2026 LOOKS Price Prediction: Expert Analysis and Market Forecast for the NFT Platform Token

Introduction: LOOKS Market Position and Investment Value

LooksRare (LOOKS), positioned as a community-first NFT marketplace where participants can earn rewards through buying and selling NFTs, has been serving the NFT ecosystem since its launch in 2022. As of 2026, LOOKS maintains a market capitalization of approximately $705,983, with a circulating supply of around 993 million tokens and a current price hovering at $0.0007109. This asset, recognized as a "community-driven NFT trading incentive token," is playing an increasingly important role in the decentralized NFT marketplace sector.

This article will comprehensively analyze LOOKS price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. LOOKS Price History Review and Market Status

LOOKS Historical Price Evolution Trajectory

- 2022: LOOKS token launched in January, reaching its all-time high of $7.1 on January 21, 2022, demonstrating strong initial market interest in the community-oriented NFT trading platform

- 2023-2025: The token experienced a prolonged downward trend as the broader crypto market faced headwinds and NFT trading volumes declined across the industry

- 2026: Price continued its downward trajectory, reaching an all-time low of $0.00064821 on February 1, 2026, representing a significant decline from its peak

LOOKS Current Market Situation

As of February 4, 2026, LOOKS is trading at $0.0007109, showing a slight recovery from its recent all-time low. Over the past 24 hours, the token has declined by 8.58%, with an intraday high of $0.0008184 and a low of $0.0006927. The 24-hour trading volume stands at $32,705.23.

The token's circulating supply is approximately 993.08 million LOOKS out of a maximum supply of 1 billion tokens, representing a circulation rate of 99.31%. The current market capitalization is approximately $705,983, with the fully diluted valuation matching this figure due to the high circulation rate. LOOKS maintains a market dominance of 0.000026% in the broader cryptocurrency ecosystem.

Looking at longer timeframes, LOOKS has declined 8.98% over the past week, 41.28% over the past month, and 96.88% over the past year. The token is deployed on the Ethereum blockchain as an ERC-20 token, with the contract address 0xf4d2888d29d722226fafa5d9b24f9164c092421e. Currently, there are 76,575 token holders, and LOOKS is listed on 6 exchanges, with trading available on Gate.com.

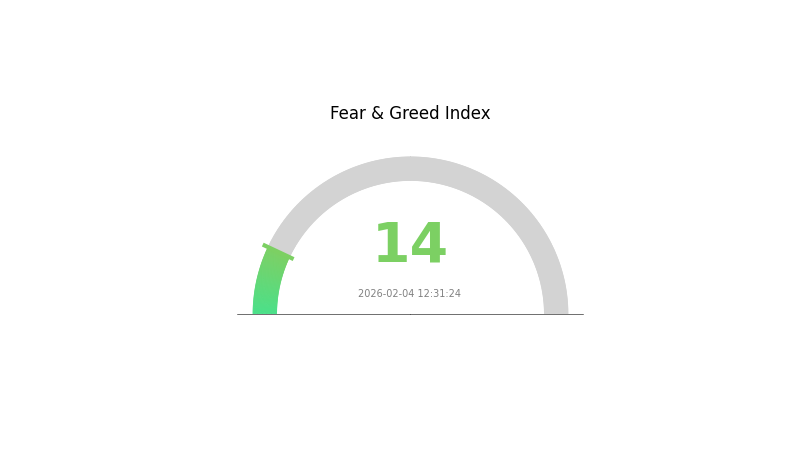

The current market sentiment index stands at 14, indicating "Extreme Fear" conditions in the broader cryptocurrency market, which may be contributing to the continued price pressure on LOOKS.

Click to view current LOOKS market price

LOOKS Market Sentiment Indicator

2026-02-04 Fear and Greed Index: 14 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear with an index reading of 14. This exceptionally low sentiment indicates investors are highly pessimistic about near-term market prospects. Such extreme fear typically presents contrarian opportunities, as markets often reverse sharply from these levels. However, caution remains warranted until clear recovery signals emerge. Traders should monitor key support levels and volume patterns for potential trend shifts. This environment may favor patient accumulation strategies for long-term investors while short-term traders should exercise heightened risk management discipline.

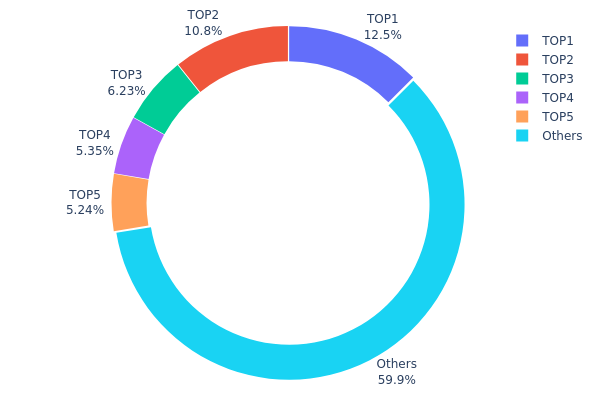

LOOKS Holdings Distribution

The holdings distribution chart illustrates the concentration of LOOKS tokens across different wallet addresses, revealing the level of centralization within the token's ecosystem. By analyzing the distribution pattern, we can assess whether a small number of addresses control a disproportionate share of the total supply, which may influence market dynamics and price stability.

According to current data, the top five addresses collectively hold approximately 40.07% of the total LOOKS supply. The largest holder controls 12.51% (125,116.35K LOOKS), while the second and third largest addresses hold 10.75% and 6.22% respectively. This concentration level suggests a moderately centralized distribution pattern, where significant decision-making power rests within a relatively small number of entities. The remaining 59.93% is distributed among other addresses, indicating some degree of decentralization but not enough to fully mitigate concentration risks.

This distribution pattern presents both opportunities and challenges for market participants. The moderate concentration among top holders could lead to increased price volatility, as large-scale transactions by these addresses may significantly impact market liquidity and price movements. Additionally, such concentration raises concerns about potential market manipulation, where coordinated actions by major holders could artificially influence trading patterns. However, the fact that nearly 60% of tokens are distributed among smaller holders provides a cushion against complete centralization and suggests a relatively active community participation. Overall, LOOKS demonstrates a balanced yet cautiously concentrated on-chain structure that requires continued monitoring to ensure healthy market development.

Click to view current LOOKS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0d07...b492fe | 125116.35K | 12.51% |

| 2 | 0xe7ba...e13ce4 | 107521.64K | 10.75% |

| 3 | 0x91d4...c8debe | 62287.04K | 6.22% |

| 4 | 0x465a...e0d3b1 | 53543.63K | 5.35% |

| 5 | 0xf42a...36f173 | 52436.13K | 5.24% |

| - | Others | 599095.21K | 59.93% |

II. Core Factors Influencing LOOKS Future Price

Supply Mechanism

- Token Issuance Plan: LOOKS token has a fixed total supply with an emission rate that decreases year by year.

- Historical Pattern: Past supply reductions have typically led to price increases as selling pressure diminished.

- Current Impact: The gradually declining supply rate may support upward price momentum by reducing available tokens in circulation.

Institutional and Major Holder Dynamics

- Institutional Investment: Institutional adoption and investment activities are identified as key factors that could drive LOOKS token value.

- Network Adoption: The platform's community-driven nature and network adoption rate play significant roles in determining the token's intrinsic value.

Macroeconomic Environment

- Monetary Policy Impact: Macroeconomic pressures, such as potential interest rate adjustments by the Federal Reserve, could create downward pressure on token prices during periods of economic tightening.

- Market Sentiment: Risk appetite fluctuations and asset reallocation strategies among investors affect capital flows into NFT marketplace tokens.

- Geopolitical Factors: While geopolitical developments provide underlying support for long-term upward trends, they have not yet been sufficient to drive strong breakouts in the short term.

Technology Development and Ecosystem Building

- Platform Development: LooksRare's unique community-driven platform model differentiates it within the NFT marketplace sector.

- Ecosystem Applications: The growth and activity level of NFT trading on the platform directly influence token demand and utility.

III. 2026-2031 LOOKS Price Prediction

2026 Outlook

- Conservative Prediction: $0.00044 - $0.00071

- Neutral Prediction: Around $0.00071

- Optimistic Prediction: Up to $0.00077 (requires favorable market conditions)

2027-2029 Outlook

- Market Stage Expectation: Progressive growth phase with moderate volatility, potentially transitioning into a broader crypto market recovery cycle

- Price Range Prediction:

- 2027: $0.00067 - $0.00079

- 2028: $0.00072 - $0.00109

- 2029: $0.00049 - $0.00133

- Key Catalysts: Platform development progress, NFT market sentiment shifts, increased trading volume on Gate.com and other platforms, and potential ecosystem expansion

2030-2031 Long-term Outlook

- Baseline Scenario: $0.0009 - $0.00113 (assuming steady platform adoption and stable NFT market conditions)

- Optimistic Scenario: $0.00095 - $0.00137 (assuming accelerated ecosystem growth and favorable regulatory environment)

- Transformative Scenario: $0.00125 - $0.00169 (requires significant breakthrough in NFT infrastructure, mainstream adoption, and robust market conditions)

- 2026-02-04: LOOKS trading within projected range (early-stage development phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00077 | 0.00071 | 0.00044 | 0 |

| 2027 | 0.00079 | 0.00074 | 0.00067 | 4 |

| 2028 | 0.00109 | 0.00076 | 0.00072 | 7 |

| 2029 | 0.00133 | 0.00093 | 0.00049 | 30 |

| 2030 | 0.00137 | 0.00113 | 0.0009 | 58 |

| 2031 | 0.00169 | 0.00125 | 0.00095 | 75 |

IV. LOOKS Professional Investment Strategy and Risk Management

LOOKS Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: NFT market participants and community-oriented investors who believe in the long-term development of decentralized NFT trading platforms

- Operational Recommendations:

- Consider accumulating positions during market downturns when LOOKS trades near support levels

- Monitor the platform's trading volume and user engagement metrics as indicators of ecosystem health

- Storage Solution: Use Gate Web3 Wallet for secure storage with multi-signature protection and regular security audits

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume of $32,705.23 to identify potential trend reversals and liquidity conditions

- Price Range Analysis: Track daily price movements between the 24-hour low of $0.0006927 and high of $0.0008184 to identify support and resistance levels

- Swing Trading Points:

- Set stop-loss orders given the high volatility, as evidenced by the 8.58% 24-hour decline

- Consider the 41.28% monthly decline when evaluating short-term risk-reward ratios

LOOKS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 5-8% with active monitoring and hedging strategies

(2) Risk Hedging Solutions

- Diversification Strategy: Balance LOOKS holdings with other NFT-related tokens and established cryptocurrencies to reduce concentration risk

- Position Sizing: Given the 96.88% yearly decline, limit position size to amounts that align with individual risk tolerance

(3) Security Storage Solutions

- Primary Recommendation: Gate Web3 Wallet offers comprehensive security features for ERC-20 tokens like LOOKS

- Multi-layer Security: Enable two-factor authentication and hardware wallet integration for enhanced protection

- Security Considerations: Never share private keys, regularly update wallet software, and verify contract addresses (0xf4d2888d29d722226fafa5d9b24f9164c092421e) before transactions

V. LOOKS Potential Risks and Challenges

LOOKS Market Risks

- High Volatility Risk: The token has experienced an 8.58% decline in 24 hours and 41.28% decline over 30 days, indicating significant price instability

- Liquidity Risk: With a market cap of approximately $705,983 and ranking at #2762, the token may face liquidity constraints during volatile market conditions

- NFT Market Correlation: As an NFT trading platform token, LOOKS is highly correlated with NFT market sentiment and trading volumes, which can be cyclical

LOOKS Regulatory Risks

- NFT Trading Regulations: Evolving regulatory frameworks for NFT marketplaces may impact platform operations and token utility

- Securities Classification: Potential regulatory scrutiny regarding whether platform reward mechanisms constitute securities offerings

- Cross-border Compliance: International regulatory requirements may affect the platform's ability to serve users in different jurisdictions

LOOKS Technical Risks

- Smart Contract Risk: The ERC-20 token contract on Ethereum (address: 0xf4d2888d29d722226fafa5d9b24f9164c092421e) may contain undiscovered vulnerabilities

- Platform Competition: The NFT marketplace sector is highly competitive, with established players potentially affecting LooksRare's market share

- Network Dependency: Reliance on Ethereum network may expose the token to gas fee fluctuations and network congestion issues

VI. Conclusion and Action Recommendations

LOOKS Investment Value Assessment

LooksRare presents a community-focused approach to NFT trading with reward mechanisms for participants. However, the token has experienced significant depreciation with a 96.88% decline over the past year and currently trades at $0.0007109, approaching its all-time low of $0.00064821 recorded on February 1, 2026. With a circulating supply of 993,084,046 LOOKS (99.31% of max supply) and relatively low market capitalization, the token faces considerable volatility risks. While the platform's community-first model and reward system offer unique value propositions within the NFT ecosystem, investors should carefully weigh the high-risk profile against potential long-term opportunities in the evolving NFT marketplace sector.

LOOKS Investment Recommendations

✅ Beginners: Exercise extreme caution due to high volatility; consider observing the project and NFT market trends before committing capital; if participating, limit exposure to less than 1% of total portfolio

✅ Experienced Investors: May consider small speculative positions during periods of NFT market recovery; implement strict stop-loss orders and monitor platform metrics including trading volume and user growth

✅ Institutional Investors: Conduct comprehensive due diligence on platform fundamentals, competitive positioning, and regulatory landscape; consider LOOKS as a minor component within a diversified NFT ecosystem investment strategy

LOOKS Trading Participation Methods

- Spot Trading: Buy and sell LOOKS directly on Gate.com with 6 exchanges currently supporting the token

- Dollar-Cost Averaging: Reduce timing risk by accumulating positions gradually over extended periods

- Community Engagement: Participate in the LooksRare platform to earn rewards through buying or selling NFTs, thereby gaining firsthand experience with the ecosystem

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance, and it is recommended to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What price could LOOKS token reach in the future?

LOOKS token is projected to reach a maximum price of $0.466295 by 2036. Based on current market analysis, significant growth is anticipated in the coming years, with potential peaks driven by increasing adoption and market demand.

What are the main factors affecting LOOKS price?

LOOKS price is primarily influenced by NFT market trends, platform competitiveness, trading volume, investor sentiment, and overall cryptocurrency market conditions.

What are the advantages of LOOKS token compared to other NFT platform tokens?

LOOKS token offers lower trading fees compared to other NFT platforms, reducing transaction costs significantly. It provides superior trading efficiency and higher transaction value rewards for active participants.

2024年LOOKS价格预测如何?

Based on current market analysis, LOOKS was predicted to reach approximately $0.09 in 2024. However, price predictions are subject to market volatility and may fluctuate significantly. Monitor market trends for the most accurate forecasts.

What risks should I be aware of when purchasing LOOKS tokens?

LOOKS faces reward dilution from high token supply relative to demand, and competition from well-funded rivals offering zero-fee trading. Market volatility and platform adoption risks also exist. Conduct thorough research before investing.

What are the practical use cases and value of LOOKS tokens?

LOOKS tokens enable NFT trading on LooksRare platform and support community governance. They provide users with a secure, fast, and transparent trading environment for digital assets.

How to Withdraw Money from Crypto Exchanges in 2025: A Beginner's Guide

Hedera Hashgraph (HBAR): Founders, Technology, and Price Outlook to 2030

Jasmy Coin: A Japanese Crypto Tale of Ambition, Hype, and Hope

IOTA (MIOTA) – From Tangle Origins to 2025 Price Outlook

Bitcoin Price in 2025: Analysis and Market Trends

How to Trade Bitcoin in 2025: A Beginner's Guide

Ultimate Guide to NFT Minting: Create and Sell NFTs for Free

Free Money for App Registration in 2025

Who Is John J. Ray III, FTX's New CEO?

Best Crypto Exchanges for Beginners: Top 10 Options — Current Recommendations

Are there methods to minimize taxes through offsetting gains and losses from crypto assets (virtual currencies)?