Is 3KDS (3KDS) a good investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Future Outlook

Introduction: 3KDS Investment Position and Market Outlook

3KDS is an IP-driven transmedia entertainment ecosystem in the cryptocurrency sector, launched in January 2026. The project aims to bridge Web2 mass users with Web3 ownership through original characters inspired by the Three Kingdoms, integrating games, AI-powered virtual idols, and digital collectibles into a unified fan-driven ecosystem. As of February 07, 2026, 3KDS has a market capitalization of approximately $255,968, with a circulating supply of 152,000,000 tokens, and the current price is around $0.001684. Backed by strategic investors including Gate Labs, DWF Labs, Castrum Capital, Genesis Ventures, and others with experience in Web3 infrastructure and venture investment, 3KDS has attracted attention from investors evaluating "Is 3KDS a good investment?" This article provides a comprehensive analysis of 3KDS's investment value, historical price movements, future price projections, and associated risks to offer reference for potential investors.

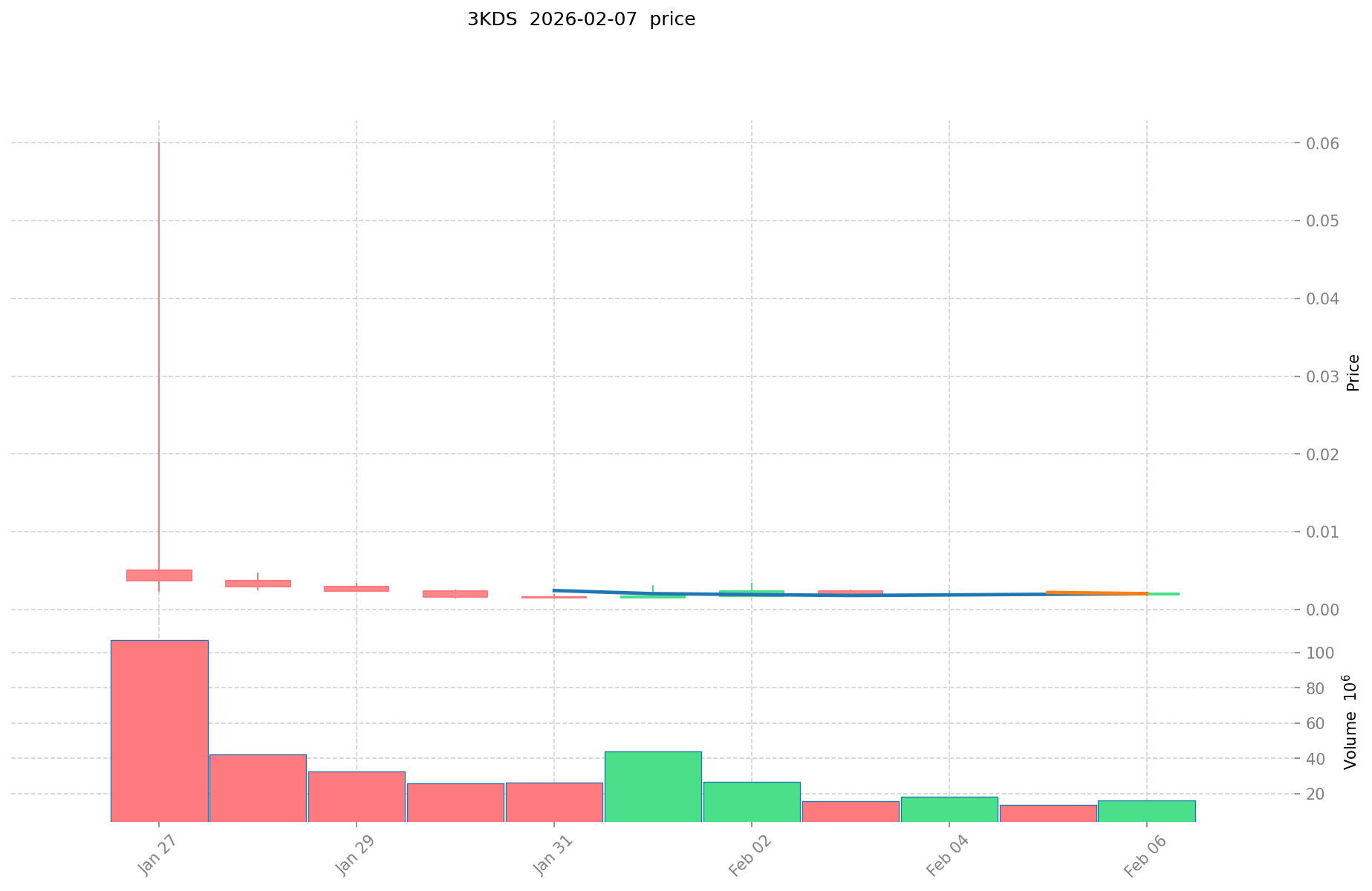

I. 3KDS Price History Review and Current Investment Value

3KDS Historical Price Trends and Investment Returns (3KDS Investment Performance)

- January 2026: Following its Gate.com launch on 26 January 2026, 3KDS experienced significant volatility. The token opened and quickly reached a peak of 0.06 USD on 27 January 2026, representing initial market enthusiasm for the Three Kingdoms-inspired IP-driven ecosystem.

- Late January 2026: Sharp correction followed as the token declined to 0.001413 USD on 30 January 2026, reflecting early profit-taking and market adjustment to the project's fundamentals.

- Early February 2026: Price stabilized around the 0.001684 USD level as of 07 February 2026, showing 4.09% recovery over the previous 7 days despite broader short-term weakness.

Current 3KDS Investment Market Status (February 2026)

- Current 3KDS price: 0.001684 USD

- 24-hour trading volume: 42,478.74 USD

- Market capitalization: 255,968 USD (ranking #3678)

- Circulating supply: 152,000,000 3KDS (15.2% of total supply)

- Total supply: 1,000,000,000 3KDS

- Recent price performance: -7.28% (24H), +4.09% (7D), -96.57% (30D)

- Institutional backing: The project is supported by strategic investors including b2en, rolling-stone, COSNINE, Gate Labs, DWF Labs, Castrum Capital, Genesis Ventures, and SeasideArden.

- Trading availability: Listed on 2 exchanges with 4,686 token holders

Click to view real-time 3KDS market price

II. Core Factors Affecting Whether 3KDS is a Good Investment

Supply Mechanism and Scarcity (3KDS investment scarcity)

- Total supply of 3KDS is capped at 1,000,000,000 tokens, with a current circulating supply of 152,000,000 tokens (15.2% of total supply), which establishes a defined supply framework that may influence price dynamics.

- The relatively low circulating ratio suggests that a significant portion of tokens remains unlocked, which could impact future supply-side pressures and price movements as additional tokens enter circulation.

- Investment consideration: The fixed maximum supply provides a degree of scarcity, though the current low circulation percentage (15.2%) means investors should assess potential dilution effects as more tokens are released into the market.

Institutional Investment and Mainstream Adoption (Institutional investment in 3KDS)

- 3KDS is supported by strategic investors and partners with experience across Web3 infrastructure, trading, and venture investment, including b2en, rolling-stone, COSNINE, Gate Labs, DWF Labs, Castrum Capital, Genesis Ventures, and SeasideArden.

- The project's listing on exchanges such as Gate and MEXC, along with staking opportunities offering up to 300% APR on MEXC Earn, reflects exchange-level support and early-stage market positioning.

- The project emphasizes sustainable user onboarding and content quality, aiming to convert existing IP fandom into long-term Web3 participation, which may influence adoption patterns over time.

Macroeconomic Environment Impact on 3KDS Investment

- As a Web3 entertainment and gaming token, 3KDS operates within a sector that can be influenced by broader cryptocurrency market trends, risk appetite, and liquidity conditions in digital asset markets.

- The token's performance may correlate with shifts in capital flows toward speculative or utility-driven blockchain assets, particularly within the gaming and entertainment segments of Web3.

- Market sentiment and broader economic factors affecting discretionary spending on digital collectibles and entertainment products may also play a role in shaping demand for 3KDS.

Technology and Ecosystem Development (Technology & Ecosystem for 3KDS investment)

- 3KDS is built around an IP-driven transmedia entertainment ecosystem inspired by the Three Kingdoms, integrating games, AI-powered virtual idols, and digital collectibles into a unified fan-driven ecosystem.

- The project operates on the BEP-20 standard (Binance Smart Chain), with a contract address on BSC (0x490153b338c2469e21c55e4ff88bdcfadac68141) and a holder base of 4,686 as of the reference date.

- The ecosystem's focus on bridging Web2 mass users with Web3 ownership through content-driven engagement and digital collectibles may contribute to long-term value proposition, though adoption and user retention remain key variables for investment assessment.

III. 3KDS Future Investment Forecast and Price Outlook (Is 3KDS(3KDS) worth investing in 2026-2031)

Short-term Investment Forecast (2026, short-term 3KDS investment outlook)

Based on available market data as of February 7, 2026, short-term price scenarios for 3KDS present varied trajectories. The conservative forecast suggests a potential range between $0.00115 and $0.00177, reflecting cautious market sentiment amid recent volatility. The neutral scenario points toward a price band of $0.00177 to $0.00220, while the optimistic outlook anticipates movement toward $0.00220 to $0.00270, contingent upon positive ecosystem developments and broader Web3 gaming sector momentum.

Mid-term Investment Outlook (2027-2029, mid-term 3KDS(3KDS) investment forecast)

The mid-term horizon presents a picture of gradual value accumulation tied to platform maturation. Market stage expectations center on ecosystem expansion, with increasing user engagement in the Three Kingdoms-inspired transmedia entertainment platform potentially serving as a value driver.

Investment return projections:

- 2027: Price range of $0.00193 to $0.00278, representing potential appreciation as the platform's game content and AI-powered virtual idol features gain traction.

- 2028: Estimated range of $0.00198 to $0.00293, with projected growth rates around 10.25% reflecting steady but moderate expansion.

- 2029: Anticipated band of $0.00258 to $0.00314, corresponding to a potential 15.76% growth trajectory as ecosystem effects compound.

Key catalysts may include: expansion of the digital collectibles marketplace, strategic partnerships within the Web3 infrastructure space, and successful user onboarding from Web2 to Web3 platforms.

Long-term Investment Outlook (Is 3KDS a good long-term investment?)

Long-term value trajectories extend through 2031 and beyond, with multiple scenario frameworks:

Baseline scenario: $0.00168 to $0.00405 (corresponding to steady ecosystem development and sustained user participation)

Optimistic scenario: $0.00313 to $0.00508 (aligned with accelerated adoption and favorable market conditions within the blockchain gaming sector)

Risk scenario: Below $0.00168 (under conditions of prolonged market headwinds or platform development challenges)

For extended 3KDS long-term investment analysis and price forecasting: Price Prediction

2026-2031 Extended Outlook

- Base scenario: $0.00168 - $0.00290 USD (corresponding to gradual ecosystem maturation and steady mainstream application growth)

- Optimistic scenario: $0.00313 - $0.00508 USD (aligned with large-scale adoption and favorable market environment)

- Transformative scenario: Above $0.00508 USD (contingent upon breakthrough ecosystem achievements and mainstream integration)

- 2031-12-31 projected high: $0.00508 USD (based on optimistic development assumptions)

Disclaimer: The forecasts presented herein are based on historical data patterns, mathematical modeling, and publicly available information as of February 7, 2026. Cryptocurrency investments carry substantial risk, and actual outcomes may differ materially from projections. These price outlooks should not be construed as financial advice, and individuals should conduct independent research and consult qualified advisors before making investment decisions. Past performance does not guarantee future results, and the highly volatile nature of digital assets can result in significant value fluctuations.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.002201 | 0.001775 | 0.00115375 | 5 |

| 2027 | 0.0027832 | 0.001988 | 0.00192836 | 18 |

| 2028 | 0.002934288 | 0.0023856 | 0.001980048 | 41 |

| 2029 | 0.00313873392 | 0.002659944 | 0.00258014568 | 57 |

| 2030 | 0.004059074544 | 0.00289933896 | 0.0016816165968 | 72 |

| 2031 | 0.00507964185792 | 0.003479206752 | 0.0031312860768 | 106 |

IV. 3KDS Investment Strategy and Risk Management (How to invest in 3KDS)

Investment Methodology (3KDS investment strategy)

-

Long-term Holding (HODL 3KDS): Suitable for conservative investors who believe in the project's transmedia entertainment ecosystem vision. This approach involves acquiring 3KDS tokens and holding them through market cycles, banking on the project's ability to convert IP fandom into sustained Web3 participation. Given the project's focus on content quality and sustainable user onboarding, long-term holders may benefit from gradual ecosystem development and community growth.

-

Active Trading: This strategy relies on technical analysis and swing trading opportunities. Traders may capitalize on price movements by monitoring key support and resistance levels, volume patterns, and market sentiment indicators. Given the token's volatility characteristics, active traders should establish clear entry and exit points, utilize stop-loss orders, and remain aware of broader market conditions affecting token performance.

Risk Management (Risk management for 3KDS investment)

-

Asset Allocation Ratio:

- Conservative investors: Allocate no more than 1-3% of total portfolio to 3KDS, prioritizing established assets

- Aggressive investors: May allocate 5-10% depending on risk tolerance and conviction in the project's entertainment ecosystem model

- Professional investors: Can consider higher allocations with proper due diligence, diversification across multiple entertainment-focused tokens, and active position management

-

Risk Hedging Solutions: Implement multi-asset portfolio construction by combining 3KDS with other asset classes. Consider pairing with stablecoins to preserve capital during downturns, diversifying across different sectors within crypto (DeFi, infrastructure, other entertainment tokens), and establishing clear rebalancing protocols based on portfolio performance thresholds.

-

Secure Storage:

- Cold wallet solutions: Hardware wallets such as Ledger or Trezor for long-term holdings

- Hot wallet options: Reputable software wallets for active trading positions, ensuring two-factor authentication and regular security audits

- Best practice: Maintain majority of holdings in cold storage, keeping only necessary trading amounts in hot wallets

V. 3KDS Investment Risks and Challenges (Risks of investing in 3KDS)

-

Market Risk: The token exhibits high volatility characteristics. Price fluctuations may be influenced by overall crypto market sentiment, speculative trading activity, and limited liquidity in early stages. Market manipulation risks exist, particularly in tokens with smaller market capitalizations and concentrated holder distributions.

-

Regulatory Risk: Policy uncertainty varies across different jurisdictions regarding entertainment tokens, digital collectibles, and Web3 gaming ecosystems. Regulatory developments in key markets could impact the project's operational model, token utility, or cross-border accessibility. Investors should monitor evolving regulations concerning virtual assets, gaming tokens, and entertainment-related crypto projects.

-

Technical Risk: Potential vulnerabilities include smart contract security issues, network congestion on the underlying blockchain infrastructure, and integration challenges across the transmedia ecosystem (games, AI-powered virtual idols, digital collectibles). Upgrade implementation risks and interoperability concerns with partner platforms may affect token functionality and user experience.

VI. Conclusion: Is 3KDS a Good Investment?

-

Investment Value Summary: 3KDS presents an innovative approach to bridging Web2 audiences with Web3 ownership through its IP-driven transmedia entertainment ecosystem. The project's backing by strategic investors with experience in Web3 infrastructure and its focus on sustainable user onboarding rather than short-term speculation may support longer-term value creation. However, the token exhibits significant price volatility and operates in the emerging intersection of entertainment IP and blockchain technology, which carries inherent uncertainties.

-

Investor Recommendations:

✅ Beginners: Consider dollar-cost averaging (DCA) approach to mitigate timing risk, prioritize secure wallet storage solutions, and limit exposure to a small percentage of overall portfolio. Focus on understanding the project's ecosystem development and community engagement metrics.

✅ Experienced Investors: Explore swing trading opportunities based on technical indicators and market cycles, implement diversified portfolio allocation across multiple entertainment and gaming tokens, and actively monitor project milestones and partnership developments.

✅ Institutional Investors: Evaluate strategic long-term positioning within entertainment and Web3 convergence thesis, conduct thorough due diligence on tokenomics and vesting schedules, and consider phased accumulation strategies aligned with ecosystem growth indicators.

⚠️ Disclaimer: Cryptocurrency investment carries high risk. This content is for informational purposes only and does not constitute investment advice. Investors should conduct independent research and consult qualified financial advisors before making investment decisions.

VII. FAQ

Q1: Is 3KDS a good investment for beginners in 2026?

3KDS may be suitable for beginners who understand the high-risk nature of cryptocurrency investments and are interested in the Web3 entertainment sector. However, beginners should limit exposure to 1-3% of their total portfolio and employ a dollar-cost averaging (DCA) strategy to mitigate timing risk. The token's significant volatility—evidenced by a 96.57% decline over 30 days following its January 2026 launch—means new investors must be prepared for substantial price fluctuations. Beginners should prioritize secure storage solutions (cold wallets for long-term holdings) and focus on understanding the project's transmedia ecosystem development before committing capital.

Q2: What are the main risks of investing in 3KDS?

The primary risks include extreme market volatility, limited liquidity, and regulatory uncertainty. Market risk manifests through 3KDS's price movements, which ranged from a peak of $0.06 USD to $0.001413 USD within days of launch. Regulatory risk stems from policy uncertainty across jurisdictions regarding entertainment tokens, digital collectibles, and Web3 gaming ecosystems, which could impact the project's operational model. Technical risks encompass smart contract vulnerabilities, blockchain network congestion, and integration challenges across the transmedia ecosystem (games, AI-powered virtual idols, digital collectibles). Additionally, the current circulating supply represents only 15.2% of total supply, creating potential dilution effects as more tokens enter circulation.

Q3: How does 3KDS's tokenomics affect its investment potential?

3KDS has a fixed maximum supply of 1,000,000,000 tokens, with current circulating supply at 152,000,000 (15.2%), establishing a scarcity framework. However, the low circulation percentage means 84.8% of tokens remain unlocked, which could create significant supply-side pressure on price as additional tokens are released. The market capitalization of approximately $255,968 (ranking #3678) indicates early-stage positioning with limited liquidity, as evidenced by 24-hour trading volume of $42,478.74 USD. Investors evaluating tokenomics should assess vesting schedules, unlock timelines, and distribution mechanisms to understand potential dilution impacts on long-term value.

Q4: What investment strategy works best for 3KDS?

The optimal strategy depends on investor profile and risk tolerance. Long-term holding (HODL) suits conservative investors who believe in the transmedia entertainment ecosystem vision and can withstand volatility through market cycles. Active trading appeals to experienced investors who can capitalize on price movements using technical analysis, establishing clear entry/exit points and stop-loss orders. Conservative investors should allocate 1-3% of portfolio to 3KDS, while aggressive investors may consider 5-10% depending on risk appetite. Risk management should include multi-asset portfolio construction, pairing with stablecoins during downturns, and maintaining majority holdings in cold storage with only necessary trading amounts in hot wallets.

Q5: What factors could drive 3KDS price appreciation in the future?

Key value drivers include ecosystem expansion success, strategic partnerships within Web3 infrastructure, and effective user onboarding from Web2 to Web3 platforms. The project's Three Kingdoms-inspired IP and integration of games, AI-powered virtual idols, and digital collectibles could attract sustained user engagement. Institutional backing from strategic investors including Gate Labs, DWF Labs, Castrum Capital, and Genesis Ventures provides credibility and potential partnership opportunities. Exchange support, such as listing on Gate.com and MEXC with staking opportunities offering up to 300% APR, enhances accessibility and liquidity. However, actual price appreciation depends on execution of the transmedia ecosystem vision, sustained community growth, and favorable broader cryptocurrency market conditions.

Q6: How does 3KDS compare to other Web3 entertainment tokens?

3KDS differentiates itself through its IP-driven transmedia approach inspired by the Three Kingdoms, combining games, AI-powered virtual idols, and digital collectibles into a unified fan-driven ecosystem. The project emphasizes sustainable user onboarding and content quality over short-term speculation, which may support longer-term value creation compared to purely speculative entertainment tokens. However, at a market cap of $255,968 and ranking #3678, 3KDS operates at an early stage compared to established gaming and entertainment tokens. Investors should evaluate competitive positioning based on user acquisition metrics, content pipeline, partnership network, and ability to convert existing IP fandom into sustained Web3 participation.

Q7: What is the realistic price outlook for 3KDS through 2031?

Price projections vary significantly based on development scenarios. For 2026, conservative forecasts suggest $0.00115-$0.00177, neutral scenarios indicate $0.00177-$0.00220, and optimistic outlooks project $0.00220-$0.00270. Mid-term (2027-2029) expectations center on gradual appreciation tied to ecosystem maturation, with 2027 ranging $0.00193-$0.00278, 2028 at $0.00198-$0.00293, and 2029 reaching $0.00258-$0.00314. Long-term baseline scenarios (through 2031) project $0.00168-$0.00405, while optimistic scenarios suggest $0.00313-$0.00508. However, these forecasts carry substantial uncertainty due to market volatility, regulatory developments, and execution risks. Investors should note that past performance—including the 96.57% decline over 30 days—does not guarantee future results.

Q8: Should institutional investors consider 3KDS for strategic positioning?

Institutional investors may consider 3KDS as part of a broader Web3 entertainment and gaming convergence thesis, but should conduct thorough due diligence on tokenomics, vesting schedules, and ecosystem development roadmap. The project's backing by strategic investors with experience in Web3 infrastructure (b2en, rolling-stone, COSNINE, Gate Labs, DWF Labs, Castrum Capital, Genesis Ventures, SeasideArden) provides institutional credibility. However, the current market capitalization of $255,968 and limited liquidity present challenges for large position accumulation without significant price impact. Institutional strategies should include phased accumulation aligned with ecosystem growth milestones, diversification across multiple entertainment and gaming tokens, and active monitoring of user engagement metrics, partnership developments, and regulatory landscape evolution.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

Hot Wallets vs. Cold Wallets: What's the Difference?

What is Crypto: A Comprehensive Guide to Cryptocurrency for Beginners

What is a mempool and how does it work in plain language

What is MLP: A Comprehensive Guide to Multilayer Perceptrons and Their Applications in Deep Learning

What is BMON: A Comprehensive Guide to Business Performance Monitoring and Optimization