2026 QSP Price Prediction: Expert Analysis and Market Forecast for Quantstamp Token

Introduction: QSP's Market Position and Investment Value

Quantstamp (QSP), as a blockchain security audit protocol, has been serving the Ethereum ecosystem since its launch in 2017. As of 2026, QSP maintains a market capitalization of approximately $730,790, with a circulating supply of around 713.8 million tokens, and the price hovering around $0.001024. This asset, recognized as a pioneer in smart contract security verification, is playing an increasingly important role in blockchain security auditing and decentralized application development.

This article will comprehensively analyze QSP's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. QSP Price History Review and Market Status

QSP Historical Price Evolution Trajectory

- January 2018: QSP reached its peak price level at $0.866421, representing a significant milestone in the token's early trading history

- August 2025: The token recorded its lowest price point at $0.003370653149, marking a substantial decline from historical levels

- 2025-2026: Throughout this period, QSP experienced continued price pressure, with the current trading range fluctuating between relatively modest levels

QSP Current Market Situation

As of February 04, 2026, QSP is trading at $0.0010238, showing a 24-hour increase of 1.33%. The token's recent price action has been characterized by mixed performance across different timeframes. Over the past hour, QSP declined by 0.41%, while the weekly performance shows a decrease of 15.54%. The 30-day performance indicates a decline of 2.36%, and the annual change reflects an 11.43% decrease.

The token's 24-hour trading range spans from a low of $0.0009744 to a high of $0.0010349, with total trading volume reaching $13,215.50. QSP's current market capitalization stands at $730,790.43, with a circulating supply of 713,801,947 tokens out of a maximum supply of 976,442,388 tokens, representing a circulation ratio of 73.10%. The fully diluted market cap is calculated at $999,681.72.

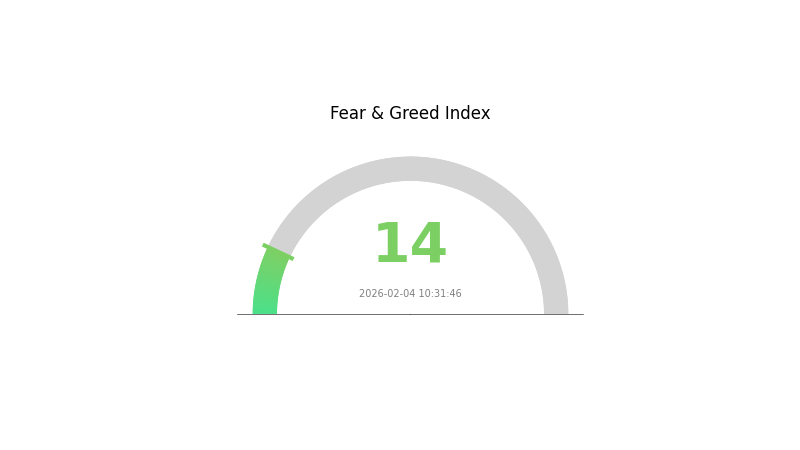

The market cap to fully diluted valuation ratio sits at 73.1%, and the token holds 33,315 holders according to available data. Current market sentiment indicators show an extreme fear level with a VIX reading of 14, suggesting cautious investor positioning in the broader market environment.

Click to view current QSP market price

QSP Market Sentiment Indicator

2026-02-04 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 14. This exceptionally low reading indicates widespread investor panic and pessimism across the digital asset landscape. Market participants are showing strong risk-averse behavior, with selling pressure dominating trading activity. Such extreme fear conditions often present contrarian buying opportunities for long-term investors, as markets typically tend to recover from panic-driven lows. Traders should exercise caution while monitoring for potential reversal signals before making major portfolio adjustments.

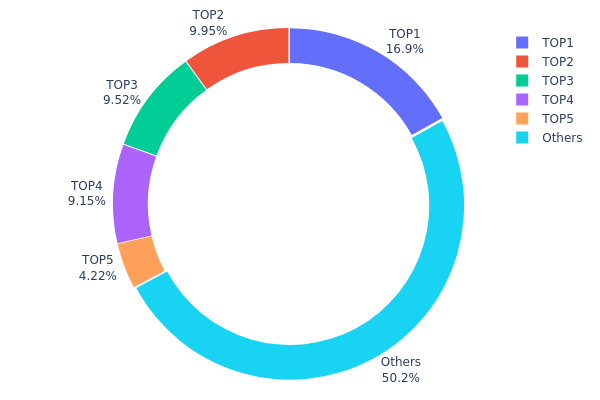

QSP Holding Distribution

The holding distribution chart illustrates the concentration of QSP tokens across different wallet addresses, providing crucial insights into the decentralization level and potential market manipulation risks. By analyzing the proportion of tokens held by top addresses versus the broader holder base, we can assess the health of the token's on-chain structure and its vulnerability to large-scale sell-offs.

Based on current data, QSP exhibits a relatively high concentration pattern. The top holder controls 165,437.54K tokens (16.94%), while the second and third largest addresses hold 97,202.91K (9.95%) and 93,000.00K (9.52%) respectively. Collectively, the top five addresses account for 49.78% of the total supply, indicating that nearly half of all QSP tokens are concentrated among a small group of entities. This level of concentration suggests moderate centralization risk, as coordinated actions by these major holders could significantly impact market liquidity and price stability.

The current distribution structure presents both opportunities and challenges for the QSP market. On one hand, the remaining 50.22% held by other addresses indicates a reasonably diverse holder base, which provides some level of market stability and organic trading activity. On the other hand, the substantial holdings by top addresses create potential for price manipulation and increased volatility, particularly if any of these large holders decide to liquidate their positions. From a market structure perspective, this concentration level is typical for many utility tokens but warrants close monitoring, especially during periods of high volatility when whale movements could trigger cascading liquidations or FOMO-driven rallies.

Click to view current QSP Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe569...b3ff67 | 165437.54K | 16.94% |

| 2 | 0x22e9...214a37 | 97202.91K | 9.95% |

| 3 | 0xf977...41acec | 93000.00K | 9.52% |

| 4 | 0x4db2...35e5c4 | 89381.71K | 9.15% |

| 5 | 0x0d07...b492fe | 41208.20K | 4.22% |

| - | Others | 490212.03K | 50.22% |

II. Core Factors Influencing QSP's Future Price

Macroeconomic Environment

- Monetary Policy Impact: AI's suppressive effect on overseas employment markets is becoming evident, which suggests that loosening monetary policy by the Federal Reserve may not trigger inflationary pressures. This shift in monetary policy expectations could influence capital flows into risk assets, including digital assets.

- Technology Sector Valuation: Tech stocks driven by loose monetary policies have seen valuation impacts during rate hike cycles. The market shows differentiation between high-growth-focused enterprises and companies with substantial fundamentals, which may affect investor sentiment toward technology-related assets.

Market Competition and Innovation

- Sector Investment Opportunities: From the QSP perspective, various sectors present investment opportunities as market conditions evolve. The balance between growth potential and fundamental strength continues to shape market dynamics.

- Competitive Landscape: As market competition density increases, pricing mechanisms may experience adjustments. Future market developments will likely reflect the interplay between technological advancement and competitive positioning.

III. 2026-2031 QSP Price Forecast

2026 Outlook

- Conservative forecast: $0.00073 - $0.00102

- Neutral forecast: approximately $0.00102

- Optimistic forecast: up to $0.00106 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: The token is anticipated to enter a gradual growth phase, with expanding use cases potentially driving steady appreciation

- Price range forecast:

- 2027: $0.00097 - $0.00143

- 2028: $0.00119 - $0.00163 (projected 20% year-over-year change)

- 2029: $0.00090 - $0.00185 (projected 39% cumulative change from 2026)

- Key catalysts: Enhanced platform utility, broader ecosystem integration, and potential partnerships could serve as primary price drivers during this period

2030-2031 Long-term Outlook

- Baseline scenario: $0.00146 - $0.00203 (assuming steady ecosystem development and sustained market interest)

- Optimistic scenario: $0.00164 - $0.00248 (contingent upon significant protocol upgrades and mainstream adoption acceleration)

- Transformational scenario: approaching $0.00248 (requires exceptional market conditions, major institutional adoption, and substantial ecosystem expansion)

- 2026-02-04: QSP trading within the $0.00073 - $0.00106 range (early-stage valuation period)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00106 | 0.00102 | 0.00073 | 0 |

| 2027 | 0.00143 | 0.00104 | 0.00097 | 1 |

| 2028 | 0.00163 | 0.00123 | 0.00119 | 20 |

| 2029 | 0.00185 | 0.00143 | 0.0009 | 39 |

| 2030 | 0.00203 | 0.00164 | 0.00146 | 60 |

| 2031 | 0.00248 | 0.00184 | 0.00125 | 79 |

IV. QSP Professional Investment Strategies and Risk Management

QSP Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors focused on blockchain security sector development and Ethereum ecosystem growth

- Operational Recommendations:

- Consider accumulating positions during market downturns, given QSP's 73.1% circulating supply ratio

- Monitor developments in smart contract security demand as Ethereum ecosystem expands

- Utilize secure storage solutions such as Gate Web3 Wallet for long-term holdings

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Track the 24-hour trading volume of $13,215.50 to identify liquidity patterns

- Price Range Monitoring: Observe movements between 24-hour low ($0.0009744) and high ($0.0010349)

- Swing Trading Considerations:

- Consider the 7-day decline of 15.54% when evaluating entry points

- Monitor 1-hour price movements (currently -0.41%) for short-term positioning

QSP Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio

- Moderate Investors: 2-5% of crypto portfolio

- Experienced Investors: 5-10% of crypto portfolio, subject to individual risk tolerance

(II) Risk Hedging Approaches

- Portfolio Diversification: Balance QSP holdings with established blockchain security tokens and major cryptocurrencies

- Position Sizing: Limit exposure based on market capitalization ($730,790.43) and trading volume considerations

(III) Secure Storage Solutions

- Web3 Wallet Recommendation: Gate Web3 Wallet supports ERC-20 tokens including QSP

- Hardware Wallet Option: Consider cold storage solutions for long-term holdings

- Security Precautions: Verify contract address (0x99ea4dB9EE77ACD40B119BD1dC4E33e1C070b80d) when conducting transactions, enable two-factor authentication, and never share private keys

V. QSP Potential Risks and Challenges

QSP Market Risks

- Liquidity Constraints: With a market capitalization of approximately $730,790.43 and ranking of 2,746, QSP faces limited liquidity compared to major cryptocurrencies

- Price Volatility: Recent performance shows significant fluctuations, including a 15.54% decline over 7 days

- Market Share: Minimal market dominance of 0.000037% may result in susceptibility to broader market movements

QSP Regulatory Risks

- Smart Contract Auditing Standards: Evolving regulatory frameworks for blockchain security services may impact demand

- Compliance Requirements: Changes in cryptocurrency regulations across jurisdictions could affect token utility and trading

- Securities Classification: Regulatory determinations regarding token classification may influence market accessibility

QSP Technical Risks

- Ethereum Network Dependency: As an ERC-20 token, QSP is subject to Ethereum network congestion and transaction costs

- Smart Contract Vulnerabilities: Despite Quantstamp's security focus, the token contract itself requires ongoing security maintenance

- Competition: Emergence of alternative blockchain security solutions may impact Quantstamp's market position

VI. Conclusion and Action Recommendations

QSP Investment Value Assessment

Quantstamp (QSP) operates in the blockchain security sector, providing smart contract auditing services for Ethereum-based projects. With a circulating supply of 713,801,947 tokens (73.1% of maximum supply) and current price of $0.0010238, the token has experienced notable volatility, declining 15.54% over the past week and 11.43% over one year. The project serves established clients in the blockchain ecosystem, yet faces challenges including limited liquidity and market capitalization. Long-term value depends on sustained demand for smart contract security services and Ethereum ecosystem growth, while short-term risks include price volatility and market uncertainty.

QSP Investment Recommendations

✅ Beginners: Consider minimal allocation only after thoroughly researching blockchain security sector dynamics and understanding high volatility risks ✅ Experienced Investors: May consider strategic positions during market downturns, with strict risk management and portfolio diversification ✅ Institutional Investors: Evaluate QSP as part of broader blockchain infrastructure and security sector exposure, with appropriate due diligence

QSP Trading Participation Methods

- Spot Trading: Available on Gate.com with QSP trading pairs

- Dollar-Cost Averaging: Implement systematic purchase strategies to mitigate timing risks

- Secure Storage: Transfer holdings to Gate Web3 Wallet or other secure wallet solutions after purchase

Cryptocurrency investment carries extreme risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is QSP (Quantstamp) token and what is its purpose?

QSP is the native token of Quantstamp, a smart contract security audit platform. It facilitates platform operations, incentivizes participants, and enables governance. With a total supply of 1 billion tokens, QSP is used for transactions and reward mechanisms within the ecosystem.

QSP代币的历史价格走势如何?目前价格是多少?

QSP currently trades at approximately $0.001276, up 1.51% in the last 24 hours. The token has shown volatility historically. Market cap stands at 6.342 million, with 24-hour trading volume at 9.9176 million.

What are the main factors affecting QSP price?

QSP price is primarily influenced by market demand, trading volume, network adoption, project development progress, overall crypto market sentiment, and technical upgrades to the Quantstamp protocol ecosystem.

What is the QSP price prediction for 2024-2025?

QSP price prediction for 2024-2025 remains uncertain due to market volatility. However, analysts expect potential growth driven by increased smart contract auditing demand and ecosystem expansion. Price movements will depend on broader crypto market trends and platform adoption rates.

What are QSP's advantages compared to other security audit tokens?

QSP offers superior automated smart contract security analysis with advanced vulnerability detection capabilities, providing faster and more accurate auditing compared to competing security audit platforms.

What are the risks of investing in QSP?

QSP investment faces market volatility, smart contract technical risks, and project uncertainty. Price fluctuations depend on market conditions and technology development. Investors should conduct thorough research before investing.

Where can I buy QSP tokens?

QSP tokens are available on major cryptocurrency exchanges. You can purchase QSP by trading against Bitcoin or Ethereum on leading platforms that support ERC-20 tokens. Check your preferred exchange for current QSP trading pairs and liquidity.

What is the development prospect and roadmap of Quantstamp project?

Quantstamp leads Web3 security with highly-valued smart contract audit services. The company plans to expand technology and services supporting future blockchain development. Expected to launch innovative solutions within five years, strengthening its market position.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Survey Note: Detailed Analysis of the Best AI in 2025

Detailed Analysis of the Best 10 GameFi Projects to Play and Earn in 2025

Kaspa’s Journey: From BlockDAG Innovation to Market Buzz

Best Crypto Wallets 2025: How to Choose and Secure Your Digital Assets

Popular GameFi Games in 2025

Comprehensive Guide to Token Generation Events

Comprehensive Guide to Creating and Selling NFTs for Free

How to Profit from Cryptocurrency — Leading Strategies of Recent Years

Best Crypto Trading Bots for Automated Trading

Top 5 Tokens Recommended for DeFi Investment