2026 SFI Price Prediction: Expert Analysis and Market Forecast for the Next Generation of Blockchain Technology

Introduction: SFI's Market Position and Investment Value

Singularity Finance (SFI), as the first AI-centric EVM-compatible Layer 2 blockchain bringing the AI economy on-chain, has been making significant strides since its launch in 2025. As of February 2026, SFI maintains a market capitalization of approximately $1.07 million, with a circulating supply of about 141.53 million tokens, and the price holding around $0.0076. This asset, positioned as a "financial chain for everything AI," is playing an increasingly important role in the tokenization and monetization of the AI value chain.

This article will comprehensively analyze SFI's price movements from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic environment to provide investors with professional price forecasts and practical investment strategies.

I. SFI Price History Review and Market Status

SFI Historical Price Evolution Trajectory

- 2025: Token launched in February with an all-time high price reaching 0.135 USDT on February 19, marking the peak of its initial market phase

- 2026: Price experienced significant correction, declining from the all-time high to a new low of 0.007324 USDT on February 2

SFI Current Market Conditions

As of February 3, 2026, SFI is trading at 0.007579 USDT, showing a 0.22% increase over the past hour and a 0.9% decrease over the past 24 hours. The 24-hour trading range spans from 0.007324 USDT to 0.008538 USDT, with a trading volume of 13,572.29 USDT.

The token's circulating supply stands at 141,532,390 SFI, representing approximately 28.31% of the maximum supply of 500,000,000 SFI. The current market capitalization is 1,072,673.98 USDT, with a fully diluted market cap of 3,789,500 USDT. SFI holds a market dominance of 0.00013%.

Over the weekly timeframe, SFI has declined 20.97%, while the monthly performance shows a decrease of 20.09%. The annual performance indicates a decline of 95.50% from previous levels. The token holder count currently stands at 9,512 addresses.

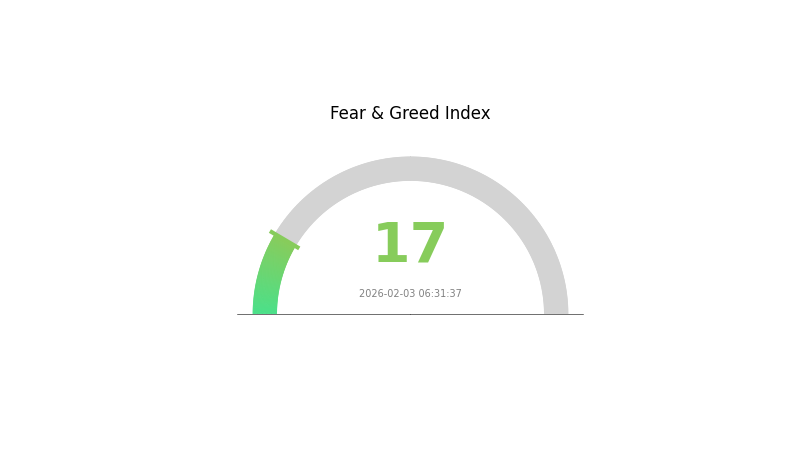

The current market sentiment index registers at 17, indicating an extreme fear condition in the broader cryptocurrency market environment.

Click to view current SFI market price

SFI Market Sentiment Index

2026-02-03 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 17. This indicates significant market pessimism and investor anxiety. During such periods, risk assets face intense selling pressure as traders prioritize capital preservation over growth opportunities. However, extreme fear historically presents contrarian buying opportunities for long-term investors, as panic-driven price declines often create attractive entry points. Market participants should remain cautious while monitoring key support levels and considering their risk tolerance when making investment decisions.

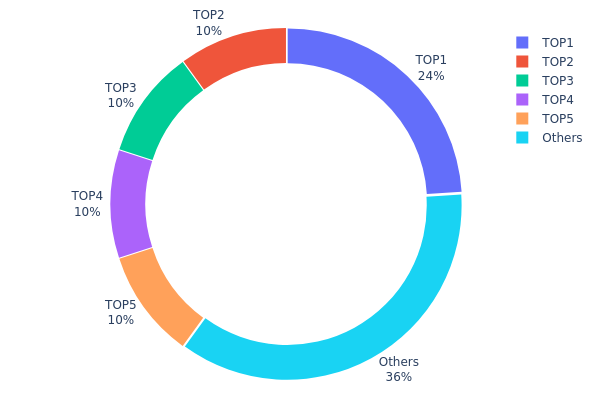

SFI Holding Distribution

The holding distribution chart illustrates how SFI tokens are allocated across different wallet addresses on the blockchain, providing crucial insights into the degree of decentralization and concentration risk within the token ecosystem. According to the latest on-chain data, the top address holds 120,000K SFI tokens, accounting for 24.00% of the total supply, while the subsequent four addresses each control 50,000K tokens (10.00% each). The remaining addresses collectively hold 180,000K tokens, representing 36% of the total supply.

This distribution pattern reveals a moderate to high concentration level in SFI's current market structure. The top five addresses cumulatively control 64% of the total token supply, indicating that a significant portion of SFI remains in the hands of a relatively small number of holders. Such concentration introduces elevated volatility risks, as large-scale sell-offs from these major holders could trigger substantial price fluctuations. Furthermore, this level of centralization raises concerns about potential market manipulation, where coordinated actions by top holders could disproportionately influence trading dynamics and price discovery mechanisms.

From a market structure perspective, while the 36% distribution among other addresses suggests some degree of token dispersion, the dominant position of the top five wallets undermines the project's decentralization narrative. This concentration pattern is common among newer or smaller-cap projects but may pose challenges for long-term ecosystem stability and investor confidence. The current on-chain structure indicates that SFI's market remains vulnerable to the decision-making of a few large stakeholders, necessitating continued monitoring of holding distribution trends to assess whether the token is moving toward broader community ownership or maintaining its concentrated ownership model.

Click to view the current SFI Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x772a...41e674 | 120000.00K | 24.00% |

| 2 | 0xdfdc...243d4c | 50000.00K | 10.00% |

| 3 | 0x63b5...3ef5fa | 50000.00K | 10.00% |

| 4 | 0xeb18...7bf186 | 50000.00K | 10.00% |

| 5 | 0xaeb2...53a45d | 50000.00K | 10.00% |

| - | Others | 180000.00K | 36% |

II. Core Factors Influencing SFI's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Major central banks are expected to maintain cautious stances. The Federal Reserve's interest rate decisions play a significant role in SFI's price trajectory. As of January 2026, the Fed is projected to maintain the federal funds rate in the range of 3.50% to 3.75%, reflecting a wait-and-see approach amid mixed economic signals.

-

Inflation Hedge Attribute: Under inflationary pressure, digital assets may serve as alternative stores of value. However, SFI's performance in this regard depends on broader market sentiment and investor confidence in crypto assets during periods of elevated consumer price indices.

-

Geopolitical Factors: International tensions, including trade policies and tariff adjustments, continue to create uncertainty in global markets. Shifts in cross-border capital flows and risk appetite can indirectly affect cryptocurrency valuations, including SFI.

Market Demand and Adoption Trends

-

Investor Participation: SFI's price outlook is influenced by retail and institutional demand patterns. Broader cryptocurrency market cycles, liquidity conditions, and risk sentiment shape investor interest in tokens like SFI.

-

Adoption Dynamics: The extent to which SFI gains traction in decentralized finance applications or other blockchain-based services can drive long-term value. Market adoption remains a key variable in price forecasting.

Supply Mechanisms

-

Token Distribution: Understanding SFI's token supply model, including vesting schedules and circulating supply dynamics, is essential for evaluating potential price pressure or scarcity effects.

-

Historical Patterns: Past supply adjustments or token unlock events have historically correlated with price volatility, highlighting the importance of monitoring supply-side developments.

Regulatory and Policy Considerations

-

Regulatory Clarity: Evolving frameworks for digital assets across jurisdictions can impact market confidence. Clear guidelines tend to support stable growth, while regulatory uncertainty may dampen investor enthusiasm.

-

Cross-Border Policy Coordination: International cooperation on cryptocurrency standards and compliance requirements influences the broader ecosystem in which SFI operates.

III. 2026-2031 SFI Price Prediction

2026 Outlook

- Conservative prediction: $0.00679 - $0.00763

- Neutral prediction: $0.00763 average price level

- Optimistic prediction: up to $0.00938 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: gradual growth phase with progressive price appreciation as the project matures and gains traction

- Price range prediction:

- 2027: $0.00621 - $0.01157, representing approximately 12% increase

- 2028: $0.00873 - $0.01476, showing 32% growth trajectory

- 2029: $0.00756 - $0.01699, with potential 63% appreciation

- Key catalysts: ecosystem development, potential partnerships, broader DeFi market recovery, and increased user adoption

2030-2031 Long-term Outlook

- Baseline scenario: $0.01234 - $0.01836 (assuming steady market growth and project fundamentals remain solid)

- Optimistic scenario: $0.01469 - $0.01836 in 2030, potentially reaching $0.01372 - $0.01752 by 2031 (with enhanced platform utility and favorable regulatory environment)

- Transformative scenario: approaching $0.01836 or higher (contingent upon significant technological breakthroughs, mainstream DeFi adoption, or major institutional integration)

- February 3, 2026: SFI trading within $0.00679 - $0.00938 range (early stage of projected growth cycle)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00938 | 0.00763 | 0.00679 | 0 |

| 2027 | 0.01157 | 0.00851 | 0.00621 | 12 |

| 2028 | 0.01476 | 0.01004 | 0.00873 | 32 |

| 2029 | 0.01699 | 0.0124 | 0.00756 | 63 |

| 2030 | 0.01836 | 0.01469 | 0.01234 | 93 |

| 2031 | 0.01752 | 0.01653 | 0.01372 | 118 |

IV. SFI Professional Investment Strategy and Risk Management

SFI Investment Methodology

(I) Long-Term Holding Strategy

- Target Investors: AI-focused blockchain investors and believers in the AI economy tokenization vision

- Operational Recommendations:

- Consider dollar-cost averaging to mitigate price volatility, particularly given SFI's notable price fluctuations

- Monitor developments in the SingularityNET ecosystem and Artificial Superintelligence Alliance for fundamental value drivers

- Utilize Gate Web3 Wallet for secure storage with multi-signature protection

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor 24-hour trading volume trends, currently at 13,572.29 USD, to identify liquidity patterns

- Support and Resistance Levels: Track the 24-hour low at 0.007324 USD and high at 0.008538 USD as key technical levels

- Swing Trading Points:

- Consider the significant volatility with 7-day change of -20.97% and 30-day change of -20.09% for potential entry opportunities

- Set strict stop-loss orders due to the high volatility profile of this AI-focused token

SFI Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: No more than 1-2% of cryptocurrency portfolio

- Aggressive Investors: 3-5% of cryptocurrency portfolio with proper diversification

- Professional Investors: Up to 5-8% with active monitoring and hedging strategies

(II) Risk Hedging Solutions

- Diversification Strategy: Balance SFI holdings with established cryptocurrencies and stablecoins

- Position Sizing: Limit exposure considering SFI's circulating supply of 141,532,390 tokens representing 28.31% of maximum supply

(III) Secure Storage Solutions

- Hardware Wallet Option: Gate Web3 Wallet with enhanced security features for EVM-compatible tokens

- Multi-Wallet Approach: Distribute holdings across multiple wallets to minimize single-point failure risk

- Security Precautions: Enable two-factor authentication, regularly update security protocols, and never share private keys

V. SFI Potential Risks and Challenges

SFI Market Risks

- High Volatility: With a 1-year change of -95.50%, SFI demonstrates significant price volatility that may lead to substantial losses

- Limited Liquidity: Ranking at 2462 with 24-hour volume of 13,572.29 USD suggests relatively limited trading liquidity

- Market Cap Concentration: Market capitalization of 1,072,673.98 USD represents only 0.00013% market dominance, indicating high sensitivity to market movements

SFI Regulatory Risks

- AI and Blockchain Compliance: The intersection of AI and blockchain technology may face evolving regulatory frameworks across different jurisdictions

- RWA Tokenization Regulation: The platform's RWA tokenization framework may encounter regulatory scrutiny as financial authorities develop guidelines for tokenized assets

- Cross-Border Operations: As an EVM-compatible L2 blockchain, SFI may face varying regulatory requirements in different regions

SFI Technical Risks

- Smart Contract Vulnerabilities: As an ETH-based token, SFI is subject to potential smart contract exploits or vulnerabilities

- Layer 2 Infrastructure Risks: The dependence on L2 blockchain infrastructure introduces technical complexities and potential points of failure

- Ecosystem Dependency: Close ties to SingularityNET ecosystem and Artificial Superintelligence Alliance create concentration risk if these partnerships face challenges

VI. Conclusion and Action Recommendations

SFI Investment Value Assessment

Singularity Finance presents an innovative approach to bringing the AI economy on-chain through its EVM-compatible L2 blockchain and RWA tokenization framework. However, the token's significant price decline of 95.50% over one year and high volatility indicators suggest considerable risk factors. The project's connection to the SingularityNET ecosystem provides fundamental support, but limited liquidity and market presence require careful consideration. Long-term value depends on successful execution of the AI value chain tokenization vision and growing adoption within the AI-crypto intersection.

SFI Investment Recommendations

✅ Beginners: Limit exposure to no more than 1% of crypto portfolio; focus on learning about AI-blockchain intersection before significant investment ✅ Experienced Investors: Consider small position sizing (2-3% of crypto portfolio) with strict risk management and regular monitoring of ecosystem developments ✅ Institutional Investors: Conduct thorough due diligence on the RWA tokenization framework and AI value chain implementation before allocation decisions

SFI Trading Participation Methods

- Gate.com Platform Trading: Access SFI trading pairs on Gate.com with competitive fees and liquidity

- Gate Web3 Wallet Integration: Utilize Gate Web3 Wallet for secure storage and decentralized access to SFI tokens

- Dollar-Cost Averaging: Implement systematic investment plans to mitigate timing risk given the high volatility profile

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is SFI? What are its basic functions and uses?

SFI is a decentralized finance token designed to provide liquidity solutions and yield farming opportunities within the Web3 ecosystem. Its primary functions include enabling users to participate in DeFi protocols, earn rewards through staking and liquidity provision, and facilitate governance decisions within the SFI community network.

What are the main factors affecting SFI price?

SFI price is primarily influenced by institutional capital inflows, potential ETF approvals, market ecosystem development, trading volume, and overall cryptocurrency market sentiment.

How to analyze and predict SFI's future price trends?

Analyze SFI price trends by monitoring market sentiment, trading volume, and volatility metrics. Current price stands at $295.74, with 2026 projections showing potential growth. Key factors include market fundamentals, technical indicators, and adoption trends. Use on-chain data and historical patterns for informed analysis.

What are the common technical analysis methods for SFI price prediction?

Common technical analysis methods include moving averages, Relative Strength Index (RSI), and Bollinger Bands. These tools help analyze SFI price trends and market momentum for prediction purposes.

How does SFI perform in price compared to similar tokens?

SFI demonstrates significant price volatility relative to comparable tokens. Currently trading substantially below historical peaks, SFI presents high-risk characteristics with considerable upside potential for early investors seeking exposure to emerging blockchain projects.

What risks should I pay attention to when investing in SFI for price prediction?

SFI price prediction involves market volatility, liquidity risks, and regulatory changes. Conduct thorough research, monitor market conditions closely, and only invest what you can afford to lose.

Survey Note: Detailed Analysis of the Best AI in 2025

What Is the Best AI Crypto in 2025?

What is the Best AI Now?

Why ChatGPT is Likely the Best AI Now?

How Does Solidus Ai Tech's Market Cap Compare to Other AI Cryptocurrencies?

MomoAI: AI-Powered Social Gaming Revolution on Solana

Comprehensive Guide to Token Generation Events

Comprehensive Guide to Creating and Selling NFTs for Free

How to Profit from Cryptocurrency — Leading Strategies of Recent Years

Best Crypto Trading Bots for Automated Trading

Top 5 Tokens Recommended for DeFi Investment