2026 GXE Price Prediction: Expert Analysis and Future Outlook for GXE Token Performance

Introduction: GXE's Market Position and Investment Value

XENO Governance Token (GXE) serves as the governance token for PROJECT XENO, a tactical PvP game that integrates GameFi, eSports, and entertainment elements. Since its launch in 2021, the project has developed a unique Play-Fun-Earn ecosystem where players can earn tokens and NFTs through competitive battles. As of February 2026, GXE maintains a market capitalization of approximately $287,320, with around 738.8 million tokens in circulation, trading at $0.0003889. This gaming-focused asset is playing an increasingly important role in the blockchain gaming sector, particularly within the competitive GameFi landscape.

This article will comprehensively analyze GXE's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. GXE Price History Review and Market Status

GXE Historical Price Evolution Trajectory

- 2023: The token experienced significant price activity, reaching a notable level of $0.178623 in early June, representing a period of heightened market interest in the PROJECT XENO ecosystem

- 2024-2025: The market entered a correction phase, with price gradually declining as the broader GameFi sector faced challenges

- 2026: Price continued its downward trajectory, touching $0.00038188 in early February, reflecting ongoing market pressure

GXE Current Market Status

As of February 7, 2026, GXE is trading at $0.0003889, showing a 24-hour decline of 6.82%. The token's 24-hour trading range spans from $0.000349 to $0.0004184, with a total trading volume of $22,908.13.

The current circulating supply stands at 738.8 million GXE tokens, representing 12.31% of the maximum supply of 6 billion tokens. The circulating market capitalization is approximately $287,320, while the fully diluted valuation reaches $2.33 million. The token maintains a market dominance of 0.000093%.

Recent performance data indicates a 0.11% decrease over the past hour, a 14.54% decline over the past week, and a 37.6% drop over the past month. The one-year performance shows a decrease of 75.6%. The current market sentiment index registers at 6, indicating extreme fear conditions in the broader cryptocurrency market.

GXE is available for trading on Gate.com and maintains contract addresses on both Ethereum (0x510975edA48A97E0cA228dD04d1217292487bea6) and Binance Smart Chain (0x510975edA48A97E0cA228dD04d1217292487bea6). The token currently has approximately 2,043 holders across these networks.

Click to view current GXE market price

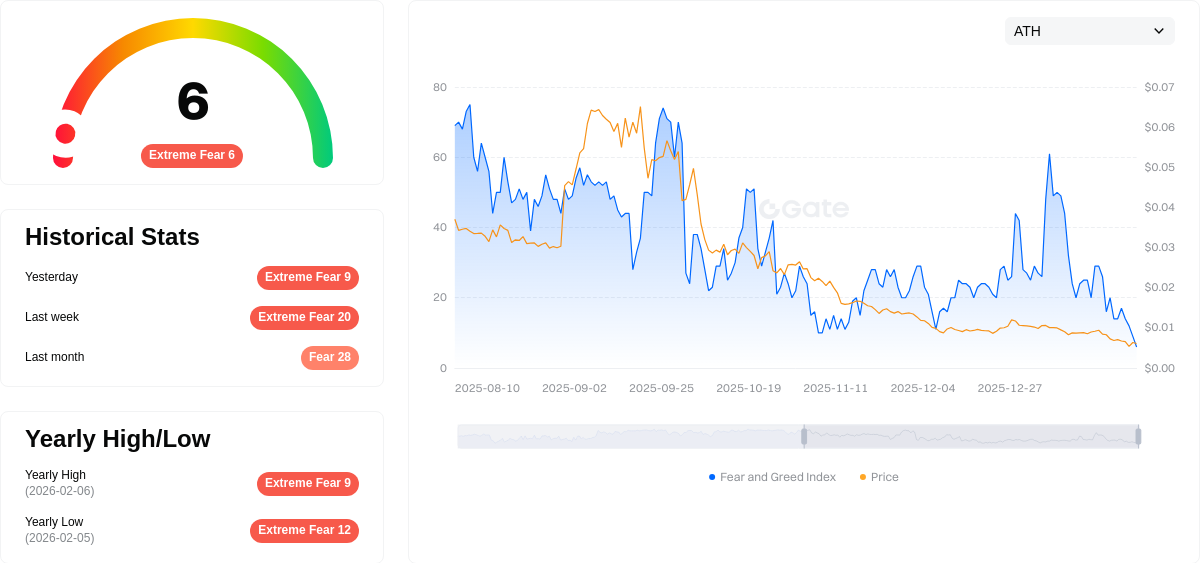

GXE Market Sentiment Index

2026-02-07 Fear and Greed Index: 6 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at a critically low level of 6. This indicates widespread investor pessimism and risk aversion across the market. Such extreme fear levels often present contrarian buying opportunities for long-term investors, as markets tend to eventually recover from panic-driven sell-offs. However, caution is still warranted, and investors should conduct thorough due diligence before making investment decisions. Monitoring market sentiment through tools like the Fear and Greed Index can help traders better understand market cycles and make more informed portfolio decisions.

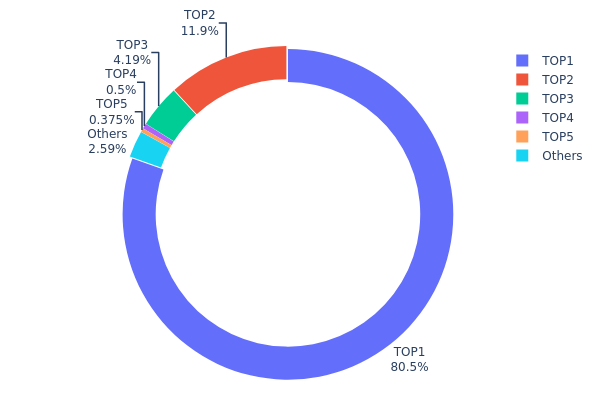

GXE Holding Distribution

The holding distribution chart illustrates the allocation of GXE tokens across different wallet addresses, serving as a critical indicator of asset decentralization and market structure stability. This metric reveals the concentration level of token ownership, which directly impacts potential market manipulation risks, liquidity characteristics, and the overall health of the token's ecosystem.

Based on the current data, GXE exhibits an extremely high concentration pattern. The top holder controls 965,880.95K tokens, representing an overwhelming 80.49% of the total supply. The second-largest address holds 142,246.33K tokens (11.85%), while the third holds 50,238.74K tokens (4.18%). Combined, the top three addresses control 96.52% of the circulating supply, leaving only 2.62% distributed among all other addresses. This concentration level significantly exceeds typical industry standards and raises substantial concerns regarding centralization risks.

Such extreme concentration creates a highly vulnerable market structure. The dominant holder possesses sufficient control to substantially influence price movements through relatively modest trading activities. This asymmetric power distribution increases volatility risk and potential manipulation concerns, as large-scale sell-offs could trigger cascading liquidations. Furthermore, the limited distribution among retail participants suggests restricted market depth, which may result in amplified price swings during periods of heightened trading activity. From a decentralization perspective, this holding pattern contradicts the fundamental principles of distributed ledger technology and raises questions about governance centralization and long-term ecosystem sustainability.

Click to view current GXE Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb968...b771a4 | 965880.95K | 80.49% |

| 2 | 0x0d07...b492fe | 142246.33K | 11.85% |

| 3 | 0xdea0...18c534 | 50238.74K | 4.18% |

| 4 | 0x53f4...a48447 | 6000.00K | 0.49% |

| 5 | 0x0458...dc5fcf | 4495.24K | 0.37% |

| - | Others | 31138.95K | 2.62% |

II. Core Factors Influencing GXE's Future Price

Supply Mechanism

Based on available information, specific supply mechanism details for GXE are not provided in the reference materials. The token's supply dynamics would typically involve factors such as issuance schedules, circulation patterns, and distribution mechanisms, though these particulars require further verification.

Institutional and Whale Activity

Concrete data regarding institutional holdings, major enterprise adoption, or specific national-level policies directly related to GXE are not available in the provided materials. Market participants should monitor official announcements and verified sources for updates on institutional positioning and regulatory developments.

Macroeconomic Environment

-

Monetary Policy Impact: Global central bank policies continue to shape risk asset appetite. Shifts in interest rate trajectories and liquidity conditions may influence investor positioning across digital assets, potentially affecting GXE's price dynamics.

-

Inflation Hedge Characteristics: The broader cryptocurrency market has exhibited varied performance during inflationary periods. Individual token behavior depends on multiple factors including utility, adoption, and market sentiment rather than solely macroeconomic conditions.

-

Geopolitical Factors: International developments and regulatory changes across jurisdictions may create volatility in digital asset markets. Cross-border policy coordination and regional regulatory frameworks could impact market confidence and trading activity.

Technology Development and Ecosystem Building

Specific technical upgrades, development milestones, or major decentralized applications (DApps) within the GXE ecosystem are not detailed in the reference materials. Technology advancement and ecosystem expansion typically serve as fundamental drivers for long-term value, though concrete information regarding GXE's technical roadmap requires verification through official project channels.

Market participants should conduct comprehensive due diligence and consult multiple verified sources when evaluating factors that may influence GXE's price trajectory. The cryptocurrency market remains subject to high volatility and multiple risk factors beyond those mentioned above.

III. 2026-2031 GXE Price Forecast

2026 Outlook

- Conservative forecast: $0.00035

- Neutral forecast: $0.00039

- Optimistic forecast: $0.00049

2027-2029 Outlook

- Market stage expectations: The token may experience gradual development with moderate volatility as adoption patterns evolve

- Price range forecasts:

- 2027: $0.00038 - $0.00053

- 2028: $0.00033 - $0.00051

- 2029: $0.00032 - $0.00068

- Key catalysts: Potential ecosystem expansion and broader market sentiment shifts could influence price movements

2030-2031 Long-term Outlook

- Baseline scenario: $0.00034 - $0.00059 (assuming steady market conditions)

- Optimistic scenario: $0.00053 - $0.00079 (with favorable market environment and increased adoption)

- Transformative scenario: Reaching higher price levels would require significant breakthrough developments in utility and widespread acceptance

- February 7, 2026: GXE trading range $0.00035 - $0.00049 (current forecast period)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00049 | 0.00039 | 0.00035 | 0 |

| 2027 | 0.00053 | 0.00044 | 0.00038 | 12 |

| 2028 | 0.00051 | 0.00048 | 0.00033 | 23 |

| 2029 | 0.00068 | 0.00049 | 0.00032 | 26 |

| 2030 | 0.00079 | 0.00059 | 0.00034 | 50 |

| 2031 | 0.00077 | 0.00069 | 0.00053 | 77 |

IV. GXE Professional Investment Strategy and Risk Management

GXE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: GameFi enthusiasts and blockchain gaming investors with medium to long-term horizons

- Operational Recommendations:

- Consider accumulating positions during market downturns, particularly when prices approach historical support levels

- Monitor PROJECT XENO ecosystem developments, including NFT marketplace activity and gaming updates

- Utilize secure storage solutions such as Gate Web3 Wallet for asset custody

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Track the 24-hour trading volume of approximately $22,908 to identify liquidity patterns

- Price Action: Monitor key support around $0.000349 and resistance near $0.0004184 based on recent 24-hour ranges

- Swing Trading Considerations:

- Be aware of recent volatility patterns, with 7-day movements showing notable fluctuations

- Set appropriate stop-loss levels given the asset's price sensitivity

GXE Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 5-8% with active monitoring and hedging strategies

(2) Risk Hedging Solutions

- Position Sizing: Limit individual position exposure relative to total portfolio value

- Diversification: Balance GXE holdings with other blockchain gaming assets and established cryptocurrencies

(3) Secure Storage Solutions

- Hot Wallet Option: Gate Web3 Wallet for active trading and liquidity access

- Cold Storage Approach: Hardware wallet solutions for long-term holdings exceeding trading needs

- Security Considerations: Enable two-factor authentication, regularly update security protocols, and never share private keys

V. GXE Potential Risks and Challenges

GXE Market Risks

- Price Volatility: Recent performance shows significant fluctuations, with 30-day decline of approximately 37.6% and 1-year decline around 75.6%

- Liquidity Constraints: Daily trading volume of approximately $22,908 may limit execution for larger orders

- Market Cap Position: Ranking at 3573 with a market share of 0.000093% indicates limited mainstream adoption

GXE Regulatory Risks

- GameFi Classification: Evolving regulatory frameworks for play-to-earn models may impact token utility and value proposition

- Cross-Border Compliance: Multi-chain deployment (Ethereum and BSC) requires adherence to varying jurisdictional requirements

- NFT Integration: Regulatory uncertainty surrounding NFT-based gaming mechanics could affect project operations

GXE Technical Risks

- Smart Contract Vulnerabilities: Multi-chain deployment on Ethereum and BSC networks requires robust security auditing

- Token Supply Dynamics: With only 12.31% circulating supply relative to max supply of 6 billion tokens, future unlocks may create selling pressure

- Platform Dependency: Value closely tied to PROJECT XENO game adoption and user engagement metrics

VI. Conclusion and Action Recommendations

GXE Investment Value Assessment

GXE represents a specialized opportunity within the blockchain gaming and GameFi sectors, designed for investors interested in the play-to-earn model. The token's utility is closely connected to PROJECT XENO's tactical PvP gaming ecosystem, where NFT ownership and battle participation drive token economics. However, current market metrics indicate significant challenges, including limited liquidity, substantial price declines over recent periods, and a low circulating supply ratio that may present future dilution risks. The project's positioning within the competitive GameFi landscape requires careful evaluation of long-term sustainability and ecosystem growth potential.

GXE Investment Recommendations

✅ Beginners: Approach with caution; consider allocating only a small portion of speculative capital after thoroughly researching the PROJECT XENO ecosystem and understanding play-to-earn mechanics

✅ Experienced Investors: May consider limited exposure for portfolio diversification within the GameFi sector, with strict risk management protocols and position sizing appropriate to volatility levels

✅ Institutional Investors: Conduct comprehensive due diligence on tokenomics, game adoption metrics, and competitive positioning before considering entry; monitor ecosystem developments and liquidity conditions closely

GXE Trading Participation Methods

- Spot Trading: Available on Gate.com with direct token purchase using major cryptocurrencies or fiat options

- NFT Integration: Participate in the PROJECT XENO marketplace to understand ecosystem utility and token use cases

- Staking and Rewards: Monitor official channels for potential yield-generating opportunities within the gaming platform

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the historical price trend of GXE? What price level is it currently at?

GXE currently trades at $0.0004646, down 0.17% in the last 24 hours with $12.24K in trading volume. The token has maintained relatively stable levels, positioning itself as a micro-cap asset with significant growth potential ahead.

What are the main factors affecting GXE price?

GXE price is primarily influenced by market adoption, trading volume, ecosystem expansion, regulatory changes, competitive landscape, overall crypto market sentiment, and technological innovation.

What are professional analysts' predictions for GXE's future price?

Professional analysts predict GXE's price will be influenced by supply dynamics, adoption trends, and market sentiment. Based on historical performance and tokenomics, the token may experience volatility, with potential upside as ecosystem adoption grows.

How does GXE perform compared to other mainstream cryptocurrencies?

GXE has significantly lower market capitalization and liquidity than Bitcoin and Ethereum. It ranks lower among mainstream cryptocurrencies in terms of recognition and adoption rates. GXE exhibits higher price volatility compared to market leaders.

What risks should I pay attention to when investing in GXE?

GXE investment carries price volatility risk and market uncertainty. Investors should have adequate risk tolerance and be cautious with private transactions. Monitor market conditions closely before investing.

What is the role and value of GXE in the Gxchain ecosystem?

GXE serves as the utility token for transaction fees and network incentives within Gxchain. It rewards validators and participants, enhancing network security and ecosystem vitality while enabling governance participation and value accrual for stakeholders.

Detailed Analysis of the Best 10 GameFi Projects to Play and Earn in 2025

Popular GameFi Games in 2025

What Are the Key On-Chain Metrics Revealing About Litecoin's Whale Activity in 2025?

What is GameFi and How Does It Work?

What is DeFi: Understanding Decentralized Finance in 2025

How Will Virtuals Protocol's AI Agent Economy Evolve by 2030?

What Is Market Capitalization? Why Is It Important in Crypto?

Top 7 Best Stock Investment Apps for Vietnamese Investors

Cryptocurrency Lending Mechanisms and Domestic Service Providers

10 Best NFT Marketing Agencies To Promote Your Digital Art

What Is an Automated Market Maker?