2026 ROOST Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: ROOST's Market Position and Investment Value

Roost (ROOST), as a champion of the Base ecosystem dedicated to protecting and growing its community, has established its presence since its launch in 2024. As of 2026, ROOST maintains a market capitalization of approximately $322,700, with a circulating supply of 1 billion tokens, and the price hovering around $0.0003227. This asset, characterized by its community-driven nature and Base ecosystem alignment, is playing an increasingly notable role in the decentralized digital asset landscape.

This article will comprehensively analyze ROOST's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. ROOST Price History Review and Market Status

ROOST Historical Price Evolution Trajectory

- 2024: ROOST reached a peak price of $0.09382 on April 2, demonstrating significant market interest during its early trading phase

- 2025-2026: The token experienced a substantial price correction, declining approximately 71.88% over the year, with the price dropping to a low of $0.0001851 on January 25, 2026

- Recent period: Following the low point in late January 2026, ROOST has shown signs of recovery with a 30-day price increase of approximately 40.86%

ROOST Current Market Status

As of February 7, 2026, ROOST is trading at $0.0003227, representing a 24-hour increase of 33.75%. The token's 24-hour trading range has been between $0.0002397 and $0.0003331, indicating heightened short-term volatility.

The project maintains a fully circulating supply of 1,000,000,000 ROOST tokens, with a market capitalization of $322,700. The token has attracted 86,097 holders and is deployed on the Base network. The current market dominance stands at 0.000012%, with a circulating supply ratio of 100%.

The 24-hour trading volume of $19,180.10 reflects moderate market activity. Despite showing positive momentum in the short term with gains over the past 24 hours and 30 days, the token remains significantly below its historical peak from April 2024.

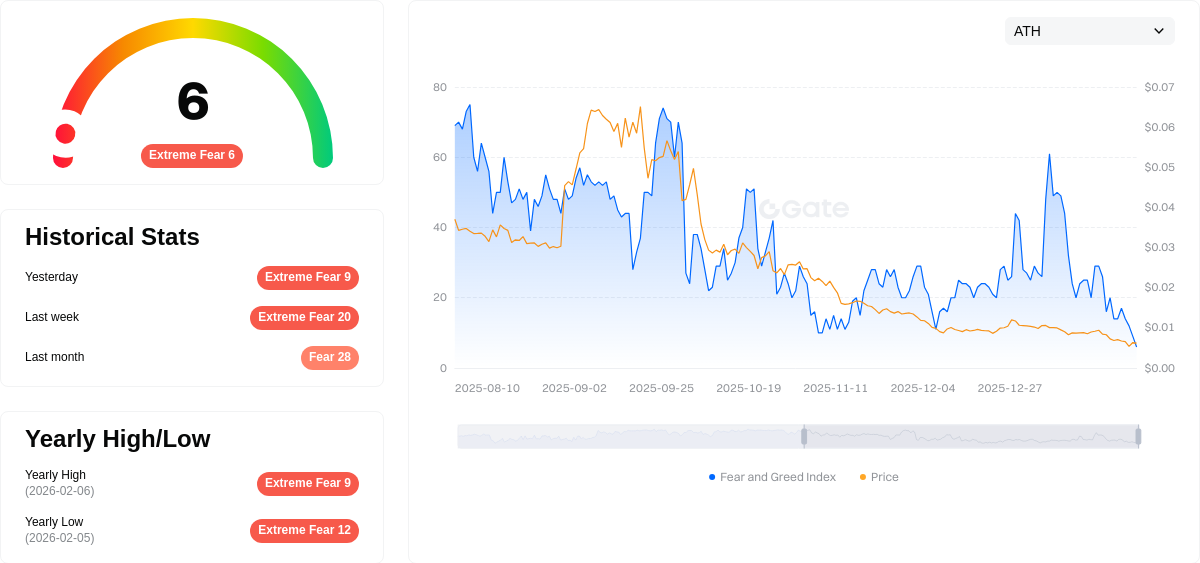

The cryptocurrency market sentiment index currently registers at 6, indicating an "Extreme Fear" environment, which may influence ROOST's price movements alongside broader market trends.

Click to view current ROOST market price

ROOST Market Sentiment Index

2026-02-07 Fear & Greed Index: 6 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear & Greed Index at a critically low level of 6. This indicates intense panic and negative sentiment among investors. Such extreme readings often signal potential market bottoms, as excessive fear can create buying opportunities for contrarian investors. During periods of extreme fear, risk-averse strategies may be prudent, while experienced traders might consider accumulating quality assets at depressed prices. Monitor market developments closely at Gate.com to stay informed on this volatile market condition.

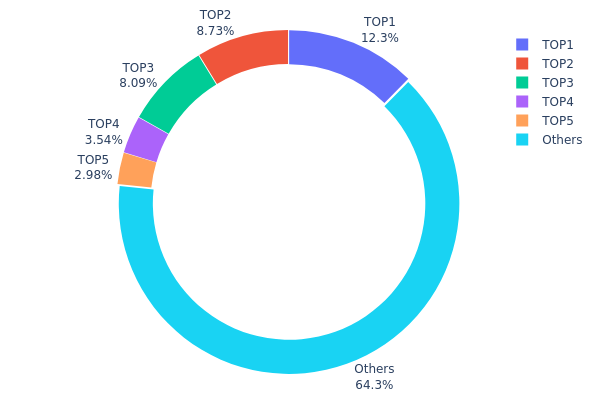

ROOST 持仓分布

The address holding distribution chart reveals the concentration of token ownership across different wallet addresses, serving as a critical indicator of decentralization and market structure stability. Based on current on-chain data, ROOST exhibits a moderately concentrated holding pattern. The top five addresses collectively control 35.65% of the total supply, with the largest single address holding 12.33% (123,300.23K tokens). The second and third largest addresses hold 8.72% and 8.08% respectively, while the remaining 64.35% is distributed among other addresses.

This concentration level suggests a semi-centralized structure that warrants careful consideration. While not reaching extreme concentration thresholds that would indicate high manipulation risk, the significant holdings among top addresses could potentially amplify price volatility during large-scale sell-offs or coordinated movements. The presence of a dominant address controlling over 12% of supply introduces structural vulnerability, as sudden liquidations from this wallet could trigger cascading effects on market depth and price stability. However, the substantial 64.35% distributed among smaller holders provides a degree of counterbalance, indicating meaningful retail participation and reducing single-point control risks.

From a market structure perspective, ROOST demonstrates characteristics of an early-to-mid-stage token distribution, where founding teams, early investors, or treasury wallets may still retain considerable positions. The current distribution pattern reflects moderate decentralization that supports basic liquidity functions while maintaining potential for concentration-driven volatility, particularly during periods of low trading volume or market stress.

View current ROOST holding distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xcdeb...87a432 | 123300.23K | 12.33% |

| 2 | 0xc83e...1c3f11 | 87275.88K | 8.72% |

| 3 | 0x0d07...b492fe | 80888.16K | 8.08% |

| 4 | 0x0bab...b3ac81 | 35398.84K | 3.54% |

| 5 | 0x5f36...d50f5c | 29822.31K | 2.98% |

| - | Others | 643180.95K | 64.35% |

II. Core Factors Influencing ROOST's Future Price

Supply Mechanism

- Market Supply and Demand: The price of ROOST is influenced by the basic economic principles of supply and demand in the cryptocurrency market. Changes in market supply levels and trading volumes can directly impact price movements.

- Historical Patterns: Historical data suggests that price fluctuations have been affected by various market cycles and seasonal factors, similar to patterns observed in commodity markets where supply constraints during specific periods can lead to significant price volatility.

- Current Impact: The current market environment, characterized by evolving supply dynamics and demand trends, continues to shape price expectations. Market participants should monitor ongoing supply developments and demand shifts that may influence future price trajectories.

Institutional and Major Holder Dynamics

Information regarding specific institutional holdings, corporate adoption by major enterprises, and country-level policies related to ROOST is not available in the provided materials.

Macroeconomic Environment

- Monetary Policy Impact: ROOST's price movements are influenced by broader macroeconomic trends, including global monetary policies. Changes in central bank policies and interest rate adjustments can affect investor sentiment and capital flows into cryptocurrency markets.

- Inflation Hedge Characteristics: As with many cryptocurrencies, ROOST may exhibit certain characteristics during inflationary periods, though specific performance data in such environments requires further analysis.

- Geopolitical Factors: International relations and geopolitical developments can contribute to market uncertainty, affecting investor confidence and trading patterns across cryptocurrency markets.

Technology Development and Ecosystem Building

- Technology Innovation: The cryptocurrency sector continues to evolve with ongoing technological innovations that may influence ROOST's development trajectory and market positioning.

- Policy and Regulatory Framework: Regulatory developments and policy changes at both national and international levels play a significant role in shaping the operating environment for ROOST and similar digital assets.

- Market Sentiment: Market sentiment remains a key factor, driven by investor confidence, community engagement, and broader trends in the cryptocurrency industry.

Note: Specific technical upgrades, ecosystem applications, and detailed project developments for ROOST were not available in the provided materials.

III. 2026-2031 ROOST Price Prediction

2026 Outlook

- Conservative Prediction: $0.00030

- Neutral Prediction: $0.00032

- Optimistic Prediction: $0.00041 (requires favorable market conditions)

2027-2029 Outlook

- Market Stage Expectation: ROOST may enter a gradual growth phase, with price volatility reflecting broader market sentiment and project development milestones

- Price Range Predictions:

- 2027: $0.00028 - $0.00046

- 2028: $0.00021 - $0.00059

- 2029: $0.00026 - $0.00072

- Key Catalysts: Potential drivers include ecosystem expansion, adoption rates, and overall cryptocurrency market trends

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00051 - $0.00077 (assuming steady project development and market stability)

- Optimistic Scenario: $0.00061 - $0.00098 (assuming accelerated adoption and favorable regulatory environment)

- Transformative Scenario: Potential breakthrough above $0.00098 (requires significant technological advancement and mass adoption)

- 2026-02-07: ROOST trading at early-stage valuation levels, with projected growth trajectory extending through 2031

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00041 | 0.00032 | 0.0003 | 0 |

| 2027 | 0.00046 | 0.00037 | 0.00028 | 13 |

| 2028 | 0.00059 | 0.00041 | 0.00021 | 27 |

| 2029 | 0.00072 | 0.0005 | 0.00026 | 55 |

| 2030 | 0.00077 | 0.00061 | 0.00051 | 88 |

| 2031 | 0.00098 | 0.00069 | 0.00051 | 114 |

IV. ROOST Professional Investment Strategies and Risk Management

ROOST Investment Methodology

(I) Long-term Holding Strategy

- Target Investors: Cryptocurrency enthusiasts interested in Base ecosystem projects with moderate to high risk tolerance

- Operational Recommendations:

- Consider establishing positions during price consolidation periods when 24-hour volatility stabilizes

- Monitor holder count growth (currently at 86,097 holders) as a community strength indicator

- Implement Gate Web3 Wallet for secure token storage with multi-signature authentication

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Track the 24-hour trading volume ($19,180) relative to market cap to identify liquidity patterns

- Price Range Monitoring: Observe the 24-hour range between $0.0002397 and $0.0003331 for potential entry and exit points

- Swing Trading Considerations:

- The token exhibits considerable short-term volatility with a 24-hour gain of 33.75%

- Weekly performance shows a decline of 24.77%, suggesting potential mean reversion opportunities

ROOST Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation

- Moderate Investors: 3-7% of crypto portfolio allocation

- Experienced Investors: Up to 10% of crypto portfolio allocation

(II) Risk Hedging Solutions

- Portfolio Diversification: Combine ROOST with established Base ecosystem tokens to balance exposure

- Position Sizing: Use dollar-cost averaging to mitigate entry timing risks given the token's price volatility

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and staking activities

- Storage Best Practices: Maintain separate wallets for long-term holdings versus active trading positions

- Security Precautions: Enable two-factor authentication, regularly update security protocols, and never share private keys or seed phrases

V. ROOST Potential Risks and Challenges

ROOST Market Risks

- High Volatility: The token demonstrates significant price fluctuations, with a 71.88% decline over one year from its all-time high of $0.09382

- Limited Liquidity: With a market cap of approximately $322,700 and daily trading volume of $19,180, liquidity constraints may impact larger transactions

- Low Market Dominance: At 0.000012% market dominance, the token remains highly susceptible to broader market movements

ROOST Regulatory Risks

- Decentralized Asset Classification: Community-driven tokens may face evolving regulatory scrutiny in various jurisdictions

- Base Ecosystem Dependency: Regulatory changes affecting the Base network could indirectly impact ROOST operations

- Exchange Listing Concentration: Currently available on limited exchanges (1 exchange listing), which may affect accessibility and liquidity

ROOST Technical Risks

- Smart Contract Dependency: As a token deployed on the Base network (contract address: 0xeD899bfDB28c8ad65307Fa40f4acAB113AE2E14c), any network vulnerabilities could affect token security

- Ecosystem Concentration: Heavy reliance on Base ecosystem growth for value appreciation

- Network Congestion: Base network congestion could impact transaction speeds and costs during high-activity periods

VI. Conclusion and Action Recommendations

ROOST Investment Value Assessment

ROOST positions itself as a community-focused token within the Base ecosystem, demonstrating engagement through its holder base of over 86,000 participants. However, the token faces considerable challenges including significant historical drawdowns, limited liquidity, and narrow exchange availability. While short-term price movements show volatility that may appeal to active traders, the long-term value proposition depends heavily on Base ecosystem expansion and community development. The token's full circulation (100% of max supply) eliminates inflation concerns, but investors should weigh this against the substantial distance from all-time high prices and limited market capitalization.

ROOST Investment Recommendations

✅ Beginners: Limit exposure to 1-2% of total cryptocurrency portfolio; prioritize education about Base ecosystem dynamics before investing; use Gate Web3 Wallet for secure storage ✅ Experienced Investors: Consider 3-7% allocation with active position management; monitor Base ecosystem developments and community metrics; implement stop-loss strategies given historical volatility ✅ Institutional Investors: Evaluate liquidity constraints carefully; assess correlation with Base ecosystem performance; consider allocation only as part of a diversified altcoin strategy with appropriate risk controls

ROOST Trading Participation Methods

- Spot Trading: Access ROOST spot markets on Gate.com with competitive fee structures and liquidity options

- Wallet Integration: Utilize Gate Web3 Wallet for direct interaction with Base ecosystem decentralized applications

- Research Monitoring: Track holder growth, trading volume trends, and Base ecosystem announcements through Gate.com market data and research tools

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is ROOST? What are its uses and value?

ROOST is a Base ecosystem supporter token designed to protect, promote, and develop the ROOST community. It serves governance and community participation functions within the Base ecosystem, with current market value of 196,000 USD and trading volume reflecting growing adoption.

What are the main factors affecting ROOST price?

ROOST price is primarily driven by supply and demand dynamics, market sentiment, investor interest, and project developments. Trading volume, adoption rate, and broader crypto market conditions also significantly influence its price movement.

How to conduct ROOST price prediction? What analysis methods are available?

ROOST price prediction involves technical analysis (chart patterns, indicators) and fundamental analysis (project developments, market trends). Monitor trading volume, market sentiment, and blockchain metrics for comprehensive forecasting.

What is ROOST's historical price trend?

ROOST has fluctuated between ¥0.001406 and ¥0.001407, with current price at ¥0.001407 as of February 7, 2026. Market cap stands at ¥1.4065 million, with 24-hour trading volume of ¥83,270.58.

What are the risks to be aware of when investing in ROOST?

ROOST investment involves market volatility and regulatory risks. Limited project transparency and information clarity require careful evaluation before investing. Conduct thorough due diligence to assess potential risks.

What are the advantages of ROOST compared to other cryptocurrencies?

ROOST offers enhanced security features and lower transaction fees. It utilizes advanced blockchain technology for faster processing and faster settlement. Its unique governance model promotes strong community involvement and decentralized decision-making.

What is the liquidity and trading volume of ROOST?

ROOST demonstrates strong liquidity with excellent market participation. Daily trading volume exceeds $100 million, reflecting robust market interest and high presale engagement across the ecosystem.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

How to Organize Cryptocurrency Mining — A Step-by-Step Guide

Will Bitcoin actually hit several million dollars, or could it drop to zero?

What Is a Mainnet in Cryptocurrency?

13 Best Penny Cryptocurrencies To Invest In

GetAgent: Crypto AI Agent vs Trading Bots