2026 TURBOS Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: TURBOS Market Position and Investment Value

Turbos (TURBOS), positioned as a non-custodial decentralized exchange (DEX) on the Sui blockchain with horizontal scalability and digital asset ownership, has been operating since its launch in 2023. Backed by prominent investors including Jump Crypto and Mysten Labs, Turbos bridges the gap between the Sui ecosystem and the broader market, ensuring robust liquidity and efficient trading for users. As of 2026, TURBOS maintains a market capitalization of approximately $860,600, with a circulating supply of around 6.62 billion tokens, and a price hovering near $0.00013. This asset, recognized as a key infrastructure component within the Sui DeFi landscape, plays an increasingly important role in expanding decentralized finance accessibility for developers and users.

This article will comprehensively analyze TURBOS price trends from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. TURBOS Price History Review and Market Status

TURBOS Historical Price Evolution Trajectory

- 2023: TURBOS launched in May with an initial offering price of $0.005, reaching its highest price point of $0.024 on May 15, 2023. The token experienced significant volatility during its early trading period, with price declining to $0.0000707 by December 17, 2023.

- 2024-2025: The token underwent a prolonged correction phase, with prices remaining under pressure.

- 2026: As of February 4, 2026, TURBOS is trading at $0.00013, representing a decline of 97.4% from its initial offering price.

TURBOS Current Market Dynamics

TURBOS is currently trading at $0.00013, with a 24-hour trading volume of $21,863.97. The token has shown a 0.62% increase over the past hour, while experiencing a decline of 10.84% over the past 7 days and 22.71% over the past 30 days. Over the past year, TURBOS has declined by 94.48%.

The circulating supply stands at 6.62 billion tokens, representing 66.2% of the total supply of 10 billion tokens. The current market capitalization is approximately $860,600, with a fully diluted market cap of $1.3 million. The token's market dominance is 0.000048%.

TURBOS maintains a 24-hour price range between $0.0001271 and $0.0001353. The token is held by 6,208 addresses and is available for trading on 2 exchanges, including Gate.com. Market sentiment indicators suggest current conditions reflect a state of extreme caution among participants.

Click to view the current TURBOS market price

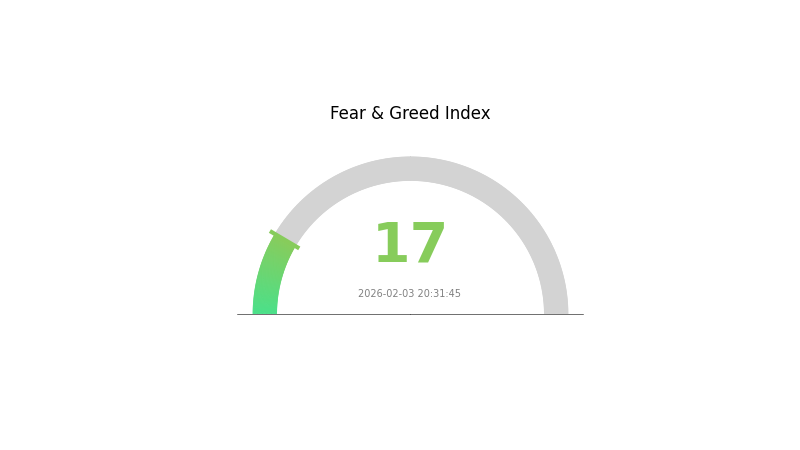

TURBOS Market Sentiment Indicator

2026-02-03 Fear & Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear & Greed Index plummeting to 17. This represents a significant sentiment shift toward panic, indicating investors are highly risk-averse. Such extreme fear levels historically present contrarian opportunities for long-term investors, as markets often recover from these oversold conditions. However, caution is warranted as further downside cannot be ruled out. Traders should manage risk carefully and consider diversifying their positions during this period of heightened market uncertainty.

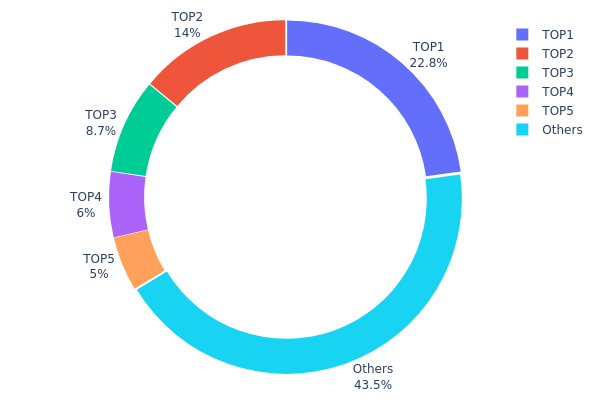

TURBOS Holdings Distribution

The holdings distribution chart illustrates the percentage allocation of TURBOS tokens across different wallet addresses, serving as a crucial metric to assess the degree of decentralization and potential concentration risks within the token ecosystem. By analyzing the distribution pattern, investors can evaluate whether the token supply is broadly distributed among numerous holders or concentrated in the hands of a few major addresses, which directly impacts market stability and price volatility.

According to the current data, TURBOS exhibits a moderate concentration pattern. The top five addresses collectively hold 5,650,031.08K tokens, accounting for 56.5% of the total supply. The largest single address (0xc43b...beb1f7) holds 22.80%, followed by the second-largest address (0xd6f2...bf4ba2) with 14.00%. The remaining 43.5% of tokens are distributed among other addresses, indicating that while there is significant concentration in the top tier, nearly half of the supply maintains relatively dispersed holdings.

This distribution structure presents both stability and risk factors. The 56.5% concentration in the top five addresses suggests potential vulnerability to large-scale sell-offs or coordinated market manipulation. However, the 43.5% allocation to other addresses demonstrates a reasonable level of decentralization, which can provide some cushion against extreme price volatility. From an on-chain structural perspective, this distribution pattern reflects a relatively mature market structure where institutional or early investors maintain substantial positions while allowing for broader community participation.

Click to view current TURBOS holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc43b...beb1f7 | 2280000.00K | 22.80% |

| 2 | 0xd6f2...bf4ba2 | 1400000.00K | 14.00% |

| 3 | 0xfd5b...90e8f7 | 870031.08K | 8.70% |

| 4 | 0x6e55...50d86a | 600000.00K | 6.00% |

| 5 | 0x15a4...1ea230 | 500000.00K | 5.00% |

| - | Others | 4349968.92K | 43.5% |

II. Core Factors Influencing TURBOS Future Price

Market Trends and Volatility

- High Volatility Risk: TURBOS exhibits significant price fluctuation characteristics, with market sentiment directly impacting its price movements.

- Market Sentiment Impact: The overall cryptocurrency market sentiment serves as a primary driver for TURBOS price action, with broader market trends strongly correlating with its performance.

- Liquidity Considerations: Limited trading volume may affect transaction efficiency and contribute to heightened price volatility.

Technology Development and Innovation

- Continuous Technical Innovation: The future performance of TURBOS depends heavily on sustained technological advancement and platform improvements.

- User Demand Dynamics: Market adoption and user base expansion represent critical factors for long-term value creation.

- Ecosystem Evolution: The token's trajectory will be shaped by ongoing development within its technical infrastructure and application ecosystem.

Regulatory Environment

- Regulatory Changes: Policy shifts in the cryptocurrency sector may materially affect TURBOS market positioning and accessibility.

- Compliance Framework: Evolving regulatory requirements across different jurisdictions will influence operational parameters and market participation.

Strategic Partnerships

- Industry Collaboration: Strategic alliances with key opinion leaders in the cryptocurrency space have accelerated TURBOS market presence and brand recognition.

- Partnership Network: Collaborative efforts within the blockchain ecosystem may create additional utility and demand drivers for the token.

III. 2026-2031 TURBOS Price Prediction

2026 Outlook

- Conservative Forecast: $0.0001

- Neutral Forecast: $0.00013

- Optimistic Forecast: $0.00015 (requiring favorable market conditions and increased adoption)

2027-2029 Outlook

- Market Phase Expectation: Gradual growth phase with potential for moderate volatility as the project matures and expands its ecosystem

- Price Range Forecast:

- 2027: $0.00011 - $0.0002

- 2028: $0.00009 - $0.00023

- 2029: $0.00017 - $0.00028

- Key Catalysts: Ecosystem development, strategic partnerships, technological improvements, and broader market sentiment in the cryptocurrency sector

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00015 - $0.00027 (assuming steady adoption and stable market conditions)

- Optimistic Scenario: $0.00021 - $0.00029 (assuming accelerated ecosystem growth and favorable regulatory environment)

- Transformative Scenario: Above $0.00029 (requiring breakthrough developments, mass adoption, and exceptional market conditions)

- 2026-02-04: TURBOS maintaining early-stage valuation with potential for gradual appreciation

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00015 | 0.00013 | 0.0001 | 0 |

| 2027 | 0.0002 | 0.00014 | 0.00011 | 7 |

| 2028 | 0.00023 | 0.00017 | 0.00009 | 30 |

| 2029 | 0.00028 | 0.0002 | 0.00017 | 54 |

| 2030 | 0.00027 | 0.00024 | 0.00015 | 83 |

| 2031 | 0.00029 | 0.00026 | 0.00021 | 97 |

IV. TURBOS Professional Investment Strategies and Risk Management

TURBOS Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors who believe in the long-term potential of decentralized finance (DeFi) on the Sui blockchain and seek exposure to DEX infrastructure projects

- Operational Recommendations:

- Consider establishing positions during periods of market consolidation, observing key support levels around $0.000127

- Implement dollar-cost averaging to mitigate timing risk, particularly given the token's historical volatility

- Storage Solution: Utilize Gate Web3 Wallet for secure storage, which supports Sui ecosystem assets and provides convenient access to DeFi protocols

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the current 24-hour trading volume of approximately $21,864 to identify potential breakout opportunities; increased volume may signal trend changes

- Moving Averages: Apply short-term (7-day) and medium-term (30-day) moving averages to identify trend reversals; note the recent -10.84% decline over 7 days and -22.71% over 30 days

- Swing Trading Considerations:

- Establish position sizing rules to limit exposure per trade to 2-5% of total portfolio given high volatility

- Set stop-loss orders approximately 8-12% below entry points to preserve capital during adverse movements

TURBOS Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% allocation to speculative altcoins like TURBOS within overall crypto portfolio

- Aggressive Investors: 5-8% allocation for those seeking higher risk-reward opportunities in emerging DeFi protocols

- Professional Investors: Up to 10-15% allocation with active hedging strategies and continuous monitoring

(II) Risk Hedging Solutions

- Portfolio Diversification: Combine TURBOS with established cryptocurrencies and stablecoins to reduce concentration risk

- Position Sizing: Limit individual position size relative to overall portfolio to prevent catastrophic losses from single-asset decline

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and DeFi participation on Sui ecosystem

- Cold Storage Approach: For long-term holdings exceeding $1,000 equivalent, consider transferring to hardware wallet solutions after initial accumulation

- Security Precautions: Enable two-factor authentication, verify contract addresses (0x5d1f47ea69bb0de31c313d7acf89b890dbb8991ea8e03c6c355171f84bb1ba4a::turbos::TURBOS on Sui), and never share private keys or seed phrases

V. TURBOS Potential Risks and Challenges

TURBOS Market Risks

- Extreme Volatility: TURBOS has experienced significant price fluctuations, with a -94.48% decline over one year from its all-time high of $0.024 in May 2023 to current levels around $0.00013

- Limited Liquidity: With a 24-hour trading volume of approximately $21,864 and availability on only 2 exchanges, low liquidity may result in substantial slippage during large transactions

- Market Capitalization Concerns: A circulating market cap of approximately $860,600 and ranking of 2,616 indicates limited market recognition, which may restrict price appreciation potential

TURBOS Regulatory Risks

- DeFi Regulatory Uncertainty: As a non-custodial DEX protocol, TURBOS operates in an evolving regulatory environment where future DeFi regulations could impact protocol operations

- Geographic Restrictions: Potential regulatory changes in key markets may limit user access or impose compliance requirements that affect protocol functionality

- Token Classification: Regulatory clarity regarding the classification of utility tokens versus securities remains uncertain and could affect token trading and usage

TURBOS Technical Risks

- Smart Contract Vulnerabilities: As a DEX protocol on Sui blockchain, TURBOS is exposed to potential smart contract bugs or exploits that could result in loss of user funds

- Blockchain Dependency: TURBOS's performance is intrinsically linked to the Sui blockchain; any technical issues, network congestion, or security compromises on Sui could adversely impact the protocol

- Competition Risk: The DEX landscape is highly competitive with established players and emerging protocols potentially offering superior features, liquidity, or user experience

VI. Conclusion and Action Recommendations

TURBOS Investment Value Assessment

TURBOS Finance represents an infrastructure project within the emerging Sui blockchain ecosystem, backed by notable investors including Jump Crypto and Mysten Labs. The protocol aims to provide non-custodial DEX services with horizontal scalability. However, the token faces significant headwinds: a -94.48% decline from its all-time high, limited liquidity with only 2 exchange listings, and a relatively low market capitalization of approximately $860,600. With 66.2% of total supply in circulation and a maximum supply of 10 billion tokens, future token emissions appear manageable. The long-term value proposition depends heavily on successful adoption within the Sui ecosystem and the protocol's ability to capture meaningful trading volume. Short-term risks include continued price volatility, liquidity constraints, and competitive pressure from established DEX protocols.

TURBOS Investment Recommendations

✅ Beginners: Approach TURBOS with caution due to extreme volatility and limited liquidity; consider allocating no more than 1-2% of a diversified crypto portfolio, and prioritize education about DeFi protocols and risk management before investing

✅ Experienced Investors: May consider small speculative positions (3-5% of crypto portfolio) with strict stop-loss discipline; focus on monitoring Sui ecosystem development and TURBOS protocol metrics such as total value locked (TVL) and trading volume

✅ Institutional Investors: Conduct comprehensive due diligence on protocol fundamentals, audit reports, and competitive positioning; consider TURBOS only as part of a broader Sui ecosystem thesis with appropriate hedging strategies

TURBOS Trading Participation Methods

- Spot Trading: Purchase TURBOS tokens on Gate.com, which supports spot trading with various trading pairs

- DeFi Participation: Interact directly with Turbos Finance protocol on Sui blockchain using Gate Web3 Wallet for liquidity provision or token swaps

- Dollar-Cost Averaging: Establish systematic purchase plans to accumulate positions over time, reducing timing risk associated with volatile price movements

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is TURBOS? What are its uses and value?

TURBOS is a prediction token tool for analyzing and trading future price movements. It leverages token economics and market trends to provide investors with market insights and trading signals. Its value lies in helping traders make informed decisions based on supply dynamics and adoption trends.

What is the historical price trend of TURBOS token?

TURBOS token showed a downward trend in October 2025, declining from ¥0.005457 on October 9th to ¥0.003931 by October 12th. The token experienced significant volatility during this period, reflecting market dynamics and investor sentiment shifts.

How will TURBOS price prediction develop in 2024?

TURBOS price in 2024 is expected to fluctuate between 0.0020-0.0032 USD, driven by market trends and community engagement. Price movements will depend on trading volume and overall market sentiment in the crypto sector.

What advantages does TURBOS have compared to similar projects?

TURBOS stands out through superior technology efficiency, lower transaction costs, faster settlement times, and enhanced security features. It delivers better user experience with advanced functionality and community-driven development.

What are the main risks to pay attention to when investing in TURBOS?

Main risks include market volatility, price manipulation, regulatory uncertainty, and technical vulnerabilities. These factors may lead to potential investment losses.

What is the circulating supply and total supply of TURBOS?

TURBOS has a circulating supply of 6.62B tokens and a total supply of 10B tokens. The current market cap is $1.04M with a fully diluted valuation (FDV) of $1.57M.

Where can TURBOS be traded?

TURBOS token is available for trading on multiple centralized and decentralized exchanges. The most active trading pair is TURBOS/USDT, offering high trading volume and liquidity across various platforms.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

What is MOBI: A Comprehensive Guide to Amazon's E-Book File Format and Its Uses

What is ALMANAK: A Comprehensive Guide to Digital Calendar and Event Management Systems

Proof of Work vs Proof of Stake: Which Is Superior?

What is RWAINC: A Comprehensive Guide to Real-World AI and Networking Capabilities

The Most Promising Cryptocurrencies: Where to Invest