2026 PYM Price Prediction: Expert Analysis and Market Forecast for Polymarket's Native Token

Introduction: PYM's Market Position and Investment Value

Playermon (PYM), positioned as a play-to-earn NFT gaming ecosystem, has been developing since its launch in 2021, establishing itself in the blockchain gaming sector. As of February 2026, PYM maintains a market capitalization of approximately $260,281, with a circulating supply of around 510.56 million tokens, and the price stabilizing near $0.0005098. This gaming-focused digital asset is playing an increasingly relevant role in the NFT gaming and metaverse exploration space.

This article will comprehensively analyze PYM's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. PYM Price History Review and Market Status

PYM Historical Price Evolution Trajectory

- 2021: Reached peak performance period with the price climbing to $0.456594 on November 22, marking a significant milestone in the token's early development phase

- 2025: Experienced substantial market correction, with the price declining to its historical low of $0.00018417 on June 28, reflecting broader market challenges

- 2026: Currently trading at $0.0005098 as of February 8, representing a recovery from the historical low but remaining significantly below previous peak levels

PYM Current Market Status

As of February 8, 2026, PYM is trading at $0.0005098, showing mixed short-term performance indicators. The token has experienced a modest increase of 1.19% over the past hour and 0.9% over the past 24 hours, with the 24-hour trading range between $0.0004872 and $0.0005447.

Looking at longer time frames, PYM has faced downward pressure with a 15.5% decline over the past 7 days and a more substantial 31.54% decrease over the past 30 days. The one-year performance shows a decline of 50.68%, indicating ongoing market headwinds.

The token's market capitalization stands at approximately $260,281.83, with a circulating supply of 510,556,757 PYM tokens, representing 51.06% of the maximum supply of 1 billion tokens. The fully diluted valuation is calculated at $509,800. Current 24-hour trading volume reaches $30,689.48, with PYM maintaining a market dominance of 0.000020%.

The project has attracted a community of 12,106 token holders. The market cap to fully diluted valuation ratio of 51.06% suggests that approximately half of the total token supply is currently in circulation.

Click to view current PYM market price

PYM Market Sentiment Indicator

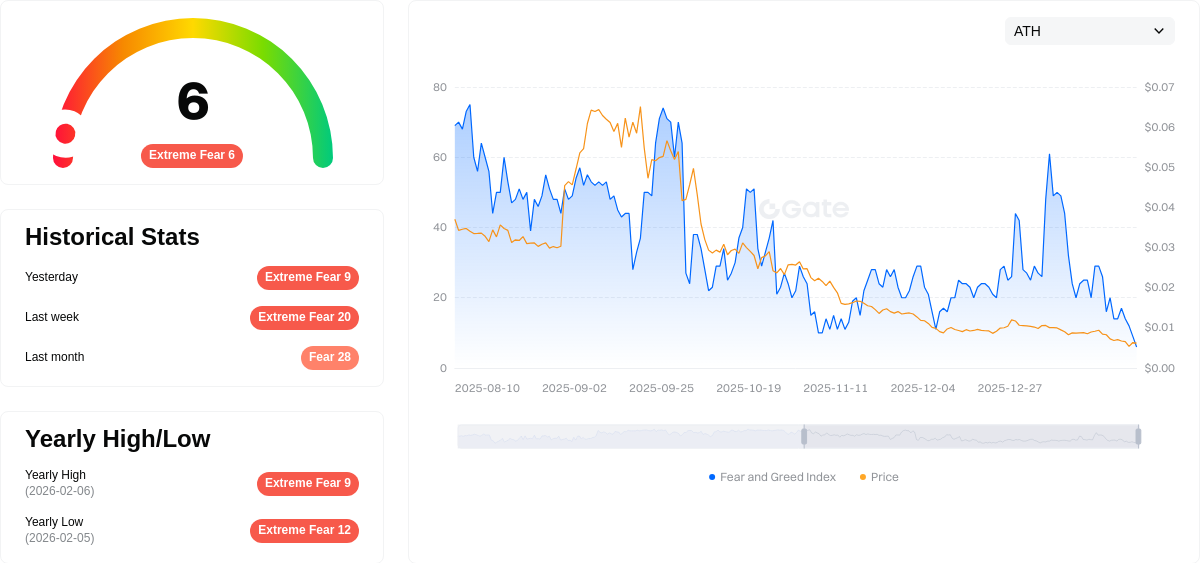

2026-02-07 Fear & Greed Index: 6 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear, with the Fear & Greed Index reaching a low of 6. This indicates severe market pessimism and heightened risk aversion among investors. Such extreme fear conditions often present contrarian opportunities for long-term investors, as markets tend to be oversold during these periods. However, caution is warranted as further downside pressure may continue in the short term. Traders should monitor key support levels closely and consider dollar-cost averaging strategies to mitigate timing risks during this volatile phase.

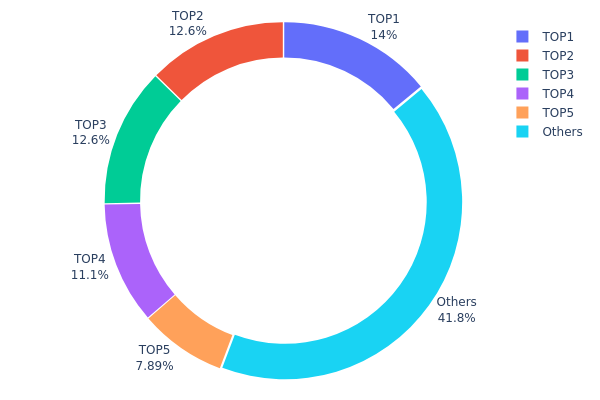

PYM Holder Distribution

The holder distribution chart provides a comprehensive view of how PYM tokens are allocated across different wallet addresses, serving as a critical indicator of the token's decentralization level and market structure stability. This metric reveals the concentration of holdings among top addresses and helps assess potential risks associated with large-holder influence on price movements.

According to the current on-chain data, PYM exhibits a moderately concentrated distribution pattern. The top five addresses collectively hold approximately 57.23% of the total token supply, with the largest holder controlling 14.00% (140,000K tokens), followed by addresses holding 12.64%, 12.60%, 11.10%, and 7.89% respectively. The remaining 41.77% is distributed among other addresses, indicating a relatively dispersed base of smaller holders.

This concentration level presents a mixed outlook for market dynamics. While the top five holders' combined stake exceeds 50%, suggesting potential vulnerability to coordinated selling pressure or market manipulation, the relatively balanced distribution among these major addresses (ranging from 7.89% to 14.00%) mitigates the risk of single-entity dominance. The substantial 41.77% held by other addresses demonstrates meaningful community participation and provides a buffer against extreme centralization. However, investors should remain cognizant that any significant movement from the top holders could trigger noticeable price volatility, particularly in lower liquidity conditions. The current structure reflects a typical early-to-mid stage token distribution, where strategic stakeholders maintain substantial positions while gradual decentralization continues through broader market circulation.

Click to view the current PYM Holder Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4eec...834ca8 | 140000.00K | 14.00% |

| 2 | 0xb6f1...185198 | 126495.73K | 12.64% |

| 3 | 0xa70e...ebdbab | 126050.42K | 12.60% |

| 4 | 0x49d5...319000 | 111000.00K | 11.10% |

| 5 | 0x0d07...b492fe | 78941.43K | 7.89% |

| - | Others | 417512.43K | 41.77% |

II. Core Factors Influencing PYM's Future Price

Market Sentiment

- Investor Confidence: Market sentiment and investor confidence directly influence PYM's price trajectory. Positive news regarding widespread adoption or significant technological breakthroughs tends to generate upward momentum.

- News Announcements: Public announcements and community sentiment serve as important catalysts for price movements. Market participants often react swiftly to developments that signal growing acceptance or enhanced utility.

- Trading Behavior: Short-term trading activity and inherent market volatility create price fluctuations that can amplify both gains and losses in brief periods.

Technological Advancement

- Innovation Milestones: Major technological upgrades can enhance PYM's functionality and scalability, potentially attracting broader institutional and retail interest.

- Development Progress: Continuous improvements in the underlying technology may strengthen the project's competitive position within the broader cryptocurrency landscape.

Overall Market Conditions

- Macroeconomic Environment: Broader economic factors, including monetary policy shifts and inflation dynamics, influence cryptocurrency markets as a whole and affect PYM's valuation.

- Market Volatility: The cryptocurrency sector's inherent volatility means that PYM's price can experience significant swings driven by both internal project developments and external market forces.

- Regulatory Landscape: Evolving regulatory frameworks across different jurisdictions may impact investor sentiment and market accessibility for PYM and similar digital assets.

III. 2026-2031 PYM Price Prediction

2026 Outlook

- Conservative Forecast: $0.00048 - $0.00051

- Neutral Forecast: Around $0.00051

- Optimistic Forecast: Up to $0.00053 (requires favorable market conditions)

Based on current market analysis, PYM is expected to maintain relatively stable price levels throughout 2026, with predicted trading range between $0.00048 and $0.00053. The average price is anticipated to hover around $0.00051, reflecting a consolidation phase as the project establishes its market position.

2027-2029 Outlook

- Market Phase Expectation: Gradual growth and market expansion phase

- Price Range Predictions:

- 2027: $0.00048 - $0.00063

- 2028: $0.00052 - $0.00066

- 2029: $0.00039 - $0.0008

- Key Catalysts: Market adoption expansion, ecosystem development, and broader cryptocurrency market sentiment

During this mid-term period, PYM is projected to experience gradual price appreciation, with 2027 showing approximately 1% growth potential, followed by 12% in 2028 and 21% in 2029. The widening price ranges in later years suggest increasing market volatility and potential for significant price movements based on project developments and market conditions.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00043 - $0.00071 (assuming steady market conditions)

- Optimistic Scenario: $0.00079 - $0.00106 (with strong adoption and favorable market dynamics)

- Transformative Scenario: Potential to reach $0.00109 by 2031 (under exceptionally favorable conditions)

The long-term forecast suggests substantial growth potential, with 2030 projected to see approximately 39% price change and 2031 potentially reaching 73% growth. By 2031, the average predicted price stands at $0.00088, with a potential high of $0.00109, representing significant appreciation from current levels. These projections assume continued project development, increased market penetration, and favorable cryptocurrency market conditions over the forecast period.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00053 | 0.00051 | 0.00048 | 0 |

| 2027 | 0.00063 | 0.00052 | 0.00048 | 1 |

| 2028 | 0.00066 | 0.00057 | 0.00052 | 12 |

| 2029 | 0.0008 | 0.00062 | 0.00039 | 21 |

| 2030 | 0.00106 | 0.00071 | 0.00043 | 39 |

| 2031 | 0.00109 | 0.00088 | 0.00079 | 73 |

IV. PYM Professional Investment Strategies and Risk Management

PYM Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors interested in the Play-to-Earn gaming sector with medium to long-term investment horizons

- Operational Recommendations:

- Consider accumulating positions during market corrections when PYM trades near its support levels

- Monitor the development progress of the Playermon ecosystem and major partnership announcements

- Implement a diversified crypto portfolio approach, allocating only a modest portion to gaming tokens like PYM

- Storage Solution: Use Gate Web3 Wallet for secure storage with multi-signature protection enabled

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Monitor 50-day and 200-day moving averages to identify trend directions and potential reversal points

- Volume Analysis: Track trading volume patterns on Gate.com to gauge market sentiment and validate price movements

- Support/Resistance Levels: Identify key price levels based on historical trading ranges

- Key Points for Swing Trading:

- Pay attention to the high volatility characteristics of PYM, with recent 7-day fluctuations reaching -15.5%

- Set clear stop-loss orders to protect against sudden price drops in this relatively low-liquidity asset

- Consider the 24-hour trading range between support and resistance levels for intraday opportunities

PYM Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 5-8% with active monitoring and hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance PYM holdings with major cryptocurrencies and stablecoins to reduce concentration risk

- Position Sizing: Use dollar-cost averaging to build positions gradually rather than investing lump sums

- Profit Taking: Implement systematic profit-taking at predetermined price targets to lock in gains

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading and staking participation

- Cold Storage Solution: Transfer long-term holdings to hardware wallets for enhanced security against online threats

- Security Precautions: Enable two-factor authentication, verify contract addresses (0x0bd49815ea8e2682220bcb41524c0dd10ba71d41 on Polygon), never share private keys, and beware of phishing attempts

V. PYM Potential Risks and Challenges

PYM Market Risks

- High Volatility: PYM has demonstrated substantial price fluctuations, with a 50.68% decline over the past year and significant recent drawdowns

- Low Liquidity: With a 24-hour trading volume of approximately $30,689 and limited exchange listings, large orders may experience considerable slippage

- Market Cap Risk: With a relatively small market capitalization of around $260,000, PYM is highly susceptible to market manipulation and whale activity

- Gaming Sector Correlation: Performance may be heavily influenced by broader trends in the Play-to-Earn gaming market and NFT sector sentiment

PYM Regulatory Risks

- Gaming Token Classification: Evolving regulations regarding Play-to-Earn games and gaming tokens could impact PYM's operational model

- NFT Regulatory Uncertainty: Potential regulatory frameworks for NFTs in various jurisdictions may affect the Playermon ecosystem

- Securities Law Considerations: Gaming tokens with reward mechanisms may face scrutiny under securities regulations in different countries

PYM Technical Risks

- Smart Contract Vulnerabilities: As a Polygon-based token, PYM is subject to potential smart contract bugs or exploits that could affect token functionality

- Blockchain Network Dependency: Token performance and usability depend on the Polygon network's stability and transaction processing capabilities

- Game Development Risks: The project's success relies on continuous development and maintenance of the Playermon gaming platform

- Competition: Intense competition in the Play-to-Earn gaming space may impact user adoption and token utility

VI. Conclusion and Action Recommendations

PYM Investment Value Assessment

Playermon (PYM) represents a high-risk, speculative investment in the Play-to-Earn gaming sector. While the project offers exposure to the intersection of gaming, NFTs, and blockchain technology, several factors warrant caution. The token has experienced substantial depreciation from its all-time high, declining over 50% in the past year. With a modest market capitalization and limited liquidity, PYM carries elevated volatility and concentration risks. Long-term value depends heavily on the project's ability to attract and retain users, expand its gaming ecosystem, and navigate the competitive Play-to-Earn landscape. The current circulating supply represents approximately 51% of the total supply, suggesting potential dilution risks. Investors should view PYM as a speculative position suitable only for those with high risk tolerance and thorough understanding of the gaming token sector.

PYM Investment Recommendations

✅ Beginners: Consider gaining experience with more established cryptocurrencies before allocating to small-cap gaming tokens. If interested in PYM, limit exposure to less than 1% of your crypto portfolio and thoroughly research the Playermon project

✅ Experienced Investors: Approach PYM as a speculative allocation within a diversified gaming token portfolio. Implement strict risk management with stop-loss orders and position sizing appropriate to your risk tolerance. Monitor ecosystem developments and user engagement metrics closely

✅ Institutional Investors: Conduct comprehensive due diligence on the project team, tokenomics, and competitive positioning. Consider PYM only as part of a broader thematic allocation to gaming and metaverse opportunities, with appropriate hedging strategies

PYM Trading Participation Methods

- Spot Trading on Gate.com: Purchase PYM directly through the spot market with various trading pairs available

- Dollar-Cost Averaging: Implement systematic purchases at regular intervals to mitigate timing risk and average entry prices

- Portfolio Rebalancing: Periodically adjust PYM allocation within your overall crypto portfolio to maintain target risk levels

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is PYM? What are its practical uses?

PYM is the token of PLAYERMON, primarily used for transactions and rewards on gaming platforms. Its practical applications include incentivizing user participation, enabling in-game transactions, and providing governance rights within the ecosystem.

What is the historical price trend of PYM?

PYM has an all-time high of $0.456594 and an all-time low of $0.00018417. In the past 24 hours, the price fluctuated between $0.00052526 and $0.00058008, demonstrating significant market volatility.

What do experts predict for PYM's future price?

Experts predict PYM will experience moderate growth driven by increasing adoption and market demand. Long-term price trends suggest upward momentum, though short-term volatility remains expected. Market fundamentals support cautious optimism for sustained value appreciation.

What are the main factors affecting PYM price?

PYM price is primarily influenced by supply dynamics, market demand, ecosystem development, technological advancements, and overall market sentiment in the crypto sector.

What are the advantages and disadvantages of PYM compared to similar cryptocurrencies?

PYM advantages: highly active community with strong engagement, innovative community-driven growth model, and growing transaction volume. Disadvantages: faces competition from established cryptocurrencies and lacks widespread market recognition compared to major players.

What are the risks to pay attention to when investing in PYM?

PYM price volatility is significant, potentially causing capital loss. Investors bear full responsibility for investment decisions and cannot guarantee principal recovery. Market fluctuations and sentiment impact returns.

How to conduct technical analysis of PYM to assist with price prediction?

Analyze PYM's price charts using moving averages, RSI, and MACD indicators. Monitor trading volume trends and support/resistance levels. Track on-chain metrics like holder distribution and transaction activity. Combine these signals with market sentiment to identify potential price movements and trading opportunities.

Detailed Analysis of the Best 10 GameFi Projects to Play and Earn in 2025

Popular GameFi Games in 2025

What Are the Key On-Chain Metrics Revealing About Litecoin's Whale Activity in 2025?

What is GameFi and How Does It Work?

What is DeFi: Understanding Decentralized Finance in 2025

How Will Virtuals Protocol's AI Agent Economy Evolve by 2030?

Is Cryptocurrency Mining Profitable?

What Is FOMO Syndrome? How Does It Lead to Loss of Wealth?

What is Satoshi and Why Bitcoin is Divided into Parts

Movement Coin Price Outlook and Delisting Controversy: Everything You Need to Know

Understanding Byzantine Fault Tolerance in Blockchain: A Comprehensive Guide to 10 Key Concepts