FOURCOIN vs XRP: Which Digital Asset Offers Better Investment Potential in the Evolving Cryptocurrency Market?

Introduction: FOURCOIN vs XRP Investment Comparison

In the cryptocurrency market, the comparison between FOURCOIN and XRP has drawn attention from investors exploring different asset profiles. The two tokens differ significantly in market capitalization ranking, application scenarios, and price performance, representing distinct positioning within the crypto asset landscape.

FOURCOIN (FOUR): Launched in May 2023, this token operates as a meme token on the Ethereum blockchain, targeting a specific community-driven market segment.

XRP (XRP): Introduced in 2011, XRP has been positioned as a digital asset built for payment efficiency, operating on the XRP Ledger with characteristics of fast transaction speeds and low costs, becoming one of the cryptocurrencies with substantial trading volume and market capitalization globally.

This article will comprehensively analyze the investment value comparison between FOURCOIN and XRP, focusing on historical price trends, supply mechanisms, institutional adoption, technical ecosystems, and future outlook, attempting to address the question investors care about most:

"Which is the better buy right now?"

I. Historical Price Comparison and Current Market Status

FOURCOIN and XRP Historical Price Trends

-

2023: FOURCOIN launched on the Ethereum blockchain on May 8, 2023, with a publish price of $0.00006546. Shortly after launch, the token experienced price movement, reaching its all-time high of $0.00009646 on May 9, 2023.

-

2012-2023: XRP, created in 2012 as the native digital asset of the XRP Ledger, established itself as a payment-focused cryptocurrency. The token experienced various market cycles during this period.

-

2025: XRP reached a notable price level of $3.65 on July 18, 2025, marking a significant point in its price history.

-

Comparative Analysis: FOURCOIN experienced a decline from its all-time high of $0.00009646 to its all-time low of $0.000000841649 recorded on April 9, 2025. In comparison, XRP's price range spanned from an all-time low of $0.00268621 (May 22, 2014) to its peak of $3.65 in 2025, demonstrating substantially different price magnitudes and market positioning.

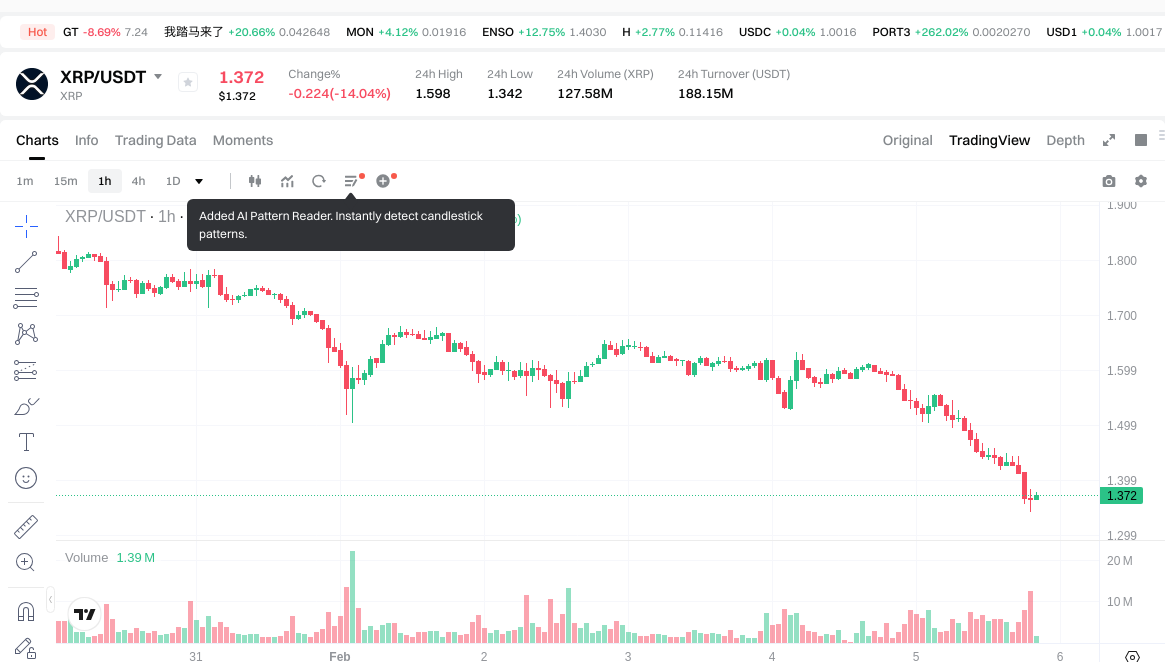

Current Market Status (February 5, 2026)

- FOURCOIN current price: $0.000001124

- XRP current price: $1.373

- 24-hour trading volume: FOURCOIN $12,831.58 vs XRP $187,021,186.90

- Market Fear & Greed Index: 12 (Extreme Fear)

View real-time prices:

- Check FOURCOIN current price Market Price

- Check XRP current price Market Price

II. Core Factors Affecting FOURCOIN vs XRP Investment Value

Tokenomics Comparison

- FourCoin: The investment value is closely tied to blockchain technology innovation, with continuous development in scalability solutions and security enhancements providing fundamental support for value growth.

- XRP: Market demand and technological development serve as primary drivers, with value determination influenced by market forces and adoption trends.

- 📌 Historical Pattern: Supply mechanisms and technological advancement cycles have historically influenced price movements, though specific supply models require further detailed analysis for both assets.

Institutional Adoption and Market Application

- Institutional Holdings: Comprehensive data on institutional preference between the two assets is not extensively documented in available materials.

- Enterprise Adoption: Cross-border payment applications, settlement systems, and portfolio integration patterns vary between FourCoin and XRP, with market positioning influenced by technological capabilities.

- National Policies: Regulatory attitudes differ across jurisdictions, affecting adoption pathways and market accessibility for both digital assets.

Technical Development and Ecosystem Construction

- FourCoin Technical Upgrades: Blockchain technology continues to evolve with focus on scalability optimization and security improvements, which may impact long-term value proposition.

- XRP Technical Development: Ongoing technological progress responds to market demands, though specific upgrade details require case-by-case evaluation.

- Ecosystem Comparison: DeFi integration, NFT support, payment solutions, and smart contract implementation levels differ between the two assets, influencing their respective use cases and market positioning.

Macroeconomic Environment and Market Cycles

- Performance Under Inflation: Anti-inflation characteristics vary based on market perception, adoption rates, and technological fundamentals rather than inherent properties.

- Macroeconomic Monetary Policy: Interest rate fluctuations, US dollar index movements, and central bank policies affect crypto asset valuations through risk appetite and capital flow dynamics.

- Geopolitical Factors: Cross-border transaction demand, international relations, and regional policy frameworks create varying conditions for digital asset adoption and valuation.

III. 2026-2031 Price Forecast: FOURCOIN vs XRP

Short-term Forecast (2026)

- FOURCOIN: Conservative 0.00000057324 - 0.000001124 | Optimistic 0.000001124 - 0.00000119144

- XRP: Conservative 0.97057 - 1.367 | Optimistic 1.367 - 1.65407

Medium-term Forecast (2028-2029)

- FOURCOIN may enter a gradual growth phase, with projected price range of 0.000001186199912 - 0.000001364887047

- XRP may enter an expansion phase, with projected price range of 1.480928514 - 2.39755438377

- Key drivers: institutional capital inflows, ETF developments, ecosystem expansion

Long-term Forecast (2031)

- FOURCOIN: Baseline scenario 0.000001485889534 - 0.000001664196278 | Optimistic scenario up to 0.000001664196278

- XRP: Baseline scenario 2.367892332740025 - 3.007223262579831 | Optimistic scenario up to 3.007223262579831

Disclaimer

FOURCOIN:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00000119144 | 0.000001124 | 0.00000057324 | 0 |

| 2027 | 0.0000013661096 | 0.00000115772 | 0.0000010651024 | 3 |

| 2028 | 0.000001362867984 | 0.0000012619148 | 0.000001186199912 | 12 |

| 2029 | 0.000001364887047 | 0.000001312391392 | 0.000001063037027 | 16 |

| 2030 | 0.000001633139848 | 0.000001338639219 | 0.0000008567291 | 19 |

| 2031 | 0.000001664196278 | 0.000001485889534 | 0.00000089153372 | 32 |

XRP:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 1.65407 | 1.367 | 0.97057 | 0 |

| 2027 | 1.9334848 | 1.510535 | 1.22353335 | 9 |

| 2028 | 2.376373662 | 1.7220099 | 1.480928514 | 25 |

| 2029 | 2.39755438377 | 2.049191781 | 1.45492616451 | 49 |

| 2030 | 2.51241158309505 | 2.223373082385 | 1.80093219673185 | 61 |

| 2031 | 3.007223262579831 | 2.367892332740025 | 2.012708482829021 | 72 |

IV. Investment Strategy Comparison: FOURCOIN vs XRP

Long-term vs Short-term Investment Strategies

- FOURCOIN: May appeal to investors with higher risk tolerance seeking community-driven meme token exposure, though the asset carries significant volatility characteristics given its price history and market positioning.

- XRP: May suit investors focusing on payment infrastructure applications and established market presence, with consideration for its historical adoption in cross-border transaction scenarios.

Risk Management and Asset Allocation

- Conservative Investors: A potential allocation framework could consider FOURCOIN 5-10% vs XRP 90-95%, reflecting the substantial difference in market maturity and liquidity profiles between the two assets.

- Aggressive Investors: Portfolio structures might explore FOURCOIN 20-30% vs XRP 70-80%, acknowledging the higher volatility characteristics of meme tokens compared to established payment-focused digital assets.

- Hedging Tools: Stablecoin allocation for liquidity management, options strategies for downside protection, cross-asset diversification approaches to manage correlation risks.

V. Potential Risk Comparison

Market Risks

- FOURCOIN: Price volatility remains elevated given the token's meme classification and limited trading volume ($12,831.58 as of February 5, 2026), with historical price movements showing substantial fluctuation between all-time high and low levels.

- XRP: Market sentiment shifts and trading volume variations ($187,021,186.90 as of February 5, 2026) may influence price dynamics, with consideration for its established market presence and historical price cycles.

Technical Risks

- FOURCOIN: Operating on the Ethereum blockchain, the token faces considerations related to network congestion patterns, gas fee structures, and smart contract security frameworks inherent to the platform.

- XRP: Technical considerations include network stability patterns on the XRP Ledger, transaction processing capacity maintenance, and ongoing infrastructure development requirements.

Regulatory Risks

- Global regulatory frameworks continue evolving with differing approaches across jurisdictions, potentially affecting adoption pathways, exchange listing accessibility, and institutional participation levels for both assets differently based on their respective classifications and use cases.

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- FOURCOIN Characteristics: Community-driven meme token with Ethereum blockchain integration, exhibiting price volatility patterns typical of this asset category, currently trading at $0.000001124 with 24-hour volume of $12,831.58.

- XRP Characteristics: Payment-focused digital asset with established market presence since 2011, operating on dedicated XRP Ledger infrastructure, currently priced at $1.373 with substantial trading volume of $187,021,186.90.

✅ Investment Considerations:

- Novice Investors: May consider prioritizing established assets with greater liquidity and market history, while maintaining awareness of overall market volatility levels (current Fear & Greed Index: 12 - Extreme Fear).

- Experienced Investors: Portfolio approaches might incorporate risk-adjusted allocation strategies reflecting individual risk tolerance, market cycle positioning, and diversification objectives across different asset categories.

- Institutional Participants: Evaluation frameworks may emphasize liquidity profiles, regulatory clarity levels, custody infrastructure availability, and alignment with organizational investment mandates when comparing assets across different market segments.

⚠️ Risk Disclosure: Cryptocurrency markets demonstrate substantial volatility characteristics. This content does not constitute investment advice, financial guidance, or recommendations for specific investment decisions. Market participants should conduct independent research and consider professional consultation appropriate to their individual circumstances.

VII. FAQ

Q1: What are the main differences between FOURCOIN and XRP in terms of their fundamental purpose and market positioning?

FOURCOIN and XRP serve fundamentally different purposes in the cryptocurrency ecosystem. FOURCOIN operates as a community-driven meme token launched on the Ethereum blockchain in May 2023, targeting a specific niche market segment focused on community engagement rather than utility-based applications. In contrast, XRP was introduced in 2011 as a payment-focused digital asset built on the XRP Ledger, designed specifically for fast and low-cost cross-border transactions. XRP has established itself as a cryptocurrency with substantial institutional adoption in payment infrastructure, while FOURCOIN represents a speculative community token with significantly different liquidity levels and market maturity.

Q2: How do the current trading volumes and liquidity compare between FOURCOIN and XRP?

The liquidity difference between the two assets is substantial. As of February 5, 2026, FOURCOIN's 24-hour trading volume stands at $12,831.58, while XRP's 24-hour trading volume reaches $187,021,186.90—approximately 14,574 times larger. This massive disparity reflects XRP's established market presence and institutional adoption compared to FOURCOIN's limited trading activity. Higher liquidity generally translates to easier entry and exit positions, tighter bid-ask spreads, and reduced slippage for traders. For investors, this liquidity differential represents a critical consideration for portfolio allocation and risk management strategies.

Q3: What historical price performance patterns distinguish FOURCOIN from XRP?

FOURCOIN experienced extreme volatility since its May 2023 launch, with its price ranging from an all-time high of $0.00009646 (May 9, 2023) to an all-time low of $0.000000841649 (April 9, 2025)—representing a decline of over 99%. Currently trading at $0.000001124, the token demonstrates characteristic meme token price behavior. XRP, by comparison, has shown a broader historical range from $0.00268621 (May 22, 2014) to $3.65 (July 18, 2025), currently priced at $1.373. XRP's price movements reflect market cycles typical of established cryptocurrencies, while FOURCOIN's trajectory shows the high volatility associated with community-driven tokens lacking fundamental utility applications.

Q4: What are the long-term price projections for FOURCOIN versus XRP through 2031?

Price forecasts indicate different growth trajectories for both assets. For FOURCOIN, projections suggest relatively modest movement with 2031 predicted prices ranging from $0.00000089153372 (low) to $0.000001664196278 (high), representing approximately 32% change from current levels. XRP forecasts show more substantial potential appreciation, with 2031 predictions ranging from $2.012708482829021 (low) to $3.007223262579831 (high), representing approximately 72% change. These projections reflect XRP's established market position and ongoing ecosystem development, while FOURCOIN's forecasts account for its meme token characteristics and limited fundamental drivers. However, cryptocurrency price predictions carry inherent uncertainty and should not be solely relied upon for investment decisions.

Q5: How should investors approach portfolio allocation between FOURCOIN and XRP based on risk tolerance?

Portfolio allocation strategies should reflect individual risk profiles and investment objectives. Conservative investors might consider a framework emphasizing XRP at 90-95% allocation versus FOURCOIN at 5-10%, given XRP's established market presence, higher liquidity, and payment infrastructure applications. Aggressive investors with higher risk tolerance might explore FOURCOIN at 20-30% versus XRP at 70-80%, acknowledging the speculative nature and higher volatility of meme tokens. Both allocation approaches should incorporate risk management tools including stablecoin reserves for liquidity, diversification across multiple assets to reduce correlation risks, and consideration of hedging strategies such as options for downside protection. The current market Fear & Greed Index reading of 12 (Extreme Fear) suggests heightened caution is warranted regardless of allocation strategy.

Q6: What technical and regulatory risks should investors consider when comparing FOURCOIN and XRP?

Technical risks differ significantly between the two assets. FOURCOIN, operating on the Ethereum blockchain, faces considerations related to network congestion, variable gas fees, and smart contract security vulnerabilities inherent to the Ethereum ecosystem. XRP operates on its dedicated XRP Ledger with considerations around network stability, transaction processing capacity, and ongoing infrastructure maintenance requirements. Regulatory risks apply to both assets but potentially in different ways—XRP has faced historical regulatory scrutiny regarding its classification as a security, while FOURCOIN as a meme token may encounter evolving regulations targeting community-driven tokens. Global regulatory frameworks continue developing with varying approaches across jurisdictions, affecting exchange listing accessibility, institutional participation levels, and adoption pathways differently based on each asset's classification and use case.

Q7: What factors make XRP potentially more suitable for institutional investors compared to FOURCOIN?

XRP demonstrates several characteristics that may align better with institutional investment mandates. First, its substantially higher liquidity ($187 million in 24-hour volume versus $12,831 for FOURCOIN) facilitates larger position sizes without significant market impact. Second, XRP's payment infrastructure focus and established adoption in cross-border transaction scenarios provide fundamental utility beyond speculative trading. Third, the availability of custody solutions, regulatory clarity (despite historical challenges), and integration with traditional financial systems make XRP more accessible for institutional portfolios. Fourth, XRP's longer operational history since 2011 provides more extensive performance data for risk modeling and due diligence processes. FOURCOIN, as a meme token with limited liquidity and community-driven value proposition, typically falls outside institutional investment parameters that prioritize fundamental utility, regulatory compliance, and established market infrastructure.

Q8: Given the current market conditions showing "Extreme Fear," how should this sentiment affect investment decisions between FOURCOIN and XRP?

The Fear & Greed Index reading of 12 (Extreme Fear) as of February 5, 2026, suggests heightened market pessimism and risk aversion. Historically, extreme fear conditions can present contrarian buying opportunities for long-term investors, though timing market bottoms remains challenging. For FOURCOIN versus XRP comparison, extreme fear conditions typically impact higher-risk assets more severely—meme tokens like FOURCOIN often experience amplified volatility during market stress as speculative capital withdraws first. XRP, with its established market presence and institutional adoption, may demonstrate relatively greater resilience during fearful market conditions, though still subject to broader crypto market correlations. Investors should consider dollar-cost averaging strategies rather than large lump-sum positions during extreme fear periods, maintain adequate liquidity reserves, and ensure portfolio allocations align with personal risk tolerance regardless of short-term sentiment indicators. Market sentiment represents one factor among many in comprehensive investment analysis and should not override fundamental research and risk management principles.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

How to Buy Cryptocurrency: Top Strategies

Cryptocurrency for Beginners: Which Coin Should You Invest In

A Comprehensive Overview of the Future Potential and Types of Altcoins

Comprehensive Guide to Decentralized Finance (DeFi)

Mining Calculator: How to Calculate Cryptocurrency Mining Profitability