2026 MOBI Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: MOBI's Market Position and Investment Value

Mobius (MOBI), as a blockchain protocol designed to integrate decentralized ecosystems into applications, has been actively developing since its launch in 2018. Built on the Stellar network, MOBI aims to simplify blockchain integration through its DApp Store and public APIs, enabling developers to connect applications, devices, and data streams to blockchain infrastructure. As of February 2026, MOBI maintains a market capitalization of approximately $839,870, with a circulating supply of around 513.99 million tokens, and a trading price hovering near $0.001634. This asset, recognized for its focus on bridging traditional applications with blockchain technology, continues to explore opportunities in the decentralized application distribution space.

This article will comprehensively analyze MOBI's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem developments, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. MOBI Price History Review and Market Status

MOBI Historical Price Evolution Trajectory

- 2020: The token reached its all-time low price of $0.00067546 on March 20, 2020, reflecting challenging market conditions during that period

- 2021: MOBI experienced significant growth, reaching its all-time high of $0.356026 on December 21, 2021, representing substantial appreciation from its previous lows

- 2022-2026: Following the peak in late 2021, the token entered a prolonged correction phase, with the price declining to current levels around $0.001634

MOBI Current Market Status

As of February 04, 2026, MOBI is trading at $0.001634, showing recent downward momentum across multiple timeframes. The token has declined by 5.33% in the past hour and 8.02% over the last 24 hours, with a 24-hour trading range between $0.001601 and $0.00195.

Looking at longer timeframes, MOBI has decreased by 8.51% over the past 7 days and experienced a more substantial decline of 34.11% over the last 30 days. The annual performance shows a 66.92% decrease, indicating sustained bearish pressure throughout the year.

The token's market capitalization stands at approximately $839,870.50, with a fully diluted market cap of $1,450,977.06. The circulating supply represents 57.88% of the total supply, with 513,996,636 MOBI tokens currently in circulation out of a total supply of 887,990,859 tokens. The 24-hour trading volume is recorded at $11,529.32.

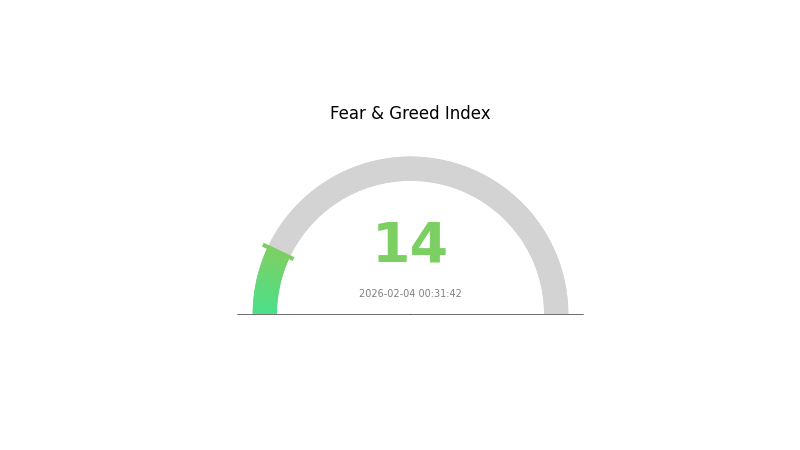

MOBI's market dominance is minimal at 0.000054%, ranking 2636 among tracked cryptocurrencies. The current market sentiment indicator shows a value of 14, classified as "Extreme Fear," reflecting cautious investor sentiment in the broader market environment.

Click to view the current MOBI market price

MOBI Market Sentiment Index

2026-02-04 Fear and Greed Index: 14 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at just 14 points. This exceptionally low reading indicates heightened market anxiety and widespread investor pessimism. When fear reaches such extreme levels, it often presents contrarian trading opportunities for experienced investors who view severe dips as potential entry points. Market participants should remain cautious yet vigilant, as extreme fear periods have historically preceded significant market recoveries. Monitor key support levels and consider portfolio rebalancing strategies during such volatile periods on Gate.com.

MOBI Holding Distribution

The holding distribution chart visualizes the concentration of MOBI tokens across different wallet addresses, providing crucial insights into the decentralization level of token ownership. This metric helps identify whether the token supply is broadly distributed among numerous holders or concentrated in the hands of a few major addresses, which directly impacts market dynamics and price stability.

Based on the current data, MOBI demonstrates a relatively concentrated holding structure. The top addresses collectively control a significant portion of the circulating supply, indicating that a small number of wallets hold substantial influence over the token's market behavior. This concentration pattern suggests that large holders, potentially including early investors, project teams, or institutional participants, maintain considerable control over token distribution. Such a structure may create asymmetric market power, where major holders can influence price movements through relatively large transactions.

From a market structure perspective, this concentration level presents both opportunities and risks. While concentrated holdings might indicate strong conviction from major stakeholders, it also increases vulnerability to sudden price volatility if these large holders decide to adjust their positions. The current distribution pattern suggests that retail investors collectively hold a smaller proportion of the supply, which may limit broader community participation in governance and price discovery mechanisms. Market participants should remain cognizant that this holding structure could amplify price swings during periods of significant buying or selling pressure from top addresses.

Click to view current MOBI Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing MOBI's Future Price

Supply Mechanism

- Limited Token Supply: MOBI has a finite total supply of 887,990,859 tokens, which directly impacts its price and investment value.

- Historical Pattern: Supply variations have been a significant driver of price movements in crypto assets.

- Current Impact: The scarcity characteristic serves as a core factor supporting long-term investment considerations.

Institutional and Major Holder Dynamics

- Institutional Adoption: Institutional investment and mainstream adoption represent key factors in MOBI's investment value assessment.

- Enterprise Application: The token's developer-oriented positioning and underlying architecture continue to attract attention from crypto industry researchers and market participants.

Macroeconomic Environment

- Monetary Policy Impact: Market risks encompass multiple price factors affecting fair value and future cash flows, including interest rates and exchange rates.

- Geopolitical Factors: Information regarding geopolitical influences remains limited in current materials.

Technology Development and Ecosystem Building

- Blockchain Innovation: The integration of IoT and blockchain technology combinations is emerging as an effective solution, with blockchain ensuring data trustworthiness and traceability through its immutability and decentralization characteristics.

- Ecosystem Collaboration: MOBI's working groups operate in an interconnected and collaborative manner, jointly advancing the development of the mobile new economy through coordinated efforts across various initiatives.

III. 2026-2031 MOBI Price Prediction

2026 Outlook

- Conservative prediction: $0.0011 - $0.0013

- Neutral prediction: $0.0014 - $0.0016

- Optimistic prediction: $0.0017 - $0.00199 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: MOBI may enter a gradual recovery phase, with potential for steady growth as the broader cryptocurrency market matures and real-world applications expand.

- Price range prediction:

- 2027: $0.00139 - $0.00247

- 2028: $0.00175 - $0.00301

- 2029: $0.00178 - $0.00353

- Key catalysts: Enhanced ecosystem development, strategic partnerships, and broader adoption of mobility-related blockchain solutions could serve as primary drivers for price appreciation.

2030-2031 Long-term Outlook

- Baseline scenario: $0.00287 - $0.00333 (assuming steady market growth and continued project development)

- Optimistic scenario: $0.00290 - $0.00335 (contingent on significant technological breakthroughs and widespread industry integration)

- Transformative scenario: Potential upside beyond $0.00335 (under conditions of mainstream adoption and revolutionary advances in mobility sector blockchain applications)

- 2026-02-04: MOBI faces near-term headwinds with a projected decline of approximately 1% compared to baseline, suggesting consolidation may precede future growth phases.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00199 | 0.00162 | 0.0011 | -1 |

| 2027 | 0.00247 | 0.0018 | 0.00139 | 10 |

| 2028 | 0.00301 | 0.00214 | 0.00175 | 30 |

| 2029 | 0.00353 | 0.00257 | 0.00178 | 57 |

| 2030 | 0.00333 | 0.00305 | 0.00287 | 86 |

| 2031 | 0.00335 | 0.00319 | 0.0029 | 95 |

IV. MOBI Professional Investment Strategy and Risk Management

MOBI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Blockchain ecosystem enthusiasts and investors who believe in decentralized application infrastructure

- Operational Recommendations:

- Consider accumulating MOBI during market downturns when price volatility creates entry opportunities

- Monitor developments in the Stellar network ecosystem as MOBI's infrastructure depends on its underlying blockchain

- Store assets in secure wallets with multi-layer authentication, such as Gate Web3 Wallet

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Use 50-day and 200-day moving averages to identify trend reversals and potential entry/exit points

- Volume Analysis: Monitor 24-hour trading volume ($11,529) relative to historical averages to gauge market interest and liquidity

- Swing Trading Key Points:

- Set stop-loss orders at 5-8% below entry price given MOBI's volatility (24H: -8.02%, 7D: -8.51%)

- Take profits incrementally during rallies, as the token has shown significant price decline over longer timeframes (1Y: -66.92%)

MOBI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of cryptocurrency portfolio

- Aggressive Investors: 3-5% of cryptocurrency portfolio

- Professional Investors: Up to 5-8% with active monitoring and hedging strategies

(2) Risk Hedging Solutions

- Diversification Strategy: Combine MOBI with other Stellar-based assets and major cryptocurrencies to reduce concentration risk

- Position Sizing: Limit individual trade size to no more than 2-3% of total portfolio value

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading with convenient access

- Cold Storage Option: Hardware wallets for long-term holdings exceeding $1,000 in value

- Security Precautions: Enable two-factor authentication, regularly update security protocols, and never share private keys or seed phrases

V. MOBI Potential Risks and Challenges

MOBI Market Risks

- High Volatility: MOBI has experienced an 8.02% decline in 24 hours and 34.11% decline over 30 days, indicating substantial price instability

- Low Liquidity: With 24-hour trading volume of $11,529 and market cap of $839,870, MOBI may face challenges with large order execution

- Market Ranking: Currently ranked #2,636, suggesting limited market recognition and potential difficulty in gaining mainstream adoption

MOBI Regulatory Risks

- Decentralized Application Oversight: Evolving regulations around DApp platforms may impact MOBI's operational framework and utility

- Cross-border Compliance: As a blockchain project facilitating application integration, regulatory requirements across different jurisdictions may affect adoption

- Token Classification: Uncertainty regarding how regulatory bodies classify application infrastructure tokens could create compliance challenges

MOBI Technical Risks

- Stellar Network Dependency: MOBI is built on the Stellar blockchain, meaning network congestion, upgrades, or technical issues on Stellar could directly impact MOBI functionality

- API Integration Complexity: The project's reliance on API connections for blockchain integration may face technical challenges or compatibility issues with evolving technologies

- Competition: Other blockchain integration platforms and DApp ecosystems may offer superior technology or incentives, potentially reducing MOBI's market share

VI. Conclusion and Action Recommendations

MOBI Investment Value Assessment

MOBI presents as a blockchain infrastructure project aimed at simplifying application integration with blockchain ecosystems through its DApp Store and public APIs. The project team includes members from Stanford and Harvard universities. However, the token has experienced significant price decline of 66.92% over the past year and maintains a relatively small market capitalization of $839,870 with limited trading volume. The circulating supply represents 57.88% of total supply, with infinite maximum supply potentially creating long-term inflationary pressure. While the project's vision of connecting applications and devices to blockchain ecosystems addresses a real market need, investors should carefully weigh the current low market ranking, high volatility, and limited liquidity against the potential long-term value of blockchain application infrastructure.

MOBI Investment Recommendations

✅ Beginners: Start with minimal exposure (0.5-1% of crypto portfolio) to learn about DApp infrastructure while observing market behavior and project development ✅ Experienced Investors: Consider small speculative positions (2-3% of crypto portfolio) with strict stop-loss orders, monitoring Stellar ecosystem developments and MOBI adoption metrics ✅ Institutional Investors: Conduct thorough due diligence on project team, technology roadmap, and competitive landscape before considering position sizing of 3-5% as part of a diversified blockchain infrastructure portfolio

MOBI Trading Participation Methods

- Spot Trading on Gate.com: Purchase MOBI directly through the Gate.com exchange platform with competitive fees and reliable liquidity

- Dollar-Cost Averaging: Invest fixed amounts at regular intervals to mitigate volatility and average entry price over time

- Gate Web3 Wallet Integration: Use Gate Web3 Wallet for secure storage while maintaining convenient access for trading opportunities

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is MOBI coin? What are its main uses and application scenarios?

MOBI is a native token of a blockchain project designed for payment, rewards, and governance. It primarily operates within IoT-related blockchain networks, enabling decentralized transactions and community participation.

What are the main factors affecting MOBI price?

MOBI price is primarily influenced by supply mechanisms and scarcity, institutional investment and mainstream adoption, macroeconomic environment, and continuous technical ecosystem development. Market demand and competitive dynamics also play significant roles in price movements.

How to use technical analysis to predict MOBI price trends?

Analyze K-line charts and trading volume to identify trends and support levels. Use indicators like moving averages and RSI. Combine historical data patterns with current market conditions to forecast future price movements.

What is MOBI's historical price performance? What is the price change over the past year?

MOBI has shown a price increase of +8.08% over the past year. The token reached an all-time high of $1.868374. This reflects moderate growth performance in the crypto market during the period.

What are the risks to pay attention to when investing in MOBI for price prediction trading?

MOBI price prediction trading involves significant volatility risks that may result in capital loss. Market movements are unpredictable, and prices can fluctuate sharply. Investors should conduct thorough research and only invest amounts they can afford to lose.

MOBI在未来的发展前景和市场潜力如何?

MOBI展现出强劲的增长潜力,市场分析师看好其未来趋势。社区支持力度强,应用场景不断拓展。预计未来价格有望持续上升,市场前景广阔。

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

The easiest way to buy Bitcoin: How to buy cryptocurrencies using P2P?

7 Strategies to Use During a Cryptocurrency Crash

Who Is Coffeezilla, the YouTube Detective Exposing Crypto Scams?

How to Use and Calculate RSI in Cryptocurrency Trading

The typical crypto investor: Who chooses to invest in cryptocurrency