Is ADAPad (ADAPAD) a good investment?: Analyzing the Cardano-based Platform's Potential and Market Risks

Introduction: ADAPad (ADAPAD) Investment Position and Market Outlook

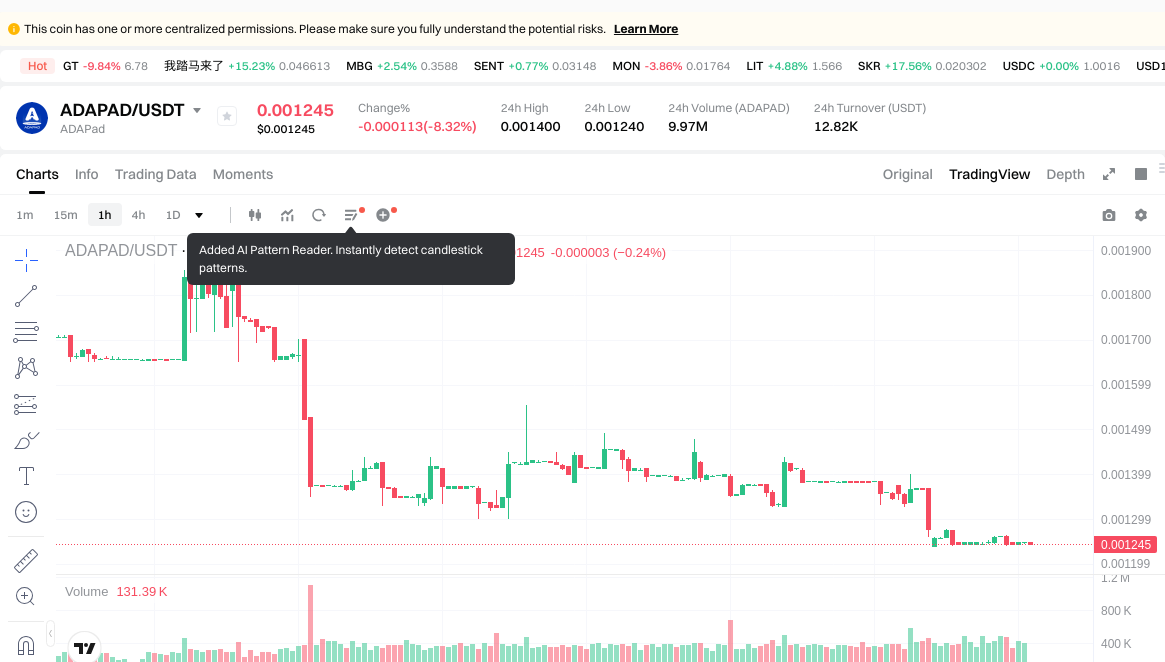

ADAPad (ADAPAD) is a token issuance platform built on Cardano, featuring a deflationary mechanism. As of February 6, 2026, ADAPAD maintains a market capitalization of approximately $463,358.76, with a circulating supply of around 371.28 million tokens and a current trading price near $0.001248. The platform operates with a unique deflationary model, where token burns are triggered through sales activities, unlock events, and IDO participation. The primary deflationary mechanisms include a 10% fee on all token sales and up to 25% fees for early unlock scenarios. With a holder base of 14,927 participants and a circulating ratio of 37.13%, ADAPAD has positioned itself within the launchpad ecosystem on Cardano. Recent price movements show declines across multiple timeframes, including an 8.1% decrease over 24 hours, a 28.81% decline over seven days, and a 61.91% decrease year-over-year. The token maintains deployments on both Ethereum and BSC networks with the contract address 0xDB0170e2d0c1CC1b2E7a90313d9B9afA4f250289. This article provides a comprehensive analysis of ADAPAD's investment characteristics, historical performance patterns, future price considerations, and associated risk factors for reference purposes.

I. ADAPad (ADAPAD) Price History Review and Current Investment Value Status

ADAPad (ADAPAD) Historical Price Performance and Investment Returns

- 2021: ADAPad reached $1.28 in October following initial market enthusiasm → Early investors experienced substantial gains during the initial launch period

- 2025: Market conditions deteriorated significantly → ADAPAD price declined to $0.0015904 in December, reflecting reduced investor interest

- 2026: Continued downward pressure persists → Price stands at $0.001248 as of February 6, demonstrating ongoing market challenges

Current ADAPAD Investment Market Status (February 2026)

- Current ADAPAD price: $0.001248

- 24-hour trading volume: $12,866.55

- Token holders: 14,927 addresses

- Circulating supply: 371,280,871.68 ADAPAD (37.13% of maximum supply)

Click to view real-time ADAPAD market price

II. Core Factors Affecting Whether ADAPAD is a Good Investment (Is ADAPad(ADAPAD) a Good Investment)

Supply Mechanism and Scarcity (ADAPAD investment scarcity)

- Deflationary tokenomics → impacts price and investment value

- ADAPad implements deflationary mechanisms including a 10% fee on all token sales and up to 25% early unlock fees, with triggers linked to sales, unlocks, and IDO participation

- Maximum supply capped at 1,000,000,000 tokens, with current circulating supply at 371,280,871 tokens (37.13% of maximum supply)

- Investment significance: the deflationary model creates potential scarcity dynamics that may support long-term investment considerations

Supply Circulation Status

- Current circulating supply represents 37.13% of maximum supply

- Total supply stands at 371,281,060 tokens

- The relatively low circulation ratio indicates potential future supply releases that investors should consider

Market Liquidity and Trading Activity

- Holder base of 14,927 addresses demonstrates community participation

- 24-hour trading volume of approximately $12,866.55

- Available on 1 exchange, which may limit liquidity compared to more widely traded assets

Technical Infrastructure (Technology & Ecosystem for ADAPAD investment)

- Token launch platform operating on Cardano blockchain

- Dual-chain deployment with contract addresses on both ETH and BSC networks

- Platform designed for token issuance with integrated deflationary mechanisms

- The IDO participation structure forms a core component of the ecosystem utility

III. ADAPAD Future Investment Predictions and Price Outlook (Is ADAPad(ADAPAD) worth investing in 2026-2031)

Short-term Investment Prediction (2026, short-term ADAPAD investment outlook)

- Conservative prediction: $0.001170 - $0.001245

- Neutral prediction: $0.001245 - $0.001537

- Optimistic prediction: $0.001537 - $0.001830

Mid-term Investment Outlook (2027-2029, mid-term ADAPad(ADAPAD) investment forecast)

- Market stage expectation: ADAPad may experience gradual recovery phase with potential price fluctuations influenced by overall crypto market sentiment and platform adoption rate.

- Investment return prediction:

- 2027: $0.001122 - $0.001753

- 2028: $0.000971 - $0.002336

- 2029: $0.001035 - $0.002050

- Key catalysts: Platform development progress, IDO participation volume, token burn mechanism effectiveness, and broader Cardano ecosystem growth.

Long-term Investment Outlook (Is ADAPad a good long-term investment?)

- Base scenario: $0.001919 - $0.002404 (assuming steady platform growth and moderate market conditions through 2030-2031)

- Optimistic scenario: $0.002404 - $0.003252 (assuming accelerated adoption, successful IDO launches, and favorable crypto market environment)

- Risk scenario: Below $0.001170 (under prolonged bearish market conditions or significant platform challenges)

Click to view ADAPAD long-term investment and price prediction: Price Prediction

2026-02-06 - 2031 Long-term Outlook

- Base scenario: $0.001919 - $0.002404 (corresponding to steady progress and gradual mainstream application enhancement)

- Optimistic scenario: $0.002212 - $0.003252 (corresponding to large-scale adoption and favorable market environment)

- Transformative scenario: Above $0.003252 (if ecosystem achieves breakthrough progress and mainstream popularization)

- 2031-12-31 predicted high: $0.003252 (based on optimistic development assumptions)

Disclaimer: The predictions presented are based on historical data analysis and current market trends. Cryptocurrency investments carry significant risks, and actual prices may vary substantially from predictions due to market volatility, regulatory changes, technological developments, and other unforeseen factors. This content does not constitute investment advice, and readers should conduct their own research and consult with financial professionals before making any investment decisions.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00183015 | 0.001245 | 0.0011703 | 0 |

| 2027 | 0.0017528355 | 0.001537575 | 0.00112242975 | 23 |

| 2028 | 0.002336191455 | 0.00164520525 | 0.0009706710975 | 31 |

| 2029 | 0.002050419303075 | 0.0019906983525 | 0.0010351631433 | 59 |

| 2030 | 0.002404465005067 | 0.002020558827787 | 0.001919530886398 | 61 |

| 2031 | 0.003252392517148 | 0.002212511916427 | 0.001991260724784 | 77 |

IV. ADAPad Investment Strategy and Risk Management (How to invest in ADAPad)

Investment Methodology (ADAPad investment strategy)

Long-term Holding (HODL ADAPad)

Long-term holding may be suitable for investors with a moderate risk tolerance who believe in the fundamental value proposition of ADAPad as a token launch platform on Cardano. This approach involves acquiring ADAPAD tokens and maintaining positions through market cycles, focusing on the project's long-term development rather than short-term price fluctuations.

Key considerations for long-term holders include:

- Monitoring the adoption rate of ADAPad's platform for new token launches

- Tracking the effectiveness of the deflationary mechanisms, including the 10% fee on token sales and early unlock penalties up to 25%

- Evaluating the growth of the Cardano ecosystem and its impact on ADAPad's utility

- Assessing the expansion of the holder base, which currently stands at 14,927 addresses

Active Trading

Active trading strategies rely on technical analysis and momentum-based operations. Given ADAPad's notable price volatility, as evidenced by price changes of -0.24% (1H), -8.1% (24H), -28.81% (7D), and -27.68% (30D), traders may identify opportunities through:

- Technical indicator analysis including support and resistance levels

- Volume analysis, with 24-hour trading volume at approximately $12,866.55

- Chart pattern recognition across multiple timeframes

- Monitoring liquidity conditions given the relatively limited exchange availability (1 exchange)

Risk Management (Risk management for ADAPad investment)

Asset Allocation Ratios

Conservative Investors:

- Suggested allocation: 1-3% of crypto portfolio

- Focus on stable, established digital assets with ADAPad as a minor speculative position

- Emphasis on capital preservation

Moderate Investors:

- Suggested allocation: 3-7% of crypto portfolio

- Balanced approach combining established assets with selected emerging projects

- Acceptance of measured volatility for potential growth

Aggressive Investors:

- Suggested allocation: 7-15% of crypto portfolio

- Higher risk tolerance with focus on growth potential

- Active monitoring and position adjustment capabilities

Risk Hedging Solutions

Multi-Asset Portfolio Approach:

- Diversification across multiple blockchain ecosystems beyond Cardano

- Allocation to different crypto categories (Layer 1s, DeFi, infrastructure)

- Balance between large-cap, mid-cap, and small-cap digital assets

Hedging Instruments:

- Maintaining stablecoin reserves for portfolio rebalancing opportunities

- Consideration of inverse positions during high volatility periods

- Strategic allocation to assets with low correlation to ADAPad

Secure Storage Solutions

Hot Wallet Considerations:

- Suitable for active trading amounts only

- Multi-signature options for enhanced security

- Regular security audits and password management

Cold Wallet Storage:

- Recommended for majority of long-term holdings

- Air-gapped solutions for maximum security

- Geographic distribution of backup seeds

Hardware Wallet Recommendations:

- Ledger devices supporting ERC-20 and BEP-20 tokens (compatible with ADAPad's contract addresses on ETH: 0xDB0170e2d0c1CC1b2E7a90313d9B9afA4f250289 and BSC: 0xDB0170e2d0c1CC1b2E7a90313d9B9afA4f250289)

- Trezor devices with appropriate firmware for multi-chain support

- Regular firmware updates and security verification

V. ADAPad Investment Risks and Challenges (Risks of investing in ADAPad)

Market Risks

High Volatility

ADAPad demonstrates substantial price volatility across multiple timeframes. The token has experienced a 61.91% decline over the past year, with a current price of $0.001248 compared to a previous level. Recent weekly and monthly performance shows declines of 28.81% and 27.68% respectively, indicating persistent downward pressure.

The token's price range within 24 hours ($0.00124 to $0.0014) represents approximately 16% volatility, which presents both opportunities and risks for investors. Historical data shows the token has traded between an all-time low of $0.0012408 (recorded on February 5, 2026) and a significantly different level previously, demonstrating extreme price swings.

Limited Liquidity

With trading activity concentrated on a single exchange and 24-hour trading volume of approximately $12,866.55, ADAPad faces liquidity constraints. This limited liquidity can result in:

- Wider bid-ask spreads

- Increased slippage on larger orders

- Difficulty executing significant position changes without market impact

- Potential for rapid price movements on relatively small trading volumes

Regulatory Risks

Jurisdictional Uncertainty

The regulatory landscape for token launch platforms and associated assets varies significantly across jurisdictions:

Regulatory Considerations:

- Evolving frameworks for token offerings in major markets

- Potential classification changes affecting platform operations

- Compliance requirements for IDO participation platforms

- Cross-border regulatory coordination challenges

Geographic Variations:

- Different regulatory approaches between regions

- Potential restrictions on platform accessibility

- Varying treatment of deflationary tokenomics models

- Uncertainty regarding token classification in multiple jurisdictions

Technical Risks

Network Security Considerations

As a multi-chain token with presence on both Ethereum (contract: 0xDB0170e2d0c1CC1b2E7a90313d9B9afA4f250289) and Binance Smart Chain (contract: 0xDB0170e2d0c1CC1b2E7a90313d9B9afA4f250289), ADAPad faces various technical considerations:

Smart Contract Risks:

- Potential vulnerabilities in token contract code

- Bridge security between different blockchain networks

- Interaction risks with third-party protocols

- Dependencies on underlying blockchain security

Platform-Specific Risks:

- Technical challenges in operating a launch platform

- Integration complexities with Cardano ecosystem

- Potential issues with deflationary mechanism implementation

- Smart contract upgrade risks and governance considerations

Operational Challenges

Platform Development Risks:

- Competition from established launchpad platforms

- Execution risks in platform feature deployment

- User experience and adoption challenges

- Technical scalability considerations

Tokenomics Implementation:

- Effectiveness of deflationary mechanisms in practice

- Impact of fee structures on platform competitiveness

- Token distribution and unlock schedule effects

- Circulating supply management (currently 371,280,871.68 tokens, representing 37.13% of total supply)

VI. Conclusion: Is ADAPad a Good Investment?

Investment Value Assessment

ADAPad presents a complex investment profile characterized by both potential opportunities and significant challenges. As a token launch platform operating within the Cardano ecosystem, the project occupies a specialized niche in the broader crypto launchpad sector.

Key Observations:

The token's deflationary mechanism, incorporating a 10% fee on all token sales and early unlock penalties reaching 25%, represents a distinctive tokenomics model. However, the project currently holds a market ranking of 3,073 with a market capitalization of approximately $463,358.53, indicating limited market adoption relative to the broader crypto market.

Recent performance data shows notable declines across multiple timeframes, including a 61.91% decrease over one year and significant monthly volatility. The current price of $0.001248 trades near the token's recorded low, while the market cap to fully diluted valuation ratio of 37.13% suggests substantial token supply yet to enter circulation.

With a holder base of 14,927 addresses and trading activity on a single exchange, liquidity and adoption metrics reflect an early-stage project facing growth and development challenges.

Investor Recommendations

✅ New Investors

Approach Considerations:

- Comprehensive research and due diligence before any allocation

- Understanding of multi-chain token mechanics (ETH and BSC presence)

- Secure storage using hardware wallets supporting ERC-20 and BEP-20 standards

- Limited position sizing appropriate to risk tolerance

- Continuous monitoring of project developments and market conditions

Risk Awareness:

- Recognition of high volatility and liquidity constraints

- Understanding of early-stage project risks

- Awareness of limited exchange availability

✅ Experienced Investors

Strategic Considerations:

- Technical analysis given notable price volatility patterns

- Evaluation of risk-reward ratio based on current market positioning

- Assessment of Cardano ecosystem growth as a factor

- Portfolio diversification across multiple launchpad projects

- Active position management given liquidity limitations

Advanced Tactics:

- Monitoring of on-chain metrics and holder distribution

- Analysis of deflationary mechanism effectiveness

- Evaluation of platform adoption and IDO success rates

- Consideration of correlation with broader Cardano ecosystem performance

✅ Institutional Investors

Due Diligence Framework:

- Comprehensive technical and fundamental analysis

- Evaluation of project team, development roadmap, and execution capability

- Assessment of competitive positioning within launchpad sector

- Legal and regulatory compliance review

- Liquidity and exit strategy considerations

Allocation Approach:

- Integration within broader crypto portfolio strategy

- Risk management through position sizing and diversification

- Continuous monitoring and rebalancing protocols

- Consideration of lock-up terms and deflationary fee structures

⚠️ Important Notice

Cryptocurrency investments involve substantial risk, including the potential loss of principal. Digital assets are subject to high volatility, regulatory uncertainty, technological risks, and market manipulation. ADAPad, with its limited liquidity, early-stage development, and significant recent price declines, presents elevated risk factors.

This analysis is provided for informational purposes only and does not constitute financial, investment, legal, or tax advice. Prospective investors should conduct independent research, consult qualified financial advisors, and carefully consider their risk tolerance, investment objectives, and financial situation before making any investment decisions.

Past performance does not indicate future results. Market conditions, regulatory environments, and project fundamentals can change rapidly in the cryptocurrency sector. Investors should only allocate capital they can afford to lose entirely and should maintain appropriate diversification across asset classes.

VII. FAQ

Q1: What is ADAPad and what makes it unique in the launchpad ecosystem?

ADAPad is a token issuance platform built on the Cardano blockchain that distinguishes itself through a deflationary tokenomics model. The platform implements a 10% fee on all token sales and early unlock penalties reaching up to 25%, with burns triggered through sales activities, unlock events, and IDO participation. This deflationary mechanism aims to create scarcity dynamics by permanently removing tokens from circulation. The platform operates with dual-chain deployment on both Ethereum (contract: 0xDB0170e2d0c1CC1b2E7a90313d9B9afA4f250289) and Binance Smart Chain, providing multi-chain accessibility while maintaining its core operations on Cardano.

Q2: How has ADAPad's price performed historically and what is its current market status?

ADAPad reached its peak price of $1.28 in October 2021 during initial market enthusiasm but has experienced significant decline since then. As of February 6, 2026, ADAPAD trades at $0.001248, representing a 61.91% decrease over the past year and trading near its all-time low of $0.0012408 recorded on February 5, 2026. The token demonstrates substantial volatility with declines of 8.1% over 24 hours, 28.81% over seven days, and 27.68% over 30 days. With a market capitalization of approximately $463,358.76, ranking at 3,073, and trading volume of $12,866.55 across a single exchange, the token currently faces limited liquidity and adoption challenges.

Q3: What are the key risks associated with investing in ADAPad?

Investing in ADAPad carries several significant risks. Market risks include high volatility, with price swings of approximately 16% within 24-hour periods, and limited liquidity given the token's availability on only one exchange with relatively low trading volume. Technical risks encompass smart contract vulnerabilities across multiple chains, platform operational challenges, and the complexity of managing deflationary mechanisms. Regulatory uncertainty affects token launch platforms globally, with varying jurisdictional approaches to IDO platforms and token classifications. Additionally, the circulating supply represents only 37.13% of the maximum supply, indicating potential future supply releases that could impact price dynamics. The project's early-stage status and limited market adoption further compound these risk factors.

Q4: What investment strategies are suitable for ADAPad holders?

Investment strategies for ADAPad should align with risk tolerance and investment objectives. Long-term holding (HODL) may suit moderate-risk investors who believe in the platform's fundamental value proposition within the Cardano ecosystem, focusing on adoption metrics, deflationary mechanism effectiveness, and holder base growth (currently 14,927 addresses). Active trading strategies can capitalize on the token's high volatility through technical analysis, momentum-based operations, and chart pattern recognition, though liquidity constraints must be considered. Conservative investors should limit allocation to 1-3% of their crypto portfolio, moderate investors to 3-7%, and aggressive investors to 7-15%. All strategies should incorporate secure storage solutions using hardware wallets supporting ERC-20 and BEP-20 standards, portfolio diversification across multiple blockchain ecosystems, and risk hedging through stablecoin reserves and multi-asset approaches.

Q5: What are the price predictions for ADAPad through 2031?

Short-term predictions for 2026 range from a conservative outlook of $0.001170-$0.001245 to an optimistic scenario of $0.001537-$0.001830. Mid-term forecasts for 2027-2029 suggest potential recovery phases with price ranges of $0.001122-$0.001753 (2027), $0.000971-$0.002336 (2028), and $0.001035-$0.002050 (2029), influenced by platform development progress, IDO participation volume, and broader Cardano ecosystem growth. Long-term projections through 2030-2031 present a base scenario of $0.001919-$0.002404, an optimistic scenario of $0.002404-$0.003252, and a risk scenario below $0.001170. The 2031 predicted high reaches $0.003252 under optimistic development assumptions. However, these predictions carry significant uncertainty due to cryptocurrency market volatility, regulatory changes, and technological developments, and should not be considered investment advice.

Q6: How does ADAPad's deflationary mechanism work and what impact does it have?

ADAPad's deflationary mechanism operates through multiple fee structures designed to permanently remove tokens from circulation. The platform charges a 10% fee on all token sales, meaning every transaction reduces total supply. Early unlock scenarios incur fees up to 25%, penalizing participants who exit positions before scheduled vesting periods. Additional token burns occur through IDO participation activities on the platform. With a maximum supply capped at 1,000,000,000 tokens and current circulating supply of 371,280,871 tokens (37.13% of maximum), these mechanisms aim to create scarcity dynamics that may support long-term value. The effectiveness of this deflationary model depends on platform adoption rates, transaction volumes, and the frequency of triggering events. However, investors should consider that deflationary mechanics alone do not guarantee price appreciation and must be evaluated alongside platform utility, competitive positioning, and market demand.

Q7: Is ADAPad suitable for institutional investors?

ADAPad presents significant challenges for institutional investors due to several limiting factors. The token's market capitalization of approximately $463,358.76 and ranking at 3,073 indicate limited market adoption and size. Trading activity on a single exchange with 24-hour volume of $12,866.55 creates substantial liquidity constraints that could impede institutional-scale position building or exits without significant market impact. The early-stage development status, recent performance showing 61.91% annual decline, and limited holder base of 14,927 addresses suggest elevated execution risks. For institutions considering exposure, a comprehensive due diligence framework should include technical and fundamental analysis, competitive positioning assessment within the launchpad sector, legal and regulatory compliance review, and integration within broader portfolio diversification strategies. Any institutional allocation should be limited, incorporate rigorous risk management protocols, and account for lock-up terms and deflationary fee structures that may affect liquidity and exit strategies.

Q8: What factors should investors monitor when evaluating ADAPad's future potential?

Investors should continuously monitor several key indicators when assessing ADAPad's investment prospects. Platform adoption metrics include the number and success rate of IDO launches, total value raised through the platform, and growth in the holder base beyond the current 14,927 addresses. Token burn effectiveness can be tracked through on-chain data showing actual tokens removed from circulation versus projections. The Cardano ecosystem's overall growth and development significantly impacts ADAPad's potential, as the platform's utility depends on activity within this blockchain. Technical developments should be monitored, including platform feature enhancements, user interface improvements, and integration with other Cardano protocols. Market indicators such as trading volume trends, exchange listing expansions beyond the current single platform, and price correlation with broader crypto markets provide important signals. Regulatory developments affecting token launch platforms globally and specifically within key jurisdictions should be tracked closely. Finally, competitive analysis of other launchpad platforms within and beyond the Cardano ecosystem helps contextualize ADAPad's relative positioning and market share potential.

Cardano (ADA) Price Prediction 2025 & 2030 – Is ADA Set to Soar?

Cardano (ADA): A History, Tech Overview, and Price Outlook

How Does Cardano's Proof of Stake (PoS) Mechanism Work?

What is Cardano?

Cardano (ADA) Price Analysis and Outlook for 2025

Factors Affecting Cardano's Price

What Is the DXY Index? Why Should Traders and Investors Monitor This Indicator?

Comprehensive Guide to NGMI and WAGMI in Crypto

![Cryptocurrency Trading Patterns [Illustrated, Fundamentals Edition]](https://gimg.staticimgs.com/learn/6e0f5c52f4da3cf14c7ae5002f14d250fa491fbf.png)

Cryptocurrency Trading Patterns [Illustrated, Fundamentals Edition]

Ocean Protocol: Striking a Balance Between Data Monetization and Privacy Protection

Games with Cashouts: Top 23 Projects for Earning