2026 CATGPT Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: CATGPT's Market Position and Investment Value

CatGPT (CATGPT), a meme token on the Solana blockchain, has positioned itself as a unique community-driven asset since its launch in 2024. As of February 2026, CATGPT maintains a market capitalization of approximately $334,162, with a circulating supply of around 5.25 billion tokens and a current price hovering near $0.00006365. This asset, which serves as the "soul companion" of its community, is carving out its niche in the evolving meme token landscape.

This article provides a comprehensive analysis of CATGPT's price trajectory from 2026 through 2031, examining historical patterns, market supply-demand dynamics, ecosystem developments, and broader macroeconomic conditions to offer professional price forecasts and practical investment strategies for interested participants.

I. CATGPT Price History Review and Current Market Status

CATGPT Historical Price Evolution Trajectory

- 2024: CATGPT launched on Solana blockchain in April with a publish price of $0.006, reaching an all-time high of $0.006388 on April 26, 2024, representing a modest increase from its initial offering price.

- 2024-2025: Following its peak, CATGPT experienced a downward trend as part of the broader meme token market adjustment cycle.

- 2026: The token continued its decline, reaching an all-time low of $0.00004609 on February 6, 2026, marking a significant price compression from its historical peak.

CATGPT Current Market Situation

As of February 7, 2026, CATGPT is trading at $0.00006365, showing signs of recovery with a 24-hour price increase of 10.73%. The token has demonstrated volatility within a daily range between $0.00004609 and $0.00006494.

From a broader perspective, CATGPT has experienced substantial price corrections across different timeframes. The 7-day performance shows a decline of 24.58%, while the 30-day period reflects a decrease of 35.089%. Over the past year, the token has declined by 57.79%, indicating challenging market conditions for this Solana-based meme token.

The market capitalization currently stands at $334,162.5, with a circulating supply of 5.25 billion tokens representing 35% of the maximum supply of 15 billion tokens. The 24-hour trading volume is recorded at $18,392.96, suggesting relatively modest trading activity. The token maintains a market dominance of 0.000013%, positioning it at rank 3417 among digital assets.

CatGPT has attracted a community of approximately 11,200 holders on the Solana blockchain, where it operates under the contract address FGf1Us3kqu9AXu2x1yWKfiKE8uSx42ACvRiUrbuAodzq. The project positions itself as a unique community token that serves as a soul companion to its community members.

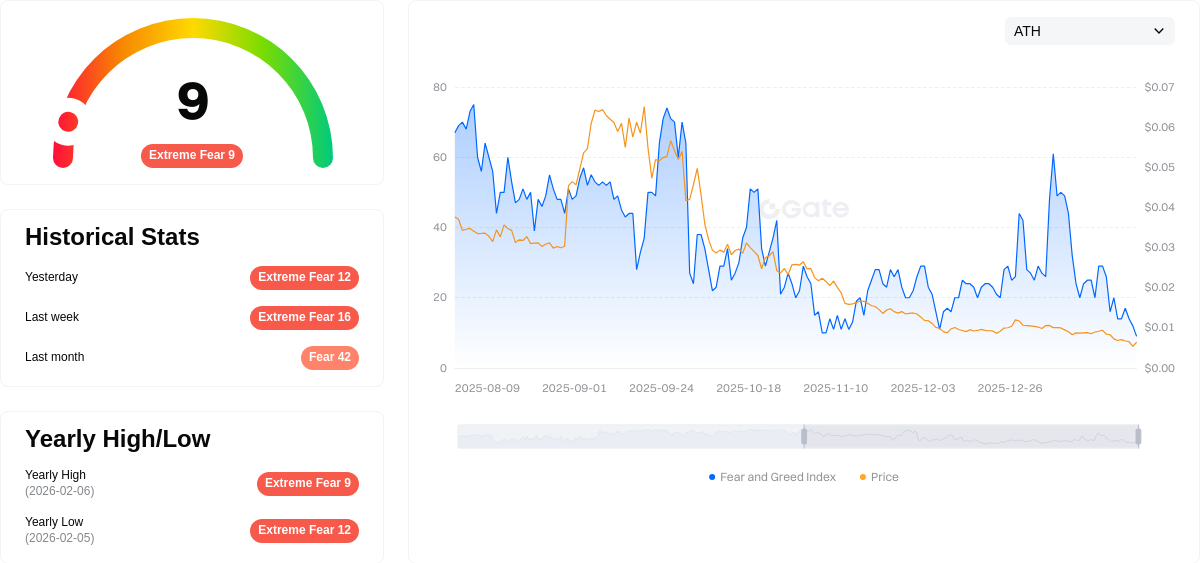

The current crypto market sentiment indicator shows an extreme fear reading of 9, which may influence short-term price movements and trading behavior across meme tokens including CATGPT.

Click to view current CATGPT market price

CATGPT Market Sentiment Indicator

2026-02-06 Fear and Greed Index: 9 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index plummeting to 9, signaling severe investor anxiety. This historically low reading reflects heightened market pessimism and risk aversion across digital assets. During such extreme fear periods, experienced traders often view this as a potential contrarian buying opportunity, as excessive pessimism frequently precedes market reversals. However, investors should exercise caution and conduct thorough research before making investment decisions. Monitor market developments closely and consider your risk tolerance when navigating this volatile environment on Gate.com.

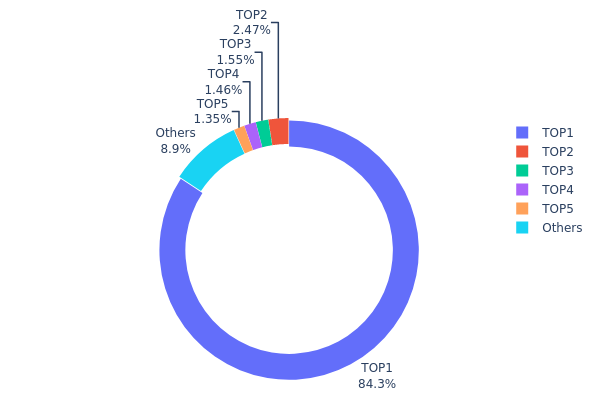

CATGPT Holdings Distribution

The holdings distribution chart reflects the allocation of token holdings across different wallet addresses, serving as a critical indicator of decentralization levels and market structure stability. By analyzing the concentration of tokens among top holders, we can assess potential risks related to price manipulation and evaluate the overall health of the token's on-chain ecosystem.

According to the current data, CATGPT exhibits a highly concentrated holdings structure. The top-ranked address holds 4,070,249.23K tokens, accounting for 84.26% of the total supply, while the second through fifth addresses collectively hold only 6.82%. The remaining 8.92% is distributed among other addresses. This extreme concentration pattern indicates that the majority of CATGPT tokens are controlled by a single entity, which significantly deviates from the ideal decentralized distribution model.

Such high concentration poses substantial risks to market stability. The dominant holder possesses considerable influence over price movements and can potentially execute large-scale sell-offs that would trigger severe price volatility. Additionally, this structure limits the token's liquidity depth, as a small number of addresses control the overwhelming majority of circulating supply. From a decentralization perspective, CATGPT's current holdings distribution suggests weak resistance to centralized control and increased vulnerability to market manipulation. The limited distribution among secondary holders further constrains the development of a robust and diverse holder base, which is essential for long-term ecosystem sustainability and price stability.

Click to view current CATGPT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 4070249.23K | 84.26% |

| 2 | u6PJ8D...ynXq2w | 119463.02K | 2.47% |

| 3 | A77HEr...oZ4RiR | 75018.40K | 1.55% |

| 4 | Fqzdo2...6u9kiq | 70615.47K | 1.46% |

| 5 | ACQBmC...48NFid | 65014.19K | 1.34% |

| - | Others | 430044.47K | 8.92% |

II. Core Factors Influencing CATGPT's Future Price

Supply Mechanism

- Market Demand Dynamics: As more enterprises and individuals recognize CATGPT's value, market demand is expected to increase, which may drive prices higher.

- Historical Pattern: Growing adoption of AI models has historically correlated with price appreciation as demand outpaces immediate supply capabilities.

- Current Impact: The expansion of AI computing infrastructure and increased business recognition of AI model value suggests potential upward pressure on pricing in the near to medium term.

Institutional and Major Player Activity

- Enterprise Adoption: Major technology companies and industrial players are integrating AI models into production systems, data analysis platforms, and business operations. Companies across sectors including manufacturing, finance, and technology are exploring AI model implementations.

- Computing Power Investment: Cloud computing providers and technology firms continue significant capital allocation toward AI infrastructure development, indicating sustained institutional commitment to AI model ecosystems.

Macroeconomic Environment

- Computing Power as Economic Foundation: According to research data, national computing power indices show positive correlation with GDP and digital economy growth. Analysis indicates that for every one-point increase in computing power index, digital economy and GDP growth rates increase by measurable percentages.

- Digital Economy Expansion: The digital transformation across industries creates expanding use cases and economic value for AI capabilities, potentially supporting long-term price stability or appreciation.

Technology Development and Ecosystem Building

- Specialized and Vertical Models: The emergence of industry-specific AI models tailored for finance, manufacturing, government services, and other sectors represents a differentiation strategy that may impact competitive positioning.

- Multi-Modal Development: AI models are evolving toward multi-modal capabilities, processing text, images, and video content within unified frameworks, expanding potential application scenarios.

- Ecosystem Pricing Strategies: Some providers adopt low-cost or free-tier strategies to rapidly acquire users and data, while others focus on premium enterprise customization services, creating varied competitive dynamics within the AI model marketplace.

III. 2026-2031 CATGPT Price Forecast

2026 Outlook

- Conservative Prediction: $0.00003 - $0.00006

- Neutral Prediction: $0.00006

- Optimistic Prediction: $0.00008 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market Stage Expectations: The token may enter a gradual growth phase as the project matures and expands its ecosystem presence

- Price Range Forecast:

- 2027: $0.00005 - $0.00011 (potential 13% price change)

- 2028: $0.00008 - $0.00012 (potential 41% price change)

- 2029: $0.00009 - $0.00013 (potential 63% price change)

- Key Catalysts: Market sentiment improvement, potential technological developments, and broader cryptocurrency market trends

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00009 - $0.00016 (assuming steady market development and sustained project activity)

- Optimistic Scenario: $0.00012 - $0.00018 (assuming enhanced ecosystem integration and positive regulatory environment)

- Transformative Scenario: Approaching $0.00018 (requires exceptional adoption rates, significant partnerships, and favorable macroeconomic conditions)

- 2026-02-07: CATGPT is currently positioned at the beginning of its forecast period with conservative price expectations

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00008 | 0.00006 | 0.00003 | 0 |

| 2027 | 0.00011 | 0.00007 | 0.00005 | 13 |

| 2028 | 0.00012 | 0.00009 | 0.00008 | 41 |

| 2029 | 0.00013 | 0.0001 | 0.00009 | 63 |

| 2030 | 0.00016 | 0.00012 | 0.00009 | 86 |

| 2031 | 0.00018 | 0.00014 | 0.00012 | 118 |

IV. CATGPT Professional Investment Strategy and Risk Management

CATGPT Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Community-focused investors and meme token enthusiasts

- Operational Recommendations:

- Consider dollar-cost averaging to mitigate volatility in this meme token

- Monitor community engagement and social media sentiment as key indicators

- Gate Web3 Wallet provides secure storage solutions for Solana-based tokens like CATGPT

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Track the 24-hour trading volume of approximately $18,392 to identify liquidity trends

- Support and Resistance Levels: Monitor the recent low of $0.00004609 and 24-hour high of $0.00006494

- Swing Trading Key Points:

- CATGPT has shown significant volatility with a 10.73% increase in 24 hours following a 24.58% decline over 7 days

- Consider short-term positions during community-driven sentiment surges

CATGPT Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% allocation maximum

- Aggressive Investors: 3-5% allocation

- Professional Investors: Up to 7% with active monitoring

(II) Risk Hedging Solutions

- Portfolio Diversification: Balance CATGPT exposure with established cryptocurrencies

- Position Sizing: Given the 57.79% decline over one year, limit exposure to manageable levels

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading with convenient access

- Cold Storage Solution: Hardware wallet solutions for long-term holdings

- Security Considerations: Verify the contract address (FGf1Us3kqu9AXu2x1yWKfiKE8uSx42ACvRiUrbuAodzq) before any transaction, enable two-factor authentication, and never share private keys

V. CATGPT Potential Risks and Challenges

CATGPT Market Risks

- High Volatility: CATGPT has experienced a 35.089% decline over 30 days, demonstrating significant price instability

- Limited Liquidity: With a market cap of $334,162 and ranking at 3417, liquidity may be constrained during market stress

- Meme Token Characteristics: Value is heavily dependent on community sentiment and social media trends rather than fundamental utility

CATGPT Regulatory Risks

- Meme Token Scrutiny: Regulatory bodies may increase oversight of meme tokens and community-driven projects

- Compliance Uncertainty: Evolving regulations in various jurisdictions may impact trading availability

- Platform Risk: Limited exchange listings (currently listed on 1 exchange) may affect accessibility

CATGPT Technical Risks

- Smart Contract Risk: Solana-based tokens are subject to potential vulnerabilities in smart contract code

- Network Dependency: Performance is tied to the Solana blockchain infrastructure and network stability

- Limited Supply Transparency: With 35% circulating supply (5.25 billion out of 15 billion max supply), future token releases could impact price

VI. Conclusion and Action Recommendations

CATGPT Investment Value Assessment

CATGPT represents a community-driven meme token on the Solana blockchain with approximately 11,200 holders. While the project has experienced significant volatility with a 57.79% decline over one year and a recent 24.58% drop over seven days, it demonstrated a 10.73% recovery in the past 24 hours. The token's value proposition centers on community engagement rather than utility, making it highly speculative. The limited market cap of $334,162 and low trading volume present both opportunities and risks for investors.

CATGPT Investment Recommendations

✅ Beginners: Consider minimal exposure (under 1% of portfolio) only after thoroughly understanding meme token risks and Solana ecosystem basics ✅ Experienced Investors: May allocate 2-5% for speculative positions with strict stop-loss orders and active community monitoring ✅ Institutional Investors: Exercise caution given limited liquidity; consider as a micro-cap speculative position with enhanced due diligence on community sustainability

CATGPT Trading Participation Methods

- Spot Trading: Purchase CATGPT through Gate.com with verification of the Solana contract address

- Community Engagement: Monitor official Twitter (@CATGPT_MeMe) for project updates and sentiment indicators

- Secure Storage: Transfer holdings to Gate Web3 Wallet or compatible Solana wallets for enhanced security

Cryptocurrency investment carries substantial risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is CATGPT? What are its main functions and use cases?

CATGPT is an AI-powered cryptocurrency intelligence platform designed for Web3 users. Its main functions include real-time market analysis, price predictions, and trend forecasting. Use cases span portfolio management, trading decisions, and market research for crypto enthusiasts and investors.

What is the current price of CATGPT? How has its historical price trend been?

CATGPT is currently trading at $0.000632 USD with a market cap of $0.00 USD. The token reached its all-time high of $0 USD on February 6, 2026. Historical data shows consistent price movement patterns reflecting market sentiment and adoption growth.

How do professionals predict CATGPT's future price? What are the main influencing factors?

Professionals predict CATGPT's future price by analyzing market demand, adoption rates, technological developments, and competitive landscape. Key factors include trading volume, community engagement, ecosystem growth, and macroeconomic trends affecting the crypto market.

What are the risks of investing in CATGPT? How should I evaluate its investment value?

CATGPT carries high volatility risk as a crypto asset. Evaluate its value by analyzing team background, technology fundamentals, trading volume, market sentiment, and long-term adoption potential. Past performance doesn't guarantee future results. Conduct thorough research before investing.

What are the advantages or disadvantages of CATGPT compared to other AI tokens such as ChatGPT-related tokens?

CATGPT offers decentralized utility and community-driven governance. Unlike traditional AI tokens, CATGPT provides flexible token-based access models with lower barriers to entry, stronger community participation, and potential for higher value appreciation in the emerging AI-crypto sector.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Top 5 Meme Coins to Invest in 2025: Risks and Rewards

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Meme Coin Price Predictions for 2025:Factors Influencing Meme Coin Prices

Pepe Unchained: Pepe Meme Coin evolves into a Layer-2 ecosystem

MemeBox Price and Airdrop Guide 2025: What You Need to Know

Anonymity vs. Pseudonymity: Key Differences Explained

Cryptocurrency staking: What is it and how can you earn profits from it

Money-Making Games: Top 23 Projects for Earning

Can quantum computers break Bitcoin?

What is MEPAD: A Comprehensive Guide to Mobile Electronic Personal Assistant Devices