2026 ITHACA Price Prediction: Expert Analysis and Future Market Outlook for Blockchain Innovation Token

Introduction: ITHACA's Market Position and Investment Value

Ithaca Protocol (ITHACA), positioned as a non-custodial and composable options protocol, has been developing its innovative decentralized infrastructure since its launch in 2024. As of 2026, ITHACA maintains a market capitalization of approximately $203,287, with a circulating supply of about 64.25 million tokens and a price hovering around $0.003164. This asset, recognized for its modular approach to options and structured product markets, is playing an increasingly important role in decentralized finance derivatives trading.

This article will comprehensively analyze ITHACA's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. ITHACA Price History Review and Market Status

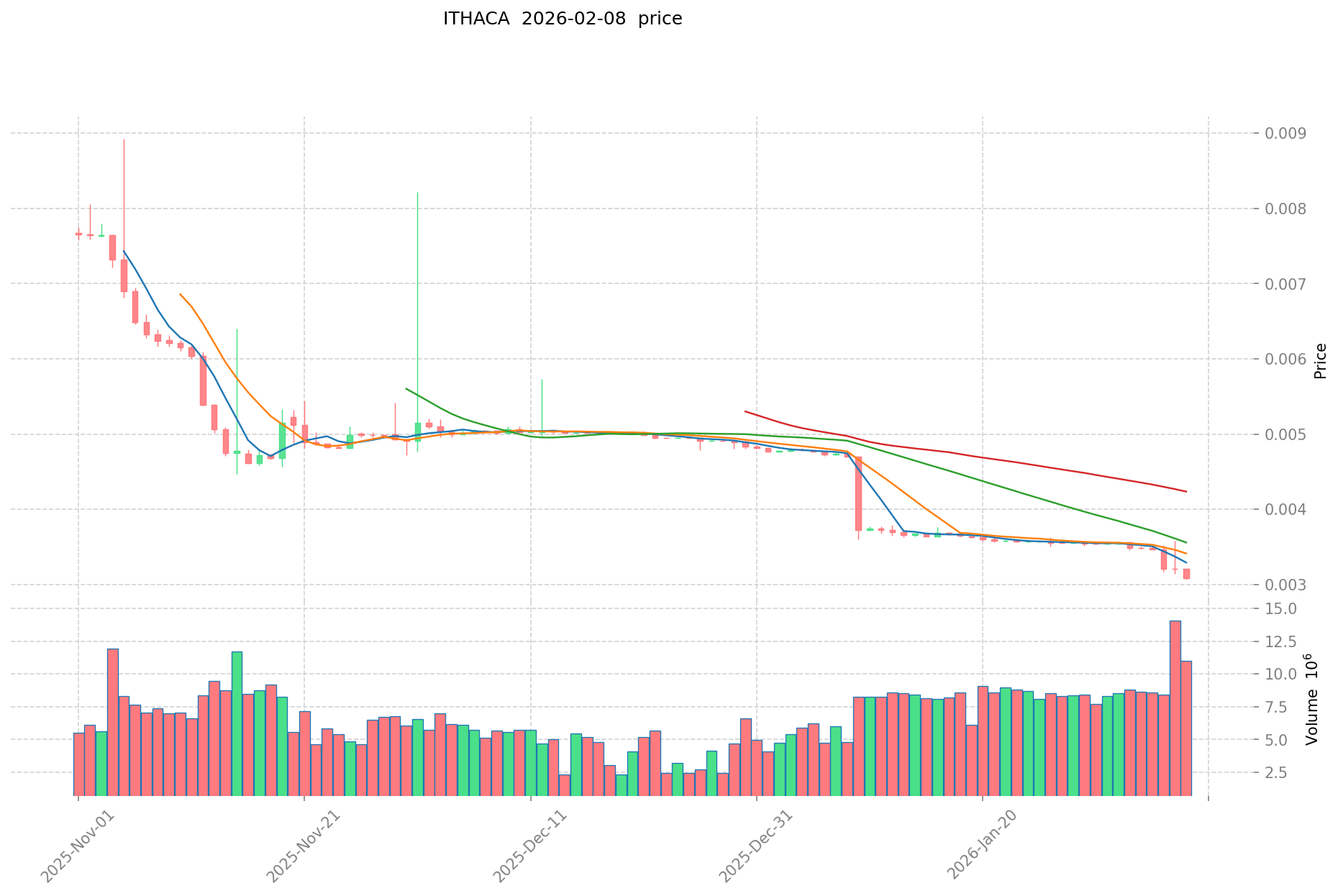

ITHACA Historical Price Evolution Trajectory

- December 2024: ITHACA launched on Gate.com, reaching an all-time high of $0.1456 on December 19, 2024, marking the protocol's initial market entry phase.

- 2025: The token experienced significant price correction throughout the year, with continuous downward pressure affecting valuation.

- February 2026: Price reached historical low of $0.003062 on February 7, 2026, representing a decline of approximately 97.9% from the all-time high recorded in December 2024.

ITHACA Current Market Status

As of February 8, 2026, ITHACA is trading at $0.003164, showing a modest recovery of 3.33% from its recent historical low. The token exhibits mixed short-term performance, with a 0.25% increase over the past hour but experiencing declines of 1.84% over 24 hours and 11.1% over the past week. The 30-day performance shows a 19.81% decrease.

The protocol maintains a market capitalization of approximately $203,287, with a circulating supply of 64.25 million tokens representing 6.43% of the maximum supply of 1 billion tokens. The fully diluted market cap stands at $3.164 million, ranking ITHACA at position 3,928 in the broader cryptocurrency market with a market dominance of 0.00012%.

ITHACA's 24-hour trading volume reached $31,226.57, indicating relatively limited liquidity compared to established protocols. The token holder count stands at 1,236 addresses. Current market sentiment reflects extreme caution, with the broader crypto market fear and greed index registering at 7, indicating "Extreme Fear" conditions.

The price range over the past 24 hours spans from a low of $0.003062 to a high of $0.00322, demonstrating continued volatility within a compressed range. The significant gap between the circulating market cap and fully diluted valuation suggests substantial token supply yet to enter circulation, which may influence future price dynamics.

Click to view current ITHACA market price

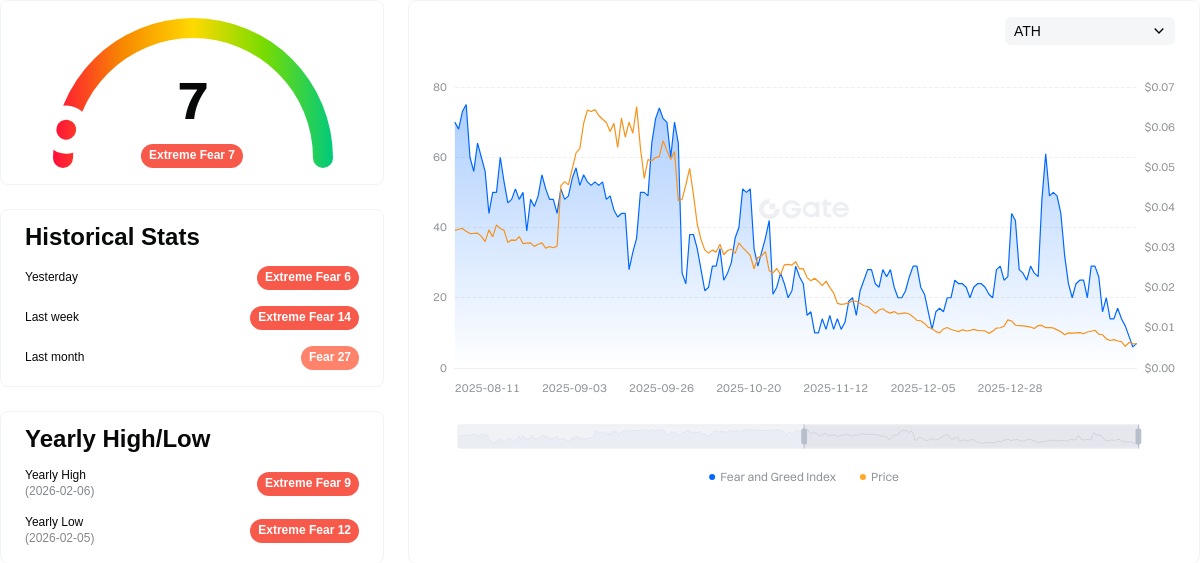

ITHACA Market Sentiment Index

2026-02-08 Fear and Greed Index: 7 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index hitting 7. This indicates severe market pessimism and heightened investor anxiety. Such extreme readings typically present contrarian opportunities for long-term investors, as markets driven by fear often overshoot downside targets. However, caution remains warranted until sentiment stabilizes. Monitor key support levels and wait for accumulation signals before entering positions. Consider dollar-cost averaging strategies to mitigate timing risks during periods of extreme market panic.

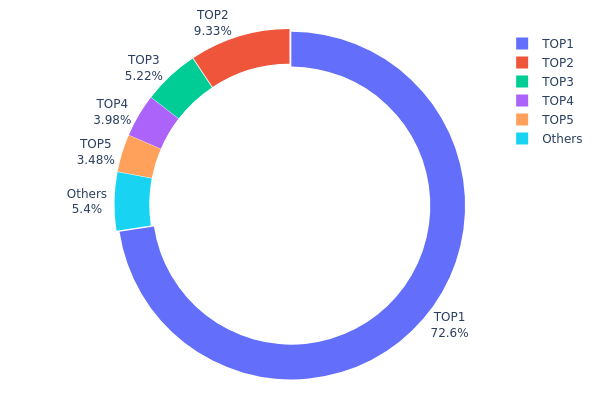

ITHACA Holding Distribution

ITHACA's on-chain holding distribution reveals a highly concentrated ownership structure that warrants careful consideration. The top address (0x48ca...fb0962) controls 653,317.43K tokens, representing 72.59% of the total supply. The top five addresses collectively hold 851,427.46K tokens, accounting for 94.58% of the circulating supply, while all other addresses combined hold merely 5.42%. This extreme concentration pattern indicates that the token's distribution remains in its early stages or is deliberately centralized for specific operational purposes.

Such pronounced concentration presents both structural risks and implications for market dynamics. The dominant position of the largest holder creates potential single points of failure and exposes the token to significant price volatility should this entity decide to redistribute or liquidate holdings. The limited distribution among retail and smaller institutional holders suggests restricted market depth, which could amplify price movements during periods of increased trading activity. From a decentralization perspective, this distribution pattern contradicts the fundamental principles of distributed ledger technology, as effective governance and price discovery mechanisms require broader token dispersion across diverse stakeholders.

The current holding structure reflects an immature market ecosystem that has yet to achieve organic distribution through trading activity and community participation. While concentrated holdings are not uncommon during early project phases or among protocol treasuries and team allocations, the sustainability of such distribution depends heavily on planned unlocking schedules and the project's strategy for gradual token release. Market participants should monitor future distribution trends closely, as any significant shift in the top holders' positions could trigger substantial market reactions given the limited liquidity cushion provided by smaller holders.

Click to view current ITHACA Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x48ca...fb0962 | 653317.43K | 72.59% |

| 2 | 0xa107...534e75 | 84000.00K | 9.33% |

| 3 | 0x81b4...300a17 | 46962.01K | 5.21% |

| 4 | 0x5d76...2f64f4 | 35804.11K | 3.97% |

| 5 | 0x560b...680880 | 31343.91K | 3.48% |

| - | Others | 48572.44K | 5.42% |

II. Core Factors Influencing ITHACA's Future Price

Supply Mechanism

- Market Cycles: ITHACA price demonstrates significant sensitivity to cryptocurrency market cyclical patterns. Historical trading patterns during major market movements have notably influenced ITHACA's price trajectory.

- Historical Patterns: Trading volume fluctuations during significant market phases have profoundly impacted ITHACA pricing dynamics.

- Current Impact: The ongoing market cycle continues to shape ITHACA's price behavior, with supply-demand dynamics playing a central role in value determination.

Institutional and Major Holder Dynamics

- Market Demand: ITHACA's price outlook is influenced by market demand levels and adoption trends.

- Institutional Participation: The degree of institutional involvement represents a key factor in price formation and market stability.

Macroeconomic Environment

- Monetary Policy Impact: Currency policy adjustments and interest rate movements may affect the asset's attractiveness to investors.

- Inflation Hedge Characteristics: The positioning as a potential inflation hedge remains under development, with market validation ongoing.

- Geopolitical Factors: International uncertainties and geopolitical developments may contribute to ITHACA's risk-on or risk-off dynamics.

Technical Development and Ecosystem Building

- Network Health Indicators: On-chain metrics including transaction volume, active addresses, and network health status serve as important technical indicators.

- Market Data Analytics: Price movements, trading volumes, and exchange liquidity patterns provide insights into ecosystem vitality.

- Community and Development Activity: Media coverage, community growth rates, and developer engagement levels reflect the project's developmental momentum.

III. 2026-2031 ITHACA Price Prediction

2026 Outlook

- Conservative Prediction: $0.0028 - $0.0031

- Neutral Prediction: $0.0031 (average price level)

- Optimistic Prediction: $0.00352 (requires favorable market sentiment and increased trading volume)

2027-2029 Mid-term Outlook

- Market Stage Expectation: ITHACA may experience a recovery phase with gradual price appreciation as the crypto market matures

- Price Range Prediction:

- 2027: $0.00182 - $0.00481

- 2028: $0.0037 - $0.00447

- 2029: $0.0035 - $0.00635

- Key Catalysts: Market adoption expansion, potential ecosystem development, and broader cryptocurrency sector growth momentum

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00377 - $0.00531 (assuming steady market conditions and continued project development)

- Optimistic Scenario: $0.00531 - $0.00611 in 2030 (contingent on accelerated ecosystem adoption and positive regulatory environment)

- Transformative Scenario: $0.00531 - $0.00845 by 2031 (requires breakthrough technological advancements and significant market expansion)

- 2026-02-08: ITHACA is positioned for potential price fluctuations within a relatively modest range as the token seeks to establish stronger market fundamentals

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00352 | 0.00311 | 0.0028 | -1 |

| 2027 | 0.00481 | 0.00332 | 0.00182 | 4 |

| 2028 | 0.00447 | 0.00406 | 0.0037 | 28 |

| 2029 | 0.00635 | 0.00426 | 0.0035 | 34 |

| 2030 | 0.00611 | 0.00531 | 0.00377 | 67 |

| 2031 | 0.00845 | 0.00571 | 0.00531 | 80 |

IV. ITHACA Professional Investment Strategies and Risk Management

ITHACA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a medium to long-term horizon who believe in the potential of decentralized options protocols and structured product markets

- Operational Recommendations:

- Consider accumulating positions during periods of market volatility when the token trades near its support levels

- Monitor the protocol's development progress, including expansion to additional blockchains and integration of new features

- Utilize Gate Web3 Wallet for secure, non-custodial storage of ITHACA tokens with full control over private keys

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Track the 24-hour trading volume (currently around $31,226) to identify periods of increased market activity and potential breakout opportunities

- Support and Resistance Levels: Monitor key price levels, with recent low at $0.003062 and 24-hour high at $0.00322

- Swing Trading Considerations:

- Pay attention to short-term price movements, as the token has shown volatility with a 1-hour change of +0.25% and 24-hour change of -1.84%

- Consider the broader trend context, noting the 7-day decline of -11.1% and 30-day decline of -19.81%

ITHACA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: Allocate no more than 1-2% of crypto portfolio to ITHACA, focusing on established assets for the majority of holdings

- Aggressive Investors: May consider 3-5% allocation, while maintaining diversification across multiple DeFi protocols

- Professional Investors: Could allocate 5-10% with active monitoring and hedging strategies in place

(2) Risk Hedging Solutions

- Portfolio Diversification: Combine ITHACA holdings with other DeFi protocol tokens and established cryptocurrencies to reduce concentration risk

- Position Sizing: Use dollar-cost averaging to build positions gradually, rather than entering with full capital at once

(3) Secure Storage Solutions

- Non-Custodial Wallet Recommendation: Gate Web3 Wallet provides secure, user-controlled storage for ITHACA tokens with multi-chain support

- Hardware Wallet Option: For larger holdings, consider transferring tokens to hardware wallets for enhanced security

- Security Precautions: Never share private keys or seed phrases, enable two-factor authentication, and verify contract addresses before transactions

V. ITHACA Potential Risks and Challenges

ITHACA Market Risks

- High Volatility: The token has experienced a decline of approximately 95% from its all-time high of $0.1456 in December 2024, indicating substantial price volatility

- Limited Liquidity: With a market cap of approximately $203,287 and relatively low trading volume, the token may experience significant price slippage during larger transactions

- Low Market Capitalization: Currently ranked #3928 with a market share of 0.00012%, indicating limited mainstream adoption and potential for further price fluctuations

ITHACA Regulatory Risks

- DeFi Protocol Oversight: Decentralized options protocols may face evolving regulatory scrutiny as authorities develop frameworks for derivatives products in crypto markets

- Compliance Requirements: Future regulatory developments could impact the protocol's operations or accessibility in certain jurisdictions

- Token Classification: Potential regulatory changes regarding the classification of protocol tokens could affect trading and holding requirements

ITHACA Technical Risks

- Smart Contract Vulnerabilities: As with any DeFi protocol, smart contract bugs or exploits could potentially affect the security of user funds

- Protocol Complexity: The sophisticated nature of options and structured products may introduce technical challenges in implementation and maintenance

- Multi-Chain Expansion Risks: Planned expansion to Base and Solana introduces additional technical complexity and potential integration challenges

VI. Conclusion and Action Recommendations

ITHACA Investment Value Assessment

Ithaca Protocol presents an interesting proposition in the decentralized options market, backed by notable market makers Cumberland and Wintermute, and consistently ranking among the top protocols on DeFiLlama. The protocol's innovative modular infrastructure for creating liquid options and structured product markets represents a meaningful contribution to DeFi derivatives.

However, the token currently faces significant challenges, including a substantial decline from its all-time high, limited market capitalization, and relatively low liquidity. The low circulating supply ratio of 6.43% (64.25 million out of 1 billion total supply) suggests potential future token unlocks that could impact price dynamics. While the protocol's technical capabilities and backing are noteworthy, investors should carefully weigh these factors against the current market conditions and risk profile.

ITHACA Investment Recommendations

✅ Beginners: Approach ITHACA with caution. If interested in exposure to decentralized options protocols, start with a small allocation (no more than 1% of crypto portfolio) and prioritize learning about the protocol's functionality before investing

✅ Experienced Investors: Consider ITHACA as a speculative allocation within a diversified DeFi portfolio. Monitor protocol development, trading volume trends, and potential catalysts such as new chain integrations. Maintain strict position sizing and risk management discipline

✅ Institutional Investors: Evaluate the protocol's market maker relationships and DeFiLlama rankings as indicators of institutional interest. Consider the token's low liquidity and market cap in relation to position sizing requirements. Conduct thorough due diligence on smart contract security and protocol governance

ITHACA Trading Participation Methods

- Spot Trading: ITHACA tokens can be traded on Gate.com, providing access to immediate buying and selling with various order types

- Dollar-Cost Averaging: Consider systematic purchases at regular intervals to mitigate timing risk and build positions gradually

- Secure Storage: After purchasing, transfer tokens to Gate Web3 Wallet for non-custodial storage with full control over assets

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is ITHACA? What are its main uses and features?

ITHACA is a prominent cryptocurrency asset in the DeFi sector, designed to support decentralized applications and services. It features strong market performance with a circulating supply of approximately 64.25 million tokens. ITHACA enables efficient transactions within decentralized finance ecosystems while maintaining robust protocol security and governance mechanisms for its community.

What is ITHACA's historical price trend and current market performance?

ITHACA has fluctuated between ¥0.033266 and ¥0.033510, currently trading at ¥0.033322 with a market cap of ¥33.32 million. The 24-hour trading volume stands at ¥516,400, showing steady market activity and stable price consolidation.

What are the main factors affecting ITHACA's price?

ITHACA's price is influenced by market demand, trading volume, ecosystem development, token utility, overall crypto market sentiment, and adoption rate within the platform's network.

How to predict ITHACA price? What are the analysis methods?

You can predict ITHACA price using technical analysis and fundamental analysis. Technical analysis examines historical price and trading volume patterns. Fundamental analysis evaluates project development, tokenomics, and market conditions to forecast future price movements.

What are the investment risks of ITHACA? How should they be avoided?

ITHACA faces market volatility and liquidity risks typical of cryptocurrencies. Mitigate by diversifying your portfolio, investing only disposable capital, setting stop-loss orders, and conducting thorough research before trading. Monitor market sentiment and regulatory developments continuously.

What are the advantages and disadvantages of ITHACA compared to other similar cryptocurrencies?

ITHACA stands out with innovative DeFi protocol architecture and growing liquidity, offering better transaction efficiency. However, compared to established competitors, it faces challenges including lower market recognition and higher price volatility. Its emerging status presents growth potential but carries execution risks.

What are professional analysts' predictions for ITHACA's future price?

Professional analysts predict ITHACA's maximum price target at 254.36 GBX and minimum at 135.64 GBX. These forecasts are based on current market analysis and technical evaluation as of February 2026.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Top 8 Cryptocurrency Exchanges for Lowest Trading Fees

What is mobile mining, and can you earn income with it

Stochastic RSI Indicates Bitcoin Price Bottom

Comprehensive Guide to Creating and Selling NFT Tokens

Comprehensive Guide to Blockchain Technology and Applications in Thailand