-hour gain and -24.87% weekly decline

- Set strict stop-loss orders due to low liquidity and significant price fluctuations

BDP Risk Management Framework

(I) Asset Allocation Principles

- Conservative investors: 0.5-1% of total crypto portfolio

- Aggressive investors: 2-3% of total crypto portfolio

- Professional investors: May allocate up to 5% with active monitoring and hedging strategies

(II) Risk Hedging Solutions

- Portfolio diversification: Combine BDP with established cryptocurrencies and stablecoins to balance risk exposure

- Position sizing: Given BDP's low market cap ($306,579) and ranking (#3512), limit position size to minimize impact from price volatility

(III) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet for easy access to trading and protocol participation

- Cold storage option: Consider hardware wallet solutions for long-term holdings to minimize security risks

- Security considerations: Enable two-factor authentication, never share private keys, and verify contract addresses (0xf3dcbc6D72a4E1892f7917b7C43b74131Df8480e) before transactions

V. BDP Potential Risks and Challenges

BDP Market Risks

- Low liquidity risk: With only $22,088 in 24-hour trading volume and listing on just one exchange, BDP faces significant liquidity constraints that may lead to slippage and difficulty executing large orders

- High volatility: The token has experienced an 81.089% decline over the past year, indicating substantial price instability and potential for continued downward pressure

- Limited market presence: With a market cap of approximately $306,579 and 0.000032% market dominance, BDP has minimal market recognition and adoption

BDP Regulatory Risks

- Data tokenization compliance: The concept of tokenizing commercial data may face regulatory scrutiny regarding data privacy laws and securities regulations in various jurisdictions

- Decentralized data market oversight: Regulatory frameworks for decentralized data marketplaces remain unclear, potentially impacting the protocol's operational model

- Token classification uncertainty: Authorities may classify BDP differently across regions, affecting its trading status and legal compliance requirements

BDP Technical Risks

- Smart contract vulnerabilities: As an Ethereum-based token, BDP is exposed to potential smart contract bugs or exploits that could compromise user funds

- Platform dependency: The protocol's reliance on Uniswap for data token circulation creates dependency risks if the DEX experiences technical issues or liquidity challenges

- Token burn mechanism: The requirement to burn BDP for protocol access may create deflationary pressure, but also raises questions about long-term sustainability if adoption remains low

VI. Conclusion and Action Recommendations

BDP Investment Value Assessment

Big Data Protocol presents an innovative approach to data tokenization through its network of professional data providers. However, the token currently faces significant challenges including extremely low market cap, limited liquidity, severe price decline over the past year, and minimal exchange listings. The 30.2% circulating supply relative to fully diluted valuation suggests potential dilution risks. While the protocol's concept of tokenizing commercial data and enabling liquidity provision has theoretical merit, current market metrics indicate limited adoption and high investment risk. The substantial distance from its all-time high of $14.93 to the current price of $0.01269 reflects reduced market confidence.

BDP Investment Recommendations

✅ Beginners: Avoid investing in BDP due to its high volatility, low liquidity, and significant decline in value. Focus on more established cryptocurrencies with proven track records

✅ Experienced investors: Consider only micro-allocation (under 1% of crypto portfolio) if you have strong conviction in data tokenization and can tolerate potential total loss. Conduct thorough due diligence on protocol development and ecosystem growth

✅ Institutional investors: Approach with extreme caution given low market cap and liquidity constraints that make position building and exit difficult. Consider waiting for clearer signs of adoption and regulatory clarity in data tokenization

BDP Trading Participation Methods

- Spot trading: Purchase BDP on Gate.com, currently the primary exchange offering BDP trading pairs

- Liquidity provision: Participate in Uniswap liquidity pools for data tokens while earning rewards, though be aware of impermanent loss risks

- Protocol participation: Hold BDP tokens to unlock access to exclusive data sets and receive airdropped data tokens, though verify minimum holding requirements and actual utility before committing capital

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is BDP? What are its uses and features?

BDP is a Business Data Platform that integrates data storage, processing, and analysis. It helps enterprises manage and leverage data effectively, improving decision-making efficiency. Key features include data integration, high performance, and comprehensive analytics capabilities.

BDP的历史价格走势如何?过去的表现如何?

BDP/USD shows significant volatility over the past year. Current price stands at $0.01675999, with recent fluctuations reflecting strong market dynamics. Performance demonstrates considerable price movement and trading activity throughout the period.

What are the main factors affecting BDP price?

BDP price is influenced by market demand, trading volume, token supply, market sentiment, project developments, regulatory news, and macroeconomic factors. Ecosystem growth and strategic partnerships typically drive positive price momentum.

What are professional analysts' price predictions for BDP?

Professional analysts predict BDP will reach $0.019042 by 2030, representing a 27.63% increase. By 2040, BDP could potentially grow 97.99%, with prices reaching approximately $0.038 based on current predictive models.

How to conduct technical analysis of BDP price? What are the common indicators?

Common BDP technical indicators include moving averages, RSI, MACD, Bollinger Bands, and volume analysis. These tools help identify trends, support/resistance levels, and potential entry/exit points for trading decisions.

What are the risks in BDP price prediction and how should I evaluate the reliability of predictions?

BDP price predictions face risks from market volatility, policy shifts, and technical developments. Evaluate reliability by assessing data sources, historical accuracy, model complexity, expert consensus, and market trend analysis.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

What Is DeFi? Four Key Real-World Applications of DeFi

Find the top trading bot to maximize your profits in cryptocurrencies

What Is Cloud Mining? Top 9 Best Cloud Mining Platforms

Comprehensive Guide to Bull Flag Trading

Comprehensive Guide to NGMI and WAGMI: Understanding Crypto Community Culture