2026 EARNM Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: EARNM's Market Position and Investment Value

EARN'M (EARNM), as a DePIN rewards ecosystem with over 45 million users, has emerged since its launch in December 2024 as an innovative platform converting everyday mobile activity into rewards. As of February 2026, EARNM maintains a market capitalization of approximately $556,400, with a circulating supply of about 3.25 billion tokens, and the price fluctuating around $0.0001712. This asset, recognized as a "user attention and data monetization pioneer," is playing an increasingly vital role in the Web3 rewards and decentralized infrastructure sectors.

This article will comprehensively analyze EARNM's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. EARNM Price History Review and Market Status

EARNM Historical Price Evolution Trajectory

- 2024: EARNM launched on Gate.com in December with an initial listing price of $0.01, experiencing significant price fluctuation during the early trading phase

- 2024-12-19: EARNM reached its historical high of $0.0666, representing the peak trading activity following its launch period

- 2026-01-14: EARNM recorded its historical low of $0.0001105, reflecting a notable adjustment phase in market valuation

EARNM Current Market Status

As of February 5, 2026, EARNM is trading at $0.0001712, with a 24-hour trading volume of $12,462.40. The token currently holds a market capitalization of $556,400, ranking 2957 in the cryptocurrency market with a market share of 0.000033%. The circulating supply stands at 3.25 billion EARNM tokens, representing 65% of the maximum supply of 5 billion tokens.

The token has shown mixed short-term performance with a 1.11% increase over the past hour and a 1.05% gain in the last 24 hours. However, EARNM has experienced a 0.80% decline over the past 7 days and a 13.10% decrease over the past 30 days. The 24-hour price range has been between $0.0001712 and $0.0001732.

EARNM maintains a community of over 45 million users within its DePIN rewards ecosystem and has recorded 129,741 token holders. The project team, recognized by Deloitte as North America's fastest-growing company in 2023 with a 32,481% growth rate, has generated over $70 million in Web2 and Web3 revenue, delivering $350 million in value earned and saved by users.

Click to view current EARNM market price

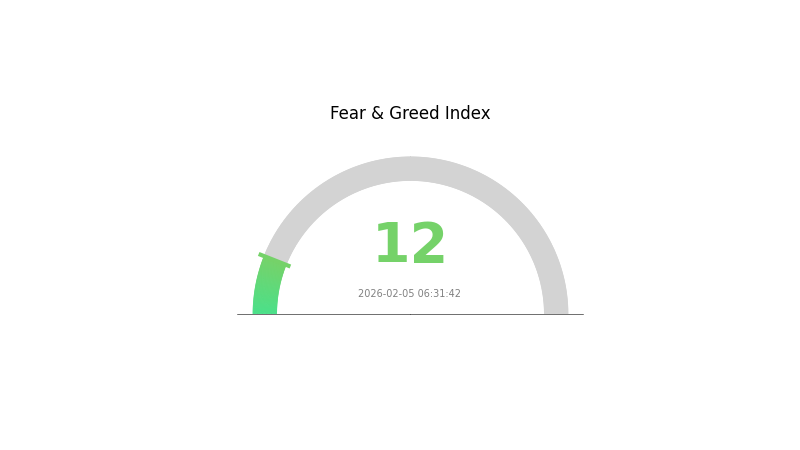

EARNM Market Sentiment Indicator

2026-02-05 Fear and Greed Index: 12 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 12. This exceptionally low reading indicates widespread pessimism and panic among investors. During such periods of extreme fear, market sentiment is heavily negative, and risk appetite diminishes significantly. Experienced traders often view extreme fear as a potential buying opportunity, as assets may be oversold. However, caution is still warranted as markets can remain volatile. Monitor market developments closely and ensure proper risk management before making any investment decisions.

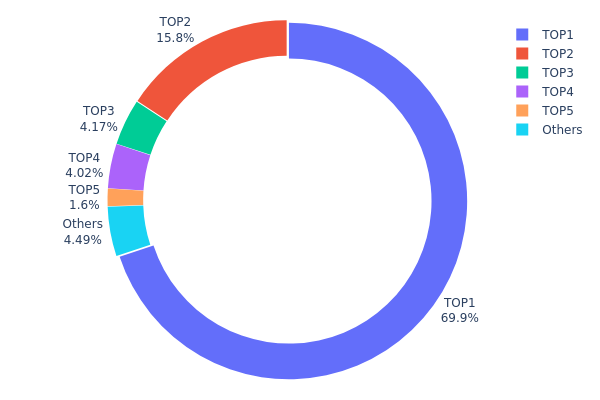

EARNM Holding Distribution

The holding distribution chart reflects the allocation of tokens across different wallet addresses within the blockchain network, serving as a crucial indicator of decentralization and market structure stability. By analyzing the concentration of holdings among major addresses, investors can assess potential risks related to price manipulation and market liquidity.

Current data reveals a highly concentrated holding pattern for EARNM. The top address holds 3,497,313.24K tokens, accounting for 69.94% of the total supply, while the second-largest address controls 789,209.79K tokens (15.78%). Combined, the top two addresses possess approximately 85.72% of the entire token supply. The top five addresses collectively hold 95.49% of total tokens, with remaining addresses accounting for merely 4.51%. This extreme concentration suggests that EARNM's token distribution remains highly centralized at present.

Such concentrated holdings present significant implications for market dynamics. The dominance of a single address controlling nearly 70% of supply creates substantial systemic risks, as large-scale transfers or sell-offs could trigger severe price volatility. Additionally, this concentration pattern may indicate that major holdings remain locked within project treasury, exchange reserves, or institutional wallets. The limited token circulation among retail holders could restrict organic price discovery mechanisms and heighten vulnerability to potential market manipulation. From a decentralization perspective, this distribution pattern suggests that EARNM's on-chain governance structure and token economics may still be in developmental stages, requiring closer monitoring of future token unlock schedules and distribution strategies to evaluate long-term ecosystem health.

Click to view current EARNM Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9957...2b665b | 3497313.24K | 69.94% |

| 2 | 0x8e93...ce12d4 | 789209.79K | 15.78% |

| 3 | 0x0d07...b492fe | 208514.44K | 4.17% |

| 4 | 0x51e3...bc75e0 | 200899.73K | 4.01% |

| 5 | 0x9cee...955df7 | 79760.58K | 1.59% |

| - | Others | 224302.23K | 4.51% |

II. Core Factors Influencing EARNM's Future Price

Supply Mechanism

- Token Unlocking Schedule and Staking Incentives: EARNM implements a structured token release mechanism combined with staking rewards that can reach up to 250% APY. This dual approach aims to balance token circulation while encouraging long-term holding behavior.

- Historical Patterns: Supply dynamics in blockchain reward ecosystems typically demonstrate that controlled token releases paired with attractive staking yields can help moderate selling pressure during unlock events.

- Current Impact: The high staking APY structure may contribute to reducing immediate market supply, potentially supporting price stability as tokens unlock according to the predetermined schedule.

Institutional and Large Holder Dynamics

- User Adoption Metrics: EARNM has attracted over 13 million unique active wallets, demonstrating substantial user engagement within its loyalty ecosystem. As of 2025, the platform has grown to over 45 million users with an actively participating development team.

- Ecosystem Growth: The expanding user base and development activity suggest growing institutional interest in the mobile activity rewards sector and DePIN (Decentralized Physical Infrastructure Network) rewards ecosystem.

Macroeconomic Environment

- Inflation Hedge Characteristics: Global macroeconomic trends, including inflation concerns and geopolitical tensions, may drive increased interest in digital assets as alternative stores of value.

- Monetary Policy Impact: Central bank interest rate adjustments and monetary policy shifts can influence capital flows into cryptocurrency markets, potentially affecting demand for reward-based tokens like EARNM.

- Geopolitical Factors: During periods of uncertainty, demand for digital assets may experience fluctuations as investors reassess their portfolio allocations.

Technical Development and Ecosystem Building

- Core Product and Reward Mechanism Development: The ongoing evolution of EARNM's reward infrastructure represents a critical factor in its value proposition. Development progress in the core product directly impacts user retention and ecosystem sustainability.

- Ecosystem Applications: As the heart of the DePIN rewards ecosystem, EARNM serves as the foundational token for mobile activity rewards and the EARNM loyalty ecosystem, with applications spanning user incentivization, partner rewards, and potential future products and services.

- Technical Architecture: The platform's blockchain protocol continues to develop its technical framework, with the active development team working on expanding functionality and improving user experience within the digital finance space.

III. 2026-2031 EARNM Price Forecast

2026 Outlook

- Conservative prediction: $0.00012 - $0.00017

- Neutral prediction: $0.00017

- Optimistic prediction: $0.00024 (requires favorable market conditions)

2027-2029 Outlook

- Market stage expectation: The token may experience gradual growth as adoption potentially increases and ecosystem development progresses

- Price range predictions:

- 2027: $0.00015 - $0.00029

- 2028: $0.00015 - $0.00033

- 2029: $0.00026 - $0.00037

- Key catalysts: Market maturity, potential ecosystem expansion, and broader adoption patterns could serve as primary drivers

2030-2031 Long-term Outlook

- Baseline scenario: $0.00022 - $0.00033 (assuming steady market conditions)

- Optimistic scenario: $0.00033 - $0.00045 (assuming enhanced adoption and favorable market dynamics)

- Transformative scenario: $0.00032 - $0.00049 by 2031 (under exceptionally favorable conditions including significant ecosystem growth)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00024 | 0.00017 | 0.00012 | 1 |

| 2027 | 0.00029 | 0.0002 | 0.00015 | 19 |

| 2028 | 0.00033 | 0.00025 | 0.00015 | 43 |

| 2029 | 0.00037 | 0.00029 | 0.00026 | 68 |

| 2030 | 0.00045 | 0.00033 | 0.00022 | 93 |

| 2031 | 0.00049 | 0.00039 | 0.00032 | 129 |

IV. EARNM Professional Investment Strategy and Risk Management

EARNM Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to DePIN ecosystem growth and willing to hold through market cycles

- Operational Suggestions:

- Consider dollar-cost averaging (DCA) to gradually build positions and reduce timing risk

- Monitor the project's user growth metrics and platform revenue generation as key performance indicators

- Utilize Gate Web3 Wallet for secure self-custody storage with full control over private keys

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume analysis: Monitor 24-hour trading volume fluctuations to identify potential breakout or breakdown signals

- Support and resistance levels: Track price movements relative to recent highs and lows for entry and exit points

- Swing Trading Considerations:

- Pay attention to short-term price volatility patterns, as EARNM has shown notable fluctuations

- Set stop-loss orders to manage downside risk given the token's significant price movement history

EARNM Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation

- Aggressive Investors: 5-10% of crypto portfolio allocation

- Professional Investors: Up to 15% with active management and hedging strategies

(II) Risk Hedging Solutions

- Portfolio diversification: Balance EARNM holdings with established cryptocurrencies and stablecoins to reduce concentration risk

- Position sizing discipline: Limit initial exposure and scale positions based on project milestone achievements and market validation

(III) Secure Storage Solutions

- Hot wallet solution: Gate Web3 Wallet provides convenient access for active trading while maintaining security standards

- Cold storage approach: Consider hardware wallet solutions for long-term holdings to minimize online exposure risks

- Security Precautions: Never share private keys, enable two-factor authentication, and regularly verify wallet addresses before transactions

V. EARNM Potential Risks and Challenges

EARNM Market Risks

- High volatility exposure: The token has experienced substantial price fluctuations, with a 97.44% decline from its all-time high, indicating significant market volatility

- Limited liquidity considerations: With relatively modest 24-hour trading volume, large orders may face slippage or execution challenges

- Market cap positioning: As a lower market cap asset, EARNM may experience heightened sensitivity to broader crypto market movements

EARNM Regulatory Risks

- DePIN sector oversight: Evolving regulatory frameworks for decentralized physical infrastructure networks may introduce compliance requirements

- Data monetization regulations: The project's model of leveraging user data and attention may face scrutiny under data protection and privacy laws

- Token classification uncertainty: Regulatory treatment of reward-based tokens remains subject to interpretation across different jurisdictions

EARNM Technical Risks

- Smart contract dependencies: The project relies on Polygon-based smart contracts, which carry inherent technical vulnerabilities

- Integration complexity: The ecosystem's multiple components including Fractal Box Protocol, SmartWallet, and EarnOS create integration points that require ongoing maintenance

- Scalability considerations: Supporting a user base of over 45 million requires robust infrastructure to maintain performance and user experience

VI. Conclusion and Action Recommendations

EARNM Investment Value Assessment

EARNM presents an innovative approach to monetizing mobile user activity within the DePIN ecosystem, backed by a team with demonstrated growth achievements. The project's model of converting everyday mobile interactions into rewards addresses a tangible use case with a large existing user base. However, investors should weigh this potential against considerable challenges, including substantial historical price decline, regulatory uncertainties in the data monetization space, and technical implementation risks. The token's circulating supply represents 65% of maximum supply, suggesting moderate dilution risk. The investment proposition centers on the project's ability to sustain on-chain revenue generation and maintain user engagement over time.

EARNM Investment Recommendations

✅ Newcomers: Start with minimal allocation (under 2% of crypto portfolio) to gain exposure while learning about DePIN ecosystems; prioritize understanding the project's fundamentals before increasing position size

✅ Experienced Investors: Consider strategic position building during periods of price stability, combined with active monitoring of user growth metrics and platform revenue data; maintain strict position limits relative to overall portfolio

✅ Institutional Investors: Conduct comprehensive due diligence on the project's business model sustainability, regulatory compliance framework, and technical architecture; consider pilot allocation with defined evaluation milestones

EARNM Trading Participation Methods

- Spot trading on Gate.com: Direct purchase and sale of EARNM tokens with immediate settlement and full ownership

- Gradual accumulation strategy: Implement scheduled purchases over time to average entry costs and reduce market timing risk

- Portfolio rebalancing approach: Periodically adjust EARNM allocation relative to portfolio performance targets and risk tolerance changes

Cryptocurrency investment carries high risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the current price of EARNM token? What are its all-time high and all-time low prices?

EARNM token is currently priced at BTC0.082436. The all-time high price is BTC0.063395, and the all-time low price is BTC0.081261. The 24-hour trading volume is $13,027.83.

How to predict the future price trend of EARNM? What technical analysis indicators can be referenced?

Predict EARNM price using technical indicators like moving averages, RSI, and MACD. Monitor trading volume, market sentiment, and on-chain metrics. Combine fundamental analysis with technical patterns for comprehensive price forecasting.

What are the main factors affecting EARNM price? How do market sentiment, project progress, and macro environment impact it?

EARNM price is primarily driven by market sentiment, project milestones, and macroeconomic factors. Positive news and community momentum boost prices, while project achievements enhance long-term value. Global economic events and regulatory developments significantly influence overall crypto market movements and EARNM valuations.

What are the advantages and disadvantages of EARNM compared to similar tokens?

EARNM's advantages include zero trading fees, multiple payment methods, and a crypto payment card for global transactions. However, it lacks clear yield mechanisms compared to competitors, and may have lower security standards than established alternatives.

What risks exist when investing in EARNM? How to assess its long-term investment value?

EARNM investment carries market volatility and adoption risks. Assess long-term value by analyzing tokenomics, project fundamentals, development progress, and community strength. Strong utility and growing ecosystem support positive valuation prospects.

What is the project team and technical foundation of EARNM? What impact does this have on price prediction?

EARNM's team comprises industry experts with strong technical foundations including EarnOS and DePIN technology. These innovations bridging Web2 and Web3, combined with smart wallet integration and mobile accessibility, position EARNM for significant price appreciation as adoption grows.

Top 10 DePIN Crypto Projects to Invest in 2025

How to Participate in a DePIN Project

What is DePIN?How Does DePIN Work?

What Does Onyxcoin's DApp Ecosystem Look Like in 2025?

How to Earn with The RWA DePin Protocol in 2025

TrendX (XTTA): An Innovative Investment Platform Integrating AI and DePIN

What is DOOD price today and how does it rank in the crypto market cap?

What is DOOD token and how does it compare to other NFT ecosystem competitors in market cap and user adoption?

How to use MACD and RSI indicators for crypto trading signals and price predictions

What are crypto derivatives market signals and how do funding rates, liquidations, and open interest reveal investor sentiment in 2026?

Who Are Cameron and Tyler Winklevoss? A Profile on the Twins