2026 CREO Price Prediction: Expert Analysis and Market Forecast for Creo Token's Future Value

Introduction: CREO's Market Position and Investment Value

Creo Engine (CREO), as a web3 gaming ecosystem platform, has been building its presence in the blockchain gaming sector since its launch in 2022. As of February 2026, CREO maintains a market capitalization of approximately $363,451, with a circulating supply of around 290.3 million tokens, and the price hovering at $0.001252. This asset, recognized as a connector of gaming worlds through a unified gaming hub, is playing an increasingly relevant role in the web3 gaming infrastructure space.

This article will comprehensively analyze CREO's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. CREO Price History Review and Current Market Status

CREO Historical Price Evolution Trajectory

- 2024: Reached a notable price level of $0.26 on March 13, marking a significant peak in the token's trading history

- 2026: Experienced substantial volatility, with price declining from higher levels to establish a new historical low of $0.001231 on February 6

CREO Current Market Landscape

As of February 6, 2026, CREO is trading at $0.001252, reflecting a 4.7% decrease over the past 24 hours. The token's intraday trading range has fluctuated between $0.001231 and $0.001319.

Over broader timeframes, CREO has experienced notable price movements. The 7-day performance shows a 14.45% decline, while the 30-day period reflects a 32.42% decrease. The year-over-year comparison indicates a 90.8% decline in value.

The current market capitalization stands at approximately $363,451, with a circulating supply of 290,296,616 CREO tokens representing 29.03% of the total supply. The fully diluted market capitalization is calculated at $987,686. The 24-hour trading volume amounts to $34,011, indicating moderate trading activity.

CREO maintains a market dominance of 0.000041% within the broader cryptocurrency ecosystem. The token is listed on 8 exchanges and has a holder base of 18,149 addresses. The project operates as a BEP-20 token on the BSC (Binance Smart Chain) infrastructure.

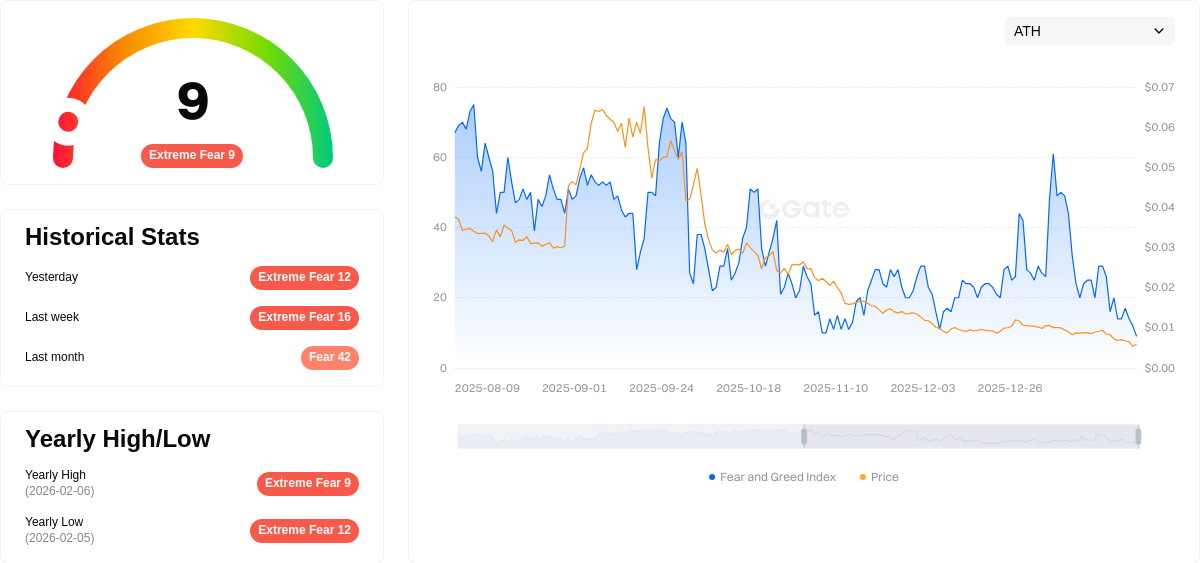

Market sentiment indicators suggest an environment of extreme caution, with the current fear and greed index registering at 9, classified as "Extreme Fear."

Click to view current CREO market price

CREO Market Sentiment Index

2026-02-06 Fear and Greed Index: 9 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of 9, indicating panic-driven selling pressure. Investors are displaying heightened risk aversion as negative sentiment dominates the market landscape. Such extreme readings historically present contrarian opportunities for long-term investors, as markets often reverse after reaching these psychological extremes. However, caution remains warranted until stabilization signals emerge. Monitor key support levels and market developments closely during this volatile period.

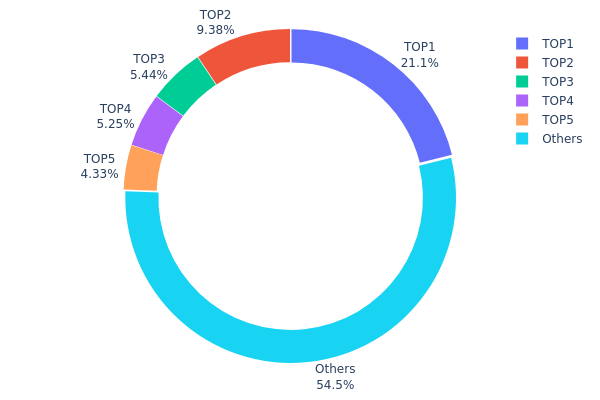

CREO Holding Distribution

The holding distribution chart reveals the concentration of token ownership across different wallet addresses, serving as a critical indicator of decentralization level and potential market manipulation risks. For CREO, the current on-chain data demonstrates a moderately concentrated holding structure that warrants careful examination.

According to the latest statistics, the top holder is the burn address (0x0000...00dead) controlling 211,113.39K tokens (21.11% of total supply), representing permanently removed tokens from circulation. Beyond this deflationary mechanism, the second-largest address holds 93,774.14K tokens (9.37%), while the third and fourth positions account for 5.44% and 5.24% respectively. Notably, the top five addresses collectively control approximately 45.48% of circulating supply, with the remaining 54.52% distributed among other participants. This distribution pattern suggests a relatively balanced ownership structure, though significant concentration exists among early participants or institutional holders.

From a market structure perspective, CREO's holding distribution exhibits mixed characteristics. While the substantial burn allocation demonstrates commitment to token scarcity economics, the presence of multiple large holders possessing 4-9% stakes introduces potential centralization concerns. Such concentration levels could amplify price volatility during market stress periods, as coordinated selling by major holders may trigger cascading liquidations. However, the majority ownership (54.52%) residing with smaller participants provides a degree of decentralization that mitigates extreme manipulation risks, creating a more resilient on-chain ecosystem compared to projects with dominant whale control.

Click to view current CREO Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 211113.39K | 21.11% |

| 2 | 0x2e8f...725e64 | 93774.14K | 9.37% |

| 3 | 0x1ab4...8f8f23 | 54445.56K | 5.44% |

| 4 | 0x4982...6e89cb | 52457.30K | 5.24% |

| 5 | 0xeaed...6a6b8d | 43258.05K | 4.32% |

| - | Others | 544951.56K | 54.52% |

II. Core Factors Influencing CREO's Future Price

Market Demand and Software Updates

- Market Demand: CREO's pricing is significantly influenced by the demand for CAD tools across various industries. As companies continue to adopt advanced design software, fluctuations in market demand can lead to adjustments in CREO's pricing structure.

- Software Updates: Regular software updates and feature enhancements play a crucial role in maintaining CREO's competitive edge. Updates that introduce new functionalities or improve user experience can drive higher adoption rates and potentially support pricing adjustments.

- Current Impact: The ongoing evolution of CAD technology and increasing user expectations may lead to periodic pricing reviews to align with the value delivered through software improvements.

Competition from Similar CAD Tools

- Competitive Landscape: CREO operates in a competitive environment with other CAD software providers. The presence of alternative tools influences pricing strategies, as CREO must remain competitive while demonstrating its unique value proposition.

- Technological Advancements: Continuous innovation and the introduction of advanced features by competitors may pressure CREO to adjust its pricing or enhance its offerings to retain market share.

- User Feedback: Feedback from users regarding functionality, ease of use, and pricing is a key factor that can drive changes in CREO's pricing model.

Licensing Models and User Volume

- Licensing Flexibility: CREO's pricing may vary based on the licensing model chosen by organizations, such as perpetual licenses, subscription-based models, or volume licensing for large enterprises. These models provide flexibility and can influence the overall cost structure.

- User Volume: The number of users within an organization can impact pricing, with volume discounts or enterprise agreements potentially reducing the per-user cost.

- Current Influence: As organizations evaluate cost-effectiveness and scalability, licensing models and user volume considerations remain central to pricing decisions.

III. 2026-2031 CREO Price Forecast

2026 Outlook

- Conservative Forecast: $0.00079 - $0.00125

- Neutral Forecast: Around $0.00125

- Optimistic Forecast: Up to $0.00176 (contingent on favorable market conditions and increased adoption)

2027-2029 Mid-term Outlook

- Market Phase Expectations: CREO may enter a gradual growth phase with moderate volatility, potentially driven by broader cryptocurrency market trends and ecosystem developments

- Price Range Forecast:

- 2027: $0.00128 - $0.00163 (approximately 20% increase anticipated)

- 2028: $0.00139 - $0.00227 (approximately 25% growth projected)

- 2029: $0.00125 - $0.00282 (potential 53% appreciation)

- Key Catalysts: Expanding utility within the ecosystem, strategic partnerships, and overall crypto market sentiment shifts could serve as primary price drivers

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00166 - $0.00310 (assuming steady ecosystem growth and sustained market interest)

- Optimistic Scenario: $0.00237 - $0.00298 (contingent on significant adoption milestones and favorable regulatory developments)

- Transformative Scenario: Up to $0.00310 (requires exceptional market conditions, widespread institutional adoption, and breakthrough use cases)

- 2026-02-06: CREO trading within early-stage valuation range, establishing foundation for potential multi-year growth trajectory

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00176 | 0.00125 | 0.00079 | 0 |

| 2027 | 0.00163 | 0.00151 | 0.00128 | 20 |

| 2028 | 0.00227 | 0.00157 | 0.00139 | 25 |

| 2029 | 0.00282 | 0.00192 | 0.00125 | 53 |

| 2030 | 0.0031 | 0.00237 | 0.00166 | 89 |

| 2031 | 0.00298 | 0.00274 | 0.00257 | 118 |

IV. CREO Professional Investment Strategies and Risk Management

CREO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to web3 gaming ecosystems with higher risk tolerance

- Operational Recommendations:

- Consider dollar-cost averaging to mitigate entry price volatility

- Monitor project development milestones and gaming ecosystem expansion

- Utilize secure storage solutions such as Gate Web3 Wallet for long-term holdings

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Utilize 50-day and 200-day moving averages to identify potential trend reversals and momentum shifts

- Volume Analysis: Monitor 24-hour trading volume fluctuations to assess market participation and liquidity conditions

- Swing Trading Considerations:

- Observe price action near recent support level around $0.001231 and resistance near $0.001319

- Implement stop-loss orders to manage downside risk given recent volatility patterns

CREO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 10% with active risk monitoring and hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Maintain exposure across multiple sectors including gaming, DeFi, and infrastructure tokens

- Position Sizing: Limit single-token exposure to prevent concentrated risk in volatile market conditions

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading and moderate holdings

- Cold Storage Solution: Hardware wallet solution for long-term holdings exceeding significant threshold amounts

- Security Precautions: Enable two-factor authentication, regularly update security protocols, and verify contract addresses (0x9521728bf66a867bc65a93ece4a543d817871eb7 on BSC) before transactions

V. CREO Potential Risks and Challenges

CREO Market Risks

- High Volatility: CREO has experienced significant price decline of 90.8% over the past year, indicating substantial market volatility

- Limited Liquidity: With 24-hour trading volume of approximately $34,011, liquidity constraints may impact execution pricing for larger orders

- Low Market Capitalization: Current market cap of approximately $363,451 presents higher risk profile compared to established projects

CREO Regulatory Risks

- Web3 Gaming Regulations: Evolving regulatory frameworks for blockchain gaming and NFT assets may impact project operations

- Token Classification: Potential regulatory scrutiny regarding token utility and classification across different jurisdictions

- Compliance Requirements: Increasing regulatory demands for web3 projects may affect operational costs and market accessibility

CREO Technical Risks

- Smart Contract Vulnerabilities: BEP-20 token standard contracts may face security risks requiring ongoing audits and monitoring

- Blockchain Dependency: Project functionality relies on BSC network performance and security infrastructure

- Development Execution: Web3 gaming ecosystem success depends on continued technical development and user adoption rates

VI. Conclusion and Action Recommendations

CREO Investment Value Assessment

CREO presents a speculative opportunity within the web3 gaming sector, operating as an ecosystem connecting gaming worlds through a unified hub. While the project addresses the growing intersection of gaming and blockchain technology, investors should carefully consider the significant risks. The token has experienced substantial depreciation of 90.8% over the past year, with limited market capitalization of approximately $363,451 and constrained liquidity. The circulating supply represents 29.03% of total supply, with maximum supply capped at 1 billion tokens. Short-term volatility remains elevated with 7-day decline of 14.45% and 30-day decline of 32.42%. Long-term value proposition depends on successful ecosystem development, user adoption, and broader web3 gaming market expansion.

CREO Investment Recommendations

✅ Beginners: Allocate minimal exposure (under 1% of crypto portfolio) only after thorough research and understanding of web3 gaming sector risks ✅ Experienced Investors: Consider limited allocation (2-3% of crypto portfolio) with strict risk management protocols and regular portfolio rebalancing ✅ Institutional Investors: Evaluate as part of diversified web3 gaming exposure with comprehensive due diligence on project fundamentals and market conditions

CREO Trading Participation Methods

- Spot Trading: Purchase CREO tokens on Gate.com with direct ownership and custody options

- Dollar-Cost Averaging: Implement systematic purchase strategy to reduce timing risk in volatile market conditions

- Portfolio Integration: Include CREO as part of broader web3 gaming sector allocation alongside established projects

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is CREO? What is its purpose?

CREO is a blockchain-based platform designed for decentralized creative content and digital asset management. It enables creators to tokenize, trade, and monetize their work securely on-chain, offering transparent ownership and seamless value transfer within the web3 ecosystem.

How has CREO's historical price performance been?

CREO reached its all-time high of over $0.198477 on March 18, 2024, demonstrating strong market performance. The lowest point occurred on November 2, 2023. The token has shown significant volatility and growth potential throughout its trading history.

What will the CREO price reach in 2024?

CREO price prediction for 2024 is uncertain. Current trading range is $0.001232-$0.001318, with historical high of $0.1985 reached in March 2024. Market momentum depends on project development and adoption trends.

What are the main factors affecting CREO price?

CREO price is primarily influenced by market demand, technological developments, competitive landscape, and regulatory policies. Investor sentiment and overall macroeconomic conditions also play significant roles in price movements.

What risks should I pay attention to when investing in CREO?

CREO investment carries high volatility risks. Manage exposure through portfolio diversification, secure your private keys, monitor market trends, and stay updated on regulatory changes. Crypto investments require careful consideration.

What are the advantages of CREO compared to other mainstream cryptocurrencies?

CREO offers superior liquidity and diverse payment options, supporting multiple fiat currencies and cryptocurrencies for seamless conversion. Its innovative technology and strong community backing provide competitive advantages in the crypto market.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

Digital Nomads & Web3: Traveling and Working Around the World

Top 8 NEAR Wallets

Comprehensive Guide to Understanding and Managing FUD in Cryptocurrency Markets

Bitcoin Pizza Day Explained: The Story of the First BTC Transaction

Are NFTs obsolete? A comprehensive look at NFT applications