ASMATCH vs OP: A Comprehensive Comparison of Two Leading Automation Testing Frameworks

Introduction: ASMATCH vs OP Investment Comparison

In the cryptocurrency market, the comparison between ASMATCH and OP has become a topic of interest for investors. These two assets exhibit notable differences in market capitalization ranking, application scenarios, and price performance, representing distinct positioning within the crypto asset landscape.

ASMATCH (ASMATCH): Launched in December 2023, this token positions itself as the first Social Layer on Manta Network, powered by Polygon CDK and Celestia DA. It aims to democratize SocialFi with a community-first approach, rewarding user interactions with $ASM tokens.

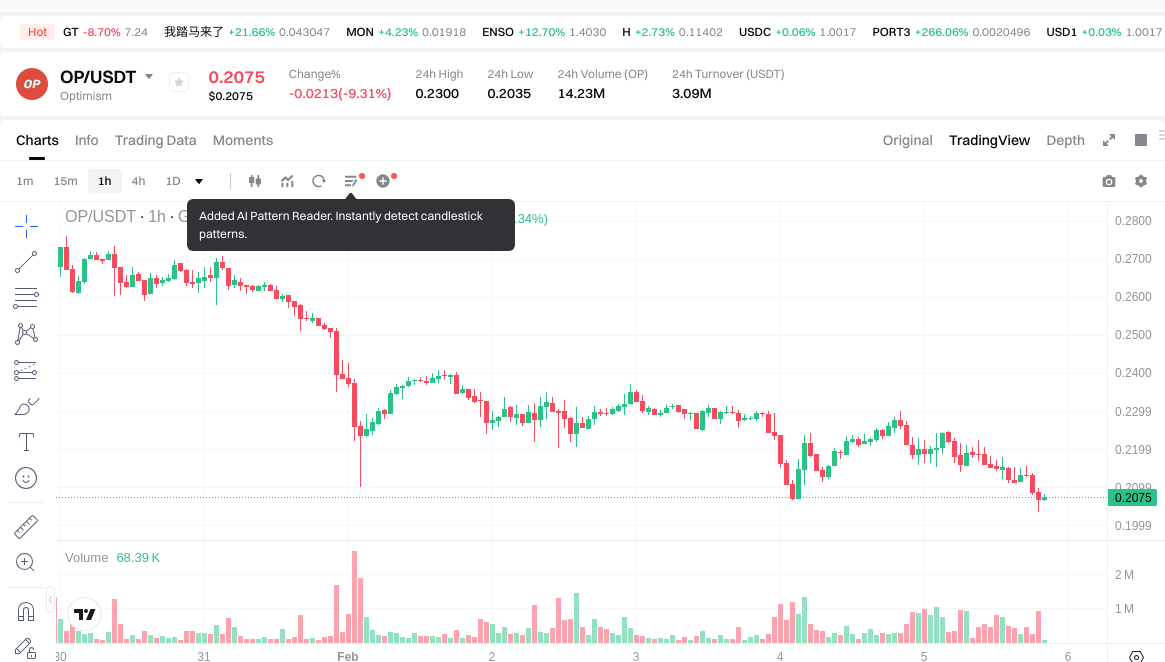

Optimism (OP): Introduced in May 2022, OP serves as the native governance token for Optimism, a low-cost, high-speed Ethereum Layer 2 blockchain solution. It addresses practical needs of developers and users within the Ethereum ecosystem.

This article will analyze the investment value comparison between ASMATCH and OP through multiple dimensions including historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future projections, attempting to address investors' primary concern:

"Which is the better buy right now?"

I. Historical Price Comparison and Current Market Status

ASMATCH (Coin A) and OP (Coin B) Historical Price Trends

- 2025: ASMATCH experienced significant price volatility, reaching a historical high of $4.8026 in May 2025, followed by a sharp decline to a historical low of $0.00728 in June 2025.

- 2024: OP reached its historical high of $4.84 in March 2024, but has since experienced a substantial decline of 81.3% over the past year.

- Comparative Analysis: During the recent market cycle, ASMATCH fluctuated from $4.8026 to $0.00728, while OP declined from $4.84 to its current low near $0.204348.

Current Market Status (2026-02-05)

- ASMATCH current price: $0.027862

- OP current price: $0.208

- 24-hour trading volume: ASMATCH $12,171.90 vs OP $3,098,907.45

- Market Sentiment Index (Fear & Greed Index): 12 (Extreme Fear)

Click to view real-time prices:

- View ASMATCH current price Market Price

- View OP current price Market Price

II. Core Factors Influencing ASMATCH vs OP Investment Value

Tokenomics Comparison

-

ASMATCH: Based on available information, ASMATCH is positioned as a SocialFi application integrating artificial intelligence within the Calamari and Manta Pacific ecosystems. The token supply mechanism focuses on supporting social networking, dating, and professional networking functionalities through its AI-integrated platform.

-

OP: The token supply mechanism emphasizes supporting Layer 2 scaling solutions and ecosystem development through structured emission schedules designed to incentivize network participation and governance.

-

📌 Historical Pattern: Supply mechanisms tend to influence price cycles through emission rates, vesting schedules, and token utility expansion within their respective ecosystems.

Institutional Adoption and Market Application

-

Institutional Holdings: The comparative institutional preference between ASMATCH and OP depends on factors including ecosystem maturity, technological innovation, and market positioning within the broader blockchain infrastructure landscape.

-

Enterprise Adoption: ASMATCH focuses on SocialFi applications spanning dating, social networking, and professional networking domains with AI integration. OP concentrates on Layer 2 scaling infrastructure supporting decentralized applications and transaction efficiency improvements.

-

Regulatory Stance: Different jurisdictions maintain varying approaches toward social networking tokens versus infrastructure layer solutions, with considerations for data privacy, financial compliance, and technological standards.

Technology Development and Ecosystem Building

-

ASMATCH Technology: The project integrates artificial intelligence capabilities within its SocialFi platform, operating on Calamari and Manta Pacific networks to facilitate user interactions across dating, social networking, and professional networking use cases.

-

OP Technology: Development focuses on Layer 2 scaling solutions, optimizing transaction throughput, reducing fees, and enhancing Ethereum ecosystem compatibility.

-

Ecosystem Comparison: ASMATCH emphasizes social application scenarios within the SocialFi domain, while OP supports broader DeFi protocols, NFT marketplaces, payment systems, and smart contract deployment across its Layer 2 infrastructure.

Macroeconomic Environment and Market Cycles

-

Performance Under Inflation: Infrastructure tokens and application-focused tokens respond differently to inflationary pressures based on utility demand, network effects, and real-world adoption metrics.

-

Macroeconomic Monetary Policy: Interest rate adjustments, dollar index movements, and central bank policies influence risk appetite for both infrastructure layer solutions and application-specific tokens.

-

Geopolitical Factors: Cross-border transaction demand, international regulatory developments, and regional market dynamics affect adoption trajectories for both social networking applications and scaling infrastructure solutions.

III. 2026-2031 Price Forecast: ASMATCH vs OP

Short-term Forecast (2026)

- ASMATCH: Conservative $0.0246-$0.0277 | Optimistic $0.0277-$0.0288

- OP: Conservative $0.176-$0.207 | Optimistic $0.207-$0.286

Mid-term Forecast (2028-2029)

- ASMATCH may enter a consolidation phase with projected price range of $0.0287-$0.0476

- OP may enter an expansion phase with projected price range of $0.239-$0.379

- Key drivers: institutional capital flows, ETF developments, ecosystem growth

Long-term Forecast (2030-2031)

- ASMATCH: Baseline scenario $0.0279-$0.0457 | Optimistic scenario $0.0457-$0.0544

- OP: Baseline scenario $0.289-$0.404 | Optimistic scenario $0.404-$0.517

Disclaimer

ASMATCH:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.02879552 | 0.027688 | 0.02464232 | 0 |

| 2027 | 0.0384087936 | 0.02824176 | 0.0259824192 | 1 |

| 2028 | 0.034658287872 | 0.0333252768 | 0.028659738048 | 19 |

| 2029 | 0.0475884952704 | 0.033991782336 | 0.02651359022208 | 22 |

| 2030 | 0.050579772115968 | 0.0407901388032 | 0.033040012430592 | 46 |

| 2031 | 0.054365096996904 | 0.045684955459584 | 0.027867822830346 | 63 |

OP:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.286212 | 0.2074 | 0.17629 | 0 |

| 2027 | 0.30603944 | 0.246806 | 0.22952958 | 18 |

| 2028 | 0.3786991264 | 0.27642272 | 0.2598373568 | 32 |

| 2029 | 0.36031701552 | 0.3275609232 | 0.239119473936 | 57 |

| 2030 | 0.464317608636 | 0.34393896936 | 0.2889087342624 | 65 |

| 2031 | 0.51728420991744 | 0.404128288998 | 0.38796315743808 | 94 |

IV. Investment Strategy Comparison: ASMATCH vs OP

Long-term vs Short-term Investment Strategies

-

ASMATCH: Suited for investors focusing on emerging SocialFi applications, early-stage ecosystem growth potential, and AI-integrated social networking innovations. The token's positioning within niche social networking, dating, and professional networking domains may appeal to those seeking exposure to evolving Web3 social infrastructure.

-

OP: Suited for investors prioritizing established Layer 2 infrastructure, Ethereum ecosystem alignment, and proven scaling solutions. The token's governance role within a mature Layer 2 network may attract those seeking exposure to foundational blockchain infrastructure with demonstrated utility.

Risk Management and Asset Allocation

-

Conservative Investors: ASMATCH 20-30% vs OP 70-80% - This allocation emphasizes established infrastructure while maintaining limited exposure to emerging SocialFi applications.

-

Aggressive Investors: ASMATCH 40-50% vs OP 50-60% - This balanced approach allows participation in both early-stage social application potential and established Layer 2 infrastructure growth.

-

Hedging Tools: Stablecoin reserves for volatility management, options strategies for downside protection, cross-asset portfolio diversification across infrastructure and application layers.

V. Potential Risk Comparison

Market Risks

-

ASMATCH: High volatility risk evidenced by historical price fluctuation from $4.8026 to $0.00728 within a 12-month period. Limited trading volume of $12,171.90 suggests lower liquidity and potential for significant price swings. Early-stage positioning within SocialFi sector exposes holders to adoption uncertainty and competitive pressures from established social platforms.

-

OP: Market capitalization contraction risk with 81.3% decline over the past year from $4.84 to current levels. Despite higher trading volume of $3,098,907.45, exposure to broader Ethereum ecosystem performance and Layer 2 competition from alternative scaling solutions presents ongoing market pressure. Current extreme fear sentiment (Fear & Greed Index: 12) indicates challenging market conditions.

Technical Risks

-

ASMATCH: Scalability considerations related to operating across Calamari and Manta Pacific networks. Network stability dependencies on underlying infrastructure providers. Integration complexity between AI components and blockchain architecture may present operational challenges. Limited historical performance data for long-term technical reliability assessment.

-

OP: Dependency on Ethereum mainnet security and performance characteristics. Potential for bridge vulnerabilities between Layer 1 and Layer 2 environments. Competition from alternative Layer 2 solutions may impact network effects and developer adoption. Technical upgrade coordination across governance processes introduces execution risk.

Regulatory Risks

- Global regulatory frameworks treat social networking applications and infrastructure layer solutions differently. SocialFi platforms like ASMATCH may face scrutiny regarding data privacy, user protection, and content moderation requirements across jurisdictions. Infrastructure tokens like OP encounter regulatory considerations around governance mechanisms, token utility classification, and securities law interpretations. Evolving regulatory landscapes in major markets including the United States, European Union, and Asian jurisdictions present ongoing compliance uncertainties for both asset categories.

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

-

ASMATCH Advantages: Early-stage positioning within emerging SocialFi sector with AI integration differentiation. Potential for significant upside in conservative scenarios projecting $0.0246-$0.0288 range for 2026, with optimistic long-term scenarios reaching $0.0457-$0.0544 by 2031. Exposure to novel social networking applications spanning dating, professional networking, and community engagement use cases.

-

OP Advantages: Established Layer 2 infrastructure with proven Ethereum ecosystem integration. Higher trading volume ($3,098,907.45) indicates better liquidity conditions. Price forecasts suggest conservative 2026 range of $0.176-$0.286, with long-term optimistic scenarios projecting $0.404-$0.517 by 2031. Governance utility within mature scaling solution ecosystem provides foundational value proposition.

✅ Investment Recommendations:

-

Beginner Investors: Consider prioritizing OP allocation (70-80%) due to established infrastructure positioning, higher liquidity, and clearer utility within Ethereum ecosystem. Limit ASMATCH exposure (20-30%) to manageable risk levels while gaining exposure to SocialFi innovation.

-

Experienced Investors: Evaluate balanced allocation strategies (40-60% range for each asset) based on risk tolerance, market cycle positioning, and portfolio diversification objectives. Monitor ecosystem developments, adoption metrics, and regulatory clarity evolution for both infrastructure and application layer opportunities.

-

Institutional Investors: Conduct comprehensive due diligence on governance frameworks, technical architectures, regulatory compliance postures, and long-term sustainability models for both assets. Consider staged allocation approaches tied to milestone achievements in ecosystem growth, institutional adoption indicators, and regulatory clarity developments.

⚠️ Risk Disclaimer: Cryptocurrency markets exhibit extreme volatility characteristics. Historical price movements, including ASMATCH's range from $4.8026 to $0.00728 and OP's 81.3% decline, demonstrate significant downside risks. Current extreme fear market sentiment (Fear & Greed Index: 12) reflects challenging conditions. This analysis does not constitute investment advice. Conduct independent research and consult qualified financial advisors before making investment decisions.

VII. FAQ

Q1: Which cryptocurrency offers better short-term investment potential in 2026 - ASMATCH or OP?

OP demonstrates stronger short-term investment potential for 2026 with a conservative price range of $0.176-$0.207 and optimistic projections reaching $0.286, compared to ASMATCH's more modest range of $0.0246-$0.0288. OP's established Layer 2 infrastructure, significantly higher trading volume ($3,098,907.45 vs $12,171.90), and proven Ethereum ecosystem integration provide more stable fundamentals for near-term appreciation. ASMATCH's extreme historical volatility (from $4.8026 to $0.00728 within 12 months) and limited liquidity present substantial short-term risks despite its SocialFi innovation positioning.

Q2: How do the tokenomics of ASMATCH and OP differ in supporting long-term value creation?

OP's tokenomics emphasize governance utility within a mature Layer 2 scaling ecosystem through structured emission schedules designed to incentivize network participation and infrastructure development. ASMATCH focuses on supporting SocialFi applications across dating, social networking, and professional networking domains with AI integration, rewarding user interactions through its token mechanism. OP's model benefits from established network effects within the broader Ethereum ecosystem, while ASMATCH's value proposition depends on achieving critical mass adoption within emerging Web3 social infrastructure applications.

Q3: What are the primary risk factors investors should consider when choosing between ASMATCH and OP?

ASMATCH presents higher volatility risk evidenced by its extreme price fluctuation range and limited trading volume, creating liquidity challenges and significant downside exposure. Its early-stage positioning within the SocialFi sector introduces adoption uncertainty and competitive pressures from established platforms. OP faces market capitalization contraction risks with an 81.3% decline over the past year, exposure to Layer 2 competition, and dependency on Ethereum mainnet performance. Both assets operate under current extreme fear market sentiment (Fear & Greed Index: 12), but OP's established infrastructure and higher liquidity provide relatively more stable risk profiles.

Q4: How should portfolio allocation differ between ASMATCH and OP based on investor experience levels?

Conservative and beginner investors should prioritize OP allocation (70-80%) due to its established infrastructure positioning, proven utility, and superior liquidity conditions, while limiting ASMATCH exposure (20-30%) to manageable risk levels. Aggressive and experienced investors may consider balanced allocation strategies (40-60% range for each asset) based on individual risk tolerance and market cycle positioning. Institutional investors should implement staged allocation approaches tied to milestone achievements in ecosystem growth, regulatory clarity developments, and technical audit results before committing significant capital to either asset.

Q5: What technological advantages distinguish ASMATCH from OP in their respective market segments?

ASMATCH integrates artificial intelligence capabilities within its SocialFi platform, operating on Calamari and Manta Pacific networks to facilitate user interactions across dating, social networking, and professional networking applications. This represents differentiation within emerging Web3 social infrastructure. OP concentrates on Layer 2 scaling solutions, optimizing transaction throughput, reducing fees, and enhancing Ethereum ecosystem compatibility through proven rollup technology. While ASMATCH targets niche social application scenarios, OP supports broader DeFi protocols, NFT marketplaces, payment systems, and smart contract deployment across established infrastructure.

Q6: How do regulatory considerations differ between SocialFi tokens like ASMATCH and infrastructure tokens like OP?

SocialFi platforms like ASMATCH face regulatory scrutiny regarding data privacy requirements, user protection standards, and content moderation obligations across multiple jurisdictions. These considerations align with traditional social media regulatory frameworks while incorporating blockchain-specific compliance challenges. Infrastructure tokens like OP encounter regulatory evaluation around governance mechanisms, token utility classification under securities laws, and smart contract operational compliance. Global regulatory frameworks treat these categories differently, with infrastructure solutions often facing clearer pathways for institutional adoption compared to social networking applications requiring navigation of evolving data protection regimes.

Q7: What market indicators should investors monitor to assess the relative performance of ASMATCH versus OP?

Critical monitoring indicators include trading volume trends (currently $12,171.90 for ASMATCH vs $3,098,907.45 for OP), ecosystem development metrics such as active users and protocol integrations, institutional adoption announcements, regulatory clarity developments in key jurisdictions, and technical milestone achievements. For ASMATCH, monitor SocialFi sector adoption rates, AI integration performance metrics, and user engagement statistics. For OP, track Layer 2 transaction volumes, total value locked (TVL) growth, developer activity, and competitive positioning against alternative scaling solutions. Market sentiment indicators like the Fear & Greed Index (currently at 12 - Extreme Fear) provide context for broader risk appetite affecting both assets.

Q8: What are the projected long-term price trajectories for ASMATCH and OP through 2031?

Long-term forecasts through 2031 project ASMATCH baseline scenarios ranging from $0.0279-$0.0457 with optimistic scenarios reaching $0.0457-$0.0544, representing potential appreciation from current levels of $0.027862. OP's baseline projections range from $0.289-$0.404 with optimistic scenarios extending to $0.404-$0.517, suggesting significant upside from the current price of $0.208. These projections depend on successful ecosystem development, institutional capital flows, regulatory clarity achievement, and sustained network adoption. However, cryptocurrency market volatility, competitive dynamics, and macroeconomic conditions introduce substantial uncertainty to multi-year price forecasts for both assets.

Top Layer 2 projects worth following in 2025: From Arbitrum to zkSync

Pepe Unchained: Pepe Meme Coin evolves into a Layer-2 ecosystem

2025 Layer-2 Solution: Ethereum Scalability and Web3 Performance Optimization Guide

What is Layer 2 in crypto assets? Understand the scaling solution for Ethereum

How Layer 2 Changes the Crypto Assets Experience: Speed, Cost, and Mass Adoption

Pepe Unchained (PEPU): Building the New Era of Meme Coins on Layer 2

How to Buy Cryptocurrency: Top Strategies

Cryptocurrency for Beginners: Which Coin Should You Invest In

A Comprehensive Overview of the Future Potential and Types of Altcoins

Comprehensive Guide to Decentralized Finance (DeFi)

Mining Calculator: How to Calculate Cryptocurrency Mining Profitability