2026 SCOR Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: SCOR's Market Position and Investment Value

SCOR, as a Web3 infrastructure network connecting professional sports intellectual property, fans, and developers in a verified on-chain environment, has been making significant strides since its launch in 2025. As of February 2026, SCOR has achieved a market capitalization of approximately $1.64 million, with a circulating supply of around 206 million tokens, and the price hovering around $0.007936. This asset, developed by Sweet, the official Web3 partner of the NHL and MLS, is playing an increasingly important role in revolutionizing the fan economy model within the sports industry.

This article will comprehensively analyze SCOR's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. SCOR Price History Review and Current Market Status

SCOR Historical Price Evolution Trajectory

- December 2025: SCOR reached a price peak of $0.0658 on December 17, 2025, marking a significant milestone shortly after its market debut

- January 2026: The token experienced notable volatility, declining to its record low of $0.006019 on January 28, 2026, representing a substantial correction from previous highs

- Early February 2026: Trading activity remained relatively subdued with 24-hour volume of $202,477.26, reflecting a consolidation phase following earlier price movements

SCOR Current Market Status

As of February 2, 2026, SCOR is trading at $0.007936, positioning itself within the lower range of its historical trading band. The token has demonstrated mixed short-term performance, with a modest decline of 0.16% over the past hour and 1.67% over the past 24 hours. The 7-day performance shows a 3.52% decrease, while the 30-day period reflects a more pronounced decline of 23.34%.

The current market capitalization stands at approximately $1.64 million, with a circulating supply of 206,025,560.51 SCOR tokens, representing 5.15% of the maximum supply of 4 billion tokens. The fully diluted market cap is calculated at $31.74 million. The 24-hour trading range spans from $0.007884 to $0.009442, indicating moderate intraday volatility.

SCOR ranks at position 2168 in the broader cryptocurrency market, with a market dominance of 0.0011%. The token is held by 4,682 addresses and is available for trading on 4 exchanges. The project operates on the BASE blockchain infrastructure, with its smart contract deployed at address 0xd67ec255100ef200a439d09ff865fbaa2ad9c730.

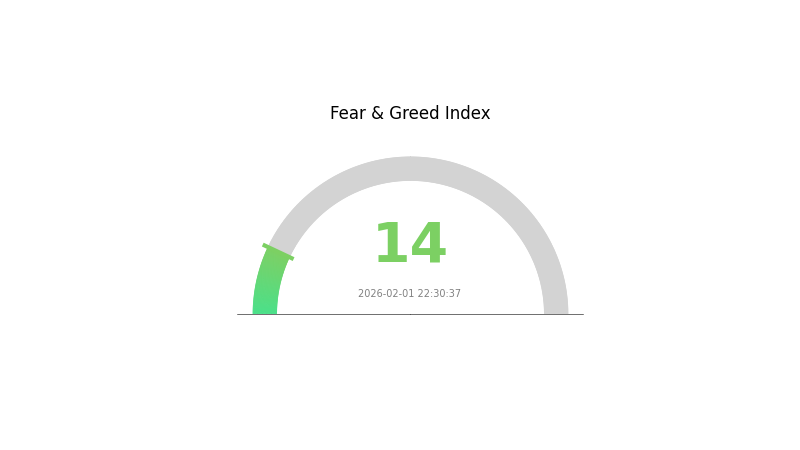

The broader cryptocurrency market sentiment index registers at 14, indicating an "Extreme Fear" environment, which may be contributing to the current price consolidation and subdued trading activity across the sector.

Click to view current SCOR market price

SCOR Market Sentiment Indicator

2026-02-01 Fear and Greed Index: 14 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently in a state of extreme fear, with the sentiment index hitting 14. This exceptionally low reading reflects heightened investor anxiety and pessimism across digital assets. During such extreme fear periods, risk-averse traders typically reduce exposure, while contrarian investors may view this as potential buying opportunities. Market volatility remains elevated, and investors should exercise caution while monitoring key support levels and fundamental developments that could signal a shift in sentiment.

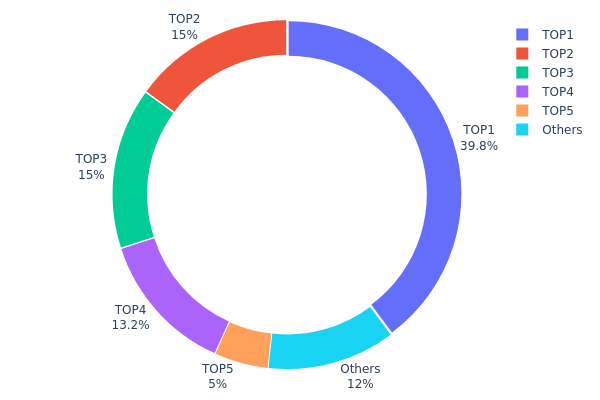

SCOR Holding Distribution

The holding distribution chart visualizes the concentration of token ownership across different wallet addresses, serving as a critical indicator of decentralization and potential market risk. According to the latest on-chain data, SCOR exhibits a highly concentrated holding pattern that warrants careful examination.

The top five addresses collectively control 88.04% of the total token supply, with the largest holder alone accounting for 39.79% (1,591,947.72K SCOR). The second and third addresses each hold exactly 15.00% (600,000.00K SCOR), while the fourth address contains 13.25% (530,000.00K SCOR). This concentration level significantly exceeds typical market standards, as only 11.96% of tokens are distributed among all remaining addresses. Such distribution patterns typically indicate early-stage project characteristics or strategic token allocation structures.

This concentration presents both structural implications and market dynamics concerns. The dominant position of top holders creates substantial price manipulation risks, as large-scale sell-offs from any major address could trigger significant market volatility. Additionally, the uniform holdings of 600,000.00K tokens in the second and third positions suggest potential coordination or institutional allocation strategies. While concentrated holdings can provide price stability during market downturns, they simultaneously reduce liquidity depth and limit genuine decentralization. Investors should monitor on-chain movements from these major addresses closely, as any significant transfer activity could serve as leading indicators for price action.

Click to view current SCOR Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc97a...9802c4 | 1591947.72K | 39.79% |

| 2 | 0x7bc5...8a999a | 600000.00K | 15.00% |

| 3 | 0xd53e...0f59d1 | 600000.00K | 15.00% |

| 4 | 0x5df1...052b0c | 530000.00K | 13.25% |

| 5 | 0x33e3...143b3e | 200000.00K | 5.00% |

| - | Others | 478052.28K | 11.96% |

II. Core Factors Influencing SCOR's Future Price

Supply Mechanism

- Market Demand and Competition Landscape: The supply configuration is influenced by delivery channels, inventory settings, and product manufacturing locations. Market demand dynamics and competitive positioning within the industry play significant roles in determining price trajectories.

- Historical Patterns: Supply chain configurations and market competitiveness have historically affected pricing structures through operational efficiency and market positioning adjustments.

- Current Impact: Current market demand trends and evolving competitive landscapes may continue to exert influence on price movements through shifts in supply-demand equilibrium.

Institutional and Major Holder Dynamics

Insufficient data available in the provided materials regarding institutional holdings, corporate adoption patterns, or national-level policy frameworks specifically related to SCOR.

Macroeconomic Environment

- Monetary Policy Impact: Future macroeconomic conditions, capital market performance, and investment channel developments may affect discount rates and investment return assumptions, introducing varying degrees of uncertainty into price formation.

- Investment Strategy Influence: Insurance capital investment channels and strategic allocation decisions represent external factors that could impact valuation assumptions and subsequent price behavior.

- Geopolitical Factors: International trade barriers and geopolitical tensions may create unpredictable effects on cross-border flows and supply chain stability, potentially affecting asset valuations.

Technical Development and Ecosystem Construction

Insufficient data available in the provided materials regarding specific technical upgrades, protocol improvements, or ecosystem application developments directly related to SCOR.

III. 2026-2031 SCOR Price Prediction

2026 Outlook

- Conservative prediction: $0.00476 - $0.00794

- Neutral prediction: $0.00794 (average scenario)

- Optimistic prediction: $0.00921 (requires favorable market conditions)

2027-2029 Outlook

- Market stage expectation: Gradual recovery and moderate growth phase, with potential market consolidation and progressive adoption trends

- Price range prediction:

- 2027: $0.00643 - $0.00892, with an 8% price change

- 2028: $0.00577 - $0.01023, with a 10% price change

- 2029: $0.00816 - $0.01176, with a 19% price change

- Key catalysts: Progressive market maturation, potential ecosystem developments, and broader cryptocurrency market sentiment

2030-2031 Long-term Outlook

- Baseline scenario: $0.00839 - $0.01445 (assuming stable market conditions and continued adoption)

- Optimistic scenario: $0.01063 - $0.01680 (assuming enhanced ecosystem growth and positive regulatory developments)

- Transformative scenario: Potential range reaching $0.01680 with 58% growth by 2031 (requires exceptionally favorable market conditions, significant technological advancements, and widespread adoption)

- 2026-02-02: SCOR trading within the predicted range of $0.00476 - $0.00921 (initial forecast period)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00921 | 0.00794 | 0.00476 | 0 |

| 2027 | 0.00892 | 0.00857 | 0.00643 | 8 |

| 2028 | 0.01023 | 0.00874 | 0.00577 | 10 |

| 2029 | 0.01176 | 0.00949 | 0.00816 | 19 |

| 2030 | 0.01445 | 0.01063 | 0.00839 | 33 |

| 2031 | 0.0168 | 0.01254 | 0.01154 | 58 |

IV. SCOR Professional Investment Strategy and Risk Management

SCOR Investment Methodology

(I) Long-term Holding Strategy

- Target Investors: Investors who believe in the Web3 sports infrastructure ecosystem and are willing to hold through market cycles

- Operational Recommendations:

- Consider accumulating positions during market downturns when the price shows oversold signals

- Monitor key partnerships and ecosystem developments as indicators of long-term value

- Utilize Gate Web3 Wallet for secure storage with multi-signature protection

(II) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Use 50-day and 200-day moving averages to identify trend reversals and entry points

- Volume Analysis: Monitor 24-hour trading volume trends to confirm price movements and liquidity conditions

- Swing Trading Points:

- Set stop-loss orders at key support levels to manage downside risk

- Take profits incrementally during upward momentum phases

SCOR Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio

- Aggressive Investors: 5-8% of portfolio

- Professional Investors: Up to 10% of portfolio with active risk hedging

(II) Risk Hedging Solutions

- Diversification: Balance SCOR holdings with established cryptocurrencies and stablecoins

- Position Sizing: Implement dollar-cost averaging to reduce timing risk

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading and staking access

- Cold Storage Solution: Hardware wallet storage for long-term holdings exceeding investment comfort levels

- Security Precautions: Enable two-factor authentication, never share private keys, regularly update security settings, and verify contract addresses before transactions

V. SCOR Potential Risks and Challenges

SCOR Market Risk

- Volatility Risk: SCOR has experienced a 23.34% decline over 30 days, indicating susceptibility to market-wide corrections

- Liquidity Risk: With a 24-hour trading volume of approximately $202,477, liquidity may be limited during volatile periods

- Market Cap Risk: As a relatively smaller project with a market cap of approximately $1.64 million, SCOR may experience amplified price swings

SCOR Regulatory Risk

- Sports IP Tokenization Compliance: The tokenization of professional sports intellectual property may face evolving regulatory scrutiny

- Securities Classification: Regulatory bodies may classify certain token distributions as securities offerings, requiring compliance adjustments

- Multi-Jurisdiction Challenges: Operating across various sports leagues and territories may expose the project to diverse regulatory frameworks

SCOR Technical Risk

- Smart Contract Vulnerabilities: Despite being built on BASE infrastructure, smart contract bugs could potentially impact token functionality

- Network Dependency: Reliance on BASE blockchain performance and security for transaction processing

- Integration Complexity: Coordinating with multiple sports organizations and maintaining secure on-chain verification systems presents technical challenges

VI. Conclusion and Action Recommendations

SCOR Investment Value Assessment

SCOR represents an innovative approach to connecting professional sports intellectual property with Web3 infrastructure, backed by notable partners including the NHL and MLS. The project demonstrates long-term potential through its partnerships with established sports organizations and support from strategic investors like Animoca Brands and Madison Square Garden. However, investors should recognize the current market challenges, including recent price declines and the relatively early stage of the fan economy ecosystem. The low circulating supply ratio of 5.15% suggests potential for future token unlocks that may impact price dynamics.

SCOR Investment Recommendations

✅ Beginners: Start with minimal allocation (1-2% of portfolio), focus on learning about the Web3 sports ecosystem, and avoid investing more than you can afford to lose ✅ Experienced Investors: Consider strategic accumulation during market corrections, monitor partnership announcements and ecosystem growth metrics, and maintain strict position sizing discipline ✅ Institutional Investors: Conduct thorough due diligence on tokenomics and unlock schedules, evaluate long-term sports IP tokenization trends, and implement professional risk management frameworks

SCOR Trading Participation Methods

- Spot Trading: Buy and hold SCOR tokens through Gate.com for direct exposure to price appreciation

- Dollar-Cost Averaging: Accumulate positions gradually over time to reduce timing risk and average entry price

- Active Monitoring: Track ecosystem developments, partnership announcements, and technical indicators to inform trading decisions

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is SCOR token and what is its current market price?

SCOR token is a digital asset with a current market price of $0.00000003213 USD and market cap of $2.78. It represents a blockchain-based token in the crypto ecosystem with minimal price volatility in recent trading activity.

What factors influence SCOR price movements and market trends?

SCOR price is influenced by trading volume, market sentiment, supply and demand dynamics, broader cryptocurrency market trends, regulatory developments, and project-specific news or partnerships.

How can I analyze SCOR price predictions and forecasts?

Review market trends, trading volume, and technical indicators on CoinMarketCap. Analyze expert forecasts, on-chain metrics, and historical price patterns to make informed SCOR price predictions and identify potential opportunities.

What is the historical price performance of SCOR token?

SCOR token has demonstrated a 16.82% change over the past year, with a 52-week range from 21.22 to 31.82. Current price reflects moderate market volatility and steady positioning within its annual trading range.

What are the risks and potential returns associated with SCOR price speculation?

SCOR speculation involves risks like market volatility and regulatory changes, but offers substantial returns potential. Strong fundamentals support upside opportunity, though price fluctuations and macroeconomic factors require careful monitoring for optimal entry timing.

How does SCOR compare to other similar tokens in the market?

SCOR differentiates itself through superior efficiency and scalability compared to competitors. Unlike Bitcoin's PoW model, SCOR employs an optimized consensus mechanism similar to Cardano, positioning it as a more energy-efficient alternative with stronger market fundamentals and adoption potential.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Top Staking Coins for Passive Income

Free Money for App Registration 2025

What is crypto? How can you explain digital currencies to a young child?

Top Cold Wallets for Cryptocurrency: Rankings

Everything You Need to Know About Sybil Attacks