BC vs ATOM: Which Blockchain Platform Will Dominate the Future of Decentralized Finance?

Introduction: BC vs ATOM Investment Comparison

In the cryptocurrency market, the comparison between BC and ATOM has consistently been a topic investors cannot avoid. Both assets exhibit notable differences in market capitalization ranking, application scenarios, and price performance, representing distinct positioning within the crypto asset landscape.

Blood Crystal (BC): Launched in March 2024, BC emerged as an innovative project combining the classic Wizardry franchise with blockchain gaming concepts. The token operates within the Eternal Crypt ecosystem, transforming traditional RPG mechanics into a blockchain-enabled cookie clicker format while maintaining strategic party formation elements.

Cosmos (ATOM): Since its March 2019 launch, ATOM has established itself as a foundational infrastructure project focused on blockchain interoperability. Built on the Tendermint consensus mechanism, Cosmos aims to create an "Internet of Blockchains" that enables cross-chain communication and interaction.

This article will comprehensively analyze the investment value comparison between BC and ATOM through historical price trends, supply mechanisms, institutional adoption, technical ecosystems, and future predictions, attempting to address investors' most pressing question:

"Which is the better buy right now?"

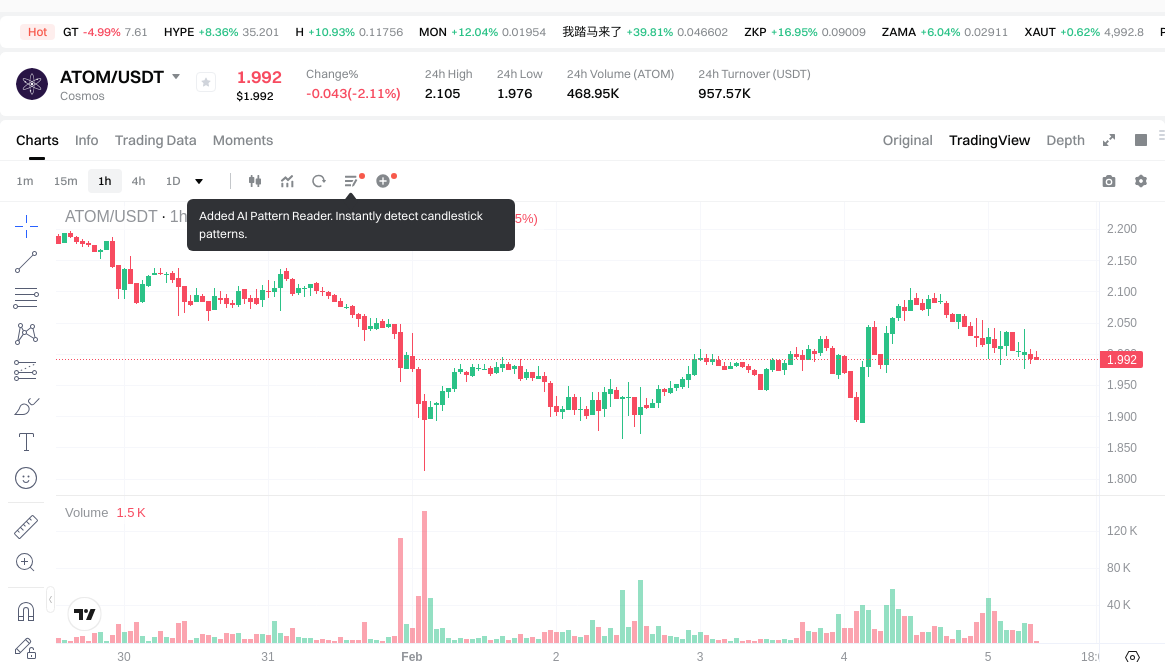

The analysis will examine BC's current price of $0.000706 with a market cap of approximately $595,895, positioned at rank 2903, against ATOM's price of $1.994 with a market cap exceeding $980 million at rank 74. Both tokens have experienced significant volatility, with BC showing a 24-hour decline of 36.79% and ATOM recording a 0.98% decrease. Through systematic evaluation of their respective value propositions, technical fundamentals, and market dynamics, this report aims to provide data-driven insights for informed investment decision-making.

I. Historical Price Comparison and Current Market Status

Historical Price Trends of BC (Blood Crystal) and ATOM (Cosmos)

- 2024: BC reached an all-time high of $0.095102 on December 18, 2024, driven by the launch of the blockchain game "Eternal Crypt - Wizardry BC -" which utilizes the BC utility token within its ecosystem.

- 2022: ATOM experienced significant price movements, reaching its all-time high of $44.45 on January 17, 2022, reflecting strong market interest in the Cosmos ecosystem's interoperability vision.

- Comparative Analysis: During the recent market cycle, BC declined from its peak of $0.095102 to a low of $0.000424 (recorded on February 4, 2026), representing a decline of approximately 99.5%. Meanwhile, ATOM dropped from $44.45 to $1.16 (historical low recorded on March 13, 2020), though its current price shows a more moderate decline from recent highs.

Current Market Situation (February 5, 2026)

- BC Current Price: $0.000706

- ATOM Current Price: $1.994

- 24-Hour Trading Volume: BC $15,196.74 vs ATOM $978,325.33

- Market Sentiment Index (Fear & Greed Index): 14 (Extreme Fear)

Check real-time prices:

- View BC current price Market Price

- View ATOM current price Market Price

II. Core Factors Influencing BC vs ATOM Investment Value

Supply Mechanism Comparison (Tokenomics)

- BC: The provided materials do not contain specific information regarding BC's supply mechanism or tokenomics structure.

- ATOM: The provided materials do not contain detailed information regarding ATOM's supply mechanism or tokenomics structure.

- 📌 Historical Pattern: Supply mechanisms can influence price cycles through factors such as scarcity dynamics and distribution schedules, though specific historical data for BC and ATOM is not available in the provided materials.

Institutional Adoption and Market Application

- Institutional Holdings: The provided materials do not contain specific data comparing institutional preference between BC and ATOM.

- Enterprise Adoption: The provided materials do not contain detailed information regarding BC or ATOM's application in cross-border payments, settlements, or investment portfolios.

- National Policies: The provided materials do not contain specific information regarding different countries' regulatory attitudes toward BC or ATOM.

Technological Development and Ecosystem Building

- BC Technology Upgrades: The provided materials mention BC in the context of new technology deployment in the solar energy sector, specifically BC cell technology, but do not provide information about BC as a cryptocurrency or its technological upgrades.

- ATOM Technology Development: The provided materials reference ATOM's blockchain technology as a key factor in its investment value, but do not provide specific details about technological developments or their potential impact.

- Ecosystem Comparison: The provided materials do not contain specific information regarding DeFi, NFT, payment systems, or smart contract implementation for BC or ATOM.

Macroeconomic Environment and Market Cycles

- Performance Under Inflation: The provided materials do not contain specific information comparing BC and ATOM's performance characteristics under inflationary conditions.

- Macroeconomic Monetary Policy: The provided materials do not contain specific information regarding how interest rates or the US Dollar Index affect BC or ATOM.

- Geopolitical Factors: The provided materials do not contain specific information regarding cross-border transaction demand or international situations affecting BC or ATOM.

III. 2026-2031 Price Forecast: BC vs ATOM

Short-term Forecast (2026)

- BC: Conservative $0.0006707 - $0.000706 | Optimistic $0.000706 - $0.00105194

- ATOM: Conservative $1.77555 - $1.995 | Optimistic $1.995 - $2.49375

Medium-term Forecast (2028-2029)

- BC may enter a gradual growth phase, with estimated price range between $0.000778152141 - $0.001436588568 in 2028, potentially reaching $0.00088849012407 - $0.00163092707706 by 2029

- ATOM may enter a consolidation phase, with estimated price range between $2.026670625 - $2.497989375 in 2028, potentially reaching $1.723377009375 - $3.54384568125 by 2029

- Key drivers: institutional capital flows, ETF developments, ecosystem expansion

Long-term Forecast (2030-2031)

- BC: Baseline scenario $0.000928388807634 - $0.001267376392046 in 2030 | Optimistic scenario $0.001573540351923 - $0.001888248422307 by 2031

- ATOM: Baseline scenario $1.699534938002343 - $2.14960940775 in 2030 | Optimistic scenario $3.090063523640625 - $4.264287662624062 by 2031

Disclaimer

Price predictions are based on historical data analysis and market trends. Cryptocurrency markets are highly volatile and subject to various risks including regulatory changes, technological developments, and macroeconomic factors. These forecasts should not be considered as investment advice. Users should conduct their own research and consult with financial professionals before making any investment decisions.

BC:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00105194 | 0.000706 | 0.0006707 | 0 |

| 2027 | 0.0011162919 | 0.00087897 | 0.0008174421 | 24 |

| 2028 | 0.001436588568 | 0.00099763095 | 0.000778152141 | 41 |

| 2029 | 0.00163092707706 | 0.001217109759 | 0.00088849012407 | 72 |

| 2030 | 0.001723062285816 | 0.00142401841803 | 0.001267376392046 | 101 |

| 2031 | 0.001888248422307 | 0.001573540351923 | 0.000928388807634 | 122 |

ATOM:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 2.49375 | 1.995 | 1.77555 | 0 |

| 2027 | 2.4688125 | 2.244375 | 1.3017375 | 12 |

| 2028 | 2.497989375 | 2.35659375 | 2.026670625 | 18 |

| 2029 | 3.54384568125 | 2.4272915625 | 1.723377009375 | 21 |

| 2030 | 3.19455842540625 | 2.985568621875 | 2.14960940775 | 49 |

| 2031 | 4.264287662624062 | 3.090063523640625 | 1.699534938002343 | 54 |

IV. Investment Strategy Comparison: BC vs ATOM

Long-term vs Short-term Investment Strategies

- BC: May be suitable for investors with higher risk tolerance seeking exposure to blockchain gaming ecosystems and emerging utility token concepts, though the asset's extreme volatility and limited market depth suggest caution for both short and long-term positions

- ATOM: May appeal to investors interested in blockchain infrastructure projects focused on interoperability solutions, with its established market position potentially offering relatively more liquidity compared to smaller-cap alternatives

Risk Management and Asset Allocation

- Conservative Investors: BC 5-10% vs ATOM 15-25% (within overall crypto portfolio allocation)

- Aggressive Investors: BC 15-25% vs ATOM 25-35% (within overall crypto portfolio allocation)

- Hedging Tools: Stablecoin reserves for rebalancing opportunities, diversified cryptocurrency holdings across different sectors, dollar-cost averaging to mitigate timing risk

V. Potential Risk Comparison

Market Risk

- BC: Exhibits substantial price volatility with 24-hour decline of 36.79% and approximately 99.5% decline from its peak, coupled with limited trading volume of $15,196.74 indicating potential liquidity concerns

- ATOM: Shows moderate price fluctuations with 24-hour decline of 0.98%, though historical data indicates significant volatility cycles, with trading volume of $978,325.33 suggesting relatively better market liquidity

Technical Risk

- BC: Limited information available regarding network scalability, security infrastructure, or technical development roadmap based on provided materials

- ATOM: Built on Tendermint consensus mechanism for blockchain interoperability, though specific details regarding current network stability, scalability solutions, or potential security vulnerabilities are not extensively documented in provided materials

Regulatory Risk

- Global regulatory developments may impact both assets differently based on their functional classifications, with utility tokens in gaming applications potentially facing distinct regulatory considerations compared to infrastructure-focused blockchain protocols, though specific jurisdictional stances remain subject to ongoing policy evolution

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- BC Advantages: Represents exposure to the intersection of blockchain technology and gaming entertainment, with utility function within the Eternal Crypt ecosystem potentially creating usage-driven demand dynamics

- ATOM Advantages: Established infrastructure project with focus on blockchain interoperability solutions, ranked at position 74 with market capitalization exceeding $980 million suggesting greater market recognition and liquidity profile

✅ Investment Recommendations:

- Novice Investors: Consider prioritizing established projects with greater liquidity and market depth, employing dollar-cost averaging strategies, and limiting exposure to highly volatile assets until developing stronger understanding of market dynamics

- Experienced Investors: May explore diversified allocation strategies incorporating both infrastructure projects and emerging use-case tokens, while maintaining strict risk management protocols including position sizing limits and stop-loss mechanisms

- Institutional Investors: Focus on comprehensive due diligence regarding regulatory compliance, custody solutions, and liquidity requirements, potentially favoring assets with established market infrastructure and transparent governance frameworks

⚠️ Risk Disclaimer: Cryptocurrency markets exhibit extreme volatility and carry substantial risk of capital loss. This analysis does not constitute investment advice, financial guidance, or recommendations to buy or sell any assets. Market conditions, regulatory environments, and project fundamentals can change rapidly. Investors should conduct independent research, assess their risk tolerance, and consult qualified financial professionals before making investment decisions. Past performance does not guarantee future results.

VII. FAQ

Q1: What is the main difference between BC and ATOM in terms of their core functionality?

BC serves as a utility token within the Eternal Crypt gaming ecosystem, specifically designed for the blockchain game "Eternal Crypt - Wizardry BC -" which combines RPG mechanics with blockchain technology. ATOM, on the other hand, functions as the native token of the Cosmos Hub, an infrastructure project focused on enabling blockchain interoperability through its "Internet of Blockchains" vision built on the Tendermint consensus mechanism.

Q2: Why has BC experienced such extreme price volatility compared to ATOM?

BC has declined approximately 99.5% from its December 2024 peak of $0.095102 to its current price of $0.000706, primarily due to its limited market depth with only $15,196.74 in 24-hour trading volume and its ranking at position 2903. In contrast, ATOM maintains a market capitalization exceeding $980 million with $978,325.33 in daily trading volume at rank 74, providing substantially greater liquidity and price stability. BC's exposure to the gaming sector also subjects it to additional volatility from the cyclical nature of gaming trends and user adoption patterns.

Q3: Which asset is more suitable for long-term holding based on current market conditions?

ATOM presents a more established profile for long-term investment considerations, with its focus on blockchain infrastructure and interoperability solutions addressing fundamental technological challenges in the crypto ecosystem. Its market position at rank 74 and substantial trading volume indicate greater institutional recognition and liquidity. BC, while offering exposure to blockchain gaming innovation, carries higher risk due to its limited market depth, extreme volatility, and dependence on the success of a specific gaming ecosystem. Conservative investors may find ATOM's risk-reward profile more aligned with long-term strategies, while BC may appeal to those seeking speculative exposure to emerging gaming applications.

Q4: How do the 2031 price predictions compare between BC and ATOM?

According to the baseline scenario forecasts, BC's predicted price range for 2031 spans from $0.000928 to $0.001888, representing a potential 122% increase from current levels. ATOM's 2031 predictions range from $1.699 to $4.264, indicating a potential 54% increase. However, these predictions should be interpreted within the context of each asset's market capitalization and volatility profile. BC's percentage gains reflect its low base price and high volatility, while ATOM's projections suggest more moderate growth from a larger market cap base. Both forecasts remain subject to significant uncertainty given cryptocurrency market dynamics.

Q5: What are the primary risks specific to investing in BC versus ATOM?

BC faces concentrated risks including limited liquidity (evidenced by low trading volume), dependency on the success of the Eternal Crypt gaming ecosystem, and potential regulatory challenges specific to utility tokens in gaming applications. Its extreme price volatility and limited market information create additional uncertainty. ATOM's primary risks relate to competition in the blockchain interoperability space, potential technological challenges in scaling cross-chain solutions, and broader infrastructure adoption timelines. While ATOM benefits from greater market establishment, both assets remain subject to general cryptocurrency market risks including regulatory developments and macroeconomic conditions.

Q6: How should portfolio allocation differ between BC and ATOM for different investor profiles?

Conservative investors should consider limiting BC exposure to 5-10% of their cryptocurrency portfolio due to its high volatility and limited liquidity, while ATOM may constitute 15-25% given its more established market position. Aggressive investors with higher risk tolerance might allocate 15-25% to BC for speculative exposure to blockchain gaming and 25-35% to ATOM for infrastructure play. Both allocation strategies should exist within a diversified cryptocurrency portfolio that includes stablecoin reserves for rebalancing opportunities and represents only a portion of overall investment assets appropriate to individual risk tolerance levels.

Q7: What role do institutional investors play in the market dynamics of BC versus ATOM?

Based on available information, institutional participation appears significantly more developed in ATOM's market, as evidenced by its substantially higher trading volume and market capitalization ranking. ATOM's focus on blockchain infrastructure and interoperability solutions aligns more closely with institutional investment theses around foundational crypto technologies. BC, as a gaming utility token with limited market depth, likely sees minimal institutional involvement currently, with its market primarily driven by retail participants in the blockchain gaming community. This difference in institutional presence contributes to the divergent liquidity profiles and volatility characteristics observed between the two assets.

Q8: How does the current "Extreme Fear" market sentiment (Fear & Greed Index at 14) affect investment decisions for BC and ATOM?

The Extreme Fear reading of 14 suggests widespread market pessimism, which historically has preceded both significant opportunities and continued downside risk. For BC, this sentiment exacerbates its existing high volatility and limited liquidity, potentially leading to oversold conditions but also heightened risk of further declines. ATOM, with its greater market establishment, may present relatively more stability during fearful market conditions, though it remains subject to broader crypto market sentiment. Investors should recognize that extreme fear periods can offer long-term accumulation opportunities but require careful risk management, including dollar-cost averaging strategies, strict position sizing, and maintaining adequate stablecoin reserves for potential market dislocations.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

How to Avoid Slippage in Cryptocurrency Trading

What Is a Blockchain Game Guild? Should You Join a Game Guild?

Free Money for App Registration: Crypto Rewards Guide

Top 4 Cryptocurrency Exchanges for Free Registration Bonuses

What is Slippage? How Can We Avoid It While Trading Crypto?