2026 MTV Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: MTV's Market Position and Investment Value

MultiVAC (MTV), as a flexible public blockchain based on trusted sharding designed for large-scale decentralized applications, has been developing since its launch in 2019. As of 2026, MTV maintains a market capitalization of approximately $757,000, with a circulating supply of around 3.46 billion tokens, and a price hovering at $0.0002188. This asset, recognized as a "next-generation high-performance blockchain platform," is playing an increasingly important role in supporting complex commercial DApps through its full-dimensional sharding solution.

This article will comprehensively analyze MTV's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. MTV Price History Review and Current Market Status

MTV Historical Price Evolution Trajectory

- 2020: On March 13, 2020, MTV reached its historical low price of $0.00015261, reflecting challenging market conditions during that period.

- 2021: MTV achieved significant price appreciation during the 2021 market cycle, reaching its historical high of $0.0290681 on October 27, 2021, representing substantial growth from its earlier lows.

- 2022-2026: Following the peak in late 2021, MTV experienced a notable correction phase, with the price declining over subsequent years as part of broader market adjustments.

MTV Current Market Status

As of February 4, 2026, MTV is trading at $0.0002188, showing a modest increase of 0.03% over the past hour. The 24-hour trading volume stands at $25,443.24, with the price fluctuating between a low of $0.00021536 and a high of $0.00022376 during this period.

Over the past 24 hours, MTV has experienced a decline of 1.88%. The weekly performance shows a decrease of 5.16%, while the monthly trend indicates a decline of 25.61%. The one-year performance reflects a decrease of 60.49%, demonstrating the ongoing price adjustment phase.

MTV's current market capitalization is approximately $757,000, with a circulating supply of 3.46 billion tokens out of a total supply of 10 billion tokens, representing a circulation ratio of approximately 34.6%. The fully diluted market capitalization stands at $2.19 million. The current market dominance is 0.000080%, reflecting its position within the broader cryptocurrency market landscape.

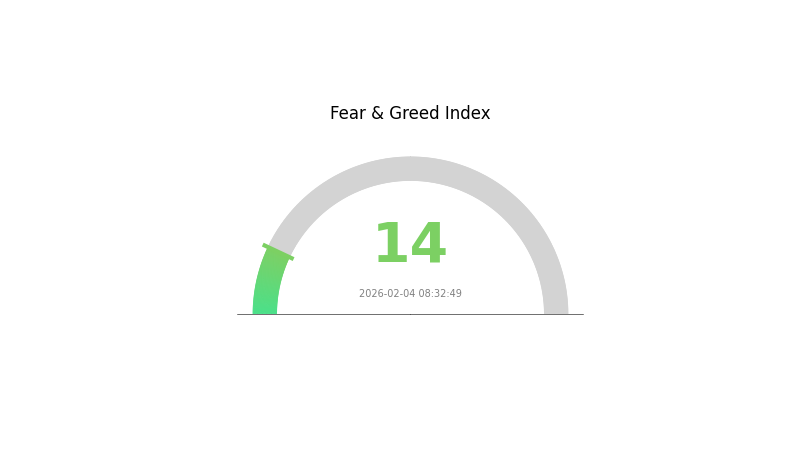

The market sentiment indicator shows a reading of 14, classified as "Extreme Fear," suggesting cautious investor sentiment in the current market environment. MTV is listed on 2 exchanges and has approximately 19,777 token holders.

Click to view current MTV market price

MTV Market Sentiment Index

2026-02-04 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at 14. This indicates significant market pessimism and investor anxiety. Such extreme fear conditions historically present contrarian opportunities, as markets often experience sharp reversals when sentiment reaches these levels. However, traders should exercise caution and conduct thorough due diligence before making investment decisions. Market volatility remains elevated, and risk management is paramount during periods of extreme fear.

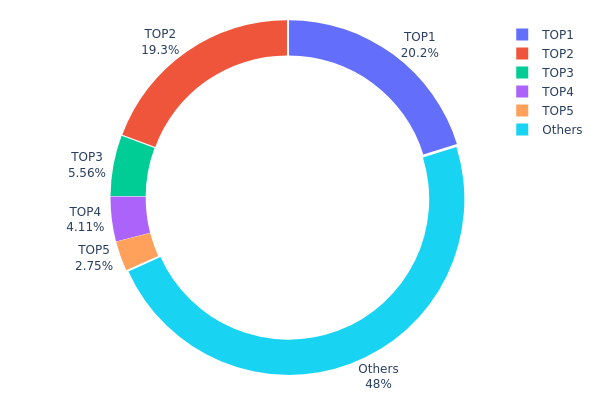

MTV Holding Distribution

The holding distribution chart reflects the concentration of token ownership across different wallet addresses on the blockchain network. By analyzing the percentage of total supply held by top addresses versus smaller holders, this metric provides insights into the decentralization level and potential market manipulation risks of a cryptocurrency project.

Based on the current data, MTV exhibits a moderately high concentration pattern. The top address holds 2,020,949.49K tokens (20.20% of total supply), while the second-largest address controls 1,932,562.22K tokens (19.32%). Combined, the top two addresses account for approximately 39.52% of the total circulating supply. The top five addresses collectively hold 51.92% of all tokens, leaving 48.08% distributed among other holders. This distribution pattern indicates that a significant portion of MTV's supply is concentrated in a relatively small number of wallets, which could be attributed to team reserves, early investor allocations, or strategic institutional holdings.

This concentration level presents both opportunities and risks for the MTV ecosystem. On one hand, such distribution may reflect strong conviction from early supporters and provide price stability during market volatility. On the other hand, the substantial holdings in top addresses create potential risks for sudden market movements if these large holders decide to liquidate their positions. The relatively balanced distribution between top holders and the "Others" category (48.08%) suggests that while concentration exists, there is still a meaningful degree of token dispersion across the broader community. Investors should monitor changes in this distribution pattern over time, as shifts in top holder positions could signal important developments in project fundamentals or market sentiment.

Click to view current MTV Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...000000 | 2020949.49K | 20.20% |

| 2 | 0x6d6c...797fec | 1932562.22K | 19.32% |

| 3 | 0x175c...69c9cc | 555987.94K | 5.55% |

| 4 | 0x446b...d027ba | 411486.12K | 4.11% |

| 5 | 0x58ed...a36a51 | 274676.79K | 2.74% |

| - | Others | 4804337.43K | 48.08% |

II. Core Factors Affecting MTV's Future Price

Supply Mechanisms

- Token Supply Structure: MTV's price trajectory is influenced by its supply mechanisms, which govern token distribution and circulation patterns.

- Historical Pattern: Historical supply adjustments have demonstrated measurable impacts on MTV's price movements, with controlled supply releases generally supporting price stability.

- Current Impact: The existing supply framework continues to shape market expectations and investor sentiment regarding MTV's valuation trends.

Institutional and Major Holder Dynamics

- Institutional Involvement: Institutional participation represents a significant factor in MTV's market development, though specific holdings data requires further verification.

- Market Participation: The level of institutional engagement influences MTV's liquidity profile and overall market depth.

Macroeconomic Environment

- Monetary Policy Influence: Central bank policies and broader monetary conditions affect cryptocurrency markets, including MTV's trading dynamics.

- Economic Indicators: Macroeconomic factors such as interest rate expectations and liquidity conditions contribute to investor risk appetite in digital assets.

- Geopolitical Considerations: International economic developments may influence capital flows into cryptocurrencies, potentially affecting MTV's market performance.

Technological Development and Ecosystem Growth

- Technical Infrastructure: MTV's underlying technology infrastructure supports its operational functionality and network capabilities.

- Ecosystem Applications: The development of applications and use cases within MTV's ecosystem may contribute to its utility proposition and adoption potential.

III. 2026-2031 MTV Price Prediction

2026 Outlook

- Conservative Prediction: $0.00014 - $0.00022

- Neutral Prediction: $0.00022 (average price scenario)

- Optimistic Prediction: $0.00027 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market Stage Expectation: MTV may enter a gradual growth phase with moderate price appreciation as the project develops its ecosystem and expands its user base

- Price Range Prediction:

- 2027: $0.00017 - $0.00028 (approximately 11% increase from 2026)

- 2028: $0.00014 - $0.00033 (potential 19% growth with enhanced volatility)

- 2029: $0.00019 - $0.00044 (possible 35% appreciation driven by market maturation)

- Key Catalysts: Market sentiment shifts, technological improvements, broader cryptocurrency adoption trends, and potential partnerships could drive price movements during this period

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00025 - $0.00044 (assuming steady development and market stability)

- Optimistic Scenario: $0.00037 - $0.00053 (with strong ecosystem growth and favorable regulatory environment)

- Transformative Scenario: Approaching $0.00053 (under exceptionally favorable conditions including significant technological breakthroughs and mass adoption)

- 2026-02-04: MTV shows a stable foundation with projected average price of $0.00022, positioning for potential long-term growth trajectory

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00027 | 0.00022 | 0.00014 | 0 |

| 2027 | 0.00028 | 0.00024 | 0.00017 | 11 |

| 2028 | 0.00033 | 0.00026 | 0.00014 | 19 |

| 2029 | 0.00044 | 0.0003 | 0.00019 | 35 |

| 2030 | 0.00044 | 0.00037 | 0.00025 | 68 |

| 2031 | 0.00053 | 0.00041 | 0.00038 | 85 |

IV. MTV Professional Investment Strategy and Risk Management

MTV Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to blockchain scalability solutions with high risk tolerance

- Operational recommendations:

- Consider accumulating positions during market corrections, particularly when price approaches support levels around $0.000215

- Monitor development progress and ecosystem updates to assess long-term viability

- Utilize Gate Web3 Wallet for secure storage with private key control

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Track 50-day and 200-day moving averages to identify trend direction and potential reversal points

- Volume Analysis: Monitor the 24-hour trading volume ($25,443) relative to historical averages to confirm trend strength

- Swing trading key points:

- Set stop-loss orders below recent lows ($0.000215) to limit downside exposure

- Take partial profits at resistance levels to manage risk in volatile conditions

MTV Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 0.5-1% of crypto portfolio

- Aggressive investors: 2-3% of crypto portfolio

- Professional investors: Up to 5% with active risk monitoring

(2) Risk Hedging Solutions

- Diversification: Balance MTV holdings with established cryptocurrencies and stablecoins

- Position sizing: Limit exposure due to low market cap ($757,000) and liquidity constraints

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet for convenient trading and DApp interaction

- Cold storage solution: Consider hardware wallet solutions for long-term holdings exceeding $1,000

- Security precautions: Never share private keys, enable two-factor authentication, and verify contract addresses (0x6226e00bCAc68b0Fe55583B90A1d727C14fAB77f) before transactions

V. MTV Potential Risks and Challenges

MTV Market Risks

- Liquidity risk: With daily trading volume of only $25,443 and listing on only 2 exchanges, selling large positions may significantly impact price

- Volatility risk: Recent price movements show declines of 5.16% (7D), 25.61% (30D), and 60.49% (1Y), indicating substantial price instability

- Market cap risk: With market cap of approximately $757,000 and market dominance of only 0.000080%, MTV is highly susceptible to market manipulation

MTV Regulatory Risks

- Classification uncertainty: Evolving regulatory frameworks may impact trading availability or compliance requirements

- Exchange delisting risk: Low trading volume may lead to reduced exchange support

- Regional restrictions: Future regulatory changes could limit accessibility in certain jurisdictions

MTV Technical Risks

- Development risk: As a blockchain infrastructure project, execution delays or technical challenges in achieving full-dimensional sharding could impact adoption

- Competition risk: Established layer-1 blockchains with proven scalability solutions may limit MTV's market penetration

- Adoption risk: With 19,777 holders and limited ecosystem development, achieving critical mass remains challenging

VI. Conclusion and Action Recommendations

MTV Investment Value Assessment

MultiVAC presents a high-risk, speculative investment opportunity focused on blockchain scalability through trusted sharding technology. While the project's technical approach to addressing the blockchain trilemma through multi-dimensional sharding is innovative, significant concerns exist regarding market liquidity, trading volume, and ecosystem development. The token has experienced considerable depreciation from its all-time high of $0.029068 (October 2021) to its current price of $0.0002188, representing a decline of over 99%. The extremely low market cap and limited exchange listings indicate early-stage or distressed project status. Investors should approach MTV with extreme caution and only allocate capital they can afford to lose entirely.

MTV Investment Recommendations

✅ Beginners: Avoid MTV investment due to extreme volatility, low liquidity, and significant technical complexity. Focus on established cryptocurrencies with stronger fundamentals ✅ Experienced investors: Consider only micro-allocation (under 1% of portfolio) for speculative purposes, with strict stop-loss parameters and regular monitoring ✅ Institutional investors: Conduct comprehensive due diligence on development progress, team credentials, and competitive positioning before any allocation consideration

MTV Trading Participation Methods

- Spot trading: Access MTV/USDT trading pairs on Gate.com with appropriate risk management protocols

- Dollar-cost averaging: For those with conviction in the technology, systematic small purchases may reduce timing risk

- Portfolio rebalancing: Regularly review position size relative to overall portfolio to prevent overexposure

Cryptocurrency investment carries extreme risk, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is MTV's historical price performance?

MTV reached its all-time high of $0.0290681 on October 27, 2021, and its all-time low of $0.00015261 on March 13, 2020. The token has experienced significant volatility throughout its history, reflecting dynamic market conditions and evolving investor sentiment in the crypto market.

What are the main factors affecting MTV price?

MTV price is primarily influenced by regulatory changes, market trading volume, overall market sentiment, technological progress, and institutional adoption. These factors collectively impact price movements in the cryptocurrency market.

How to predict MTV price? What are the analysis methods?

Predict MTV prices using technical analysis(chart patterns,indicators),fundamental analysis(project metrics,market trends),and on-chain data analysis(transaction volume,holder distribution). Combine multiple methods for accurate predictions.

What are MTV's future price prospects?

MTV shows strong growth potential driven by increasing adoption and market demand. With expanding use cases and development progress, analysts expect positive price momentum. Long-term outlook remains optimistic for early supporters.

What is the risk level of MTV price volatility?

MTV exhibits high price volatility driven by market demand, liquidity fluctuations, and external factors. Price swings can be significant, making it suitable for experienced traders. Monitor market conditions and manage risk accordingly before trading.

What are MTV's advantages and disadvantages compared to similar tokens?

MTV's main advantages include strong community incentives and active ecosystem participation. Disadvantages include high market volatility and limited unique technical differentiation from competitors.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Comprehensive Guide to No-KYC Crypto Exchanges

Comprehensive Guide to Take Profit and Stop Loss in Trading

Top Cryptocurrencies to Watch in 2025: Investment Opportunities

NFT: What Is Digital Art and How Does It Differ from Traditional Artworks?

Top 7 Bitcoin Mining Machines for Cryptocurrency Mining Operations