2026 RFC Price Prediction: Expert Analysis and Market Forecast for the Next Generation of Decentralized Finance

Introduction: RFC's Market Position and Investment Value

Retard Finder Coin (RFC), as a community-driven meme coin built on the Solana blockchain, has developed since its launch in 2025. As of 2026, RFC maintains a market capitalization of approximately $557,150, with a circulating supply of around 961.43 million tokens, and the price is currently hovering around $0.0005795. This asset, inspired by the "I Find Retards" community on X (formerly Twitter), is positioned within the decentralized finance and meme coin ecosystem, emphasizing freedom of speech and community engagement.

This article will comprehensively analyze RFC's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. RFC Price History Review and Market Status

RFC Historical Price Evolution Trajectory

- 2025: RFC launched on the Solana blockchain via Pump.fun in January 2025, starting its trading journey with initial community enthusiasm.

- April 2025: The token reached a notable price level of $0.14129 on April 14, 2025, representing a significant milestone in its early trading history.

- 2026: Price experienced substantial volatility, declining to $0.0005655 on February 4, 2026, reflecting broader market adjustments and changing sentiment.

RFC Current Market Status

As of February 5, 2026, RFC is trading at $0.0005795, showing a slight recovery from recent lows. The 24-hour trading volume stands at $18,373.90, indicating moderate market activity for this community-driven token.

The token has experienced mixed short-term performance, with a 0.024% increase over the past hour, though facing a 6.75% decline in the 24-hour period. Weekly and monthly trends show more pronounced downward pressure, with declines of 35.68% and 57.07% respectively.

With a circulating supply of 961.43 million RFC tokens out of a maximum supply of 1 billion, the token maintains a circulation ratio of 96.14%. The market capitalization stands at approximately $557,150, while the fully diluted market cap reaches $579,500, representing a market cap to FDV ratio of 96.14%.

The token's holder base consists of 11,904 addresses, reflecting sustained community engagement despite recent price movements. The current market dominance stands at 0.000022% within the broader cryptocurrency ecosystem.

RFC's 24-hour price range has fluctuated between $0.0005655 and $0.0006295, demonstrating typical volatility patterns common in meme tokens. The token is currently listed on 7 exchanges and maintains active trading presence on Gate.com.

Click to view current RFC market price

RFC Market Sentiment Indicator

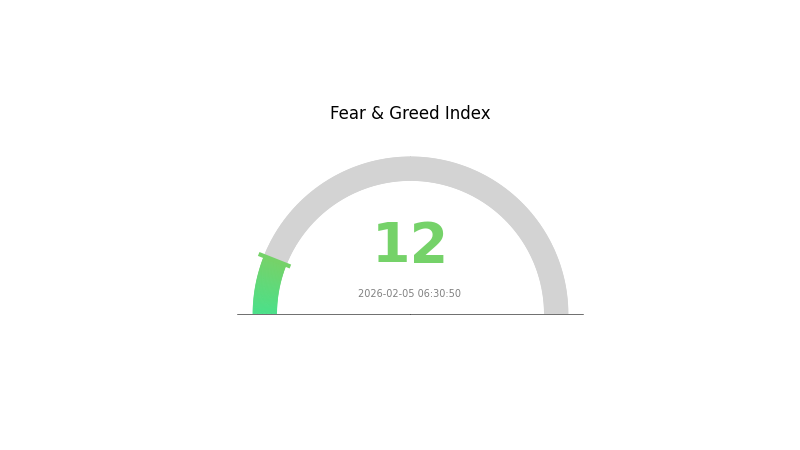

2026-02-05 Fear and Greed Index: 12 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 12. This reading indicates significant market pessimism and heightened investor anxiety. During periods of extreme fear, asset prices often reach attractive levels for long-term investors. However, this sentiment typically reflects underlying market concerns such as regulatory uncertainty or macroeconomic headwinds. Traders should exercise caution while identifying potential opportunities. Monitor key support levels and market fundamentals closely before making investment decisions during such volatile market conditions.

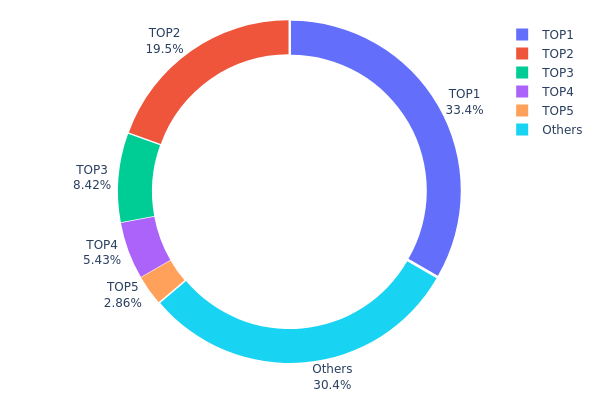

RFC Token Holding Distribution

The token holding distribution chart reflects the concentration of RFC tokens across different wallet addresses on the blockchain, serving as a critical indicator of market structure and decentralization level. According to the latest on-chain data as of February 5, 2026, RFC exhibits a notably concentrated holding pattern. The top-ranked address controls 333,550.39K tokens, representing 33.36% of the total supply, while the second-largest holder possesses 194,785.73K tokens (19.48%). Combined, the top two addresses alone account for over 52% of the circulating supply, indicating significant concentration in the hands of a few entities.

This high degree of centralization poses considerable implications for market dynamics. When substantial token quantities are concentrated among limited addresses, it creates potential vulnerabilities including heightened price volatility risk and susceptibility to market manipulation. Large holders possess the capacity to significantly influence price movements through concentrated buying or selling activities. The top five addresses collectively control 69.55% of the supply, leaving only 30.45% distributed among remaining market participants, which fundamentally constrains the token's decentralization characteristics.

From a market structure perspective, such concentration patterns typically correlate with reduced liquidity depth and increased systemic risk. While concentrated holdings may represent project team reserves, early investor allocations, or institutional positions serving legitimate purposes, this distribution configuration suggests RFC currently operates within a relatively centralized ecosystem. This structural characteristic may impact long-term price stability and ecosystem development trajectory, warranting careful monitoring of large holder activity and potential distribution changes over time.

Click to view current RFC Token Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 4QXXp1...zGaYB3 | 333550.39K | 33.36% |

| 2 | D6Rgz1...HGRrZC | 194785.73K | 19.48% |

| 3 | u6PJ8D...ynXq2w | 84211.05K | 8.42% |

| 4 | 9ZPsRW...ZgE4Y4 | 54331.56K | 5.43% |

| 5 | BmFdpr...WTymy6 | 28596.47K | 2.86% |

| - | Others | 304370.29K | 30.45% |

II. Core Factors Influencing RFC's Future Price

Supply Mechanism

- Market Demand and Sentiment: RFC's price is highly sensitive to overall market demand and sentiment shifts. As a meme-driven asset, its value relies heavily on sustained viral spread and community engagement rather than traditional tokenomics fundamentals.

- Historical Patterns: Past data indicates RFC experiences pronounced volatility during broader crypto market fluctuations. The asset demonstrated significant downside during the October 2025 market crash, when altcoins broadly lost substantial value within minutes.

- Current Impact: Given RFC's nature as a Solana-based meme coin, supply-side considerations remain secondary to demand dynamics. The asset's extreme volatility continues to stem from sentiment-driven trading rather than structural supply constraints.

Institutional and Whale Activity

- Institutional Holdings: Available materials contain no verified information regarding institutional positions in RFC. As a meme cryptocurrency, institutional participation appears minimal or non-existent at present.

- Corporate Adoption: No evidence exists in provided sources of corporate entities adopting RFC for operational purposes.

- National Policies: Regulatory environments in major crypto markets significantly impact RFC indirectly through broader market effects. Regulatory developments and legal clarity in key jurisdictions play critical roles in shaping sentiment toward speculative assets like RFC.

Macroeconomic Environment

- Monetary Policy Impact: Federal Reserve rate decisions and trade policy developments have demonstrated capacity to trigger systemic crypto market movements. The October 2025 flash crash, partially attributed to renewed trade tensions, illustrated how macroeconomic shocks cascade through altcoin markets including RFC.

- Inflation Hedge Characteristics: Materials provided contain no specific analysis of RFC's behavior during inflationary periods. As a speculative meme asset, its correlation with traditional inflation hedges remains unestablished.

- Geopolitical Factors: International developments, particularly US trade policy shifts, have shown capacity to destabilize crypto markets broadly. RFC's sensitivity to these macro shocks stems from its position within the risk-on asset spectrum rather than direct geopolitical exposure.

Technical Development and Ecosystem Building

- Viral Transmission Dynamics: RFC's price trajectory depends heavily on sustained social media engagement and viral content propagation. This mechanism represents the primary "technical" driver for meme-based assets.

- Liquidity Challenges: Following major market events like the October leverage liquidation crisis, RFC faces persistent liquidity depth issues. Reduced market-making activity amplifies price swings from large order flow.

- Ecosystem Applications: Available materials contain no information regarding DApp integrations or broader ecosystem utility for RFC. The asset appears to function primarily as a speculative trading vehicle rather than a foundation for application development.

III. 2026-2031 RFC Price Prediction

2026 Outlook

- Conservative prediction: $0.00031 - $0.00058

- Neutral prediction: $0.00058

- Optimistic prediction: $0.00063 (requires favorable market conditions)

2027-2029 Mid-term Outlook

- Market stage expectation: The token may enter a gradual growth phase as the cryptocurrency market matures and adoption increases

- Price range prediction:

- 2027: $0.00052 - $0.0007

- 2028: $0.00038 - $0.00088

- 2029: $0.00067 - $0.00097

- Key catalysts: Market sentiment shifts, broader cryptocurrency adoption, and potential technological developments may drive price movement

2030-2031 Long-term Outlook

- Baseline scenario: $0.00069 - $0.00127 (assuming steady market growth)

- Optimistic scenario: $0.00099 - $0.00145 (assuming accelerated adoption and favorable regulatory environment)

- Transformative scenario: Above $0.00145 (requires breakthrough developments and widespread institutional adoption)

- 2026-02-05: RFC price forecast indicates potential gradual appreciation over the five-year period with expected volatility

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00063 | 0.00058 | 0.00031 | 0 |

| 2027 | 0.0007 | 0.0006 | 0.00052 | 4 |

| 2028 | 0.00088 | 0.00065 | 0.00038 | 12 |

| 2029 | 0.00097 | 0.00076 | 0.00067 | 32 |

| 2030 | 0.00127 | 0.00087 | 0.00069 | 50 |

| 2031 | 0.00145 | 0.00107 | 0.00099 | 84 |

IV. RFC Professional Investment Strategy and Risk Management

RFC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with understanding of meme coin volatility and community-driven projects

- Operating Recommendations:

- Consider accumulating positions during periods of reduced volatility, acknowledging the high-risk nature of meme tokens

- Monitor community engagement on X (formerly Twitter) and developments from the I Find Retards community for sentiment indicators

- Storage Solution: Utilize Gate Web3 Wallet for secure storage with multi-signature functionality, ensuring private key control and recovery phrase backup in secure offline locations

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Apply short-term (7-day) and medium-term (30-day) moving averages to identify potential trend reversals, noting RFC's recent 35.68% decline over 7 days and 57.07% decline over 30 days

- Volume Analysis: Monitor 24-hour trading volume (currently $18,373.90) in conjunction with price movements to assess buying/selling pressure and liquidity conditions

- Swing Trading Considerations:

- Establish clear entry and exit points based on support levels (recent low: $0.0005655) and resistance levels (24-hour high: $0.0006295)

- Implement strict stop-loss orders due to significant volatility, as evidenced by the 87.63% decline from historical highs

RFC Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of total crypto portfolio, given RFC's meme coin classification and high volatility profile

- Aggressive Investors: 2-5% of total crypto portfolio, with understanding of potential complete capital loss

- Professional Investors: Up to 10% of speculative crypto allocation, employing advanced hedging strategies and real-time monitoring

(2) Risk Hedging Approaches

- Portfolio Diversification: Balance RFC exposure with established cryptocurrencies (BTC, ETH) and stablecoins to mitigate meme coin-specific risks

- Position Sizing: Utilize incremental entry strategies rather than single large positions, spreading purchases across different price levels

(3) Secure Storage Solutions

- Software Wallet Recommendation: Gate Web3 Wallet, offering user-friendly interface with robust security features for Solana-based tokens

- Cold Storage Approach: For larger RFC holdings, consider hardware wallet solutions compatible with Solana network, maintaining offline storage for long-term positions

- Security Precautions: Never share private keys or recovery phrases, verify contract address (C3DwDjT17gDvvCYC2nsdGHxDHVmQRdhKfpAdqQ29pump) before transactions, and be cautious of phishing attempts targeting meme coin communities

V. RFC Potential Risks and Challenges

RFC Market Risks

- Extreme Volatility: RFC has experienced substantial price fluctuations, declining 87.63% from its historical high of $0.14129 (April 14, 2025) to current levels around $0.0005795, indicating heightened volatility common in meme coins

- Limited Liquidity: With 24-hour trading volume of approximately $18,373.90 and market cap around $557,150, RFC presents liquidity constraints that may result in significant slippage during larger transactions

- Meme Coin Dependency: As a community-driven token inspired by social media communities, RFC's value is heavily dependent on sustained community engagement and social media trends, which can be unpredictable and short-lived

RFC Regulatory Risks

- Meme Coin Scrutiny: Regulatory authorities may increase oversight of meme tokens, particularly those launched on platforms like Pump.fun, potentially affecting trading availability and compliance requirements

- Platform Regulatory Changes: Changes in regulations affecting decentralized launch platforms or Solana network could impact RFC's operational environment and accessibility

- Content-Related Concerns: The project's association with specific social media communities and its thematic approach may attract regulatory attention regarding content standards and community governance

RFC Technical Risks

- Smart Contract Vulnerabilities: Despite Solana blockchain's robust infrastructure, tokens launched on platforms like Pump.fun may carry inherent smart contract risks if not thoroughly audited

- Network Dependency: RFC's reliance on Solana blockchain means that any network congestion, technical issues, or security incidents affecting Solana could directly impact RFC transactions and accessibility

- Limited Holder Base: With approximately 11,904 holders, RFC has a relatively concentrated ownership structure, creating potential risks from large holder movements and reduced decentralization

VI. Conclusion and Action Recommendations

RFC Investment Value Assessment

Retard Finder Coin presents as a high-risk, community-driven meme token built on Solana blockchain. While it demonstrates the accessibility and transparency benefits of fair-launch platforms like Pump.fun, investors should acknowledge substantial risks. The token has experienced significant depreciation (87.63% from historical highs), limited liquidity (market cap approximately $557,150), and dependence on social media community engagement. Long-term value proposition remains highly speculative and contingent on sustained community interest and broader meme coin market trends. Short-term risks include continued volatility, potential regulatory developments affecting meme tokens, and liquidity constraints.

RFC Investment Recommendations

✅ Beginners: Approach with extreme caution. If considering participation, allocate only minimal amounts you can afford to lose entirely (less than 1% of total investment portfolio). Prioritize education about meme coin dynamics, Solana ecosystem, and secure wallet management before any investment.

✅ Experienced Investors: RFC may serve as a speculative position within a diversified crypto portfolio (2-5% allocation). Employ strict risk management protocols, including predetermined exit strategies, stop-loss orders, and continuous monitoring of community engagement metrics on X platform. Recognize this as high-risk speculation rather than fundamental investment.

✅ Institutional Investors: Due to limited liquidity, concentrated holder base, and lack of fundamental utility beyond community engagement, RFC presents challenges for institutional allocation. If considering exposure, limit to experimental or speculative venture portfolios with appropriate risk disclosure and compliance frameworks addressing meme token characteristics.

RFC Trading Participation Methods

- Spot Trading on Gate.com: Access RFC trading pairs through Gate.com exchange, offering established platform infrastructure with various trading tools and liquidity options for RFC transactions

- Decentralized Trading: Engage with RFC through Solana-based decentralized exchanges, utilizing Gate Web3 Wallet for direct blockchain interaction and maintaining self-custody of assets

- Gradual Accumulation: Consider dollar-cost averaging strategies to mitigate entry timing risks, spreading purchases across multiple time periods to reduce impact of short-term price volatility

Cryptocurrency investment carries extreme risks. This article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is RFC token? What practical application value does it have?

RFC is a meme token designed for community culture exchange. It serves as a digital carrier of shared community values and culture, without complex staking or liquidity mining mechanisms. Its primary utility is community engagement and cultural expression.

What is RFC's historical price trend? What was the price change over the past year?

RFC has maintained stable performance over the past year with approximately 0% fluctuation. Despite experiencing a 28% decline at its lowest point previously, the price has recovered significantly. Over longer periods of 3 to 5 years, RFC continues to demonstrate strong performance metrics.

How will RFC price perform in 2024? What are the influencing factors?

RFC price in 2024 is expected to rise driven by Fed policy shifts and easing monetary conditions. Key factors include quantitative tightening end, market demand growth, and technological development progress. Macroeconomic stability will support upward momentum.

What are the advantages and disadvantages of RFC compared to other similar tokens?

RFC Token excels in transparent tokenomics and genuine product utility. However, it faces challenges in scalability and security infrastructure compared to established competitors. Strong fundamentals position it as a promising investment opportunity.

What risks should I be aware of when investing in RFC tokens?

RFC token investment carries high volatility and market uncertainty. Price fluctuations can be significant, requiring careful risk management. Thoroughly research market dynamics before investing.

How is RFC's liquidity and trading volume? On which exchanges can it be traded?

RFC maintains good liquidity with strong trading volume. The token is available on multiple major exchanges, providing traders with accessible entry and exit points for efficient price discovery and market participation.

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Solana Price in 2025: SOL Token Analysis and Market Outlook

How Does Solana's Proof of History Work?

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Is Solana a Good Investment?

Solana in 2025: Ecosystem Growth and DeFi Dominance

What is DOOD price today and how does it rank in the crypto market cap?

What is DOOD token and how does it compare to other NFT ecosystem competitors in market cap and user adoption?

How to use MACD and RSI indicators for crypto trading signals and price predictions

What are crypto derivatives market signals and how do funding rates, liquidations, and open interest reveal investor sentiment in 2026?

Who Are Cameron and Tyler Winklevoss? A Profile on the Twins