2026 DMAIL Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: DMAIL's Market Position and Investment Value

Dmail (DMAIL), as an AI-enhanced decentralized communication platform, has been serving the Web3 ecosystem since its launch in 2024, providing encrypted email services, unified notification systems, and tailored marketing solutions across multiple blockchain networks. As of 2026, DMAIL maintains a market capitalization of approximately $193,453, with a circulating supply of around 122.91 million tokens, and the price hovering around $0.001574. This asset, characterized as a key infrastructure component in decentralized communication, is playing an increasingly important role in connecting users, developers, marketers, and influencers within the Web3 space.

This article will comprehensively analyze DMAIL's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price predictions and practical investment strategies.

I. DMAIL Price History Review and Market Status

DMAIL Historical Price Evolution Trajectory

- 2024: Platform launched on January 30, price reached notable levels during initial trading period

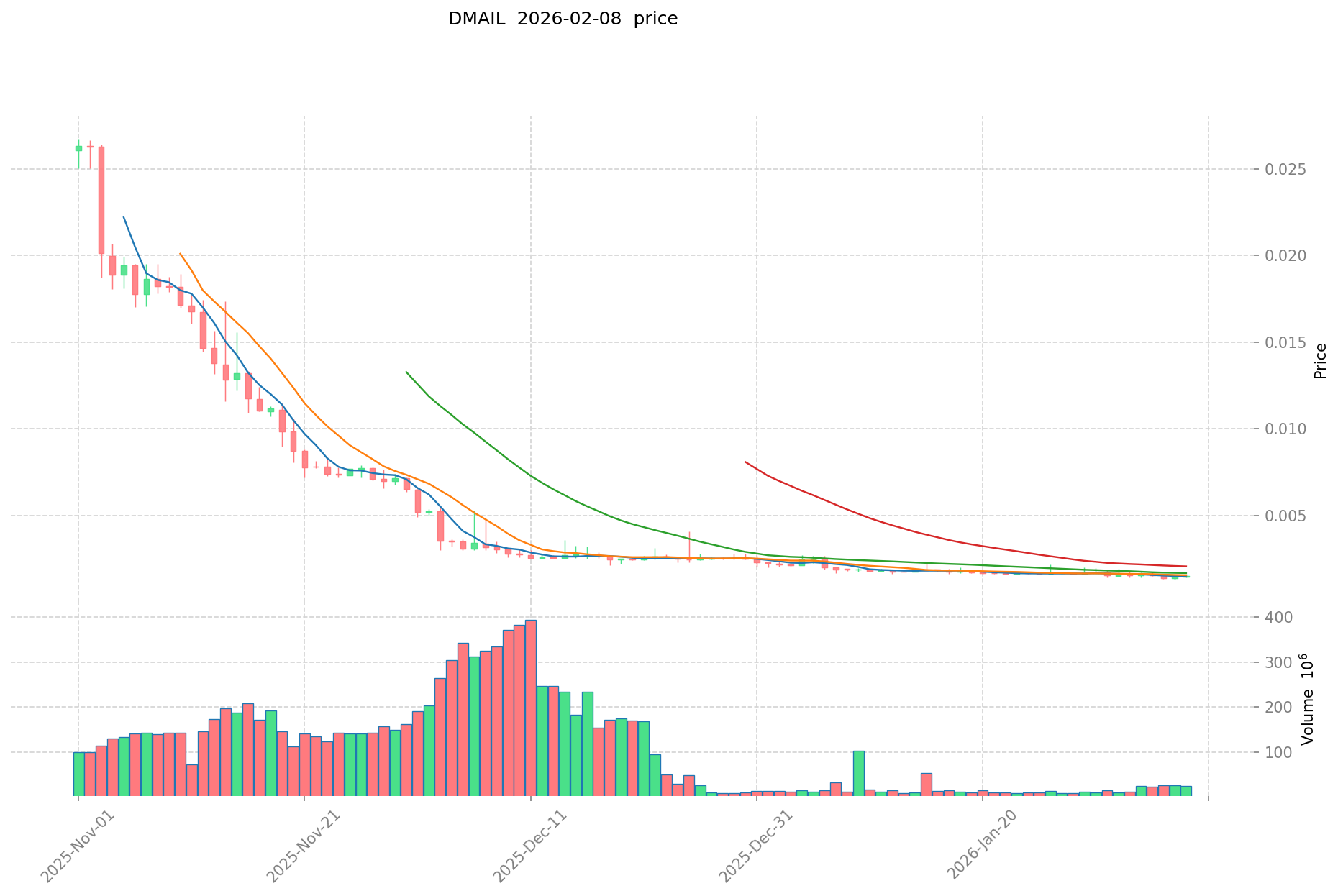

- 2026: Market experienced significant volatility, price declined from higher levels to lower ranges in early February

DMAIL Current Market Situation

As of February 09, 2026, DMAIL is trading at $0.001574, showing a 24-hour increase of 7.07%. The trading volume over the past 24 hours reached $30,133.18, indicating moderate market activity for the token.

The token's 24-hour price range fluctuated between $0.001445 (low) and $0.001647 (high), demonstrating relatively contained volatility within the day. Looking at broader timeframes, DMAIL experienced a 4.49% decline over the past 7 days and a 14.09% decrease over the past 30 days.

The circulating supply stands at 122,905,634 DMAIL tokens, representing 61.45% of the maximum supply of 200,000,000 tokens. The current market capitalization is approximately $193,453, with a fully diluted market cap of $314,800. The market cap to fully diluted valuation ratio of 61.45% reflects the current circulation percentage.

DMAIL maintains a market dominance of 0.000012%, indicating its position as an emerging project within the broader cryptocurrency ecosystem. The token is currently listed on 4 exchanges and has 433 holders according to available data.

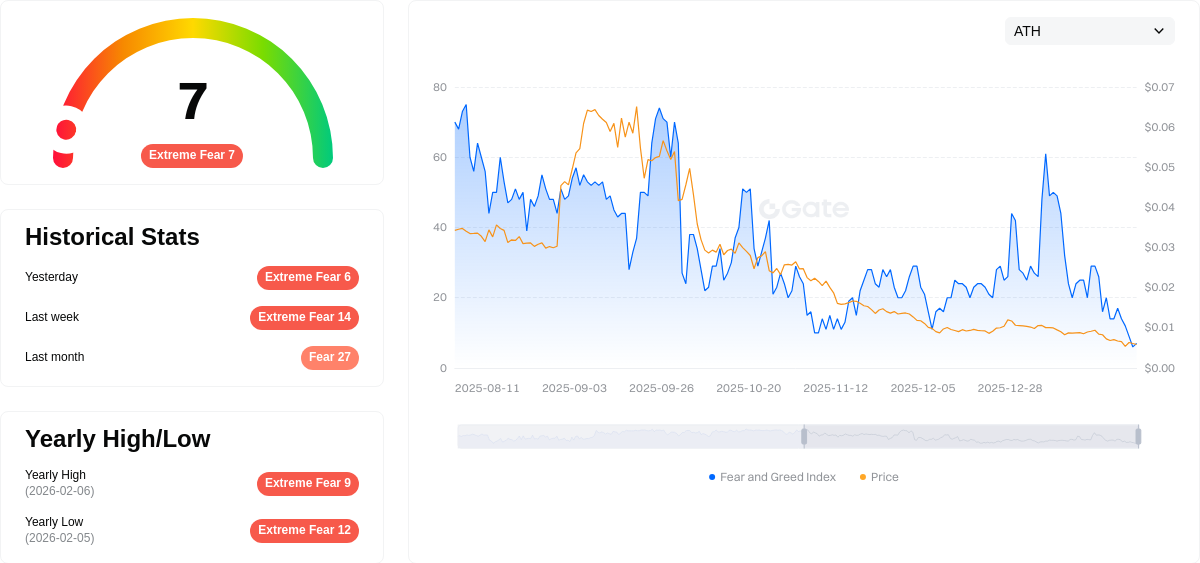

The crypto market sentiment index registers at 7, indicating an "Extreme Fear" environment, which may influence trading behaviors and price movements across the sector.

Click to view current DMAIL market price

DMAIL Market Sentiment Indicator

2026-02-08 Fear and Greed Index: 7 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 7. This indicates widespread market pessimism and heightened investor anxiety. During such periods, market volatility typically increases as investors become risk-averse. This presents potential opportunities for contrarian investors who view significant price declines as buying opportunities. However, traders should exercise caution and conduct thorough research before making investment decisions. Extreme fear conditions often precede market recoveries, but timing the bottom remains challenging for most investors.

DMAIL 持仓分布

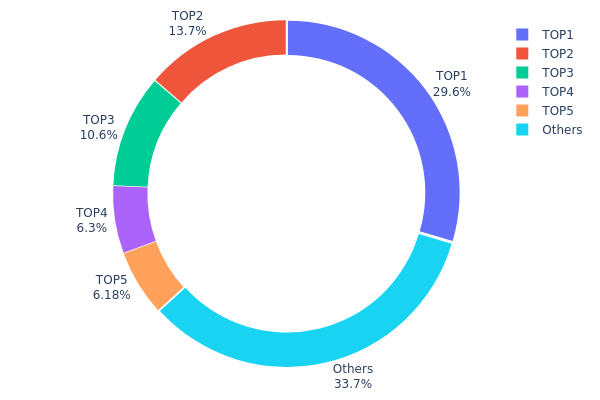

Based on the current on-chain data, DMAIL's address holding distribution exhibits a relatively concentrated pattern. The top 5 addresses collectively hold approximately 66.3% of the total supply, with the largest single address (0x29a9...2aae22) controlling 29.55% of all tokens. The second and third-largest addresses hold 13.70% and 10.58% respectively, while the remaining holders account for 33.7% of the distribution. This level of concentration indicates that DMAIL's token ownership structure remains primarily dominated by large holders, potentially including project teams, early investors, or institutional participants.

From a market structure perspective, this concentration level presents both opportunities and risks. On one hand, the presence of major stakeholders may reflect strong confidence in the project's long-term development and could provide price stability during market volatility. On the other hand, such concentration creates potential risks for price manipulation, as coordinated actions by a few large holders could significantly impact market liquidity and price discovery mechanisms. The 33.7% held by smaller addresses suggests some degree of community participation, though the decentralization level remains moderate compared to more widely distributed cryptocurrencies.

The current distribution pattern indicates DMAIL is still in a relatively early stage of ecosystem development, with token circulation primarily concentrated among core participants. As the project matures and adoption expands, monitoring whether this concentration gradually disperses toward a more balanced distribution will be crucial for assessing long-term market health and on-chain structural stability.

Click to view current DMAIL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x29a9...2aae22 | 31464.39K | 29.55% |

| 2 | 0x0d07...b492fe | 14587.41K | 13.70% |

| 3 | 0xf89d...5eaa40 | 11263.33K | 10.58% |

| 4 | 0x0529...c553b7 | 6710.43K | 6.30% |

| 5 | 0x58ed...a36a51 | 6576.12K | 6.17% |

| - | Others | 35843.87K | 33.7% |

II. Core Factors Influencing DMAIL's Future Price

Governance Token Dynamics

- Community-Driven Governance: As Dmail expands its functionality, the project will issue governance tokens, with the DAO becoming the core factor guiding project development. The direction of the project and the addition or reduction of features will be determined by all community members.

- Historical Pattern: Decentralized governance models have historically influenced project trajectories and token valuations in the Web3 space, with community engagement often correlating with sustained development momentum.

- Current Impact: The transition to DAO governance may enhance community participation and potentially create positive sentiment around DMAIL's long-term value proposition.

Macroeconomic Environment

- Monetary Policy Influence: US monetary policy remains a significant factor affecting cryptocurrency markets. The Federal Reserve's interest rate decisions and balance sheet adjustments continue to shape liquidity conditions across digital asset markets. Current economic cycles show characteristics of late-stage expansion, with monetary policy entering later stages and labor market tightening signals emerging.

- Global Economic Trends: The interplay between economic cycles, credit cycles, and monetary policy cycles creates complex dynamics. The current period shows rolling sectoral weakness in various economic segments, which may influence risk appetite for digital assets including DMAIL.

- Market Sentiment Factors: Investor positioning for risk-on scenarios must be balanced against potential outcomes if monetary and fiscal policies underperform expectations or lead to economic overheating.

Regulatory and Market Conditions

- Policy Environment: Regulatory developments across major jurisdictions continue to shape the operating environment for cryptocurrency projects. Changes in regulatory frameworks may impact project development and token adoption.

- Market Structure: Broader cryptocurrency market conditions, including liquidity dynamics and trading patterns, influence individual token performance. The evolving market structure in digital assets creates both opportunities and challenges for emerging projects like DMAIL.

III. 2026-2031 DMAIL Price Prediction

2026 Outlook

- Conservative estimate: $0.00096 - $0.00157

- Neutral estimate: $0.00157 (average price level)

- Optimistic estimate: $0.00183 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: DMAIL may enter a gradual growth phase as the decentralized communication sector matures and user adoption expands

- Price range predictions:

- 2027: $0.00136 - $0.00187 (approximately 8% year-over-year change)

- 2028: $0.00136 - $0.00207 (approximately 13% cumulative growth)

- 2029: $0.00158 - $0.00249 (approximately 22% cumulative increase)

- Key catalysts: Technology infrastructure improvements, expanding user base in decentralized email services, and potential partnerships within the Web3 ecosystem

2030-2031 Long-term Outlook

- Baseline scenario: $0.00190 - $0.00221 (assuming steady market development and consistent protocol adoption)

- Optimistic scenario: $0.00269 - $0.00318 (assuming accelerated mainstream adoption of decentralized communication tools)

- Transformational scenario: Up to $0.00326 (requires breakthrough integration with major Web3 platforms and significant expansion in global user adoption)

- February 9, 2026: DMAIL trading within the $0.00096 - $0.00183 range (early-stage price discovery phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00183 | 0.00157 | 0.00096 | 0 |

| 2027 | 0.00187 | 0.0017 | 0.00136 | 8 |

| 2028 | 0.00207 | 0.00178 | 0.00136 | 13 |

| 2029 | 0.00249 | 0.00193 | 0.00158 | 22 |

| 2030 | 0.00318 | 0.00221 | 0.0019 | 40 |

| 2031 | 0.00326 | 0.00269 | 0.00197 | 71 |

IV. DMAIL Professional Investment Strategy and Risk Management

DMAIL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors who believe in the long-term potential of decentralized communication platforms and Web3 infrastructure

- Operational Recommendations:

- Consider accumulating DMAIL during market downturns when the price approaches support levels

- Monitor the project's development milestones, including AI integration enhancements and cross-chain expansion

- Implement a dollar-cost averaging approach to mitigate volatility impact

- Storage Solution: Use Gate Web3 Wallet for secure multi-chain asset management, supporting both ETH and BSC networks where DMAIL is deployed

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume ($30,133) relative to market cap to identify liquidity patterns

- Price Action: Track key support levels around $0.001282 (ATL) and resistance zones near recent highs

- Swing Trading Points:

- Consider the high volatility (7.07% in 24H, -4.49% in 7D) as opportunities for short-term trades

- Set stop-loss orders below key support levels to manage downside risk

- Monitor market sentiment indicators before entering positions

DMAIL Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 5-8% with active risk monitoring

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance DMAIL holdings with established cryptocurrencies and other Web3 infrastructure tokens

- Position Sizing: Limit individual position size based on the token's market cap ($193,453) and liquidity constraints

(3) Secure Storage Solutions

- Multi-Chain Wallet Recommendation: Gate Web3 Wallet supports both Ethereum (ERC20) and BNB Smart Chain (BEP20) networks, allowing seamless management of DMAIL tokens

- Cold Storage Option: For long-term holdings, consider transferring tokens to hardware wallet solutions after initial purchase

- Security Precautions: Always verify contract addresses (0xcC6f1e1B87cfCbe9221808d2d85C501aab0B5192 on both ETH and BSC), enable two-factor authentication, and never share private keys

V. DMAIL Potential Risks and Challenges

DMAIL Market Risks

- High Volatility: The token has experienced substantial price fluctuations, with a 98.8% decline over one year from its peak

- Limited Liquidity: With only 4 exchange listings and relatively low 24-hour trading volume, large orders may face slippage

- Low Market Capitalization: The current market cap of approximately $193,453 indicates early-stage project status with associated risks

DMAIL Regulatory Risks

- Communication Platform Scrutiny: Decentralized encrypted communication services may face regulatory examination in various jurisdictions

- Compliance Requirements: Evolving regulations regarding privacy-focused blockchain applications could impact project operations

- Token Classification: Uncertainty around whether DMAIL might be classified as a security in certain jurisdictions

DMAIL Technical Risks

- Smart Contract Vulnerabilities: As with all blockchain projects, potential security flaws in smart contracts could pose risks

- Cross-Chain Complexity: Operating across multiple blockchain networks (ETH and BSC) introduces additional technical challenges

- Competition: The decentralized communication sector faces competition from other Web3 messaging and email solutions

VI. Conclusion and Action Recommendations

DMAIL Investment Value Assessment

DMAIL represents an early-stage investment in decentralized communication infrastructure with AI-enhanced features. While the project addresses a genuine need in the Web3 ecosystem for secure, cross-chain communication, investors should consider the substantial risks. The token's limited circulation (61.45% of total supply) and small market presence suggest high volatility potential. The significant price decline from its all-time high of $2.505 to current levels around $0.001574 reflects market uncertainty. Long-term value depends on successful execution of the platform's roadmap, user adoption, and broader Web3 ecosystem growth.

DMAIL Investment Recommendations

✅ Beginners: Start with minimal allocation (under 1% of crypto portfolio) to gain exposure while learning about decentralized communication platforms. Use Gate.com's spot trading platform for initial purchases and store tokens in Gate Web3 Wallet.

✅ Experienced Investors: Consider a tactical allocation of 2-3% with active monitoring of project developments and market sentiment. Implement strict stop-loss rules and rebalance based on technical indicators and fundamental progress.

✅ Institutional Investors: Conduct thorough due diligence on the project's technology, team, and competitive positioning before considering any allocation. Monitor holder distribution (currently 433 holders) and on-chain metrics regularly.

DMAIL Trading Participation Methods

- Spot Trading: Purchase DMAIL tokens on Gate.com using USDT or other trading pairs, suitable for long-term accumulation strategies

- Technical Trading: Utilize Gate.com's advanced charting tools to identify entry and exit points based on technical patterns and volume analysis

- Portfolio Integration: Add DMAIL as part of a diversified Web3 infrastructure portfolio, balanced with more established projects in the decentralized application sector

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is DMAIL project and what practical application value does it have?

DMAIL is a decentralized email service built on Dfinity blockchain, providing secure and private communication. It offers practical value through enhanced privacy protection, NFT integration capabilities, and Web3-native messaging infrastructure for users seeking decentralized alternatives to traditional email.

DMAIL代币的当前价格是多少,历史价格表现如何?

DMAIL历史最高价为2024年1月的2.505美元,最低价为2025年11月的0.007172美元。代币经历了显著波动,反映了市场对去中心化邮件协议的动态评估。

How will DMAIL price prediction develop in 2024-2025?

DMAIL reached a peak of $2.505 in January 2024 and dropped to $0.007172 by November 2025. Based on market analysis, projections suggest the price may stabilize within a range of approximately $0.013 by 2030, depending on ecosystem adoption and market conditions.

What are the main risk factors for investing in DMAIL?

DMAIL investment risks include market volatility, regulatory uncertainty, technology vulnerabilities, and leveraged trading amplifying potential losses. Investors should carefully assess their risk tolerance before participating.

What advantages does DMAIL have compared to other email protocol tokens like Mailchain?

DMAIL excels in cross-chain interoperability, enabling seamless messaging and interaction across different blockchains and dApps. This superior functionality provides greater flexibility and broader application potential than comparable email protocol tokens.

How is DMAIL's liquidity and trading volume? Which exchanges can it be traded on?

DMAIL maintains robust liquidity and trading volume across major platforms. The token is listed on multiple leading exchanges, providing excellent accessibility and trading options for users and investors globally.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Ethereum 2.0 in 2025: Staking, Scalability, and Environmental Impact

2025 Layer-2 Solution: Ethereum Scalability and Web3 Performance Optimization Guide

What is BOOP: Understanding the Web3 Token in 2025

Altcoin Season Index 2025: How to Use and Invest in Web3

Top 10 Solana Meme Coins to Watch

What is GALO: A Comprehensive Guide to Global Automated Logistics Optimization

What is Balancer

What is SLICE: A Comprehensive Guide to Understanding This Powerful Data Analysis Framework

What is LKI: A Comprehensive Guide to Understanding Lymphokine-Activated Killer Cells and Their Role in Immunotherapy