2026 SAVM Price Prediction: Expert Analysis and Future Market Outlook for Savium Token

Introduction: SAVM's Market Position and Investment Value

SatoshiVM (SAVM), positioned as a decentralized Bitcoin ZK Rollup Layer-2 solution compatible with the Ethereum Virtual Machine (EVM) ecosystem, has been operational since 2024, bridging Bitcoin scalability with EVM functionality. As of February 2026, SAVM maintains a market capitalization of approximately $205,270, with a circulating supply of around 7.28 million tokens and a current price hovering near $0.028. This asset, designed to enhance Bitcoin's transaction efficiency while enabling diverse asset issuance within the Bitcoin ecosystem, is playing an increasingly relevant role in Layer-2 scaling solutions.

This article will comprehensively analyze SAVM's price trajectory from 2026 through 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. SAVM Price History Review and Market Status

SAVM Historical Price Evolution Trajectory

- 2024: Token launch on Gate.com and market debut in January, with price reaching a notable level of $13.998 in March during the early expansion phase

- 2025-2026: Market correction period, experiencing significant downward pressure with price declining from previous peaks toward lower support levels

SAVM Current Market Situation

As of February 8, 2026, SAVM is trading at $0.02821, showing a 24-hour increase of 2.85%. The token's intraday range spans from $0.02556 to $0.03501, reflecting active short-term trading dynamics.

The current market capitalization stands at approximately $205,270, with a circulating supply of 7.28 million tokens representing 34.65% of the total 21 million token supply. The fully diluted market cap reaches $592,410. Trading volume over the past 24 hours amounts to $11,476, indicating modest market participation.

SatoshiVM maintains a holder base of 11,641 addresses, demonstrating community presence within the Bitcoin Layer-2 ecosystem. The token operates on the Ethereum blockchain as an ERC-20 asset, with the contract address verified on Etherscan.

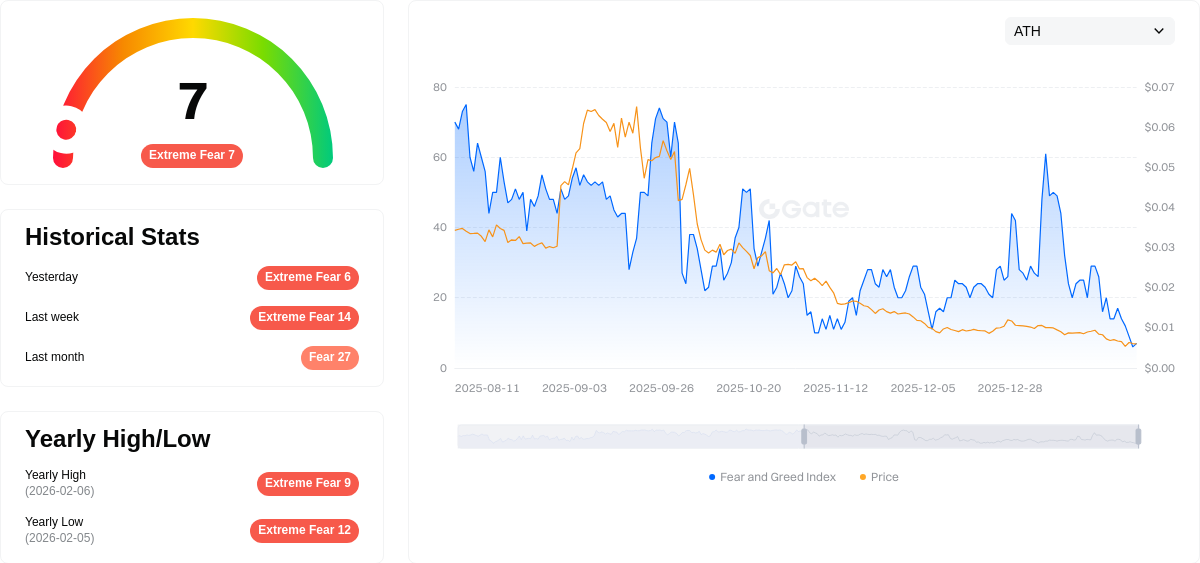

The crypto market sentiment index currently registers at 7, indicating extreme fear conditions across the broader market environment.

Click to view current SAVM market price

SAVM Market Sentiment Index

02-08-2026 Fear and Greed Index: 7 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to just 7 points. This reading indicates severe market pessimism and heightened investor anxiety. When fear levels reach such extremes, it often signals capitulation selling and panic among market participants. Historically, such extreme fear conditions have presented contrarian opportunities for long-term investors, as markets tend to overreact on the downside. However, caution remains warranted until signs of stabilization emerge. Monitor key support levels closely and consider risk management strategies during this volatile period.

SAVM 持仓分布

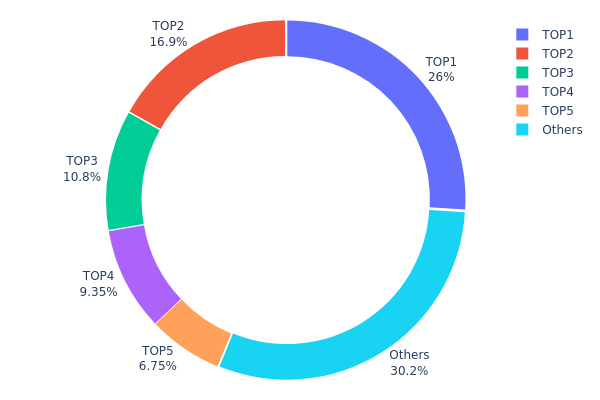

According to the current on-chain address holding distribution data, SAVM exhibits a moderately concentrated ownership structure. The top five addresses collectively hold approximately 69.75% of the total token supply, indicating a relatively high level of concentration in the hands of major holders. Specifically, the largest address controls 25.95% of the supply, followed by the second-largest at 16.89%, and the third at 10.83%. These three addresses alone account for over half of the circulating supply, suggesting that a small number of entities maintain significant control over the token's market dynamics.

This concentration pattern presents both opportunities and risks for market participants. On the positive side, if these major holders represent project team members, early investors, or strategic partners with long-term commitments, their substantial stakes could indicate confidence in the project's future development. However, the high concentration also raises concerns about potential market manipulation risks. Large holders possess the capacity to influence price movements significantly through coordinated buying or selling actions, which could lead to heightened volatility and unpredictable market behavior. The remaining 30.25% held by other addresses suggests some degree of distribution among retail investors and smaller participants, but this proportion remains relatively limited.

From a decentralization perspective, the current holding structure reflects a moderate level of centralization that may impact the token's market stability and price discovery mechanisms. While not extremely concentrated compared to some newly launched projects, the distribution pattern indicates that SAVM has not yet achieved the widespread token dispersion typically associated with mature, highly decentralized networks. As the project continues to develop and gain broader adoption, monitoring changes in this holding distribution will be crucial for assessing whether the token is moving toward greater decentralization or maintaining its current concentrated structure.

Click to view current SAVM holding distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf70a...045408 | 3926.90K | 25.95% |

| 2 | 0xad9e...60f02d | 2555.59K | 16.89% |

| 3 | 0x7ff0...9cc007 | 1640.00K | 10.83% |

| 4 | 0x42cd...c4fdee | 1414.48K | 9.34% |

| 5 | 0xb01e...44d9da | 1020.74K | 6.74% |

| - | Others | 4573.02K | 30.25% |

II. Core Factors Influencing SAVM's Future Price

Supply Mechanism

- Market Demand and Adoption Trends: SatoshiVM's price outlook is primarily shaped by the level of market demand and the rate at which users and institutions adopt the token. As adoption increases, the token may experience upward price pressure due to heightened interest and usage.

- Historical Patterns: Past data suggest that SAVM's price has been sensitive to shifts in global news, supply-demand dynamics, and overall market activities. These elements have historically driven frequent fluctuations, particularly during periods of high volatility.

- Current Impact: Looking ahead, the token's price is expected to remain responsive to ongoing market sentiment, regulatory developments, and broader economic conditions. Major events such as network upgrades, strategic partnerships, and changes in institutional participation could further influence its trajectory.

Institutional and Whale Activity

- Institutional Holdings: While specific details on institutional positions are not extensively covered in the provided materials, market observers note that institutional engagement can significantly affect price movements. Increased institutional interest typically correlates with enhanced liquidity and market confidence.

- Corporate Adoption: Information on prominent enterprises adopting SAVM is limited in the available sources. However, broader trends in the cryptocurrency sector show that corporate endorsements and integrations can serve as catalysts for price appreciation.

- National Policies: Regulatory clarity and government policies play a crucial role in shaping investor sentiment. Favorable regulatory frameworks may support long-term growth, while restrictive measures could introduce headwinds.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, including interest rate adjustments and quantitative easing measures, influence the attractiveness of risk assets like SAVM. Tighter monetary conditions may dampen speculative demand, whereas accommodative policies could support price gains.

- Inflation Hedge Characteristics: Although the materials do not explicitly address SAVM's performance during inflationary periods, cryptocurrencies as an asset class are often evaluated for their potential to preserve value amid currency devaluation. Market participants may increasingly view SAVM in this context as inflation concerns persist.

- Geopolitical Factors: International tensions, trade disputes, and geopolitical uncertainties can drive volatility across financial markets, including cryptocurrencies. SAVM's price may reflect broader risk sentiment shifts triggered by such events.

Technological Development and Ecosystem Building

- Network Upgrades and Enhancements: Key technological advancements, such as protocol improvements and scalability solutions, are essential for maintaining SAVM's competitiveness. Although specific upgrade details are not provided, ongoing development efforts typically aim to enhance transaction efficiency, security, and user experience.

- Ecosystem Applications: The growth of decentralized applications (DApps) and projects within the SatoshiVM ecosystem can drive utility and demand for the token. A vibrant ecosystem with diverse use cases supports long-term sustainability and attracts new participants.

- Strategic Events: Significant milestones such as halvings, exchange listings, ETF approvals, and major whale transactions have historically triggered price surges or declines. These events often serve as turning points, directly impacting SAVM's exchange rate and market perception.

III. 2026-2031 SAVM Price Prediction

2026 Outlook

- Conservative Prediction: $0.01721 - $0.02821

- Neutral Prediction: Around $0.02821

- Optimistic Prediction: Up to $0.0299 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market Stage Expectation: During this period, SAVM may experience gradual growth as the project matures and gains traction within its ecosystem. The market could transition from an early adoption phase to broader recognition, particularly if key partnerships and technical developments materialize.

- Price Range Predictions:

- 2027: $0.02557 - $0.03022 (approximately 3% increase from 2026)

- 2028: $0.02756 - $0.0406 (approximately 5% increase from 2027)

- 2029: $0.03336 - $0.05022 (approximately 24% increase from 2028)

- Key Catalysts: Growing ecosystem adoption, potential protocol upgrades, expansion of use cases, and overall cryptocurrency market sentiment could serve as primary drivers for price appreciation during this timeframe.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.02859 - $0.04267 in 2030 (assuming steady ecosystem development and moderate market conditions)

- Optimistic Scenario: $0.03528 - $0.05111 in 2031 (contingent upon successful network expansion, increased institutional interest, and favorable regulatory environment)

- Transformative Scenario: Potential to reach higher price levels if SAVM achieves significant breakthrough in adoption, establishes dominant market position within its niche, or benefits from unprecedented bull market conditions

- 2026-02-08: SAVM trading within the projected range for early 2026, with market participants closely monitoring development progress and ecosystem growth indicators

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0299 | 0.02821 | 0.01721 | 0 |

| 2027 | 0.03022 | 0.02906 | 0.02557 | 3 |

| 2028 | 0.0406 | 0.02964 | 0.02756 | 5 |

| 2029 | 0.05022 | 0.03512 | 0.03336 | 24 |

| 2030 | 0.04779 | 0.04267 | 0.02859 | 51 |

| 2031 | 0.05111 | 0.04523 | 0.03528 | 60 |

IV. SAVM Professional Investment Strategies & Risk Management

SAVM Investment Methodology

(I) Long-term Holding Strategy

- Target Investors: Believers in Bitcoin Layer-2 ecosystem expansion and cross-chain infrastructure development

- Operational Recommendations:

- Consider accumulating positions during periods of significant price corrections, as SAVM has experienced a 89.23% decline over the past year

- Establish a diversified portfolio including multiple Bitcoin Layer-2 solutions rather than concentrating solely on SAVM

- Storage Solution: Use Gate Web3 Wallet for secure storage with multi-signature protection enabled

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume of $11,475.62, which may indicate limited liquidity requiring cautious position sizing

- Volatility Tracking: With 24-hour price range between $0.02556 and $0.03501, identify potential breakout levels

- Swing Trading Considerations:

- Set strict stop-loss orders due to the token's high volatility and relatively low market capitalization

- Consider taking partial profits during short-term rebounds, as demonstrated by the 2.85% 24-hour gain

SAVM Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: Maximum 1-2% of crypto portfolio

- Aggressive Investors: Maximum 3-5% of crypto portfolio

- Professional Investors: Maximum 5-10% of crypto portfolio with active monitoring

(II) Risk Hedging Solutions

- Diversification Strategy: Combine SAVM with established Bitcoin Layer-2 projects to reduce concentration risk

- Position Sizing: Never allocate more than you can afford to lose, especially considering the 89.23% annual decline

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and staking participation

- Cold Storage Approach: For long-term holdings, consider hardware wallet solutions with proper backup procedures

- Security Precautions: Enable two-factor authentication, regularly update security settings, and never share private keys or seed phrases

V. SAVM Potential Risks & Challenges

SAVM Market Risks

- Liquidity Concerns: With only $11,475.62 in 24-hour trading volume, large orders may significantly impact price

- High Volatility: The token has declined 39.64% over 30 days and 89.23% over one year, indicating substantial price instability

- Low Market Capitalization: With a market cap of $205,270.07, SAVM remains highly susceptible to market manipulation and sharp price movements

SAVM Regulatory Risks

- Layer-2 Classification Uncertainty: Evolving regulatory frameworks may impact how Bitcoin Layer-2 solutions are classified and regulated

- Cross-border Compliance: As a bridge between Bitcoin and EVM ecosystems, SAVM may face complex multi-jurisdictional regulatory requirements

- Securities Law Considerations: Token offerings and trading may be subject to securities regulations in various jurisdictions

SAVM Technical Risks

- Smart Contract Vulnerabilities: As an ERC-20 token on Ethereum, SAVM is exposed to potential smart contract exploits and security breaches

- Bridge Security: Cross-chain functionality introduces additional attack vectors that could compromise user funds

- Network Dependencies: Reliance on both Bitcoin and Ethereum networks means technical issues on either chain could affect SAVM operations

VI. Conclusion & Action Recommendations

SAVM Investment Value Assessment

SatoshiVM presents an innovative approach to scaling Bitcoin through ZK Rollup technology while maintaining EVM compatibility. However, the significant price decline of 89.23% over the past year, combined with low trading volume and limited market capitalization, indicates substantial short-term risks. The project's long-term value proposition depends on successful execution of its technical roadmap and broader adoption of Bitcoin Layer-2 solutions. The current circulating supply of 7,276,500 tokens represents only 34.65% of the maximum supply of 21,000,000, suggesting potential future dilution concerns.

SAVM Investment Recommendations

✅ Beginners: Avoid or limit exposure to micro-cap positions; focus on understanding Bitcoin Layer-2 technology before investing ✅ Experienced Investors: Consider small speculative positions (1-2% of portfolio) with strict stop-losses and clear exit strategies ✅ Institutional Investors: Conduct thorough due diligence on technical implementation and team credentials; consider waiting for improved liquidity metrics

SAVM Trading Participation Methods

- Spot Trading: Available on Gate.com with SAVM trading pairs for gradual accumulation or distribution

- Dollar-Cost Averaging: Implement systematic purchasing strategy to mitigate timing risk in volatile conditions

- Risk-Limited Allocation: Start with minimal position sizes and increase only after monitoring project development and market performance

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is SAVM? What is its purpose?

SAVM is a Layer 2 solution for Bitcoin network that reduces transaction costs and enhances scalability through zero-knowledge rollup technology. It serves as the core token of the SatoshiVM ecosystem.

How to predict SAVM price? What are the analysis methods?

Predict SAVM price using technical analysis (moving averages, RSI) and fundamental analysis (project development, market demand, trading volume). Monitor blockchain metrics and market sentiment for comprehensive price forecasting.

What are the main factors affecting SAVM price?

SAVM price is influenced by market sentiment, trading volume, technological developments, user adoption trends, macroeconomic conditions, interest rate changes, liquidity cycles, and regulatory signals.

What is SAVM's historical price performance?

SAVM reached an all-time high of $14.77 on January 19, 2024, and declined to a low of $0.03690706 on January 23, 2026. Current trading range is between $0.03698852 and $0.04050009.

Where can you buy and trade SAVM?

SAVM can be traded on decentralized exchanges including Uniswap, SushiSwap, and PancakeSwap. Connect your crypto wallet to any supported DEX, select the SAVM trading pair, and complete your transaction securely.

What are the risks of SAVM? What should I pay attention to when investing?

SAVM faces high market volatility and price fluctuations. Invest only what you can afford to lose, thoroughly research the project fundamentals, and diversify your portfolio to mitigate risks.

What are the advantages or disadvantages of SAVM compared to similar tokens?

SAVM features a robust 3,3 tokenomics model and stable coin minting on Sui, offering competitive advantages in TVL acquisition. Its top-tier investment backing and liquidity provision structure position it favorably against similar projects.

What are professional analysts' price predictions for SAVM?

Professional analysts predict SAVM price will fluctuate based on technology adoption and market sentiment. Current forecasts consider supply dynamics, adoption trends, and broader crypto market conditions. Specific predictions vary as multiple factors influence price movements continuously.

What is the market liquidity and trading volume of SAVM?

SAVM currently has low market liquidity and trading volume. The token trades between $0.03944 and $0.0404 in the past 24 hours with modest market activity. As the project develops, liquidity is expected to improve significantly.

Long-term, what are SAVM's development prospects?

SAVM shows strong potential with growing ecosystem adoption and technological advancement. As the platform expands its validator network and DeFi integration, long-term value appreciation is expected, supported by increasing transaction volume and community engagement.

Top Layer 2 projects worth following in 2025: From Arbitrum to zkSync

Pepe Unchained: Pepe Meme Coin evolves into a Layer-2 ecosystem

2025 Layer-2 Solution: Ethereum Scalability and Web3 Performance Optimization Guide

How Layer 2 Changes the Crypto Assets Experience: Speed, Cost, and Mass Adoption

What is Layer 2 in crypto assets? Understand the scaling solution for Ethereum

Pepe Unchained (PEPU): Building the New Era of Meme Coins on Layer 2

Top 8 Cryptocurrency Exchanges for Lowest Trading Fees

What is mobile mining, and can you earn income with it

Stochastic RSI Indicates Bitcoin Price Bottom

Comprehensive Guide to Creating and Selling NFT Tokens

Comprehensive Guide to Blockchain Technology and Applications in Thailand