2026 BICITY Price Prediction: Expert Analysis and Market Forecast for the Next Generation of Urban Mobility Tokens

Introduction: BICITY's Market Position and Investment Value

BiCity (BICITY), positioned as an AI-powered digital content creation platform, has been developing its ecosystem since its launch in 2024. As of February 2026, BICITY maintains a market capitalization of approximately $604,260, with a circulating supply of 3 billion tokens and a current trading price around $0.00020142. This asset, leveraging cutting-edge artificial intelligence technology, is playing an increasingly important role in streamlining content creation processes for individuals and businesses through its advanced tools for generating articles, visuals, and audio content.

This article will comprehensively analyze BICITY's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. BICITY Price History Review and Market Status

BICITY Historical Price Evolution Trajectory

- 2024: BICITY launched on Gate.com in May 2024, with the price reaching a notable level of $0.322 in July 2024

- 2025: The market experienced significant adjustment, with price declining substantially from the previous high

- 2026: As of early February 2026, the price fell to approximately $0.00019498, reflecting ongoing market volatility

BICITY Current Market Situation

As of February 05, 2026, BICITY is trading at $0.00020142, representing a 24-hour decrease of 0.7%. The intraday trading range shows a high of $0.00020262 and a low of $0.00019498. Over broader timeframes, the token has experienced a 14.09% decline over the past 7 days and a 39.25% decrease over the past 30 days.

The market capitalization stands at approximately $604,260, with a circulating supply of 3 billion BICITY tokens out of a maximum supply of 10 billion tokens, resulting in a circulation ratio of 30%. The 24-hour trading volume reached $22,985.37. With a market dominance of 0.000077%, BICITY maintains a presence in the broader cryptocurrency ecosystem.

The token currently holds a ranking of 2888 in the market, with a fully diluted market cap of approximately $2,014,200. The market cap to fully diluted valuation ratio stands at 30%, indicating that a significant portion of the total supply remains unvested. The token has attracted 23,996 holders since its deployment.

According to the current market sentiment indicator, the cryptocurrency market is experiencing a fear index reading of 12, classified as "Extreme Fear," which may influence short-term trading dynamics.

Click to view current BICITY market price

BICITY Market Sentiment Index

2026-02-05 Fear and Greed Index: 12 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index hitting just 12 points. This indicates significant market pessimism and heightened risk aversion among investors. Such extreme fear conditions historically present contrarian opportunities, as markets often find support when sentiment reaches these levels. Investors should remain cautious while monitoring potential buying opportunities. At Gate.com, you can track real-time market sentiment and make informed trading decisions based on comprehensive market data and analysis tools.

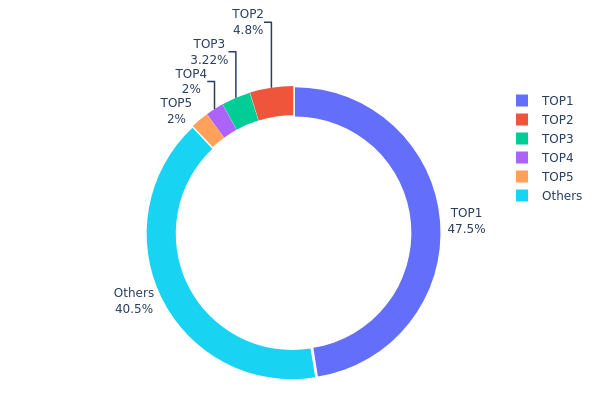

BICITY Holding Distribution

The holding distribution chart reflects the concentration of token holdings across different wallet addresses, serving as a key indicator of decentralization and market structure stability. By analyzing the proportion of tokens held by top addresses, we can assess potential risks related to market manipulation and price volatility.

According to the current data, the top address holds 4,747,601.72K BICITY tokens, accounting for 47.47% of the total supply, indicating a significant concentration of holdings. The second-ranked address (0x0000...00dead) holds 480,000.00K tokens (4.80%), which appears to be a burn address, suggesting that the project team has implemented token destruction mechanisms. The third through fifth addresses hold 3.22%, 2.00%, and 2.00% respectively, while the remaining addresses collectively hold 40.51% of the total supply. This distribution pattern reveals a relatively high concentration at the top, with nearly half of the circulating supply controlled by a single address.

Such a concentrated holding structure presents both risks and considerations for market participants. The dominance of the top address creates potential for significant price impact should this holder decide to liquidate or redistribute their position. However, the presence of a burn address and the relatively broad distribution among other holders (40.51% held by numerous addresses) provides some degree of decentralization. This mixed structure suggests that while the project exhibits centralization risks typical of early-stage tokens, there are also mechanisms in place that could support long-term stability as the token distribution gradually broadens through market activities and community participation.

Click to view current BICITY Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe34a...9c6f57 | 4747601.72K | 47.47% |

| 2 | 0x0000...00dead | 480000.00K | 4.80% |

| 3 | 0x4982...6e89cb | 322172.66K | 3.22% |

| 4 | 0xa6b7...58c6d4 | 200000.00K | 2.00% |

| 5 | 0x4ba9...a2f991 | 200000.00K | 2.00% |

| - | Others | 4050225.62K | 40.51% |

II. Core Factors Influencing BICITY's Future Price

Market Demand and Adoption Trends

- Demand Dynamics: BICITY AI PROJECTS price outlook is influenced by market demand and adoption trends. The cryptocurrency's value tends to correlate with the level of interest and utilization within its ecosystem.

- Adoption Patterns: The rate at which users and projects integrate BICITY technology may create upward or downward pressure on pricing, depending on market sentiment and practical use cases.

- Growth Projections: Analysis suggests potential annual growth patterns that could shape medium-term price expectations through 2027 and longer-term forecasts extending to 2030.

Institutional Participation

- Institutional Involvement: The level of institutional engagement plays a role in BICITY's price stability and growth potential. Increased institutional participation typically brings additional liquidity and market confidence.

- Investment Flows: Changes in institutional investment patterns may signal shifting market sentiment and could influence price movements in either direction.

Macroeconomic Environment

- Economic Factors: Broader economic conditions impact BICITY's price prospects alongside other digital assets. Economic uncertainty, inflation expectations, and monetary policy shifts may affect investor behavior.

- Market Conditions: Overall cryptocurrency market trends and risk appetite among investors contribute to BICITY's price volatility and directional movements.

- External Pressures: Global economic developments and financial market dynamics create an environment of fluctuation that investors should monitor when considering BICITY positions.

Risk Considerations

- Volatility Profile: BICITY exhibits price fluctuations characteristic of cryptocurrency markets. Investors should approach with appropriate risk management strategies.

- Market Dynamics: Price movements may be influenced by multiple factors simultaneously, creating periods of increased uncertainty.

- Investment Approach: Given the dynamic nature of cryptocurrency valuations, careful monitoring of market developments and policy changes remains important for those holding or considering BICITY positions.

III. 2026-2031 BICITY Price Forecast

2026 Outlook

- Conservative Estimate: $0.00017 - $0.00020

- Neutral Estimate: $0.00020

- Optimistic Estimate: $0.00025 (subject to favorable market conditions)

2027-2029 Mid-Term Outlook

- Market Phase Expectation: The token may enter a gradual growth phase with increased adoption and utility expansion

- Price Range Forecast:

- 2027: $0.00016 - $0.00033

- 2028: $0.00017 - $0.00038

- 2029: $0.00031 - $0.00037

- Key Catalysts: Projected price change of 11% in 2027, 38% in 2028, and 64% in 2029 could be driven by ecosystem development, user base expansion, and broader market recovery

2030-2031 Long-Term Outlook

- Baseline Scenario: $0.00034 - $0.00049 (assuming steady market development and sustained project execution)

- Optimistic Scenario: $0.00028 - $0.00052 (contingent upon accelerated adoption and favorable regulatory environment)

- Transformative Scenario: Potential to reach upper range thresholds (under exceptionally favorable conditions including significant partnerships and technological breakthroughs)

- 2026-02-05: BICITY currently in early forecast period with baseline average price of $0.0002

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00025 | 0.0002 | 0.00017 | 0 |

| 2027 | 0.00033 | 0.00022 | 0.00016 | 11 |

| 2028 | 0.00038 | 0.00028 | 0.00017 | 38 |

| 2029 | 0.00037 | 0.00033 | 0.00031 | 64 |

| 2030 | 0.00049 | 0.00035 | 0.00034 | 74 |

| 2031 | 0.00052 | 0.00042 | 0.00028 | 107 |

IV. BICITY Professional Investment Strategy and Risk Management

BICITY Investment Methodology

(1) Long-Term Holding Strategy

- Suitable for: Investors who believe in AI-powered content creation and are willing to hold through market volatility

- Operational Recommendations:

- Accumulate positions gradually during price dips, considering the token's high volatility (down 83.02% over 1 year)

- Set clear exit targets based on project milestone achievements, such as the launch of mobile and web applications

- Store assets in Gate Web3 Wallet for secure long-term custody with full control of private keys

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Monitor 7-day and 30-day trends to identify reversal points, noting the recent 14.09% decline over 7 days

- Volume Analysis: Track the current 24h trading volume of approximately $22,985 to assess market interest and liquidity conditions

- Swing Trading Key Points:

- Capitalize on high volatility with short-term positions, considering the 24h price range between $0.00019498 and $0.00020262

- Implement strict stop-loss orders given the token's proximity to its all-time low of $0.00019498

BICITY Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio due to high risk profile and limited exchange listings

- Aggressive Investors: 5-10% allocation for those comfortable with emerging AI tokens and significant volatility

- Professional Investors: Up to 15% with active management and diversification across AI and content creation tokens

(2) Risk Hedging Solutions

- Diversification Strategy: Balance BICITY holdings with established AI tokens and stablecoins to mitigate sector-specific risks

- Position Sizing: Use dollar-cost averaging to reduce timing risk, particularly given the 39.25% decline over 30 days

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading access and integrated DeFi features

- Cold Storage Option: Consider hardware wallet solutions for larger holdings intended for long-term investment

- Security Precautions: Enable two-factor authentication, regularly backup wallet credentials, and verify contract address (0x6fa9c0ee8a1f237466bb9cac8466bfa2aa63a978 on BSC) before transactions

V. BICITY Potential Risks and Challenges

BICITY Market Risks

- Extreme Volatility: The token has experienced an 83.02% decline over one year and remains near its all-time low, indicating substantial downside pressure

- Limited Liquidity: With only 24-hour trading volume of approximately $22,985 and listing on one exchange, market depth may be insufficient for large transactions

- Low Market Capitalization: Current market cap of approximately $604,260 with only 30% of total supply in circulation suggests potential dilution risks as more tokens enter the market

BICITY Regulatory Risks

- AI Content Regulation: Potential regulatory scrutiny of AI-generated content platforms could impact business operations and token utility

- Securities Classification: Profit-sharing mechanisms mentioned in the project may attract regulatory attention regarding securities law compliance

- Geographic Restrictions: Evolving crypto regulations in major markets may limit platform accessibility and user adoption

BICITY Technical Risks

- Platform Development: Dependence on successful launch of mobile and web applications creates execution risk for the project's value proposition

- Competition: Intense competition in the AI content creation space from both Web2 and Web3 platforms may limit market share and adoption

- Smart Contract Security: As a BEP-20 token on BSC, vulnerabilities in smart contracts or the underlying blockchain could pose security risks to holders

VI. Conclusion and Action Recommendations

BICITY Investment Value Assessment

BICITY presents a speculative opportunity in the intersection of AI and blockchain technology, focusing on digital content creation tools. While the project addresses a growing market need for AI-powered content generation with features including 3D avatars, text-to-image, and text-to-speech capabilities, the token faces significant headwinds. The 83.02% decline over one year, limited exchange listings, and low trading volume reflect substantial market skepticism. The upcoming mobile and web applications represent potential catalysts, but execution risks remain high. Only investors with high risk tolerance and belief in the long-term AI content creation thesis should consider allocation, treating this as a highly speculative position within a diversified portfolio.

BICITY Investment Recommendations

✅ Beginners: Avoid or limit exposure to less than 1% of total crypto portfolio due to high volatility and limited liquidity ✅ Experienced Investors: Consider small speculative positions (3-5%) with strict stop-losses, focusing on platform development milestones ✅ Institutional Investors: Conduct thorough due diligence on revenue model and competitive positioning before any allocation, limiting exposure to less than 2% of high-risk portfolio segment

BICITY Trading Participation Methods

- Spot Trading: Access BICITY spot markets on Gate.com for straightforward buy and hold strategies

- Dollar-Cost Averaging: Implement systematic purchasing plans to mitigate timing risk in volatile market conditions

- Portfolio Rebalancing: Periodically review allocation percentages and adjust based on project development progress and market conditions

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is BICITY and what is its current price?

BICITY (BiCity AI Projects) is an AI-powered cryptocurrency token. As of February 5, 2026, BICITY is trading at $0.000225. The price updates in real-time as market conditions change.

What factors influence BICITY price movements and market trends?

BICITY price is driven by market demand and supply dynamics, trading volume, regulatory developments, and overall crypto market sentiment. Technical indicators and Bitcoin's performance also significantly impact BICITY's price movements and trends.

What are expert predictions for BICITY price in the next 6-12 months?

Expert analysts project BICITY could reach approximately $0.0003279-$0.0004500 within the next 6-12 months, driven by increasing market adoption and ecosystem development. Predictions vary based on market conditions and trading volume trends.

What are the risks and volatility factors associated with BICITY price prediction?

BICITY price volatility stems from market sentiment shifts, regulatory developments, and crypto market trends. Prediction accuracy depends on multiple unpredictable factors including trading volume fluctuations and macroeconomic conditions affecting the broader digital asset ecosystem.

How does BICITY compare to other similar cryptocurrencies in terms of price performance?

BICITY demonstrates moderate price volatility relative to major cryptocurrencies, with performance influenced by its unique blockchain technology and community engagement. Its price movement typically reflects lower market capitalization dynamics compared to established assets, offering differentiated growth opportunities within the altcoin market.

What technical and fundamental analysis methods can be used for BICITY price forecasting?

Technical analysis includes moving averages, RSI, and chart patterns. Fundamental analysis examines market sentiment, trading volume, and project developments. Machine learning models can identify price trends by analyzing historical data patterns.

Survey Note: Detailed Analysis of the Best AI in 2025

What Is the Best AI Crypto in 2025?

What is the Best AI Now?

Why ChatGPT is Likely the Best AI Now?

How Does Solidus Ai Tech's Market Cap Compare to Other AI Cryptocurrencies?

MomoAI: AI-Powered Social Gaming Revolution on Solana

Ultimate Guide to MVRV Z-Score for Bitcoin Price Forecasting and Trading

What is GARI: A Comprehensive Guide to Understanding the Decentralized Social Media Token and Its Ecosystem

What is ZYRA: A Comprehensive Guide to Understanding the Revolutionary Platform and Its Key Features

How to Use and Calculate the RSI in Cryptocurrency Trading

2026 PAL Price Prediction: Expert Analysis and Market Forecast for the Coming Year