2026 DEAI Price Prediction: Analyzing Market Trends and Future Outlook for Decentralized AI Token

Introduction: DEAI's Market Position and Investment Value

Zero1 Labs (DEAI), as a pioneering project in the decentralized artificial intelligence (DeAI) ecosystem, has been developing its Proof-of-Stake-based infrastructure since its launch in 2024. As of 2026, DEAI has achieved a market capitalization of approximately $1.37 million, with a circulating supply of around 97.56 million tokens, and maintains a price level near $0.014. This asset, recognized as an innovative bridge between blockchain technology and artificial intelligence, is playing an increasingly significant role in the decentralized AI computation and multi-modal AI tools sectors.

This article will comprehensively analyze DEAI's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development progress, and macroeconomic environmental factors to provide investors with professional price forecasts and practical investment strategies.

I. DEAI Price History Review and Market Status

DEAI Historical Price Evolution Trajectory

- March 2024: DEAI launched on Gate.com with a publishing price of $0.18, marking the initial entry of Zero1 Labs' native token into the cryptocurrency exchange market

- December 2024: The token reached its historical peak of $1.1 on December 6, 2024, representing significant appreciation from its launch price

- December 2025: Price experienced substantial correction, falling to a historical low of $0.01092 on December 9, 2025, reflecting broader market volatility and adjustments

DEAI Current Market Status

As of February 2, 2026, DEAI is trading at $0.014, showing a 24-hour increase of 5.9%. The token's 24-hour trading range spans from $0.0126 to $0.01435, with a total trading volume of $28,948.46.

The current market capitalization stands at approximately $1.37 million, with 97.56 million tokens in circulation, representing 9.76% of the total supply of 1 billion tokens. The fully diluted market cap is valued at $14 million. DEAI holds a market dominance of 0.00051% in the cryptocurrency sector.

The token demonstrates mixed performance across different timeframes: declining 0.21% in the past hour and 8.44% over the past week, while showing positive momentum with an 8.7% gain over the past 30 days. The one-year performance reflects a decline of 93.05% from the previous year's levels.

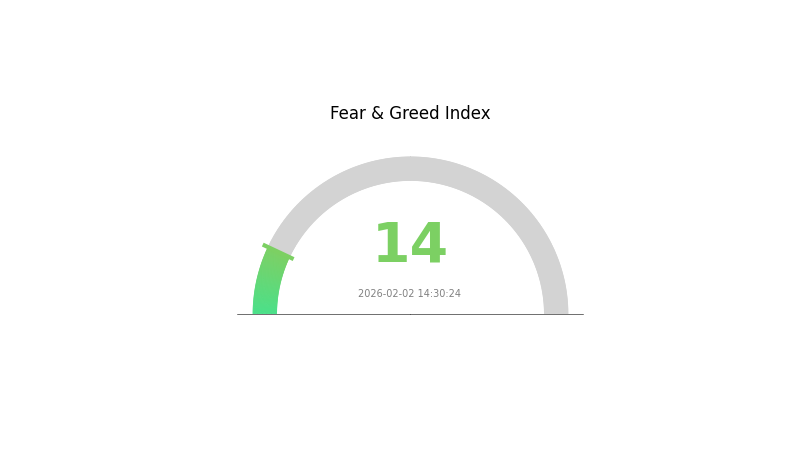

The current market sentiment index registers at 14, indicating an "Extreme Fear" condition in the broader cryptocurrency market. The token is listed on 7 exchanges and has attracted 18,036 holders. DEAI operates as an ERC20 token on the Ethereum blockchain, with the contract address 0x1495bc9e44af1f8bcb62278d2bec4540cf0c05ea.

Click to view current DEAI market price

DEAI Market Sentiment Indicator

2026-02-02 Fear and Greed Index: 14 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index at 14. This historically low reading indicates strong bearish sentiment among investors, driven by significant market uncertainty and risk aversion. During periods of extreme fear, asset prices often reach attractive entry points for long-term investors. However, caution is warranted, as further downside pressure may persist. Monitor market conditions closely and consider your risk tolerance before making investment decisions.

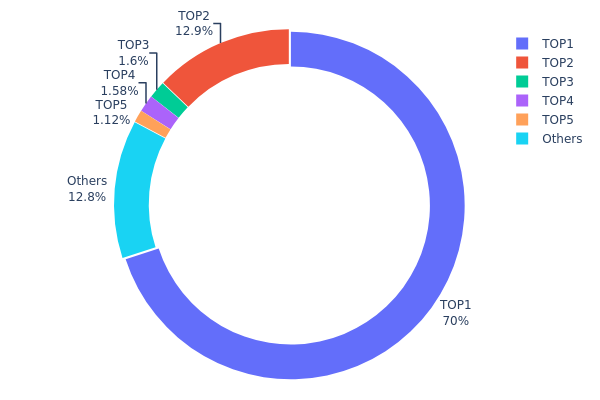

DEAI Holding Distribution

According to the on-chain holding distribution data, DEAI exhibits a highly concentrated ownership structure. The holding distribution chart visualizes the percentage of total token supply held by different wallet addresses, serving as a key indicator to assess the degree of decentralization and potential market manipulation risks within a cryptocurrency project.

The top holder controls 700 million tokens, representing 70% of the total supply, demonstrating extreme concentration. The second-largest address holds approximately 128.55 million tokens (12.85%), while addresses ranked 3rd through 5th hold between 1.12% and 1.59% each. The remaining addresses collectively account for only 12.86% of the supply. This distribution pattern reveals that the top two addresses alone control over 82% of the entire token supply, indicating a severely centralized ownership structure.

Such high concentration poses significant implications for market dynamics. Large holders possess substantial influence over price movements and can potentially trigger sharp volatility through coordinated selling or accumulation activities. The limited token distribution among retail participants may result in reduced liquidity and heightened susceptibility to price manipulation. From a decentralization perspective, this structure deviates considerably from the ideal token distribution model, potentially undermining the project's long-term stability and community governance effectiveness.

Click to view current DEAI Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe2fe...1435fb | 700000.00K | 70.00% |

| 2 | 0xdf36...45d687 | 128553.58K | 12.85% |

| 3 | 0x3cc9...aecf18 | 15962.29K | 1.59% |

| 4 | 0x1385...b7f80d | 15818.31K | 1.58% |

| 5 | 0x6860...1fdcc6 | 11249.77K | 1.12% |

| - | Others | 128416.05K | 12.86% |

II. Core Factors Influencing DEAI's Future Price

Market Demand and Adoption Trends

- Market Demand: DEAI's price trajectory is fundamentally driven by market demand within the decentralized AI ecosystem. As institutional investors and retail participants increasingly recognize the potential of AI-driven blockchain solutions, demand dynamics may shift accordingly.

- Adoption Patterns: The token's value proposition depends significantly on the adoption rate of Zero1 Labs' decentralized AI infrastructure. Broader ecosystem integration and practical use cases will play a crucial role in determining sustained demand.

- Institutional Participation: Growing institutional involvement in the crypto space, particularly in AI and blockchain convergence sectors, could provide support for DEAI's market positioning.

Macroeconomic Environment

- Monetary Policy Impact: The broader cryptocurrency market remains sensitive to central bank policies, particularly Federal Reserve decisions regarding interest rates. A high-rate environment may exert pressure on risk assets, including DEAI, while expectations of rate adjustments could create different market dynamics.

- Economic Data Influence: Key economic indicators, such as employment figures and inflation metrics, continue to shape investor sentiment toward digital assets. Strong economic performance might delay monetary easing, potentially limiting upside potential for crypto assets.

- Risk Asset Correlation: DEAI's performance may correlate with broader risk asset movements, including traditional equity markets and major cryptocurrencies like Bitcoin, whose price action often sets the tone for altcoin performance.

Technological Innovation and Ecosystem Development

- AI and Web3 Integration: The convergence of artificial intelligence and Web3 technologies represents a significant narrative for DEAI. Advanced AI algorithms applied to decentralized applications, automated trading systems, and data-driven decision-making tools may enhance the token's utility proposition.

- Decentralized AI Infrastructure: Zero1 Labs' development of decentralized AI solutions, including potential applications in predictive analytics and autonomous systems, could differentiate DEAI within the competitive landscape.

- Ecosystem Expansion: The growth of decentralized autonomous organizations (DAOs), AI-driven governance mechanisms, and related infrastructure developments may provide fundamental support for long-term value appreciation.

Regulatory Landscape

- Regulatory Clarity Progress: Evolving regulatory frameworks in major jurisdictions could impact market sentiment. The development of clear guidelines for digital assets, particularly those combining AI and blockchain technology, may reduce uncertainty and attract institutional capital.

- Compliance Considerations: As regulatory oversight of the crypto sector continues to mature, projects demonstrating strong compliance frameworks and transparent operations may gain competitive advantages in attracting institutional and retail investment.

III. 2026-2031 DEAI Price Prediction

2026 Outlook

- Conservative prediction: $0.01405 - $0.01479

- Neutral prediction: $0.01479 (average market conditions)

- Optimistic prediction: $0.01775 (requires favorable market sentiment and increased adoption)

2027-2029 Outlook

- Market stage expectation: Gradual growth phase with moderate volatility as the project matures and expands its ecosystem

- Price range predictions:

- 2027: $0.01155 - $0.01936

- 2028: $0.01532 - $0.02441

- 2029: $0.01372 - $0.03019

- Key catalysts: Potential technological upgrades, partnerships, community expansion, and broader AI-related token market trends

2030-2031 Long-term Outlook

- Baseline scenario: $0.0218 - $0.02565 (assuming steady market development and sustained project growth)

- Optimistic scenario: $0.02565 - $0.03155 (requires strong ecosystem expansion and favorable regulatory environment)

- Transformative scenario: Above $0.03155 (contingent on breakthrough technological advancements and widespread mainstream adoption)

- 2026-02-02: DEAI maintains a moderate growth trajectory with projected annual increase of approximately 5%

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.01775 | 0.01479 | 0.01405 | 5 |

| 2027 | 0.01936 | 0.01627 | 0.01155 | 16 |

| 2028 | 0.02441 | 0.01781 | 0.01532 | 27 |

| 2029 | 0.03019 | 0.02111 | 0.01372 | 50 |

| 2030 | 0.03155 | 0.02565 | 0.0218 | 83 |

| 2031 | 0.03003 | 0.0286 | 0.02145 | 104 |

IV. DEAI Professional Investment Strategy and Risk Management

DEAI Investment Methodology

(I) Long-term Holding Strategy

- Target Investors: Investors with long-term vision who recognize the potential of decentralized AI ecosystem development and have risk tolerance for emerging technology projects

- Operational Recommendations:

- Consider establishing positions when the market sentiment is neutral or bearish, utilizing dollar-cost averaging to mitigate short-term volatility risks

- Monitor key milestones in the Zero1 Labs ecosystem development, particularly the expansion of Keymaker Platform's multi-modal DeAI tools and Cypher FHE EVEM Layer technological advancements

- Storage Solution: Prioritize secure storage solutions such as Gate Web3 Wallet for enhanced security with multi-signature capabilities, ensuring private key control remains with the investor

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume trends (current volume approximately $28,948) relative to historical averages to identify potential breakout or breakdown scenarios

- Support and Resistance Levels: Track key price levels including recent 24-hour range ($0.0126-$0.01435) and historical reference points to establish entry and exit positions

- Key Swing Trading Points:

- Consider the high volatility characteristics reflected in the -93.05% annual decline, suggesting significant price swings that may present short-term trading opportunities

- Monitor broader DeAI sector sentiment and developments in competitive decentralized AI projects that may influence DEAI price movements

DEAI Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation, focusing on risk mitigation and capital preservation

- Aggressive Investors: 5-10% of crypto portfolio allocation, accepting higher volatility for potential growth in the DeAI sector

- Professional Investors: 10-15% of crypto portfolio allocation, with active monitoring and dynamic rebalancing based on ecosystem developments

(II) Risk Hedging Solutions

- Diversification Approach: Combine DEAI holdings with established cryptocurrencies and other AI-related tokens to reduce sector-specific concentration risk

- Position Sizing Strategy: Implement scaling strategies based on technical levels, avoiding full position commitment at any single price point given the token's historical volatility

(III) Secure Storage Solutions

- Hardware Wallet Recommendation: Gate Web3 Wallet provides robust security features including multi-chain support and encrypted private key storage, suitable for long-term DEAI holdings

- Hot Wallet Solution: For active traders, maintain only necessary trading amounts on exchanges like Gate.com, with the majority stored in cold storage solutions

- Security Precautions: Never share private keys or seed phrases, enable two-factor authentication on all accounts, and regularly verify contract addresses (0x1495bc9e44af1f8bcb62278d2bec4540cf0c05ea on Ethereum) before transactions

V. DEAI Potential Risks and Challenges

DEAI Market Risks

- High Volatility Exposure: DEAI has experienced significant price fluctuations, declining approximately 93.05% over the past year, indicating substantial downside risk that could result in significant capital loss

- Limited Liquidity Concerns: With a 24-hour trading volume of approximately $28,948 and circulation on 7 exchanges, liquidity constraints may lead to slippage during large transactions or market stress periods

- Market Capitalization Dynamics: The current market cap of approximately $1.37 million represents only 9.76% of fully diluted valuation, suggesting potential dilution pressure as more tokens enter circulation from the 1 billion total supply

DEAI Regulatory Risks

- DeAI Sector Scrutiny: Decentralized artificial intelligence projects may face evolving regulatory frameworks as authorities globally develop guidelines for AI technology and cryptocurrency intersection

- Compliance Uncertainty: The integration of AI computation with blockchain technology may trigger regulatory requirements across multiple jurisdictions, potentially affecting project operations and token utility

- Securities Classification Risk: Token classification uncertainties in various jurisdictions could impact trading availability and investor accessibility depending on regulatory determinations

DEAI Technical Risks

- Smart Contract Vulnerabilities: As an ERC-20 token operating on Ethereum, DEAI is subject to potential smart contract bugs or exploits that could compromise token security or functionality

- Ecosystem Development Execution: The success of Zero1 Labs' Proof-of-Stake DeAI ecosystem depends on successful implementation of complex technologies including Fully Homomorphic Encryption (FHE) and the Keymaker Platform's multi-modal tools

- Competition and Obsolescence: The rapidly evolving DeAI sector presents risks that competing projects may develop superior technology or capture market share, potentially diminishing DEAI's utility and value proposition

VI. Conclusion and Action Recommendations

DEAI Investment Value Assessment

Zero1 Labs positions itself as a pioneer in the Proof-of-Stake-based decentralized AI ecosystem, offering technological infrastructure through its Cypher FHE EVEM Layer and Keymaker Platform. The long-term value proposition centers on the growing intersection of blockchain and artificial intelligence, potentially benefiting from increased demand for confidential AI computation solutions. However, significant short-term risks include substantial price volatility evidenced by the 93.05% annual decline, relatively low market capitalization, and execution challenges inherent in developing complex DeAI infrastructure. The token's current low circulation ratio of approximately 9.76% suggests potential future supply pressure that investors should carefully consider.

DEAI Investment Recommendations

✅ Beginners: Approach with extreme caution; limit exposure to less than 1-2% of total crypto portfolio; prioritize education about DeAI technology and broader market fundamentals before investing; consider observing ecosystem developments before establishing positions ✅ Experienced Investors: Consider strategic accumulation during market downturns using dollar-cost averaging; monitor Zero1 Labs' technological milestones and partnership announcements; maintain diversified exposure across multiple AI-related crypto projects ✅ Institutional Investors: Conduct thorough due diligence on Zero1 Labs' technology architecture and team capabilities; evaluate DeAI market positioning relative to competitors; consider strategic positions aligned with broader AI and blockchain thesis while maintaining strict risk controls

DEAI Trading Participation Methods

- Spot Trading: Participate in DEAI spot markets on Gate.com and other supporting exchanges, allowing direct ownership and transfer flexibility for long-term holding or active trading strategies

- Portfolio Integration: Incorporate DEAI as part of a diversified AI-crypto portfolio strategy, balancing exposure with more established cryptocurrencies and other emerging DeAI projects

- Research-Driven Approach: Monitor Zero1 Labs' development progress including Keymaker Platform expansion and Cypher FHE EVEM Layer implementations to inform position sizing and timing decisions

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is DEAI? What are its main uses and value?

DEAI is decentralized artificial intelligence designed to enhance healthcare data sharing. It enables secure analysis of anonymized medical data to predict diseases and personalize treatments. Its core value lies in protecting data privacy while advancing AI-driven healthcare solutions.

What is DEAI's historical price trend? What were the main drivers of past price movements?

DEAI has experienced significant price volatility driven by market demand and regulatory changes. Historical peaks typically correlate with technological breakthroughs and positive news events, while downturns often coincide with market corrections and regulatory concerns. Trading volume fluctuations have also influenced price dynamics substantially.

What is the 2024 DEAI price prediction? What are analysts' expectations?

DEAI price predictions for 2024 range between 80,000 to 90,000 USD. Analysts expect significant upside potential driven by renewed ETF demand and positive market sentiment, with 70,000 USD serving as a key support level.

What are the main factors affecting DEAI price?

DEAI price is primarily influenced by supply scarcity, institutional adoption, macroeconomic conditions, and technological innovation. Market demand and ecosystem development are key drivers of price movements.

What distinguishes DEAI from other AI-related cryptocurrencies?

DEAI focuses on decentralized AI services with unique governance mechanisms. Unlike general AI tokens, DEAI emphasizes community-driven decision-making, enabling token holders to vote on platform development. DEAI provides direct access to AI infrastructure and computational resources, differentiating it through superior scalability and transaction volume.

What are the main risks to consider when investing in DEAI?

Key risks include market volatility, price manipulation, regulatory uncertainty, and technical security vulnerabilities. Investors should conduct thorough due diligence and only invest capital they can afford to lose.

How to conduct technical analysis of DEAI to predict price trends?

Analyze DEAI's historical price movements, trading volume, and chart patterns using technical indicators like moving averages, RSI, and MACD. Combine AI-driven pattern recognition with support/resistance levels to identify potential breakpoints and forecast price direction for trading opportunities.

Survey Note: Detailed Analysis of the Best AI in 2025

What Is the Best AI Crypto in 2025?

What is the Best AI Now?

How Does Solidus Ai Tech's Market Cap Compare to Other AI Cryptocurrencies?

Why ChatGPT is Likely the Best AI Now?

MomoAI: AI-Powered Social Gaming Revolution on Solana

Top 7 GPUs Previously Used for Ethereum Mining in 2025

Top 5 Tokens Recommended for DeFi Investment

Top 7 Cloud Gaming Services

Top 7 Specialized Ethereum Mining Rigs for 2025

Participating in DAO Communities in the Web3 Era and Prominent DAOs