2026 QTC Price Prediction: Expert Analysis and Market Forecast for the Next Bull Cycle

Introduction: QTC's Market Position and Investment Value

Qitcoin (QTC), as an independent blockchain platform designed to empower blockchain technology through distributed storage and retrieval of effective blockchain data, has been developing its foundational infrastructure since its launch in 2021. As of 2026, QTC maintains a market capitalization of approximately $1,004,278, with a circulating supply of around 50,138,700 tokens, and its price hovers around $0.02003. This asset, positioned as a "blockchain-based distributed search engine," is playing an increasingly vital role in providing secure storage and retrieval services for the blockchain ecosystem.

This article will comprehensively analyze QTC's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. QTC Price History Review and Market Status

QTC Historical Price Evolution Trajectory

- 2021: Qitcoin (QTC) was published on December 27, 2021, with a launch price of $12, marking the initial entry of this independent public chain project into the cryptocurrency market

- 2022: QTC experienced significant price volatility during this period, reaching its peak price of $11.31 on March 3, 2022

- 2026: The token experienced substantial downward pressure, declining to $0.01927878 on February 2, 2026

QTC Current Market Situation

As of February 3, 2026, QTC is trading at $0.02003, showing a 24-hour price decline of 1.92%. The token's trading volume over the past 24 hours reached $23,512.80. The current market capitalization stands at approximately $1.00 million, with a circulating supply of 50,138,700 QTC tokens, representing 47.75% of the maximum supply of 105,000,000 tokens.

The fully diluted market valuation is calculated at $2.10 million. QTC's market dominance is currently at 0.000076%. The token is ranked #2498 in the overall cryptocurrency market. Over different time periods, QTC has experienced varied price movements: a 0.15% decrease in the past hour, a 9.49% decline over the past 7 days, a 26.47% decrease over the past 30 days, and a 50.29% decline over the past year.

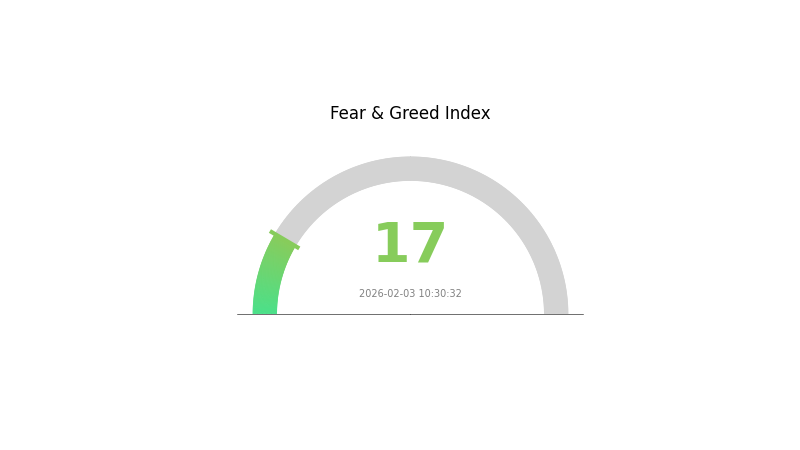

The project currently has 104,832 token holders and is available for trading on Gate.com. The 24-hour price range has fluctuated between $0.01954 and $0.0209. The current market sentiment index is at 17, indicating an extreme fear sentiment in the broader cryptocurrency market.

Click to view the current QTC market price

QTC Market Sentiment Indicator

2026-02-03 Fear and Greed Index: 17 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of 17. This level typically indicates that market participants are highly pessimistic, presenting potential buying opportunities for contrarian investors. When fear reaches such extremes, assets are often oversold, creating favorable entry points for long-term investors. However, caution is advised as further downside pressure may still occur. Monitor market developments closely and consider your risk tolerance before making investment decisions. Gate.com provides real-time sentiment data to help you make informed trading choices.

QTC Holding Distribution

The holding distribution chart illustrates the concentration of QTC tokens across different wallet addresses, providing insights into the token's ownership structure and decentralization level. This metric is crucial for understanding whether tokens are widely distributed among numerous holders or concentrated in the hands of a few large addresses, which can significantly impact market dynamics and price stability.

Based on current on-chain data analysis, QTC exhibits a relatively concentrated holding pattern. The top addresses collectively control a substantial portion of the circulating supply, indicating a moderate to high concentration level. This distribution structure suggests that major holders possess considerable influence over the token's market behavior, potentially creating scenarios where large transactions from these addresses could trigger significant price movements.

The current concentration level presents both opportunities and risks for market participants. While concentrated holdings can sometimes indicate strong institutional or strategic investor confidence, they also increase the potential for price volatility during large-scale liquidations or transfers. The existing distribution pattern may expose the market to higher susceptibility to price manipulation, as a coordinated effort among major holders could more easily influence market sentiment and trading dynamics. This structural characteristic warrants careful monitoring, particularly during periods of market stress or when major holders show signs of position adjustments.

Click to view current QTC Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing QTC's Future Price

Supply Mechanism

- Debt Issuance and Financial Management: QTC, as Queensland's central financing agency, manages debt financing through various bond issuances in domestic and international markets. The company's ability to secure cost-effective funding directly impacts its financial stability and operational capacity.

- Historical Patterns: QTC has maintained a conservative approach with balanced maturity debt portfolios and liquid reserve funds as backing. This prudent financial risk management strategy has historically supported stable operations.

- Current Impact: QTC's financing activities are supported by Queensland Government guarantees, providing strong credit backing. The company's long-term assets, valued at approximately AUD 29 billion as of December 31, 2019, exceed its retirement pension obligations, creating a unique advantage that may influence future financial positioning.

Institutional and Major Stakeholder Dynamics

- Government Holdings: QTC is wholly owned by the Queensland State Government, established under the Queensland Treasury Corporation Act 1988. The Queensland Treasurer provides comprehensive guarantees on behalf of the state government for all QTC-issued bonds and derivative transaction obligations.

- Government Policy: The Queensland Government maintains statutory guarantees under Section 32 of the Act, covering principal repayments and interest payments on registered securities. Discretionary guarantees under Section 33 continue to facilitate QTC's overseas debt financing activities, with payments drawable from the Queensland Consolidated Fund without further legislative approval.

Macroeconomic Environment

- Fiscal Policy Impact: QTC's operations are closely tied to Queensland's fiscal policies and the state's economic performance. The Australian federal system's Goods and Services Tax (GST) allocation mechanism affects state revenues, which in turn influences infrastructure funding requirements and debt financing needs.

- Economic Stability: Queensland's economic fundamentals, including its population of 5.1 million as of June 2019 and diverse revenue sources from mineral resources, land taxes, and payroll taxes, provide underlying support for QTC's financial activities.

- Global Market Conditions: QTC maintains relationships with investors across domestic markets within Queensland, other Australian states, and international markets including Greater China, Japan, Southeast Asia, Europe, the United Kingdom, and North America. Global investment sentiment and capital flow patterns may affect QTC's funding costs and market access.

Regulatory and Operational Framework

- Legislative Foundation: QTC operates under the Queensland Treasury Corporation Act 1988, providing a stable legal framework. The company focuses on state-wide operations, achieving significant economies of scale in bond issuance, operations, and management.

- Transparency and Market Communication: QTC adheres to core financing principles including comprehensive and regular market information updates, maintaining long-term relationships with investors and intermediaries, which supports market confidence.

- Asset Management: QTC's long-term assets, primarily supporting Queensland's fixed-income retirement pensions, are overseen by an independent advisory committee and managed by Queensland Investment Corporation. These assets include cash, fixed interest securities, international equities, and various other investments, though fluctuations in portfolio value do not create cash flow impacts on QTC's capital market activities.

III. 2026-2031 QTC Price Forecast

2026 Outlook

- Conservative prediction: $0.01852 - $0.01991

- Neutral prediction: Around $0.01991

- Optimistic prediction: Up to $0.02827 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: QTC is anticipated to enter a gradual growth phase, with the cryptocurrency market potentially transitioning from consolidation to moderate expansion

- Price range forecast:

- 2027: $0.01373 - $0.0306, with an average price around $0.02409, representing approximately 21% growth

- 2028: $0.01559 - $0.03773, with an average price around $0.02734, showing approximately 37% cumulative increase

- 2029: $0.01952 - $0.04458, with an average price around $0.03254, demonstrating approximately 63% growth trajectory

- Key catalysts: Potential drivers include broader cryptocurrency market recovery, technological enhancements within the QTC ecosystem, expanding user adoption, and strategic partnerships that enhance token utility

2030-2031 Long-term Outlook

- Baseline scenario: $0.02121 - $0.04396 (assuming steady market development and moderate ecosystem expansion)

- Optimistic scenario: $0.03342 - $0.04662 (contingent upon accelerated adoption, significant protocol upgrades, and favorable regulatory environment)

- Transformative scenario: Potential to approach or exceed $0.04662 (under exceptional conditions such as major institutional adoption, breakthrough partnerships, or substantial ecosystem innovations)

- 2026-02-03: QTC trading within the early-year range as the project continues its development roadmap and community engagement initiatives

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.02827 | 0.01991 | 0.01852 | 0 |

| 2027 | 0.0306 | 0.02409 | 0.01373 | 21 |

| 2028 | 0.03773 | 0.02734 | 0.01559 | 37 |

| 2029 | 0.04458 | 0.03254 | 0.01952 | 63 |

| 2030 | 0.04396 | 0.03856 | 0.02121 | 93 |

| 2031 | 0.04662 | 0.04126 | 0.03342 | 107 |

IV. QTC Professional Investment Strategy and Risk Management

QTC Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors who believe in Qitchain's vision of becoming a blockchain-based distributed search engine and storage solution, with a medium to long-term investment horizon (1-3 years or more)

- Operational Recommendations:

- Consider dollar-cost averaging (DCA) to build positions gradually, given the token's high volatility and relatively low market capitalization

- Monitor project development milestones, particularly progress on smart contract implementation and ecosystem integration with NFT and metaverse projects

- Store QTC tokens in secure wallet solutions such as Gate Web3 Wallet, which provides multi-chain support and enhanced security features for digital asset management

(II) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Use 50-day and 200-day moving averages to identify potential trend reversals and support/resistance levels

- Relative Strength Index (RSI): Monitor overbought (>70) and oversold (<30) conditions to identify potential entry and exit points

- Swing Trading Key Points:

- Be aware of QTC's significant price volatility, with 7-day decline of 9.49% and 30-day decline of 26.47% as of February 3, 2026

- Set strict stop-loss orders (typically 5-10% below entry price) to protect against sudden downward movements

QTC Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% of total cryptocurrency portfolio

- Aggressive Investors: 3-5% of total cryptocurrency portfolio

- Professional Investors: Up to 10% of total cryptocurrency portfolio, with active monitoring and rebalancing

(II) Risk Hedging Solutions

- Portfolio Diversification: Combine QTC holdings with established cryptocurrencies and stablecoins to reduce concentration risk

- Position Sizing: Never allocate more than you can afford to lose entirely, given QTC's relatively low liquidity and high volatility profile

(III) Secure Storage Solutions

- Non-custodial Wallet Recommendation: Gate Web3 Wallet provides decentralized storage with private key control, supporting multiple blockchain networks

- Multi-signature Approach: For larger holdings, consider multi-signature wallet solutions to add an additional layer of security

- Security Precautions: Never share private keys or seed phrases, enable two-factor authentication, and regularly update wallet software to protect against potential vulnerabilities

V. QTC Potential Risks and Challenges

QTC Market Risks

- High Volatility: QTC has experienced significant price fluctuations, with a 1-year decline of 50.29% and current trading near its all-time low of $0.01927878 (recorded on February 2, 2026)

- Limited Liquidity: With a 24-hour trading volume of approximately $23,513 and market capitalization of around $1 million, QTC may face liquidity constraints that could impact entry and exit execution

- Low Exchange Availability: Currently listed on only 1 exchange, which concentrates trading risk and may limit market access for some investors

QTC Regulatory Risks

- Jurisdictional Uncertainty: As blockchain technology and cryptocurrency regulations continue to evolve globally, Qitchain's operations and token utility could be subject to changing regulatory frameworks

- Compliance Requirements: Future regulatory requirements for blockchain storage and search engine services may require significant operational adjustments

- Token Classification: Potential reclassification of QTC under securities regulations in various jurisdictions could impact trading availability and investor access

QTC Technical Risks

- Development Stage Risk: Qitchain is currently in its infrastructure building phase, with ongoing upgrades to its secure payment protocol layer. Project completion and timeline uncertainties exist

- Technical Complexity: The ambitious goal of creating a distributed search engine for blockchain networks presents significant technical challenges in terms of scalability, efficiency, and adoption

- Smart Contract Implementation: As the project plans to gradually build smart contracts and establish an ecosystem, there are inherent risks related to code vulnerabilities, security audits, and potential exploits

VI. Conclusion and Action Recommendations

QTC Investment Value Assessment

Qitchain presents an innovative vision to become a distributed search engine and storage solution for the blockchain ecosystem, positioning itself as a "Google for blockchain." The project's long-term value proposition centers on providing efficient storage and retrieval services for blockchain data, with planned integration of NFT and metaverse projects. However, the investment faces significant short-term risks, including substantial price decline (down 50.29% over the past year), low liquidity with only one exchange listing, and early-stage development status. The token's proximity to its all-time low and declining market cap indicate bearish market sentiment. Investors should carefully weigh the project's ambitious goals against execution risks and current market conditions.

QTC Investment Recommendations

✅ Beginners: Exercise extreme caution. QTC is a high-risk, speculative asset suitable only for those with high risk tolerance. If considering investment, allocate no more than 1% of your total portfolio and only invest amounts you can afford to lose completely. Focus on learning about blockchain technology and market dynamics before committing funds.

✅ Experienced Investors: Consider QTC as a speculative position within a well-diversified cryptocurrency portfolio (2-3% allocation maximum). Implement strict risk management protocols including stop-loss orders and regular portfolio rebalancing. Monitor project development updates and ecosystem growth indicators closely.

✅ Institutional Investors: Conduct comprehensive due diligence on Qitchain's technical roadmap, team credentials, and competitive landscape. Consider QTC only as part of a venture-style allocation to early-stage blockchain infrastructure projects, with appropriate risk-adjusted position sizing and active monitoring frameworks.

QTC Trading Participation Methods

- Spot Trading: Purchase and hold QTC tokens through available cryptocurrency exchanges, with secure storage in non-custodial wallets like Gate Web3 Wallet

- Dollar-Cost Averaging: Implement systematic periodic purchases to mitigate timing risk and volatility impact over extended periods

- Active Monitoring: Track project development milestones, partnership announcements, and ecosystem integration progress to inform position adjustments

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is QTC? What are its uses and features?

QTC is an innovative cryptocurrency with broad market potential and unique applications. It features novel technology scenarios and distinctive characteristics that attract specific communities, driving its market value growth.

What are the main factors affecting QTC price?

QTC price is primarily influenced by market interest rates, economic conditions, and Queensland government fiscal needs. Supply and demand dynamics, market sentiment, and trading volume also play significant roles in price movements.

How to conduct QTC price prediction? What are the analysis methods?

Analyze QTC price trends using technical analysis(charting patterns,support/resistance levels),fundamental analysis(project developments,market sentiment),and on-chain metrics(transaction volume,holder distribution). Monitor market cycles and volume patterns for prediction insights.

QTC price prediction accuracy and existing risks?

QTC price predictions are based on technical analysis and market trends. Accuracy varies due to market volatility and unpredictable factors. Investors should conduct thorough research before making decisions, as crypto markets involve inherent risks and price fluctuations.

How is QTC's price potential compared to similar projects?

QTC demonstrates strong price potential driven by government backing, deep market liquidity, and institutional adoption. Lower yield spreads reflect premium positioning among comparable projects, offering sustained upside prospects.

What is QTC's historical price trend? Are there any patterns to follow?

QTC shows volatile price movements without clear patterns. Market demand and supply dynamics are primary drivers. Historical data suggests cyclical fluctuations influenced by market sentiment and trading volume, though predicting future trends requires continuous monitoring of market conditions.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

What is NEAR Protocol's current market cap and 24-hour trading volume in 2026?

How active is the Chiliz community and what is the size of its DApp ecosystem?

What are the key derivatives market signals showing about funding rates, open interest, and liquidation data in 2026?

How to Use Technical Indicators (MACD, RSI, KDJ) to Predict Crypto Price Movements in 2026

What is Euler (EUL) DeFi Super App: Whitepaper logic, use cases, and technical innovations explained