2026 DPR Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: DPR's Market Position and Investment Value

Deeper Network (DPR), as a decentralized blockchain network focused on building private, secure, and equitable internet infrastructure, has been developing its Web 3.0 vision since its establishment in 2018. As of 2026, DPR maintains a market capitalization of approximately 672,266 USD with a circulating supply of around 3.29 billion tokens, trading at approximately 0.0002041 USD. This asset, representing a gateway to household-accessible decentralized networking, is playing an increasingly important role in the Web 3.0 infrastructure development space.

This article will comprehensively analyze DPR's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. DPR Price History Review and Market Status

DPR Historical Price Evolution Trajectory

- 2021: Token launch and initial market entry, price experienced significant growth reaching an all-time high of $0.334751 on April 12, 2021

- 2022-2025: Extended consolidation phase, market conditions led to downward price movement

- 2026: Price continued adjusting, reaching a recorded low of $0.0001416 on January 4, 2026

DPR Current Market Situation

As of February 4, 2026, DPR is trading at $0.0002041, showing a 24-hour increase of 18.11%. The token has demonstrated upward momentum with a 7-day gain of 14.02% and a 30-day increase of 38.75%.

The 24-hour trading range spans from $0.0001704 to $0.0002141, with total trading volume reaching $15,517.49. The current market capitalization stands at $672,266.86, with a circulating supply of 3,293,811,188.65 DPR tokens, representing 32.94% of the total supply of 10 billion tokens.

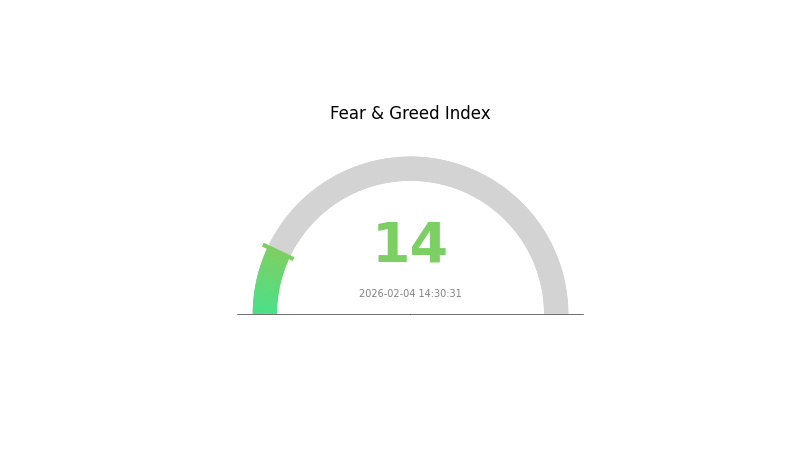

The fully diluted market cap is calculated at $2,041,000. Current market sentiment indicators show a fear index of 14, suggesting extreme fear conditions in the broader market. The token maintains a market dominance of 0.000076% and is held by 9,674 addresses.

DPR has contracts deployed on both Ethereum (ETH) and Binance Smart Chain (BSC) networks, with contract addresses verified on their respective blockchain explorers.

Click to view current DPR market price

DPR Market Sentiment Indicator

2026-02-04 Fear and Greed Index: 14 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 14. This exceptionally low reading suggests heightened market anxiety and pessimism among investors. Such extreme fear conditions often create significant buying opportunities for contrarian investors, as panic-driven selling may present attractive entry points. However, traders should remain cautious and conduct thorough due diligence. Market conditions at these levels can be highly volatile, requiring careful risk management and strategic positioning before making investment decisions.

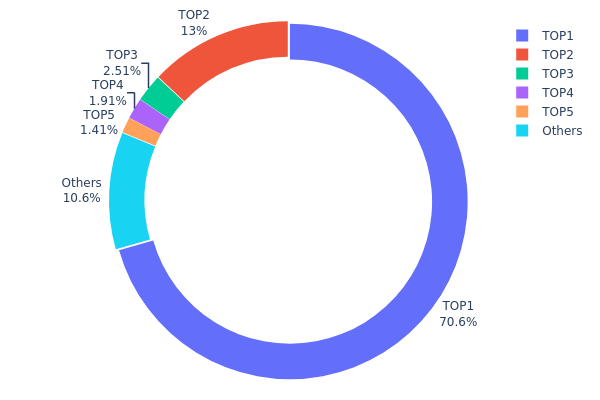

DPR Holding Distribution

The DPR holding distribution chart illustrates the concentration of tokens across different wallet addresses, providing insights into the decentralization level and potential market control dynamics. Based on the current data, the top five addresses collectively hold approximately 89.35% of the total DPR supply, indicating a highly concentrated ownership structure.

The dominant holder at address 0x1959...289aaf controls 4,669,500K tokens, representing 70.57% of the entire supply. The second-largest holder maintains 858,116K tokens (12.96%), while the remaining top three addresses hold significantly smaller portions ranging from 1.41% to 2.51%. The remaining 10.65% is distributed among other addresses, suggesting limited token dispersion beyond major holders.

This extreme concentration presents notable implications for market dynamics. With over 70% of supply controlled by a single address and nearly 90% held by just five entities, DPR exhibits substantial centralization risk. Such distribution patterns typically amplify price volatility, as large holders possess the capacity to influence market movements through significant buy or sell actions. Additionally, this structure raises concerns regarding potential market manipulation and challenges the project's decentralization narrative. The current holding distribution reflects a fragile market structure where token governance and price stability remain vulnerable to decisions made by a small group of major stakeholders, warranting careful consideration by prospective investors regarding liquidity and long-term stability risks.

Click to view current DPR Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1959...289aaf | 4669500.00K | 70.57% |

| 2 | 0x7a7a...753697 | 858116.00K | 12.96% |

| 3 | 0x4a89...6ac675 | 166156.77K | 2.51% |

| 4 | 0x0d07...b492fe | 126120.64K | 1.90% |

| 5 | 0x0000...e08a90 | 93451.21K | 1.41% |

| - | Others | 703134.93K | 10.65% |

II. Core Factors Influencing DPR's Future Price

Supply Mechanism

- Market Competition: The intensity of competition within the cryptocurrency market can significantly affect DPR's price dynamics. As more projects emerge with similar value propositions, DPR may face pressure to differentiate itself through technological innovation or strategic partnerships.

- Historical Patterns: Market competition has historically influenced price volatility across various cryptocurrency projects. Projects that successfully navigate competitive landscapes through innovation and community engagement tend to maintain more stable price trajectories.

- Current Impact: Given the evolving competitive environment, DPR's ability to demonstrate unique value propositions and maintain technological advancement will be important for its price stability.

Institutional and Major Holder Dynamics

- Policy Risk Considerations: Regulatory developments represent a significant factor in DPR's price outlook. Changes in cryptocurrency regulations across different jurisdictions can create both opportunities and challenges for the token's adoption and valuation.

- Regulatory Environment: The cryptocurrency regulatory landscape continues to evolve globally, with various governments developing frameworks for digital asset oversight. These policy developments can influence investor sentiment and institutional participation.

Macroeconomic Environment

- Monetary Policy Influence: Global monetary policy trends, including interest rate decisions and liquidity conditions, can affect investor appetite for risk assets like cryptocurrencies. Tightening monetary conditions may create headwinds, while accommodative policies could support valuation.

- Economic Uncertainty: Broader macroeconomic factors, including inflation trends and economic growth patterns, can influence cryptocurrency market dynamics and investor behavior toward digital assets like DPR.

- Geopolitical Factors: International economic conditions and geopolitical developments can create market volatility that affects cryptocurrency valuations across the sector.

Technological Development and Ecosystem Building

- Technical Innovation: The pace and quality of technological development within DPR's ecosystem will play an important role in its long-term value proposition. Continuous improvement and innovation can help maintain competitive positioning.

- Ecosystem Growth: The development of applications and use cases within DPR's ecosystem may contribute to its utility and adoption. A robust and growing ecosystem can support long-term value creation.

- Development Trajectory: The project's ability to execute on its technical roadmap and deliver meaningful upgrades will be an important consideration for its future market performance.

III. 2026-2031 DPR Price Forecast

2026 Outlook

- Conservative prediction: $0.00016 - $0.00020

- Neutral prediction: $0.00020 - $0.00025

- Optimistic prediction: $0.00025 - $0.00029 (requires sustained market momentum and increased adoption)

2027-2029 Outlook

- Market stage expectation: Gradual accumulation phase with moderate volatility as the project gains traction

- Price range forecast:

- 2027: $0.00021 - $0.00035

- 2028: $0.00017 - $0.00040

- 2029: $0.00029 - $0.00038

- Key catalysts: Platform development milestones, ecosystem expansion, and broader crypto market sentiment shifts

2030-2031 Long-term Outlook

- Base scenario: $0.00029 - $0.00036 (assuming steady project growth and stable market conditions)

- Optimistic scenario: $0.00036 - $0.00052 (assuming enhanced utility adoption and favorable regulatory environment)

- Transformational scenario: $0.00040 - $0.00057 (contingent on major partnerships, significant technological breakthroughs, or exceptional market conditions)

- 2026-02-04: DPR trading within $0.00016 - $0.00029 range (early consolidation phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00029 | 0.0002 | 0.00016 | 0 |

| 2027 | 0.00035 | 0.00024 | 0.00021 | 20 |

| 2028 | 0.0004 | 0.0003 | 0.00017 | 44 |

| 2029 | 0.00038 | 0.00035 | 0.00029 | 70 |

| 2030 | 0.00052 | 0.00036 | 0.00029 | 78 |

| 2031 | 0.00057 | 0.00044 | 0.0004 | 116 |

IV. DPR Professional Investment Strategies and Risk Management

DPR Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking Web 3.0 infrastructure exposure with higher risk tolerance

- Operational Recommendations:

- Accumulate positions during price consolidation periods, considering DPR's significant volatility (38.75% monthly increase as of February 2026)

- Focus on project development milestones and adoption metrics rather than short-term price movements

- Storage Solution: Utilize Gate Web3 Wallet for secure asset custody with multi-signature options

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor 24-hour trading volume ($15,517.49) relative to market cap ($672,266.86) for liquidity assessment

- Price Range Tracking: Observe key levels between $0.0001704 (24h low) and $0.0002141 (24h high) for entry/exit points

- Swing Trading Considerations:

- Capitalize on high volatility periods, noting 18.11% daily fluctuations

- Set strict stop-loss orders due to low liquidity and wide spreads

DPR Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of crypto portfolio

- Aggressive Investors: 2-3% of crypto portfolio

- Professional Investors: Up to 5% with hedging strategies

(2) Risk Hedging Solutions

- Diversification: Balance DPR exposure with established Layer-1 tokens and stablecoins

- Position Sizing: Limit individual trade size to account for low trading volume

(3) Secure Storage Solutions

- Hot Wallet Solution: Gate Web3 Wallet for active trading needs with multi-layer security

- Cold Storage Option: Hardware wallet integration for long-term holdings

- Security Precautions: Enable two-factor authentication, regularly update recovery phrases, and avoid sharing private keys

V. DPR Potential Risks and Challenges

DPR Market Risks

- Extreme Volatility: 88.75% year-over-year decline demonstrates susceptibility to market sentiment shifts

- Low Liquidity: Daily trading volume of $15,517.49 may result in significant slippage for larger orders

- Limited Exchange Availability: Trading on single exchange increases counterparty risk and price discovery limitations

DPR Regulatory Risks

- Web 3.0 Infrastructure Uncertainty: Evolving regulatory frameworks for decentralized network projects may impact token utility

- Cross-border Compliance: Token deployment on multiple chains (Ethereum and BSC) creates complex jurisdictional considerations

- Privacy Technology Scrutiny: Privacy-focused features may attract regulatory attention in certain jurisdictions

DPR Technical Risks

- Smart Contract Vulnerabilities: Dual-chain deployment increases attack surface area

- Network Adoption Dependency: Token value correlation with Deeper Network gateway adoption rates

- Competition Risk: Emerging Web 3.0 infrastructure projects may dilute market share

VI. Conclusion and Action Recommendations

DPR Investment Value Assessment

DPR presents a speculative opportunity within the Web 3.0 infrastructure sector, offering exposure to decentralized internet technologies. The token's utility in economic incentives and service payments within the Deeper Network ecosystem provides fundamental value proposition. However, significant price volatility, limited liquidity, and concentrated exchange availability pose substantial risks. The 32.94% market cap to fully diluted valuation ratio indicates considerable token supply yet to enter circulation. Investors should approach with caution, recognizing the early-stage nature of both the project and token market development.

DPR Investment Recommendations

✅ Beginners: Avoid or limit exposure to micro-allocation (under 0.5%) after thorough research and only with disposable capital ✅ Experienced Investors: Consider small speculative positions (1-2%) within diversified Web 3.0 portfolio, employing strict risk controls ✅ Institutional Investors: Conduct comprehensive due diligence on network adoption metrics, liquidity constraints, and regulatory landscape before position establishment

DPR Trading Participation Methods

- Spot Trading: Direct token purchase on Gate.com with immediate settlement

- Dollar-Cost Averaging: Systematic periodic purchases to mitigate volatility impact

- Limit Orders: Pre-set price targets to capitalize on volatility while managing execution risk

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is DPR? What is the purpose of Deeper Network token?

DPR is the functional token of Deeper Network, used to pay for network services. It enables bandwidth sharing between devices, allowing users to pay for bandwidth usage from other network participants. DPR drives transactions and services within the decentralized infrastructure.

What is the historical price trend of DPR tokens?

DPR reached an all-time high of $0.34, currently trading 99.95% below that peak. The token has experienced significant price decline since its launch, reflecting market volatility in the crypto sector.

What are the main factors affecting DPR price?

DPR price is primarily influenced by market sentiment, regulatory environment, and trading volume. Crypto markets are highly sensitive to news and investor sentiment. Government regulations and legal clarity significantly impact price movements. Additionally, overall market conditions and adoption trends play crucial roles.

How to conduct technical analysis on DPR price?

Analyze DPR price using key indicators: track trading volume trends, monitor support and resistance levels, observe moving averages for momentum direction, and watch RSI and MACD for overbought/oversold conditions. Combine chart patterns with market sentiment for comprehensive technical assessment.

What price is DPR expected to reach in the future?

Based on historical price performance analysis, DPR is projected to reach approximately $0.0001880 by 2027, with potential 9% growth anticipated through 2032. Actual prices depend on market conditions and adoption.

What are the risks and limitations of DPR price predictions?

DPR price prediction risks include market volatility, data inaccuracy, and sudden regulatory changes. Limitations stem from models relying on historical data that may not reflect future market conditions, liquidity fluctuations, and unforeseen macro events affecting crypto markets unpredictably.

What are DPR's advantages compared to other Layer 2 or network tokens?

DPR powers Deeper Network's decentralized infrastructure with lower fees and higher flexibility than traditional Layer 2 solutions. It enables efficient bandwidth payments and supports a more performant, cost-effective Web3 ecosystem.

Where can DPR be traded?

DPR token is available for trading on centralized and decentralized exchanges. The primary trading pair is DPR/USDT, with significant trading volume across multiple platforms.

Deeper Network项目的发展前景如何?

Deeper Network前景广阔。项目通过Polkadot生态集成,主网成功上线,具有优异的可扩展性和创新潜力。随着生态不断扩展,用户将获得更多项目和产品访问权限,市场位置持续强化。

What risks should I pay attention to when investing in DPR tokens?

DPR token investments carry risks including price volatility, potential capital loss, and market uncertainty. Investors bear full responsibility for their investment decisions. Regulatory changes may also impact token value.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Ethereum 2.0 in 2025: Staking, Scalability, and Environmental Impact

2025 Layer-2 Solution: Ethereum Scalability and Web3 Performance Optimization Guide

What is BOOP: Understanding the Web3 Token in 2025

Altcoin Season Index 2025: How to Use and Invest in Web3

Comprehensive Guide to APR vs APY in Cryptocurrency

What Is Slippage? How Can You Prevent Slippage in Crypto Trading?

Free Bitcoin Mining

What is Crypto DePIN? DePIN's Potential for Web3

Understanding Bull Flag and Bear Flag Patterns in Trading