2026 IMT Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: IMT's Market Position and Investment Value

Immortal Rising 2 (IMT), as a next-generation mobile idle RPG token designed by a 2024 BAFTA-winning game designer, has demonstrated notable performance since its launch in early 2025. As of February 2026, IMT maintains a market capitalization of approximately $308,484, with a circulating supply of 180.4 million tokens and a current price hovering around $0.00171. This gaming-focused digital asset, recognized as a bridge between web2 and web3 gaming ecosystems, is playing an increasingly significant role in the blockchain gaming sector, particularly on the Immutable platform where it has achieved top rankings.

This article will comprehensively analyze IMT's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. IMT Price History Review and Market Status

IMT Historical Price Evolution Trajectory

- March 2025: IMT reached its all-time high of $0.05026 on March 27, marking the peak performance since its launch in January 2025.

- February 2026: The token experienced significant correction, dropping to its all-time low of $0.001161 on February 1, representing a decline of over 97% from its peak.

IMT Current Market Situation

As of February 7, 2026, IMT is trading at $0.00171, showing a 24-hour increase of 6.41%. The token has experienced notable volatility in recent periods, with a 7-day decline of 18.97% and a 30-day decrease of 39.81%.

The current market capitalization stands at $308,484, with 180.4 million tokens in circulation out of a total supply of 1 billion IMT tokens. This represents a circulating supply ratio of 18.04%. The fully diluted market cap is calculated at $1.71 million.

IMT maintains a market dominance of 0.000068% and ranks 3507 in the cryptocurrency market. The 24-hour trading volume reaches $20,871, with the token being listed on 2 exchanges and held by 1,092 addresses. The token operates on the Ethereum blockchain as an ERC-20 token.

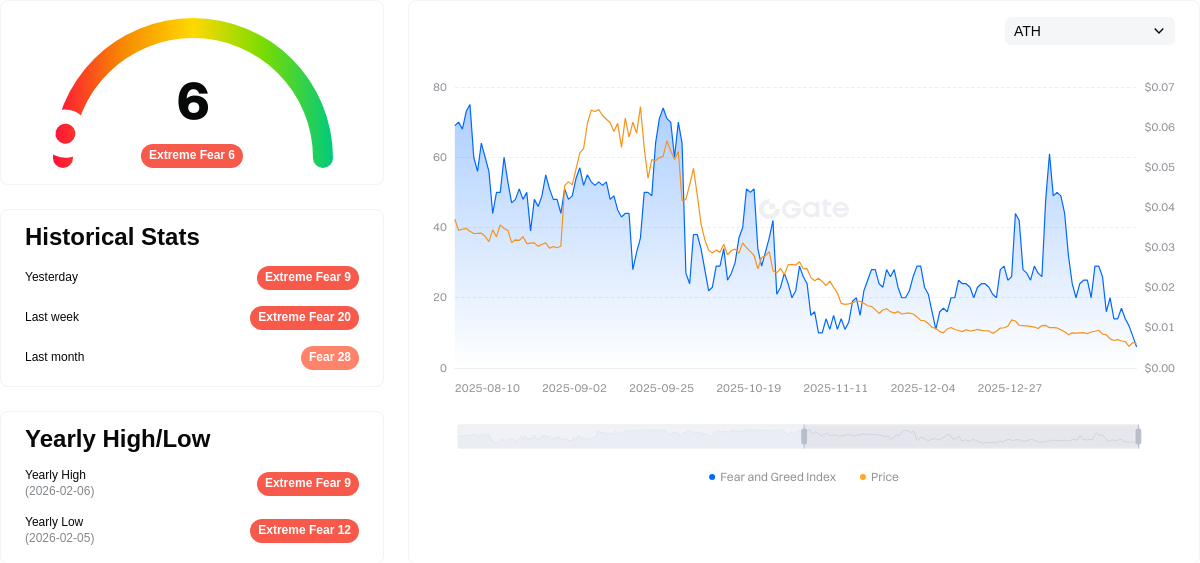

The market sentiment indicator shows a reading of 6, indicating extreme fear in the current market environment.

Click to view current IMT market price

IMT Market Sentiment Index

2026-02-07 Fear and Greed Index: 6 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at a critically low level of 6. This represents a significant shift in market sentiment, indicating investors are highly risk-averse and pessimistic about near-term price movements. Such extreme fear often precedes market capitulation or major price corrections. Historically, these periods can create opportunities for contrarian investors, as excessive fear may signal oversold conditions. Monitor key support levels and consider dollar-cost averaging strategies during heightened uncertainty. Stay informed through Gate.com's market data tools to make well-informed trading decisions.

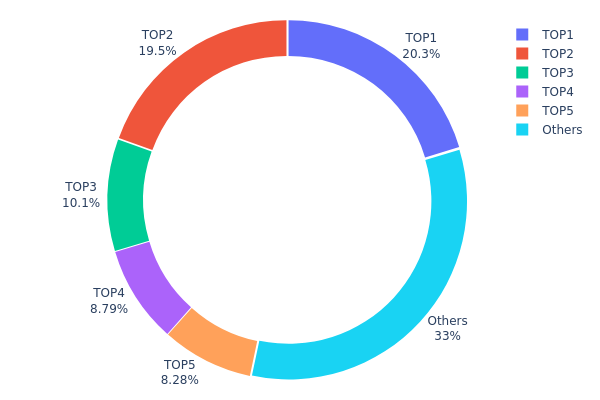

IMT Holding Distribution

The holding distribution chart reflects the concentration level of token allocation across different wallet addresses on the blockchain. By analyzing the proportion of tokens held by top addresses versus the broader market, this metric provides insights into the degree of decentralization and potential risks associated with concentrated ownership structures.

According to the current data, IMT exhibits a highly concentrated holding pattern. The top five addresses collectively control approximately 67% of the total token supply, with the largest single address holding 20.33% (203,379.31K tokens) and the second-largest holding 19.48% (194,846.34K tokens). The third through fifth positions hold 10.13%, 8.78%, and 8.28% respectively. Only 33% of the total supply is distributed among all other addresses, indicating that a significant portion of IMT tokens remains concentrated within a small number of wallets.

This concentration level presents notable implications for market structure and price dynamics. Such a distribution pattern increases the risk of substantial price volatility, as large holders possess sufficient token quantities to significantly impact market liquidity and price movements through their trading activities. The concentrated ownership structure may also raise concerns regarding potential market manipulation, where coordinated actions by major holders could artificially influence price discovery mechanisms. From a decentralization perspective, the current distribution suggests limited token dispersal across the broader community, which may affect the project's resilience against single-point failures and governance centralization risks.

Click to view current IMT Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa49e...8ad76e | 203379.31K | 20.33% |

| 2 | 0x4dda...8d4b88 | 194846.34K | 19.48% |

| 3 | 0xc3e8...22af17 | 101327.01K | 10.13% |

| 4 | 0xf62d...01bd58 | 87855.88K | 8.78% |

| 5 | 0xdb06...ebbfc5 | 82820.75K | 8.28% |

| - | Others | 329770.71K | 33% |

II. Core Factors Influencing IMT's Future Price

Supply Mechanism

- Token Distribution Model: The supply mechanism details for IMT are not clearly documented in available materials. General blockchain gaming tokens typically follow structured release schedules to manage market circulation.

- Historical Patterns: Historical supply change patterns and their price impacts are not available in the provided materials.

- Current Impact: Specific current supply changes and their expected market influence cannot be determined from the available information.

Institutional and Major Holder Dynamics

- Institutional Holdings: Detailed information regarding major institutional positions in IMT is not available in the reference materials.

- Enterprise Adoption: Specific enterprise adoption cases for IMT are not documented in the provided sources.

- National Policies: Government-level policies directly related to IMT have not been identified in the materials.

Macroeconomic Environment

- Monetary Policy Impact: Changes in monetary policies and interest rates by major central banks can alter the investment appeal of digital assets. In tightening monetary environments, risk assets like gaming tokens may face reduced liquidity.

- Inflation Hedge Attributes: Some digital assets are positioned as "digital gold" alternatives during inflationary periods, though IMT's specific performance in such environments is not detailed in available materials.

- Geopolitical Factors: Geopolitical uncertainties can increase demand for decentralized digital assets as alternative investment vehicles, potentially influencing IMT's market dynamics.

Technological Development and Ecosystem Building

- 6G Network Infrastructure: The International Telecommunication Union has completed the "IMT-2030 Framework and Overall Objectives Recommendation," serving as a foundational document for 6G development. This framework consolidates global 6G vision consensus and outlines future trends, though direct connections to IMT token technology are not established in the materials.

- AI and Communication Integration: IMT-2030 frameworks define six major usage scenarios including AI and communication services, supporting distributed computing and AI applications. However, specific implications for IMT token development are not documented.

- Ecosystem Applications: Detailed information about major DApps or ecosystem projects specifically built around IMT is not available in the reference materials.

Note: Market sentiment and regulatory clarity in major cryptocurrency markets play crucial roles in price dynamics. The broader regulatory environment and legal clarity surrounding digital assets can significantly impact investor confidence and market performance.

III. 2026-2031 IMT Price Prediction

2026 Outlook

- Conservative forecast: $0.00117 - $0.00169

- Neutral forecast: $0.00169 average price level

- Optimistic forecast: $0.00215 (requiring sustained market momentum and increased adoption)

The 2026 projection indicates a potential decline of approximately 1% compared to current levels, suggesting a period of market consolidation. Price fluctuations are expected to remain within a relatively narrow range as the token seeks to establish a stable foundation.

2027-2029 Mid-term Outlook

- Market stage expectation: Gradual recovery and growth phase, with increasing volatility as the market matures

- Price range predictions:

- 2027: $0.00115 - $0.00246, representing a potential 12% increase year-over-year

- 2028: $0.00195 - $0.00302, showing accelerated growth momentum with a projected 28% gain

- 2029: $0.00229 - $0.00367, continuing the upward trajectory with an estimated 52% increase

- Key catalysts: Technology development milestones, expanding ecosystem partnerships, broader market adoption, and favorable regulatory environment could drive sustained price appreciation during this period.

2030-2031 Long-term Outlook

- Baseline scenario: $0.00279 - $0.00355 (assuming steady ecosystem development and market conditions)

- Optimistic scenario: $0.00314 average price in 2030, representing an 83% cumulative increase, followed by $0.00334 in 2031 with a 95% total gain

- Transformative scenario: $0.00384 (contingent upon breakthrough adoption, significant technological advancement, or exceptional market conditions)

- February 7, 2026: IMT trading within the $0.00117 - $0.00215 range (consolidation phase)

The long-term outlook suggests a generally positive trajectory, though investors should remain aware of inherent market volatility and the importance of comprehensive risk management strategies.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00215 | 0.00169 | 0.00117 | -1 |

| 2027 | 0.00246 | 0.00192 | 0.00115 | 12 |

| 2028 | 0.00302 | 0.00219 | 0.00195 | 28 |

| 2029 | 0.00367 | 0.00261 | 0.00229 | 52 |

| 2030 | 0.00355 | 0.00314 | 0.00279 | 83 |

| 2031 | 0.00384 | 0.00334 | 0.00224 | 95 |

IV. IMT Professional Investment Strategy and Risk Management

IMT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Gaming enthusiasts and web3 ecosystem believers who recognize the potential of blockchain gaming convergence

- Operational recommendations:

- Consider establishing positions during market corrections when price volatility increases

- Monitor the project's user acquisition metrics and retention rates as key performance indicators

- Utilize Gate Web3 Wallet for secure storage with multi-signature protection enabled

(2) Active Trading Strategy

- Technical analysis tools:

- Volume analysis: Monitor the 24-hour trading volume of $20,871 relative to market capitalization to identify liquidity patterns

- Support and resistance levels: Track price movements between the all-time high of $0.05026 and all-time low of $0.001161

- Swing trading considerations:

- Observe correlation between gaming milestone announcements and price movements

- Consider the relatively low circulating supply ratio of 18.04% when planning entry and exit points

IMT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio allocation

- Moderate investors: 3-5% of crypto portfolio allocation

- Experienced investors: 5-10% of crypto portfolio allocation based on risk appetite

(2) Risk Hedging Approaches

- Portfolio diversification: Balance IMT holdings with established gaming tokens and major cryptocurrencies

- Position sizing: Scale investments gradually rather than deploying capital in single transactions

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet for active trading with convenient access

- Cold storage approach: Hardware wallet integration for long-term holdings exceeding trading needs

- Security considerations: Enable two-factor authentication, regularly update security protocols, and never share private keys

V. IMT Potential Risks and Challenges

IMT Market Risks

- Liquidity concerns: With a ranking of 3507 and relatively modest trading volume, market depth may be limited during high volatility periods

- Price volatility: The token has experienced significant fluctuations, with a 39.81% decline over 30 days, indicating substantial short-term price risk

- Market dominance: With only 0.000068% market share, the token remains susceptible to broader market movements and sentiment shifts

IMT Regulatory Risks

- Gaming token classification: Evolving regulatory frameworks may impact how blockchain gaming tokens are categorized and governed

- Cross-border gaming regulations: Different jurisdictions maintain varying approaches to blockchain gaming, potentially affecting user adoption

- Token utility compliance: Regulatory scrutiny of gaming tokens and their economic models may influence project development

IMT Technical Risks

- Smart contract vulnerabilities: ERC-20 token implementation requires ongoing security audits to prevent potential exploits

- Platform dependency: Project success relies on continued functionality and security of the Immutable platform

- Scaling challenges: As user base expands from web2 to web3, technical infrastructure must accommodate growth without performance degradation

VI. Conclusion and Action Recommendations

IMT Investment Value Assessment

IMT presents an interesting proposition within the blockchain gaming sector, backed by BAFTA-winning game design credentials and strong early traction on major mobile platforms. The project's positioning as the leading game on Immutable demonstrates technical execution capability. However, investors should weigh this potential against significant considerations: substantial price decline over recent periods, limited liquidity with modest trading volume, and the inherent uncertainties of bridging traditional gaming audiences to blockchain platforms. The low circulating supply ratio of 18.04% suggests future token releases may impact price dynamics.

IMT Investment Recommendations

✅ Beginners: Consider waiting for increased liquidity and clearer price stability patterns before establishing positions. Start with minimal allocation to understand token dynamics ✅ Experienced investors: May explore measured position-building during periods of reduced volatility, with strict stop-loss parameters and regular portfolio rebalancing ✅ Institutional investors: Conduct comprehensive due diligence on tokenomics, vesting schedules, and user acquisition metrics before considering allocation

IMT Trading Participation Methods

- Spot trading: Purchase IMT through Gate.com trading platform with various fiat and cryptocurrency pairs

- Dollar-cost averaging: Implement systematic investment approach to mitigate timing risk in volatile market conditions

- Staking opportunities: Monitor project announcements for potential staking programs or gaming rewards that may provide additional utility

Cryptocurrency investment carries extreme risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their personal risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is IMT and what is its current price?

IMT (Immortal Token) is a cryptocurrency token. As of now, IMT is priced at $0.001648 with a 24-hour trading volume of $79,125.65. The token has experienced a -6.07% price decline over the last 24 hours.

How to predict IMT token price movements?

Analyze historical price trends, trading volume patterns, and market sentiment indicators. Monitor on-chain data and consensus scores from prediction platforms. Track macroeconomic factors and IMT project developments for accurate forecasting.

What factors affect IMT price prediction?

IMT price prediction is influenced by supply and demand dynamics, block reward changes, protocol updates, and hard forks. Market trends, trading volume, and real-world events also significantly impact price movements.

Is IMT a good investment based on price predictions?

Based on current forecasts, IMT shows strong potential with predictions indicating it could double in price by 2029, suggesting profitable investment opportunities. However, always conduct thorough research before investing.

What is the historical price performance of IMT?

IMT reached an all-time high of approximately $0.022734 in March 2025. The token has experienced price fluctuations throughout its trading history. As of February 2026, IMT continues to trade in the market with ongoing price movements reflecting broader market dynamics and project developments.

How does IMT compare to other cryptocurrencies in terms of price volatility?

IMT exhibits higher price volatility compared to established cryptocurrencies, with significant price fluctuations occurring within short timeframes. This elevated volatility is characteristic of emerging digital assets in the market.

What are the risks involved in IMT price speculation and trading?

IMT price speculation involves market volatility risk, leverage amplification, and unpredictable market movements. High leverage can magnify both gains and losses significantly. Inadequate market research may result in substantial financial losses during trading.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

Is OpenLeverage (OLE) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Position in Decentralized Finance

Comprehensive Guide to NGMI and WAGMI in Crypto Culture

What is Learn and Earn? A Beginner's Introduction

What Is DeFi? Four Key Real-World Applications of DeFi

Find the top trading bot to maximize your profits in cryptocurrencies