2026 STBU Price Prediction: Expert Analysis and Market Forecast for Strategic Growth

Introduction: STBU's Market Position and Investment Value

Stobox (STBU), positioned as a tokenization solutions provider in the digital securities space, has been operational since its launch in May 2021. As of 2026, STBU maintains a market capitalization of approximately $231,500, with a circulating supply of around 125 million tokens and a current trading price hovering near $0.001852. This asset, recognized for its role in the tokenization ecosystem, is playing an increasingly significant role in bridging traditional finance with blockchain technology.

This article will comprehensively analyze STBU's price trends from 2026 to 2031, incorporating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. STBU Price History Review and Market Status

STBU Historical Price Evolution Trajectory

- 2021: Project launched on May 6, 2021 with an initial offering price of $0.23, reaching an all-time high of $0.449805 on March 17, 2021, demonstrating strong early market interest

- 2022: Market experienced significant correction, with price declining to an all-time low of $0.00045058 on January 23, 2022, reflecting broader crypto market downturn

- 2025-2026: Price showed considerable volatility, declining approximately 54.81% over the past 30 days and 83.48% over the past year

STBU Current Market Status

As of February 8, 2026, STBU is trading at $0.001852, with a 24-hour trading volume of $28,102. The token has experienced an 8.31% decline over the past 24 hours, with intraday prices fluctuating between a high of $0.002142 and a low of $0.00165.

The current circulating supply stands at 125,000,000 STBU tokens, representing 50% of the total supply of 150,000,000 tokens. The maximum supply is capped at 250,000,000 tokens. The market capitalization is approximately $231,500, with a fully diluted market cap of $277,800.

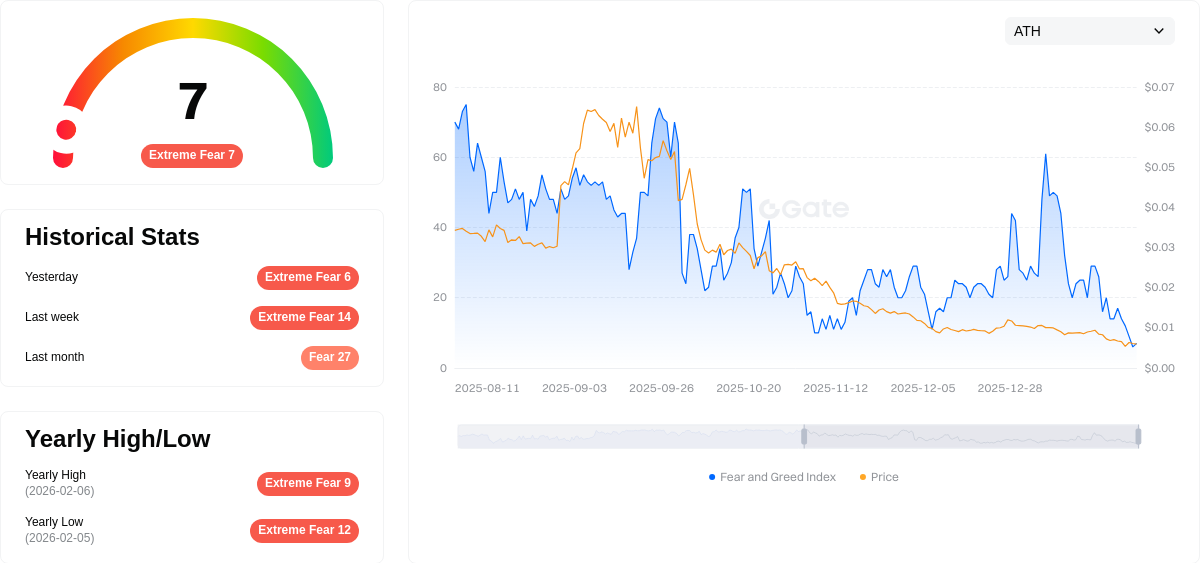

Stobox maintains a market share of 0.000011% and is currently ranked #3,781 among digital assets. The token is held by approximately 1,392 addresses and is available for trading on Gate.com. The current market sentiment index registers at 7, indicating an extreme fear level in the broader market.

Click to view current STBU market price

STBU Market Sentiment Indicator

02-08-2026 Fear and Greed Index: 7(Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index hitting just 7 points. This historically low reading suggests investors are highly pessimistic about market conditions. During such periods of extreme fear, opportunities often emerge for contrarian investors. However, caution remains essential as further downside risks may exist. Traders should carefully evaluate their risk tolerance and consider dollar-cost averaging strategies. Market sentiment can shift rapidly, so staying informed through reliable indicators remains crucial for making informed investment decisions.

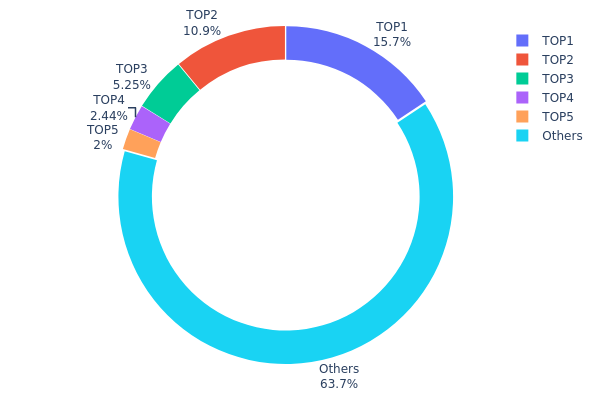

STBU Holdings Distribution

The holdings distribution chart illustrates how STBU tokens are allocated across different wallet addresses, providing crucial insights into the token's decentralization level and potential market control dynamics. By analyzing the concentration of tokens among top holders versus the broader distribution, we can assess the project's resilience to price manipulation and overall market structure stability.

Current data reveals a moderately concentrated holdings pattern for STBU. The top address controls 15.69% of the total supply (15,697.03K tokens), while the burn address (0x0000...00dead) holds 10.92%, effectively removing these tokens from circulation. The top five addresses collectively account for 36.29% of total supply, with the remaining 63.71% distributed among other holders. This distribution suggests a balanced ecosystem where no single entity holds overwhelming control, though the top holder's position remains significant enough to influence short-term price movements.

From a market structure perspective, this distribution pattern presents both opportunities and considerations. The substantial burn allocation demonstrates a commitment to deflationary tokenomics, potentially supporting long-term value appreciation. However, the 15.69% concentration in the top address warrants monitoring, as large-scale movements from this wallet could trigger notable price volatility. The relatively broad distribution among other holders (63.71%) indicates healthy retail participation and reduces the risk of coordinated market manipulation, contributing to a more organic price discovery mechanism.

Click to view current STBU Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0d07...b492fe | 15697.03K | 15.69% |

| 2 | 0x0000...00dead | 10923.23K | 10.92% |

| 3 | 0x3cc9...aecf18 | 5251.79K | 5.25% |

| 4 | 0x44e7...d18c74 | 2444.92K | 2.44% |

| 5 | 0xdfb5...2cc218 | 1999.70K | 1.99% |

| - | Others | 63683.32K | 63.71% |

II. Core Factors Influencing STBU's Future Price

Supply and Demand Dynamics

- Market Demand: The token's price trajectory is significantly influenced by overall market demand within the cryptocurrency ecosystem, which reflects investor sentiment and broader adoption trends.

- Competition Landscape: The competitive environment plays a crucial role in determining STBU's market position, as the project faces competition from other tokenization platforms and blockchain-based solutions.

- Supply-Demand Relationship: Price movements are fundamentally driven by the balance between circulating supply and market demand, with shifts in this equilibrium directly impacting valuation.

Ecosystem Development and Governance

- Token Holder Participation: STBU token holders have the ability to participate in decision-making processes, which influences the future direction of the ecosystem and can affect long-term price stability.

- Ecosystem Expansion: The development and growth of the Stobox ecosystem, including partnerships and platform integrations, may contribute to increased utility and demand for the token.

Market Trends and Trading Activity

- On-Chain Data Analysis: Monitoring on-chain metrics and trading patterns helps identify factors affecting supply-demand relationships, potentially signaling upcoming trend formations or cycle transitions.

- Trading Volume: Current 24-hour trading volume reflects market activity levels and liquidity, which are important indicators of price stability and investor interest.

III. 2026-2031 STBU Price Prediction

2026 Outlook

- Conservative estimate: $0.00133

- Neutral estimate: $0.00185

- Optimistic estimate: $0.00272

Based on the current market data as of February 8, 2026, STBU is expected to trade within a relatively narrow range throughout the year. The predicted average price of $0.00185 suggests moderate stability in the near term, with potential fluctuations between the low of $0.00133 and the high of $0.00272.

2027-2029 Mid-term Outlook

- Market stage expectation: Gradual upward momentum with periodic consolidation phases

- Price range predictions:

- 2027: $0.00185 - $0.00304 (23% potential increase)

- 2028: $0.00248 - $0.00293 (43% potential increase from 2026 baseline)

- 2029: $0.00148 - $0.00381 (51% potential increase from 2026 baseline)

- Key catalysts: Market adoption trends, technological developments in the broader crypto ecosystem, and evolving regulatory frameworks may contribute to price movements during this period.

The mid-term forecast indicates a progressive appreciation trajectory, with 2029 potentially marking a significant milestone as the average price could reach $0.0028, representing sustained growth over the three-year period.

2030-2031 Long-term Outlook

- Baseline scenario: $0.00274 - $0.00353 (assuming steady market conditions and continued project development)

- Optimistic scenario: $0.00342 - $0.00444 (assuming favorable market dynamics and increased adoption)

- Transformative scenario: Above $0.00444 (contingent upon exceptional market conditions and breakthrough developments)

- February 8, 2031: STBU projected average of $0.00342 (representing an 84% increase from 2026 levels)

The long-term outlook suggests potential for sustained appreciation, with 2031 predictions indicating the possibility of STBU reaching new valuation levels. However, investors should note that cryptocurrency markets remain inherently volatile, and actual performance may vary significantly based on numerous factors including market sentiment, technological advancements, regulatory developments, and broader economic conditions.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00272 | 0.00185 | 0.00133 | 0 |

| 2027 | 0.00304 | 0.00229 | 0.00185 | 23 |

| 2028 | 0.00293 | 0.00266 | 0.00248 | 43 |

| 2029 | 0.00381 | 0.0028 | 0.00148 | 51 |

| 2030 | 0.00353 | 0.0033 | 0.00274 | 78 |

| 2031 | 0.00444 | 0.00342 | 0.00219 | 84 |

IV. STBU Professional Investment Strategy and Risk Management

STBU Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to tokenization infrastructure with moderate to high risk tolerance

- Operational Recommendations:

- Consider dollar-cost averaging due to high volatility (83.48% decline over the past year)

- Monitor regulatory developments in digital securities and tokenization frameworks

- Utilize Gate Web3 Wallet for secure storage with multi-signature protection

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Daily trading volume of $28,102 suggests limited liquidity, requiring careful position sizing

- Support/Resistance Levels: 24-hour range between $0.00165 (support) and $0.002142 (resistance)

- Swing Trading Considerations:

- High volatility presents opportunities but requires strict stop-loss implementation

- Low market cap ($231,500) increases susceptibility to price manipulation

STBU Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of crypto portfolio

- Aggressive Investors: 2-3% of crypto portfolio

- Professional Investors: Up to 5% with active monitoring

(2) Risk Hedging Solutions

- Position Sizing: Limit exposure due to low liquidity and high volatility

- Diversification: Combine with established tokenization projects to reduce sector-specific risk

(3) Secure Storage Solutions

- Hot Wallet Option: Gate Web3 Wallet for active trading with multi-chain support (ETH, BSC, MATIC)

- Cold Storage Solution: Hardware wallet for long-term holdings exceeding $1,000

- Security Precautions: Verify contract addresses on Etherscan, BscScan, or PolygonScan before transactions; never share private keys

V. STBU Potential Risks and Challenges

STBU Market Risks

- Extreme Volatility: 83.48% price decline over one year and 54.81% drop in the past 30 days indicate significant downside risk

- Limited Liquidity: Trading volume of $28,102 and listing on only one exchange increases slippage risk

- Market Cap Vulnerability: Total market capitalization of $231,500 makes the asset susceptible to whale manipulation

STBU Regulatory Risks

- Securities Token Regulations: Evolving frameworks for tokenized securities may impact project operations and token classification

- Jurisdictional Uncertainty: Multi-chain deployment across ETH, BSC, and MATIC may face varying regulatory treatments

- Compliance Requirements: Increased scrutiny on security token offerings could affect token utility and liquidity

STBU Technical Risks

- Smart Contract Vulnerabilities: Multi-chain deployment across three networks increases attack surface area

- Low Development Activity: Limited information on recent protocol upgrades or security audits

- Holder Concentration: 1,392 holders with 50% circulating supply ratio suggests potential centralization concerns

VI. Conclusion and Action Recommendations

STBU Investment Value Assessment

STBU presents a high-risk, speculative opportunity within the tokenization infrastructure sector. While Stobox's advisory role in regulatory framework development demonstrates industry relevance, the token faces significant headwinds including extreme price volatility, limited liquidity, and a 99.59% decline from its all-time high of $0.449805. The project's multi-chain presence (Ethereum, BSC, Polygon) provides technical flexibility, but low trading volume ($28,102 daily) and minimal exchange listings pose substantial exit risks. Long-term value depends heavily on broader adoption of security token frameworks and project execution, which remains uncertain given current market performance.

STBU Investment Recommendations

✅ Beginners: Avoid STBU due to extreme volatility and complexity of tokenization sector; focus on established projects with higher liquidity ✅ Experienced Investors: Allocate no more than 1-2% of portfolio as a speculative position; employ strict stop-loss orders and monitor regulatory developments ✅ Institutional Investors: Conduct thorough due diligence on Stobox's business model and compliance framework; consider position only as part of diversified tokenization sector exposure with appropriate risk controls

STBU Trading Participation Methods

- Spot Trading: Available on Gate.com with direct purchase using major cryptocurrencies

- Dollar-Cost Averaging: Systematic small purchases to mitigate timing risk in volatile market

- Limit Orders: Use limit orders rather than market orders to minimize slippage given low liquidity conditions

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the current price of STBU token?

The current price of STBU token is $0.001961 USD. The market cap stands at $294,148.78 USD, with 24-hour trading volume of $44,534.03 USD.

What are the main factors influencing STBU price predictions?

STBU price is primarily driven by supply-demand dynamics, market sentiment, and regulatory developments. Institutional adoption rates and macroeconomic trends also significantly impact price movement. These factors collectively determine STBU's overall price trajectory.

STBU项目的基本面和发展前景如何?

STBU leverages biomass and wind energy with strong fundamentals. Supported by renewable energy policies and continuous technical innovation, the project shows promising growth potential. Expected to enhance energy efficiency and expand market reach significantly in coming years.

What are the main risks of investing in STBU tokens?

STBU investment carries market volatility risk, potential losses, regulatory uncertainty, and liquidity constraints. Investors should assess their risk tolerance and thoroughly understand the project fundamentals before investing.

What are the advantages of STBU compared to similar tokens?

STBU offers anonymous transactions and limited supply, ensuring transaction security and scarcity. Blockchain technology protects user privacy and fund safety while maintaining transparent, decentralized operations for enhanced trust.

How to get STBU real-time price information and market data?

You can access STBU real-time price, market cap, 24-hour trading volume, and price charts through major cryptocurrency data platforms. Current STBU price is 0.0018 USD with a market cap of 270,000 USD. Monitor price movements and market trends in real-time on dedicated crypto tracking websites.

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

How to Mine Ethereum in 2025: A Complete Guide for Beginners

Newbie Must Read: How to Formulate Investment Strategies When Nasdaq Turns Positive in 2025

Best Crypto Wallets 2025: How to Choose and Secure Your Digital Assets

TapSwap Listing Date: What Investors Need to Know in 2025

Byzantine Fault Tolerance Explained

What is Ergo? A Combination of Bitcoin and Ethereum

7 Strategies for Earning Passive Income with Crypto Assets

A detailed explanation of the differences, advantages, and disadvantages between PoS and PoW

Which ASIC Miner Should You Buy? A Review of Top Models for Cryptocurrency Mining