2026 STORM Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: STORM's Market Position and Investment Value

Storm Trade (STORM), positioned as a social-first derivatives trading platform on Telegram operating on the TON blockchain, has been facilitating trading of cryptocurrencies, forex, equities, and commodities since its launch in October 2024. As of February 2026, STORM maintains a market capitalization of approximately $339,063, with a circulating supply of around 46.62 million tokens, and the price stabilizing around $0.007273. This asset, characterized by its deep integration with Telegram's ecosystem, is playing an increasingly notable role in the decentralized derivatives trading sector.

This article will comprehensively analyze STORM's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasting and practical investment strategies.

I. STORM Price History Review and Current Market Status

STORM Historical Price Evolution Trajectory

- October 2024: Storm Trade launched on Gate.com with an initial offering price of $0.012, marking the token's entry into the cryptocurrency trading market

- December 2024: STORM reached a notable price level of $0.056522 on December 5th, representing significant growth from its launch price

- February 2026: The token experienced price fluctuations, with the price declining to $0.006359 on February 6th, followed by a recovery to $0.007273

STORM Current Market Situation

As of February 7th, 2026, STORM is trading at $0.007273, showing a 24-hour price increase of 6.69%. The token's 24-hour trading volume stands at $47,973.59, with a market capitalization of approximately $339,062.95.

The current circulating supply is 46,619,408 STORM tokens, representing 4.66% of the maximum supply of 1 billion tokens. The fully diluted market cap is calculated at $7,273,000. Over different time periods, STORM has shown varied performance: a slight increase of 0.08% in the past hour, a decline of 7.76% over the past week, a decrease of 10.47% over the past month, and a significant decline of 71.57% over the past year.

The token is deployed on the TON blockchain as a Jetton standard token, with the contract address EQBsosmcZrD6FHijA7qWGLw5wo_aH8UN435hi935jJ_STORM. Currently, STORM has approximately 25,906 token holders and is listed on 2 exchanges. The market sentiment index stands at 9, indicating an extreme fear sentiment in the broader market.

The 24-hour price range for STORM has fluctuated between $0.006359 and $0.00727. The token's market dominance is minimal at 0.00028% of the total cryptocurrency market capitalization.

Click to view the current STORM market price

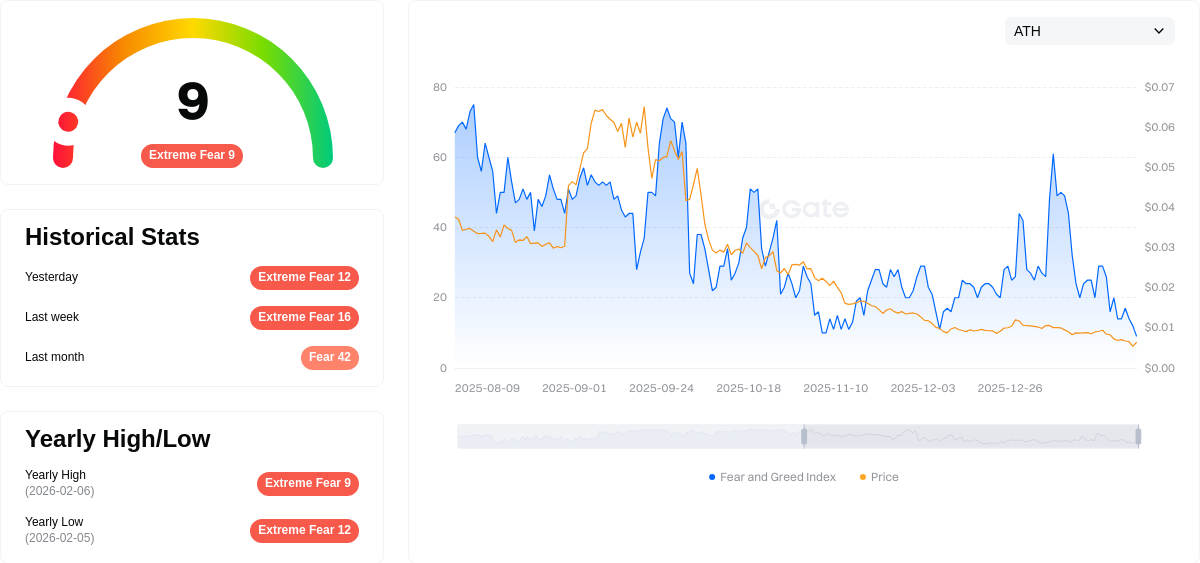

STORM Market Sentiment Index

2026-02-06 Fear and Greed Index: 9 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to just 9. This exceptionally low reading signals severe market pessimism and investor anxiety. Such extreme fear conditions typically present contrarian opportunities for long-term investors, as markets often stabilize or recover from these panic lows. However, caution remains warranted as volatility may persist. Traders should monitor key support levels and market fundamentals closely before making investment decisions.

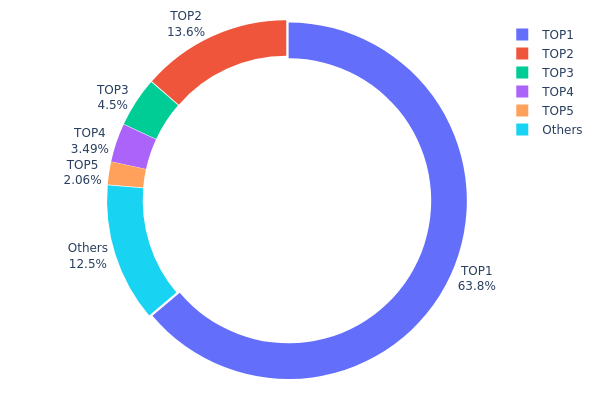

STORM Holding Distribution

The holding distribution chart reflects the concentration of token holdings across different wallet addresses on the blockchain, serving as a critical indicator of decentralization levels and potential market manipulation risks. For STORM, the current on-chain data reveals a highly concentrated ownership structure that warrants careful examination.

According to the latest holding distribution data, the top address controls approximately 638.34 million STORM tokens, representing 63.83% of the total supply. The second-largest holder possesses 135.88 million tokens (13.58%), while the third ranks at 45.01 million tokens (4.50%). Cumulatively, the top five addresses account for 87.45% of the entire token supply, with only 12.55% distributed among other addresses. This extreme concentration indicates a severely centralized token structure, where a small number of entities wield substantial control over the circulating supply.

Such concentrated holding distribution poses significant implications for market dynamics and price stability. The dominant position of the top holder creates substantial selling pressure risks, as any liquidation activity from this address could trigger dramatic price volatility. Additionally, this concentration level raises concerns regarding potential market manipulation, as major holders possess sufficient leverage to influence price movements through coordinated trading activities. The limited circulation among smaller holders also suggests weak retail participation and reduced organic trading volume, potentially compromising market liquidity and price discovery mechanisms. From a decentralization perspective, this distribution pattern deviates considerably from the ideal of distributed ownership, indicating that STORM's on-chain structure remains vulnerable to centralized control and lacks the robust ecosystem foundation characteristic of mature blockchain projects.

Click to view current STORM Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | UQBDMz...0BasXR | 638338.62K | 63.83% |

| 2 | EQDaC-...VNUdik | 135875.51K | 13.58% |

| 3 | EQByAD...JNJGx6 | 45011.44K | 4.50% |

| 4 | UQC6mq...pvU4NC | 34900.00K | 3.49% |

| 5 | EQA82S...QODs0r | 20553.52K | 2.05% |

| - | Others | 125319.98K | 12.55% |

II. Core Factors Influencing STORM's Future Price

Supply Mechanism

-

Mining Grade Collapse: Global silver mining output peaked in 2016 at 900.1 million ounces. Despite silver prices more than doubling over the subsequent nine years, 2025 production stood at approximately 835 million ounces, a 7% decline from peak levels. Mining companies now require processing 1.5 times more ore than a decade ago to extract equivalent silver quantities, significantly amplifying costs, energy consumption, and environmental impact.

-

Historical Pattern: Following the 2013 silver price crash, many mining companies prioritized extraction from the richest ore deposits to maintain output and profitability. While this stabilized short-term production, it left lower-grade ore underground, which only becomes economically viable when blended with high-grade material.

-

Current Impact: Silver supply demonstrates extreme insensitivity to price signals. As 70-80% of global silver derives as a byproduct from copper, lead-zinc, and gold mining, silver output depends primarily on these base metals' extraction decisions rather than silver prices themselves. Even if silver reaches $150 per ounce, production increases would remain limited without corresponding rises in copper and zinc prices.

Institutional and Major Holder Dynamics

-

Institutional Holdings: In mid-January, market reports indicated Tesla initiated a one-time purchase of 85 million ounces of physical silver—exceeding COMEX's entire registered inventory. This transaction combined mine contracts, vault purchases, and private deals, bypassing all public exchanges entirely.

-

Corporate Adoption: Major technology corporations are evaluating direct long-term supply agreements with Latin American silver mining enterprises. In October of the previous year, Samsung C&T secured a $7 million prepayment offtake financing arrangement with Canada's Silver Storm Mining to restart Mexico's La Parrilla silver mine, with underground drilling commencing in mid-January 2026 for potential Q2 2026 production restart. Apple's internal procurement plan reportedly authorized long-term silver supply contracts at psychological price levels up to approximately $573 per ounce under extreme supply disruption scenarios.

-

National Policy: Market speculation suggests leading electronics and electric vehicle manufacturers, including Apple and Samsung, are assessing opportunities to directly lock in key metal resources through agreements worth hundreds of millions to billions of dollars in coming years, reducing dependence on exchange inventories.

Macroeconomic Environment

-

Monetary Policy Impact: As of February 2026, the U.S. Federal Reserve's policy stance toward interest rate adjustments remains a focal point for precious metals markets. Recent inflation data releases have influenced market expectations regarding potential rate cuts, though considerable uncertainty persists regarding the Fed's response to evolving economic dynamics.

-

Inflation Hedge Characteristics: Silver's performance in inflationary environments has historically demonstrated mixed results. While precious metals typically serve as inflation hedges, silver's dual nature as both an industrial and monetary metal creates complex price dynamics during periods of rising consumer prices.

-

Geopolitical Factors: Four mutually reinforcing forces drive current silver price revaluation: exchange credit crises, geopolitical supply disruptions, rigid industrial demand lockdown, and supply-side loss of responsiveness to price signals. China's export control measures and central bank de-dollarization purchasing have contributed to structural shifts in global silver flows.

Technological Development and Ecosystem Building

-

Battery Technology Requirements: Samsung's solid-state battery technology requires silver-carbon composite anode layers, where silver cannot be substituted. Once solid-state batteries enter mass production, Samsung's silver demand will grow exponentially, necessitating secured supply regardless of market price levels.

-

Photovoltaic Industry Demand: 2025 industrial demand reached 680 million ounces, representing approximately 60% of total demand. Photovoltaic applications accounted for 200-250 million ounces, with this figure unlikely to decline through 2026-2028 as global installation capacity continues expanding.

-

Ecosystem Applications: Electric vehicle applications consumed 40-60 million ounces, with continued growth anticipated as electrification penetration rates advance. Data centers, 5G infrastructure, and semiconductor manufacturing, while representing smaller individual shares, demonstrate rapid growth trajectories. These applications exhibit economic demand rigidity—they will not disappear due to 50% price increases, as factories, power stations, and reactors cannot operate without silver.

III. 2026-2031 STORM Price Prediction

2026 Outlook

- Conservative prediction: $0.00668 - $0.00726

- Neutral prediction: $0.00726 - $0.00800

- Optimistic prediction: $0.00800 - $0.00900 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market phase expectation: STORM is anticipated to enter a gradual growth phase during this period, potentially benefiting from broader crypto market recovery and ecosystem development.

- Price range prediction:

- 2027: $0.00618 - $0.01154 (approximately 11% average increase)

- 2028: $0.00836 - $0.01289 (approximately 35% average increase)

- 2029: $0.00716 - $0.01534 (approximately 56% average increase)

- Key catalysts: Market sentiment shifts, potential technological upgrades, and expanding use cases within the STORM ecosystem could serve as primary drivers for price appreciation.

2030-2031 Long-term Outlook

- Baseline scenario: $0.01028 - $0.01509 (assuming steady ecosystem growth and moderate market conditions)

- Optimistic scenario: $0.01335 - $0.01592 (assuming enhanced platform adoption and favorable regulatory environment)

- Transformative scenario: exceeding $0.01600 (requires breakthrough partnerships, significant user base expansion, and sustained bull market momentum)

- February 7, 2026: STORM trading at approximately $0.00668 - $0.00726 range (establishing baseline for future growth trajectory)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.009 | 0.00726 | 0.00668 | 0 |

| 2027 | 0.01154 | 0.00813 | 0.00618 | 11 |

| 2028 | 0.01289 | 0.00984 | 0.00836 | 35 |

| 2029 | 0.01534 | 0.01136 | 0.00716 | 56 |

| 2030 | 0.01509 | 0.01335 | 0.01028 | 83 |

| 2031 | 0.01592 | 0.01422 | 0.0081 | 95 |

IV. STORM Professional Investment Strategy and Risk Management

STORM Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors who believe in the long-term potential of decentralized derivatives trading on TON blockchain and Telegram-integrated platforms

- Operational Recommendations:

- Consider accumulating STORM tokens during market dips, focusing on dollar-cost averaging to mitigate volatility risks

- Monitor the platform's trading volume growth and user adoption metrics, as these directly impact token utility

- Storage Solution: Use Gate Web3 Wallet for secure storage with support for TON blockchain assets, enabling convenient management while maintaining custody control

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume ($47,973.59 as of February 7, 2026) to identify accumulation or distribution phases

- Price Action Analysis: Track key support levels around $0.006359 (recent low) and resistance near $0.00727 (24-hour high) for entry and exit points

- Swing Trading Key Points:

- Watch for volatility patterns given recent 24-hour gain of 6.69% against 7-day decline of 7.76%

- Set stop-loss orders below recent support levels to manage downside risk in this high-volatility environment

STORM Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 8-10% with active monitoring and hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance STORM holdings with more established cryptocurrencies and stablecoins to reduce concentration risk

- Position Sizing: Given the 71.57% decline over the past year, limit individual position size and avoid over-exposure to single token risk

(3) Secure Storage Solutions

- Software Wallet Recommendation: Gate Web3 Wallet, which provides seamless integration with TON blockchain and enables direct interaction with Storm Trade platform

- Multi-signature Solution: For larger holdings, consider implementing multi-signature wallet arrangements to enhance security controls

- Security Considerations: Never share private keys, enable two-factor authentication on all accounts, and regularly verify contract addresses before transactions

V. STORM Potential Risks and Challenges

STORM Market Risks

- High Volatility: STORM has experienced significant price fluctuations, declining 71.57% over the past year from its all-time high of $0.056522, indicating substantial downside risk potential

- Limited Liquidity: With a market cap of approximately $339,063 and trading on only 2 exchanges, liquidity constraints may result in slippage during larger transactions

- Low Circulation Ratio: Only 4.66% of total supply is currently circulating, suggesting potential selling pressure if additional tokens enter the market

STORM Regulatory Risks

- Derivatives Trading Regulations: As a derivatives trading platform, Storm Trade may face evolving regulatory scrutiny in various jurisdictions regarding leveraged trading products

- Telegram Integration Compliance: The platform's deep integration with Telegram messaging service may encounter regulatory challenges related to financial services within communication platforms

- TON Blockchain Uncertainty: Regulatory developments affecting the TON blockchain ecosystem could indirectly impact Storm Trade's operations and token value

STORM Technical Risks

- Smart Contract Vulnerabilities: As a derivatives platform operating on TON blockchain, potential smart contract bugs or exploits could compromise user funds and platform stability

- Platform Adoption Risk: Success depends heavily on user acquisition and retention within the competitive Telegram mini-app and derivatives trading landscape

- Integration Dependencies: Heavy reliance on Telegram's @wallet infrastructure creates technical dependency risks if the underlying integration changes or experiences disruptions

VI. Conclusion and Action Recommendations

STORM Investment Value Assessment

Storm Trade represents an innovative approach to derivatives trading through its Telegram-native platform on TON blockchain, offering exposure to the growing social trading sector. However, the token faces significant headwinds, evidenced by a 71.57% decline over the past year and limited market capitalization of approximately $339,063. The platform's value proposition centers on accessibility and social integration, potentially appealing to users seeking simplified derivatives trading experiences. Short-term risks include continued volatility, limited liquidity across only 2 exchanges, and low circulation ratio that may create supply overhang concerns. The investment carries substantial risk and should only be considered by those with high risk tolerance and understanding of early-stage blockchain projects.

STORM Investment Recommendations

✅ Beginners: Avoid or allocate minimal exposure (under 1% of crypto portfolio). Focus on understanding the platform's mechanics and derivatives trading risks before committing significant capital. Consider starting with small test transactions to evaluate platform usability.

✅ Experienced Investors: Consider speculative position sizing of 2-3% maximum, employing strict stop-loss discipline. Monitor platform growth metrics, trading volume trends, and TON ecosystem developments. Use technical analysis to time entries during consolidation periods.

✅ Institutional Investors: Conduct thorough due diligence on smart contract security, regulatory compliance, and platform economics. Consider strategic allocation only within high-risk venture buckets, with emphasis on ongoing monitoring of user acquisition and platform revenue metrics.

STORM Trading Participation Methods

- Spot Trading: Purchase STORM tokens directly on Gate.com or other supporting exchanges for straightforward exposure to price movements

- Platform Utilization: Use STORM tokens within the Storm Trade ecosystem to access derivatives trading features and potentially benefit from platform utility demand

- DCA Strategy: Implement dollar-cost averaging approach to build positions gradually, reducing timing risk in this volatile asset

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is STORM token? What is the project background and use case?

STORM is a blockchain-based decentralized project designed to enhance user network activity efficiency and provide financial freedom. It offers innovative digital currency applications for global users seeking financial independence and improved network participation.

What is STORM's historical price performance? What are the highest and lowest prices?

STORM reached an all-time high of HK$0.059203 on December 5, 2024, and an all-time low of HK$0.052274 on December 26, 2025. The token has demonstrated moderate volatility within this range throughout its trading history.

What is the STORM price prediction for 2024? What factors will affect the price?

STORM's 2024 price prediction reached a maximum of $0.002126. Key factors influencing price include market demand, technology development, trading volume, and overall market sentiment. Predictions are based on technical analysis and market trends.

What are the advantages and disadvantages of STORM compared to similar tokens?

STORM emphasizes decentralization and privacy protection with higher transaction anonymity. Advantages include stronger anonymity features and community governance. Disadvantages include potential regulatory risks and lower mainstream adoption compared to established tokens.

What are the risks to pay attention to when investing in STORM tokens?

STORM token investment carries high volatility risk and market uncertainty. Price fluctuations can be dramatic due to market dynamics. Investors should thoroughly understand the asset and only invest capital they can afford to lose. Market conditions are unpredictable.

Where can STORM be traded? How is the liquidity?

STORM is listed on multiple major exchanges including Gate.com, MEXC, and BingX, offering solid liquidity. Users can easily buy, sell, and trade STORM tokens on these platforms with good trading volume and market depth.

What signals do STORM's technical indicators and on-chain data show?

STORM demonstrates strong technical fundamentals with superior on-chain metrics. Data indicates robust network activity, consistent transaction volume growth, and positive holder sentiment. Technical indicators suggest bullish momentum with key support levels holding firm, signaling potential upside movement in the near term.

What is the future development roadmap for the STORM project?

STORM project will enhance its distributed computing framework, improve performance and scalability, and launch new APIs and tools to support broader applications and ecosystem growth.

How to Withdraw Money from Crypto Exchanges in 2025: A Beginner's Guide

Hedera Hashgraph (HBAR): Founders, Technology, and Price Outlook to 2030

Jasmy Coin: A Japanese Crypto Tale of Ambition, Hype, and Hope

IOTA (MIOTA) – From Tangle Origins to 2025 Price Outlook

Bitcoin Price in 2025: Analysis and Market Trends

How to Trade Bitcoin in 2025: A Beginner's Guide

Anonymity vs. Pseudonymity: Key Differences Explained

Cryptocurrency staking: What is it and how can you earn profits from it

Money-Making Games: Top 23 Projects for Earning

Can quantum computers break Bitcoin?

What is MEPAD: A Comprehensive Guide to Mobile Electronic Personal Assistant Devices