ETHS vs VET: A Comprehensive Comparison of Two Leading Blockchain Projects in 2024

Introduction: Comparative Investment Analysis of ETHS and VET

In the cryptocurrency market, the ETHS vs VET comparison represents a meaningful discussion for investors exploring diverse blockchain investment opportunities. These two assets differ significantly in market capitalization ranking, application scenarios, and price performance, while representing distinct positioning within the crypto asset landscape.

ETHS: Launched in December 2023, ETHS serves as the core asset of the Facet protocol, a decentralized Ethereum L1 scaling solution supported by the Ethereum Foundation. It is positioned as a pioneering asset driving the next generation of data and value layers.

VET (Vechain): Founded in 2015 by Sunny Lu, VeChain initially focused on providing blockchain solutions for supply chain transparency and anti-counterfeiting. Through its VeChainThor blockchain, an enterprise-grade Layer-1 network, it has established partnerships with organizations such as DNV, Walmart, and BCG, validating its real-world business applications.

This article will examine historical price trends, supply mechanisms, institutional adoption, technical ecosystems, and future outlook to provide a comprehensive analysis of ETHS vs VET investment value comparison, addressing investors' key questions:

"Which asset presents a more suitable investment opportunity based on current market conditions?"

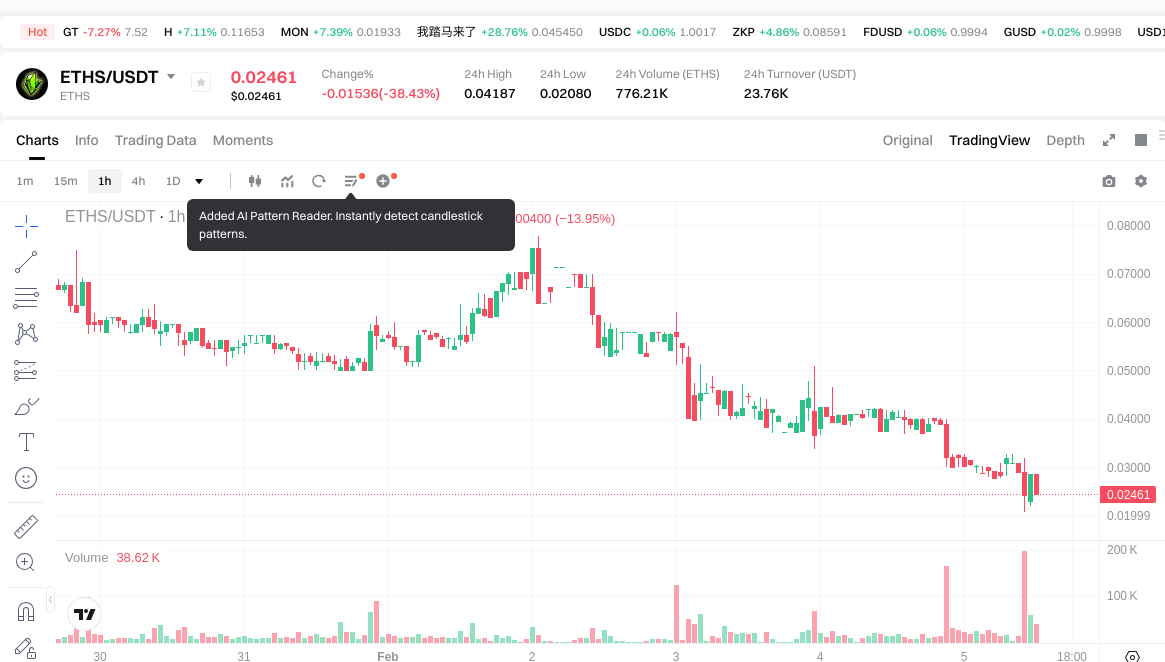

I. Historical Price Comparison and Current Market Status

ETHS and VET Historical Price Trends

- 2024: ETHS experienced significant price movements, reaching an all-time high of $13.9 on January 5, 2024, reflecting early market interest in the Facet protocol and Ethereum Layer-1 scaling solutions.

- 2021: VET saw notable price action, achieving its all-time high of $0.280991 on April 19, 2021, driven by enterprise partnerships and supply chain blockchain adoption momentum.

- Comparative Analysis: During the recent market cycle, ETHS declined from its peak of $13.9 to $0.02681, representing substantial volatility, while VET decreased from $0.280991 to $0.008153, showing a more moderate downward trajectory relative to its historical range.

Current Market Landscape (February 5, 2026)

- ETHS Current Price: $0.02681

- VET Current Price: $0.008153

- 24-Hour Trading Volume: ETHS recorded $22,864.84 compared to VET's $594,251.44

- Market Sentiment Index (Fear & Greed Index): 12 (Extreme Fear)

View real-time prices:

- Check current ETHS price Market Price

- Check current VET price Market Price

II. Core Factors Influencing ETHS vs VET Investment Value

Supply Mechanism Comparison (Tokenomics)

- ETHS: The supply mechanism details were not covered in available materials, making it difficult to assess its tokenomics structure and inflationary or deflationary characteristics.

- VET: Similarly, specific supply mechanism information for VET was not available in the reference materials.

- 📌 Historical Pattern: Supply mechanisms can influence price cycles through scarcity dynamics, emission schedules, and token burn mechanisms, though specific historical data for these assets was not provided.

Institutional Adoption and Market Application

- Institutional Holdings: Available materials did not provide comparative data on institutional preference between ETHS and VET.

- Enterprise Adoption: Reference materials lacked specific information regarding the application of either ETHS or VET in cross-border payments, settlements, or investment portfolios.

- National Policies: The regulatory stance of different countries toward these specific assets was not documented in the provided materials.

Technical Development and Ecosystem Building

- ETHS Technical Upgrades: Specific technical development roadmaps and their potential impacts were not detailed in available resources.

- VET Technical Development: Similarly, concrete information about VET's technical evolution and future developments was absent from reference materials.

- Ecosystem Comparison: The materials did not provide comparative analysis of DeFi, NFT, payment solutions, or smart contract implementation between these two projects.

Macroeconomic Factors and Market Cycles

- Performance in Inflationary Environments: The reference materials emphasized that successful projects typically demonstrate clear development direction and stable growth potential, though specific anti-inflation characteristics of ETHS or VET were not documented.

- Macroeconomic Monetary Policy: The impact of interest rates and dollar index movements on these specific assets was not covered in available materials.

- Geopolitical Factors: While cross-border transaction demand and international situations can influence crypto assets, specific analysis for ETHS and VET was not provided in the reference materials.

III. 2026-2031 Price Prediction: ETHS vs VET

Short-term Forecast (2026)

- ETHS: Conservative $0.020412 - $0.0252 | Optimistic $0.0252 - $0.025956

- VET: Conservative $0.00451055 - $0.008201 | Optimistic $0.008201 - $0.01090733

Mid-term Forecast (2028-2029)

- ETHS may enter a growth phase, with estimated prices ranging from $0.0231007707 to $0.044798383476

- VET may enter a development phase, with estimated prices ranging from $0.007230995735471 to $0.013532997014250

- Key drivers: institutional capital inflows, ETF developments, ecosystem expansion

Long-term Forecast (2030-2031)

- ETHS: Base scenario $0.034659652855697 - $0.046837368723915 | Optimistic scenario $0.046837368723915 - $0.061825326715567

- VET: Base scenario $0.008058411313071 - $0.014285365509535 | Optimistic scenario $0.014285365509535 - $0.020999487299016

Disclaimer

ETHS:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.025956 | 0.0252 | 0.020412 | -6 |

| 2027 | 0.03146094 | 0.025578 | 0.0217413 | -4 |

| 2028 | 0.0373605057 | 0.02851947 | 0.0231007707 | 6 |

| 2029 | 0.044798383476 | 0.03293998785 | 0.028328389551 | 22 |

| 2030 | 0.05480555178483 | 0.038869185663 | 0.0349822670967 | 44 |

| 2031 | 0.061825326715567 | 0.046837368723915 | 0.034659652855697 | 74 |

VET:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.01090733 | 0.008201 | 0.00451055 | 0 |

| 2027 | 0.01079620645 | 0.009554165 | 0.00812104025 | 17 |

| 2028 | 0.01353299701425 | 0.010175185725 | 0.00864890786625 | 24 |

| 2029 | 0.012565336851802 | 0.011854091369625 | 0.007230995735471 | 45 |

| 2030 | 0.016361016908356 | 0.012209714110713 | 0.008058411313071 | 49 |

| 2031 | 0.020999487299016 | 0.014285365509535 | 0.009142633926102 | 75 |

IV. Investment Strategy Comparison: ETHS vs VET

Long-term vs Short-term Investment Strategies

- ETHS: May suit investors interested in Ethereum Layer-1 scaling solutions and early-stage protocol development, though current price levels suggest elevated volatility requiring careful position management

- VET: May appeal to investors focused on enterprise blockchain adoption and supply chain applications, with established partnerships potentially providing business case validation

Risk Management and Asset Allocation

- Conservative Investors: ETHS 20% vs VET 30%, with remaining portfolio in established assets

- Aggressive Investors: ETHS 40% vs VET 35%, with tolerance for higher volatility

- Hedging Tools: Stablecoin allocation for liquidity management, options strategies for downside protection, cross-asset portfolio diversification

V. Potential Risk Comparison

Market Risk

- ETHS: Exhibits substantial price volatility with significant drawdown from historical peaks, reflecting sensitivity to market sentiment shifts and limited trading volume

- VET: Demonstrates correlation with broader market cycles, though enterprise partnerships may provide some fundamental support during downturns

Technical Risk

- ETHS: Scalability and network stability considerations as an emerging Layer-1 solution

- VET: Network infrastructure maturity and ongoing technical development requirements

Regulatory Risk

- Global regulatory developments may affect both assets differently based on their respective use cases, with enterprise-focused projects potentially facing distinct compliance requirements compared to protocol-layer solutions

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- ETHS Advantages: Positions within Ethereum Layer-1 scaling narrative, supported by Ethereum Foundation, represents emerging protocol development

- VET Advantages: Established enterprise partnerships including DNV and Walmart, demonstrated real-world supply chain applications, longer operational history since 2015

✅ Investment Recommendations:

- Novice Investors: Consider starting with smaller position sizes in VET given its established use cases, while monitoring ETHS development progress before significant allocation

- Experienced Investors: May evaluate portfolio allocation based on risk tolerance, with potential for diversified exposure across both Layer-1 scaling solutions and enterprise blockchain applications

- Institutional Investors: Could assess alignment with investment mandates, considering VET's enterprise partnerships and ETHS's protocol-layer positioning within broader portfolio strategy

⚠️ Risk Disclosure: Cryptocurrency markets exhibit extreme volatility. This analysis does not constitute investment advice. Investors should conduct independent research and consider their risk tolerance before making investment decisions.

VII. FAQ

Q1: What are the primary differences between ETHS and VET in terms of their blockchain applications?

ETHS and VET serve fundamentally different purposes within the blockchain ecosystem. ETHS operates as the core asset of the Facet protocol, functioning as a decentralized Ethereum Layer-1 scaling solution launched in December 2023, positioning itself as a pioneering asset for next-generation data and value layers. VET (VeChain), established in 2015, focuses on enterprise-grade blockchain solutions specifically designed for supply chain transparency, anti-counterfeiting, and business logistics through its VeChainThor blockchain, with established partnerships including DNV, Walmart, and BCG that validate real-world commercial applications.

Q2: How do the current market capitalizations and trading volumes compare between ETHS and VET?

VET demonstrates significantly higher market liquidity compared to ETHS. As of February 5, 2026, VET recorded a 24-hour trading volume of $594,251.44, substantially exceeding ETHS's trading volume of $22,864.84. This volume differential indicates that VET maintains broader market participation and liquidity, making it potentially easier for investors to execute larger transactions without substantial price impact. The current prices stand at $0.02681 for ETHS and $0.008153 for VET, though trading volume rather than price alone better indicates market depth and investor accessibility.

Q3: What were the all-time highs for ETHS and VET, and how do current prices compare?

ETHS reached its all-time high of $13.9 on January 5, 2024, while VET achieved its peak of $0.280991 on April 19, 2021. Current prices represent substantial declines from these historical peaks: ETHS has decreased approximately 99.8% from $13.9 to $0.02681, demonstrating extreme volatility, while VET has declined approximately 97.1% from $0.280991 to $0.008153. These significant drawdowns reflect both assets' sensitivity to broader market cycles, though ETHS shows more pronounced volatility given its shorter operational history and the timing of its launch relative to market conditions.

Q4: Which asset shows better long-term growth potential according to 2026-2031 forecasts?

According to long-term forecasts through 2031, both assets show potential for recovery and growth, though with different trajectories. ETHS demonstrates projected price ranges from $0.034659652855697 to $0.061825326715567 by 2031 in optimistic scenarios, representing approximately 74% growth from 2026 levels. VET shows projected ranges from $0.009142633926102 to $0.020999487299016 by 2031, also representing approximately 75% growth potential. Both projections suggest similar percentage growth rates, though actual performance will depend heavily on institutional adoption, ecosystem development, regulatory environments, and broader market cycles affecting cryptocurrency assets.

Q5: What portfolio allocation strategies are suggested for ETHS vs VET investments?

Portfolio allocation recommendations vary based on investor risk profiles and experience levels. Conservative investors might consider a 20% ETHS and 30% VET allocation with remaining portfolio in established assets, acknowledging ETHS's higher volatility and VET's more established business case. Aggressive investors with higher risk tolerance could allocate 40% ETHS and 35% VET, accepting elevated volatility for potential upside exposure. Both strategies emphasize diversification beyond these two assets, incorporating stablecoin positions for liquidity management, options strategies for downside protection, and cross-asset portfolio diversification to manage concentrated cryptocurrency exposure risks.

Q6: What are the main risk factors investors should consider when comparing ETHS and VET?

Investors face multiple risk categories when evaluating these assets. Market risk includes ETHS's substantial price volatility with extreme drawdowns and limited trading volume, while VET demonstrates correlation with broader market cycles despite enterprise partnership support. Technical risks encompass ETHS's scalability and network stability as an emerging Layer-1 solution, and VET's ongoing network infrastructure requirements. Regulatory risk affects both assets differently: enterprise-focused projects like VET may face distinct compliance requirements compared to protocol-layer solutions like ETHS, with global regulatory developments potentially impacting their respective use cases and adoption trajectories in unpredictable ways.

Q7: How does the current market sentiment (Extreme Fear at 12) affect investment decisions for ETHS and VET?

The current Fear & Greed Index reading of 12 (Extreme Fear) indicates highly negative market sentiment across cryptocurrency markets, historically associated with potential accumulation opportunities for long-term investors, though also signaling increased short-term downside risks. During extreme fear periods, both ETHS and VET may experience additional selling pressure from capitulation events, creating potential entry points for patient investors with longer time horizons. However, extreme fear can persist for extended periods, and timing market bottoms remains challenging. Investors should consider dollar-cost averaging strategies rather than attempting to predict exact market bottoms, maintaining strict risk management protocols given the elevated uncertainty characteristic of extreme fear environments.

Q8: What role do institutional partnerships play in differentiating VET's investment case from ETHS?

VET's established enterprise partnerships with organizations such as DNV, Walmart, and BCG provide tangible business case validation and real-world utility that differentiate its value proposition from ETHS's protocol-layer positioning. These partnerships demonstrate VET's practical application in supply chain management, product authenticity verification, and logistics optimization, potentially providing revenue visibility and adoption metrics beyond speculative trading activity. In contrast, ETHS represents exposure to Ethereum Layer-1 scaling infrastructure development, supported by the Ethereum Foundation but without the same enterprise client validation. Institutional investors evaluating these assets may weigh VET's demonstrated business applications against ETHS's positioning within Ethereum's technical ecosystem development roadmap.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

What Is Financial Freedom?

Everything About the Cryptocurrency Fear and Greed Index

Cryptocurrency for Beginners: Which Coin Should You Invest In?

The Triangle Pattern in Trading: Everything You Need to Know

Will there be good opportunities to buy meme coins in 2025?