2026 MMPRO Price Prediction: Expert Analysis and Market Forecast for the Next Generation Cryptocurrency

Introduction: MMPRO's Market Position and Investment Value

Market Making Pro (MMPRO), positioned as a B2B SaaS one-stop solution for market making in cryptocurrency CEX and DEX exchanges, has been serving the crypto market since its launch. As of 2026, MMPRO maintains a market capitalization of approximately $285,358, with a circulating supply of around 92.08 million tokens, and the price stabilizes at approximately $0.003099. This asset, characterized as a comprehensive market-making platform integrated with liquidity mining and NFT reward systems, is playing an increasingly important role in addressing liquidity needs across centralized and decentralized trading venues.

This article will comprehensively analyze MMPRO's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. MMPRO Price History Review and Market Status

MMPRO Historical Price Evolution Trajectory

- 2022: MMPRO reached a notable price level in April, with the token trading at $0.824202 on April 10

- 2025: The token experienced significant downward pressure, declining to $0.00247369 on December 25

- Recent Period: The token has shown price fluctuations, with a one-year decline of approximately 59.01%, reflecting broader market adjustments

MMPRO Current Market Situation

As of February 7, 2026, MMPRO is trading at $0.003099, with a 24-hour trading volume of $21,050.80. The token's market capitalization stands at approximately $285,358.26, with a circulating supply of 92,080,754.83 MMPRO tokens, representing 92.08% of the maximum supply of 100 million tokens.

In terms of recent price movement, MMPRO has demonstrated mixed performance across different timeframes. Over the past hour, the token has increased by 0.18%, while maintaining stability over the 24-hour period. However, the token has experienced a decline of 0.89% over the past week and 10.61% over the past 30 days.

The token's 24-hour price range has been relatively narrow, fluctuating between $0.003093 and $0.003107. The fully diluted market capitalization is calculated at $309,900, with the token holding approximately 0.000012% of the total cryptocurrency market share.

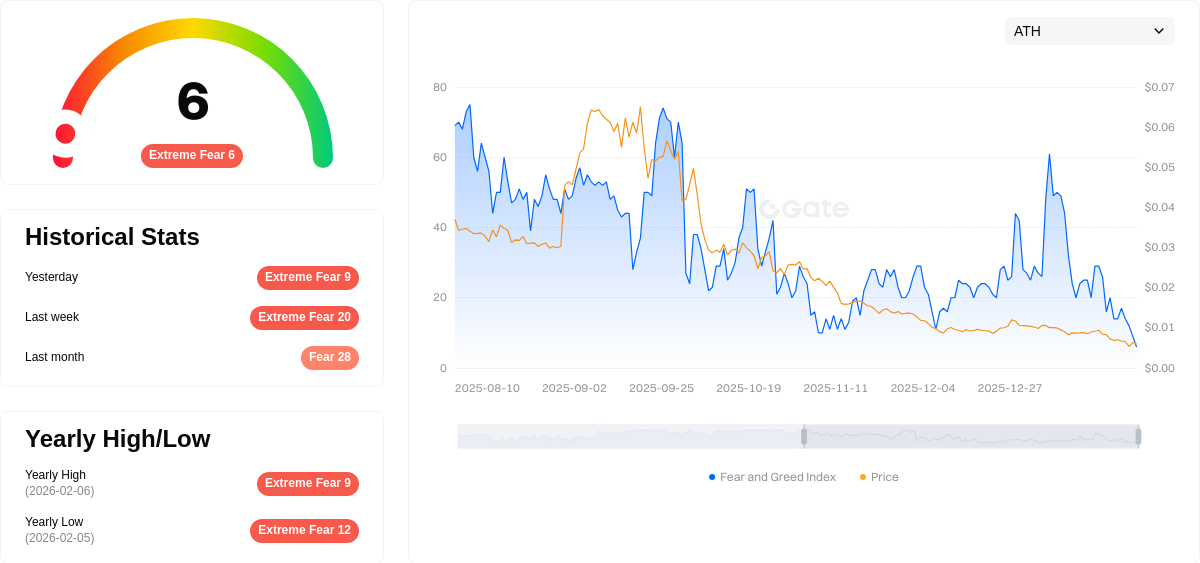

MMPRO is currently supported on one exchange platform and has a holder base of 11,607 addresses. The token operates on the Binance Smart Chain (BSC), with its contract address verified on BscScan. According to market sentiment indicators, the current fear and greed index stands at 6, suggesting an "Extreme Fear" market condition.

Click to view the current MMPRO market price

MMPRO Market Sentiment Index

2026-02-07 Fear and Greed Index: 6 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to just 6 points. This indicates severe market pessimism and heightened risk aversion among investors. During such extreme fear periods, market volatility typically intensifies as panic selling accelerates. However, historically, extreme fear conditions often precede significant recovery opportunities for long-term investors with strong conviction. It's crucial to maintain a calm approach and conduct thorough research before making investment decisions during such turbulent market conditions.

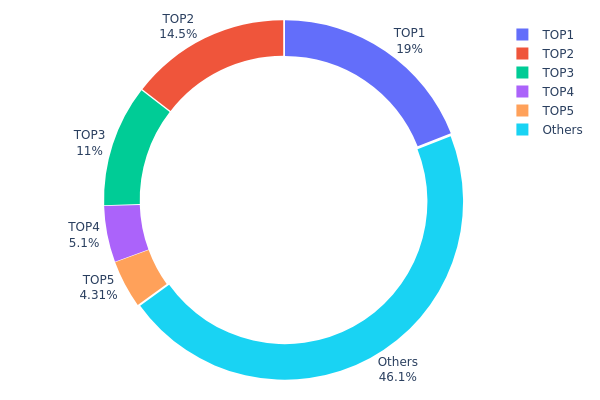

MMPRO Holdings Distribution

The holdings distribution chart reflects the concentration of token supply across different wallet addresses, serving as a crucial indicator of decentralization and potential market manipulation risks. According to current on-chain data, the top holder controls 19.02% of MMPRO's total supply (19,023.41K tokens), while the second-largest address holds 14.50% (14,500.00K tokens). Notably, the burn address (0x0000...00dead) ranks third with 11.01% of tokens permanently removed from circulation, demonstrating the project's deflationary mechanism.

The top 5 addresses collectively control approximately 53.93% of the total supply, indicating a moderately high concentration level. The remaining 46.07% is distributed among other holders, suggesting a relatively concentrated ownership structure. This concentration pattern presents both opportunities and risks: while large holders may provide price stability during volatile periods, their position sizes also grant them significant influence over market movements. The presence of substantial tokens in the burn address partially mitigates centralization concerns by reducing the effective circulating supply.

From a market structure perspective, this distribution pattern suggests that MMPRO remains vulnerable to coordinated selling pressure from top holders. However, the nearly equal holdings between the first and second-largest addresses (19.02% vs. 14.50%) indicate a balance of power that may prevent single-entity domination. The current distribution reflects a developing ecosystem where early adopters and institutional participants maintain significant positions, typical of projects in growth phases where token distribution is gradually transitioning toward broader community ownership.

Click to view current MMPRO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x82ff...92889c | 19023.41K | 19.02% |

| 2 | 0x0c89...518820 | 14500.00K | 14.50% |

| 3 | 0x0000...00dead | 11010.55K | 11.01% |

| 4 | 0xb655...0447cf | 5099.99K | 5.09% |

| 5 | 0x0d07...b492fe | 4313.19K | 4.31% |

| - | Others | 46052.86K | 46.07% |

II. Core Factors Influencing MMPRO's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Global central banks' policy directions significantly affect MMPRO's valuation. Currency devaluation trends and inflationary pressures create conditions that may influence price movements, as investors seek alternative stores of value during periods of monetary expansion.

-

Inflation Hedging Attribute: In environments characterized by rising inflation and currency depreciation, MMPRO may exhibit characteristics similar to other alternative assets that investors consider for portfolio diversification and value preservation strategies.

-

Geopolitical Factors: International tensions and geopolitical uncertainties contribute to market volatility. Recent developments in various regions have created an environment where investors reassess their asset allocations, potentially impacting demand dynamics for digital assets including MMPRO.

Technology Development and Ecosystem Building

-

Technological Advancements: The rapid progression of artificial intelligence and related technologies drives increased demand for data center infrastructure and associated components. This technological shift creates new use cases and potential applications that may influence the broader ecosystem in which MMPRO operates.

-

Ecosystem Applications: The expansion of technological infrastructure, particularly in areas requiring advanced computing capabilities, establishes a foundation for ecosystem development. However, specific applications and their direct impact on MMPRO require further observation as the market evolves.

Regulatory Environment

-

Policy Changes: Regulatory frameworks continue to evolve globally, with authorities implementing various measures to address market dynamics. Historical patterns suggest that regulatory interventions can trigger significant price adjustments, as demonstrated by margin requirement changes and trading restrictions in comparable markets.

-

Market Oversight: Enhanced regulatory scrutiny aims to maintain market stability and protect participants. These oversight mechanisms may influence trading patterns and liquidity conditions, which in turn affect price discovery processes for MMPRO and similar assets.

III. 2026-2031 MMPRO Price Forecast

2026 Outlook

- Conservative forecast: $0.00236 - $0.0031

- Neutral forecast: $0.0031 (average expected value)

- Optimistic forecast: $0.00431 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: During this period, MMPRO may experience gradual growth as the project matures and expands its ecosystem partnerships

- Price range forecast:

- 2027: $0.00356 - $0.00504, with an average of $0.00371 (approximately 19% increase from 2026)

- 2028: $0.00424 - $0.00599, with an average of $0.00438 (approximately 41% cumulative increase)

- 2029: $0.00467 - $0.0071, with an average of $0.00519 (approximately 67% cumulative increase)

- Key catalysts: Project development milestones, community engagement growth, and broader cryptocurrency market sentiment recovery

2030-2031 Long-term Outlook

- Baseline scenario: $0.0059 - $0.00645 in 2030 (assuming steady ecosystem development and stable market conditions)

- Optimistic scenario: $0.00504 - $0.00938 in 2031 (assuming accelerated adoption and favorable regulatory environment, with potential 103% increase from baseline)

- Transformational scenario: Above $0.00938 (requires exceptional market conditions, major partnership announcements, and significant technological breakthroughs)

- 2026-02-07: MMPRO is positioned at the early stage of its forecasted growth trajectory, with current predictions suggesting multi-year appreciation potential

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00431 | 0.0031 | 0.00236 | 0 |

| 2027 | 0.00504 | 0.00371 | 0.00356 | 19 |

| 2028 | 0.00599 | 0.00438 | 0.00424 | 41 |

| 2029 | 0.0071 | 0.00519 | 0.00467 | 67 |

| 2030 | 0.00645 | 0.00614 | 0.0059 | 98 |

| 2031 | 0.00938 | 0.0063 | 0.00504 | 103 |

IV. MMPRO Professional Investment Strategy and Risk Management

MMPRO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to DeFi market-making infrastructure and liquidity provision platforms

- Operational Recommendations:

- Consider dollar-cost averaging to mitigate entry price volatility, given the token's historical price fluctuation from ATH of $0.824202 to current levels

- Monitor the platform's market-making services adoption and NFT system developments as key value drivers

- Utilize secure storage solutions such as Gate Web3 Wallet for long-term holdings

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume ($21,050.80) relative to market cap ($285,358.26) to identify liquidity patterns

- Support and Resistance Levels: Track the 24-hour range between $0.003093 (low) and $0.003107 (high) for short-term entry and exit points

- Swing Trading Considerations:

- The token has shown recent weakness with -0.89% over 7 days and -10.61% over 30 days, suggesting cautious position sizing

- Monitor hourly momentum indicators, noting the +0.18% 1-hour change for potential short-term reversal signals

MMPRO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation, given the token's volatility and -59.01% yearly performance

- Aggressive Investors: 3-5% allocation, with strict stop-loss protocols

- Professional Investors: May allocate up to 5-8% with active hedging strategies and regular rebalancing

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance MMPRO exposure with established DeFi tokens and stablecoins to reduce sector-specific risk

- Position Sizing: Limit individual position to levels that allow for potential 50%+ drawdowns without materially impacting overall portfolio

(3) Secure Storage Solutions

- Non-Custodial Wallet Recommendation: Gate Web3 Wallet provides secure storage with user-controlled private keys

- Multi-Signature Options: For larger holdings, consider implementing multi-signature wallet configurations

- Security Precautions: Enable two-factor authentication, regularly update security protocols, never share private keys, and be vigilant against phishing attempts targeting BSC-based tokens

V. MMPRO Potential Risks and Challenges

MMPRO Market Risks

- High Volatility: The token has experienced substantial price decline of 59.01% over the past year, indicating significant market volatility and potential for further downside

- Low Liquidity Concerns: With 24-hour trading volume of approximately $21,051 against a market cap of $285,358, the relatively low liquidity may result in higher slippage and difficulty executing larger orders

- Limited Exchange Availability: Currently trading on only 1 exchange may restrict accessibility and price discovery efficiency

MMPRO Regulatory Risks

- DeFi Regulatory Uncertainty: As regulatory frameworks evolve globally for decentralized market-making platforms and liquidity provision services, potential compliance requirements may impact operational models

- Token Classification Ambiguity: Uncertainty around whether utility tokens associated with market-making services may face regulatory scrutiny in various jurisdictions

- Cross-Border Compliance: Operating across both CEX and DEX environments may create complex regulatory obligations as different jurisdictions develop crypto asset regulations

MMPRO Technical Risks

- Smart Contract Vulnerabilities: As a BSC-based token (contract: 0x6067490d05f3cf2fdffc0e353b1f5fd6e5ccdf70), potential smart contract bugs or exploits could affect token security and platform functionality

- Platform Development Risk: The success of the B2B SaaS market-making solution, liquidity mining platform, and NFT system depends on continued technical development and adoption

- Blockchain Network Dependencies: Reliance on BSC infrastructure means network congestion, security incidents, or technical issues on the underlying blockchain could impact token operations

VI. Conclusion and Action Recommendations

MMPRO Investment Value Assessment

Market Making Pro represents a specialized niche within the DeFi infrastructure sector, focusing on B2B market-making solutions across both centralized and decentralized exchanges. The project's value proposition centers on providing liquidity provision tools, a mining platform, and NFT-based reward mechanisms. However, the token has experienced substantial price depreciation of 59.01% over the past year and currently trades at $0.003099, significantly below its all-time high of $0.824202. With a circulating supply of approximately 92.08 million tokens (92.08% of max supply) and relatively modest trading volume, investors should carefully weigh the platform's potential for adoption against current market performance and liquidity constraints.

MMPRO Investment Recommendations

✅ Beginners: Exercise extreme caution and consider MMPRO only as a small speculative position (under 1% of portfolio) if interested in DeFi infrastructure. Prioritize education about market-making platforms and ensure understanding of token mechanics before investing.

✅ Experienced Investors: May consider MMPRO as a satellite holding (2-3% allocation) within a diversified DeFi portfolio, with strict risk management protocols including stop-losses and regular performance reviews. Focus on monitoring platform development milestones and adoption metrics.

✅ Institutional Investors: Conduct thorough due diligence on the platform's B2B market-making services, competitive positioning, and regulatory compliance. Consider MMPRO only as part of a broader DeFi infrastructure thesis with appropriate risk controls and hedging strategies.

MMPRO Trading Participation Methods

- Spot Trading: Direct purchase and sale of MMPRO tokens on supported exchanges, suitable for both long-term holding and active trading strategies

- Secure Storage: Utilize Gate Web3 Wallet or other reputable BSC-compatible wallets for secure token custody with full private key control

- Platform Participation: Engage with the Market Making Pro ecosystem's liquidity mining features and NFT system to potentially generate additional yield, while understanding associated smart contract risks

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the current price of MMPRO? How has the historical price trend been?

MMPRO is currently trading at $0.0030931, down 0.24% in the past 24 hours. The token has shown moderate volatility with potential for recovery as market conditions stabilize. Historical price charts are available on TradingView for detailed trend analysis.

Will MMPRO price rise or fall in the future? What factors affect price predictions?

MMPRO price may rise or fall, primarily driven by market supply and demand dynamics. Key factors include trading volume, adoption rate, network development progress, and overall crypto market sentiment. Increased institutional interest and platform upgrades typically support upward momentum.

How does MMPRO compare to similar tokens in terms of investment value and risk?

MMPRO features fixed supply with anti-inflationary potential and multi-chain deployment advantages. Compared to similar tokens, it offers unique scarcity model. However, risks include market volatility, liquidity constraints, and speculative pressures. Success depends on ecosystem adoption and sustained demand.

What is the fundamentals of MMPRO project? How about the team background and technical strength?

MMPRO is led by an experienced team with strong financial backgrounds and robust technical capabilities, delivering innovative blockchain solutions and maintaining solid market fundamentals for long-term growth.

What risks should I consider when investing in MMPRO? How can I manage these risks?

MMPRO investment involves market volatility and regulatory risks. Manage risk through portfolio diversification, position sizing, and regular monitoring. Stay informed on market trends and maintain a long-term investment perspective for optimal returns.

Where can MMPRO be traded and what is the liquidity like?

MMPRO maintains strong liquidity across major platforms with consistent trading volume. The token benefits from robust market presence and easy accessibility for traders seeking to buy or sell MMPRO positions.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

What Is Market Capitalization? Why Is It Important in Crypto?

Top 7 Best Stock Investment Apps for Vietnamese Investors

Cryptocurrency Lending Mechanisms and Domestic Service Providers

10 Best NFT Marketing Agencies To Promote Your Digital Art

What Is an Automated Market Maker?