2026 MENGO Price Prediction: Expert Analysis, Market Trends, and Investment Outlook for the Next Generation of Digital Assets

Introduction: MENGO's Market Position and Investment Value

Flamengo Fan Token (MENGO) represents an innovative digital asset designed to strengthen the connection between fans and the Flamengo football club. As of February 4, 2026, MENGO holds a market capitalization of approximately $896,198, with a circulating supply of about 15.5 million tokens and a current price around $0.05783. This fan engagement asset plays a significant role in the sports fan token sector, offering unique benefits such as participation in club decision-making processes and access to special discounts and rewards.

This article provides a comprehensive analysis of MENGO's price trajectory from 2026 through 2031, examining historical patterns, market supply-demand dynamics, ecosystem developments, and macroeconomic factors. Investors will find professional price forecasts and practical investment strategies tailored to the evolving landscape of fan tokens and their integration within the broader digital asset ecosystem.

I. MENGO Price History Review and Market Status

MENGO Historical Price Evolution Trajectory

- November 2021: MENGO reached a significant price peak at $3.94, marking a notable milestone in its early trading history.

- February 2026: The token experienced considerable downward pressure, recording a low point at $0.05646, representing a substantial decline from historical highs.

MENGO Current Market Situation

As of February 04, 2026, Flamengo Fan Token (MENGO) is trading at $0.05783, showing a 24-hour decline of 5.4%. The token has experienced notable volatility in recent periods, with a 1-hour decrease of 1.79% and a more pronounced 7-day decline of 17.97%. Over the past 30 days, MENGO has decreased by 21.19%, while the annual performance reflects a decline of 69.19%.

The current market capitalization stands at approximately $896,198, with a circulating supply of 15,497,115 tokens out of a maximum supply of 30,000,000 tokens, representing a circulation ratio of 51.66%. The fully diluted market cap is calculated at $1,734,900. Within the past 24 hours, the token has traded within a range of $0.05736 to $0.06173, with a total trading volume of $14,192.27.

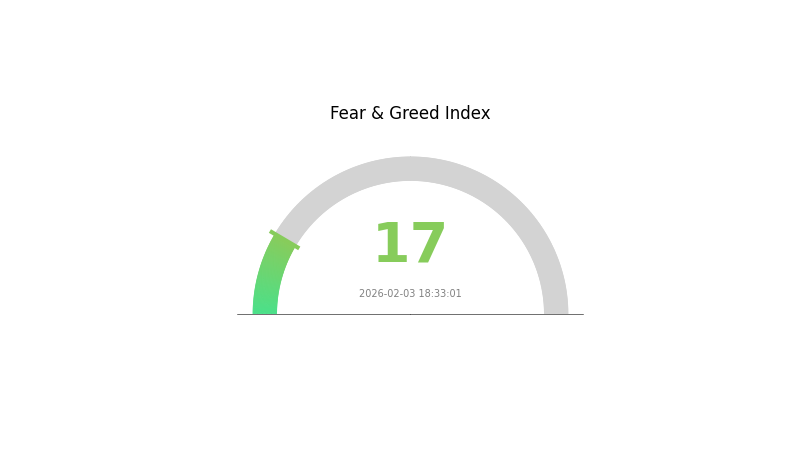

MENGO holds a market share of 0.000066% and is currently available on 2 exchanges. The token's contract is deployed on the CHZ2 chain with the address 0xD1723Eb9e7C6eE7c7e2d421B2758dc0f2166eDDc. The overall cryptocurrency market sentiment index currently stands at 17, indicating an extreme fear phase in the broader market environment.

Click to view current MENGO market price

MENGO Market Sentiment Index

2026-02-03 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at just 17. This exceptionally low reading suggests intense market pessimism and heightened risk aversion among investors. During such periods, volatility typically increases, and asset prices may face significant downward pressure. However, historically, extreme fear has often preceded substantial market recoveries, presenting potential opportunities for long-term investors with strong conviction. Traders should exercise caution and implement proper risk management strategies while monitoring key support levels closely during this volatile market phase.

MENGO 持仓分布

The address holding distribution chart reflects the concentration of token ownership across different wallet addresses in the blockchain network. By analyzing the distribution of MENGO tokens among top holders, we can evaluate the degree of decentralization and assess potential risks related to market manipulation or excessive concentration. A more balanced distribution typically indicates healthier market structure, while high concentration among a few addresses may suggest increased volatility risk and reduced resistance to large-scale sell-offs.

Based on the current holding distribution data, MENGO demonstrates a relatively moderate concentration pattern. The top-tier addresses collectively control a significant portion of the circulating supply, which is common among emerging tokens but warrants careful monitoring. This concentration level suggests that major holders possess considerable influence over short-term price movements. However, the gradual decline in holding percentages as we move down the ranking indicates some degree of distribution among secondary holders, which provides a buffer against extreme volatility triggered by single large transactions.

The current address distribution structure presents both opportunities and considerations for market participants. While the concentration among top holders could potentially lead to price fluctuations during large transfer events, it also suggests that major stakeholders have vested interests in the project's long-term success. The on-chain structure appears relatively stable for a token in its current development phase, though continued monitoring of holding pattern changes will be essential for assessing market maturity. Investors should remain aware that shifts in these concentration metrics could signal changes in market sentiment or strategic positioning among major holders.

Click to view current MENGO Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing MENGO's Future Price

Supply Mechanism

- Mainnet Launch: The advancement and performance validation of MENGO's mainnet will directly impact price trajectories. The network demonstrates high throughput capabilities exceeding 297,450 TPS alongside cross-chain interoperability features.

- Historical Pattern: Supply mechanisms typically influence market sentiment through scarcity dynamics and ecosystem support strategies.

- Current Impact: The actual implementation and verification of mainnet performance, particularly the high-performance capabilities and cross-chain interoperability, remain critical factors pending real-world deployment validation.

Macroeconomic Environment

- Monetary Policy Impact: Global macroeconomic factors, including central bank policies and interest rate adjustments, may affect cryptocurrency market sentiment and capital flows.

- Inflation Hedge Characteristics: During periods of economic uncertainty, cryptocurrency assets may experience volatility influenced by broader market conditions and investor risk appetite.

- Geopolitical Factors: Major economic events and policy shifts can trigger increased volatility in fiat currencies, potentially affecting the relative strength of cryptocurrency assets depending on global investor responses.

Technical Development and Ecosystem Building

- Multi-Virtual Machine Infrastructure: MENGO operates as a Layer 1 multi-virtual machine omnichain infrastructure network, integrating OPStack technology with Move's core advantages. The network supports both MoveVM and EVM, addressing fragmentation issues in Web3 applications and DeFi protocols.

- Cross-Chain Communication: The platform constructs an efficient blockchain network supporting cross-chain communication and multi-virtual machine interoperability, providing developers and users with secure, modular, and high-performance Web3 infrastructure.

- Ecosystem Applications: The network aims to deliver solutions for user experience fragmentation and liquidity challenges within the Web3 and DeFi space, though specific ecosystem project developments require ongoing monitoring.

III. 2026-2031 MENGO Price Prediction

2026 Outlook

- Conservative Prediction: $0.03344 - $0.05766

- Neutral Prediction: $0.05766

- Optimistic Prediction: $0.07726 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market Stage Expectation: The token may enter a gradual growth phase, with price appreciation driven by ecosystem development and broader market sentiment.

- Price Range Predictions:

- 2027: $0.05667 - $0.09175

- 2028: $0.0597 - $0.11065

- 2029: $0.05993 - $0.12747

- Key Catalysts: Potential drivers include technological upgrades, partnership announcements, and overall cryptocurrency market recovery cycles.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.09015 - $0.1113 (assuming stable market conditions and continued project development)

- Optimistic Scenario: $0.12132 - $0.13345 (contingent on significant ecosystem expansion and mainstream adoption)

- Transformative Scenario: Above $0.13345 (requires exceptional market conditions, major institutional adoption, or breakthrough technological implementations)

- 2026-02-04: MENGO trading within the lower predicted range (early-stage price discovery phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.07726 | 0.05766 | 0.03344 | 0 |

| 2027 | 0.09175 | 0.06746 | 0.05667 | 16 |

| 2028 | 0.11065 | 0.07961 | 0.0597 | 37 |

| 2029 | 0.12747 | 0.09513 | 0.05993 | 64 |

| 2030 | 0.13133 | 0.1113 | 0.09015 | 92 |

| 2031 | 0.13345 | 0.12132 | 0.06672 | 109 |

IV. MENGO Professional Investment Strategy and Risk Management

MENGO Investment Methodology

(1) Long-term Holding Strategy

- Target Audience: Fan token enthusiasts and sports-focused crypto investors who believe in the long-term value of fan engagement tokens

- Operation Recommendations:

- Consider gradual accumulation during market dips rather than lump-sum purchases, given the token's recent 69.19% decline over the past year

- Monitor Flamengo club's fan engagement initiatives and token utility expansion announcements

- Utilize Gate Web3 Wallet for secure storage with support for CHZ2 chain where MENGO is deployed

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Current 24H trading range shows resistance at $0.06173 and support near $0.05736, near the all-time low of $0.05646

- Volume Analysis: Monitor daily trading volume (currently $14,192) for liquidity assessment before position sizing

- Swing Trading Considerations:

- Be cautious with high volatility, as the token experienced -17.97% decline over 7 days

- Set strict stop-loss orders due to the token's proximity to historical lows

MENGO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: No more than 0.5-1% of crypto portfolio

- Aggressive Investors: 2-3% maximum allocation

- Professional Investors: 3-5% with active hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance MENGO holdings with more established cryptocurrencies and other fan tokens to reduce concentration risk

- Position Sizing: Given the limited circulating supply of 15.5M tokens (51.66% of max supply), maintain smaller position sizes to manage liquidity risk

(3) Secure Storage Solutions

- Web3 Wallet Recommendation: Gate Web3 Wallet supports CHZ2 chain for secure MENGO storage

- Multi-signature Solution: For larger holdings, consider multi-signature wallet arrangements

- Security Precautions: Never share private keys, enable two-factor authentication, and regularly backup wallet recovery phrases in secure offline locations

V. MENGO Potential Risks and Challenges

MENGO Market Risks

- Limited Liquidity: With only 2 exchanges listing the token and daily trading volume around $14,000, liquidity constraints may result in significant slippage during trades

- High Volatility: The token has declined 69.19% over the past year and 21.19% over 30 days, indicating substantial price instability

- Low Market Capitalization: At approximately $896,000 in market cap (ranking #2584), the token is susceptible to manipulation and lacks the stability of higher-cap assets

MENGO Regulatory Risks

- Fan Token Regulatory Uncertainty: Regulatory frameworks for fan tokens remain unclear in many jurisdictions, potentially affecting token utility and trading access

- Sports Partnership Dependencies: Token value heavily depends on the club's continued partnership and engagement initiatives, which could be affected by regulatory changes in sports-related digital assets

- Geographic Restrictions: Potential limitations on fan token trading in certain regions may reduce market accessibility

MENGO Technical Risks

- Smart Contract Dependencies: The token relies on contract address 0xD1723Eb9e7C6eE7c7e2d421B2758dc0f2166eDDc on CHZ2 chain, exposing holders to potential smart contract vulnerabilities

- Chain-Specific Risks: Operating on the Chiliz chain means token functionality is tied to that network's security and operational stability

- Limited Token Utility Expansion: Without continuous development of fan engagement features, the token's value proposition may diminish over time

VI. Conclusion and Action Recommendations

MENGO Investment Value Assessment

MENGO represents a niche investment opportunity within the fan token sector, offering exposure to sports club engagement innovation. However, the token currently faces significant challenges including substantial price depreciation (down 69.19% annually), limited liquidity with only 2 exchange listings, and a market cap of approximately $896,000. The recent approach to all-time low prices ($0.05646) suggests heightened risk. While fan tokens offer unique utility in club decision-making and fan rewards, MENGO's long-term value proposition depends heavily on Flamengo's continued commitment to fan engagement initiatives and token utility expansion. Short-term risks remain elevated due to market conditions and limited trading volume.

MENGO Investment Recommendations

✅ Beginners: Avoid or limit exposure to less than 0.5% of total crypto portfolio; prioritize learning about fan token mechanics before investing

✅ Experienced Investors: Consider small speculative positions (1-2% allocation) only if you have specific conviction about Flamengo's fan engagement roadmap; implement strict stop-loss orders

✅ Institutional Investors: Conduct thorough due diligence on club partnership terms and token economics; consider as minor diversification within a broader sports-tech or fan engagement thesis

MENGO Trading Participation Methods

- Spot Trading on Gate.com: Access MENGO trading pairs with competitive fees and liquidity aggregation

- Gate Web3 Wallet Integration: Store and manage MENGO tokens directly with support for CHZ2 chain

- Research-Driven Approach: Monitor Flamengo club announcements and fan token utility updates before making investment decisions

Cryptocurrency investment carries extremely high risks; this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is MENGO? What are its practical application scenarios?

MENGO is a fan token on the Chiliz blockchain designed for Flamengo, a leading Brazilian football club. It enables fan engagement, voting rights, exclusive content access, and helps fund club operations through community participation.

What are the main factors affecting MENGO price?

MENGO price is primarily influenced by supply mechanisms and scarcity, institutional investment adoption, macroeconomic environment, and technical ecosystem development. Market trading volume and sentiment also play significant roles in price movements.

How to conduct MENGO price technical analysis and prediction?

Analyze MENGO historical price data to identify trends and patterns using technical tools like moving averages and RSI indicators. Study trading volume, support/resistance levels, and chart patterns to forecast future price movements and market direction.

MENGO投资有哪些风险需要注意?

MENGO investment carries market volatility risk, price manipulation risk, regulatory uncertainty, and smart contract technical risks. Investors should carefully assess these factors before participating.

What are the advantages or disadvantages of MENGO compared to similar tokens?

MENGO offers a unique decentralized exchange model with strong liquidity benefits. However, it faced structural vulnerabilities exploited in 2022, raising security concerns that may impact long-term confidence compared to competing tokens.

MENGO的历史价格表现和市场流动性如何?

MENGO has demonstrated significant historical volatility, reaching an all-time high of $4.03. Currently trading between $0.06591-$0.07146, the token shows active market participation with steady trading volume, indicating healthy liquidity conditions for traders in the market.

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Newbie Must Read: How to Formulate Investment Strategies When Nasdaq Turns Positive in 2025

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

How to Mine Ethereum in 2025: A Complete Guide for Beginners

Best Crypto Wallets 2025: How to Choose and Secure Your Digital Assets

TapSwap Listing Date: What Investors Need to Know in 2025

What is MOBI: A Comprehensive Guide to Amazon's E-Book File Format and Its Uses

What is ALMANAK: A Comprehensive Guide to Digital Calendar and Event Management Systems

Proof of Work vs Proof of Stake: Which Is Superior?

What is RWAINC: A Comprehensive Guide to Real-World AI and Networking Capabilities

The Most Promising Cryptocurrencies: Where to Invest