2026 LANDSHARE Price Prediction: Analyzing Growth Potential and Market Trends for the Next Generation of Real Estate Tokenization

Introduction: LANDSHARE's Market Position and Investment Value

Landshare (LANDSHARE), as a pioneering platform that tokenizes real-world properties into asset-backed, yield-bearing tokens on the Binance Smart Chain, has been transforming real estate investment accessibility since its launch in 2021. As of 2026, LANDSHARE maintains a market capitalization of approximately $1.45 million, with a circulating supply of around 6.15 million tokens, and its price currently hovers near $0.24. This asset, often recognized as a "bridge between traditional real estate and DeFi innovation," is playing an increasingly significant role in democratizing property investment and generating passive income through rental yields.

This article will comprehensively analyze LANDSHARE's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. LANDSHARE Price History Review and Market Status

LANDSHARE Historical Price Evolution Trajectory

- 2021: Project launched in August with initial trading on Gate.com, reaching an all-time high of $12.19 on November 11, 2021, demonstrating significant early market enthusiasm for the real estate tokenization concept

- 2022-2025: Extended bear market cycle affected the broader crypto sector, with LANDSHARE experiencing substantial downward pressure alongside the overall market correction

- 2026: Price continued its downward trajectory, reaching an all-time low of $0.235772 on February 2, marking a decline of approximately 98% from its historical peak

LANDSHARE Current Market Status

As of February 2, 2026, LANDSHARE is trading at $0.2361, representing a 24-hour decline of 7.19%. The token has experienced significant downward momentum across multiple timeframes, with a 1-hour decrease of 0.88%, a 7-day decline of 18.87%, and a 30-day drop of 16.25%. Over the past year, the token has decreased by 76.85%.

The current trading volume stands at $13,567.77 over the past 24 hours, with the 24-hour price range fluctuating between $0.2342 and $0.2564. LANDSHARE maintains a circulating supply of 6,147,108.41 tokens out of a total supply of 6,803,372.10 tokens and a maximum supply of 10,000,000 tokens. The circulating supply represents approximately 61.47% of the total supply.

The market capitalization currently sits at $1,451,332.30, with a fully diluted market cap of $1,606,276.15. The token holds a market share of 0.000060% and is ranked #2,251 in the overall cryptocurrency market. LANDSHARE is held by 6,308 addresses and is currently listed on 3 exchanges, with Gate.com serving as one of the primary trading platforms.

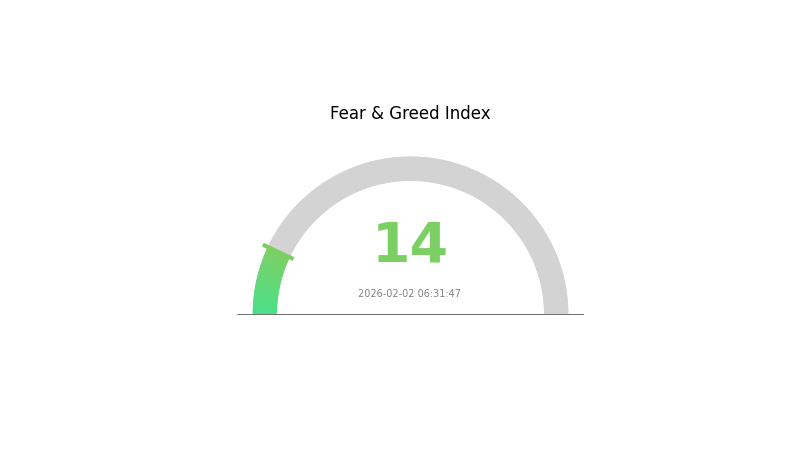

The cryptocurrency market sentiment index currently registers at 14, indicating an "Extreme Fear" state, which may be contributing to the recent price pressure experienced by LANDSHARE and the broader digital asset market.

Click to view the current LANDSHARE market price

LANDSHARE Market Sentiment Indicator

2026-02-02 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear, with the Fear and Greed Index dropping to 14. This indicates severe market pessimism and heightened investor anxiety. When sentiment reaches such extreme lows, it often signals potential opportunities for contrarian investors. However, caution remains essential as market volatility may persist. Monitor key support levels closely and consider dollar-cost averaging strategies during this fearful period. Historical patterns suggest extreme fear phases can precede significant market recoveries, making this a critical juncture for strategic positioning and risk management.

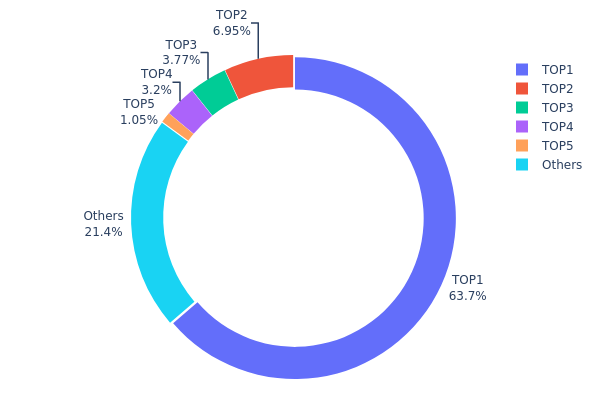

LANDSHARE Holding Distribution

The holding distribution chart visualizes how LANDSHARE tokens are allocated across different wallet addresses, providing crucial insights into the token's ownership structure and potential concentration risks. This metric serves as a key indicator of decentralization levels and helps assess the influence major holders may exert on market dynamics.

Current data reveals a significantly concentrated holding pattern for LANDSHARE. The top address controls approximately 63.67% of the total supply with 4.34 million tokens, while the second-largest holder possesses 6.94% (473.69K tokens). The top five addresses collectively account for 78.61% of the circulating supply, leaving only 21.39% distributed among other market participants. This extreme concentration suggests a highly centralized token structure, where a small number of entities maintain dominant control over the circulating supply.

Such concentrated ownership presents notable implications for market stability and price volatility. The significant control held by top addresses increases susceptibility to large-scale sell pressure and potential price manipulation. A single major holder's decision to liquidate positions could trigger substantial market movements, while coordinated actions among top holders could amplify volatility. Additionally, this concentration level indicates limited organic distribution across the broader community, which may impact liquidity depth and increase slippage during larger transactions. The current structure suggests LANDSHARE operates with a relatively centralized on-chain architecture, potentially exposing the market to heightened concentration risks that warrant careful monitoring from both traders and long-term investors.

Click to view current LANDSHARE Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3f94...47f93b | 4340.42K | 63.67% |

| 2 | 0x13f8...5caefa | 473.69K | 6.94% |

| 3 | 0x4982...6e89cb | 256.84K | 3.76% |

| 4 | 0xc882...84f071 | 218.16K | 3.20% |

| 5 | 0x0d07...b492fe | 71.27K | 1.04% |

| - | Others | 1456.63K | 21.39% |

II. Core Factors Influencing LANDSHARE's Future Price

Supply Mechanism

- Token Utility and Governance: LAND token serves as both a utility and governance token within the Landshare ecosystem. The platform also features LSRWA tokens that are directly linked to real estate assets, creating a dual-token structure that affects supply dynamics.

- Current Impact: The tokenization of real-world assets through the platform's structure may influence price stability by tying digital token value to tangible property holdings, though specific supply adjustment mechanisms were not detailed in available materials.

Institutional and Major Holder Dynamics

- Market Adoption: The tokenized real estate market shows significant growth potential driven by macroeconomic factors. Industry estimates suggest the RWA market could reach $16 trillion by 2030, representing substantial institutional interest in asset tokenization platforms.

- Regulatory Environment: Government policies regarding cryptocurrency directly affect market acceptance and value relative to traditional currencies. Regulatory developments remain a primary factor influencing institutional participation.

Macroeconomic Environment

- Global RWA Valuation: The global real-world asset valuation exceeds $600 trillion, while on-chain accessible tokenized RWA market capitalization stands at approximately $2 billion. Converting just 1% of RWA to blockchain would create $6 trillion in valuation.

- Market Demand Dynamics: LANDSHARE's exchange rate fluctuates frequently as both the token and traditional currencies continuously respond to global news, supply-demand relationships, and market activities.

Technology Development and Ecosystem Building

- Blockchain Integration: The platform leverages blockchain technology to improve transaction efficiency involving valuable assets, focusing on real estate tokenization.

- Ecosystem Applications: The platform operates within the broader RWA sector, which includes real estate tokenization alongside other asset classes such as treasury bonds and carbon credits, benefiting from overall sector development trends.

- Liquidity and Market Depth: Insufficient liquidity and market depth represent primary risk factors affecting LAND token performance, though the expanding DeFi and traditional finance integration may address these challenges over time.

III. 2026-2031 LANDSHARE Price Prediction

2026 Outlook

- Conservative prediction: $0.21-$0.24

- Neutral prediction: $0.24-$0.27

- Optimistic prediction: $0.27-$0.32 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: The market may enter a gradual recovery and growth phase, with LANDSHARE potentially benefiting from broader real estate tokenization trends and enhanced platform utility.

- Price range prediction:

- 2027: $0.23-$0.37

- 2028: $0.29-$0.37

- 2029: $0.25-$0.44

- Key catalysts: Expansion of real estate tokenization adoption, potential partnerships within the property sector, and improvements in platform features could serve as primary drivers for price appreciation.

2030-2031 Long-term Outlook

- Baseline scenario: $0.36-$0.42 (assuming steady platform development and moderate market growth)

- Optimistic scenario: $0.39-$0.43 (assuming increased mainstream adoption of real estate tokenization and favorable regulatory environment)

- Transformational scenario: $0.42-$0.47 (requires breakthrough adoption in real estate digitalization and significant expansion of user base)

- 2026-02-02: LANDSHARE price predictions suggest a potential range of $0.21-$0.32 for the current year, with long-term projections indicating possible growth through 2031.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.32346 | 0.2361 | 0.20541 | 0 |

| 2027 | 0.37211 | 0.27978 | 0.22942 | 18 |

| 2028 | 0.37157 | 0.32594 | 0.29009 | 38 |

| 2029 | 0.44292 | 0.34876 | 0.25111 | 47 |

| 2030 | 0.42751 | 0.39584 | 0.35626 | 67 |

| 2031 | 0.46519 | 0.41167 | 0.23877 | 74 |

IV. LANDSHARE Professional Investment Strategy and Risk Management

LANDSHARE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to tokenized real estate assets with passive income potential

- Operational Recommendations:

- Consider accumulating positions during market corrections when price approaches support levels

- Monitor monthly rental income distributions sent directly to wallets as part of total return calculation

- Utilize a secure storage solution such as Gate Web3 Wallet for asset custody

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Track 50-day and 200-day moving averages to identify trend direction and potential entry points

- Volume Analysis: Monitor 24-hour trading volume ($13,567.77) relative to historical averages to gauge market interest

- Swing Trading Considerations:

- Recent 7-day decline of 18.87% may present potential entry opportunities for risk-tolerant traders

- Set stop-loss orders below recent support levels to manage downside risk

LANDSHARE Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation

- Aggressive Investors: 5-8% of crypto portfolio allocation

- Professional Investors: Up to 10% with appropriate hedging strategies

(2) Risk Hedging Solutions

- Position Sizing: Limit initial investment to amounts within personal risk tolerance given the token's volatility profile

- Diversification: Balance LANDSHARE holdings with other asset classes to reduce concentration risk

(3) Secure Storage Solutions

- Software Wallet Recommendation: Gate Web3 Wallet provides convenient access for active traders

- Hardware Wallet Option: Consider cold storage solutions for long-term holdings exceeding personal security thresholds

- Security Precautions: Never share private keys, enable two-factor authentication, and verify contract addresses (BSC: 0xA73164DB271931CF952cBaEfF9E8F5817b42fA5C)

V. LANDSHARE Potential Risks and Challenges

LANDSHARE Market Risks

- Price Volatility: The token has experienced significant price fluctuations, with a 1-year decline of 76.85%, reflecting high market volatility

- Liquidity Concerns: With 24-hour trading volume of $13,567.77 and market cap of $1.45 million, the token may face liquidity constraints during large transactions

- Market Cap Position: Ranked #2,251 with 0.000060% market dominance, indicating limited market presence compared to established projects

LANDSHARE Regulatory Risks

- Real Estate Tokenization Oversight: Regulatory frameworks for tokenized real estate assets remain evolving across jurisdictions

- Securities Classification: Property-backed tokens may face regulatory scrutiny regarding securities law compliance

- Cross-border Compliance: International real estate investments through blockchain may encounter varying regulatory requirements

LANDSHARE Technical Risks

- Smart Contract Vulnerabilities: DeFi features including yield compounding and loan protocols carry inherent smart contract risks

- BSC Dependency: As a BEP20 token on Binance Smart Chain, the project's performance is tied to the underlying blockchain infrastructure

- Platform Centralization: The real estate asset backing requires trust in the platform's property management and tokenization processes

VI. Conclusion and Action Recommendations

LANDSHARE Investment Value Assessment

LANDSHARE presents an innovative approach to real estate investment through blockchain tokenization, offering potential monthly rental income and property appreciation exposure with a minimum investment threshold of $50. However, the token faces significant challenges including substantial recent price declines, limited liquidity, and evolving regulatory landscape for tokenized real estate. The project's long-term value proposition depends on successful execution of its DeFi features and property portfolio growth, while short-term risks include continued price volatility and market sentiment in both crypto and real estate sectors.

LANDSHARE Investment Recommendations

✅ Beginners: Limit exposure to small exploratory positions (under 2% of portfolio) while gaining familiarity with tokenized real estate concepts ✅ Experienced Investors: Consider strategic accumulation during market weakness with strict position sizing and risk management protocols ✅ Institutional Investors: Conduct comprehensive due diligence on underlying property assets, legal structure, and regulatory compliance before committing capital

LANDSHARE Trading Participation Methods

- Spot Trading: Purchase LANDSHARE tokens through Gate.com with available trading pairs

- Secure Storage: Transfer holdings to Gate Web3 Wallet for self-custody and direct receipt of rental income distributions

- Portfolio Monitoring: Track performance metrics including price movements, trading volume, and project developments through Gate.com platform

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is LANDSHARE? What are its main functions and uses?

LANDSHARE is a decentralized finance project where LAND token serves as the native utility and governance token. It enables payment, access, voting, staking for rewards, DAO governance participation, and premium feature access within the ecosystem.

What is the historical price trend of LANDSHARE? What were the highest and lowest prices in the past?

LANDSHARE reached its all-time high of NT$392.02 on November 11, 2021. The current price stands at NT$9.16, representing a significant decline from its peak. The token has experienced substantial volatility since its launch.

What is the current price of LANDSHARE? How are the market cap and circulation supply?

LANDSHARE is currently trading at NT$ 9.15, with a market cap of NT$ 48.59M and a circulating supply of 167.54M tokens.

What are professional analysts' price predictions for LANDSHARE in the future?

Analysts project LANDSHARE price movements based on tokenomics, adoption trends, and market sentiment. Key factors include token supply dynamics, ecosystem development, and broader crypto market conditions. Most forecasts suggest potential growth driven by increasing real-world asset adoption.

What are the main factors affecting LANDSHARE price?

LANDSHARE price is primarily influenced by market sentiment, investor confidence, technical developments, and market demand. Major news announcements, trading volume, and adoption rates also significantly impact price movements.

What are the risks of investing in LANDSHARE? How to mitigate them?

LANDSHARE carries market volatility and regulatory risks. Mitigate by diversifying your portfolio, staying informed on market trends, and regularly reviewing your investment strategy. Start with amounts you can afford to lose.

What are LANDSHARE's advantages and disadvantages compared to similar projects?

LANDSHARE's advantages include efficient land tokenization, lower barriers to entry, and transparent blockchain verification. Disadvantages involve regulatory uncertainty, limited liquidity, and potential market adoption challenges in the real estate sector.

Detailed Analysis of the Top 10 RWA Cryptocurrencies in 2025

Benefits of RWAs in Crypto

How to Earn with The RWA DePin Protocol in 2025

Detailed Analysis of RWA in Crypto Assets

Rexas Finance: A Blockchain-Powered Real-World Asset Tokenization Ecosystem

SIX Token (SIX): Core Logic, Use Cases and 2025 Roadmap Analysis

How Active Is BULLA's Community and Ecosystem in 2026? Twitter, Telegram, and DApp Growth Analysis

What are MERL compliance and regulatory risks in 2026?

Top 4 Coins with the Best Mining Profitability

How does Merlin Chain (MERL) community drive ecosystem growth with 70% activity rate on Twitter, Telegram, and Reddit?

What is the COINX price volatility analysis: historical trends, support resistance levels, and correlation with BTC in 2026?