2026 SCT Price Prediction: Expert Analysis and Market Forecast for Shardeum's Native Token

Introduction: SCT's Market Position and Investment Value

SuperCells Token (SCT), as the world's first blockchain-based stem cell membership service ecosystem, has been establishing its presence in the decentralized health technology sector since its launch. As of 2026, SCT maintains a market capitalization of approximately $223,770, with a circulating supply of around 88.44 million tokens, and its price is currently trading at approximately $0.0025. This asset, which aims to create a metaverse for stem cell storage, cultivation, research and development, trading, services, and incubation, is exploring innovative applications at the intersection of blockchain technology and the healthcare industry.

This article will comprehensively analyze SCT's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. SCT Price History Review and Market Status

SCT Historical Price Evolution Trajectory

- 2023: SCT reached its price peak on December 18, 2023, trading at $0.251382, representing a significant milestone in the token's early market performance

- 2025: The token experienced substantial volatility throughout the year, with price declining to its lowest recorded level of $0.00045025 on December 5, 2025

- 2026: As of February 8, 2026, SCT is trading at $0.0025302, showing a recovery of approximately 462% from its December 2025 low point

SCT Current Market Situation

SuperCells Token is currently trading at $0.0025302, with a 24-hour trading volume of $24,163.26. The token has experienced a price decline of 5.53% over the past 24 hours, with intraday fluctuations between a high of $0.002697 and a low of $0.0024213.

Over broader timeframes, SCT shows mixed performance indicators. The 1-hour chart reflects a modest decrease of 0.52%, while the 7-day performance shows a decline of 19.66%. The 30-day trend indicates a more substantial decrease of 43.75%. However, examining the annual performance reveals a positive gain of 8.59%, suggesting some resilience despite recent downward pressure.

The token maintains a market capitalization of approximately $223,770.89, with a circulating supply of 88,440,000 SCT tokens out of a maximum supply of 5,000,000,000 tokens. This represents a circulation ratio of approximately 1.77%. The fully diluted market capitalization stands at $12,651,000, indicating significant potential supply expansion in the future.

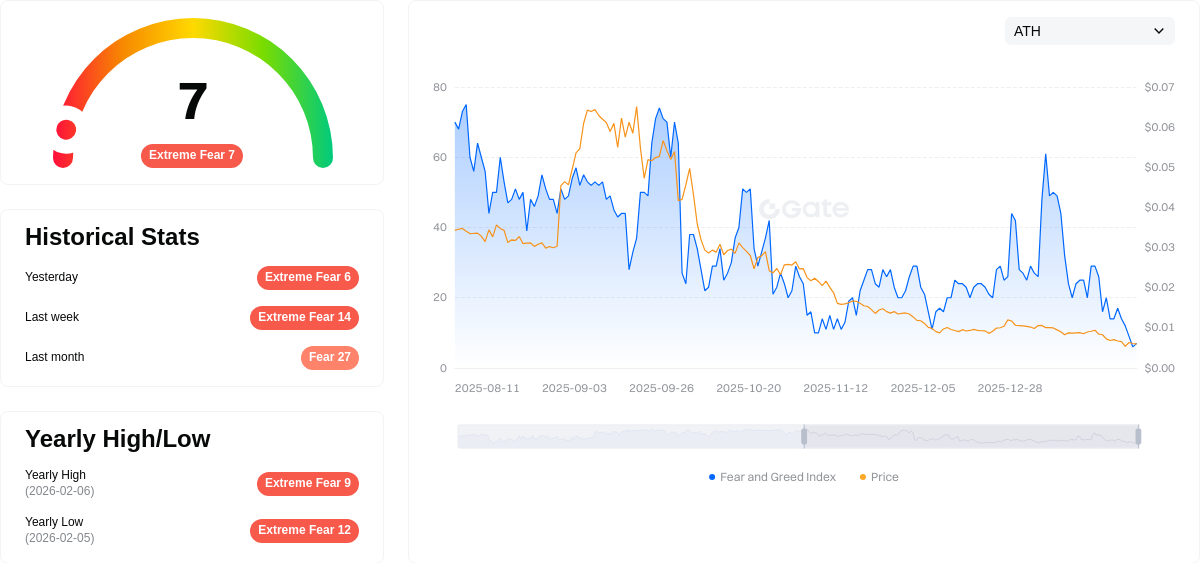

SuperCells Token holds a market dominance of 0.00050% and ranks #3803 in the cryptocurrency market. The token is currently listed on Gate.com and has approximately 26,559 holders. Market sentiment indicators show an extreme fear reading of 7 on the volatility index, reflecting cautious investor behavior in the broader cryptocurrency market environment.

Click to view current SCT market price

SCT Market Sentiment Indicator

2026-02-08 Fear and Greed Index: 7 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 7. This indicates severe market pessimism and widespread investor anxiety. Such extreme fear conditions often present contrarian opportunities, as markets tend to be oversold during these periods. Historically, when sentiment reaches these lows, recovery phases frequently follow. Investors should exercise caution but also consider that panic-driven sell-offs may create potential entry points for long-term positioning. Monitor market developments closely before making investment decisions.

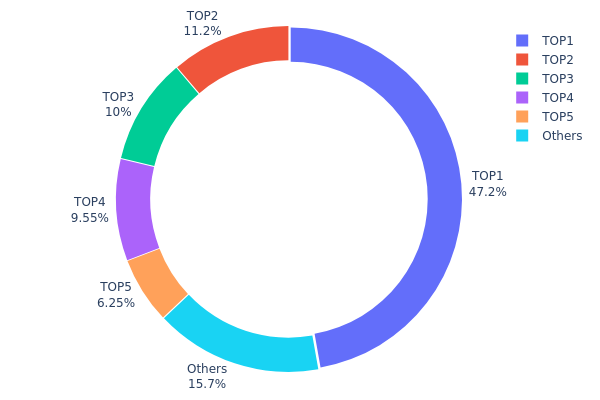

SCT Holding Distribution

The holding distribution chart illustrates the concentration of token ownership across different wallet addresses, serving as a critical indicator of decentralization and market structure stability. By examining the percentage of total supply controlled by top holders versus smaller participants, analysts can assess potential centralization risks and the likelihood of coordinated market movements.

According to current on-chain data, SCT exhibits significant concentration among its top holders. The largest address controls approximately 47.21% of the total supply (2,360,569.98K tokens), while the top five addresses collectively hold 84.23% of all circulating tokens. This pronounced concentration pattern suggests that SCT operates under a highly centralized ownership model, with the majority of decision-making power and market influence residing within a relatively small group of entities.

Such concentrated distribution presents notable implications for market dynamics. The dominant position of the top holder creates substantial price volatility risk, as any significant transaction from this address could dramatically impact market liquidity and token valuation. Additionally, the cumulative 84.23% concentration among the top five addresses indicates limited decentralization, which may expose the token to potential coordination risks and reduces the resilience typically associated with broader token distribution. The remaining 15.77% held by other addresses represents a relatively small portion of retail and institutional participants, suggesting limited organic market depth outside the major holders.

Click to view current SCT Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6aec...caeeec | 2360569.98K | 47.21% |

| 2 | 0x8556...d3426e | 562498.10K | 11.24% |

| 3 | 0x985b...bd5122 | 499833.45K | 9.99% |

| 4 | 0x74ea...a9cf3d | 477530.34K | 9.55% |

| 5 | 0x6db9...679b85 | 312499.90K | 6.24% |

| - | Others | 787068.22K | 15.77% |

II. Core Factors Influencing SCT's Future Price

Supply Mechanism

- Token Release Schedule: SCT has a total supply of 5,000,000,000 tokens with a current circulation of 88,440,000 tokens, representing a circulation rate of 1.7688%. The fully diluted valuation stands at $25,075,500.00.

- Historical Pattern: The low circulation rate indicates significant unreleased supply, which could create selling pressure as more tokens enter circulation over time.

- Current Impact: As additional tokens are gradually released into the market, this may influence price dynamics. However, controlled release mechanisms could support gradual ecosystem expansion while managing supply-side pressure.

Institutional and Major Holder Dynamics

- Concentration Risk: On-chain data reveals highly concentrated holdings. The largest address holds 47.21% of total supply, while the top 5 addresses collectively control 84.23% of all tokens.

- Market Liquidity Concerns: With only 15.77% of SCT distributed outside the top five addresses, limited liquidity may impact price stability and raise concerns about potential market manipulation by large holders.

- Governance Implications: If SCT incorporates on-chain governance mechanisms, the concentrated ownership structure may allow a small number of major holders to significantly influence project decisions.

Macroeconomic Environment

- Market Sentiment: The Fear and Greed Index registered at 34 (Fear) on October 30, 2025, indicating cautious market sentiment. Investors are generally adopting a wait-and-see approach, with some capital potentially preparing for lower entry points.

- Cyclical Market Behavior: Market volatility represents a cyclical phenomenon, and periods of fear often precede market rebounds. Diversified asset allocation strategies are recommended during such phases.

- Trading Infrastructure: Gate.com provides various tools and resources to help investors navigate complex market conditions effectively.

Technological Development and Ecosystem Building

- Blockchain Healthcare Integration: SCT positions itself as a "Stem Cell Metaverse Token," serving as a key driver in blockchain-based stem cell research, storage, and related services within the healthcare sector.

- Ecosystem Expansion Potential: As a blockchain-powered membership service token for the stem cell industry, SCT's value proposition depends on continued technological advancement and practical application deployment.

- Market Performance: Recent price action shows notable momentum with a 106.69% increase over the past 30 days and a 4.41% gain in the past week. The 24-hour trading volume of $18,383.38 indicates active market participation.

III. 2026-2031 SCT Price Forecast

2026 Outlook

- Conservative forecast: $0.00221 - $0.00254

- Neutral forecast: $0.00254 (average price level)

- Optimistic forecast: $0.00343 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: Gradual expansion phase with progressive price appreciation

- Price range forecast:

- 2027: $0.00289 - $0.00328 (approximately 17% growth anticipated)

- 2028: $0.00178 - $0.00341 (approximately 23% growth projected)

- 2029: $0.00229 - $0.00347 (approximately 29% growth expected)

- Key catalysts: Ecosystem development, enhanced token utility, and broader market recovery dynamics

2030-2031 Long-term Outlook

- Baseline scenario: $0.00172 - $0.00337 (assumes steady market participation and moderate adoption growth)

- Optimistic scenario: $0.00425 (assumes enhanced platform integration and expanded user engagement)

- Transformative scenario: $0.00335 - $0.00495 by 2031 (requires significant breakthrough in utility applications and sustained market momentum, representing approximately 50% cumulative growth)

- February 8, 2026: SCT trading within the $0.00221 - $0.00343 range (establishing foundation for potential multi-year appreciation trajectory)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00343 | 0.00254 | 0.00221 | 0 |

| 2027 | 0.00328 | 0.00298 | 0.00289 | 17 |

| 2028 | 0.00341 | 0.00313 | 0.00178 | 23 |

| 2029 | 0.00347 | 0.00327 | 0.00229 | 29 |

| 2030 | 0.00425 | 0.00337 | 0.00172 | 33 |

| 2031 | 0.00495 | 0.00381 | 0.00335 | 50 |

IV. SCT Professional Investment Strategy and Risk Management

SCT Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors interested in blockchain-based healthcare innovation and stem cell technology development

- Operational Suggestions:

- Consider accumulating positions during market corrections when volatility presents opportunities

- Monitor ecosystem development updates related to SuperCells' stem cell storage and research initiatives

- Storage Solution: Utilize Gate Web3 Wallet for secure asset management with self-custody features

(II) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the 24-hour range between $0.0024213 and $0.002697 for potential entry and exit points

- Volume Analysis: Track the current 24-hour trading volume of approximately $24,163 to assess market liquidity and trading activity

- Swing Trading Considerations:

- Be aware of recent price volatility, with a 7-day decline of 19.66% and 30-day decline of 43.75%

- Consider setting stop-loss orders to manage downside risk in volatile market conditions

SCT Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: Consider limiting SCT exposure to 1-2% of cryptocurrency portfolio due to market cap ranking of #3803

- Aggressive Investors: May allocate 3-5% with awareness of volatility patterns

- Professional Investors: Can adjust allocation based on comprehensive due diligence and risk tolerance

(II) Risk Hedging Approaches

- Position Sizing: Implement gradual accumulation rather than single large positions to average entry costs

- Diversification: Balance SCT holdings with established cryptocurrencies and different blockchain sectors

(III) Secure Storage Solutions

- Gate Web3 Wallet Recommendation: Self-custody solution providing control over private keys for BSC-based SCT tokens

- Multi-signature Options: For larger holdings, consider implementing additional security layers

- Security Precautions: Never share private keys or seed phrases; verify contract address (0x405e7454E71AEfe8897438ADc08E3f3e6d49Dfc1) before transactions; be cautious of phishing attempts

V. SCT Potential Risks and Challenges

SCT Market Risks

- Liquidity Concerns: With a relatively modest 24-hour trading volume of approximately $24,163 and presence on limited exchanges, liquidity may impact large order execution

- Price Volatility: Recent performance shows significant fluctuations, including a 43.75% decline over 30 days, indicating substantial price instability

- Market Capitalization Positioning: Ranked #3803 with a circulating market cap of approximately $223,771, indicating a smaller project with potentially higher volatility

SCT Regulatory Risks

- Healthcare Sector Oversight: As a blockchain project intersecting with stem cell services, potential regulatory developments in healthcare and biotechnology sectors could impact operations

- Geographic Compliance: Stem cell research and services face varying regulatory frameworks across jurisdictions, which may affect project expansion

- Token Classification Uncertainty: Evolving regulatory definitions for utility tokens in healthcare applications may create compliance challenges

SCT Technical Risks

- Smart Contract Dependencies: As a BSC-based token, SCT relies on the security and performance of the underlying Binance Smart Chain infrastructure

- Ecosystem Development Risk: The success of SuperCells' metaverse ecosystem for stem cell storage, cultivation, and trading depends on continued technical development and user adoption

- Network Congestion: During periods of high blockchain activity, transaction speeds and costs on BSC may fluctuate

VI. Conclusion and Action Recommendations

SCT Investment Value Assessment

SuperCells Token represents an innovative intersection of blockchain technology and healthcare services, specifically targeting stem cell storage and research ecosystems. The project's long-term value proposition centers on creating a decentralized infrastructure for stem cell-related services within a metaverse framework. However, short-term risks include significant price volatility, limited liquidity across exchanges, and the early-stage nature of the project as evidenced by its market cap ranking. The token's 1-year performance shows an 8.59% gain, but recent monthly trends indicate substantial downward pressure. Investors should carefully weigh the innovative concept against execution risks and market uncertainties.

SCT Investment Recommendations

✅ Beginners: Start with educational research about the SuperCells ecosystem and blockchain healthcare applications before considering small allocations; use Gate Web3 Wallet for secure storage; avoid investing more than you can afford to lose entirely ✅ Experienced Investors: Consider SCT as a speculative position within a diversified portfolio; implement strict position sizing limits; monitor ecosystem development milestones and community growth metrics ✅ Institutional Investors: Conduct comprehensive due diligence on the SuperCells team, technology roadmap, and regulatory landscape; assess liquidity constraints for larger positions; evaluate alignment with healthcare innovation investment theses

SCT Trading Participation Methods

- Spot Trading on Gate.com: Direct purchase and sale of SCT tokens with various trading pairs

- Dollar-Cost Averaging: Systematic periodic purchases to reduce timing risk and average entry prices over time

- Community Engagement: Monitor official SuperCells channels and developments to stay informed about project updates that may impact token value

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is SCT and what is its purpose?

SCT is a utility token designed for decentralized ecosystem participation. It enables governance, transaction settlement, and rewards distribution within Web3 applications. SCT holders can stake tokens, participate in platform decisions, and earn benefits through network activity and ecosystem growth.

What is SCT's historical price trend?

SCT was trading at $0.0050151 in October 2025, with a 106.69% increase over the past 30 days. Its market cap reached $443,535.44, ranking 3552 globally. With ongoing token releases, SCT demonstrates strong growth potential in the blockchain health ecosystem.

What is the SCT price prediction for 2024?

Based on available market analysis, SCT was projected to show modest growth through 2024. However, specific 2024 predictions are limited. Current 2026 data suggests SCT may reach approximately $0.00 by 2030 with an estimated 5% annual growth rate, indicating moderate long-term appreciation potential.

What are the main factors affecting SCT price?

SCT price is primarily influenced by supply and demand dynamics, market sentiment, project development progress, and overall cryptocurrency market trends. Trading volume and investor adoption also play significant roles in price movements.

What are the advantages of SCT compared to similar tokens?

SCT offers fast transaction speeds, low fees, and a decentralized architecture ensuring security and transparency. Its active development team and strong community support position it for sustained growth and market competitiveness.

What are the risks to pay attention to when investing in SCT?

SCT investment carries market volatility risk. Cryptocurrency prices fluctuate significantly based on market conditions. Investors should conduct thorough research, implement proper risk management strategies, and only invest capital they can afford to lose. Monitor market performance closely and stay informed about project developments.

What are the future development prospects of SCT?

SCT demonstrates strong growth potential driven by increasing adoption in precision medicine and multi-modal imaging diagnostics. With continuous technological advancement and expanding clinical applications, SCT is positioned for significant market expansion and enhanced diagnostic accuracy in healthcare sectors.

Where can I buy and trade SCT?

SCT can be purchased and traded on decentralized exchanges (DEX). Connect your crypto wallet to a DEX, select the SCT trading pair, and complete your transaction. SCT is also available on various centralized platforms for trading.

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Hedera Hashgraph (HBAR): Founders, Technology, and Price Outlook to 2030

Cardano (ADA) Price Prediction 2025 & 2030 – Is ADA Set to Soar?

2025 SUI coin: price, buying guide, and Staking rewards

Cardano (ADA): A History, Tech Overview, and Price Outlook

Jasmy Coin: A Japanese Crypto Tale of Ambition, Hype, and Hope

Comprehensive Guide to Blockchain Technology and Applications in Thailand

What is Dencun? Everything About Ethereum's Cancun-Deneb Upgrade

Bitcoin Forecast: What Will BTC Be Worth After the 2028 Halving

How to Claim NIGHT Tokens in Midnight's Glacier Drop

How to Earn Money with Cryptocurrencies and Bitcoin?