2026 GMRT Price Prediction: Expert Analysis and Market Outlook for the Coming Year

Introduction: GMRT's Market Position and Investment Value

The Game Company (GMRT), as a next-generation cloud gaming platform integrated with Web3 technology, has been reshaping the gaming landscape since its launch in 2025. As of 2026, GMRT holds a market capitalization of approximately $1.38 million, with a circulating supply of around 29.28 million tokens, and the price stabilizing near $0.047. This asset, known as a bridge between traditional gaming and blockchain-based Play-to-Earn mechanics, is playing an increasingly vital role in democratizing access to high-quality gaming experiences.

This article will comprehensively analyze GMRT's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. GMRT Price History Review and Market Status

GMRT Historical Price Evolution Trajectory

- 2025: The token launched in February at an initial price of $0.12, reaching an all-time high of $0.52 on February 13, 2025, representing a significant upward movement in the early stages of trading.

- 2025: During the second half of the year, the market experienced substantial volatility, with the price declining to an all-time low of $0.004814 on November 23, 2025, reflecting challenging market conditions.

- 2026: As of early February 2026, GMRT has shown signs of recovery with a 30-day price increase of approximately 9.99%, though it remains significantly below its historical peak levels.

GMRT Current Market Situation

As of February 2, 2026, GMRT is trading at $0.046998, with a 24-hour trading volume of $11,868.34. The token has experienced a slight decline of 1.17% over the past 24 hours, with intraday trading ranging between $0.046815 and $0.047751.

The current circulating supply stands at 29,283,333 tokens, representing approximately 2.93% of the maximum supply of 1 billion tokens. This results in a market capitalization of $1,376,258, while the fully diluted market cap is calculated at $46,998,000. GMRT's market dominance is currently at 0.0017%, ranking it at position 2304 in the broader cryptocurrency market.

Recent price trends indicate mixed performance across different timeframes. While the token has declined 36.67% over the past week and shows a year-to-date decrease, the 30-day performance presents a more optimistic picture with nearly 10% gains. The token is currently listed on 2 exchanges, with Gate.com being one of the primary trading venues. The current market sentiment index stands at 14, indicating extreme fear in the market.

The token contract is deployed on the Base blockchain, with the contract address verified at 0x6967f0974d76d34e140cae27efea32cdf546b58e. The project has attracted approximately 67,080 token holders.

Click to check the current GMRT market price

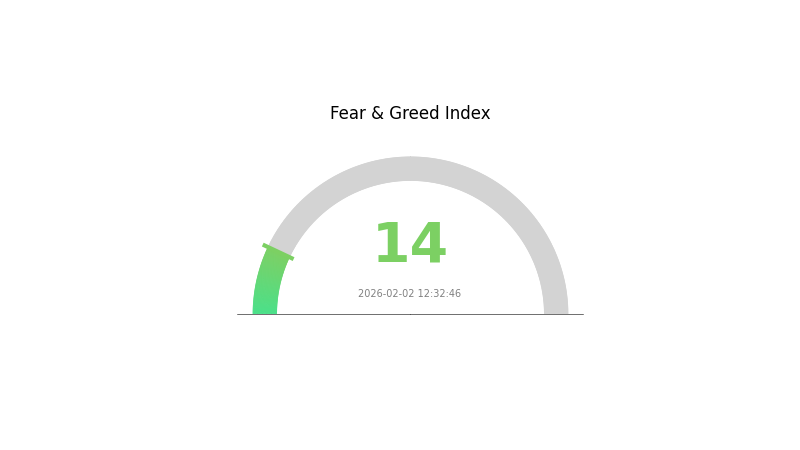

GMRT Market Sentiment Index

2026-02-02 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear with an index reading of just 14. This exceptionally low reading indicates significant market pessimism and negative sentiment among investors. When fear reaches such extreme levels, it often presents contrarian opportunities for long-term investors, as markets tend to be oversold. However, caution remains prudent, and investors should conduct thorough research before making any investment decisions. Monitor the index closely for potential shifts in market psychology.

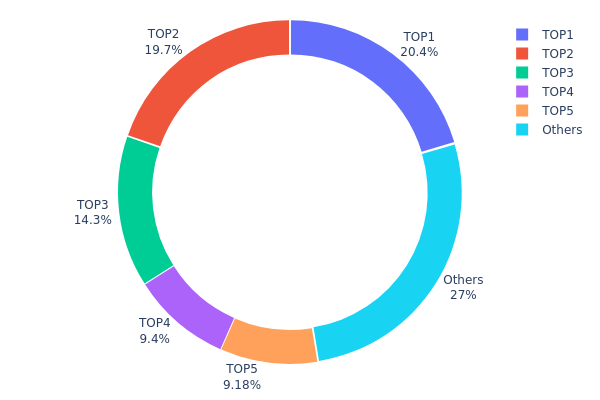

GMRT Holding Distribution

According to the on-chain holding distribution data, GMRT exhibits a significant concentration characteristic. The top five addresses collectively hold 725,570.39K tokens, accounting for 74.0% of the total supply. Among them, the top-ranked address holds 200,000K tokens (20.40%), while the second and third addresses hold 193,403.62K (19.72%) and 140,000K (14.28%) respectively. The remaining addresses outside the top five only account for 27.02% of the total supply, indicating a highly centralized holding structure.

This concentration level may pose certain risks to market stability. When a small number of addresses control the majority of tokens, any large-scale transfer or selling behavior could trigger significant price fluctuations. Additionally, such a distribution pattern may increase the risk of market manipulation, as major holders have the potential to influence market trends through coordinated actions. From a liquidity perspective, high concentration typically means that most tokens are held by a few entities, which may limit market trading activity and affect price discovery mechanisms.

From the perspective of decentralization, GMRT's current holding distribution deviates from the ideal decentralized model. Although blockchain technology itself is decentralized, the concentration of token holdings reflects a relatively centralized governance and economic structure. This situation suggests that the project may be in its early stages, with team, institutional investors, or early participants holding substantial positions. Investors need to closely monitor the unlock schedules and transfer dynamics of these major addresses, as their on-chain behavior could serve as an important leading indicator of market trends.

Click to view current GMRT Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf382...231892 | 200000.00K | 20.40% |

| 2 | 0x859c...6b9dc9 | 193403.62K | 19.72% |

| 3 | 0xae1f...2043c7 | 140000.00K | 14.28% |

| 4 | 0xbe75...f28358 | 92166.77K | 9.40% |

| 5 | 0x3f11...1f4f0f | 90000.00K | 9.18% |

| - | Others | 264776.51K | 27.02% |

II. Core Factors Influencing GMRT's Future Price

Supply Mechanism

- Token Distribution Model: GMRT has a total supply of 1 billion tokens, with an initial market cap of approximately $3.381 million at TGE. The first round sale price was set at 0.06 USDC/GMRT.

- Current Impact: The current token release represents 15% of the total supply with no lock-up period, achieving full unlock within 7 months. This relatively short unlock schedule may create selling pressure in the near term, potentially affecting price stability during the initial circulation phase.

Market Sentiment and Regulatory Environment

- Market Sentiment: GMRT's price trajectory is significantly influenced by overall cryptocurrency market sentiment. As with most digital assets, shifts in investor confidence and risk appetite can drive substantial price movements.

- Regulatory Policy: Changes in regulatory frameworks across different jurisdictions represent a key risk factor. Policy developments regarding cryptocurrency classification, taxation, and usage restrictions may impact GMRT's valuation and adoption prospects.

- Risk Considerations: The cryptocurrency market exhibits high volatility characteristics. Investors should exercise caution when considering GMRT positions, acknowledging the potential for rapid value fluctuations driven by multiple external factors.

Technology Development and Ecosystem Building

- Cloud Gaming Integration: GMRT serves as the utility token powering Game Company's Web3 cloud gaming platform, representing its primary value proposition within the gaming sector.

- Application Potential: The token's utility within the cloud gaming ecosystem positions it to benefit from growth in decentralized gaming infrastructure and Web3 gaming adoption trends.

- Ecosystem Development: The success of GMRT is closely tied to the development and user adoption of the underlying cloud gaming platform, making ecosystem growth a critical factor for long-term value appreciation.

III. 2026-2031 GMRT Price Prediction

2026 Outlook

- Conservative Prediction: $0.0259 - $0.04709

- Neutral Prediction: $0.04709

- Optimistic Prediction: $0.05463 (requires favorable market conditions and sustained adoption momentum)

2027-2029 Outlook

- Market Stage Expectation: The token may enter a gradual consolidation phase with modest growth, characterized by incremental price appreciation as the project matures and expands its ecosystem partnerships.

- Price Range Prediction:

- 2027: $0.02797 - $0.05239, with an average around $0.05086

- 2028: $0.0351 - $0.05369, with an average around $0.05162

- 2029: $0.04423 - $0.05792, with an average around $0.05266

- Key Catalysts: Continued development of the project's infrastructure, potential strategic collaborations, and broader cryptocurrency market sentiment could serve as primary drivers for price movement during this period.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.03262 - $0.06192 by 2030 (assuming stable market conditions and steady project development)

- Optimistic Scenario: $0.0545 - $0.07385 by 2031 (contingent on significant ecosystem expansion and increased market adoption)

- Transformative Scenario: Potentially reaching the upper range of $0.07385 (under exceptionally favorable conditions including major technological breakthroughs or widespread institutional adoption)

- 2026-02-02: GMRT demonstrates a projected growth trajectory with an estimated 24% cumulative increase potential through 2031, reflecting cautious optimism in its long-term value proposition.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.05463 | 0.04709 | 0.0259 | 0 |

| 2027 | 0.05239 | 0.05086 | 0.02797 | 8 |

| 2028 | 0.05369 | 0.05162 | 0.0351 | 9 |

| 2029 | 0.05792 | 0.05266 | 0.04423 | 12 |

| 2030 | 0.06192 | 0.05529 | 0.03262 | 17 |

| 2031 | 0.07385 | 0.05861 | 0.0545 | 24 |

IV. GMRT Professional Investment Strategy and Risk Management

GMRT Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to the cloud gaming and Web3 convergence with tolerance for volatility

- Operational recommendations:

- Consider establishing positions gradually during market corrections, rather than lump-sum purchases given GMRT's significant historical volatility (down 99.77% from launch price)

- Monitor project development milestones including partnership expansions with DWTC-Emerge, Telcoin, Tencent Cloud, and Aethir

- Storage solution: Utilize Gate Web3 Wallet for convenient access while maintaining recovery phrase security in offline storage

(II) Active Trading Strategy

- Technical analysis tools:

- Volume analysis: Current 24-hour trading volume of $11,868 provides insights into liquidity conditions; compare against historical averages to identify accumulation or distribution phases

- Support and resistance levels: Monitor the 30-day range performance (currently showing 9.99% gains) to identify potential entry and exit zones

- Swing trading considerations:

- Given the 7-day decline of 36.67%, traders should exercise caution with position sizing during volatile periods

- Set stop-loss orders to manage downside risk in a token that has experienced significant price swings between $0.004814 (ATL) and $0.52 (ATH)

GMRT Risk Management Framework

(I) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio allocation, prioritizing established assets

- Aggressive investors: 3-5% allocation for those comfortable with early-stage gaming platform exposure

- Professional investors: Up to 5-8% with active monitoring of platform metrics and partnership developments

(II) Risk Hedging Approaches

- Portfolio diversification: Balance GMRT exposure with established cryptocurrencies and traditional gaming sector investments

- Position scaling: Use dollar-cost averaging to mitigate timing risk in volatile market conditions

(III) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet for active traders requiring frequent access to GMRT tokens on Base network

- Cold storage approach: For long-term holders, consider hardware wallet solutions supporting Base-compatible tokens

- Security considerations: Always verify contract address (0x6967f0974d76d34e140cae27efea32cdf546b58e) before transactions; enable two-factor authentication on exchange accounts

V. GMRT Potential Risks and Challenges

GMRT Market Risks

- Price volatility: GMRT has demonstrated substantial price fluctuations, declining 36.67% over 7 days while gaining 9.99% over 30 days, indicating sensitivity to market sentiment shifts

- Liquidity concerns: With relatively modest 24-hour trading volume of $11,868 and circulation on only 2 exchanges, liquidity may impact execution during periods of high volatility

- Market capitalization positioning: Ranking at #2304 with market cap of $1.38 million suggests limited market depth compared to established gaming tokens

GMRT Regulatory Risks

- Gaming platform regulation: Cloud gaming platforms face evolving regulatory frameworks across different jurisdictions that could impact operational scope

- Token classification uncertainty: Play-to-Earn mechanics and tournament rewards may attract regulatory scrutiny regarding securities classification in various markets

- Cross-border compliance: TGC's global gaming platform model requires navigation of multiple regulatory environments for digital assets and gaming services

GMRT Technical Risks

- Platform dependency: Project success relies heavily on the performance and adoption of TGC's proprietary low-latency streaming technology

- Smart contract risks: As a Base network token, GMRT is subject to potential vulnerabilities in smart contract code; investors should monitor security audits

- Competition intensity: The cloud gaming sector faces competition from established platforms; TGC must demonstrate differentiation through Web3 integration and partnerships

VI. Conclusion and Action Recommendations

GMRT Investment Value Assessment

GMRT represents exposure to the convergence of cloud gaming and Web3 ecosystems, with strategic partnerships including Tencent Cloud and Aethir providing infrastructure credibility. The platform's offering of over 1,300 titles without hardware requirements addresses a genuine market need. However, the token's significant decline from its $0.52 all-time high to current levels around $0.047, coupled with low circulating supply (2.93% of total supply), presents considerable short-term volatility risk. Long-term value proposition depends on TGC's ability to execute its Play-to-Earn integration and scale user adoption in a competitive market.

GMRT Investment Recommendations

✅ Beginners: Limit exposure to small exploratory positions (under 1% of crypto portfolio); prioritize education on cloud gaming trends and Web3 integration before significant allocation ✅ Experienced investors: Consider strategic accumulation during market corrections with 2-4% portfolio weighting; actively monitor partnership announcements and platform user metrics ✅ Institutional investors: Conduct thorough due diligence on TGC's technology infrastructure and competitive positioning; consider participation as part of diversified gaming-focused crypto portfolio with appropriate risk controls

GMRT Trading Participation Methods

- Spot trading: Direct purchase on Gate.com with USDT or other supported pairs, suitable for establishing core positions

- Gradual accumulation: Implement dollar-cost averaging strategy to mitigate entry timing risk given historical volatility patterns

- Active monitoring: Track project developments including tournament launches and fantasy league implementations that may serve as value catalysts

Cryptocurrency investment carries extreme risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is GMRT? What are its uses and value?

GMRT is a Giant Metrewave Radio Telescope used for astronomical observations and cosmic research. It detects radio waves from celestial sources, helping scientists study galaxy structures and universe formation. GMRT provides high-resolution imaging with exceptional sensitivity, making it invaluable for astrophysics research and cosmic discoveries.

What are the main factors affecting GMRT price?

GMRT price is primarily influenced by market sentiment, investor confidence, technical developments, and trading volume. Market trends and adoption news directly impact price fluctuations.

How to predict GMRT price? What are the common prediction methods?

Common GMRT price prediction methods include technical analysis using moving averages, analyzing trading volume trends, and studying historical price patterns. These tools help identify market trends and assess whether GMRT is overbought or oversold for informed decision-making.

GMRT Price Prediction Accuracy and Risks?

GMRT price predictions are based on technical analysis and market trends, offering directional guidance for traders. However, cryptocurrency markets are highly volatile and influenced by multiple factors including market sentiment, regulatory changes, and macroeconomic conditions. Predictions carry inherent uncertainty and should be used as reference only, not as sole investment basis.

What are the advantages and disadvantages of GMRT compared to similar assets?

GMRT offers superior optimization precision and high-dimensional search capabilities with faster convergence compared to similar algorithms. It performs exceptionally well in complex environments and excels in high-dimensional optimization problems, making it a competitive choice in the crypto market.

What risk factors should be considered when investing in GMRT?

GMRT investment requires attention to market volatility, technology risks, regulatory changes, and project fundamentals. Monitor trading volume trends, team credibility, and competition to make informed decisions.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

TEN vs ENJ: A Comprehensive Comparison of Two Leading Blockchain Gaming Tokens

GAI vs IMX: Which Layer 2 Scaling Solution Offers Better Returns for Crypto Investors in 2024?

ECHO vs HBAR: A Comprehensive Comparison of Two Emerging Blockchain Ecosystems

What is a cryptocurrency paper wallet and how do you create one

What is Cryptocurrency Futures Trading?