2026 FRAG Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: FRAG's Market Position and Investment Value

Fragmetric (FRAG), positioned as Solana's pioneering native liquid (re)staking protocol that has evolved into an advanced FRAG-22 asset management standard, has been establishing its presence in the DeFi ecosystem since its launch in 2025. As of February 2026, FRAG maintains a market capitalization of approximately $333,098, with a circulating supply of around 202 million tokens and a current price hovering near $0.001649. This asset, recognized for its innovative approach to multi-asset deposits and modular yield sourcing, is playing an increasingly notable role in Solana's DeFi infrastructure and sophisticated yield strategy management.

This article will comprehensively analyze FRAG's price trajectory from 2026 to 2031, incorporating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. FRAG Price History Review and Market Status

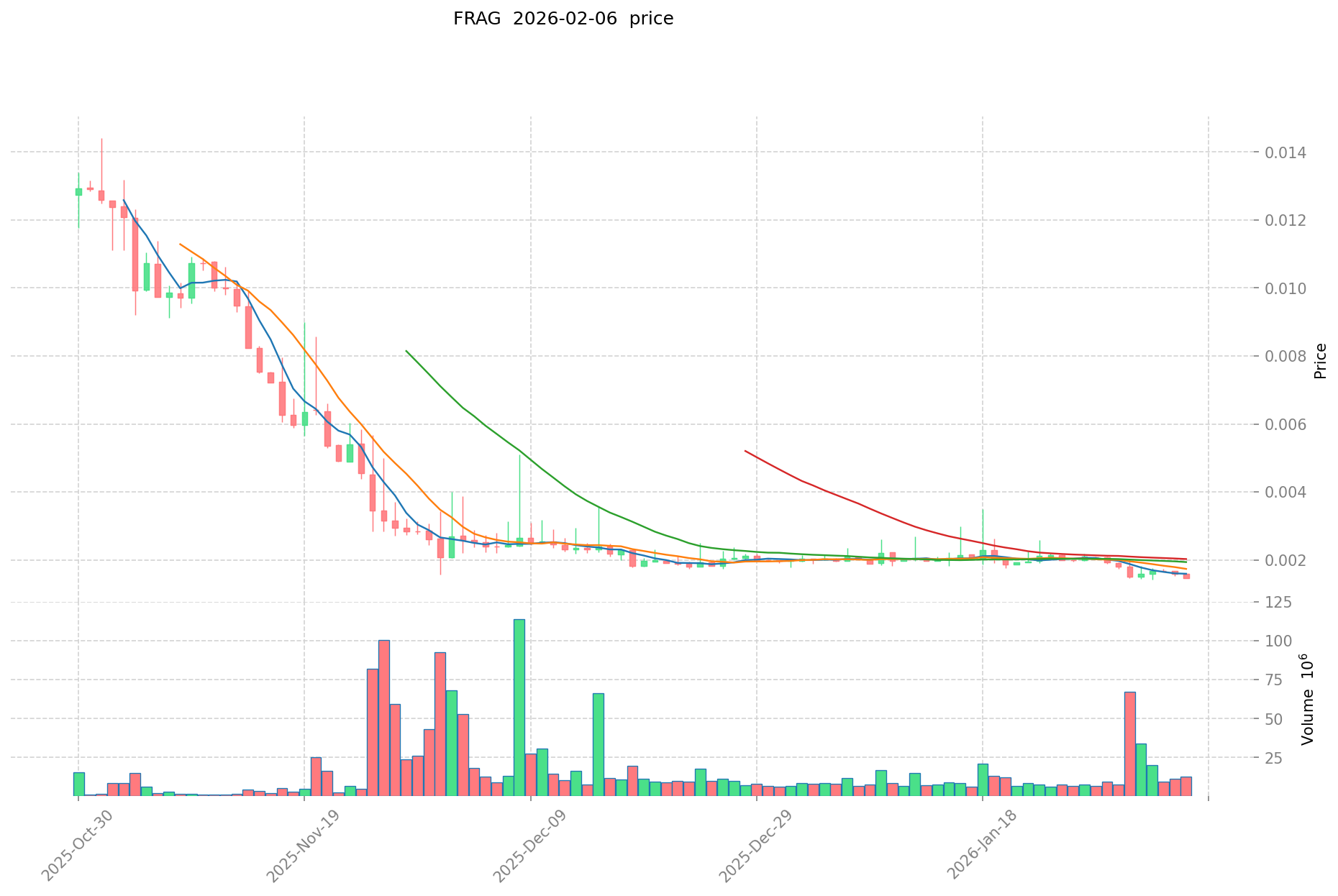

FRAG Historical Price Evolution Trajectory

- July 2025: Token launch on Gate.com, price reached 0.189 USDT

- February 2026: Price experienced significant decline, dropping to 0.001419 USDT

FRAG Current Market Situation

As of February 7, 2026, FRAG is trading at 0.001649 USDT. The token has shown a 12.4% increase over the past 24 hours, with 24-hour trading volume reaching 20,644 USDT. Within the last day, FRAG fluctuated between a high of 0.001652 USDT and a low of 0.001439 USDT.

Over different time periods, FRAG has exhibited varying performance trends. The 1-hour change shows a modest 0.3% increase, while the 7-day period reflects an 8.39% decline. The 30-day performance indicates an 18.24% decrease. Since its launch, the token has experienced a 97.34% decline from its initial levels.

The current circulating supply stands at 202,000,000 FRAG tokens, representing 20.2% of the total supply of 1,000,000,000 tokens. The circulating market capitalization is approximately 333,098 USDT, while the fully diluted market cap is 1,649,000 USDT. FRAG holds a market share of 0.000064% in the broader cryptocurrency market.

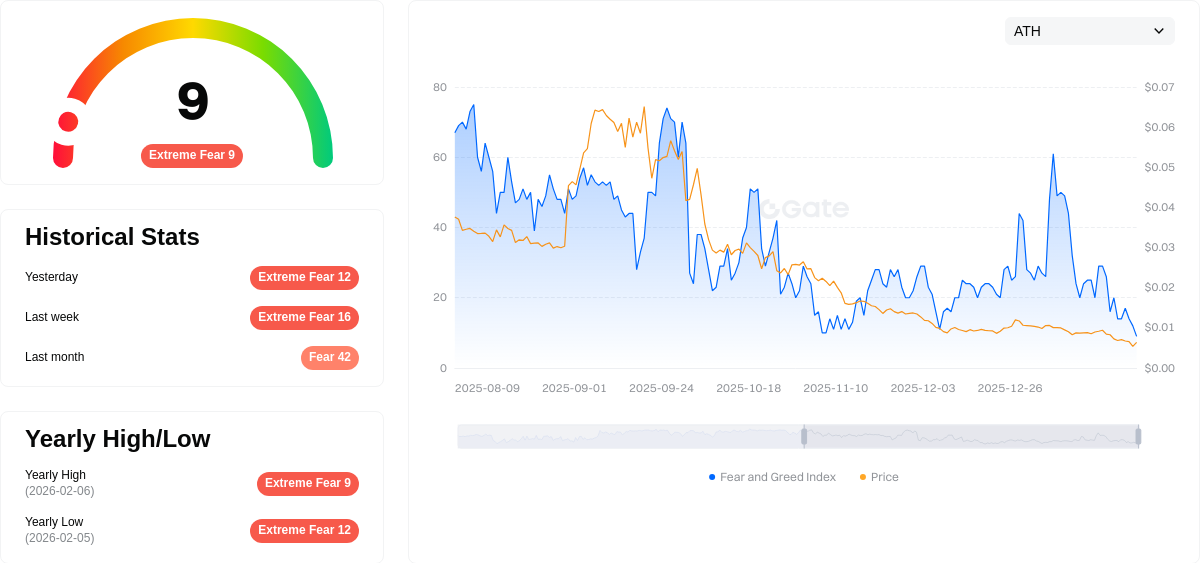

The token is actively traded on 4 exchanges and has attracted 15,276 holders. The Fear and Greed Index currently registers at 9, indicating an "Extreme Fear" sentiment in the market.

Click to view current FRAG market price

FRAG Market Sentiment Index

2026-02-06 Fear and Greed Index: 9 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index plummeting to 9. This exceptionally low reading reflects widespread market pessimism and investor anxiety. During such periods, market participants tend to adopt defensive positions, and volatility remains elevated. Historically, extreme fear levels have often preceded significant market reversals, presenting potential opportunities for contrarian investors. However, caution is advised, as the market may continue experiencing downward pressure in the short term. Traders should closely monitor support levels and sentiment shifts before making investment decisions.

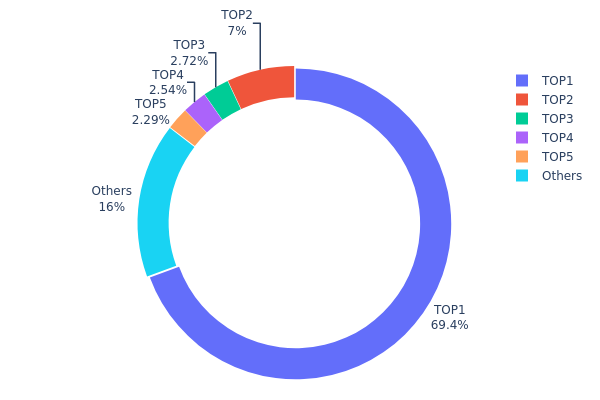

FRAG Holding Distribution

The holding distribution chart illustrates the concentration of token ownership across different wallet addresses, revealing the degree of decentralization and potential influence wielded by major holders. According to the latest on-chain data, FRAG exhibits a highly concentrated holding pattern, with the top address controlling 693,951.21K tokens, accounting for 69.39% of the total supply. The second-largest holder possesses 70,000.00K tokens (7.00%), while the remaining top five addresses collectively hold approximately 7.55% of the supply. The "Others" category, representing all remaining addresses, controls only 16.06% of the total token supply.

This extreme concentration pattern presents significant structural concerns for FRAG's market dynamics. When a single address controls nearly 70% of the circulating supply, it creates substantial price manipulation risk and liquidity vulnerability. Large holders, commonly referred to as "whales," possess the capacity to influence market prices through relatively modest trading activities, potentially triggering cascading liquidations or panic selling among retail investors. The thin distribution among other addresses—with only 16.06% spread across the broader holder base—further amplifies this vulnerability, as insufficient counterbalancing liquidity exists to absorb large-scale sell pressure should major holders decide to liquidate positions.

From a decentralization perspective, FRAG's current holding structure deviates considerably from the ideal distribution model typically observed in mature cryptocurrency projects. The dominance of a single address suggests either concentrated institutional ownership, treasury holdings, or potential centralized control mechanisms that contradict fundamental blockchain principles of distributed ownership. This configuration raises questions about the project's governance structure, token unlock schedules, and long-term commitment to community-driven development. Market participants should remain cognizant that such concentration levels inherently increase volatility risk and reduce the token's resilience against coordinated market manipulation or sudden liquidity shocks.

Click to view current FRAG Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | F8ngMX...CXAse4 | 693951.21K | 69.39% |

| 2 | BTj8Pn...JZbzRu | 70000.00K | 7.00% |

| 3 | 5MQGiz...3Vm7iC | 27207.49K | 2.72% |

| 4 | 7ifeXL...GXSmyX | 25445.23K | 2.54% |

| 5 | u6PJ8D...ynXq2w | 22908.32K | 2.29% |

| - | Others | 160482.96K | 16.06% |

II. Core Factors Influencing FRAG's Future Price

Market Conditions and Ecosystem Growth

- Web3 Gaming Ecosystem Position: FRAG has demonstrated notable growth within the Web3 gaming sector, establishing itself as a key player in this evolving space.

- Historical Performance: As of July 2025, FRAG's price reached $0.063 per token, showing substantial appreciation and reflecting growing market confidence.

- Current Impact: The token's performance indicates strengthening market positioning, with analysts anticipating continued expansion throughout 2025.

Investor Sentiment and Trading Dynamics

- Market Participation: Trading activity and investor attention significantly influence FRAG's price volatility, as participants closely monitor the token's value movements to inform their investment decisions.

- Sentiment Shifts: Changes in broader cryptocurrency market sentiment can create substantial price fluctuations, affecting both short-term trading patterns and longer-term holding strategies.

Regulatory Developments

- Compliance Landscape: Evolving regulatory frameworks for digital assets and gaming tokens continue to shape market expectations and investor confidence in FRAG.

- Policy Adaptation: The token's ability to navigate changing regulatory requirements may influence its adoption rates and institutional interest.

Technological Advancements

- Infrastructure Development: As part of Solana's modular asset management and restaking infrastructure, FRAG benefits from ongoing technological improvements within the Solana ecosystem.

- Innovation Integration: Technological upgrades and new features within the platform can enhance utility and drive demand for the token.

- Ecosystem Applications: The development and expansion of applications utilizing FRAG within the Web3 gaming space contribute to its fundamental value proposition.

III. 2026-2031 FRAG Price Prediction

2026 Outlook

- Conservative Prediction: $0.00129 - $0.00165

- Neutral Prediction: Around $0.00165

- Optimistic Prediction: Up to $0.00214 (requiring favorable market conditions)

2027-2029 Outlook

- Market Stage Expectation: Gradual growth phase with increasing market recognition and potential adoption expansion

- Price Range Prediction:

- 2027: $0.00114 - $0.00216, with an average around $0.0019 (approximately 15% increase)

- 2028: $0.00195 - $0.00223, with an average around $0.00203 (approximately 23% increase)

- 2029: $0.00153 - $0.00298, with an average around $0.00213 (approximately 29% increase)

- Key Catalysts: Sustained project development progress, enhanced ecosystem engagement, and broader market acceptance may drive price appreciation during this period.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00138 - $0.00363 (assuming steady ecosystem growth and moderate market conditions)

- Optimistic Scenario: Around $0.00256 - $0.00309 (assuming accelerated adoption and favorable macro environment)

- Transformative Scenario: Up to $0.00427 by 2031 (under exceptionally favorable conditions including significant technological breakthroughs and widespread institutional adoption, representing approximately 87% cumulative increase from 2026)

- February 7, 2026: FRAG currently trading within the predicted range of $0.00129 - $0.00214 (baseline year for forecast)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00214 | 0.00165 | 0.00129 | 0 |

| 2027 | 0.00216 | 0.0019 | 0.00114 | 15 |

| 2028 | 0.00223 | 0.00203 | 0.00195 | 23 |

| 2029 | 0.00298 | 0.00213 | 0.00153 | 29 |

| 2030 | 0.00363 | 0.00256 | 0.00138 | 55 |

| 2031 | 0.00427 | 0.00309 | 0.0021 | 87 |

IV. FRAG Professional Investment Strategies and Risk Management

FRAG Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to Solana DeFi ecosystem innovations and FRAG-22 asset management standard adoption

- Operational Recommendations:

- Consider accumulating positions during market corrections, particularly when FRAG trades near support levels

- Monitor the development progress of the FRAG-22 standard and its adoption across Solana ecosystem projects

- Storage Solution: Utilize Gate Web3 Wallet for secure custody with built-in DeFi protocol integration capabilities

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume of approximately $20,644 to identify liquidity patterns and potential breakout scenarios

- Support and Resistance Levels: Track price movements between the 24-hour low of $0.001439 and high of $0.001652 to establish trading ranges

- Swing Trading Key Points:

- Consider the 12.4% 24-hour volatility for short-term position sizing

- Pay attention to broader Solana ecosystem developments that may impact FRAG's liquid staking protocol adoption

FRAG Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 7-10% with active risk monitoring

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance FRAG exposure with other Solana ecosystem assets and major cryptocurrencies

- Position Sizing: Limit individual position size relative to the token's market cap of approximately $333,098 and relatively low liquidity

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and DeFi participation with Solana network support

- Cold Storage Option: Hardware wallet solutions for long-term holdings exceeding trading requirements

- Security Considerations: Verify the contract address (FRAGMEWj2z65qM62zqKhNtwNFskdfKs4ekDUDX3b4VD5) on Solana Explorer, enable two-factor authentication, and regularly review wallet permissions

V. FRAG Potential Risks and Challenges

FRAG Market Risks

- High Volatility: FRAG experienced a 97.34% decline over the past year, indicating substantial price volatility and market risk

- Limited Liquidity: With a market cap of approximately $333,098 and trading volume of around $20,644, liquidity constraints may impact large order execution

- Low Market Penetration: Market dominance of 0.000064% suggests limited market adoption and heightened vulnerability to broader market movements

FRAG Regulatory Risks

- DeFi Protocol Classification: Evolving regulatory frameworks around liquid staking and restaking protocols may impact operational models

- Securities Law Considerations: Potential classification changes for staking-related tokens could affect trading availability across jurisdictions

- Compliance Requirements: Increasing regulatory scrutiny on DeFi protocols may necessitate operational adjustments

FRAG Technical Risks

- Smart Contract Vulnerabilities: As an asset management protocol, FRAG depends on smart contract security for multi-asset deposits and reward distribution

- Network Dependency: Operating on Solana exposes FRAG to potential network outages or performance degradation

- Protocol Competition: The emergence of alternative liquid staking solutions on Solana may dilute market share and adoption

VI. Conclusion and Action Recommendations

FRAG Investment Value Assessment

FRAG represents an innovative approach to asset management on Solana through its FRAG-22 standard, offering potential long-term value through liquid staking protocol development. However, the token faces considerable short-term risks, including significant price decline of 97.34% year-over-year, limited liquidity with a market cap under $350,000, and a circulating supply representing only 20.2% of total supply. The protocol's evolution from a liquid restaking solution to a comprehensive asset management standard demonstrates development ambition, though market adoption remains in early stages with approximately 15,276 holders.

FRAG Investment Recommendations

✅ Beginners: Approach with extreme caution due to high volatility and limited liquidity. Consider waiting for clearer market stabilization and increased adoption signals before allocating capital. If interested, limit exposure to less than 1% of overall crypto portfolio.

✅ Experienced Investors: May consider small speculative positions (2-3% of crypto portfolio) with tight stop-loss parameters. Focus on monitoring FRAG-22 standard adoption metrics and Solana DeFi ecosystem growth. Utilize technical analysis to identify favorable entry points near support levels.

✅ Institutional Investors: Conduct comprehensive due diligence on smart contract audits, team credentials, and competitive positioning within Solana's liquid staking landscape. Consider pilot allocations with enhanced risk monitoring protocols and direct engagement with protocol developers for strategic assessment.

FRAG Trading Participation Methods

- Spot Trading: Access FRAG through Gate.com spot markets, currently listed on 4 exchanges with primary liquidity concentration

- DeFi Participation: Engage directly with Fragmetric protocol through the official application at app.fragmetric.xyz for native staking and yield generation opportunities

- Portfolio Integration: Incorporate FRAG as part of a diversified Solana ecosystem strategy, balancing exposure across liquid staking, DeFi infrastructure, and established protocols

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is FRAG token and what are its uses?

FRAG is a token on Solana enabling restaking innovation in DeFi. It allows users to stake, provide liquidity, and participate in lending protocols while earning rewards through its restaking mechanism.

What is the current price of FRAG coin? What are its all-time high and all-time low prices?

FRAG's all-time high price reached $0.170403 in July 2025, while its all-time low stands at $0.00166073 as of December 2025. Current price data updates in real-time across markets.

What are the main factors affecting FRAG price fluctuations?

FRAG price changes are primarily driven by supply and demand dynamics, market sentiment, trading volume, adoption trends, and broader crypto market movements.

What is the price prediction for FRAG coin in 2024?

Based on market analysis, FRAG coin's 2024 price prediction was anticipated to fluctuate around ¥0.3925. The price range was estimated between ¥0.3572 and ¥0.4239, with long-term projections suggesting potential growth toward ¥1.42 by 2035.

What are the advantages and disadvantages of FRAG compared to mainstream cryptocurrencies like BTC and ETH?

FRAG offers lower inflation rates and faster transaction speeds compared to BTC and ETH, but has relatively lower market recognition and liquidity in the current market.

What are the risks to pay attention to when investing in FRAG coins?

FRAG investment carries price volatility risk where you may lose principal. Market conditions are unpredictable. Investors bear full responsibility for investment decisions and potential losses independently.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

Anonymity vs. Pseudonymity: Key Differences Explained

Cryptocurrency staking: What is it and how can you earn profits from it

Money-Making Games: Top 23 Projects for Earning

Can quantum computers break Bitcoin?

What is MEPAD: A Comprehensive Guide to Mobile Electronic Personal Assistant Devices