2026 DYP Price Prediction: Expert Analysis and Market Forecast for the Next Generation of Digital Assets

Introduction: DYP's Market Position and Investment Value

Dypius (DYP), as a decentralized ecosystem focusing on scalability, security, and global adoption through next-generation infrastructure, has been serving both beginners and advanced users since its launch in 2020. As of 2026, DYP maintains a market capitalization of approximately $326,952, with a circulating supply of around 229.92 million tokens, and the price hovering around $0.001422. This asset, recognized for its comprehensive DeFi solutions encompassing yield farming, staking, DeFi tools, NFTs, and Metaverse offerings, is playing an increasingly significant role in the decentralized finance landscape.

This article will comprehensively analyze DYP's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. DYP Price History Review and Market Status

DYP Historical Price Evolution Trajectory

- 2020: DYP launched in October with a publish price of $2, marking the project's initial entry into the market

- 2023: Price reached its all-time high of $0.211299 on November 17, representing a significant milestone in the token's trading history

- 2024-2026: The token experienced substantial volatility, declining from previous highs and reaching its all-time low of $0.00044629 on January 23, 2026

DYP Current Market Status

As of February 7, 2026, DYP is trading at $0.001422, showing a recovery from its recent low point. The token has demonstrated notable short-term momentum with a 39.9% increase over the past 24 hours and a 22.08% gain over the past 7 days. The 30-day performance shows an 85.76% increase, indicating renewed interest in the token.

The 24-hour trading range has been between $0.0010163 and $0.0025912, with a trading volume of $4,330.44. The current market capitalization stands at approximately $326,952, with a circulating supply of 229,924,337 DYP tokens, representing 99.99% of the total supply of 229,926,862 tokens.

DYP currently holds a market ranking of 3,435 with a market dominance of 0.000013%. The token's market cap to fully diluted valuation ratio is at 100%, as the circulating supply nearly equals the total supply. The project maintains a presence on one exchange and has a holder base of 1,661 addresses.

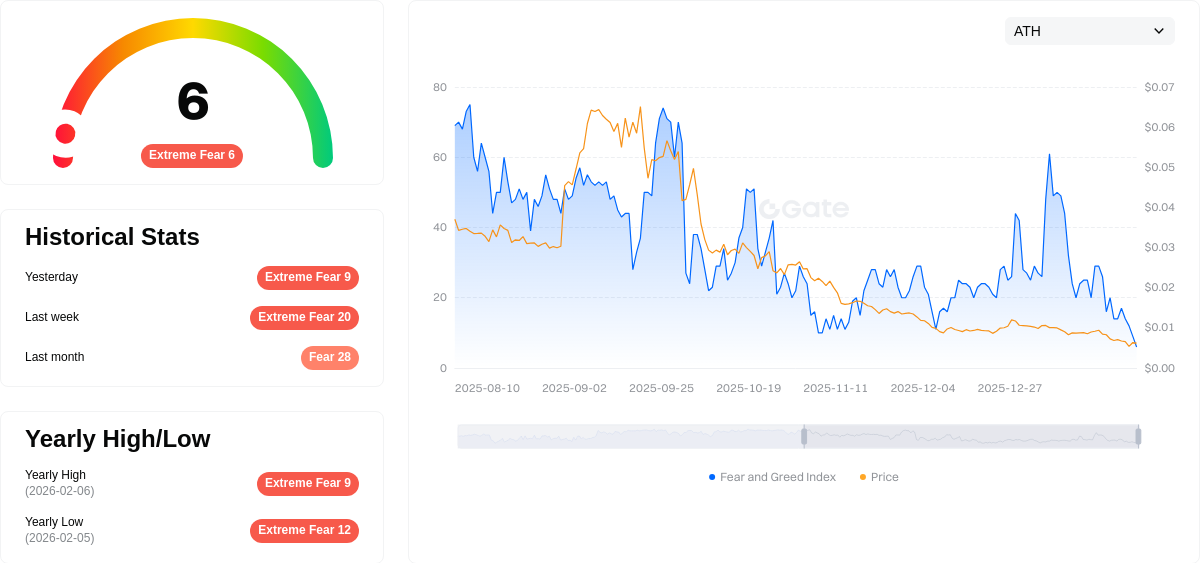

Despite the recent positive price movements, DYP remains down 88.77% over the past year, trading significantly below its all-time high. The current market sentiment index shows a reading of 6, indicating "Extreme Fear" conditions in the broader cryptocurrency market.

Click to view current DYP market price

DYP Market Sentiment Indicator

2026-02-07 Fear and Greed Index: 6 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at just 6 points. This indicates widespread panic and pessimism among investors, suggesting that market sentiment has reached extremely bearish levels. During such periods, risk-averse investors typically retreat from the market, while contrarian traders may view this as a potential buying opportunity. Extreme fear often precedes market reversals, making it a critical time for careful analysis and strategic decision-making on Gate.com.

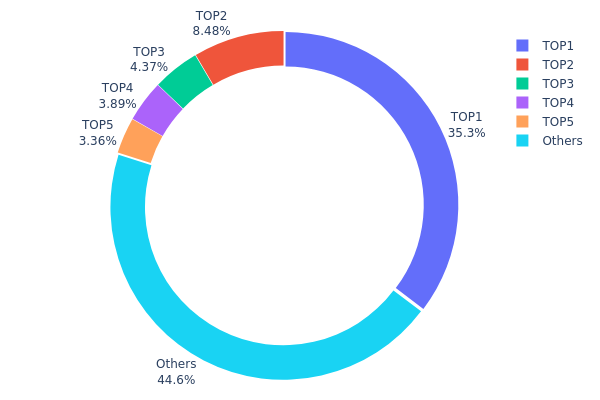

DYP Holding Distribution

The holding distribution chart reflects the concentration of token holdings across different wallet addresses, serving as a key indicator of on-chain power structure and decentralization level. According to the latest data, the top holder controls 81,170.34K DYP tokens, accounting for 35.30% of the total supply, while the top five addresses collectively hold 55.62% of the circulating supply. This indicates a moderate to high concentration pattern in DYP's current market structure.

From a market structure perspective, this concentration level presents both opportunities and risks. The dominance of the largest holder at over one-third of supply creates potential for significant market impact through large-scale transactions. The second through fifth positions hold relatively balanced percentages ranging from 3.36% to 8.47%, suggesting some distribution among major stakeholders. However, with over 55% controlled by just five addresses, the token exhibits characteristics of centralized holding patterns that could amplify price volatility during periods of whale activity.

The remaining 44.61% distributed among other addresses indicates some degree of community participation, yet the overall structure suggests limited decentralization compared to more mature crypto assets. This concentration profile typically correlates with higher susceptibility to coordinated movements and reduced resistance to manipulation attempts, particularly during low-liquidity trading periods. For investors, monitoring changes in these top holder positions becomes essential for understanding potential supply-side dynamics.

Click to view current DYP Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7617...f390af | 81170.34K | 35.30% |

| 2 | 0x1166...39421d | 19494.12K | 8.47% |

| 3 | 0xf16e...969b91 | 10050.62K | 4.37% |

| 4 | 0x1f5c...7485ba | 8952.35K | 3.89% |

| 5 | 0x0d07...b492fe | 7731.65K | 3.36% |

| - | Others | 102527.78K | 44.61% |

II. Core Factors Influencing DYP's Future Price

Supply Mechanism

- Market Demand Dynamics: The future price trajectory of DYP is closely tied to evolving market demand patterns. As adoption increases and use cases expand, demand fluctuations can create significant price volatility.

- Historical Patterns: Historical analysis suggests that periods of heightened demand have corresponded with price appreciation, while supply chain disruptions have introduced downward pressure.

- Current Impact: Present market conditions indicate that supply chain stability remains a key concern, with potential improvements in logistics and distribution networks likely to support price stabilization.

Institutional and Major Holder Dynamics

- Institutional Positioning: While specific institutional holdings data is limited, investor sentiment appears to be a driving force in DYP's valuation. Increased institutional interest could provide upward momentum.

- Corporate Adoption: Information regarding corporate adoption of DYP is not readily available in the provided materials.

- Regulatory Environment: Regulatory changes continue to play a significant role in shaping market expectations. Evolving compliance frameworks and policy adjustments may introduce both opportunities and constraints.

Macroeconomic Environment

- Monetary Policy Influence: Central bank policies, particularly interest rate decisions and liquidity measures, can affect risk appetite in cryptocurrency markets. Tighter monetary conditions may dampen speculative demand.

- Inflation Hedge Characteristics: Economic uncertainty and inflationary pressures have historically driven investors toward alternative assets. DYP's performance in such environments depends on broader market sentiment and its perceived value proposition.

- Geopolitical Factors: Global economic trends and geopolitical tensions can create volatility across financial markets, influencing investor behavior and capital flows into digital assets.

Technological Development and Ecosystem Building

- Technological Advancements: Ongoing technological improvements and protocol upgrades can enhance network efficiency, security, and scalability, potentially attracting more users and developers.

- Ecosystem Applications: The growth of decentralized applications and ecosystem projects can strengthen DYP's utility and value proposition. Expanding use cases and partnerships may drive long-term adoption.

- Innovation and Competitiveness: Staying competitive requires continuous innovation. Development efforts focused on improving user experience and addressing technical challenges can support sustained growth.

III. 2026-2031 DYP Price Forecast

2026 Outlook

- Conservative forecast: $0.00124 - $0.00142

- Neutral forecast: $0.00142 (average market conditions)

- Optimistic forecast: Up to $0.00183 (requires favorable market sentiment and increased adoption)

2027-2029 Outlook

- Market stage expectation: Potential consolidation phase with gradual accumulation, transitioning into moderate growth as the market matures

- Price range forecast:

- 2027: $0.00132 - $0.00241 (approximately 14% change from baseline)

- 2028: $0.0017 - $0.0021 (approximately 41% change, reflecting growing market recognition)

- 2029: $0.00128 - $0.0022 (approximately 44% change, indicating continued momentum)

- Key catalysts: Enhanced platform utility, broader DeFi ecosystem integration, and sustained community engagement

2030-2031 Long-term Outlook

- Baseline scenario: $0.0013 - $0.00213 in 2030 (assuming steady organic growth and stable market conditions)

- Optimistic scenario: $0.00245 - $0.00309 by 2030-2031 (assuming accelerated adoption and favorable regulatory environment)

- Transformative scenario: Potentially reaching $0.00381 by 2031 (requires breakthrough partnerships, significant protocol upgrades, and bullish crypto market cycle)

- 2031-02-07: DYP could potentially trade around $0.00261 average (representing approximately 83% growth trajectory under sustained positive developments)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00183 | 0.00142 | 0.00124 | 0 |

| 2027 | 0.00241 | 0.00163 | 0.00132 | 14 |

| 2028 | 0.0021 | 0.00202 | 0.0017 | 41 |

| 2029 | 0.0022 | 0.00206 | 0.00128 | 44 |

| 2030 | 0.00309 | 0.00213 | 0.0013 | 49 |

| 2031 | 0.00381 | 0.00261 | 0.00245 | 83 |

IV. DYP Professional Investment Strategies and Risk Management

DYP Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with moderate risk tolerance seeking exposure to decentralized ecosystem products

- Operational Recommendations:

- Consider accumulating positions during market corrections when volatility subsides

- Monitor the development progress of Dypius ecosystem products including yield farming, staking, and DeFi tools

- Storage Solution: Use Gate Web3 Wallet for secure asset custody with multi-signature protection

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor 24-hour trading volume fluctuations; current volume stands at approximately $4,330

- Price Range Tracking: Observe the 24-hour range between $0.0010163 and $0.0025912 to identify support and resistance levels

- Swing Trading Considerations:

- Given the relatively low market cap of approximately $327,000, be cautious of liquidity constraints

- Track short-term price movements, noting the recent 7-day increase of 22.08% and 30-day surge of 85.76%

DYP Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation

- Aggressive Investors: 3-5% portfolio allocation

- Professional Investors: May consider up to 5-8% allocation with active monitoring

(2) Risk Hedging Solutions

- Position Sizing: Limit single-asset exposure to minimize impact from high volatility periods

- Diversification: Balance DYP holdings with established cryptocurrencies and stablecoins

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading and staking access

- Cold Storage Solution: Consider hardware wallet solutions for long-term holdings exceeding $10,000

- Security Precautions: Enable two-factor authentication, regularly update security protocols, and never share private keys

V. DYP Potential Risks and Challenges

DYP Market Risks

- Liquidity Risk: With a relatively small market cap of approximately $327,000 and limited exchange listings, exiting large positions may face challenges

- Volatility Risk: The token has experienced significant price swings, including a 39.9% increase in 24 hours and an 88.77% decline over one year

- Low Trading Volume: Daily trading volume of around $4,330 indicates limited market depth and potential for price manipulation

DYP Regulatory Risks

- DeFi Compliance: As regulatory frameworks for decentralized finance continue evolving globally, changes in compliance requirements may impact Dypius ecosystem operations

- Jurisdictional Uncertainty: Different regulatory approaches across regions may affect user access to Dypius products and services

- NFT and Metaverse Regulations: Emerging regulatory scrutiny on NFT and virtual asset sectors could introduce operational constraints

DYP Technical Risks

- Smart Contract Vulnerabilities: DeFi protocols face ongoing risks from potential code exploits or security breaches

- Network Dependency: The Ethereum-based infrastructure exposes the project to network congestion and gas fee fluctuations

- Ecosystem Competition: Intense competition from established DeFi platforms may impact user adoption and retention rates

VI. Conclusion and Action Recommendations

DYP Investment Value Assessment

Dypius presents itself as a comprehensive decentralized ecosystem offering diverse products including yield farming, staking, DeFi tools, NFTs, and Metaverse components. While the project demonstrates ambitious scope covering multiple blockchain use cases, the current market metrics reveal significant challenges. The relatively small market capitalization, limited exchange presence, and low daily trading volume suggest early-stage development. Recent short-term price appreciation (22.08% over 7 days, 85.76% over 30 days) contrasts sharply with the significant one-year decline of 88.77%, highlighting substantial volatility risks. Long-term value depends heavily on successful ecosystem development and user adoption growth.

DYP Investment Recommendations

✅ Beginners: Consider DYP only as a micro-allocation (under 1%) for educational exposure to DeFi ecosystems; prioritize learning about decentralized protocols before significant investment ✅ Experienced Investors: May allocate 2-5% for speculative exposure while closely monitoring ecosystem development milestones and trading volume trends ✅ Institutional Investors: Exercise caution given limited liquidity; consider small pilot allocations only after thorough due diligence on smart contract audits and team credentials

DYP Trading Participation Methods

- Spot Trading: Purchase DYP directly on Gate.com with careful attention to order book depth and slippage

- Staking Participation: Explore staking opportunities within the Dypius ecosystem to generate yield while supporting network operations

- Gradual Accumulation: For interested investors, consider dollar-cost averaging to mitigate entry price risk amid high volatility

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is DYP token and what is its purpose?

DYP is a cryptocurrency supporting DeFi yield protocols on Ethereum, enabling users to stake tokens and participate in yield farming. It provides secure and profitable DeFi opportunities including staking, yield farming, and NFT trading services.

How to conduct DYP price prediction, what are the analysis methods?

DYP price prediction uses technical analysis (K-line charts, moving averages) and fundamental analysis (market trends, project developments). Monitor trading volume, market sentiment, and ecosystem progress to forecast price movements.

DYP的历史价格表现如何,未来价格走势如何预测?

DYP历史价格波动显著,近期在$0.002387至$0.002554区间波动。未来走势受市场需求、生态发展等多因素驱动,预期随着DeFi行业成熟,DYP长期看好。

What are the risks to be aware of when investing in DYP?

DYP investments carry significant price volatility risks that may result in loss of principal. Market fluctuations can be severe, and investors bear full responsibility for their investment decisions. Conduct thorough risk assessment before investing.

DYP与其他主流加密货币相比有什么优势和劣势?

DYP优势:提供DeFi Yield协议治理投票权,社区驱动。劣势:市场认可度低于比特币和以太坊,生态建设相对薄弱,交易额有限。

What are the main factors affecting DYP price?

DYP price is primarily influenced by market sentiment, supply and demand dynamics, technological innovations, regulatory policies, and macroeconomic trends. Trading volume and investor activity also significantly impact price movements.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

How to Organize Cryptocurrency Mining — A Step-by-Step Guide

Will Bitcoin actually hit several million dollars, or could it drop to zero?

What Is a Mainnet in Cryptocurrency?

13 Best Penny Cryptocurrencies To Invest In

GetAgent: Crypto AI Agent vs Trading Bots