2026 LIKE Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: LIKE's Market Position and Investment Value

Only1 (LIKE), as a social media platform integrating NFT marketplace and creator economy, has been developing its ecosystem since its launch in 2021. As of 2026, LIKE maintains a market capitalization of approximately $794,167, with a circulating supply of around 395.11 million tokens, and the price hovering around $0.00201. This asset, characterized as a "creator-fan interaction token," is playing an increasingly important role in the fields of social media monetization and NFT content creation.

This article will comprehensively analyze LIKE's price trends from 2026 to 2031, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment, to provide investors with professional price forecasts and practical investment strategies.

I. LIKE Price History Review and Market Status

LIKE Historical Price Evolution Trajectory

- 2021: Project launched in August with initial trading price of $0.01897, reached peak of $1.041 in September during NFT market expansion phase

- 2023: Price experienced substantial correction during crypto market downturn, declining to recorded low of $0.00133134 in August

- 2024-2026: Token entered extended consolidation period with reduced trading activity and limited price recovery momentum

LIKE Current Market Status

As of February 4, 2026, LIKE is trading at $0.00201, representing a decline across multiple timeframes. The token has decreased 0.15% in the past hour, 9.03% over 24 hours, 18.85% across 7 days, 34.91% in 30 days, and 90.52% over one year. The 24-hour trading range spans from $0.001976 to $0.002217, with total trading volume reaching $18,271.76.

The circulating supply stands at 395.11 million LIKE tokens out of a maximum supply of 500 million, representing 79.02% circulation. Current market capitalization is approximately $794,167, with fully diluted valuation at $1.005 million. The token holds a market ranking of 2679 with 0.000037% market dominance. The market-cap-to-FDV ratio of 79.02% indicates substantial token circulation relative to total supply.

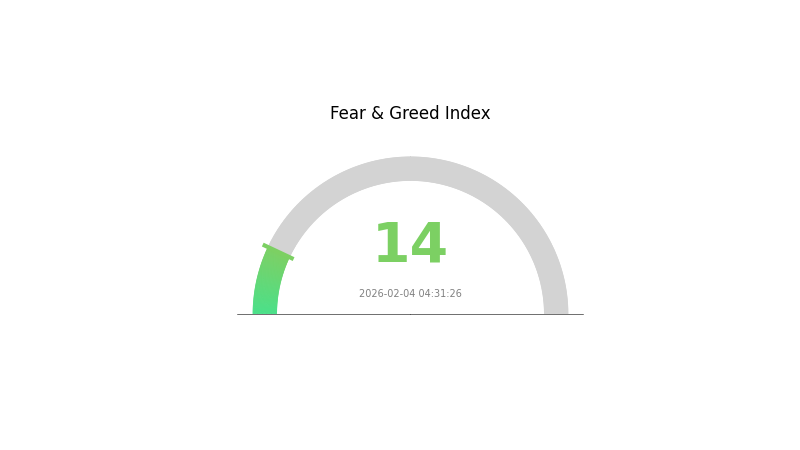

LIKE maintains presence on 4 exchanges with 38,066 token holders. Current trading price represents a 99.81% decline from the September 2021 peak of $1.041 and approximately 51% above the August 2023 low of $0.00133134. The crypto fear and greed index registers 14, indicating extreme fear sentiment in the broader market.

Click to view current LIKE market price

LIKE Market Sentiment Indicator

2026-02-04 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the index plummeting to 14. This severe sentiment reflects heightened market anxiety and widespread pessimism among investors. Such extreme readings typically indicate capitulation, where panic selling reaches peak levels. Historically, these conditions often precede significant market reversals. Risk-averse traders should exercise caution, while contrarian investors may begin identifying potential accumulation opportunities as sentiment reaches unsustainable extremes. Monitor market developments closely for signs of stabilization.

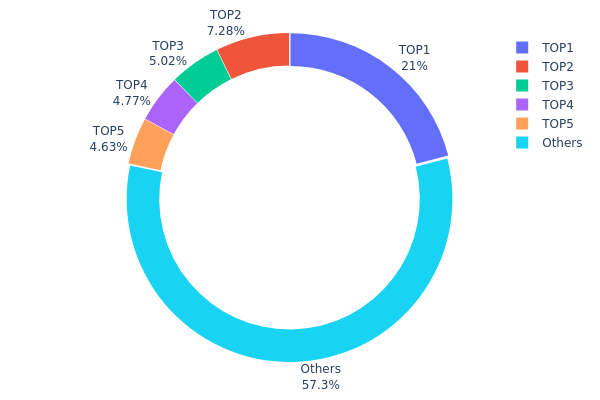

LIKE Holdings Distribution

The holdings distribution chart reveals the concentration of token ownership across different wallet addresses, serving as a key indicator of decentralization and potential market manipulation risks. By analyzing the percentage of total supply held by top addresses versus smaller holders, investors can assess the token's distribution health and the influence that large holders (whales) may exert on price movements.

Based on the current data, LIKE demonstrates a moderate concentration pattern. The top holder controls 20.99% of the total supply (104,891.97K tokens), while the top five addresses collectively hold 42.67% of the circulating supply. The remaining 57.33% is distributed among other addresses, indicating a relatively balanced distribution structure. Although the largest single holder possesses over one-fifth of the supply, the absence of extreme concentration (such as a single address holding over 50%) suggests that no individual entity has absolute control over the market.

This distribution pattern presents both opportunities and risks. On one hand, the 57.33% held by smaller addresses indicates meaningful community participation and reduces the likelihood of coordinated manipulation. On the other hand, the top five holders' combined 42.67% stake means that coordinated selling pressure from these addresses could trigger significant price volatility. The current structure reflects a moderate level of decentralization, typical of many established tokens, where early investors and project teams maintain substantial holdings while allowing for broader market participation.

View current LIKE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | EHebFp...U1M7bb | 104891.97K | 20.99% |

| 2 | u6PJ8D...ynXq2w | 36393.70K | 7.28% |

| 3 | BmFdpr...WTymy6 | 25107.16K | 5.02% |

| 4 | HRdHaH...hXDmqZ | 23811.58K | 4.76% |

| 5 | 5Q544f...pge4j1 | 23135.12K | 4.62% |

| - | Others | 286362.69K | 57.33% |

II. Core Factors Influencing LIKE's Future Price

Market Dynamics

- Market Volatility: The cryptocurrency market experiences extreme volatility, which directly impacts LIKE's price movements and trading volumes. Price fluctuations can be triggered by various factors including investor sentiment shifts, regulatory announcements, and broader market trends.

- Historical Cycle Patterns: LIKE's future trajectory may be significantly influenced by altcoin market cycles. Understanding these cyclical patterns helps investors anticipate potential price movements and market phases.

- Supply and Demand Balance: The fundamental economic principle of supply and demand plays a crucial role in determining LIKE's price levels. Changes in token circulation, trading activity, and holder behavior collectively shape the supply-demand equilibrium.

Institutional and Major Holder Activity

- Institutional Interest: The level of institutional participation in LIKE can significantly affect price stability and long-term value prospects. Institutional investors typically bring increased liquidity and market credibility.

- Investor Sentiment: Market participants' confidence and expectations directly influence trading behaviors and price movements. Sentiment can be affected by news events, technological developments, and broader market conditions.

Macroeconomic Environment

- Monetary Policy Impact: Global central bank policies, particularly interest rate decisions and quantitative measures, affect investor risk appetite and capital flows into cryptocurrency markets. Lower interest rates may enhance the attractiveness of alternative assets like LIKE.

- Geopolitical Factors: International political tensions and conflicts can drive investors toward or away from cryptocurrency assets. Geopolitical uncertainty may increase demand for decentralized digital assets as alternative stores of value.

- Economic Stability: The overall health of global and regional economies influences investment patterns across all asset classes, including cryptocurrencies. Economic downturns or growth periods can shift investor allocation strategies.

III. 2026-2031 LIKE Price Prediction

2026 Outlook

- Conservative Prediction: $0.00176 - $0.002

- Neutral Prediction: Around $0.002

- Optimistic Prediction: Up to $0.0023 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market Stage Expectation: The token may experience a gradual accumulation phase with moderate volatility, potentially transitioning into a growth phase by late 2028 as market sentiment improves.

- Price Range Predictions:

- 2027: $0.00155 - $0.00228

- 2028: $0.00202 - $0.00322

- 2029: $0.00169 - $0.00367

- Key Catalysts: Ecosystem development, strategic partnerships, broader cryptocurrency market trends, and potential increases in trading volume on platforms like Gate.com could serve as primary drivers for price movement during this period.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00294 - $0.00364 (assuming steady ecosystem growth and stable market conditions)

- Optimistic Scenario: $0.00319 - $0.00373 (contingent upon significant technological improvements and expanded user base)

- Transformative Scenario: Potential to reach upper bounds of $0.00373 (under exceptionally favorable conditions including major platform integrations and sustained bull market momentum)

- February 4, 2026: LIKE trading at approximately $0.00176 - $0.0023 range (early-stage price discovery phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0023 | 0.002 | 0.00176 | 0 |

| 2027 | 0.00228 | 0.00215 | 0.00155 | 7 |

| 2028 | 0.00322 | 0.00222 | 0.00202 | 10 |

| 2029 | 0.00367 | 0.00272 | 0.00169 | 35 |

| 2030 | 0.00364 | 0.00319 | 0.00294 | 58 |

| 2031 | 0.00373 | 0.00342 | 0.00328 | 70 |

IV. LIKE Professional Investment Strategies and Risk Management

LIKE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Believers in creator economy and NFT social platforms who have moderate to high risk tolerance

- Operational recommendations:

- Consider dollar-cost averaging to mitigate volatility risks, given LIKE's significant price fluctuations

- Monitor platform user growth and NFT transaction volume as key indicators for long-term value assessment

- Storage solution: Use Gate Web3 Wallet for secure asset custody with multi-signature protection

(2) Active Trading Strategy

- Technical analysis tools:

- Volume analysis: Monitor 24-hour trading volume ($18,271.76) relative to market cap to assess liquidity conditions

- Support and resistance levels: Current 24-hour low ($0.001976) and high ($0.002217) can serve as short-term reference points

- Swing trading considerations:

- Pay attention to broader NFT market sentiment shifts and social token sector trends

- Set stop-loss orders to manage downside risk, particularly given the token's recent negative performance trends

LIKE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 3-5% of crypto portfolio

- Professional investors: 5-10% of crypto portfolio with active position management

(2) Risk Hedging Solutions

- Diversification approach: Balance LIKE holdings with established layer-1 tokens and stablecoins

- Position sizing: Limit individual position size based on the token's high volatility profile

(3) Secure Storage Solutions

- Software wallet recommendation: Gate Web3 Wallet with support for Solana-based tokens

- Hardware wallet solution: Consider cold storage options for long-term holdings exceeding personal risk thresholds

- Security precautions: Never share private keys, enable two-factor authentication, and verify contract addresses before transactions

V. LIKE Potential Risks and Challenges

LIKE Market Risks

- High volatility: The token has experienced substantial price declines, with -9.03% in 24 hours, -18.85% over 7 days, and -90.52% over one year

- Limited liquidity: With a circulating market cap of approximately $794,167 and daily volume of $18,271, liquidity constraints may impact large transactions

- Competition pressure: The social NFT platform space faces competition from established Web2 platforms entering Web3

LIKE Regulatory Risks

- NFT regulatory uncertainty: Evolving regulatory frameworks for NFTs across different jurisdictions may impact platform operations

- Token classification concerns: Potential regulatory scrutiny regarding the classification of social tokens and their utility

- Cross-border compliance: Operating a global social platform requires navigating complex multi-jurisdictional regulatory requirements

LIKE Technical Risks

- Smart contract vulnerabilities: As with all blockchain projects, potential security vulnerabilities in smart contracts could affect user assets

- Platform scalability: The ability to handle increased user activity and NFT transactions as the platform grows

- Solana network dependency: Platform performance is tied to the underlying Solana blockchain's stability and throughput

VI. Conclusion and Action Recommendations

LIKE Investment Value Assessment

Only1 (LIKE) represents an innovative approach to combining social media with NFT functionality, offering creators monetization opportunities through blockchain technology. However, the token faces significant challenges including substantial price depreciation, limited liquidity, and competition in the social NFT space. The 79.02% circulating supply ratio indicates relatively high token availability, while the holder count of 38,066 suggests a moderately sized community. Long-term value depends on the platform's ability to attract creators, drive NFT trading activity, and differentiate itself in an increasingly competitive market. Short-term risks remain elevated given current market conditions and price trends.

LIKE Investment Recommendations

✅ Beginners: Avoid or allocate minimal funds (under 1% of portfolio) until gaining more experience with high-risk, low-liquidity tokens; focus on understanding the creator economy and NFT markets first ✅ Experienced investors: Consider small speculative positions (1-3% of crypto portfolio) with strict risk management; monitor platform development milestones and user growth metrics closely ✅ Institutional investors: Conduct thorough due diligence on platform metrics, user engagement, and competitive positioning; consider strategic positions only if aligned with broader Web3 social media thesis

LIKE Trading Participation Methods

- Spot trading: Purchase LIKE tokens on Gate.com for direct exposure to price movements

- Portfolio allocation: Incorporate LIKE as part of a diversified NFT and social token basket strategy

- Research and monitoring: Follow platform updates, creator adoption rates, and NFT marketplace activity before committing capital

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the LIKE token and what is its role in the Likecoin ecosystem?

LIKE is the native token of Likecoin that rewards content creators and incentivizes decentralized content sharing. It tracks content derivation and usage, supporting open-licensed creative works through blockchain-based mechanisms.

What are the main factors affecting LIKE price?

LIKE price is primarily influenced by market demand, trading volume, project development progress, community sentiment, and overall crypto market conditions. These factors collectively drive price movements.

How to predict LIKE token price trends?

LIKE token price can be predicted by analyzing on-chain metrics, transaction volume, market sentiment, and historical patterns. Based on current analysis, LIKE is projected to reach approximately $0.001655 within 30 days, suggesting a 5% annual growth trajectory for short-term forecasting.

What is the current market liquidity and trading volume of LIKE token?

LIKE token demonstrates strong market liquidity with substantial trading volume. The token maintains active market participation and frequent trading activity, making it suitable for traders seeking liquid assets with consistent market engagement.

What are the main risks of investing in LIKE tokens?

Main risks include market volatility, regulatory changes, and project execution challenges. Token value can fluctuate significantly based on market conditions and industry developments. Investors should conduct thorough research before participating.

What are LIKE's advantages compared to other content creation tokens like BAT and Theta?

LIKE offers a more efficient decentralized reward mechanism for creators. Its transparent, traceable incentive model builds stronger user trust and community engagement compared to BAT and Theta.

What is the development outlook of the Likecoin ecosystem? What impact does this have on the LIKE price?

Likecoin ecosystem shows strong development momentum with increasing ecosystem adoption and user growth. This positive trajectory drives market confidence, supporting upward price movement. Enhanced utility and ecosystem expansion are expected to sustain LIKE price appreciation through 2026.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

What is a non-custodial wallet and how do you use it

7 Indicators for Beginner Traders

What is a Non-Custodial Wallet vs. a Custodial Wallet?

Comprehensive Guide to Cryptocurrency Airdrops

What are Satoshis, and why is Bitcoin divided into smaller units