2026 PAL Price Prediction: Expert Analysis and Market Forecast for Palantir Technologies Stock

Introduction: PAL's Market Position and Investment Value

Palio (PAL), as the pioneering token launched on the Xterio platform with a distinctive "Community First" philosophy, has established its presence in the AI-powered gaming ecosystem since its debut in 2025. As of February 2026, PAL maintains a market capitalization of approximately $561,830, with a circulating supply of 190 million tokens and a current trading price around $0.002957. This innovative asset, characterized as an "AI companion gaming token," is playing an increasingly significant role in bridging artificial intelligence, emotional engagement, and blockchain gaming.

This article will comprehensively analyze PAL's price trajectory from 2026 through 2031, incorporating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. PAL Price History Review and Current Market Status

PAL Historical Price Evolution Trajectory

- 2025: Token launched on Xterio platform on July 7 with an initial offering price of $0.05, reaching an all-time high of $0.0314 on the same day

- 2025-2026: Price experienced significant correction following launch, declining through the second half of 2025

- 2026: On January 1, the token reached its all-time low of $0.002127, marking a substantial retreat from its peak levels

PAL Current Market Situation

As of February 5, 2026, PAL is trading at $0.002957, representing a decline of 90.58% from its all-time high. The token has shown negative momentum across multiple timeframes, with a 24-hour decrease of 5.14%, weekly decline of 24.10%, and monthly drop of 7.85%. The annual performance indicates a substantial decrease of 94.05%.

The current 24-hour trading range spans from $0.002942 to $0.003123, with total trading volume of $13,590.59. PAL maintains a market capitalization of approximately $561,830, with 190 million tokens in circulation out of a maximum supply of 1 billion tokens, resulting in a circulation ratio of 19%. The fully diluted market cap stands at $2,957,000, with the market cap to FDV ratio at 19%.

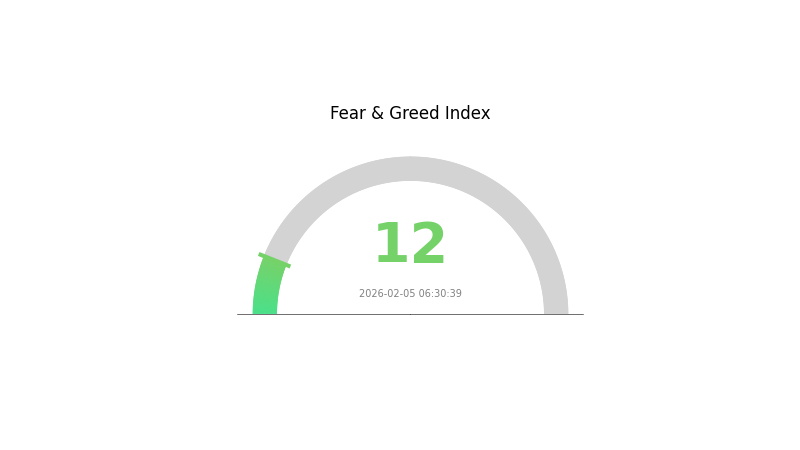

The token ranks #2947 in the overall cryptocurrency market, holding a market dominance of 0.00011%. Current market sentiment indicators show extreme fear conditions with a volatility index of 12. The project has garnered a holder base of 3,914 addresses and is listed on 5 exchanges.

Click to view current PAL market price

PAL Market Sentiment Indicator

2026-02-05 Fear and Greed Index: 12 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the index plunging to 12. This exceptionally low reading signals severe market pessimism and widespread investor anxiety. During periods of extreme fear, opportunities often emerge for contrarian investors willing to take calculated risks. Historical patterns suggest such extreme sentiment levels frequently precede market reversals. However, exercise caution as further downside volatility remains possible. Monitor key support levels closely and consider your risk tolerance before making trading decisions. This sentiment environment warrants careful portfolio management and strategic positioning.

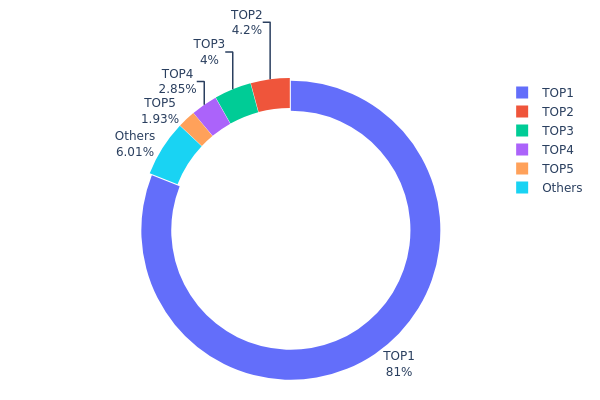

PAL Holding Distribution

According to the on-chain holding distribution data, PAL tokens exhibit a highly concentrated ownership structure. The top holder controls 810 million tokens, accounting for 81% of the total supply, demonstrating significant centralization. The second and third largest addresses hold 42 million (4.20%) and 40 million (4.00%) tokens respectively, while the remaining addresses outside the top five collectively hold only 60.14 million tokens (6.02%). This distribution pattern indicates that PAL's on-chain structure is dominated by a small number of major holders, with the top three addresses alone controlling nearly 90% of the circulating supply.

From a market structure perspective, this extreme concentration presents multiple implications. The dominant position of the largest holder could provide price stability during normal market conditions, as large-scale selling pressure is unlikely without significant movement from this whale address. However, this structure simultaneously creates substantial single-point risk—any strategic shift or liquidation decision by the top holder could trigger severe market volatility. Additionally, such concentrated holdings may raise concerns about potential market manipulation, as the largest address possesses sufficient tokens to significantly influence price discovery and trading dynamics. For investors, monitoring the on-chain activities of these major addresses becomes particularly critical for risk management.

The current holding distribution reflects PAL's relatively weak decentralization characteristics. While concentrated token ownership is not uncommon in early-stage projects or those with specific tokenomics designs, the 81% concentration level significantly exceeds typical market standards. This structure suggests that PAL's on-chain governance and market behavior remain heavily influenced by a limited number of entities, potentially impacting the token's long-term liquidity development and price stability.

Click to view current PAL Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3d2a...19a373 | 810000.00K | 81.00% |

| 2 | 0x8441...30bf7c | 42000.00K | 4.20% |

| 3 | 0x93de...85d976 | 40000.00K | 4.00% |

| 4 | 0x4982...6e89cb | 28526.39K | 2.85% |

| 5 | 0xcb90...bb3530 | 19329.12K | 1.93% |

| - | Others | 60144.50K | 6.02% |

II. Core Factors Influencing PAL's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: The cryptocurrency market in 2026 is expected to benefit from liquidity recovery in the United States. Following government shutdowns in 2024 and early 2025, which constrained liquidity through Treasury General Account (TGA) rebuilding, the market appears positioned for a reversal. Industry analysts suggest that supplemental leverage ratio (eSLR) adjustments, partial TGA releases, fiscal stimulus measures, and potential interest rate reductions could create favorable conditions. The anticipated policy approach draws parallels to the Greenspan-era playbook from 1995-2000, emphasizing rate cuts while allowing economic expansion, with productivity gains from AI development potentially moderating inflationary pressures.

-

Liquidity Dynamics: Global liquidity cycles represent a fundamental driver for cryptocurrency valuations. During recent periods, U.S. liquidity conditions have taken a dominant role, particularly as government funding issues and reverse repurchase facility depletion in 2024 created temporary constraints. Market observers note that cryptocurrencies, as long-duration assets, experience significant price sensitivity to liquidity conditions. The correlation between total liquidity metrics and digital asset performance remains a key analytical framework. As liquidity obstacles are resolved, including the conclusion of government shutdowns, market participants anticipate improved conditions for risk assets.

-

Geopolitical Factors: The intersection of monetary policy, fiscal strategy, and regulatory approaches under current U.S. leadership creates a complex environment for digital assets. Policy coordination between fiscal and monetary authorities may influence market trajectories through 2026, particularly as midterm election considerations potentially shape economic initiatives.

Market Cycle Patterns

-

Four-Year Cycle Framework: Cryptocurrency markets have historically exhibited cyclical patterns influenced by macroeconomic conditions and liquidity phases. Analysts observe that price movements often follow patterns of breakthrough, consolidation, and subsequent expansion phases. Market cycles typically demonstrate sensitivity to timing factors as much as absolute price levels, with divergences tending to resolve as cycles mature.

-

Volatility Considerations: During market downturns, smaller-cap digital assets may experience amplified volatility compared to larger cryptocurrencies. Historical patterns suggest that quality projects often demonstrate recovery potential as market conditions stabilize, though past performance does not guarantee future results.

III. 2026-2031 PAL Price Prediction

2026 Outlook

- Conservative prediction: $0.00222 - $0.00296

- Neutral prediction: $0.00296 (average scenario)

- Optimistic prediction: $0.00376 (requires favorable market conditions)

2027-2029 Outlook

- Market stage expectation: PAL may enter a gradual growth phase as the crypto market continues to evolve and mature.

- Price range prediction:

- 2027: $0.00319 - $0.0044 (approximately 13% increase from 2026)

- 2028: $0.00361 - $0.00512 (approximately 31% increase from 2026)

- 2029: $0.00414 - $0.00612 (approximately 52% increase from 2026)

- Key catalysts: Broader crypto market adoption, potential technological developments, and increasing user engagement could drive price appreciation during this period.

2030-2031 Long-term Outlook

- Baseline scenario: $0.00473 - $0.00531 (assuming steady market growth and stable fundamentals)

- Optimistic scenario: $0.0076 by 2030 (assuming enhanced ecosystem development and increased trading volume)

- Transformative scenario: $0.00942 by 2031 (assuming breakthrough adoption, significant partnerships, and favorable regulatory environment, representing approximately 118% increase from 2026)

- 2026-02-05: PAL price projections suggest potential multi-year growth trajectory with projected average price of $0.00296 in the baseline year.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00376 | 0.00296 | 0.00222 | 0 |

| 2027 | 0.0044 | 0.00336 | 0.00319 | 13 |

| 2028 | 0.00512 | 0.00388 | 0.00361 | 31 |

| 2029 | 0.00612 | 0.0045 | 0.00414 | 52 |

| 2030 | 0.0076 | 0.00531 | 0.00473 | 79 |

| 2031 | 0.00942 | 0.00645 | 0.00523 | 118 |

IV. PAL Professional Investment Strategy and Risk Management

PAL Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Community-oriented investors who believe in AI-driven companion pet ecosystems and the "Community First" model without investor or team allocations

- Operational Recommendations:

- Consider accumulating positions during market corrections, particularly when PAL trades significantly below its launch price of $0.05

- Monitor developments in the Xterio platform and the rollout of new AI Agent pets and gaming features

- Maintain a disciplined approach to portfolio allocation given the token's current circulating supply of only 19% of total supply

- Storage Solution: For long-term holding, consider using Gate Web3 Wallet for secure storage of PAL tokens on the BSC chain

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume (currently $13,590) to identify periods of increased market interest

- Support and Resistance Levels: Track key price levels including the all-time low of $0.002127 and recent 24-hour range of $0.002942-$0.003123

- Band Trading Key Points:

- Consider the significant gap between current price ($0.002957) and launch price ($0.05) as a reference for potential recovery scenarios

- Account for high volatility as evidenced by recent price movements: -0.74% (1H), -5.14% (24H), -24.099% (7D)

PAL Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio given the early-stage nature and significant price decline from launch

- Aggressive Investors: 5-8% allocation for those with higher risk tolerance and belief in the gaming and AI companion pet sector

- Professional Investors: Up to 10% with active monitoring and clear exit strategies based on technical and fundamental milestones

(2) Risk Hedging Solutions

- Diversification Approach: Balance PAL holdings with established gaming tokens and broader market exposure to mitigate sector-specific risks

- Position Sizing: Implement staged entry strategies to average cost given the token's significant drawdown from all-time high of $0.0314

(3) Secure Storage Solutions

- Primary Wallet Recommendation: Gate Web3 Wallet for seamless integration with trading and staking features

- Cold Storage Option: For larger holdings intended for long-term storage, consider hardware wallet solutions compatible with BSC BEP-20 tokens

- Security Precautions: Always verify the contract address (0xb7e548c4f133adbb910914d7529d5cb00c2e9051) before transactions; enable two-factor authentication on all exchange accounts; never share private keys or seed phrases

V. PAL Potential Risks and Challenges

PAL Market Risks

- Price Volatility: PAL has experienced substantial price decline, down 94.049% over one year from its launch, indicating high market risk and potential for continued volatility

- Low Liquidity: With 24-hour trading volume of approximately $13,590 and listing on only 5 exchanges, liquidity constraints may lead to significant price slippage during larger transactions

- Market Cap Position: Ranked 2947 with a market cap of $561,830 and market dominance of only 0.00011%, PAL remains a micro-cap asset susceptible to broader market movements

PAL Regulatory Risks

- Gaming Token Classification: Regulatory clarity around gaming and AI-related tokens remains uncertain in many jurisdictions, potentially affecting future trading access

- Platform Dependency: As the first token on the Xterio platform, PAL's regulatory standing may be influenced by how authorities view the broader platform ecosystem

- Geographic Restrictions: Investors should verify local regulations regarding gaming tokens and ensure compliance with regional cryptocurrency laws

PAL Technical Risks

- Smart Contract Dependency: PAL operates on the BSC chain using BEP-20 standard; any vulnerabilities in the underlying smart contract could pose security risks

- Token Distribution: With only 19% of total supply currently circulating (190 million out of 1 billion tokens), future unlocks could create significant selling pressure

- Platform Integration Risk: The token's utility and value are closely tied to the development and adoption of Xterio platform features and AI Agent pets

VI. Conclusion and Action Recommendations

PAL Investment Value Assessment

PAL represents an early-stage gaming and AI companion pet project with a "Community First" approach that eliminates traditional investor and team allocations. The token's association with the Xterio platform and team members from established gaming companies like Tencent, Happy Elements, and FunPlus provides some credibility to the project's vision. However, the substantial price decline from its $0.05 launch price to current levels around $0.002957 reflects significant market skepticism or early-stage challenges. Long-term value depends heavily on successful execution of the AI Agent pet ecosystem and gaming platform adoption. Short-term risks remain considerable given low liquidity, limited exchange listings, and ongoing price weakness across multiple timeframes.

PAL Investment Recommendations

✅ Beginners: Approach with extreme caution. If interested in the gaming and AI pet sector, allocate only a very small portion (1-2%) of your crypto portfolio and only invest amounts you can afford to lose completely. Focus on learning about the project's development milestones before committing significant capital.

✅ Experienced Investors: Consider PAL as a speculative position within a diversified gaming token portfolio. Implement staged entry strategies to build positions at different price levels, with strict stop-loss parameters. Monitor Xterio platform developments, user adoption metrics, and upcoming token unlock schedules closely.

✅ Institutional Investors: Given the micro-cap status, low liquidity, and limited trading venues, PAL may not meet institutional investment criteria at this stage. For those with specific interest in gaming and AI sectors, maintain watchlist status and reassess as the project demonstrates traction in user adoption and platform development.

PAL Trading Participation Methods

- Spot Trading on Gate.com: Access PAL spot trading pairs on Gate.com with competitive trading fees and integrated security features

- Web3 Wallet Integration: Utilize Gate Web3 Wallet for decentralized storage and potential participation in future Xterio platform activities

- Community Engagement: Follow official PAL channels on X (Twitter) at @PalioAI and review project documentation at palioai.gitbook.io/palioai/ to stay informed about ecosystem developments and potential airdrops or community rewards

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is PAL token? What is its project background and use case?

PAL is the native token of Palio AI, an AI-powered digital pet companion platform combining Web3 and generative AI. PAL enables in-ecosystem transactions, rewards, and governance. AI Agents drive market pricing, creating dynamic trading mechanisms with enhanced transaction efficiency and community-driven value creation.

2024年PAL价格预测是多少?专家怎么看?

Based on expert analysis with +5% annual growth rate projections, PAL demonstrated moderate upward momentum through 2024. Market analysts maintained cautiously optimistic outlooks, citing ecosystem development and growing adoption as key catalysts for continued price appreciation.

What are the main factors affecting PAL price?

PAL price is primarily influenced by market demand, governance impact, ETF recovery trends, token supply dynamics, and liquidity conditions. Restaking effects and smart contract developments also play significant roles in price movement.

How has PAL's historical price performed? What is the price change over the past year?

PAL has experienced notable volatility over the past year. Currently trading between $0.00387 and $0.003956, the token reflects active market dynamics. While specific annual performance metrics vary, PAL demonstrates ongoing market engagement with continuous price discovery.

What are the risks of investing in PAL? What should I pay attention to?

PAL carries high volatility and market risk. Monitor price fluctuations closely and invest only what you can afford to lose. Conduct thorough research, understand tokenomics, and assess your risk tolerance before investing. Consider long-term fundamentals and diversify your portfolio accordingly.

What are the advantages and disadvantages of PAL compared with similar tokens?

PAL offers lower transaction fees and faster processing speeds than competing tokens. Its focus on scalability and enhanced user experience provides clear advantages. Additionally, PAL's interoperability across multiple blockchains significantly increases its utility and adoption potential.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

Top 13 Cheapest Cryptocurrencies to Invest in for 2025–2026

Comprehensive Guide to NFT Minting Costs: Ethereum vs Polygon vs Solana

7 Steps to Take When Cryptocurrency Markets Crash

Stablecoins: Definition and Mechanism of Operation

Cryptocurrency Tax – How to File PIT-38 for Cryptocurrencies