2026 LABUBU Price Prediction: Expert Analysis and Market Forecast for the Digital Collectibles Token

Introduction: LABUBU's Market Position and Investment Value

LABUBU (LABUBU), as a cryptocurrency project inspired by Pop Mart's popular Nordic elf IP character created by Long Jiasheng, has emerged in the crypto market since its launch in 2025. As of February 2026, LABUBU maintains a market capitalization of approximately $593,888, with a circulating supply of around 999,980,482 tokens, and the price hovering around $0.0005939. This asset, which bridges the gap between mainstream trendy toy culture and blockchain technology, is exploring its role in the intersection of entertainment IP and digital assets.

This article will comprehensively analyze LABUBU's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem developments, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. LABUBU Price History Review and Market Status

LABUBU Historical Price Evolution Trajectory

- 2025: Token launched in the market (published on January 10, 2025), experiencing initial trading activity with price discovery phase

- June 2025: Reached all-time high of $0.06178 on June 16, marking a significant milestone in its early trading history

- 2026: Entered a correction phase, with price declining from previous peaks, reaching all-time low of $0.0004305 on February 3, 2026

LABUBU Current Market Status

As of February 5, 2026, LABUBU is trading at $0.0005939, reflecting notable volatility across multiple timeframes. The token has experienced a decline of 7.51% over the past 24 hours, with intraday trading ranging between $0.0005845 (24h low) and $0.0006537 (24h high). The 24-hour trading volume stands at $40,106.97.

Looking at broader timeframes, LABUBU has faced significant downward pressure, with a 39.56% decrease over the past 7 days and a 59.61% decline over the past 30 days. However, when viewed from a one-year perspective, the token shows a positive return of 55.62%, indicating substantial volatility in its price trajectory since launch.

The token maintains a market capitalization of approximately $593,888, ranking at #2,903 in the cryptocurrency market with a dominance of 0.000023%. With a circulating supply of 999,980,482 tokens, which represents 100% of its maximum supply, LABUBU demonstrates full circulation. The market cap to fully diluted valuation ratio stands at 100%, indicating no additional token inflation expected.

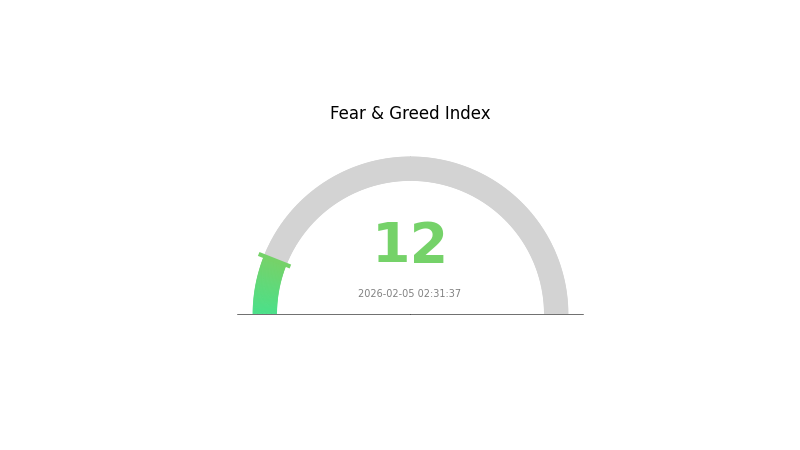

The token is held by 17,369 addresses and is listed on 7 exchanges, with Gate.com among the platforms supporting its trading. The current market sentiment index registers at 12 (Extreme Fear), reflecting cautious investor sentiment in the broader crypto market environment.

Click to view current LABUBU market price

LABUBU Market Sentiment Indicator

2026-02-05 Fear and Greed Index: 12 (Extreme Fear)

Click to view current Fear & Greed Index

The LABUBI market is currently experiencing extreme fear, with the Fear and Greed Index at 12. This historically low reading suggests intense investor pessimism and panic selling across the market. Such extreme conditions often present significant opportunities for contrarian investors, as excessive fear can precede market reversals. However, traders should exercise caution and conduct thorough due diligence before making investment decisions. This sentiment reading reflects broader market volatility and uncertainty that may continue in the near term.

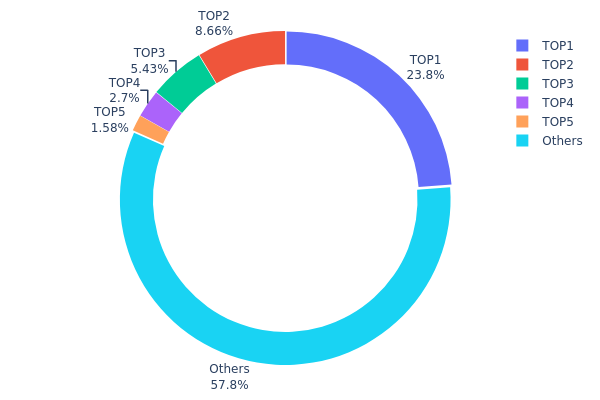

LABUBU Holders Distribution

The holders distribution chart illustrates the allocation of token supply across different wallet addresses, serving as a crucial metric for assessing market concentration and decentralization levels. By analyzing the percentage holdings of top addresses versus the broader holder base, investors can gauge potential risks associated with whale dominance and evaluate the health of token distribution within the ecosystem.

According to current on-chain data, LABUBU exhibits a moderately concentrated distribution pattern. The top holder controls approximately 23.81% of total supply (237.64M tokens), while the second and third largest addresses hold 8.66% and 5.43% respectively. Collectively, the top five addresses account for 42.17% of circulating supply, with the remaining 57.83% distributed among other holders. This concentration level, while not extreme, suggests that a relatively small group of major holders maintains significant influence over token supply.

From a market structure perspective, this distribution pattern presents both opportunities and concerns. The 57.83% allocation to "Others" indicates reasonable token dispersion across the broader community, suggesting some degree of organic adoption. However, the substantial 23.81% concentration in the leading address—combined with three top holders controlling over 37% collectively—creates potential vulnerability to large-scale sell pressure. Should these major holders decide to liquidate positions, it could trigger significant price volatility and market instability. This concentration level warrants careful monitoring, as it indicates that LABUBU's price action remains susceptible to the decisions of a few key participants, potentially limiting true market-driven price discovery mechanisms.

Click to view current LABUBU Holders Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 237637.98K | 23.81% |

| 2 | 4QXXp1...zGaYB3 | 86404.60K | 8.66% |

| 3 | u6PJ8D...ynXq2w | 54184.00K | 5.43% |

| 4 | ASTyfS...g7iaJZ | 26925.53K | 2.69% |

| 5 | A77HEr...oZ4RiR | 15770.38K | 1.58% |

| - | Others | 576794.12K | 57.83% |

II. Core Factors Influencing LABUBU's Future Price

Supply Mechanism

- Mass Production and Anti-Scalping Measures: The company has implemented large-scale production expansion, multi-channel distribution, and purchase restrictions to break the scalping-dependent ecosystem. On June 18, 2025, official mass restocking made previously scarce LABUBU hidden editions readily available, triggering a selling wave in the secondary market.

- Historical Patterns: Supply surges have directly led to significant price corrections. The third-generation hidden edition "True Self" experienced an 88% price decline, and fourth-generation mini LABUBU hidden editions also saw substantial drops.

- Current Impact: The shift from scarcity-driven investment product expectations to consumer product fundamentals has resulted in some secondary market prices falling below official retail prices, reflecting a return to rational pricing.

Market Sentiment and Consumer Psychology

- Emotional Value Consumption: LABUBU's core value stems from three psychological dimensions: emotional projection through its quirky-cute and solitary aesthetic, enhanced sense of ownership via blind box uncertainty and limited editions, and community demonstration effects from opinion leaders and celebrity endorsements.

- IP Lifecycle Dynamics: Market enthusiasm exhibits cyclical patterns. Similar to the Molly series, which experienced declining popularity over time, LABUBU faces the inherent challenge of IP lifecycle management. Once mainstream adoption occurs, original core fans may migrate to newer IPs, potentially causing sales stagnation.

- Speculative Sentiment Shifts: The investment fervor cooling reflects fundamental market logic transformation. When secondary market speculation recedes, sustainable support increasingly depends on actual consumer demand rather than appreciation expectations.

Macroeconomic Environment

- "Valley Economy" Trend: LABUBU capitalized on the emerging "Valley Economy" phenomenon, centered on derivative merchandise from popular culture IPs including anime and related content, representing a novel consumption pattern among Generation Z consumers.

- Global Expansion Performance: International market growth has been explosive, with Southeast Asian markets growing 619% and North American markets surging 900% in 2024. However, this rapid expansion may face sustainability challenges as market saturation approaches.

- Consumer Spending Patterns: Generation Z consumers prioritize brand meaning, aesthetic experience, and self-identity alignment, driving emotional value-based consumption. This demographic shift creates both opportunities and volatility as preferences evolve.

Product Strategy and Brand Development

- New Product Launches: The release schedule and popularity of new generations directly impact price trends. The third-generation global launch in April 2025 initially triggered purchasing frenzies and price increases, but subsequent mass restocking reversed this momentum.

- Brand Diversification: Expansion into jewelry, gaming, film, and animation sectors represents strategic attempts at secondary growth curves. However, execution approaches—whether through partnerships or direct operations—will significantly influence cost structures and profitability sustainability.

- Theme Park Initiatives: The experimental theme park project represents a potential third growth curve but involves heavy asset investment models that may not achieve marginal cost reduction, introducing different economic dynamics compared to the core IP licensing business.

III. 2026-2031 LABUBU Price Prediction

2026 Outlook

- Conservative prediction: $0.00049 - $0.00059

- Neutral prediction: around $0.00059

- Optimistic prediction: up to $0.00063 (requires favorable market conditions)

2027-2029 Outlook

- Market stage expectation: Early development phase with gradual price appreciation

- Price range predictions:

- 2027: $0.00058 - $0.0007

- 2028: $0.00041 - $0.0007

- 2029: $0.00045 - $0.00079

- Key catalysts: Market adoption expansion and ecosystem development could drive price growth, with projected cumulative changes ranging from 3% to 13% during this period

2030-2031 Long-term Outlook

- Baseline scenario: $0.00065 - $0.00073 (assuming steady market conditions and continued project development)

- Optimistic scenario: $0.00076 - $0.00091 (assuming enhanced market penetration and positive crypto market sentiment)

- Transformative scenario: potential to reach upper ranges near $0.00091 (requiring exceptional adoption rates and favorable regulatory environment)

- February 5, 2026: LABUBU trading around baseline predictions (early tracking phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00063 | 0.00059 | 0.00049 | 0 |

| 2027 | 0.0007 | 0.00061 | 0.00058 | 3 |

| 2028 | 0.0007 | 0.00066 | 0.00041 | 10 |

| 2029 | 0.00079 | 0.00068 | 0.00045 | 13 |

| 2030 | 0.00091 | 0.00073 | 0.00065 | 23 |

| 2031 | 0.00087 | 0.00082 | 0.00076 | 38 |

IV. LABUBU Professional Investment Strategies and Risk Management

LABUBU Investment Methodology

(I) Long-term Holding Strategy

- Target Investors: Meme token enthusiasts and cultural IP collectors who believe in the long-term value of Pop Mart's IP ecosystem

- Operational Recommendations:

- Consider dollar-cost averaging (DCA) to mitigate volatility risks, given the token's significant price fluctuations (down 59.61% over 30 days)

- Monitor holder growth trends (current holder count: 17,369) as an indicator of community strength

- Storage Solution: Utilize Gate Web3 Wallet for secure storage of LABUBU tokens on the Solana network

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Daily trading volume of $40,106.97 should be monitored for liquidity assessment

- Support/Resistance Levels: Current all-time low ($0.0004305) may serve as strong support, while all-time high ($0.06178) represents significant resistance

- Key Trading Considerations:

- Pay attention to 24-hour price ranges (recent range: $0.0005845 - $0.0006537) for short-term trading opportunities

- Be mindful of recent downward momentum (7-day decline: 39.56%) before establishing positions

LABUBU Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio

- Aggressive Investors: 5-8% of crypto portfolio

- Professional Investors: 10-15% of crypto portfolio with active risk monitoring

(II) Risk Hedging Solutions

- Portfolio Diversification: Balance LABUBU holdings with established cryptocurrencies and stablecoin reserves

- Position Sizing: Never allocate more than 10% of total crypto holdings to meme tokens with high volatility

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading and management of Solana-based tokens

- Cold Storage Option: For long-term holders, consider offline storage solutions after accumulating significant positions

- Security Precautions: Always verify contract address (JB2wezZLdzWfnaCfHxLg193RS3Rh51ThiXxEDWQDpump) before transactions, enable two-factor authentication, and never share private keys

V. LABUBU Potential Risks and Challenges

LABUBU Market Risks

- High Volatility: The token experienced a 59.61% decline over 30 days, demonstrating extreme price instability typical of meme tokens

- Limited Liquidity: With a market cap of approximately $593,888 and ranking at #2903, the token faces potential liquidity constraints during market stress

- Meme Token Characteristics: Value heavily dependent on social media trends and community sentiment rather than fundamental utility

LABUBU Regulatory Risks

- IP-based Token Scrutiny: Tokens linked to commercial IP properties may face regulatory examination regarding intellectual property rights and licensing

- Meme Token Regulations: Increasing regulatory focus on speculative digital assets could impact trading accessibility

- Cross-border Compliance: As a token associated with a Chinese company (Pop Mart), international regulatory developments may affect its global distribution

LABUBU Technical Risks

- Solana Network Dependency: Token functionality relies entirely on Solana blockchain performance and stability

- Smart Contract Risks: Potential vulnerabilities in token contract could expose holders to technical exploits

- Limited Exchange Listings: Currently listed on only 7 exchanges, which may restrict trading options and price discovery mechanisms

VI. Conclusion and Action Recommendations

LABUBU Investment Value Assessment

LABUBU represents a speculative investment tied to Pop Mart's popular Labubu character IP. While the token showed positive 1-year performance (+55.62%), recent trends indicate significant downward pressure with substantial losses across shorter timeframes. The relatively small holder base (17,369) and limited market capitalization suggest this is an early-stage, high-risk asset. Long-term value depends heavily on sustained community engagement and the broader success of IP-based tokenization trends. Short-term risks remain elevated due to market volatility and liquidity constraints.

LABUBU Investment Recommendations

✅ Beginners: Start with minimal allocation (under 1% of portfolio) to understand meme token dynamics. Consider paper trading before committing real capital.

✅ Experienced Investors: Limit exposure to 2-5% of crypto portfolio. Employ strict stop-loss orders and monitor community sentiment through official channels (@labubufans on X).

✅ Institutional Investors: Conduct thorough due diligence on IP licensing agreements and regulatory compliance. Consider strategic allocation only within diversified alternative asset portfolios.

LABUBU Trading Participation Methods

- Spot Trading: Purchase LABUBU directly on Gate.com and other supporting exchanges with SOL or USDT trading pairs

- Wallet Management: Store tokens securely using Gate Web3 Wallet for seamless integration with DeFi protocols on Solana

- Community Engagement: Monitor official website (labubu.fans) and X account for project updates that may influence token value

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is LABUBI? What are its uses and value proposition?

LABUBI is a collectible trendy toy asset with unique artistic design. Its value proposition lies in emotional satisfaction, collection rarity, blind box mechanics that create surprise, and aesthetic appeal, offering both cultural and investment potential for collectors and enthusiasts.

How has LABURIB's historical price performed? What were the price trends over the past year?

LABURIB reached an all-time high of $0.074016 and an all-time low of $0.0000309. Over the past year, the price declined by 12.08%, reflecting market volatility in the crypto space.

What is the price prediction for LABUBI in 2024? How do experts view it?

Experts predict LABUBU will maintain stable growth in 2024, with strong market demand supporting consistent price performance. The token is expected to show resilience as adoption continues to expand within the web3 community.

What are the main factors affecting LABUIB price?

LABUIB price is primarily influenced by supply volume increases and production capacity improvements. Additionally, greater diversity in popular IP choices available to consumers is a significant factor affecting market pricing.

LABUBI has what advantages compared to other similar projects?

LABUBU excels in rapid cash flow recovery, high success rate of over 35% in IP projects, and exceptional ROI of 13-185x among top IPs. Unlike traditional industries with lengthy development cycles, LABUBU achieves net positive cash flow within one year, delivering superior returns while maintaining portfolio diversification across multiple IP assets.

What are the risks of investing in LABUBI? How should I assess them?

LABUBU faces risks including IP concentration (34.7% revenue from THE MONSTERS series), rarity dilution from production surge, regulatory scrutiny on blind box mechanisms, quality control issues, and market saturation. Evaluate IP lifecycle, financial health, competitive positioning, and regulatory environment carefully.

What is LABUIB's future development prospects and roadmap?

LABUIB focuses on expanding cultural value, strengthening content ecosystem, and diversifying into film, television, and gaming sectors. The project targets sustainable long-term growth with enhanced market presence and brand recognition through strategic IP development initiatives.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Top 5 Meme Coins to Invest in 2025: Risks and Rewards

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Meme Coin Price Predictions for 2025:Factors Influencing Meme Coin Prices

Pepe Unchained: Pepe Meme Coin evolves into a Layer-2 ecosystem

MemeBox Price and Airdrop Guide 2025: What You Need to Know

4 Crypto Apps Offering Free Money for Sign-Up

What Is EIP-4488?

What is Bitcoin dominance and why does this metric matter

Cryptocurrency Tax Calculation Methods and Recommended Tools

Comprehensive Guide to Recession Preparation