Gate Ventures Weekly Crypto Assets Review (August 18, 2025)

Gate Ventures

TL;DR

- Scott Besant called for a 50 basis point rate cut in September, followed by a cumulative reduction of at least 150 to 175 basis points.

- This week's economic data includes the Federal Reserve's meeting minutes, the US housing market index, building permits, housing starts, and existing home sales.

- ETH broke through $4,700 last week, just one step away from its all-time high.

- Last week, over 400,000 ETH flowed into spot ETH ETFs, maintaining strong momentum, suggesting that the bullish trend for ETH may continue.

- OKB has burned 279 million tokens, reducing the total circulation to 21 million, igniting competition among exchange tokens.

- Sidekick, a Web3 video streaming platform, has launched its token, but its target user group remains unclear.

- Galaxy has secured $1.4 billion in debt financing to transform its Bitcoin mining center into an artificial intelligence infrastructure center.

- Pantera Capital invested $300 million in DAT to increase its Crypto Assets reserves.

- Circle reported a 53% increase in second-quarter revenue, reaching $658 million, launching Arc L1 with USDC as the native fuel.

- Most of the funded projects are in the infrastructure sector.

Macroeconomic Overview

Scott Bessenet calls for a 50 basis point rate cut in September, followed by a cumulative reduction of at least 150 to 175 basis points.

U.S. Treasury Secretary Scott Basset has sent a clear signal regarding future Federal Reserve policy—calling for a 50 basis point rate cut starting in September, followed by a total reduction of at least 150 to 175 basis points. He pointed out that if he had known about the significant downward revision of non-farm payrolls by the Labor Statistics Bureau before the last FOMC meeting, the rate cuts could have started as early as June or July. This stance greatly exceeds current market expectations: the Fed's current target range is 4.25% — 4.50%, and a 150 basis point rate cut would bring the midpoint down to 2.88%.

At the same time, Bessenet suggested that the Bank of Japan should raise interest rates. He believes that the United States needs to quickly lower interest rates to alleviate the pressure of high real interest rates on credit, real estate, and regional banks, to prevent a hard landing of the economy. Meanwhile, Japan will benefit from interest rate hikes in the context of rising wage growth and inflation expectations, to anchor inflation expectations and stabilize the yen. This divergence in policies between the U.S. easing and Japan tightening will reshape global interest rate differentials, triggering capital flows, exchange rate fluctuations, and a repricing of asset values.

The data to be released this week includes the July FOMC meeting minutes and US real estate market data. Last week's released data indicated that the US CPI rose moderately, while the PPI exceeded expectations, suggesting that US consumers remain resilient. Meanwhile, US consumer confidence fell for the first time in four months, and long-term inflation expectations rose. These mixed data suggest a complex path for interest rate cuts, thus affecting the market's confidence in the Federal Reserve's independence, leading to a decline in the US dollar index.

DXY

The US Dollar Index fell below 98 last week as the Producer Price Index (PPI) rose by 3.3%, marking the fastest annual growth rate since February 2025, which reduced the likelihood of significant interest rate cuts.

U.S. 10-year Treasury yield

The yield on the 10-year U.S. Treasury bond rose slightly to over 4.3% last week, while the latest auction rate was 4.25%. The market is considering the impact of the CPI and PPI not meeting expectations.

gold

Last week, gold prices fell from $3,400 to $3,300 as Trump and Putin met in Alaska to discuss a potential peace agreement for Ukraine, while the US PPI remained resilient, leading to weakened market expectations for a Federal Reserve rate cut.

Crypto Assets Market Overview

1. Main Assets

BTC price

ETH price

SOL/ETH ratio

Last week, the Crypto Assets market showed an overall downward trend. The price of BTC was 115,000, and the price of ETH was 4,300, representing a week-over-week decline of 5% and 1%, respectively. The weekly high for ETH reached 4,800, just a step away from its historical peak of 4,891. The price of Solana was 182, with a week-over-week decline of 2%, and the SOL/ETH exchange rate further dropped to 0.042.

In terms of spot ETFs, last week the net inflow of spot ETH ETFs was 404,700 ETH, maintaining a relatively high level of inflow. However, yesterday, with the pullback of the ETFs, there was a slight outflow of about 13,000 ETH. Based on this, we believe that the upward trend of the ETFs has not yet ended, and we maintain a bullish outlook.

Last week, the market lacked a dominant narrative, but OKX conducted a large-scale OKB token burn, and its long-developed ZK Layer2 solution XLayer was officially launched. Currently, the ecosystem is still relatively small, and the tokens are mainly driven by MEME coin style.

2. Total Market Capitalization

Crypto Assets total market value

Total market capitalization of Crypto Assets (excluding BTC and ETH)

As of this Monday, the total market capitalization of Crypto Assets is 3.85 trillion USD, with a market capitalization of 1.03 trillion USD excluding BTC and ETH. Compared to last week, this represents a week-on-week decline of 3.9% and 0%, respectively.

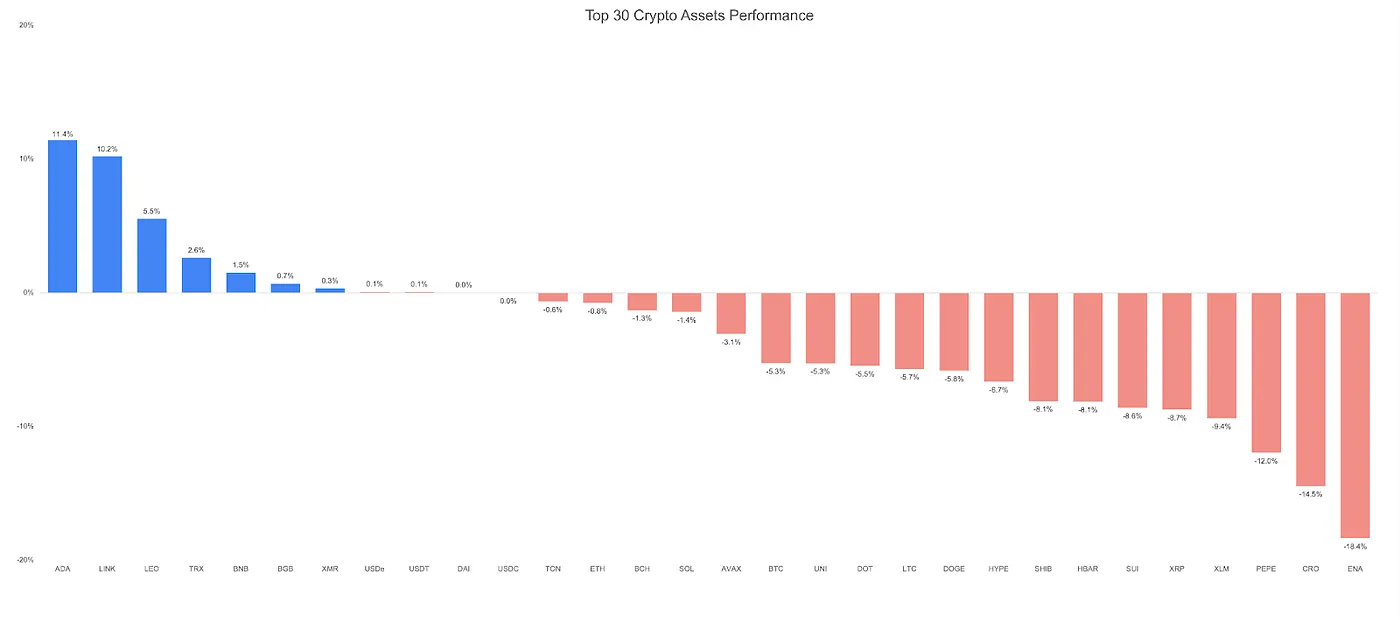

3. Performance of the Top 30 Crypto Assets

Source: Coingecko and Gate Ventures, as of August 18, 2025

Last week, the overall market was in a correction phase, leading to varying performances among the top 30 tokens. The dominant theme this week may be related to exchanges: OKX conducted a one-time burn of 279 million OKB tokens, valued at $32 billion (as of Monday). After the burn, only 21 million OKB remain in circulation. The current price is $115, and the fully diluted valuation (FDV) of the token is $2.41 billion.

As OKB ignites competition among exchange tokens, market capital flows into this sector. BNB, GT, and BGB have all experienced varying degrees of volatility and price increases.

4. New Token Launch

Last week, the market was mainly in an adjustment phase, with few new tokens listed. Sidekick is going live this week; it is a Web3 video live streaming platform. However, this consumer-facing application lacks a clear target audience, as the crypto assets native Web3 user base is relatively small and primarily driven by speculation. Sidekick is supported by YZi Labs and Mirana Ventures, currently valued at $23 million, with a fully diluted valuation (FDV) of $200 million.

Key Crypto Assets Highlights

1. Galaxy secures $1.4 billion in debt financing to transform its Bitcoin mining centers into artificial intelligence infrastructure centers.

Galaxy Digital (GLXY) has secured $1.4 billion in debt financing to renovate and expand its Helios Bitcoin mining facility in West Texas, repositioning it as a major hub for artificial intelligence and high-performance computing (HPC). This investment supports a 15-year lease agreement signed with CoreWeave (CRWV), under which Galaxy will provide 800 megawatts of IT load to support CoreWeave's AI and HPC operations. The financing structure has a 36-month term, with the assets associated with the first phase of Helios construction. The financing package is provided at 80% loan cost and includes an additional $350 million equity investment from Galaxy. Deutsche Bank is acting as the initial lender according to SEC filings.

This move reflects a broader shift of Bitcoin miners towards AI-driven high-performance computing services, leveraging existing data center capabilities and access to NVIDIA GPUs. CoreWeave itself initially started as a Crypto Assets miner and later transitioned to cloud-based GPU services in 2019, raising $1.5 billion in its IPO in March.

This is a key step in diversifying Galaxy's business model from Crypto Assets to artificial intelligence infrastructure. The company estimates that the CoreWeave protocol could generate over $1 billion in annual revenue when fully utilized. A second phase of expansion is planned, and Helios's capacity could reach 3.5 gigawatts.

2. Pantera Capital invested 300 million USD in DAT Company to increase its Crypto Assets reserves.

Pantera Capital has disclosed that it has invested over $300 million in Digital Assets Treasury (DAT) companies, a new class of public companies that hold significant Crypto Assets reserves and aim to expand token ownership per share through yield strategies. Pantera's DAT portfolio includes eight major coins: Bitcoin, Ethereum, Solana, BNB, Toncoin, Hyperliquid, Sui, and Ethena; with investments in the United States, the United Kingdom, and Israel. Portfolio companies include BitMine Immersion, Twenty One Capital, DeFi Development Corp, SharpLink Gaming, Satsuma Technology, Verb Technology Company, CEA Industries, and Mill City Ventures III.

DATs differ from direct spot holdings or ETFs by increasing the net asset value per share through generating income. Pantera believes that this model offers higher potential returns than simply holding tokens. The company has also launched two DAT-specific funds, raising over 100 million USD, although a decision on a third fund has yet to be made. Pantera highlighted BitMine Immersion, which has quickly become the largest Ethereum treasury and the third largest DAT globally, supporting its theory that Ethereum will define macro on-chain finance in the next decade, driven by the adoption of tokenization and stablecoins.

3. Circle reported a 53% increase in second-quarter revenue, reaching $658 million, and launched Arc L1 with USDC as the native fuel.

Circle announced plans to launch Arc, an EVM-compatible Layer 1 blockchain focused on stablecoin use cases. The public testnet is expected to launch this fall. Arc will use USDC (+0.0065%) as its native fuel token, featuring a stablecoin forex engine, sub-second settlement, optional privacy, and complete integration with the Circle platform while maintaining interoperability with other partner chains.

There are $65 billion USDC in circulation, with a total market capitalization of approximately $260 billion. Circle positions Arc as an enterprise-grade foundation for payment, foreign exchange, and capital market applications. This move follows the trend of issuers establishing dedicated stablecoin blockchains, with competitors like Tether supporting projects such as Stable and Plasma. The announcement coincides with Circle's release of its second-quarter 2023 financial results, which showed a 53% increase in total revenue, reaching $658 million, mainly due to a surge in reserve income and a 252% increase in service and transaction revenue. Circle also noted that the recently signed GENIUS Act, which has become law, establishes a federal regulatory framework for payment stablecoins, further solidifying Circle's position as a leading regulated issuer.

Key Venture Capital Trading

1. Hyperbeat raised $5.2 million to drive yield infrastructure on Hyperliquid.

Hyperbeat, the native yield protocol of the Hyperliquid decentralized exchange, has raised $5.2 million in an oversubscribed seed round led by ether.fi Ventures and Electric Capital. Other investors include Coinbase Ventures, Chapter One, Selini, Maelstrom, Anchorage Digital, and community participants through HyperCollective. This funding comes against the backdrop of Hyperliquid's TVL exceeding $2 billion, reflecting a surge in both institutional and retail activity. Hyperbeat is building the remainder of Hyperliquid's financial stack by combining liquid staking, isolated lending, strategy vaults, and portfolio tools, further solidifying its role in on-chain finance.

By packaging the yield from Hyperliquid's funding rate into tokenized vaults, Hyperbeat aims to make strategies that were once limited to complex participants accessible to a broader user base. Hyperbeat's product suite includes beHYPE (liquid staking), Hyperbeat Earn (high-yield vaults on HyperEVM), Morphobeat (a credit layer for borrowing against vault positions), and Hyperbeat Pay (payment protocol). Complemented by its portfolio tracker Hyperfolio, this suite aims to provide an integrated approach for trading, earning, and spending on-chain.

2. USD.AI raised $13 million in Series A funding to expand GPU collateral loans and stablecoin lending.

USD.AI has completed a $13 million Series A funding round led by Framework Ventures. The project, developed by Permian Labs, offers loans backed by GPU hardware, enabling AI startups to access funding with approval times reduced by over 90% compared to traditional financing. USD.AI's system has launched USDai, a stablecoin pegged to the US dollar, and sUSDai, a yield-bearing variant supported by income-generating computational assets. By treating GPUs as collateralized commodities, USD.AI provides fast, programmatic loans for AI companies while allowing investors to capture returns related to the industry's growth.

The platform has attracted $50 million in deposits during its private testing phase and plans to go public through an Initial Coin Offering (ICO) and a game-based distribution model. USD.AI sits at the intersection of stablecoins and artificial intelligence, aiming to create a new financial layer that allows AI agents to trade autonomously using stable, programmable currency. This approach enhances automation, risk management, and security in payments and decentralized finance (DeFi) applications, marking a broader integration between these two rapidly growing technological fields.

3. Mesh raised an additional $9.5M in funding to drive the global Crypto Assets payment expansion.

Mesh, a leading Crypto Assets payment network, has secured $9.5 million in funding from PayPal Ventures, Coinbase Ventures, Uphold, Mirana Ventures, SBI Investment, Overlook Ventures, Kingsway Capital, Moderne Ventures, and CE-Ventures, bringing its total funding to over $130 million. Mesh's SmartFunding orchestration engine supports payments from over 100 wallets and Crypto Assets, allowing real-time conversion to stablecoins for settlement. Mesh is "building a bridge between users and merchants," enabling anyone to pay with any asset at any time. Investors highlighted Mesh's ability to provide the compliance, scalability, and security that businesses need, with PayPal Ventures partner Amman Bhasin describing the company as "the infrastructure layer for embedded Crypto Assets payments." PayPal settled most of its investment in PYUSD stablecoin, showcasing the security and speed of global transfers based on stablecoins.

Mesh has integrated with platforms such as Coinbase, Binance, ByBit, OKX, Paribu, and Uphold, covering hundreds of millions of users. With the market capitalization of stablecoins exceeding $200 billion and an annual trading volume surpassing $27.6 trillion, Mesh is positioning itself as a core driver of the next wave of Crypto Assets payment adoption.

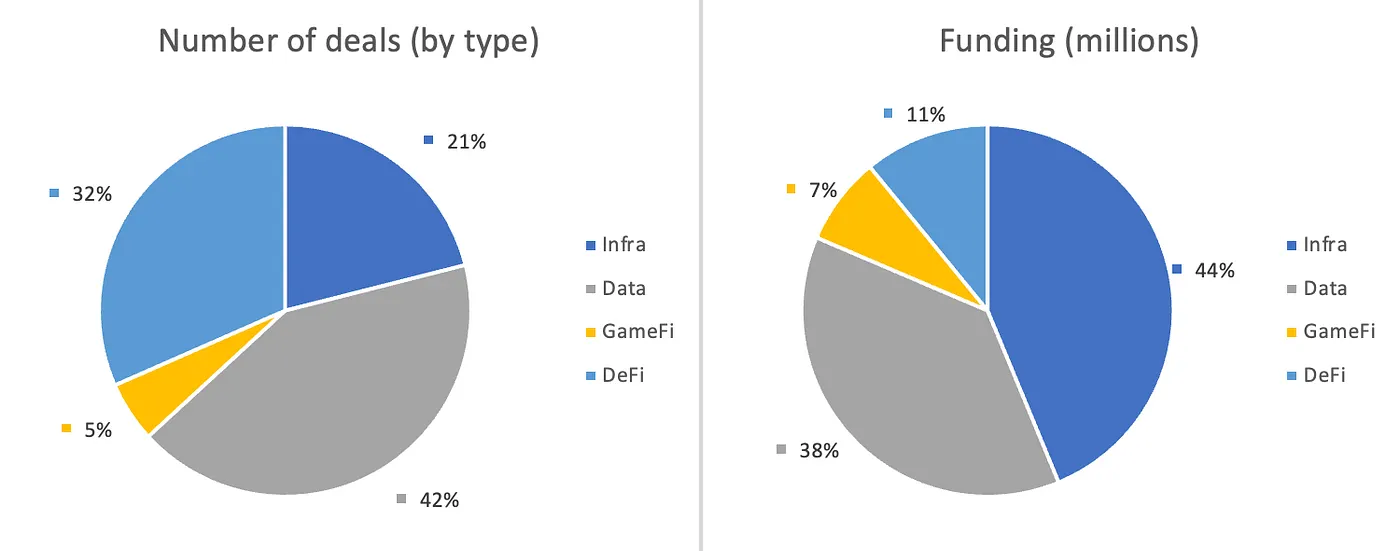

Venture Capital Market Indicators

The number of trades closed last week was 19, with the data department accounting for 8 trades, representing 42% of the total. Meanwhile, there were 4 trades (21%) in infrastructure, 1 trade (5%) in Gamefi, and 6 trades (32%) in DeFi.

Weekly Venture Capital Trading Summary, Source: Cryptorank and Gate Ventures, as of August 18, 2025

The total financing amount disclosed last week was 255 million US dollars, with 11% of transactions (2/19) not publicly disclosing the financing amount. The largest financing came from the infrastructure sector, amounting to 111 million US dollars. The transactions with the highest financing were: Story at 82 million US dollars and 1Kosmos at 57 million US dollars.

Weekly venture capital trading summary, source: Cryptorank and Gate Ventures, as of August 18, 2025

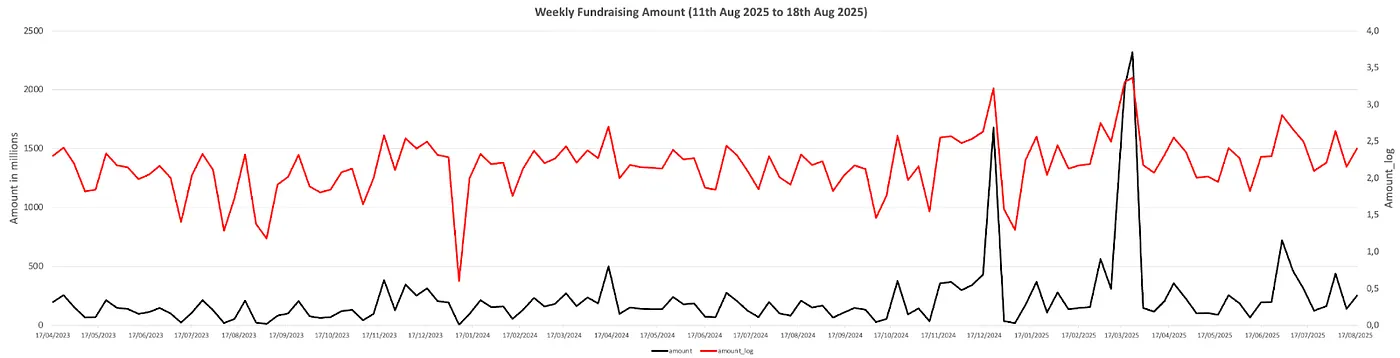

As of the third week of August 2025, the total weekly fundraising amount rose to $255 million, an increase of 78% compared to the previous week. Last week's weekly fundraising grew by 18% year-on-year.

About Gate Ventures

Gate Ventures is Gate's venture capital division, focusing on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 era. Gate Ventures collaborates with global industry leaders to assist outstanding teams and startups that have the ideas and capabilities needed to redefine social and financial interactions.

Website: https://www.gate.com/ventures

The content of this article does not constitute any offer or solicitation,or advice. You should always seek independent professional advice before making any investment decisions.. Please note that Gate Ventures may restrict or prohibit the use of all or part of its services from restricted areas. For more information, please read its applicable user agreement.

Thank you for your attention.

Where to Buy Labubu in Japan: Top Stores and Online Shops 2025

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

TerraClassicUSD (USTC) – Origin, Collapse, and Will It Repeg ?

How to Buy Bitcoin ETFs Directly in 2025

Tron (TRX), BitTorrent (BTT), and Sun Token (SUN): Can Justin Sun’s Crypto Ecosystem Moon in 2025

Cardano (ADA) Price Analysis and Outlook for 2025

Top 10 Play-to-Earn NFT Games

2026 NBLU Price Prediction: Expert Analysis and Market Forecast for NewBlue Interactive Stock Performance

2026 KYO Price Prediction: Expert Analysis and Market Forecast for the Upcoming Bull Run

2026 MTRG Price Prediction: Expert Analysis and Market Forecast for Matrixport Token

Free Money for App Registration: Crypto Exchange Welcome Bonuses