2026 CRE Price Prediction: Market Analysis, Expert Forecasts, and Investment Opportunities

Introduction: CRE's Market Position and Investment Value

Crepe Project (CRE), positioned as a Web3.0 asset management system on Polygon and BSC that enables experts to build crypto investment portfolios for ordinary users, has been operational since its launch in October 2023. As of February 2026, CRE maintains a market capitalization of approximately $328,500 with a circulating supply of 1 billion tokens, priced around $0.0003285. This asset, serving as an accessible gateway for ordinary investors to participate in professionally managed crypto portfolios, is playing an increasingly relevant role in democratizing crypto asset management.

This article will comprehensively analyze CRE's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. CRE Price History Review and Market Status

CRE Historical Price Evolution Trajectory

- October 2023: CRE launched on Gate.com at an initial offering price of $0.04389, marking the official entry of this Web3.0 asset management project into the market.

- October 2024: The token reached its all-time high of $0.49 on October 31, 2024, representing a significant milestone in its price trajectory.

- March 2025: CRE experienced a notable correction, dropping to its all-time low of $0.0000999 on March 2, 2025, reflecting broader market adjustment pressures.

CRE Current Market Situation

As of February 7, 2026, CRE is trading at $0.0003285, showing a 10.64% increase over the past 24 hours. The token's trading range within the last day spans from a low of $0.00029017 to a high of $0.000345.

From a broader timeframe perspective, CRE has demonstrated mixed performance. The token shows a decline of 2.71% over the past hour and 2.61% over the past week. The 30-day period reflects a 6.67% decrease. However, on a yearly basis, CRE has gained 77.31%, indicating recovery momentum from previous lows.

The project maintains a market capitalization of $328,500, with a fully diluted valuation matching this figure at 100% token circulation. All 1 billion tokens from the maximum supply are currently in circulation. The 24-hour trading volume stands at $19,646.80, with the token holder count reaching 6,650 addresses.

CRE operates as a BEP-20 token on the Binance Smart Chain, positioning itself within the Web3.0 asset management ecosystem on both Polygon and BSC networks. The project enables expert-designed cryptocurrency investment portfolios accessible to ordinary users.

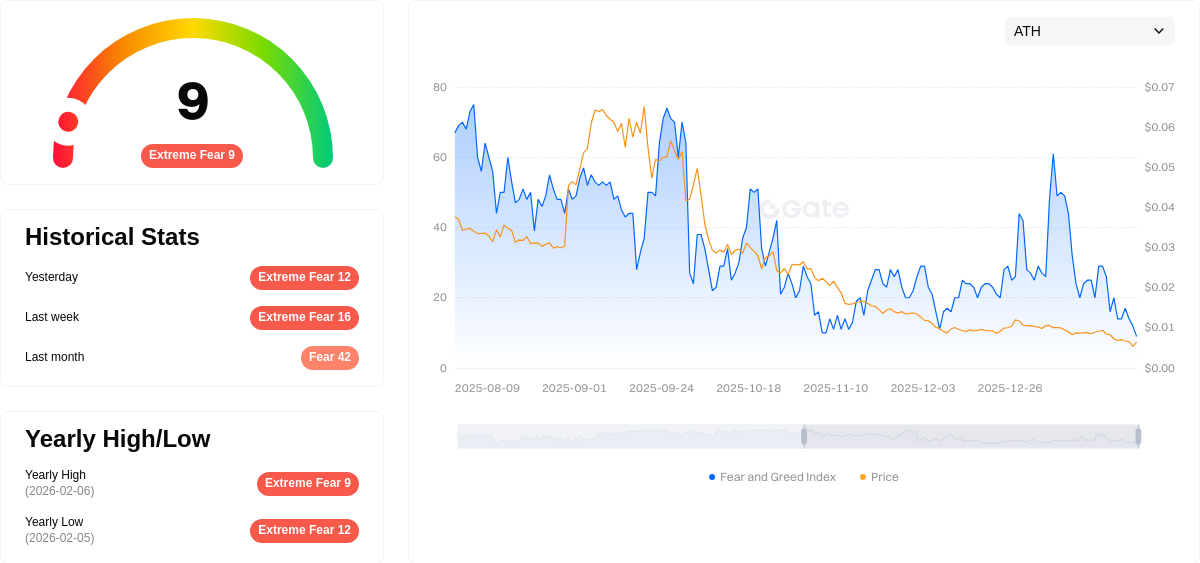

Market sentiment indicators show extreme fear at level 9, suggesting cautious investor behavior in the current trading environment. The token maintains a market dominance of 0.000012% and ranks at position 3434 in the broader cryptocurrency market.

Click to view current CRE market price

CRE Market Sentiment Indicator

2026-02-06 Fear and Greed Index: 9 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the index hitting a critical low of 9. This severe sentiment reading indicates investors are highly risk-averse and market pessimism is at peak levels. Such extreme fear often creates contrarian opportunities, as historical patterns suggest excessive panic can precede market reversals. However, caution remains warranted until indicators show stabilization. Investors should carefully evaluate their risk tolerance and portfolio allocation during this period of heightened market uncertainty and volatility.

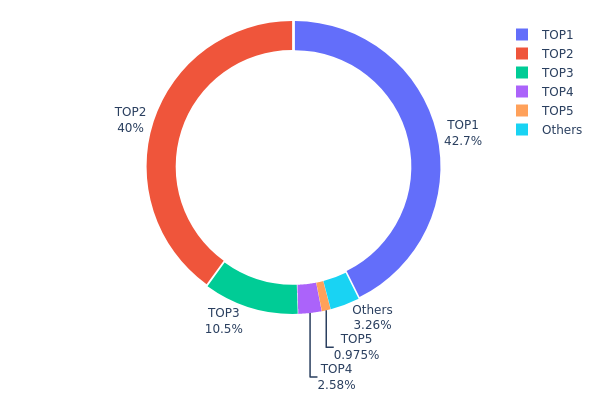

CRE Holdings Distribution

The holdings distribution chart illustrates how CRE tokens are allocated across different wallet addresses, revealing the degree of token concentration among major holders. This metric serves as a critical indicator of decentralization and potential market manipulation risks.

According to the current data, CRE exhibits a highly concentrated holdings structure. The top three addresses collectively control 93.18% of the total token supply, with the largest holder possessing 42.68% (426.81M tokens), followed by the second-largest at 40.00% (400M tokens), and the third at 10.50% (105.07M tokens). The remaining addresses outside the top five account for merely 3.27% of circulation, indicating an extremely centralized distribution pattern.

This level of concentration poses significant implications for market dynamics. The dominant position of top holders creates substantial systemic risks, as any large-scale sell-off from these addresses could trigger severe price volatility and market instability. Furthermore, such concentrated control raises concerns about potential price manipulation and undermines the fundamental principles of decentralized asset distribution. From a market structure perspective, this distribution pattern suggests limited token accessibility for retail participants and heightened vulnerability to whale movements, which may deter institutional investors seeking more balanced token economics.

Click to view current CRE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0d07...b492fe | 426810.52K | 42.68% |

| 2 | 0xb54a...83fe6d | 400000.00K | 40.00% |

| 3 | 0x40be...3e779c | 105066.68K | 10.50% |

| 4 | 0xdb6c...9da856 | 25821.01K | 2.58% |

| 5 | 0x0d8c...41e942 | 9750.00K | 0.97% |

| - | Others | 32551.79K | 3.27% |

II. Core Factors Influencing CRE's Future Price

Supply Mechanism

-

Market Liquidity: Liquidity remains the most significant factor affecting crypto market dynamics. Two primary elements influence liquidity: (i) monetary policy and (ii) stablecoin adoption rates. Under dovish (accommodative) monetary conditions, market liquidity tends to increase, potentially supporting price appreciation.

-

Historical Patterns: Past market cycles have demonstrated that changes in central bank policies and liquidity conditions significantly impact asset valuations. Periods of accommodative monetary policy have historically coincided with stronger market performance.

-

Current Impact: The current market environment continues to be shaped by evolving monetary policies and liquidity conditions. Market participants should monitor these factors as they may influence price movements in the near to medium term.

Institutional and Major Holder Dynamics

-

Institutional Positioning: Market sentiment and institutional participation patterns continue to evolve. The investment landscape shows varying levels of institutional engagement across different asset classes.

-

Strategic Partnerships: CREPE has been working on advancing accessibility in crypto investment through its technical architecture and market initiatives. The project includes strategic partner collaborations and community engagement efforts.

-

Policy Environment: Government policies and regulatory frameworks remain important considerations for market participants. The global economic environment and policy decisions may affect market conditions.

Macroeconomic Environment

-

Monetary Policy Influence: Central bank policies represent a key driver of market conditions. Monetary policy decisions, including interest rate adjustments and quantitative measures, may influence market dynamics and asset performance.

-

Inflation Considerations: In environments with inflationary pressures, certain assets may be considered for portfolio diversification strategies. Market participants evaluate various factors when assessing inflation-related risks and opportunities.

-

Geopolitical Factors: International developments and geopolitical considerations continue to influence market sentiment. Concerns about currency stability and global economic conditions may affect investment decisions across asset classes.

Technical Development and Ecosystem Building

-

DeFi Innovation: CREPE aims to contribute to the democratization of crypto investment through its technical framework and market approach. The project focuses on enhancing accessibility and user engagement within the decentralized finance space.

-

Ecosystem Applications: The broader ecosystem continues to develop with various applications and use cases. Market participants evaluate projects based on their technical merits, adoption potential, and community support.

-

Platform Integration: Integration with trading platforms like Gate.com provides users with access to various digital assets and trading services. Platform features and infrastructure continue to evolve to meet market needs.

III. 2026-2031 CRE Price Prediction

2026 Outlook

- Conservative prediction: $0.00029 - $0.00033

- Neutral prediction: Around $0.00033

- Optimistic prediction: Up to $0.00048 (requires favorable market conditions and increased adoption)

2027-2029 Mid-term Outlook

- Market stage expectation: Potential gradual recovery phase with moderate growth momentum as the cryptocurrency market matures

- Price range predictions:

- 2027: $0.00033 - $0.00051 (approximately 23% increase from 2026)

- 2028: $0.00038 - $0.00061 (approximately 38% cumulative increase)

- 2029: $0.00047 - $0.00073 (approximately 61% cumulative increase)

- Key catalysts: Broader cryptocurrency market recovery, potential ecosystem development, and improved trading infrastructure on platforms like Gate.com

2030-2031 Long-term Outlook

- Baseline scenario: $0.00042 - $0.00065 (assuming stable market conditions and continued project development)

- Optimistic scenario: $0.00054 - $0.00071 by 2031 (assuming enhanced utility and wider adoption)

- Transformative scenario: Potential for approximately 95% cumulative growth by 2031 (requires significant technological breakthroughs and mainstream adoption)

- February 7, 2026: CRE trading around baseline levels (early stage of predicted growth trajectory)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00048 | 0.00033 | 0.00029 | 0 |

| 2027 | 0.00051 | 0.00041 | 0.00033 | 23 |

| 2028 | 0.00061 | 0.00046 | 0.00038 | 38 |

| 2029 | 0.00073 | 0.00053 | 0.00047 | 61 |

| 2030 | 0.00065 | 0.00063 | 0.00042 | 92 |

| 2031 | 0.00071 | 0.00064 | 0.00054 | 95 |

IV. CRE Professional Investment Strategy and Risk Management

CRE Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors with moderate to high risk tolerance interested in Web3.0 asset management solutions

- Operational Recommendations:

- Evaluate CREPE's platform development progress and user adoption metrics on Polygon and BSC networks

- Monitor the growth of expert-created portfolio offerings and transaction volume trends

- Storage Solution: Consider using Gate Web3 Wallet for secure storage of CRE tokens, ensuring private key security and regular backup

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor 24-hour trading volume (currently $19,646.80) to identify potential breakout or reversal patterns

- Support and Resistance Levels: Track the 24-hour range ($0.00029017 - $0.000345) to identify key price levels

- Swing Trading Considerations:

- Pay attention to short-term volatility, as evidenced by the 10.64% 24-hour gain and -2.71% 1-hour decline

- Consider position sizing carefully given the relatively low liquidity compared to major cryptocurrencies

CRE Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 8% with active management and hedging strategies

(II) Risk Hedging Solutions

- Diversification: Combine CRE holdings with established assets to reduce portfolio concentration risk

- Stop-Loss Implementation: Set predetermined exit points to limit potential losses in volatile market conditions

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and convenient access

- Cold Storage Option: Hardware wallet solutions for long-term holdings exceeding $1,000 value

- Security Precautions: Never share private keys, enable two-factor authentication, and verify contract addresses (0xeec027f0d9a1de829f430b5dfafe9f7ca5be9c88 on BSC) before transactions

V. CRE Potential Risks and Challenges

CRE Market Risks

- Liquidity Risk: Limited trading volume compared to major cryptocurrencies may result in slippage during larger transactions

- Price Volatility: Historical price range from $0.0000999 to $0.49 indicates significant volatility potential

- Market Cap Concentration: With a market cap of approximately $328,500, the token is susceptible to price manipulation

CRE Regulatory Risks

- Asset Management Regulation: Web3.0 asset management platforms may face evolving regulatory scrutiny in various jurisdictions

- DeFi Compliance: Decentralized investment portfolio services may encounter regulatory challenges as authorities develop clearer frameworks

- Multi-Chain Exposure: Operating on both Polygon and BSC networks creates exposure to regulatory developments affecting multiple blockchain ecosystems

CRE Technical Risks

- Smart Contract Vulnerabilities: As with any DeFi protocol, potential smart contract bugs could pose security risks

- Platform Dependency: Success relies heavily on the continued development and adoption of the CREPE platform

- Competition Risk: The Web3.0 asset management sector faces competition from established DeFi protocols and emerging platforms

VI. Conclusion and Action Recommendations

CRE Investment Value Assessment

CRE represents a speculative opportunity in the emerging Web3.0 asset management sector, offering exposure to decentralized portfolio construction and management. The platform's dual-chain deployment on Polygon and BSC provides accessibility, while the expert-driven portfolio approach addresses a genuine market need. However, investors should recognize the significant risks, including limited liquidity, high volatility, and early-stage project uncertainties. The 77.31% year-over-year gain demonstrates growth potential, but the token's journey from $0.49 to current levels near $0.0003285 illustrates the substantial downside risks inherent in micro-cap cryptocurrencies.

CRE Investment Recommendations

✅ Beginners: Approach with extreme caution; allocate only minimal amounts you can afford to lose entirely, and thoroughly research Web3.0 asset management concepts before investing ✅ Experienced Investors: Consider as a small speculative position within a diversified crypto portfolio; monitor platform development and user metrics closely ✅ Institutional Investors: Conduct comprehensive due diligence on smart contract security, team credentials, and market positioning before consideration; maintain strict position limits

CRE Trading Participation Methods

- Spot Trading: Purchase CRE directly on Gate.com with major cryptocurrencies or stablecoins

- Platform Participation: Explore the CREPE platform to understand the investment portfolio offerings and ecosystem utility

- Community Engagement: Follow official channels to stay informed about platform updates and ecosystem developments

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How has CRE's historical price performance been? What were the major price fluctuations in the past?

CRE prices declined significantly since 2022 due to rising interest rates and increased office vacancy rates. The Federal Reserve's rate hikes and work-from-home trends compressed valuations. Office vacancies reached 18.7% historically, with prices down 11.6% year-over-year as of Q4 2022. The market remains in downtrend.

What factors affect the price of CRE?

CRE price is influenced by market demand, trading volume, regulatory changes, macroeconomic factors, and broader cryptocurrency market sentiment. External financial events and policy shifts also impact its price movements.

How to predict CRE price? What are the analysis methods?

Analyze CRE price using technical analysis, market sentiment, trading volume trends, and historical price patterns. Monitor blockchain metrics, compare with market cycles, and track institutional flows. Combine multiple indicators for comprehensive predictions.

What is the future price outlook for CRE?

CRE shows promising growth potential driven by increasing demand for lithium and strong market fundamentals. Analyst predictions range from 0.75 to 2.15 CAD, reflecting significant upside opportunity as the cryptocurrency sector expands.

What are the risks to be aware of when investing in CRE?

CRE investment risks include market volatility, economic fluctuations, tenant turnover, and property management challenges. Diversification and thorough due diligence help mitigate these risks effectively.

CRE price correlation with other assets or tokens?

CRE token price is primarily linked to Crescent Network's governance utility and asset efficiency. As the governance token, CRE correlates with DeFi market movements, Cosmos ecosystem performance, and staking demand for bCRE liquidity positions.

What is the current market liquidity and trading volume of CRE?

CRE currently has relatively low market liquidity with a daily trading volume of approximately $589,400. The market activity remains moderate, reflecting steady but limited trading interest.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

Anonymity vs. Pseudonymity: Key Differences Explained

Cryptocurrency staking: What is it and how can you earn profits from it

Money-Making Games: Top 23 Projects for Earning

Can quantum computers break Bitcoin?

What is MEPAD: A Comprehensive Guide to Mobile Electronic Personal Assistant Devices