2026 SPON Price Prediction: Expert Analysis and Market Forecast for Sponge Token's Future Value

Introduction: SPON's Market Position and Investment Value

Spheron Network (SPON) serves as a pioneering force in decentralized computing infrastructure, having launched in 2025 to establish the world's largest community-driven computational network. As of February 2026, SPON maintains a market capitalization of approximately $515,000, with a circulating supply of 220.1 million tokens and a trading price hovering around $0.002342. This asset, recognized as a cornerstone of the programmable compute economy, is playing an increasingly vital role in powering AI workloads and decentralized computing services.

This article will comprehensively analyze SPON's price trajectory from 2026 through 2031, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. SPON Price History Review and Market Status

SPON Historical Price Evolution Trajectory

- 2025: SPON reached a price peak of $0.1445 on August 8, experiencing significant early momentum following its market introduction

- 2026: The token entered a consolidation phase, with prices declining to a recorded low of $0.002304 on January 26, reflecting broader market adjustments

SPON Current Market Situation

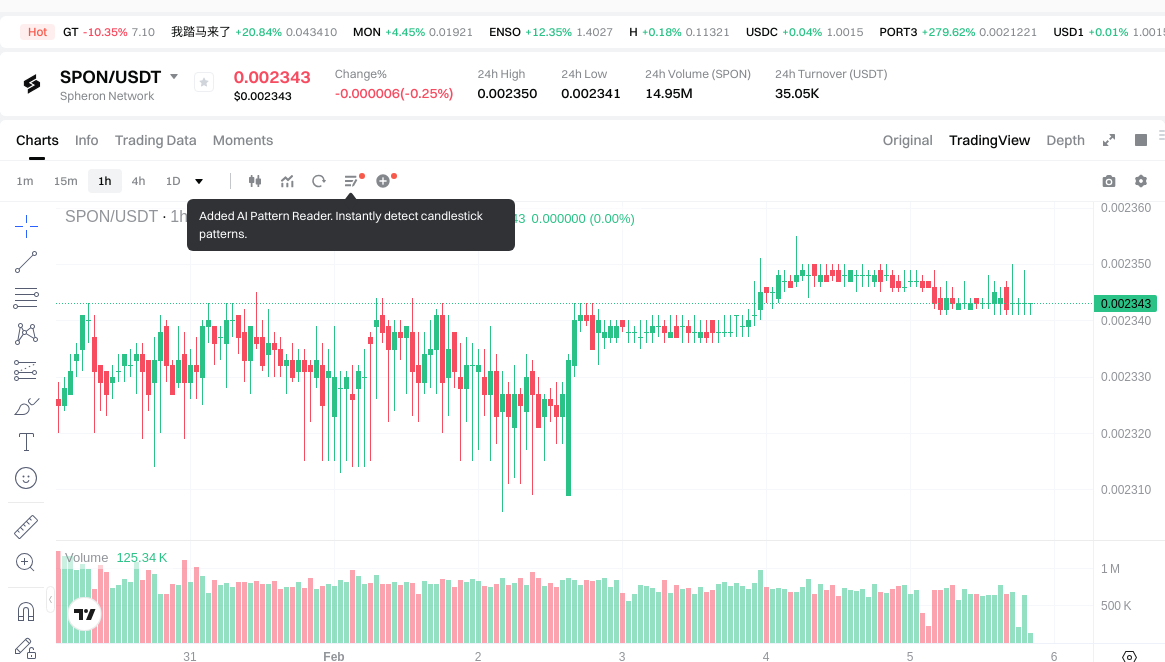

As of February 5, 2026, SPON is trading at $0.002342, showing mixed short-term performance across different timeframes. The token has demonstrated a modest 1-hour increase of 0.050% and a 7-day gain of 0.64%, suggesting some stabilization after recent declines. However, the 24-hour movement shows a slight decrease of 0.21%, while the 30-day performance reflects a more substantial decline of 24.93%.

The current trading price remains close to the historical low of $0.002304, representing approximately 98.4% below the all-time high. SPON maintains a 24-hour trading volume of $35,385, with a circulating supply of 220.1 million tokens out of a maximum supply of 1 billion tokens, resulting in a circulation ratio of 22.01%. The market capitalization stands at approximately $515,474, with a fully diluted valuation of $2.342 million.

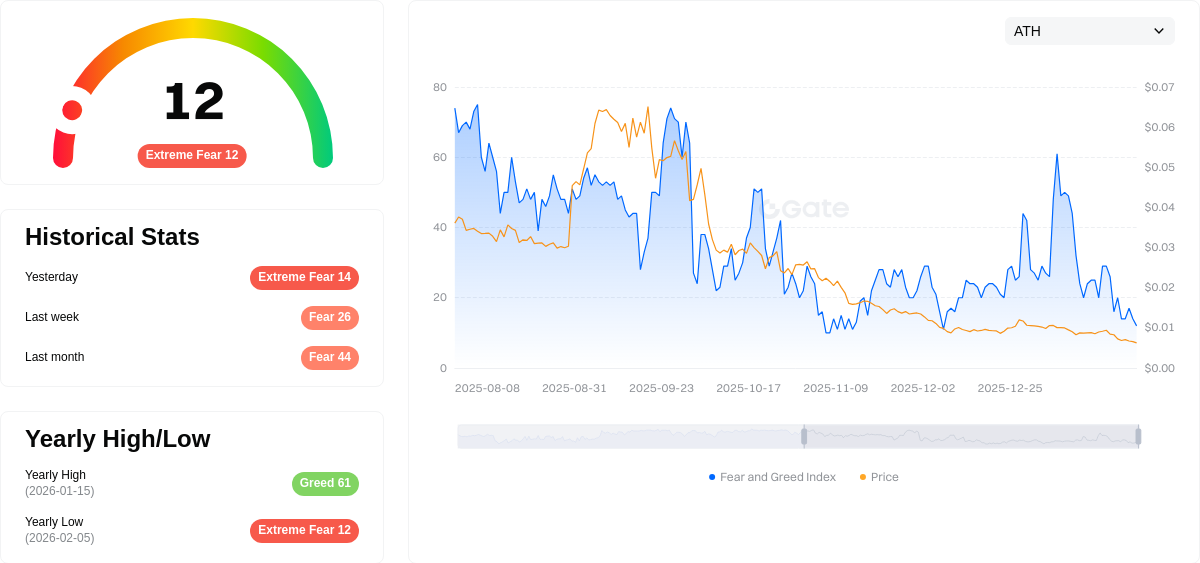

The token's market dominance is currently measured at 0.000093%, with a market cap to FDV ratio of 22.01%. SPON is available on 2 exchanges and has attracted 4,491 holders. The current market sentiment indicator reflects extreme fear at a level of 12, suggesting cautious positioning among market participants.

Click to view the current SPON market price

SPON Market Sentiment Indicator

02-05-2026 Fear and Greed Index: 12 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 12. This indicates strong negative sentiment among investors, suggesting potential panic selling and risk aversion. During periods of extreme fear, markets often present contrarian opportunities for long-term investors. However, caution is advised as further downward pressure may continue. Monitor key support levels and stay informed on market catalysts that could shift sentiment.

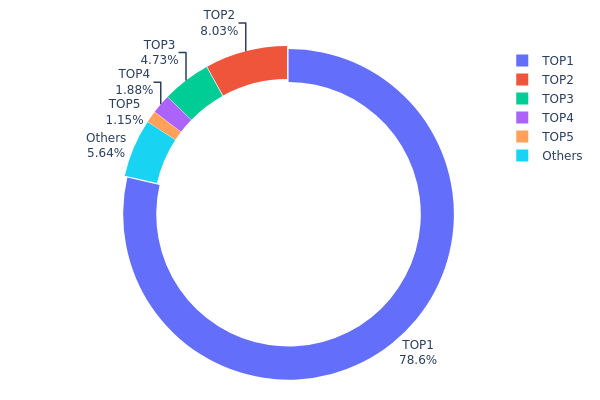

SPON Token Holding Distribution

The token holding distribution chart provides a comprehensive view of how SPON tokens are allocated across different wallet addresses on the blockchain. This metric serves as a critical indicator of market structure, measuring the degree of token concentration among top holders versus the broader community. A highly concentrated distribution pattern may signal potential centralization risks, while a more balanced distribution typically reflects healthier market dynamics and reduced vulnerability to large-scale sell pressure.

According to the current on-chain data, SPON exhibits an extremely concentrated holding structure. The top address alone controls approximately 782.43 million tokens, representing 78.56% of the total circulating supply. The second-largest holder possesses 80 million tokens (8.03%), while the third holds 47.14 million tokens (4.73%). Collectively, the top three addresses control over 91% of all SPON tokens in circulation. The remaining addresses outside the top five collectively hold only 56.20 million tokens, accounting for merely 5.66% of the total supply. This distribution pattern reveals an exceptional degree of centralization that significantly deviates from ideal decentralized token economics.

Such extreme concentration poses substantial implications for market stability and price discovery mechanisms. The dominant position of the largest holder creates considerable systemic risk, as any significant selling activity from this address could trigger severe price volatility and potentially destabilize the entire market ecosystem. Additionally, this concentration level raises concerns about potential market manipulation, as the top holder possesses sufficient leverage to influence price movements unilaterally. From a governance perspective, if SPON incorporates token-based voting mechanisms, decision-making power is overwhelmingly concentrated in the hands of a few entities, which fundamentally contradicts the principles of decentralized governance. This structural characteristic suggests that SPON currently operates more as a centrally controlled asset rather than a genuinely decentralized cryptocurrency, warranting careful consideration from potential investors regarding liquidity risks and market manipulation vulnerabilities.

Click to view current SPON Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x2cde...48f00c | 782433.33K | 78.56% |

| 2 | 0x8fe1...3e26e3 | 80000.00K | 8.03% |

| 3 | 0xd9e5...656e40 | 47135.29K | 4.73% |

| 4 | 0x0d07...b492fe | 18693.64K | 1.87% |

| 5 | 0x4e3a...a31b60 | 11480.11K | 1.15% |

| - | Others | 56195.12K | 5.66% |

II. Core Factors Influencing SPON's Future Price

Market Demand and Adoption Trends

- Market Demand Dynamics: SPON's price trajectory is fundamentally shaped by market demand patterns. As Spheron Network expands its user base and service adoption, demand fluctuations directly correlate with price movements.

- Adoption Trends: The pace at which developers, enterprises, and individual users integrate SPON into their operations serves as a key price driver. Higher adoption rates typically create upward pressure on token value through increased utility demand.

- Exchange Activity: Short-term trading volumes and conversion activities on platforms influence immediate price discovery, with active trading periods often reflecting broader market sentiment shifts.

Institutional Participation and Market Sentiment

- Institutional Involvement: The level of institutional participation in SPON markets affects price stability and long-term valuation. Institutional interest can signal market maturity and provide liquidity depth.

- Market Psychology: Investor sentiment toward decentralized infrastructure projects influences SPON's price performance. Positive sentiment around Web3 technologies and decentralized computing solutions tends to support price appreciation.

- Trading Patterns: Market participants' behavior, including conversion timing and volume concentration, creates short-term price volatility that investors should monitor.

Macroeconomic Environment

- Global Economic Factors: Broader economic conditions, including monetary policy shifts, inflation trends, and risk appetite in technology markets, exert influence on SPON's price dynamics.

- Economic Uncertainty: During periods of economic instability, cryptocurrency markets including SPON often experience heightened volatility as investors reassess risk exposures.

- Market Correlation: SPON's price movements may show correlation with general cryptocurrency market trends, particularly during macro-driven market cycles that affect digital assets broadly.

Technology Development and Network Utility

- Platform Evolution: Ongoing development of Spheron Network's infrastructure capabilities influences long-term value perception. Technical improvements that enhance network efficiency or expand use cases can support price growth.

- Utility Expansion: As SPON's role within the Spheron ecosystem evolves, changes in token utility—whether through governance functions, staking mechanisms, or service payments—affect demand fundamentals.

- Competitive Position: The project's ability to maintain technological competitiveness within the decentralized infrastructure space impacts investor confidence and price outlook.

III. 2026-2031 SPON Price Forecast

2026 Outlook

- Conservative prediction: $0.00129 - $0.00234

- Neutral prediction: $0.00234 (average expectation)

- Optimistic prediction: $0.00286 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: Gradual stabilization phase with potential volatility, as SPON seeks to establish its position in the evolving crypto landscape

- Price range predictions:

- 2027: $0.00213 - $0.00276 (approximately 11% increase from 2026 baseline)

- 2028: $0.00174 - $0.003 (approximately 14% growth trajectory)

- 2029: $0.0021 - $0.00321 (approximately 21% advancement)

- Key catalysts: Platform development progress, community growth, broader market sentiment shifts, and potential strategic partnerships

2030-2031 Long-term Outlook

- Baseline scenario: $0.00218 - $0.00302 (assuming steady ecosystem development and moderate market conditions)

- Optimistic scenario: $0.00302 - $0.00381 (contingent on successful project milestones and favorable crypto market cycles)

- Transformative scenario: $0.00342 - $0.00403 by 2031 (requires exceptional adoption rates, major platform upgrades, and sustained bull market momentum, representing approximately 45% growth from 2026 levels)

- February 5, 2026: SPON baseline reference point at approximately $0.00234 (current market positioning)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00286 | 0.00234 | 0.00129 | 0 |

| 2027 | 0.00276 | 0.0026 | 0.00213 | 11 |

| 2028 | 0.003 | 0.00268 | 0.00174 | 14 |

| 2029 | 0.00321 | 0.00284 | 0.0021 | 21 |

| 2030 | 0.00381 | 0.00302 | 0.00218 | 29 |

| 2031 | 0.00403 | 0.00342 | 0.00232 | 45 |

IV. SPON Professional Investment Strategies and Risk Management

SPON Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors who believe in decentralized computing infrastructure and AI-driven ecosystems

- Operation Recommendations:

- Accumulate positions during market corrections, particularly when prices approach support levels near $0.0023-$0.0024

- Monitor network growth metrics such as active node count (currently over 50,000) and total compute capacity ($100M+) as indicators of fundamental strength

- Storage Solution: Use Gate Web3 Wallet for secure custody with multi-signature protection and regular security audits

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor 24-hour trading volume ($35,385 as of February 5, 2026) for liquidity assessment and potential breakout signals

- Price Range Trading: Utilize the established 24-hour range ($0.002341-$0.00235) to identify entry and exit points for short-term positions

- Swing Trading Key Points:

- Consider the recent 7-day positive momentum (+0.64%) against 30-day decline (-24.93%) to identify potential reversal opportunities

- Set stop-loss orders below recent support levels to manage downside risk in volatile market conditions

SPON Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 7-10% with active hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance SPON holdings with established Layer-1 tokens and stablecoins to reduce sector-specific risk

- Position Sizing: Use scaled entry and exit strategies to average purchase costs and minimize timing risk

(3) Secure Storage Solutions

- Hardware Wallet Recommendation: Gate Web3 Wallet with support for ERC-20 tokens on Base network

- Multi-signature Setup: Implement multi-sig wallets for holdings exceeding $10,000 equivalent

- Security Precautions: Never share private keys, enable two-factor authentication, and verify contract addresses (0x080d43c2164afdbc3712422ce78ab902ccab5ca1) before transactions

V. SPON Potential Risks and Challenges

SPON Market Risks

- Volatility Risk: SPON experienced a 24.93% decline over 30 days, demonstrating susceptibility to market corrections and investor sentiment shifts

- Liquidity Risk: With a market cap of approximately $515,474 and ranking at #3012, SPON faces potential liquidity constraints during high-volatility periods

- Competition Risk: The decentralized computing sector includes multiple competitors, potentially fragmenting market share and user adoption

SPON Regulatory Risks

- Decentralized Infrastructure Scrutiny: Growing regulatory focus on decentralized computing networks may introduce compliance requirements affecting operations

- Token Classification Uncertainty: Evolving regulatory frameworks may reclassify utility tokens, impacting trading availability and investor accessibility

- Cross-border Operations: Operating a global network with 50,000+ nodes may face jurisdictional compliance challenges across different regulatory environments

SPON Technical Risks

- Smart Contract Vulnerability: As an ERC-20 token on Base network, SPON relies on contract security; any exploits could impact token value and user confidence

- Network Scaling Challenges: Maintaining performance and reliability as the network grows to accommodate AI workloads requires continuous infrastructure investment

- Integration Dependencies: Ecosystem products like KlippyAI and Agent Marketplace depend on successful technical integration and user adoption

VI. Conclusion and Action Recommendations

SPON Investment Value Assessment

Spheron Network presents a compelling value proposition in the decentralized computing sector, leveraging a substantial infrastructure of 50,000+ active nodes and $100M+ compute capacity to address growing AI workload demands. The project's focus on cost-efficient GPU access and community-governed economics positions it within the expanding intersection of AI and blockchain technology. However, investors should consider the current market dynamics, including the 24.93% monthly decline and relatively low market capitalization of $515,474, which reflect both early-stage risk and potential upside. The 22.01% circulating supply ratio indicates significant future token unlock considerations. Long-term value depends on successful ecosystem development, sustained network growth, and competitive positioning against alternative decentralized computing solutions.

SPON Investment Recommendations

✅ Beginners: Limit exposure to 1-2% of crypto portfolio, focusing on understanding the decentralized computing sector before increasing allocation. Use Gate Web3 Wallet for secure storage and start with small position sizes.

✅ Experienced Investors: Consider 3-5% allocation with active monitoring of network metrics (node count, compute capacity utilization) and ecosystem product launches. Implement scaled entry strategies during market corrections.

✅ Institutional Investors: Evaluate infrastructure partnerships, token economics, and governance mechanisms before committing capital. Consider strategic positions aligned with broader AI and decentralized computing investment theses, with professional custody solutions.

SPON Trading Participation Methods

- Spot Trading: Purchase SPON directly on Gate.com with fiat or cryptocurrency pairs, benefiting from competitive pricing and liquidity

- Dollar-Cost Averaging: Implement systematic purchase schedules to reduce timing risk and average entry costs over market cycles

- Ecosystem Participation: Engage with Spheron Network products and services to gain operational understanding and potential utility value from token holdings

Cryptocurrency investment carries extreme risk, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the historical price performance of SPON? What are the price trends over the past year?

SPON has demonstrated growth potential as an emerging infrastructure token. Over the past year, the token has experienced volatility typical of early-stage projects. Current price stands at $0.002348, with analysts projecting continued development based on network adoption and ecosystem expansion trends.

What are the main factors affecting SPON price?

SPON price is primarily influenced by market sentiment, regulatory developments, trading volume, network adoption growth, Bitcoin market trends, and investor confidence in the Spheron ecosystem.

Will SPON price rise or fall in the future? What do experts think?

SPON price is expected to rise based on growing market adoption and ecosystem development. Experts remain optimistic about long-term potential, though short-term volatility is normal in crypto markets.

What are the technical foundation and application scenarios of SPON?

SPON leverages blockchain technology for decentralized applications. Its technical foundation includes smart contracts and distributed ledgers. Application scenarios encompass DeFi protocols, cross-chain bridges, and decentralized governance systems, enabling secure and transparent transactions across Web3 ecosystems.

What risks should I pay attention to when investing in SPON?

SPON investments carry potential capital loss risks. Market volatility and system performance may impact trading. Electronic trading systems can be affected by market conditions and technical factors. Account value may fluctuate based on market movements.

What are SPON's advantages and disadvantages compared to similar projects?

SPON offers efficient search algorithms and QL language support, providing superior data flow analysis. However, it has limitations in multi-language support and cross-file processing complexity compared to some alternatives.

Top 10 DePIN Crypto Projects to Invest in 2025

How to Participate in a DePIN Project

What is DePIN?How Does DePIN Work?

What Does Onyxcoin's DApp Ecosystem Look Like in 2025?

How to Earn with The RWA DePin Protocol in 2025

TrendX (XTTA): An Innovative Investment Platform Integrating AI and DePIN

What is Jupiter Coin: Investment Analysis and Future Outlook

The 10 Best Play-to-Earn NFT Games for Earning Rewards

7 Ideas for Beginners To Create Digital Art

Squid Game – The Most Shocking Rug Pull in History. What Exactly Is a Rug Pull?

The link between Elon Musk's "America Party" and the world of cryptocurrencies