2026 SCT Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: SCT's Market Position and Investment Value

SuperCells Token (SCT), as a blockchain-based stem cell membership service ecosystem token, has been building its unique metaverse framework encompassing stem cell storage, cultivation, R&D, trading, services, and incubation since its inception. As of February 2026, SCT has a market capitalization of approximately $224,734.88, with a circulating supply of around 88.44 million tokens, and the price is maintained at approximately $0.0025411. This asset, serving the emerging intersection of blockchain technology and healthcare innovation, is playing a role in connecting demand, services, community, and supervision within the stem cell industry ecosystem.

This article will comprehensively analyze SCT's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. SCT Price History Review and Market Status

SCT Historical Price Evolution Trajectory

- 2023: SCT reached a notable price level of $0.251382 on December 18, marking a significant milestone in its early trading history

- 2025: The token experienced substantial downward pressure, declining to $0.00045025 on December 5, reflecting broader market corrections

- 2026: Following the previous decline, SCT showed signs of recovery with a year-over-year increase of approximately 9.33% as of early February

SCT Current Market Situation

As of February 8, 2026, SuperCells Token (SCT) is trading at $0.0025411, with a circulating supply of 88.44 million tokens out of a maximum supply of 5 billion tokens. The token's market capitalization stands at approximately $224,734.88, representing about 1.77% of its fully diluted valuation of $12.71 million.

Recent price performance shows mixed signals across different timeframes. Over the past hour, SCT declined by 0.08%, while the 24-hour period saw a 2.28% decrease. The 7-day performance indicates an 18.67% decline, and the 30-day chart reflects a 43.41% drop. However, the 1-year performance demonstrates a 9.33% gain, suggesting some recovery momentum from previous lows.

The 24-hour trading volume reached $25,113.03, with the token trading within a range of $0.0024213 to $0.002697. The circulating supply represents approximately 1.77% of the total supply, with 26,559 holders currently participating in the ecosystem. The market sentiment index stands at 1, indicating extreme fear conditions in the broader cryptocurrency market.

SCT is currently available for trading on Gate.com, with its primary smart contract deployed on the Binance Smart Chain (BSC) network at address 0x405e7454E71AEfe8897438ADc08E3f3e6d49Dfc1.

Click to view current SCT market price

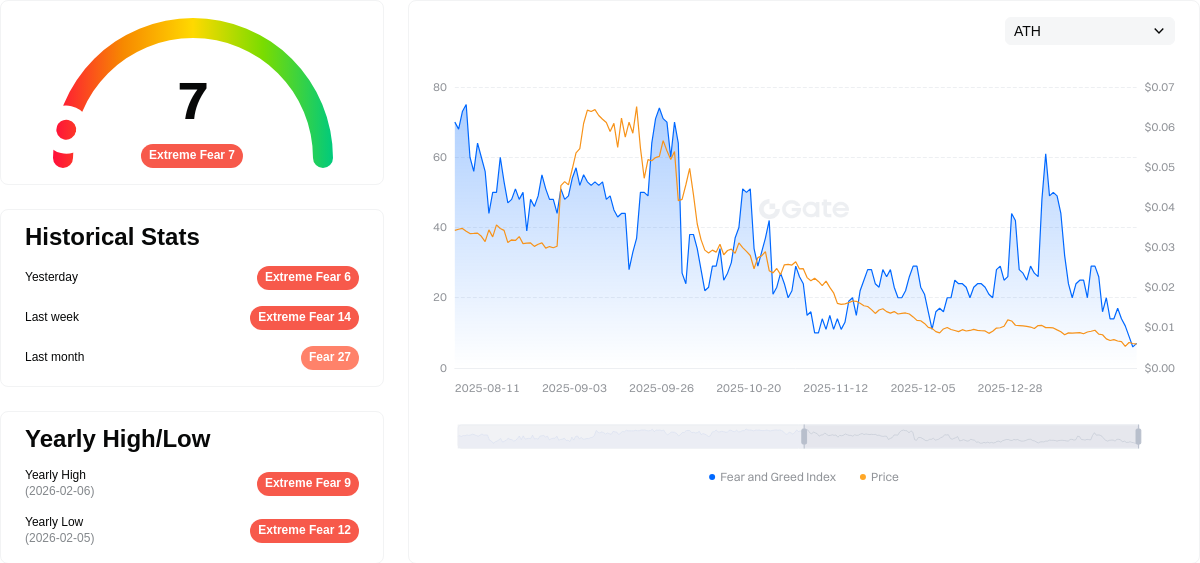

SCT Market Sentiment Index

2026-02-08 Fear and Greed Index: 7 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the index hitting a critically low level of 7. This sentiment reflects significant market uncertainty and investor pessimism. During such periods, panic selling often dominates trading activity as market participants rush to exit positions. However, historical data suggests that extreme fear can present buying opportunities for long-term investors, as assets may be oversold. Traders should exercise caution and conduct thorough analysis before making investment decisions in such volatile market conditions.

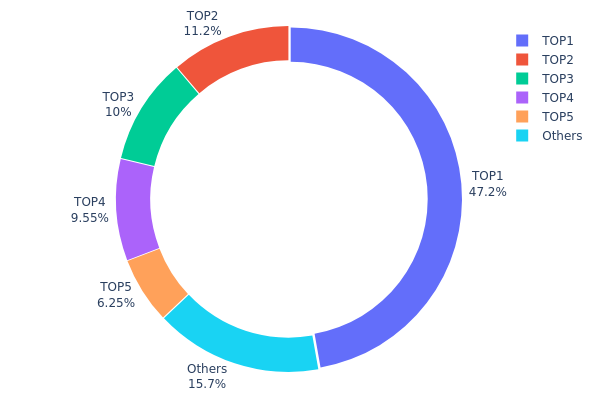

SCT Holding Distribution

The holding distribution chart illustrates the allocation of SCT tokens across different wallet addresses, ranked by their respective holdings. This metric serves as a crucial indicator of token concentration and provides insights into the decentralization level of the project's token economy.

Based on the current data, SCT exhibits a highly concentrated holding structure. The top address alone controls approximately 47.21% of the total supply (2.36 billion tokens), while the top five addresses collectively hold 84.23% of all circulating tokens. This significant concentration suggests that a small number of entities maintain substantial control over the token's market dynamics. The "Others" category, representing all remaining addresses, accounts for merely 15.77% of the total supply, indicating limited distribution across the broader holder base.

Such extreme concentration poses several implications for market structure and price stability. The dominant position of the top holder creates potential vulnerability to large-scale sell pressure, as any significant disposal from this address could trigger substantial price volatility. Additionally, this distribution pattern raises concerns regarding potential market manipulation, as holders with outsized positions possess the capability to influence price movements through coordinated trading activities. From a structural perspective, the current holding distribution reflects a relatively centralized token economy, which may impact investor confidence and long-term price discovery mechanisms. The limited diversity in the holder base suggests that SCT's on-chain structure lacks the robustness typically associated with more mature and widely distributed digital assets.

Click to view the current SCT Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6aec...caeeec | 2360569.98K | 47.21% |

| 2 | 0x8556...d3426e | 562498.10K | 11.24% |

| 3 | 0x985b...bd5122 | 499833.45K | 9.99% |

| 4 | 0x74ea...a9cf3d | 477530.34K | 9.55% |

| 5 | 0x6db9...679b85 | 312499.90K | 6.24% |

| - | Others | 787068.22K | 15.77% |

II. Core Factors Influencing SCT's Future Price

Supply Mechanism

- Token Release Model: SCT has a total supply of 5,000,000,000 tokens with a current circulation of 88,440,000 tokens, representing a circulation rate of only 1.7688%. This low circulation rate indicates significant potential for future token releases.

- Historical Patterns: The gradual release of tokens typically creates selling pressure in the market. However, when accompanied by increased demand and ecosystem development, controlled supply releases can support sustainable price growth.

- Current Impact: With over 98% of tokens yet to be released into circulation, the supply mechanism will play a crucial role in price dynamics. The pace and method of future token releases will significantly influence market stability and price trajectory.

Institutional and Large Holder Dynamics

- Institutional Holdings: On-chain data reveals highly concentrated token holdings. The largest address holds 47.21% of total supply, while the top 5 addresses collectively control 84.23% of all SCT tokens. This concentration level suggests limited institutional diversification at present.

- Adoption Patterns: The current holding structure indicates that SCT remains in an early adoption phase within the blockchain-based stem cell services ecosystem. Only 15.77% of tokens are distributed beyond the top 5 addresses, which may impact market liquidity and price stability.

- Market Implications: The high concentration among few holders introduces considerations regarding price volatility and potential market influence. This distribution pattern may affect investor confidence, particularly among new participants concerned about market dynamics.

Macroeconomic Environment

- Market Sentiment: As of October 30, 2025, the Fear and Greed Index stands at 34, indicating a "Fear" phase in the broader cryptocurrency market. This cautious sentiment reflects investor risk aversion and may create opportunities for strategic positioning.

- Sector Performance: The healthcare and metaverse blockchain sectors continue to evolve, with growing interest in tokenized healthcare services. SCT's positioning within the stem cell services ecosystem may benefit from increasing acceptance of blockchain applications in healthcare.

- Investment Climate: During periods of market caution, investors typically conduct more thorough due diligence. The current environment favors projects with clear utility and established use cases within their target sectors.

Technology Development and Ecosystem Building

- Blockchain-Healthcare Integration: SCT operates within an emerging ecosystem combining blockchain technology with stem cell membership services. This integration represents an innovative approach to healthcare service tokenization and member benefits management.

- Ecosystem Applications: As a utility token for stem cell-related services, SCT's value proposition centers on facilitating access to stem cell research, storage, and related healthcare services within a decentralized framework.

- Market Position: With a market capitalization of $443,535 and ranking 3,552 globally, SCT maintains a niche position within the broader cryptocurrency landscape. Recent performance shows notable momentum, with a 106.69% increase over 30 days and 4.41% growth in the past week, alongside 24-hour trading volume of $18,383.38.

III. 2026-2031 SCT Price Prediction

2026 Outlook

- Conservative prediction: $0.00132 - $0.00254

- Neutral prediction: $0.00254

- Optimistic prediction: $0.0031 (requiring favorable market conditions)

2027-2029 Outlook

- Market stage expectation: The token is anticipated to enter a gradual growth phase, with increasing trading activity and potential ecosystem expansion driving moderate appreciation.

- Price range prediction:

- 2027: $0.00147 - $0.00313 (11% year-over-year change)

- 2028: $0.00244 - $0.00438 (17% year-over-year change)

- 2029: $0.0032 - $0.00486 (44% year-over-year change)

- Key catalysts: Progressive adoption rates, potential platform developments, and broader market recovery cycles may serve as primary price drivers during this period.

2030-2031 Long-term Outlook

- Baseline scenario: $0.00239 - $0.00499 (assuming stable market conditions and continued project development)

- Optimistic scenario: $0.00427 - $0.00574 (contingent upon enhanced utility implementation and increased network effects)

- Transformative scenario: Approaching $0.00574 (under exceptionally favorable circumstances including major partnership announcements or significant protocol upgrades)

- 2026-02-08: SCT trading within initial prediction range, establishing foundation for potential multi-year growth trajectory

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0031 | 0.00254 | 0.00132 | 0 |

| 2027 | 0.00313 | 0.00282 | 0.00147 | 11 |

| 2028 | 0.00438 | 0.00298 | 0.00244 | 17 |

| 2029 | 0.00486 | 0.00368 | 0.0032 | 44 |

| 2030 | 0.00499 | 0.00427 | 0.00239 | 67 |

| 2031 | 0.00574 | 0.00463 | 0.00431 | 82 |

IV. SCT Professional Investment Strategy and Risk Management

SCT Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Investors with moderate to long-term horizons who believe in the potential development of blockchain-based stem cell service ecosystems

- Operational Recommendations:

- Consider accumulating positions during periods of market correction, particularly when SCT trades near its support levels

- Monitor the development progress of SuperCells' stem cell storage, cultivation, and R&D metaverse ecosystem

- Storage Solution: Utilize Gate Web3 Wallet for secure storage of SCT tokens, enabling both custody and easy access to trading opportunities

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Monitor short-term (7-day) and medium-term (30-day) moving averages to identify potential trend reversals, particularly given recent negative momentum

- Volume Analysis: Track the 24-hour trading volume of approximately $25,113 to assess market liquidity and potential breakout signals

- Key Points for Swing Trading:

- Observe the 24-hour trading range between $0.0024213 and $0.002697 to identify potential entry and exit points

- Exercise caution given the recent negative price performance (-2.28% in 24H, -18.67% in 7D, -43.41% in 30D)

SCT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 8% depending on conviction and research depth

(2) Risk Hedging Solutions

- Position Sizing: Implement gradual position building to average cost basis during volatile periods

- Stop-Loss Measures: Consider setting stop-loss levels based on individual risk tolerance, particularly given recent price decline trends

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active traders requiring frequent access

- Cold Storage Solution: For long-term holders, consider transferring significant holdings to hardware wallets after purchase

- Security Precautions: Enable two-factor authentication, regularly verify contract addresses (0x405e7454E71AEfe8897438ADc08E3f3e6d49Dfc1 on BSC), and maintain awareness of phishing attempts targeting cryptocurrency holders

V. SCT Potential Risks and Challenges

SCT Market Risks

- High Volatility: SCT has demonstrated significant price fluctuations, with a 43.41% decline over 30 days, indicating substantial short-term volatility

- Limited Liquidity: With a 24-hour trading volume of approximately $25,113 and market cap of $224,735, the token exhibits relatively low liquidity compared to major cryptocurrencies

- Low Circulating Supply Ratio: Only 1.77% of maximum supply is currently circulating, which may lead to potential dilution concerns as more tokens enter circulation

SCT Regulatory Risks

- Healthcare Sector Regulation: As SuperCells operates in the stem cell service ecosystem, it may face evolving regulatory frameworks governing blockchain applications in healthcare and biotech sectors

- Cross-border Compliance: The global nature of stem cell services may subject the project to varying regulatory standards across different jurisdictions

- Token Classification Uncertainty: Regulatory authorities may evaluate SCT's classification, potentially impacting its trading and usage

SCT Technical Risks

- Smart Contract Vulnerabilities: As a BSC-based token, SCT is subject to potential smart contract exploits or bugs that could affect token security

- Blockchain Dependency: The project relies on BNB Smart Chain infrastructure, making it susceptible to any network-level issues or congestion

- Limited Exchange Availability: Currently available on only 1 exchange platform, which concentrates trading risk and limits accessibility for global investors

VI. Conclusion and Action Recommendations

SCT Investment Value Assessment

SuperCells Token presents an innovative approach to integrating blockchain technology with stem cell service ecosystems. The project aims to create a metaverse encompassing storage, cultivation, R&D, trading, service, and incubation of stem cells. However, the recent price performance shows notable challenges, with significant declines over 7-day (-18.67%) and 30-day (-43.41%) periods, despite a positive 1-year performance (+9.33%). The low market capitalization of approximately $224,735 and limited circulating supply (1.77% of maximum) suggest this is an early-stage project with substantial development ahead. Investors should weigh the innovative concept against current market conditions and execution risks.

SCT Investment Recommendations

✅ Beginners: Exercise extreme caution. Given the high volatility, limited liquidity, and early-stage nature of the project, new investors should start with minimal exposure if interested, and prioritize learning about blockchain technology and cryptocurrency fundamentals before committing significant capital ✅ Experienced Investors: Consider SCT as a speculative allocation within a diversified cryptocurrency portfolio. Conduct thorough due diligence on the project's development progress, partnerships, and regulatory compliance. Monitor the project's roadmap execution and community engagement on platforms like Twitter before making investment decisions ✅ Institutional Investors: Evaluate SuperCells' unique positioning in the blockchain-healthcare intersection. Assess the team's ability to navigate complex regulatory environments and execute on the ambitious metaverse vision. Consider pilot allocation only after comprehensive risk assessment and regulatory analysis

SCT Trading Participation Methods

- Spot Trading: Purchase SCT directly on Gate.com with various trading pairs, allowing for immediate ownership and transfer to personal wallets

- Dollar-Cost Averaging: Implement a systematic investment approach by purchasing fixed amounts of SCT at regular intervals to mitigate timing risk

- Active Monitoring: Utilize Gate.com's trading tools and price alerts to stay informed about SCT price movements and volume changes, particularly given current market volatility

Cryptocurrency investment carries extreme risks, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is SCT and what are its main use cases?

SCT is a utility token designed for decentralized stem cell research and biomedical data sharing. Its main use cases include incentivizing research contributions, enabling secure medical data transactions, and facilitating governance in blockchain-based healthcare networks.

What factors influence SCT price movements?

SCT price movements are influenced by global uncertainty factors, oil market volatility, geopolitical risks, economic policy uncertainty, monetary policy, financial stress conditions, and investor sentiment. These elements create significant spillover effects on SCT valuations.

How can I analyze SCT price trends and make predictions?

Analyze SCT price trends using technical analysis tools and historical price data. Short-term predictions rely on 4-hour price movements, while long-term predictions consider weekly trends. Monitor trading volume, RSI indicators, and support/resistance levels. Verify predictions with personal research before making decisions.

What is the historical price performance of SCT?

SCT has shown volatility in recent periods. Over the last 24 hours, it traded between $0.002435 and $0.002685. In the past week, the price ranged from $0.002129 to $0.002685, demonstrating moderate fluctuations typical of emerging cryptocurrencies.

What are the risks associated with SCT price speculation?

SCT price speculation carries market volatility risks, including rapid price fluctuations and potential losses. Speculative trading can inflate prices unsustainably, leading new investors to overpay. High leverage amplifies these risks, and sudden market corrections may result in significant capital losses.

How does SCT price compare to other similar cryptocurrencies or tokens?

SCT currently trades at $0.004886, representing 0.49% of USDC's value. With a 24-hour decline of 2.90%, SCT maintains competitive positioning among similar tokens through its unique utility and market mechanics.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

How To Use Beefy Finance

What is Blum and How to Earn with It

Byzantine Fault Tolerance Explained

What is Ergo? A Combination of Bitcoin and Ethereum

7 Strategies to Generate Passive Income Using Crypto Assets