2026 DEAI Price Prediction: Expert Analysis and Market Outlook for Decentralized AI Token

Introduction: DEAI's Market Position and Investment Value

Zero1 Labs (DEAI), positioned as a pioneering force in the decentralized artificial intelligence (DeAI) ecosystem, has established itself as an innovative project since its launch in 2024. As of 2026, DEAI maintains a market capitalization of approximately $1.39 million, with a circulating supply of around 97.56 million tokens, and a price hovering near $0.01428. This asset, recognized as "the first inclusive Proof-of-Stake-based DeAI ecosystem," is playing an increasingly vital role in advancing confidential AI computation and decentralized AI tool development.

This article will comprehensively analyze DEAI's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. DEAI Price History Review and Market Status

DEAI Historical Price Evolution Trajectory

- March 2024: DEAI launched with an initial offering price of $0.18, marking the token's entry into the decentralized AI ecosystem space.

- December 2024: The token reached its peak value of $1.1 on December 6, 2024, representing a significant milestone in its early trading history.

- December 2025: DEAI experienced substantial volatility, declining to its lowest recorded price of $0.01092 on December 9, 2025, reflecting broader market corrections.

DEAI Current Market Status

As of February 2, 2026, DEAI is trading at $0.01428, with a 24-hour trading volume of $28,211.03. The token has demonstrated notable short-term price movement, increasing by 7.94% over the past 24 hours, with intraday prices ranging between $0.0126 and $0.01435. However, the weekly performance shows a decline of 7.58%, while the monthly trend indicates a recovery with a 7.22% gain.

The token's market capitalization stands at approximately $1.39 million, with a circulating supply of 97.56 million DEAI tokens, representing 9.76% of the total supply of 1 billion tokens. The fully diluted market cap is calculated at $14.28 million. DEAI maintains a market dominance of 0.00052% and is currently listed on 7 exchanges, with an active holder base of 18,036 addresses.

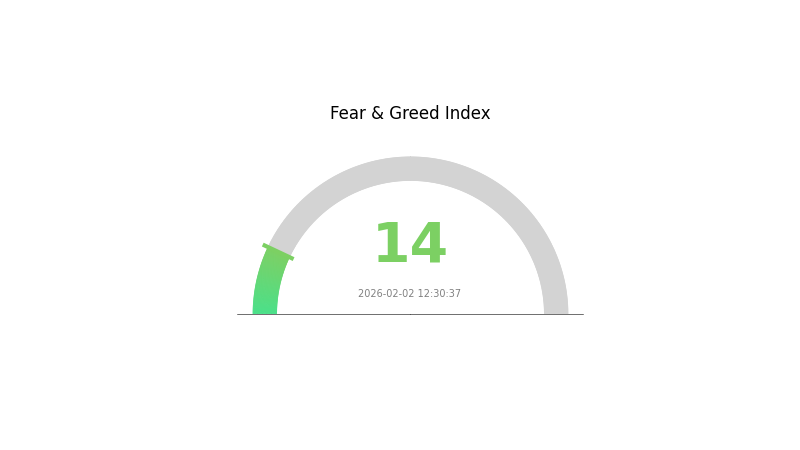

The broader cryptocurrency market sentiment, as reflected by the fear and greed index, registers at 14, indicating extreme fear conditions, which may be influencing DEAI's current trading dynamics. The token has experienced a substantial decline of 93% from its initial offering price over the past year, reflecting the challenges faced in maintaining value momentum in the competitive decentralized AI sector.

Click to view current DEAI market price

DEAI Market Sentiment Index

2026-02-02 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear, with the index hitting 14 points. This indicates significant market pessimism and heightened risk aversion among investors. During such periods, market volatility typically increases as participants reassess their positions. Extreme fear often creates contrarian opportunities for experienced traders, as sentiment-driven selloffs may present accumulation points. However, caution remains essential as underlying market conditions warrant careful analysis before making investment decisions.

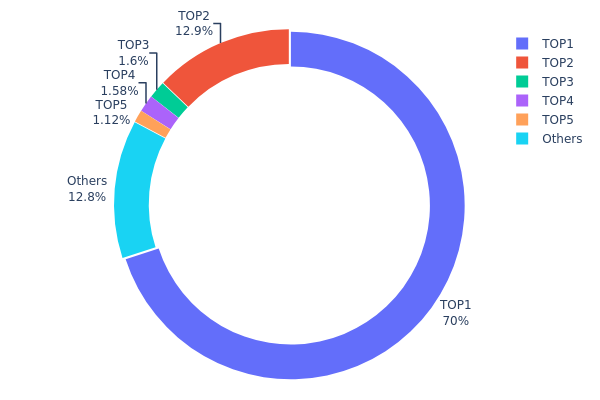

DEAI Holding Distribution

The holding distribution chart reflects the concentration of token ownership across different wallet addresses, serving as a critical indicator of decentralization and market structure stability. By analyzing the proportion of tokens held by top addresses versus smaller holders, investors can assess potential risks related to market manipulation, liquidity constraints, and price volatility.

According to the current data, DEAI exhibits a highly concentrated holding structure. The top address controls 700,000K tokens, representing 70% of the total supply, while the second-largest holder possesses 128,553.58K tokens (12.85%). Combined, these two addresses account for 82.85% of the entire token supply, indicating significant centralization risk. The remaining top five addresses collectively hold only 4.29%, with other addresses dispersed across 12.86% of the supply.

This extreme concentration presents substantial concerns for market stability and fair price discovery. The dominant holder's ability to influence market dynamics through large-scale transactions could trigger severe price fluctuations, deterring institutional participation and retail confidence. Additionally, such centralization contradicts fundamental blockchain principles of decentralization, potentially exposing the project to governance vulnerabilities and single-point-of-failure risks. While concentrated holdings may sometimes indicate strong project backing or strategic token allocation, the current 70% single-address concentration far exceeds healthy thresholds observed in mature crypto assets, suggesting investors should exercise heightened caution regarding liquidity risks and potential market manipulation scenarios.

Click to view current DEAI Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe2fe...1435fb | 700000.00K | 70.00% |

| 2 | 0xdf36...45d687 | 128553.58K | 12.85% |

| 3 | 0x3cc9...aecf18 | 15962.29K | 1.59% |

| 4 | 0x1385...b7f80d | 15818.31K | 1.58% |

| 5 | 0x6860...1fdcc6 | 11249.77K | 1.12% |

| - | Others | 128416.05K | 12.86% |

II. Core Factors Influencing DEAI's Future Price

Market Demand and Adoption Trends

- Market Demand: DEAI's price trajectory is closely tied to overall market demand within the decentralized AI ecosystem. As the integration of artificial intelligence with blockchain technology gains momentum, tokens positioned at this intersection may experience increased interest from both retail and institutional participants.

- Adoption Patterns: The token's long-term potential depends significantly on its adoption rate across various use cases and platforms. Growing recognition of decentralized AI solutions could drive broader market acceptance and utilization.

- Institutional Participation: The level of institutional engagement plays a substantial role in shaping price expectations. As institutional investors continue exploring opportunities in blockchain technology and crypto assets, projects combining AI innovation with decentralized infrastructure may attract strategic capital allocation.

Macroeconomic Environment

- Monetary Policy Impact: Broader economic conditions, including central bank policies and interest rate environments, influence risk asset performance. High interest rate conditions may constrain upward price movement for digital assets, while shifts toward accommodative monetary policy could support market expansion.

- Economic Data Sensitivity: Key economic indicators, such as employment data and inflation metrics, directly affect investor sentiment toward risk assets. Strong economic data suggesting delayed policy easing could limit price appreciation potential in the near term.

- Capital Flow Dynamics: Market observers note potential capital rotation patterns, with funds potentially shifting between traditional safe-haven assets and digital currencies depending on macroeconomic conditions and market sentiment.

Regulatory Developments

- Regulatory Clarity: The evolution of regulatory frameworks worldwide significantly impacts market confidence and institutional participation. Clear regulatory guidelines provide structure and legitimacy to the digital asset sector, potentially supporting sustainable growth.

- Policy Evolution: Ongoing discussions around digital asset regulation, including potential legislative progress in major jurisdictions, serve as important catalysts. Positive regulatory developments may enhance market certainty and encourage broader participation.

- Compliance Framework: As the regulatory landscape matures, projects demonstrating strong compliance positioning may benefit from increased credibility and institutional consideration.

Technology Innovation and Market Sentiment

- AI and Web3 Integration: The convergence of artificial intelligence with Web3 technologies represents a key narrative driving interest in related tokens. Enhanced AI capabilities in trading algorithms, predictive analytics, and decentralized applications may support ecosystem development.

- Technical Development: Continued innovation in AI-driven solutions, automated trading systems, and governance mechanisms could strengthen the value proposition of projects operating at the intersection of AI and blockchain technology.

- Market Sentiment: Overall market psychology, influenced by broader crypto market trends, technological advancements, and adoption milestones, plays a significant role in price formation. Positive sentiment cycles may amplify upward momentum, while cautious periods could lead to consolidation phases.

III. 2026-2031 DEAI Price Prediction

2026 Outlook

- Conservative forecast: $0.01055 - $0.0191

- Neutral forecast: $0.01425

- Optimistic forecast: $0.0191 (requires favorable market conditions and increased adoption)

2027-2029 Mid-term Outlook

- Market phase expectation: transitional period with gradual upward momentum as the AI and blockchain integration narrative matures

- Price range forecast:

- 2027: $0.0125 - $0.01784 (approximately 17% change)

- 2028: $0.00932 - $0.02105 (approximately 21% change)

- 2029: $0.01073 - $0.02548 (approximately 34% change)

- Key catalysts: expansion of decentralized AI applications, technological upgrades, and broader institutional interest in AI-powered blockchain solutions

2030-2031 Long-term Outlook

- Baseline scenario: $0.01205 - $0.03213 (assuming steady ecosystem development and sustained market interest)

- Optimistic scenario: $0.02231 - $0.03213 (with accelerated adoption and favorable regulatory environment)

- Transformative scenario: potentially reaching $0.02641 - $0.0324 by 2031 (under conditions of significant breakthrough in decentralized AI technology and widespread commercial application, representing approximately 91% cumulative growth)

- February 2, 2026: DEAI baseline estimate around $0.01425 (reflecting current market positioning)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0191 | 0.01425 | 0.01055 | 0 |

| 2027 | 0.01784 | 0.01667 | 0.0125 | 17 |

| 2028 | 0.02105 | 0.01726 | 0.00932 | 21 |

| 2029 | 0.02548 | 0.01915 | 0.01073 | 34 |

| 2030 | 0.03213 | 0.02231 | 0.01205 | 57 |

| 2031 | 0.0324 | 0.02722 | 0.02641 | 91 |

IV. DEAI Professional Investment Strategy and Risk Management

DEAI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Believers in decentralized AI ecosystem development and investors with high risk tolerance

- Operational Recommendations:

- Consider accumulating positions during market corrections when DEAI trades significantly below its historical averages

- Monitor the development progress of Cypher FHE EVEM Layer and Keymaker Platform expansion

- Utilize secure storage solutions such as Gate Web3 Wallet for long-term asset custody

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume ($28,211) in relation to price movements to identify potential breakout or breakdown patterns

- Support and Resistance Levels: Track key levels including the recent 24-hour low ($0.0126) and high ($0.01435)

- Swing Trading Points:

- Consider the 7-day price decline (-7.58%) as potential entry opportunities for short-term rebounds

- Monitor 24-hour volatility patterns, with recent range between $0.0126 and $0.01435 offering trading opportunities

DEAI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of cryptocurrency portfolio

- Aggressive Investors: 3-5% of cryptocurrency portfolio

- Professional Investors: up to 10% of cryptocurrency portfolio, with active monitoring

(2) Risk Hedging Solutions

- Diversification Strategy: Balance DEAI holdings with other AI-focused and DeFi tokens to reduce concentration risk

- Position Sizing: Implement gradual entry and exit strategies rather than all-at-once positions

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and staking participation

- Cold Storage Solution: Hardware wallets for long-term holdings exceeding $1,000 equivalent

- Security Precautions: Never share private keys, enable two-factor authentication, and regularly verify contract addresses (0x1495bc9e44af1f8bcb62278d2bec4540cf0c05ea on Ethereum network)

V. DEAI Potential Risks and Challenges

DEAI Market Risks

- High Volatility: DEAI has experienced significant price fluctuations, declining approximately 93% over the past year from its all-time high of $1.1

- Low Liquidity: With a 24-hour trading volume of $28,211 and market capitalization of approximately $1.39 million, DEAI may experience liquidity constraints

- Circulating Supply Concentration: Only 9.76% of total supply is currently circulating, creating potential future dilution concerns

DEAI Regulatory Risks

- AI Regulation Uncertainty: Evolving global regulations on artificial intelligence applications may impact decentralized AI projects

- Securities Classification: Regulatory authorities may scrutinize token classification and compliance requirements for AI-related digital assets

- Cross-border Compliance: Operating in multiple jurisdictions may subject Zero1 Labs to various regulatory frameworks

DEAI Technical Risks

- Smart Contract Vulnerabilities: As an ERC-20 token, DEAI depends on the security of its smart contract implementation

- Encryption Technology Complexity: The reliance on Fully Homomorphic Encryption (FHE) introduces technical complexity that may affect adoption and scalability

- Competitive Landscape: Over 100 multi-modal DeAI tools must compete in an increasingly crowded decentralized AI market

VI. Conclusion and Action Recommendations

DEAI Investment Value Assessment

Zero1 Labs presents an innovative approach to decentralized artificial intelligence through its Proof-of-Stake ecosystem, Cypher FHE EVEM Layer, and Keymaker Platform. The project addresses confidential AI computation needs through Fully Homomorphic Encryption. However, the token has experienced substantial decline from its all-time high, with current market capitalization of approximately $1.39 million and limited circulating supply (9.76%). Short-term risks include high volatility, low liquidity, and ongoing market uncertainty. Long-term value depends on successful platform development, user adoption of DeAI tools, and the broader acceptance of decentralized AI solutions.

DEAI Investment Recommendations

✅ Beginners: Start with small allocation (under 1% of crypto portfolio) and focus on understanding the technology before increasing exposure. Use Gate Web3 Wallet for secure storage. ✅ Experienced Investors: Consider dollar-cost averaging during market corrections. Monitor platform development milestones and trading volume trends. Maintain 2-5% portfolio allocation with strict stop-loss protocols. ✅ Institutional Investors: Conduct thorough due diligence on technical infrastructure and team execution capabilities. Consider strategic accumulation with 3-10% allocation, balanced with other AI and DeFi holdings.

DEAI Trading Participation Methods

- Spot Trading: Available on Gate.com and 6 other exchanges, allowing direct purchase and sale of DEAI tokens

- Long-term Accumulation: Gradually build positions during market downturns while monitoring project development progress

- Technical Trading: Utilize price range between recent support ($0.0126) and resistance ($0.01435) levels for short-term trading opportunities

Cryptocurrency investment carries extreme risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is DEAI? What are its uses and value?

DEAI is a decentralized AI token combining blockchain and artificial intelligence. It empowers data owners with enhanced control and privacy protection while revolutionizing AI development through decentralization, enabling users and developers to participate in AI ecosystems securely.

What is the historical price performance of DEAI?

DEAI reached its all-time high of $1.1 on December 6, 2024. In 2025, the market experienced significant corrections. DEAI has demonstrated strong initial momentum with notable volatility typical of emerging blockchain projects in the decentralized AI sector.

What are the main factors affecting DEAI price?

DEAI price is primarily influenced by supply scarcity, institutional investment adoption, macroeconomic conditions, and technological ecosystem development. Market demand and innovation in AI-driven blockchain solutions are key drivers.

What is the DEAI price prediction for 2024?

Based on market performance, DEAI reached its peak of $1.1 on December 6, 2024, following its initial launch. This prediction reflects early investor response and market dynamics during that period.

What are the advantages of DEAI compared to other AI-related cryptocurrencies?

DEAI offers superior adaptive capability and dynamic defense mechanisms for complex threat scenarios. It excels in DeFi, NFT trading, and asset management, providing stronger real-time response and decentralized AI optimization compared to other AI crypto projects.

What are the risks of investing in DEAI and what should I pay attention to?

DEAI investment risks include market volatility, price manipulation, regulatory uncertainty, and technical security issues. Diversify your portfolio and only invest what you can afford to lose. Monitor project developments and community sentiment regularly for informed decisions.

What is DEAI's technical development roadmap and future prospects?

DEAI will progress through infrastructure development, protocol standardization, and technology integration phases. Expected to reach maturity by 2025, with broad prospects in privacy protection and decentralized data sharing applications.

Survey Note: Detailed Analysis of the Best AI in 2025

What Is the Best AI Crypto in 2025?

What is the Best AI Now?

Why ChatGPT is Likely the Best AI Now?

How Does Solidus Ai Tech's Market Cap Compare to Other AI Cryptocurrencies?

MomoAI: AI-Powered Social Gaming Revolution on Solana

What Are LP Tokens and How to Earn From Them: A Comprehensive Overview

Comprehensive Guide to Bitcoin and Cryptocurrency Investment

How to Create an NFT for Free with Picsart

Dusting Attack: How Hackers Steal Your Information with Tiny Crypto Amounts and How to Protect Yourself

Who Is Will Clemente? A Guide to the Popular On-Chain Analyst